With bitcoin climbing over 50% in the past month, the notable gold aficionado and economist Peter Schiff has thrown shade at the market’s recent rally. Schiff argues that this uptick in value is nothing but “speculative mania” and advises folks to funnel their risky investments into gold instead. Schiff Warns of Speculative Mania in Bitcoin, […]

With bitcoin climbing over 50% in the past month, the notable gold aficionado and economist Peter Schiff has thrown shade at the market’s recent rally. Schiff argues that this uptick in value is nothing but “speculative mania” and advises folks to funnel their risky investments into gold instead. Schiff Warns of Speculative Mania in Bitcoin, […]

Source link

offers

Opinion: How restaurant-week offers can end up being being a bad deal

When it comes to dining out, I love a good deal as much as anyone else. Which means I’ve always anticipated Restaurant Week, that promotion in my hometown of New York City where hundreds of establishments offer multi-course meals at a discount.

But in recent years, I’ve noticed the math hasn’t always added up to my advantage. In one case, I visited a restaurant and realized my three-course dinner would cost less if I ordered the items a la carte. “So, why don’t you do that?” the server suggested when I pointed out the absurdity of the situation.

Sure enough, I didn’t opt for the “deal” and instead picked my way through the menu like a regular-paying customer. But the episode stuck with me as a telling example of how what once seemed like a smart idea — a way for customers to explore dining spots without having to dig as deep into their pockets while also giving restaurants an opportunity to gain new business — has perhaps played itself out.

Of course, if you look at how New York’s Restaurant Week has grown you might think otherwise. What began as a one-time promotion in 1992 with a mere 94 participating establishments has become an ongoing marketing extravaganza. There are now two separate such weeks in the city — one in the winter (it just concluded, in fact), another in the summer. And the timeframe for each promotion is not a “week” but more like half a month. Participation has also soared to 600-plus establishments, which offer prix-fixe meals from $30 to $60.

“When a skeptical colleague heard me talking about this, he joked, ‘What about Tuscaloosa?’ Sure enough, the Alabama city launched its promotion last year.”

Perhaps the most significant development is that the New York event has spawned dozens, if not hundreds, of copycats across the country — not only in big cities such as Chicago and Los Angeles, but also, well, just about everywhere. When a skeptical colleague heard me talking about this, he joked, “What about Tuscaloosa?” Sure enough, the Alabama city launched its promotion last year.

Granted, each place puts its own spin on the event. In Chicago, they’ve added a big one-night food festival, dubbed the First Bites Bash, as a kickoff to the event. In Los Angeles, they’ve featured dining deals for as little as $15. And in Tuscaloosa, they’re simply looking to take pride in a homegrown restaurant scene that promotion organizers say goes far beyond barbecue and other Southern staples.

The message was heard loud and clear during the Tuscaloosa event’s first edition, says Kelsey Rush, president of Visit Tuscaloosa, the tourism board that’s behind the newly established Restaurant Week. Rush said one place was so busy with a fish special they ran during the promotion, they had to reach out to their supplier twice during the week to get more of the catch.

“We had great success stories,” Rush said of the overall response to the citywide event.

Maybe that’s true. And yet, I still cast a somewhat skeptical eye, if not on Tuscaloosa’s event itself then on the broader state of restaurant weeks.

The value equation

Begin with the value equation: As any restaurant-industry consultant or expert will tell you, eateries always operate on tight margins, which makes it hard for them to offer deals in the best of times. Now, with rising food and labor costs, it’s harder than ever.

That means the only way a lot of these restaurant-week bargains can work is for the operator to trim costs — say, by offering smaller portion sizes or using cheaper cuts of meat. But in the end, that doesn’t exactly make for a satisfying meal, says Allen Salkin, a veteran food journalist who has done his fair share of restaurant-week dining across the country.

“You want to pay less for better, not less for less,” he told me.

Or they can go another route and try to entice diners to pay for extras — certainly, a cocktail or a glass of wine, but also for add-on foods. I even spotted New York restaurants that had a surcharge for bread. One example: Gotham, an acclaimed Manhattan dining destination, levies a $6 fee for its “housemade bread” with “cultured butter.”

Gotham managing partner Bret Csencsitz told MarketWatch that the bread charge has been in place on an ongoing basis — and not just for Restaurant Week. It is “based on the fact that the cost of doing business has dramatically increased on all fronts from labor to ingredients, to delivery surcharges, etc.,” he said via email.

“‘You want to pay less for better, not less for less.’”

— Food journalist Allen Salkin

My frustrations go beyond the bargain aspect (or lack thereof). What used to make restaurant-week promotions special was that they were limited in how long they ran, limited in how many restaurants participated in it and, yes, limited in how many places offered them.

I suppose it’s unfair to begrudge other metro areas from joining the club, especially if it helps bring in customers to their restaurants (the promotions are often timed during slower dining seasons, such as the post-holiday January period). But I also wonder if those places could come up with something unique rather than jumping on the bandwagon.

It’s not just me who sees the issue. “It’s the same-old, same-old,” said Florida-based marketing consultant Craig Agranoff of the restaurant-week dilemma. He believes it will come back to bite restaurants in the end.

“The saturation can lead to diner skepticism and fatigue,” he added.

I’d also make the argument that restaurant weeks, despite their potential low-cost allure for customers, often miss the point of what the dining experience is about. A meal isn’t about gaming the system financially. It’s about the pleasure of good food — and perhaps good company — in a convivial setting.

It’s why some restaurateurs told me they’re giving up on the whole idea of this promotion. Jack Logue, a veteran New York City chef, has participated in the Big Apple Restaurant Week with previous establishments, but hasn’t done so with his current one, the Lambs Club, located in the theater district.

“A meal isn’t about gaming the system financially. It’s about the pleasure of good food — and perhaps good company — in a convivial setting.”

Logue told me he’d rather offer a special that doesn’t box him in on price and allows him to show his contemporary American restaurant to its best advantage. So he’s now doing a pre-theater menu, priced at $85 (two courses) or $95 (three courses), that features quality fare (seared scallops, anyone?) and that he hopes speaks to his culinary passion. Oh, and he doesn’t charge for bread, either.

The goal, Logue said, is “to give the guests a better experience.”

Not that venues participating in restaurant weeks are actively seeking to give customers a bad experience. In theory, it’s just the opposite: Part of the idea behind the promotion is to have those newcomers be enticed to come back when the deal isn’t in place. And the formula can work.

Jay Kumar, the proprietor of Lore, an Indian restaurant in Brooklyn’s Park Slope neighborhood in New York, participates in the city’s Restaurant Week and said he sees about 13% of those newcomers return, a respectable figure in his books. He also said he takes pains to deliver a meal that will satisfy the customer but not ignore his need to make a living.

The problem, Kumar added, is that too many restaurant owners “don’t think of the math before they do anything.” So they end up with restaurant-week menus that don’t work for them or their diners.

Hearing Kumar talk, I thought I shouldn’t give up completely on the restaurant-week idea. I mean, I do like to eat out — and I do like to save money. (Who doesn’t?) But if I continue down this path, I’ll make doubly sure to pick places where the value and the quality look to align.

And maybe I’ll plan a visit to Tuscaloosa during its next Restaurant Week and see what the fuss is all about. I just hope they don’t run out of fish.

Ageism ‘was in the water:’ 500 applications, dozens of interviews and no offers

Chris Autry built, opened and ran corporate call centers for about 30 years. His longest stretch of unemployment was for six months in 1989. Until recently, that is.

Autry, 64, lost his job last year in a corporate downsizing and hasn’t been able to find another one in the nine months that he has been looking. He thinks ageism may be playing a role.

See: Live coverage of the January jobs report

He’s applied for about 500 jobs and gotten a 12% response rate that has led to dozens of interviews and follow-ups. Several interviews have been with CEOs or decision makers in the company, but he still hasn’t landed a job.

“Everything is virtual nowadays. I’ve found that if the first interview or screening is done over the phone, I always get to the next level. If it’s by video, I don’t make it to the next level,” Autry said. “Perhaps it might be unconscious bias if they see me as an older applicant.”

He said he never felt that ageism was overt or anything he could prove. Rather, it was more subtle.

During one interview, he said, he dressed appropriately, in his view, wearing a jacket and tie. The vice president of human resources asked him if he always dressed so formally.

“I got the impression that maybe I come off as old school, stuffy, from a bygone era,” Autry said.

He never said anything about that comment and has never filed a complaint about age discrimination, he said, because it’s always been so subtle.

“Even in my mind, I can’t prove that this was age discrimination. Maybe there was a better candidate,” he said. “I try not to let things like this defeat me.”

AARP found that 64% of adults age 50 and over in the workforce think older workers face discrimination, and nine in 10 believe that age discrimination against older workers is common in the workplace. More than one in 10 said they have been passed up for a promotion or chance to get ahead because of their age.

Read: It’s not just boomers vs. millennials. The workforce spans Gen Z to the Silent Generation.

Another job seeker, Randy G., who declined to provide his last name, said he was laid off at age 57 as a graphic designer and has been unable to find full-time work since. He’s now 62 and still is looking for a permanent job, although he has had a variety of temporary and short-term assignments.

“I had no expectation that it would take me more than a few weeks to find a job,” he said. “But it has dragged on and dragged on. I did not see that coming.”

After about a year of job hunting, he said it dawned on him that ageism could be at play.

“It was never a specific thing that happened. It was never that a person said ‘bad thing X.’ I felt it was just in the water,” he said.

AARP found that age discrimination against people age 50 and over cost the economy $850 billion in 2018, as a result of lost jobs or missed promotions and opportunities.

To make it easier to prove age discrimination, a bipartisan group in Congress in December reintroduced a proposal called the Protecting Older Workers Against Discrimination Act. The measure was first introduced in 2009, and multiple versions have failed to pass.

The new House proposal seeks to address a 2009 Supreme Court decision in the case of Gross v. FBL Financial Services Inc. that weakened protections against age discrimination under the Age Discrimination in Employment Act. That ruling set a higher bar for age discrimination than for other types of discrimination, such as those based on sex, race or physical ability.

That Supreme Court decision required plaintiffs to prove that age was the primary reason for an adverse employment action, a much higher standard than the previous rule, which required that plaintiffs demonstrate that age was a motivating factor.

“More than a decade ago, the Supreme Court undermined protections for older workers by setting an unreasonable burden of proof for age-discrimination claims,” Rep. Bobby Scott, a Democrat from Virginia, said in a press release.

The bill “would finally restore the legal rights of older workers by ensuring that the burdens of proof in age discrimination claims are treated in the same manner as other discrimination claims,” Scott said.

Read: What retirement? Older adults are working more hours for higher pay than in the past.

Despite potential age discrimination, the number of older workers is growing, and there are currently five generations in the workforce.

Almost one in five Americans age 65 and over worked for pay in 2023, nearly double the share of older adults who were working 35 years ago, according to the Pew Research Center.

And this year, the U.S. is hitting “Peak 65,” a phenomenon in which about 12,000 people per day will turn 65.

Looking forward, U.S. Bureau of Labor Statistics projections suggest that the role of older workers will continue to grow over the next decade. People 65 and over are projected to make up 8.6% of the labor force in 2032, up from 6.6% in 2022.

Read: Coming to your job — more older workers

“Older workers want what all workers want — flexibility and balance, fulfillment and satisfaction. At the end of the day, everyone wants the same thing,” said Carly Roszkowski, AARP’s vice president of financial-resilience programming.

Roszkowski said AARP has resources to help people in the workforce talk to a manager or human resources department about any potential age discrimination. For people looking for jobs, AARP offers tips for age-proofing résumés, such as removing graduation dates and limiting experience to the most relevant and the most recent 10 to 15 years.

The advocacy group is also working to help companies understand that multigenerational workforces are better for productivity, innovation and the bottom line, Roszkowski said. AARP also urges companies to include age in their efforts around diversity, equity and inclusion.

And if job seekers do encounter age discrimination, Roszkowski said, documentation is key.

“It’s the hardest discrimination to prove,” she said. “It is the largest barrier to re-enter or remain in the workplace.”

Logan Paul offers $2.3M to buy back CryptoZoo NFTs alongside indemnification against lawsuits

YouTuber Logan Paul has announced a remedial move to reimburse disillusioned investors in his failed CryptoZoo non-fungible token (NFT) game, nearly a year after he pledged redress for the purchasers.

In a Jan. 4 post on X (formerly Twitter), Paul revealed the implementation of a “buy back” initiative, backed by his commitment of $2.3 million, which aims to repurchase Base Eggs and Base Animals at their original acquisition cost of 0.1 ETH between Jan. 4 and Feb. 8 through a designated website.

“This buy-back is a way for me to make whole those who intended to play CryptoZoo. The buy-back is not intended to compensate those who gambled on the crypto market and lost.

It’s important to remember that the Zoo Token was created to support the CryptoZoo game and its players; it was “not intended as an investment vehicle,” as outlined in the original WhitePaper,” He added.

However, submitting a claim entails forfeiting any potential lawsuit against Paul or his associates and relinquishing ownership of the respective NFT. It also requires users to acknowledge that the redemption is not “an admission of any responsibility” by Paul.

“By accepting these Terms, you acknowledge and agree that you are waiving any actual or anticipated claims against PAUL, as well as against any related personnel, affiliates, agents, partners, employees, service providers, or representatives, for monetary or equitable relief arising out of or in connection with CryptoZoo, including but not limited to this Buy-Back, your purchase of any $ZOO tokens, or your purchase of any CryptoZoo NFT.

You further acknowledge that the Buy-Back does not constitute an admission by PAUL of your legal entitlement to any amount, nor does it constitute an admission of any responsibility in connection with any actual or anticipated claims relating to CryptoZoo.”

It is worth noting that in the United States, consumer protection laws can override contractual waivers in certain circumstances, especially in cases involving fraud, misrepresentation, or other illegal activities. For example, if an NFT project were to be found to involve fraud, deception, or misrepresentation, consumer protection laws at both the federal and state levels can be applicable. This includes making false claims about the value, origin, or benefits of the NFTs.

CryptoZoo was a planned blockchain-based play-to-earn game with much promise launched in 2021. Users were required to mint the Base Egg NFTs, which would later hatch into Base Animal NFTs needed to access the platform and earn yield in Zoo tokens.

However, the project gained wide notoriety following Coffeezilla’s investigations, which claimed to expose it as a scam, triggering a crash in its NFT values and leaving investors with valueless tokens.

In response, investors filed a class action against Paul and his affiliates in Feb. 2023.

The game will not be released.

Amidst the turmoil, Paul attributed the project’s earlier collapse to malevolent actors who embezzled funds and sabotaged its progress. He has now filed a federal lawsuit in Texas against these actors, asserting himself as a victim of fraud.

The social media influencer further asserted that he spent $400,000 on developing the fame and claimed it was ready in early 2023. However, he said the game would not be released because “there are too many regulatory hurdles that would need to be cleared that I did not originally understand and would ultimately delay this buy-back even further.”

Brad Garlinghouse, the CEO of Ripple, expressed his views on the aftermath of their legal battle with the US Securities and Exchange Commission (SEC).

Ripple CEO Insights On The SEC’s Stand In The Legal Battle

The Ripple CEO spoke about the case between the crypto company and the SEC in an interview at the 2023 DC Tech Week. Garlinghouse highlighted the SEC’s several setbacks since the case started.

According to the CEO, “the SEC has lost on everything that matters” when he was asked if the case is “done and dusted.” He further highlighted that the case’s conclusion rests on the SEC’s decision to pursue an appeal or not.

Nonetheless, Garlinghouse asserted that whether or not the SEC files an appeal on the case, which seems over for the regulator. This is due to the SEC’s “losing about three times to the crypto firm.”

In addition, the CEO also brought up the SEC’s losses in the Grayscale case. In a court ruling, a trial judge declared the agency was behaving “arbitrarily and capriciously” towards Grayscales’s Spot Bitcoin ETF application.

Notably, this legal wording suggests intentional and unreasonable activities done carelessly, ignoring relevant circumstances, facts, and other parties’ rights. With this incident, Garlinghouse emphasized that the SEC should reevaluate its course toward cryptocurrency regulation. The CEO stated:

I mean this is damning language from a federal judge to the SEC. At some point when you keep trying the same thing and having the same outcome, you need to change your approach. I hope the SEC’s change will be magical.

Nonetheless, Garlinghouse noted that the SEC losses will be amplified if they decide to take the appeal process higher.

Furthermore, Garlinghouse “reaffirmed” that Ripple stands prepared to pursue the matter further with the US Supreme Court should the situation demand it. Given that the Supreme Court has typically ruled against regulators, he firmly believes that the SEC would fail in the Supreme Court.

Regulatory Framework For the Cryptocurrency Industry

The Ripple CEO also spoke about the ambiguous regulatory framework for the cryptocurrency industry in the United States. According to Garlinghouse, other nations are increasing their market influence by implementing open rules and luring capital into the industry. On the other hand, the US continues to view cryptocurrencies with “skepticism.”

Garlinghouse conveyed that the US lacks a conducive regulatory framework. This causes the United States to “forfeit” its prospective position as a leader in the cryptocurrency space. So far, the Ripple CEO believes the US will create a crypto-friendly legal environment in the next ten years.

Feature image from iShock, chart by Tradingview.com

The decentralized exchange KyberSwap has offered a 10% bounty reward to the hacker who stole $46 million on Nov. 22 and left a note of negotiation. The exchange wants 90% of the loot returned by 6 am UTC on Nov. 25.

On Nov. 23, KyberSwap alerted users that its liquidity solution, KyberSwap Elastic, was compromised and advised them to withdraw funds. In the meantime, on Nov. 22, the hacker made away with roughly $20 million in Wrapped Ether (wETH), $7 million in wrapped Lido-staked Ether (wstETH) and $4 million in Arbitrum (ARB) tokens. The hacker then siphoned the loot across multiple chains, including Arbitrum, Optimism, Ethereum, Polygon and Base.

After hiding the stolen funds, the hacker wrote an on-chain message directed to KyberSwap developers, employees, decentralized autonomous organization members and liquidity providers, stating, “Negotiations will start in a few hours when I am fully rested.”

Following a day’s silence from both ends, KyberSwap responded to the hacker requesting the return of 90% of the stolen funds. The team acknowledged the skills of the hacker and laid down an offer:

“On the table is a bounty equivalent to 10% of users’ funds taken from them by your hack, for the safe return of all of the users’ funds. But we both know how this works, so lets cut to the chase so you and these users can all get on with life.”

If the hacker fails to pay back or respond to KyberSwap by 6 am UTC, Nov. 25, “you stay on the run,” said KyberSwap. The team is open to further discussion with the hacker via email.

Related: KyberSwap announces potential vulnerability, tells LPs to withdraw ASAP

A dissection of the recent KyberSwap hack by a decentralized finance (DeFi) expert suggests that the attacker used an “infinite money glitch” to drain funds.

Ambient exchange founder Doug Colkitt explained the KyberSwap attacker relied on a “complex and carefully engineered smart contract exploit” to carry out the attack.

1/ Finished a preliminary deep dive into the Kyber exploit, and think I now have a pretty good understanding of what happened.

This is easily the most complex and carefully engineered smart contract exploit I’ve ever seen…

— Doug Colkitt (@0xdoug) November 23, 2023

The attacker then repeated this exploit against other Kyberswap pools on multiple networks, eventually getting away with $46 million in crypto loot.

Magazine: This is your brain on crypto: Substance abuse grows among crypto traders

Dividend Stocks: MFA Financial Offers Investors Eye-Watering 13.4% Yield

With an eye-watering annualized yield of 13.4% MFA Financial (MFA) is back in the spotlight as one of the best dividend stocks.

X

MFA Financial — headquartered in New York — is a real estate investment trust, or REIT, that finances and manages mortgage-backed securities. Last highlighted in this column in June, MFA Financial shares struggled for months as higher yields dampened investor sentiment.

Nevertheless, after hitting an 8.41 low in late October, the stock has rebounded and is now back above both the 50-day and 200-day moving average.

A Solid Q3 For Dividend Stock

The move higher comes thanks to a modest respite in yields in addition to solid company earnings. MFA Financial reported third-quarter results on Nov. 7, which saw earnings of 40 cents beat analyst estimates of 38 cents, while net income of $46.1 million also came above the consensus estimate.

Solid financial results come despite a poor macro-environment, with the 10-year Treasury rate climbing 80 basis points in the third quarter alone. MFA Financial is expected to return to profitability this year, according to MarketSmith data.

Lower share prices have also meant higher dividend yields, and investors can now cash in on a juicy 13.4% yield. That ranks miles ahead of the Treasury market and above every stock in the S&P 500. Investors can expect the company’s next quarterly dividend to be declared in mid-December.

Naturally, this yield is not free. MFA Financial is acutely sensitive to interest rates and recession risks.

However, there are promising signs. Implied volatility in the equity market has been drained, with the Cboe Market Volatility Index, or VIX, sitting at multiyear lows and a turbulent Treasury market finally shows signs of calming.

While not for conservative investors, those chasing yield can consider MFA Financial.

Shares of the dividend stock are forming a cup base with an 11.85 buy point, per MarketSmith pattern recognition. An early entry may appear around the 11 price level.

YOU MAY ALSO LIKE:

The Income Investor archive

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest

MarketSmith’s Tools Can Help The Individual Investor

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

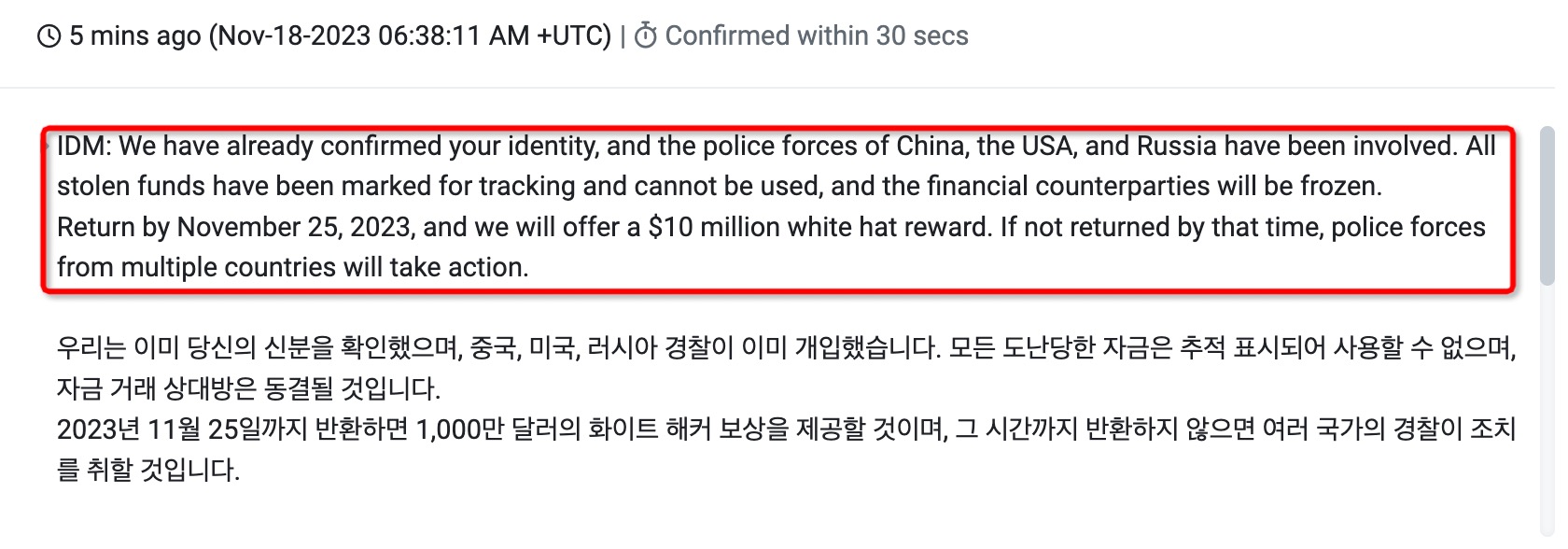

Poloniex says hacker’s identity is confirmed, offers last bounty at $10M

Crypto exchange Poloniex recently posted a message to the hacker responsible for stealing over $100 million in digital assets from one of its wallets, saying that it has identified the person and is giving the perpetrator a chance to return the assets in exchange for a $10 million bounty.

An on-chain message shared by blockchain security firm PeckShield on social media shows Poloniex’s message to the hacker. According to the exchange, it has already confirmed the hacker’s identity. The exchange further highlighted that it is working with various law enforcement agencies from the United States, Russia and China.

Furthermore, Poloniex mentioned that the stolen funds are already marked and cannot be used. Even though it confirmed the hacker’s identity, the exchange gave the hacker a chance to return the funds by Nov. 25 and get a $10 million white hat reward. However, if the funds are not returned, police forces will take action.

While the message indicates that the hacker is identified, some community members are unconvinced about the new development. In a post on X (formerly Twitter), a community member said that the exchange wouldn’t need to involve the police in three different countries and send the same message in 15 different languages if the hacker is already identified.

Related: Exploits, hacks and scams stole almost $1B in 2023: Report

The hack happened earlier in November when a crypto wallet belonging to Poloniex had suspicious outflows. On Nov. 10, various blockchain security firms determined that more than $100 million was drained from the exchange’s wallet.

In response to the attack, Poloniex disabled the wallet for maintenance. In addition, the exchange also offered a 5% bounty for the return of the funds. On Nov. 15, the exchange resumed withdrawals after enlisting the help of a security auditing firm to enhance its security.

Magazine: $3.4B of Bitcoin in a popcorn tin: The Silk Road hacker’s story

Carlos Tavares, CEO of Stellantis, poses during a presentation at the New York International Auto Show in Manhattan, New York, on April 5, 2023.

David Dee Delgado | Reuters

DETROIT — Chrysler parent Stellantis is offering buyouts to roughly half of its U.S. white-collar employees to reduce headcount and cut costs for the automaker’s North American operations.

The voluntary separation packages will be offered to 6,400 of its 12,700 nonbargaining unit U.S. employees with five or more years of employment, the company said Monday.

The move marks the latest cost-cutting efforts for the U.S. auto industry, as companies attempt to reduce costs amid economic concerns and billions of dollars in new investments for emerging technologies such as electric vehicles. Both General Motors and Ford Motor also have cut salaried workers over the past year.

“As the U.S. automotive industry continues to face challenging market conditions, Stellantis is taking the necessary structural actions to protect our operations and the Company,” Stellantis said in an emailed statement. “As we prepare for the transition to electric vehicles, Stellantis announced today that it will offer a voluntary separation package to assist those non-represented employees who would like to separate or retire from the Company to pursue other interests with a favorable package of benefits.”

A Stellantis spokeswoman declined to comment on how many people or total costs the company would like to cut. She also declined to comment on whether involuntary layoffs are planned if not enough employees accept the buyouts.

Stellantis North American Chief Operating Officer Mark Stewart informed employees Monday of the program, which was first reported by The Wall Street Journal.

Employees will have until Dec. 8 to accept buyout offers, the company said.

This marks the second round of salaried buyouts this year for Stellantis. In April, the company extended voluntary buyouts to about 33,500 U.S. employees, including 31,000 hourly employees with at least one year of employment and 2,500 salaried, nonunion employees who had 15 or more years with the company.

The latest buyouts come weeks after the automaker struck a tentative deal with the United Auto Workers union for new labor contracts covering its 43,000 unionized workers.

The tentative agreement between Stellantis and the UAW, which must still be ratified by union members, also includes voluntary buyouts.

The UAW has said the voluntary incentive plan for retirement will be for $50,000 pretax for an unlimited number of eligible production and skilled-trade members in 2024 and again in 2026.

The Stellantis spokeswoman said the salaried buyout offers are not directly connected to expected increases in U.S. labor costs as a result of the deal with the UAW.

The tentative union agreement includes 25% wage increases, including 11% upon ratification; reinstatement of cost-of-living adjustments; additional contributions for retirees; billions in new investments; and other benefits.

Don’t miss these stories from CNBC PRO:

Prenuvo offers $2,500 full-body MRI scans that can detect cancer early

Prenuvo MRI machine

Courtesy of Prenuvo

While celebrating the July Fourth holiday last year on a boat in Tyler, Texas, Dr. Julianne Santarosa received the results from her full-body MRI scan. What she saw put a damper on the festivities.

Radiologists at Prenuvo, which performed the scan, had identified a nodule in her lungs. Santarosa, who works as a spinal access surgeon in Dallas, could see the spot circled as she looked at the images from the patient portal on her phone.

“I was like, unless I swallowed a taco chip, that something should not be there,” she told CNBC in an interview.

Before paying $2,500 for the Prenuvo scan, Santarosa, who was 41 at the time, hadn’t felt any pain in and around her lungs and had no reason to suspect anything specific was wrong. Rather, she’d felt generally off since going through in vitro fertilization and had a gut feeling she should do the scan after seeing a Prenuvo ad on Facebook.

The day after seeing her Prenuvo results, Santarosa had a follow-up CT scan at a local hospital. The nodule was cancerous. She had it removed the following week.

Curious and concerned patients like Santarosa are flooding Prenuvo’s nine clinics in the U.S. and Canada. There’s so much demand that the 5-year-old Silicon Valley-based company has announced 11 more locations opening by 2024, including one in London and another in Sydney.

Kim Kardashian called Prenuvo a “life saving machine” in an August post on Instagram that’s generated more than 3.4 million likes. Actress and model Cindy Crawford is an investor, alongside Google ex-Chairman Eric Schmidt, 23andMe co-founder Anne Wojcicki and Nest Labs founder Tony Fadell. The company raised $70 million late last year in a funding round led by Felicis Ventures.

Prenuvo CEO Andrew Lacy said he wants to help customers understand what’s going on beneath their skin, which his company’s technology can do by identifying more than 500 conditions like cancer, multiple sclerosis and brain aneurysms. As of now, the scans have a limited audience because they aren’t covered by insurers, requiring patients to pay out of pocket.

For Santarosa, the imaging was worth every penny and more. Her cancer was detected early enough that she didn’t need to undergo treatments like chemotherapy or radiation. More importantly, it hadn’t spread to the point that it was life threatening.

“There’s no screening test for this,” Santarosa said. “I would’ve been stage 4. I would’ve figured this out when I was coughing up blood.”

Prenuvo CEO Andrew Lacy

Courtesy of Prenuvo

An MRI, which stands for magnetic resonance imaging, is traditionally used when ordered by a doctor. Interpreting the images is a complex science, and the scan alone can take more than an hour, even if it covers just part of the body.

Prenuvo’s custom MRI machines, which received clearance from the U.S. Food and Drug Administration in 2018, can scan a person’s entire body in about an hour. Once a scan is complete, the images are reviewed by one of the company’s 30 licensed radiologists. Customers usually receive their results back within five to 10 business days.

Waitlists are long. According to Prenuvo’s website, the next available slot for a full-body scan in New York is in March. The same is true for the Los Angeles clinic. In the Dallas suburb of Irving, there’s availability starting in mid-December.

Lacy said the business has spiked as awareness in the past 12 months has grown “incredibly.”

“These days, when people ask me what I do, and I say I work at Prenuvo, it’s ‘Oh, I heard that on this podcast,’ or ‘That influencer talked about it,'” he said.

In addition to full-body scans, Prenuvo offers a head and torso scan for $1,800 and a scan of just the torso for $1,000.

‘Old-fashioned scaling’

Lacy said Prenuvo is working to bring prices down through “old-fashioned scaling.”

Some companies have started offering Prenuvo scans as a perk for employees, which has helped increase access to the technology. Lacy said it works for companies with self-funded insurance plans, because they’re able to customize their offerings while assuming the risks.

Traditional insurance companies are paying attention.

“Over time, that data helps inform insurance companies about whether this should be something that would be covered across the insurance plans that they offer,” Lacy said.

Prenuvo is looking for other ways to lower costs through artificial intelligence and by potentially reducing the durations of the scans even further. Lacy said the cost is directly correlated to the amount of time customers spend in the expensive machines.

Prenuvo MRI machine

Courtesy of Prenuvo

Radiologists are at the core of Prenuvo’s business. That brings its own challenges.

Many radiologists are fighting burnout as an aging population has led to mounting caseloads. Emerging technologies like AI have also discouraged some young physicians from pursuing the practice. By 2034, the U.S. could see an estimated shortage of up to 35,600 radiologists and other specialists, according to a report from the Association of American Medical Colleges.

So far, it’s a problem Prenuvo has managed to avoid.

Lacy said Prenuvo has a backlog of radiologists who want to work for the company. In traditional medicine, radiologists are often diagnosing patients with serious and advanced diseases, so identifying conditions early can be a welcome change, he said.

“When you’re catching stage 1 cancer, what you’re doing will save lives,” Lacy said.

Prenuvo is still in its early days. Medical experts caution that, in addition to the steep price, full-body MRI scans won’t catch everything and aren’t meant to replace targeted screenings like colonoscopies and mammograms.

“It is a tool that your physician and you can use, but it does not replace a full diagnostic examination,” said Dr. Jasnit Makkar, an assistant professor of radiology at Columbia University Medical Center, in an interview. “It is a work in progress.”

Dr. Kimberly Amrami, vice chair of the department of radiology at Mayo Clinic Rochester, said that because of the limitations, patients’ expectations have to be set accordingly. She said it can be challenging to identify lesions in the lungs, for instance, and scanning different body parts like the knee, the pelvis, the breasts and the prostate all require different techniques.

“There’s always a wish to do an exam that’s going to answer every question,” Amrami said in an interview. “It’s just not really the way that it works with MRI in particular, because the way that you evaluate different body parts in different disease states is quite different.”

Prenuvo doesn’t use contrast, a heavy metal that’s injected into the blood vessels, when conducting its scans. Contrast can help radiologists visualize certain conditions better, but there’s controversy surrounding its use, and the company doesn’t want to deter people.

Lacy said Prenuvo’s hardware was designed to do “almost as good a job” as contrast by using other techniques.

“We believe that that’s the best possible solution for screening patients who are at normal risk and asymptomatic,” he said. “If we find something that’s very concerning, oftentimes, we will suggest that the patient gets some type of follow-up dedicated imaging that might involve contrast.”

Amrami said people should consult with their physicians to determine what kind of imaging works best for them.

“There is no one-size-fits-all for MRI,” Amrami said.

A look inside a Prenuvo clinic

Prenuvo’s clinic in New York City, New York.

Courtesy of Prenuvo

Lacy said he was inspired to create Prenuvo after he started to wonder about how his high-stress lifestyle was affecting his body. He previously started an internet search company and helped found a gaming company, among other ventures.

He found a radiologist who was offering an early version of a full-body MRI scan. Lacy said he learned a lot from that experience.

“Although my lifestyle was impacting my health, there was nothing crazy going on,” Lacy said. “I remember just this incredible feeling of peace of mind.”

Prenuvo designed its experience for relaxation. Its New York location has the feel of a cross between a spa and a doctor’s office.

Upon arrival at the clinic, patients are led from a cozy waiting room to a private area where they can change into scrubs and remove their jewelry.

While lying down in the machine, patients are given a pair of headphones and can choose to listen to music or watch TV during the scan.

Dr. Eduardo Dolhun, a family physician in San Francisco, decided to get his first Prenuvo scan more than five years ago after Lacy stopped by his office. He said he was skeptical but intrigued by the technology, so he decided to fly to Vancouver, British Columbia, to try an early version of it.

After going through his results with a Prenuvo radiologist, Dolhun called one of his medical school peers at the Mayo Clinic.

“I think this is going to change medicine,'” Dolhun said, recalling the conversation.

Dolhun said he gets a scan every 18 months or so and recommends it to some of his patients. He still advises them to get screening exams like physicals and mammograms as well.

“Good science takes time,” he said.

WATCH: Amazon links One Medical to Prime offering