A new survey says consumers find e-commerce sites often fail to meet expectations. Experts say that’s because shoppers have become accustomed to how Amazon gets things done to their liking.

Source link

Online

Gaunt photos of FTX founder Sam Bankman-Fried in prison emerge online

The first photos of Sam Bankman-Fried, the convicted founder of the bankrupt FTX exchange, at New York’s Metropolitan Detention Centre, have emerged online from crypto influencer Tiffany Fong.

Fong shared the exclusive images of SBF on Feb. 20 via the social media platform X (formerly Twitter), describing it as the “first and only” photos of him since he was convicted.

In the picture, the disgraced FTX founder was sporting a beard while standing alongside five other inmates, including a figure known as G Lock, who Fong described as her “new inmate friend.” The picture was reportedly taken on Dec. 17, 2023.

Meanwhile, several crypto community members pointed out that the disgraced founder had lost weight, with Fong asserting that:

“[SBF’s] obviously lost some weight, and I’ve heard he’s not showering very much. He’s not as clean-shaven as he used to be, but he’s obviously going through a lot right now.”

SBF has been held at the Metropolitan Detention Center since August 2023 after Judge Lewis Kaplan remanded him on suspicions of attempting to influence witnesses.

CryptoSlate, citing federal inmate records, reported that the New York center was one of the most notorious prisons in the US because of its poor conditions like staffing shortages, corruption among staff, power outages, cockroach and rodent infestations, poor food, and malfunctioning toilets.

Awaiting sentence

Despite his conviction, Bankman-Fried’s sentencing remains pending until March 28, with the judge expected to weigh multiple factors, including the nature of his offenses and his personal background.

SBF faces up to 110 years in prison, having been found guilty on all seven charges. However, speculation persists regarding a potentially reduced sentence, partly stemming from FTX’s commitment to reimburse creditors fully.

Meanwhile, the likelihood of defrauded FTX clients receiving restitution before SBF’s sentencing appears slim as the firm bankruptcy proceedings continue.

Online bank and financial technology upstart SoFi Technologies (SOFI -2.38%) has huge ambitions. It is growing quickly, adding billions of dollars in new deposits every quarter. This has many investors — both on Wall Street and Main Street — bidding up the stock. Shares of SoFi rose by 75% in the past 12 months, making it one of the best-performing stocks of 2023.

But what if I told you there was a better online bank stock than SoFi? Enter Ally Financial (ALLY 2.65%). It’s time to zig while everyone is zagging and buy this online banking powerhouse in 2024.

What is Ally Financial?

Ally Financial was born out of the financial crisis, when General Motors was forced to spin off its lending operation, GMAC (General Motors Acceptance Corporation). That institution was renamed Ally in 2009, and has operated as an independent online-only bank ever since.

The bank has two main focuses. First, it aims to attract younger depositors by offering higher interest rates on checking and savings accounts than the largest banks. Ally is able to do so while remaining profitable due to lower overhead costs. It has no physical bank branches and runs way leaner on its employee count than traditional banks, giving it a cost advantage that it can pass on to customers. This has enabled Ally to increase its customer count for 58 straight quarters. It now has $140 billion in retail deposits.

With these deposits, Ally has remained a leader in auto loans. At the end of last quarter, it had more than $115 billion in auto loans on its balance sheet earning interest income. Even though Ally pays depositors 4.35% on their savings accounts, it has a positive net interest margin due to the profitability of its auto loan operation. During the past 12 months, Ally generated $1.22 billion in net income, and it has been profitable in each of the past five years.

The stock is cheap

Though the bank has been putting up consistent growth, its stock is down by 38% from the all-time high it hit in 2021. After the Federal Reserve started raising interest rates to combat inflation, banks in the U.S. started running into trouble. They had to pay more to depositors, and their existing loan books decreased in value. This double whammy even put a few banks out of business in early 2023.

Ally was not immune to this pain. However, unlike Silicon Valley Bank and the others that failed in 2023, it weathered the storm. Its net interest margin was compressed in recent quarters due to higher interest rates paid to depositors, but its loan portfolio is performing well and turning over with higher interest rates that are adjusting to the Fed’s rate hikes. For example, in Q3 2022, Ally’s retail automotive loans were yielding 7.22%. A year later, this number had risen to 8.9%.

Now, it looks like the Fed is done raising interest rates for this cycle, and may even begin to cut rates at some point this year. Once Ally’s entire loan book reprices, its net interest margin should start expanding again and its earnings should grow. Plus, the bank continues to add deposits, giving it the capacity to make even more loans in the coming years.

Despite its earnings decline, Ally trades at a price-to-earnings ratio of less than 10, which is well below the market average. With the headwinds of rising interest rates behind it and with the bank increasing its deposits, I am confident that its earnings have a lot of room to grow this decade as well. This makes Ally stock a bargain at these prices.

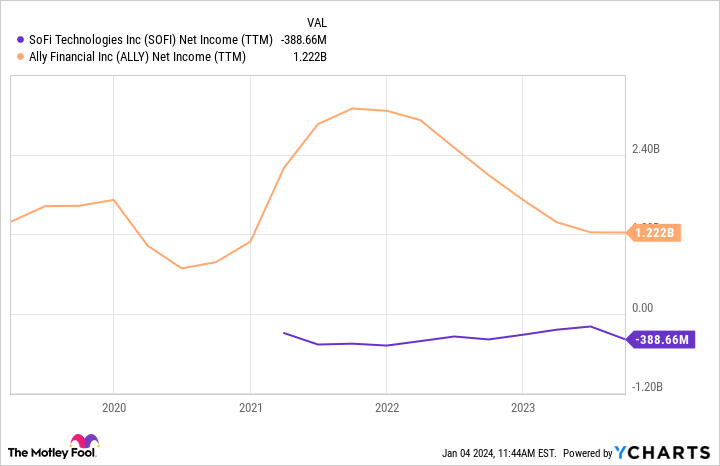

SOFI Net Income (TTM) data by YCharts.

Why it is a better buy than SoFi

Now, let’s get to SoFi. There are three reasons I think Ally is a better bet now for investors than SoFi. First is its profitability. Ally has been profitable for each of the past five years and generates more than $1 billion in earnings annually. SoFi has never generated a profit, and it had net losses of close to $400 million during the past 12 months.

Second, Ally has a longer track record of gaining depositors and making loans. Yes, SoFi has grown incredibly quickly recently, but that is likely due to its high marketing spending and the higher interest rates it pays on its savings accounts. Ally has increased its deposit base for more a decade, and has done so while generating a profit.

Last, Ally stock is cheaper than SoFi by price-to-book ratio — the standard metric for valuing a bank. Ally trades at a ratio of less than 1 while SoFi trades is at 1.6 — a 60% premium to Ally. Add it all up, and Ally Financial looks like the superior stock for investors to own in 2024.

Ally is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Secret recording of all-hands Alameda meeting played in court leaks online

An audio recording played in court on the seventh day of the SBF trial has surfaced online, revealing former Alameda Research deputy Caroline Ellison’s disclosure to employees about the misuse of customer funds days before Alameda’s collapse.

The recording, now available on SoundCloud, was posted by Insider reporter Sarah Gray on the evening of Oct. 12 and has since begun to make rounds on social media.

According to Ellison’s disclosure during the meeting, Alameda Research misused billions in FTX customer funds for high-risk venture investments and to service Alameda’s loans. The startling revelation came on the eve of Alameda’s collapse and the subsequent bankruptcy filings for FTX and affiliated companies.

Ellison previously testified about a series of crimes allegedly orchestrated and executed by ex-FTX CEO Sam Bankman-Fried. Ellison, having pleaded guilty to using billions from FTX users for Alameda’s benefit, claimed that Bankman-Fried had established the systems that facilitated these transactions. Ellison admitted to sending balance sheets that painted a less risky picture of Alameda than was accurate, contributing to a misunderstanding of Alameda’s financial health.

Ellison further testified that Alameda had received between $10 billion and $20 billion from FTX and third parties, with approximately $2 billion spent to repay loans, invest, and conduct stablecoin conversions. The remaining funds, she stated, were used for Alameda’s own purposes and other activities. Ellison’s revelations align with the testimony of FTX co-founder and former CTO, Gary Wang, describing an unlimited borrowing policy that allowed Alameda to withdraw coins even if these assets were not on hand.

Caroline Ellison has been among the government’s star witnesses in its case against the disgraced crypto mogul. She and Gary Wang both pled guilty to their respective charges stemming from the collapse of FTX in December 2022. Bankman-Fried has maintained his innocence.

The post Secret recording of all-hands Alameda meeting played in court leaks online appeared first on CryptoSlate.

Decentralized exchange (DEX) THORSwap has resumed operations after briefly going into maintenance mode due to detecting illicit funds on its platform.

THORSwap took to X (formerly Twitter) on Oct. 12 to announce that the platform is back online. The platform asked users to resume their regularly scheduled swapping of over 5,500 assets across 10 blockchains from their own self-custody wallets.

The protocol initially halted swaps on its platform on Oct. 6 as an immediate measure to counter the potential movement of illicit funds. THORSwap acknowledged that its DEX platform encountered illicit use and decided to pause to find a permanent solution to the misuse.

According to the latest announcement, THORSwap hasn’t applied any big changes on its platform other than the “shiny new terms of service.”

Updated on Oct. 11, THORSwap’s new terms of service read that users must comply with applicable laws like Anti-Money Laundering and agree to not engage or assist in any activity that violates sanctions programs or involves any unlawful financial activity. The updated terms also state that THORSwap reserves may restrict users from using the platform in case of violations, stating:

“THORSwap reserves the right to terminate your access to the THORSwap Services at any time, without notice, for any reason whatsoever, including without limitation a violation of these terms.”

The cryptocurrency community expressed outrage about THORSwap’s updated terms of use, with many questioning the platform’s “decentralized” status in the context of its new rules, which sound more like those on a centralized exchange.

“Is there any reason to use your services instead of a regular CEX? Did you just copy – paste their terms of service?” one X user asked.

According to ShapeShift founder Erik Voorhees, THORSwap is different from THORChain — the network it’s built on — in terms of centralization. THORSwap is a “centralized company that made a decision about their own interface,” while THORChain is decentralized.

You’re referring to Thorswap which is not Thorchain.

The former is a centralized company that made a decision about their own interface.

The latter is a decentralized protocol that isn’t censoring anything and can be accessed in myriad ways.

— Erik Voorhees (@ErikVoorhees) October 12, 2023

In addition to updating the terms of service, THORSwap said it has partnered with an “industry leader” to put some additional protections to prevent the flow of illicit funds. The protocol may still need to “fine tune things over the coming days,” the announcement added.

Related: Trader swaps 131K stablecoins for $0 during USDR depeg

THORSwap’s return came on the same day blockchain analytics firm Elliptic reported that the hacker of the now-defunct crypto exchange FTX had started moving the stolen funds in late September 2023. The transactions marked the first time those funds have been moved since the attack.

According to Elliptic, the anonymous hacker used THORSwap to convert 72,500 Ether (ETH), or about $120,000 million, into Bitcoin (BTC) before sending crypto to sanctioned cryptocurrency mixers like Sinbad.

A spokesperson for THORSwap stressed in a statement to Cointelegraph that FTX exploiter’s funds can be traced easily once they have been swapped to BTC. But once cryptocurrencies have gone through a mixer, they are no longer traceable.

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis

Text size

One ounce gold bars are available at Costco.

Chris Goodney/Bloomberg

By now, you might have heard that

Costco Wholesale

sells gold bars. But actually getting your hands on one may be harder than finding a pot of gold at the end of a rainbow.

The company started selling gold bars online in the past few months for about $2,000. They have become a fan favorite, garnering hundreds of five-star reviews and frequently selling out.

“I have wanted to purchase gold for some time now, but was never really confident about trusting a dealer,” reads one five-star review on

Costco

‘s website. “When I saw Costco carried this bar, I jumped on the opportunity because I trust Costco for vetting the vendor, and the price seemed really good!”

The gold bars have become so coveted they often sell out hours after they are listed on the website.

“When we load them on the site, they’re typically gone within a few hours, and we limit two per member,” Chief Financial Officer Richard Galanti said on a call with investors Tuesday.

The bars are currently available online only, but the company may test it in a few stores in the near future, said Josh Dahmen, Costco assistant vice president of financial planning and investor relations, on a call with Barron’s Thursday.

Costco members looking to stock up can buy a one-ounce bar of 24-karat gold from Pamp Suisse or from Rand Refinery for just under $2,000, according to a Yahoo Finance report. Because the bars are currently sold out, Barron’s couldn’t verify their prices, and Costco didn’t immediately provide the prices. List prices may be even lower for people holding Costco’s Executive Membership, which gives an annual 2% back reward on qualifying purchases.

While it may come as a surprise that a big-box retailer like Costco is selling gold bars, it isn’t unheard of. Competitor

Walmart

(WMT) has an array of gold bars on its website at similar prices to Costco.

The same one-ounce Pamp Suisse gold bar that Costco sells is listed for $1,952.99 on

Walmart

‘s website—and it is currently available for purchase. As of Thursday morning, Pamp Suisse bars were on sale at Canadian precious metal seller Kitco for $1,935.25 an ounce.

Gold tends to perform well in periods of economic uncertainty, and is often used as a hedge against inflation. Indeed, gold prices have been on a tear since the pandemic, creeping close to a record high earlier this year.

Prices have since come down—an ounce of gold priced at $1,890 Thursday, according to Nasdaq. But if Costco’s gold rush is anything to go by, many investors are still looking to build up a stash for a rainy day.

Write to Sabrina Escobar at sabrina.escobar@barrons.com

‘My in-laws are moving in with us, so I’d like them to inherit our home’: Should I download an online will?

Dear Quentin,

I have spoken with an attorney, but I see several online will services that are very inexpensive that include a will and a healthcare power of attorney. Is an online will service sufficient for most people? I am in the process of trying to figure out the best way to go about getting a will written as clearly and, hopefully, as affordably as possible.

Can my will specify that my life insurance and other money be used to pay off my mortgage, so I can then leave my home to a family member or friend?

“‘I plan to leave everything to my husband, but I would like my will to specify that if he predeceases me, our estate be split among others in our families.’”

I work as a consultant with my own LLC, taxed as an S corporation, but I have no employees. I live in sunny Florida. Outside of my business bank account, I believe my finances are fairly straightforward and typical — a few retirement accounts, one primary residence, an investment property, a term-life insurance policy. My husband and I have mortgages on two properties, but we should have our primary home paid off in about seven years.

I plan to leave everything to my husband, but I would like my will to specify that if he predeceases me, our estate be split among others in our families. My in-laws are moving in with us, so I would like them to inherit our home. We have no children but have very close relationships with our nieces and nephews.

I appreciate any guidance you have on writing a will.

Hoping This Won’t be Needed for a Very Long Time

Dear Hoping,

If you have a home and a business and enough assets to pay off your mortgage, pay for an attorney. You can scrimp on eating out or take one less vacation this year if you need to save money, but don’t scrimp on making sure your will is rock solid.

You should be able to find an attorney who can create a last will and testament for $300 to $500 and a durable power of attorney/living will for the same amount. The latter covers issues like end-of-life care and what happens if you become incapacitated.

You can instruct the executor of your will to use assets from your estate to pay off your mortgage, thereby allowing you to leave the house free and clear to a third party. Everyone should have a will, even people who are in their 20s and 30s or who don’t have children.

What’s more, if you leave your entire estate to your husband — that is, whatever you own that is treated as separate rather than community property — he too will need to make a will, and his may or may not align with your wishes.

“If you leave your separate property to your husband, he too will need to make a will, and his may or may not align with your wishes.”

A person making a will or signing a power of attorney must be of sound mind — also known as “testamentary capacity” — and not be under or subject to duress, restraint, fraud or undue influence. But laws do vary by state.

For example, in Pennsylvania, each spouse can write a separate will, but you can’t can’t create a will that cuts your husband out of all inheritance, according to Karen Ann Ulmer Attorneys at Law, which has offices in that state.

There are many cautionary tales of people who died without a will — like Prince and Michael Jackson — or decided to do an online will. One lawyer told me a wealthy client wrote a will with an online service, but he forgot to sign it.

If you die without a will or without a legal will — one that is not notarized or that has some other legal anomaly that invalidates it — it will be left up to the laws in your state to decide who gets what, which could get complicated if your husband dies before you do.

And when you do write a will, you should review it every three to five years. But here’s to many more years before your executor needs to step up to the plate.

“You can scrimp on eating out or take one less vacation this year if you need to save money, but don’t scrimp on making sure your will is rock solid.”

MarketWatch illustration

Readers write to me with all sorts of dilemmas.

By emailing your questions, you agree to have them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The Moneyist regrets he cannot reply to questions individually.

More from Quentin Fottrell:

Do children get 529 accounts in a divorce? My in-laws opened two plans for our kids, but their marriage is on the rocks.

I gave my daughter $5,000 for her divorce, but she lashed out when I refused to give her more. When will enough be enough?

He wanted nothing to do with me’: I discovered my biological father through Ancestry.com. Am I entitled to a share of his estate?

New law makes it harder for online sellers to hawk fake or stolen products

Shopping online has just gotten safer.

The INFORM Consumers Act, which went into effect Tuesday, aims to limit the sales of stolen and counterfeit products on e-commerce platforms.

The measure, which requires e-commerce sites to verify and disclose information about their high-volume third-party sellers, was passed into law following a lobbying campaign to address counterfeit products after being left out of the bipartisan Chips and Science Act last year.

All online marketplaces, including eBay, Etsy, Poshmark and Amazon’s third-party sales platform, will now be required to collect information from high-volume sellers, defined as those selling 200 items or more totaling at least $5,000 over the previous 12 months. These third-party sellers must submit information such as a government-issued ID, a bank-account number, a working email address and phone number, and a taxpayer identification number.

Customers will also be able to find the verified contact information for bigger third-party sellers — those with sales of over $20,000 a year — and to get in touch with them outside of the e-commerce platform. In the past, consumers often had to engage within the platform operator in order to communicate with a seller.

Those bigger sellers will also have their full names and physical addresses listed on their product pages in addition to their contact information, according to the Federal Trade Commission’s business guide.

“This is a game changer,” said Teresa Murray, director of the consumer watchdog office at U.S. PIRG, a nonprofit that lobbies on behalf of the public interest. “For bad guys, stealing items has generally been the difficult part. Selling things online once you’ve stolen them is easy. We hope that with the INFORM Act, it’s not nearly as easy in the future.”

“‘The only people opposing this may be thieves.’”

— Teresa Murray, U.S. PIRG

The act goes into effect just weeks before Amazon Prime Day, when the world’s biggest e-commerce site rolls out discounts for Prime members. This year, Prime Day will be held over two days, on July 11 and 12.

Picks: Amazon Prime Day is July 11-12. You’ll need the $139-a-year Prime membership to access the deals, but is it actually worth it?

Also see: Amazon sued by FTC, which alleges people were ‘tricked and trapped’ into Prime subscriptions

Several e-commerce platforms, including Amazon and eBay, supported the INFORM Consumers Act. TechNet, a national network of technology CEOs and senior executives representing what it calls the innovation economy, wrote to leaders in Congress last December, saying the law would improve consumer safety and increase transparency.

In a statement provided to MarketWatch, eBay

EBAY,

said it “fully supports transparency and is committed to a safe selling and buying experience for our customers. We were proud to support” the law “to protect consumers from bad actors who seek to misuse online marketplaces, while also ensuring important protections for sellers. We are fully prepared to comply with the new law.”

Etsy

ETSY,

said it “has long been supportive of the INFORM Act passing into law, as a balanced and thoughtful approach to make the ecommerce landscape safer for both consumers and sellers.” In a statement provided to MarketWatch, the company said, “We are taking appropriate steps to comply with the INFORM Act requirements.”

Amazon

AMZN,

and Poshmark, owned by South Korea–based Naver Corp.

035420,

did not immediately respond to MarketWatch requests for comment.

Some analysts, however, said the new law lacks stronger protections that were included the SHOP SAFE Act, an earlier bill that did not get passed by Congress. The INFORM Act, they noted, does not hold online platforms liable when a third party sells harmful counterfeit products or when the platform has not followed certain best practices.

“Notably, the legislation is supported by Amazon and other marketplaces as it’s seen as a watered-down bill that would head off more stringent legislation like the SHOP SAFE Act,” Ben Koltun, director of research at Beacon Policy Advisors, wrote in a note last year.

So how can consumers spot counterfeit or stolen items? A guide from PIRG has tips, such as keeping an eye out for products with suspiciously low prices or featuring misspellings or mislabeling or low-quality, photoshopped photos in their listings.

PIRG also cautions consumers about purchasing medications online. Always check the legitimacy of online pharmacies, it says.

“Many online marketplaces haven’t been doing enough to protect consumers from sellers who appear to be peddling stolen or counterfeit goods,” Murray said. “The only people opposing this [new law] may be thieves.”

Victor Reklaitis contributed.

TikTok Moves to Expand Online Retail Shop with New E-Commerce Initiative

The new shopping feature introduced by TikTok is limited to UK users for now.

TikTok, the popular video-sharing social media platform, is taking a big step into the world of e-commerce with its latest shopping venture. The company has recently introduced a new in-app feature called “Trendy Beat”, which serves as a gateway to a world of trending and popular items.

TikTok Unlocking a New E-Commerce Experience

The new shopping feature allows users to explore and purchase a wide selection of products featured in viral videos, such as ear wax extraction tools and fashionable apparel. The company has chosen the United Kingdom as the testing ground for its “Trendy Beat” shopping feature. The move allows TikTok to gather valuable insights and fine-tune the user experience before a potential global expansion.

While the new e-commerce feature is limited to UK users for now, the company said it is designed to leverage the TikTok influence on consumer behavior to provide users with a seamless and immersive shopping experience within the app.

The company has also recently filed a trademark application for its Trendy Beat in the United States, indicating a potential expansion to the country and promising a broader audience the opportunity to be part of the Trendy Beat shopping experience.

The trademark application covers many apparels, including dresses, scarves, hats, footwear, bathing suits, sleep masks, sweaters, skirts, and shirts.

TikTok to Ship Items from China

According to an earlier Financial Times report, all advertised items on Trendy Beat will be shipped and sold by an undisclosed subsidiary of ByteDance, TikTok’s parent firm. The company confirmed the news with TechCrunch on Thursday.

With TikTok’s deep understanding of product trends and user behavior, ByteDance aims to leverage its massive user base to sell its products through the platform. The Beijing-based firm plans to acquire or manufacture the items based on trends and user preferences. This ambitious move is internally referred to as “Project S”.

The new business initiative challenges traditional retail models and positions TikTok to compete with industry giants like Amazon and Shein. The social media platform aims to establish itself as a dominant player in the e-commerce sector by capitalizing on its user base’s influence and engagement.

TikTok’s influence on consumer behavior is unparalleled, and its impact on shopping habits is undeniable. The phrase “TikTok made me buy it” has become a cultural phenomenon, showcasing the platform’s ability to drive impulse purchases and shape consumer preferences.

However, introducing the new shopping feature is set to change the dynamic of its current e-commerce strategy as it plans to sell its own products. The current TikTok Shop marketplace allows other brands to leverage its popularity to sell their products to users within the app.

With billions of views and a massive audience, TikTok’s integration of the Trendy Beat shopping section aims to amplify its influence further and strengthen its position in the online retailing business.

TikTok Chief Operating Officer Steps Down

Meanwhile, TikTok’s chief operating officer V Pappas has resigned after five years of service. According to the announcement, the Australian-born COO stepped down to refocus on her entrepreneurial passion.

“Given all the successes reached at TikTok, I finally feel the time is right to move on and refocus on my entrepreneurial passions,” said Pappas.

Before her departure, the company’s CEO, Shou Chew, announced in a letter to employees that Zenia Mucha would join the TikTok team as chief brand and communications officer.

next

News, Social Media, Technology News

Chimamanda is a crypto enthusiast and experienced writer focusing on the dynamic world of cryptocurrencies. She joined the industry in 2019 and has since developed an interest in the emerging economy. She combines her passion for blockchain technology with her love for travel and food, bringing a fresh and engaging perspective to her work.

You have successfully joined our subscriber list.