On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

Source link

Open

Ethereum has, for the most part, established a foothold above the $3,500 price level throughout the week as investors continue to anticipate a return to the $4,000 mark. Interestingly, the optimism has seen the open interest of Ethereum surging to new highs. The surge in open interest, although a bullish sentiment indicator, can also serve as a bearish signal of an impending change in market trend.

Ultimately, this metric added to the current dynamics of the Ethereum ecosystem, including regulatory uncertainty and scalability concerns hinting at a complicated price trajectory for the price of Ethereum.

Ethereum Open Interest Reaches New High

Open interest is an efficient method for tracking the total number of open positions in a particular contract. Recent market dynamics and institutional investor interest have seen the total open interest in Ethereum futures surging above records set in the 2021 bull market phase.

According to data from Coinglass, the open interest on Ethereum futures, which has been on a surge since February 5, recently set a new high of $14.11 billion on March 15. This wasn’t particularly surprising, as a strong buying momentum from the bulls in the prior days saw the price of Ethereum surging past the $4,000 mark for the first time in two years.

However, Ethereum has since reversed from the $4,000 price level and is currently trading below $3,600. On the other hand, the total open interest on Ethereum contracts has maintained around its all-time high level, which allowed it to cross over $14.10 billion again on March 28. The open interest weighted average also went up to 0.0462%, indicating an increase in the demand for leveraged ETH long positions.

The majority ($4.55 billion) in the Ethereum futures market were registered on cryptocurrency exchange Binance. Bybit and OKX came in second and third, with $2.39 billion and $1.94 billion respectively. Interestingly, CME’s Ether futures also surged to $1.3 billion. At the time of writing, the CME’s Ether futures now sit at $1.31 billion, reiterating the committed bullishness among institutional investors.

What’s Next For ETH?

Ethereum has been trading flat since the beginning of the week and is currently on a 0.78% gain in the past seven days. All eyes are now on reports of the SEC looking into Ethereum’s security status, the industry awaits an official ruling similar to the one that was handed down in the XRP case that will finally provide clarity to the regulatory landscape.

At the same time, investors continue to await the SEC’s decision regarding the applications of Spot Ethereum exchange-traded fund (ETF) in the US. According to a Bloomberg senior analyst, the likelihood of approval is only 25%.

ETH price drops to $3,500 | Source: SHIBUSD on Tradingview.com

Featured image from Money, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Dogecoin open interest rose to a new all-time high earlier in March, and while there has been a small retracement, the open interest has continued to maintain very high record levels since then. Given this continuous high level, it could point to where the price of the meme coin is headed next using historical data.

Dogecoin Open Interest Maintains High Level

Open interest is a measure of the total number of futures or options contracts of a particular coin in the market at a give time. It can help to tell how much money is flowing into that particular asset, thereby revealing if there a high or love interest in the asset.

On Dogecoin’s part, its total open interest has been rising over the last few months, especially as the crypto market recovered, as shown by data from Coinglass. A natural consequence of this was that the price was also climbing at the same time as the open interest and thus, there is a high correlation between open interest and price.

The DOGE open interest hit a new all-time high of $1.47 billion on March 5, and the meme coin has not looked back since. Despite a small decline in the following days, the open interest is rising once again, reaching $.144 billion on March 14 and taking the price with it.

While the rise in open interest does point to a lot of bullishness in the market, historical performance during times like these also calls for caution. Taking a look at what happened the previous times that the Dogecoin open interest hit new all-time highs could give an idea of where the price is headed next.

Where Can DOGE Go From Here?

Over the years, there have been various points at which the Dogecoin open interest has reached new all-time highs and a trend has emerged, in a manner of speaking. Looking as far back as 2021 when the open interest hit ATHs multiple time, this trend plays out similarly.

A sustained rise until a new all-time high is reached, with the price rising along, and then followed by a crash in open interest, as well as price. This was the case in September 2021 when the open interest reached a new all-time high and then again in November 2021 when it clocked another ATH.

Moving forward, the same trend is seen in October 2021 when the DOGE open rose close to its previous all-time high, but ended the same way as the previous ones – with a crash. These crashes almost always affect the DOGE price as well, causing it to drop to the levels before the surge in open interest.

If this pattern holds this time around, then a crash might be ahead for the Dogecoin open interest and the DOGE price by extension. A likely scenario is a 20% drop that could send the DOGE price back toward $0.15 before the crypto market picks up steam once again.

DOGE bulls hold up price | Source: DOGEUSDT on Tradingview.com

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin leverage again flushed at US Market Open as inflation rises, misses estimates

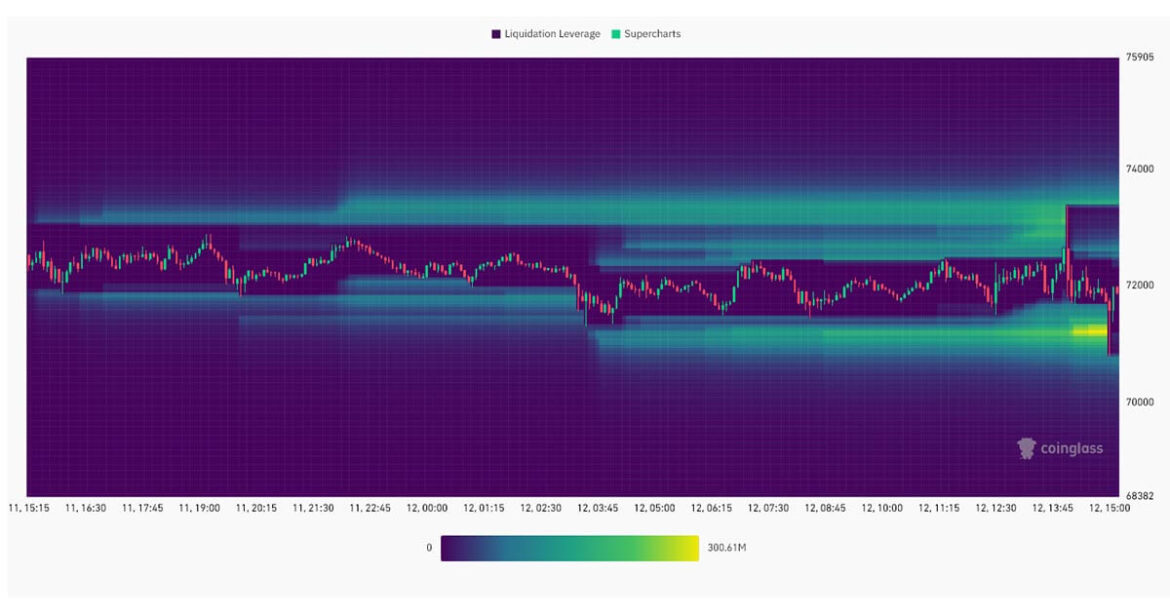

In the wake of new inflation data, the crypto market experienced $164.52M in liquidations over the past 12 hours, with $119.88M in long positions and $44.64M in short positions being flushed out. Bitcoin accounted for $48.31M of the total liquidations.

The US Market Open again seemed to be a bigger catalyst than inflation data as the open saw another leverage sweep, aligning with yesterday’s analysis of crypto leverage. Bitcoin rose by 1 % to create a new all-time high of $72,940, followed by a decline to $70,900 before returning to around $71,880 as of press time.

The US annual inflation rate unexpectedly increased to 3.2% in February, surpassing forecasts of 3.1% and rising from January’s 3.1%, per the US Bureau of Labor Statistics. The monthly inflation rate also rose to 0.4% from 0.3%, with shelter and gasoline prices contributing over 60% of the increase.

Despite the higher-than-expected inflation figures, core inflation eased slightly to 3.8% from 3.9%, compared to forecasts of 3.7%. The monthly core inflation rate remained steady at 0.4% instead of the predicted 0.3%.

| Calendar | GMT | Reference | Actual | Previous | Consensus | TEForecast |

|---|---|---|---|---|---|---|

| 2024-02-13 | 01:30 PM | Jan | 3.1% | 3.4% | 2.9% | 3.1% |

| 2024-03-12 | 12:30 PM | Feb | 3.2% | 3.1% | 3.1% | 3.2% |

| 2024-04-10 | 12:30 PM | Mar | 2.6% |

(Source: Trading Economics)

However, Aurelie Barthere, Principal Research Analyst at Nansen.ai, does not expect the US CPI release to end the crypto bull market or significantly impact prices in the coming weeks, according to comments made to CryptoSlate. She attributes this to the strong bullish momentum in the crypto space, citing recent announcements such as BlackRock allocating its own BTC ETF to two of its asset management funds.

Barthere anticipates a repricing of expected Fed rate cuts, with future markets likely to adjust from four rate cuts to two or three by December 2024. She said,

“We do not expect a significant sell-off for crypto as this repricing has happened in the past few months without questioning the bull market “

The post Bitcoin leverage again flushed at US Market Open as inflation rises, misses estimates appeared first on CryptoSlate.

Bitcoin setting a new all-time high and breaking above $72,000 is a significant milestone for the market. Riding the wave of increased institutional interest in spot Bitcoin ETFs, it smashed through the $68,000 ceiling established in November 2021 after a brief correction to $59,000 and seems to be gearing up for more gains this week.

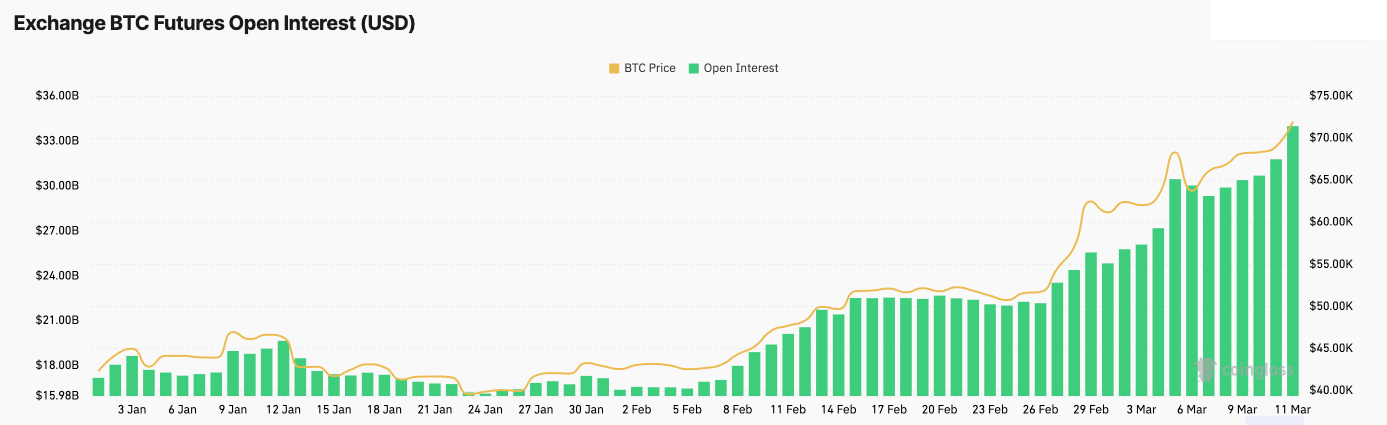

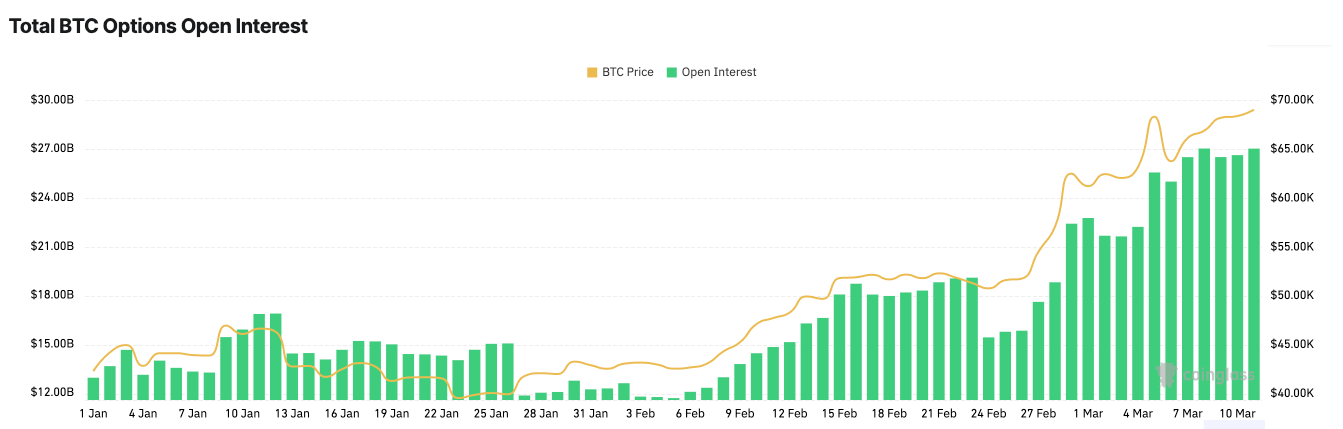

This week, the potential for more volatility is seen in the derivatives market, which peaked as Bitcoin touched $71,400. Since the beginning of the year, Bitcoin futures and options markets have seen unprecedented growth, with open interest reaching new highs on Mar. 11. Analyzing open interest is crucial for understanding market health and trader expectations. While spikes in open interest always follow price volatility, the intensity of the spikes can be a telling sign of just how leveraged the market is.

Futures open interest reached its all-time high of $33.48 billion in the early hours of Mar. 11 — almost double the $17.20 billion it posted on Jan. 1.

Options open interest reached their all-time high on Mar. 8 with $27.02 billion. A foothold seems to have been established at above $27 billion, with open interest remaining stable at $27.01 by Mar. 11. This is a significant increase from the $12.93 billion in open interest at the beginning of the year.

The growth in open interest shows a rapidly increasing appetite for derivatives. Futures and options provide traders with sophisticated strategies that allow them to hedge their positions and speculate on price movements.

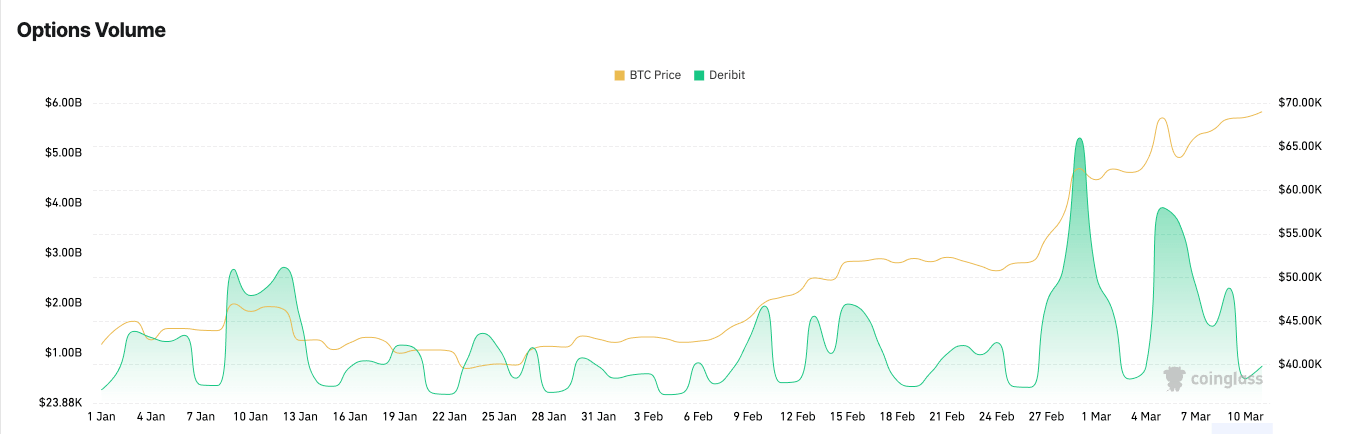

The dominance of call options, with open interest and volume percentages consistently favoring calls over puts (61.66% vs. 38.34% for open interest and 59.43% vs. 40.57% for volume), shows an overwhelmingly bullish outlook among traders. This means that most of the market is speculating on further price increases.

Significant spikes in options volume on Deribit around key dates show the derivative market’s reactive nature to Bitcoin’s price movements. Data from CoinGlass showed notable spikes in volume on Feb. 29 ($5.30 billion) and Mar. 5 ($3.91 billion), correlating with periods of intense price volatility.

Bitcoin breaking through important resistance levels played a pivotal role in this spike. Each resistance point crossed market new heights of market optimism and triggered increased trading activity as the market adjusted its positions to capitalize on the bullish momentum or protect against a potential downturn.

The rapid rise in interest in derivatives has led to the convergence of open interest in futures and options. While futures and options OI are yet to reach parity, the difference between the two is currently unprecedently low. Historically, futures open interest has been significantly higher than that of options, as futures provide a direct mechanism for hedging and speculation without the complexity of options strategies.

However, Bitcoin’s performance this year seems to have attracted many advanced traders looking for more versatile trading strategies than futures. Options are considered more sophisticated trading instruments, allowing traders to hedge their positions, speculate on price movements with limited downside risk, and generate income through strategies such as covered calls and protective puts. As investors become more knowledgeable and confident in using options, the demand for these instruments increases, leading to a rise in open interest.

Moreover, the current market conditions—high volatility and record prices—make options particularly appealing. Options can provide leverage similar to futures but with the added advantage of predetermined buyer risk. In a rapidly appreciating market, options allow investors to speculate on continued growth or protect against a potential downturn without committing as much capital as required for a futures position.

The balancing of open interest in futures and options also suggests that the market is at a crossroads, with investors divided in their outlook. While some may view the current price levels as sustainable and indicative of further growth, others might see it as overextended, warranting caution and using options for risk management.

The implications for future price movements are twofold. On the one hand, the robust derivatives activity indicates a healthy market with deep liquidity and sophisticated participants, potentially supporting further price increases. On the other hand, the high degree of leverage drastically increases the risks of market corrections — with tens of billions worth of derivatives on the line, even smaller drawdowns have the potential to turn into massive volatility.

The post Open interest reaches all-time high as Bitcoin touches $72k appeared first on CryptoSlate.

Bitcoin Futures Market Attracts Unprecedented Open Interest as Derivatives Appetite Grows

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

Source link

Want free tax prep from the IRS? Direct File will open soon in these 12 states.

The Internal Revenue Service’s free tax-prep platform will soon be open for business.

After slowly increasing capacity on its Direct File platform, the IRS will make the platform available to a wider audience on Monday, the agency said.

The platform is expected to be fully up and running on March 12. The pilot program can only prepare relatively basic tax returns, and it will only be available to eligible taxpayers in 12 states: Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington state and Wyoming.

But Direct File marks the widespread debut of a free, government-run answer to mass-market online tax preparation from commercial providers like TurboTax

INTU,

and H&R Block

HRB,

Regulators at the Federal Trade Commission have alleged that both TurboTax and H&R Block misled consumers about the extent of their free tax-preparation services. Both companies deny the allegations.

There are other free tax-filing options out there, including the IRS Free File program. That’s an IRS partnership with tax-software companies available to taxpayers with incomes of up to $79,000.

The IRS Direct File program has no income limits, just like the free tax-prep programs from H&R Block

HRB,

and TurboTax

INTU,

But all three can only be used for certain types of tax returns, mostly simple ones.

The IRS has slowly rolled out Direct File, making it available to taxpayers for certain hours of the day. Starting March 4, it will be available to new users 24 hours a day every day, according to an IRS official.

However, people who want to use the platform should look for a notice at the top of the site saying it’s open. The platform may be temporarily unavailable at times if too many users take up all the available slots for a given day, the official said.

“But more spaces will be added every day, and our goal is to ensure that all taxpayers who are interested and eligible can try out Direct File for themselves,” the IRS official added.

Someone who has already started a tax return can keep working on it even if the site isn’t accepting new users, according to the IRS.

Users in Arizona, California, Massachusetts and New York — the four states on the list with a state income tax — can also be connected to free online preparation of their state returns. Direct File can also help users in Washington state who are eligible for a certain tax credit.

The Direct File program can handle returns with W-2 job wages, common credits like the child tax credit and the student-loan interest deduction. It can’t support returns that need to report capital gains or independent-contractor income.

People who plan to use Direct File should be ready to answer eligibility questions when they log on to the program. IRS officials who designed the platform said they wanted to ask up front to quickly sort out people who cannot use the service.

The IRS began accepting and processing 2023 tax returns on Jan. 29. It has now processed over 44 million returns through late February, agency statistics show. Taxpayers are receiving an average refund of $3,213, which is more than 4% higher than the average amount at the comparable point last year.

Bitcoin Futures’ Open Interest Reaches Lifetime High, Surpassing 2021 Bull Run

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Source link

Open interest, the total number of outstanding derivative contracts that have not been settled, is an important metric for gauging market health and sentiment. An increase in open interest means new money entering the market, showing heightened trading activity and interest in Bitcoin. Conversely, a decline suggests closing positions, potentially indicating a change in market sentiment or a consolidation phase. Monitoring these trends is important for understanding the liquidity, volatility, and future price expectations in the market.

In a bullish market, an increase in open interest often correlates with rising prices, suggesting that new money is betting on further price appreciation. This scenario typically reflects a strong market sentiment and investor confidence in Bitcoin’s upward trajectory. On the other hand, in a bearish context, growing open interest might indicate that investors are hedging against expected price declines, revealing a more cautious or negative market outlook.

Furthermore, the balance between call and put options within the open interest provides deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many investors expecting price rises, whereas a majority of puts can indicate bearish expectations.

February saw a significant increase in open interest for Bitcoin futures and options.

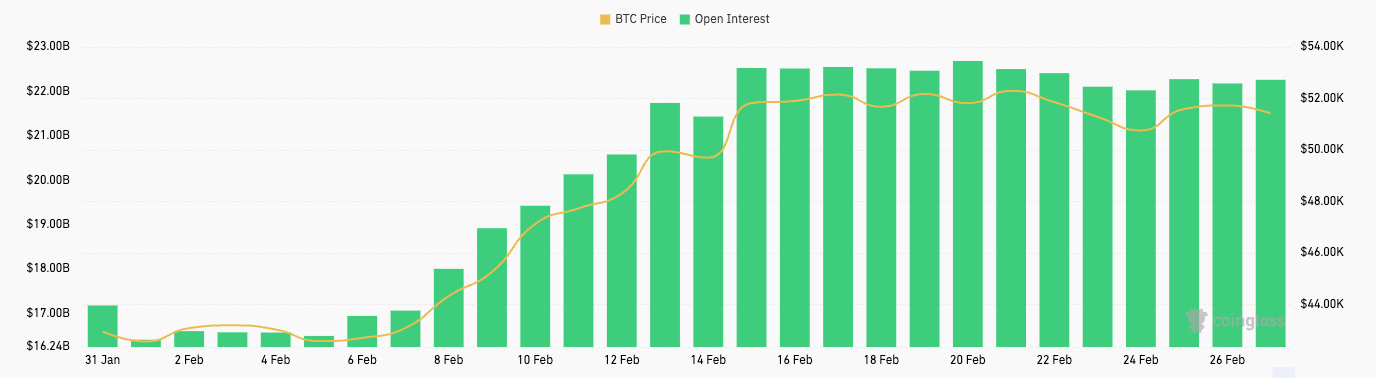

From Feb. 1 to Feb. 20, Bitcoin futures open interest grew from $16.41 billion to $22.69 billion. This substantial rise suggests that traders were increasingly entering into futures contracts, anticipating higher volatility or making directional bets on Bitcoin’s price. Interestingly, this period aligns with a notable increase in Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The slight decrease in open interest by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s price to $51,716, could indicate some traders taking profits or closing positions in anticipation of a consolidation phase or to reduce exposure ahead of potential volatility.

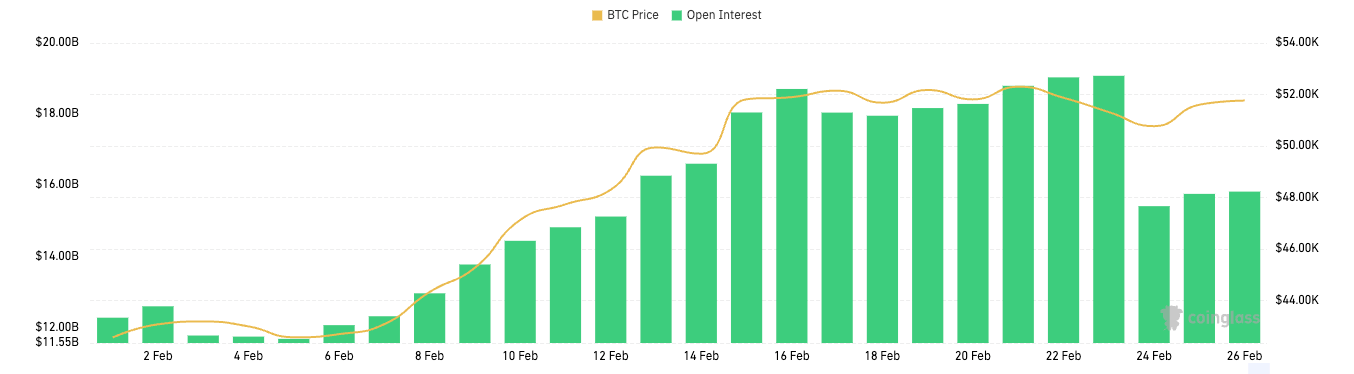

Similarly, Bitcoin options open interest saw a dramatic increase from $12.27 billion at the beginning of February to a peak of $19.08 billion by Feb.23 before dialing back to $15.82 billion towards the month’s end. Options provide the holder the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a specified price, offering more complex strategies for traders to express bullish or bearish views or to hedge existing positions. The initial spike in options open interest reflects a robust engagement from investors, leveraging options for directional bets on Bitcoin’s price and protective measures against potential downturns.

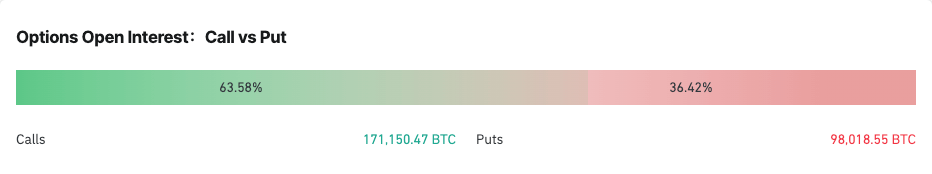

The ratio between calls and puts for Bitcoin options provides a deeper insight into market sentiment and potential expectations for Bitcoin’s price direction. The distribution between calls and puts is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising prices and puts on falling prices.

As of Feb. 26, the open interest in Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This distribution reinforces the bullish sentiment observed through the increase in options open interest earlier in the month. A predominance of calls in the open interest suggests that a significant portion of market participants were expecting Bitcoin’s price to continue rising or were utilizing calls to hedge against other positions.

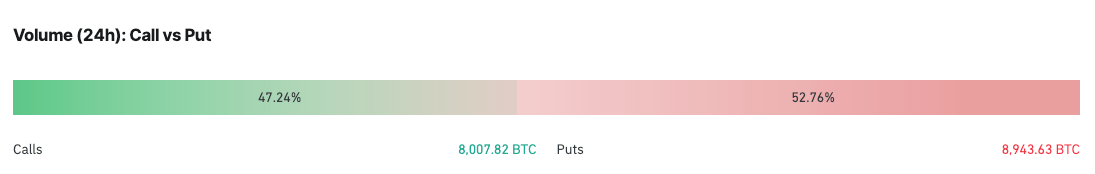

However, the 24-hour volume tells a slightly different story, with calls accounting for 47.24% and puts for 52.76%. Compared to the overall open interest, this shift towards puts in the daily trading volume might indicate a short-term increase in caution among traders. It suggests that within the last 24 hours, there was a noticeable pick-up in defensive strategies or bearish bets.

The immediate implication for Bitcoin’s price is a potential increase in volatility. The bullish sentiment, as evidenced by the growing open interest and high proportion of calls, supports a continued positive outlook among many market participants. However, the recent uptick in puts volume may signal upcoming price fluctuations as traders adjust their positions in anticipation of or in response to new information or market trends.

Considering these, the market appears to be at a crossroads, with a strong bullish sentiment tempered by short-term caution. This scenario often precedes periods of heightened volatility as conflicting expectations play out through trading activities.

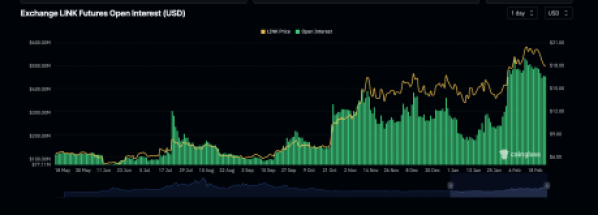

Chainlink Open Interest Sitting At Record Levels, What This Means For Price

Chainlink has seen its open interest spike significantly in the month of February, so much so that it has reached new all-time highs. This trend has not waned despite the decline in the price of the cryptocurrency, which could paint a rather bullish picture for the LINK price going forward.

Chainlink Open Interest Crosses $450 Million

The Chainlink open interest ended the month of January on a high note and carried this trend into the month of February. A major jump was seen between January 31 and February 3 when the open interest went from below $250 million to more than $320 million.

In the days following this, the open interest continued to rise, and eventually hit a peak of $533 million. This was significant because it was not just the highest point for the year but it is the highest that the open interest has ever been for the asset.

Source: Coinglass

As expected, the price would quickly rise to keep up with the open interest as investors continued to place their bets on the price. There has been a retracement in the open interest. However, Chainlink has continued to maintain more than $450 million in open interest since February 12.

Currently, Coinglass data shows that the Chainlink open interest is $456 million as of February 23, continuing to maintain a high level. Given this, it might be prudent to look at how the LINK price has reacted in the past when open interest remained elevated.

Historical Performance Of The LINK Price

While the Chainlink open interest is at record levels, there have been times in the past where the open interest had been elevated for a period of time like it is now. So, how the price reacted during those periods could provide a pointer for how it might perform now.

The last time that the open interest was this elevated for a long period of time was back in October-November 2023 when open interest more than doubled. It would maintain this elevated level for almost a month, but at the end of it, the LINK price would react positively and saw a price surge from $11 to $15, which was a 36% increase in price.

If this scenario were to repeat now, then a 36% increase would send the LINK price to $24. This is not particularly hard to believe, given that the LINK price had topped out at $52 in the last bull market. So, such a move would still leave it 50% below its all-time high levels.

On the flip side of this, the open interest levels could also taper off, as was seen in November 2023. This could see the LINK open interest lose its hold on the $450 million that it maintained in February and fall toward $400 million before recovering again.

LINK price shows strength at $17.9 | Source: LINKUSD on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.