Options reportedly include selling the entire exchange, including its extensive customer base of over nine million, to potentially forming a partnership with another entity to revive the platform.

Beyond its crypto options offerings, the exchange has set its sights on obtaining a brokerage license in the European Union (EU).

Deribit, one of the world’s leading crypto options exchanges, has recently made a significant announcement that it is set to introduce options contracts linked to three prominent alternative cryptocurrencies: XRP, Solana (SOL), and Polygon (MATIC).

This expansion initiative comes on the heels of Deribit’s continued efforts to cater to the evolving needs of crypto traders.

In September, Deribit accounted for an impressive 86% of the global crypto options market, a testament to the exchange’s dominance in this segment. This latest expansion demonstrates Deribit’s commitment to staying at the forefront of innovation in the crypto derivatives space.

Unlike traditional options that involve complex calculations related to deltas and implied volatility, linear options have a linear payout structure. This means that the payout to the option holder is directly proportional to the price movement of the underlying asset. This simplicity can attract both experienced options traders and newcomers to the world of crypto derivatives.

Traders who are actively involved in altcoin trading have traditionally relied on options linked to more established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) to hedge their positions. However, with the introduction of XRP, SOL, and MATIC options, these traders now have more tailored and versatile tools at their disposal for managing risk within the altcoin space.

Beyond its crypto options offerings, the exchange has set its sights on obtaining a brokerage license in the European Union (EU). This move demonstrates Deribit’s commitment to regulatory compliance and providing a secure and trusted trading environment for its users.

A brokerage license in the EU would open up new avenues for Deribit, allowing it to expand its services and cater to a wider audience. It would also signal to traders that the exchange is committed to adhering to the highest standards of transparency and governance.

Deribit’s recent announcement is just one piece of the puzzle in the exchange’s ongoing efforts to enhance its services and offerings. In a strategic move aimed at further diversifying its product portfolio and catering to the evolving needs of crypto traders, Deribit previously unveiled the launch of a zero-fee spot trading exchange.

This new offering marks a significant milestone in Deribit’s journey to provide a comprehensive suite of trading opportunities for its clients. The addition of a zero-fee spot exchange complements the existing derivatives and options products, positioning Deribit as a one-stop shop for crypto trading.

Crypto enthusiasts and traders worldwide will be keeping a close eye on Deribit’s journey and eagerly anticipating further updates from the exchange. With these recent developments, Deribit solidifies its position as a key player in the crypto derivatives market, making it an exciting platform to watch in the months and years ahead.

next

Altcoin News, Blockchain News, Cryptocurrency News, Market News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Options traders are bracing for an outsize swing in Nvidia Corp.’s stock price after the chip giant’s earnings report Wednesday afternoon.

So-called straddle prices in the options market can be used to calculate an implied move for an underlying stock. A straddle is an options strategy in which a trader buys a call option and a put option at the same strike price with the same expiration date.

In the case of Nvidia

NVDA,

the market is pricing in a roughly 11% move in response to the coming earnings, according to Garrett DeSimone, the head of quantitative research at OptionMetrics. He said the average move for Nvidia is between 7% and 8%, “so this is definitely outside the norm.”

The implied move translates to a stock price of about $507 on the upper end and $406 on the lower end, DeSimone told MarketWatch. Someone who employed the straddle would make money if Nvidia’s stock finishes Thursday’s session above the upper point or below the lower point.

Nvidia earnings: What Wall Street expects from the AI-chip giant

There is more at stake with Nvidia’s report than just the company’s own stock price, however, according to DeSimone.

“There’s been a lot of bullish sentiment surrounding Nvidia,” he said. “A lot of market correlation hinges on this.”

More from MarketWatch: How Nvidia’s Jensen Huang may be driving Fed rate-hike expectations

Given a belief that artificial-intelligence fervor has helped power the market higher in the past year, disappointing news “could be the start of something not so great.”

Nvidia is expected to clear its current quarterly revenue record by a wide margin when it delivers results, and demand doesn’t seem to be an issue for the company. Rather, amid rumblings of supply constraints, analysts will be looking to see how the company is striking a balance and gauge management’s expectations for its ability to meet demand for Nvidia hardware.

See more: Nvidia earnings to offer first true glimpse of the AI windfall

Don’t miss: Why Nvidia’s earnings could be a positive signal for Super Micro no matter what

The implied volatility (IV) for Bitcoin options decreased significantly in July.

The IV for Bitcoin options on Aug. 3 is as follows:

| Expiry Period | Percentage |

|---|---|

| 1-Month Expiry | 32.73% |

| 3-Month Expiry | 37.78% |

| 6-Month Expiry | 44.07% |

Implied volatility is a metric that represents the expected percentage change in the price of Bitcoin over a year, with a 68% probability. Essentially, it represents the market’s expectation of Bitcoin’s volatility over the duration of the option.

The increasing IV for longer-dated Bitcoin options suggests that the market is expecting greater price uncertainty or volatility in the longer term. This pattern is known as “volatility skew.”

However, the decrease in IV in July indicates that the market’s expectation of Bitcoin’s price volatility has reduced for the near term.

The post Options implied volatility drops but market still expects turbulence appeared first on CryptoSlate.

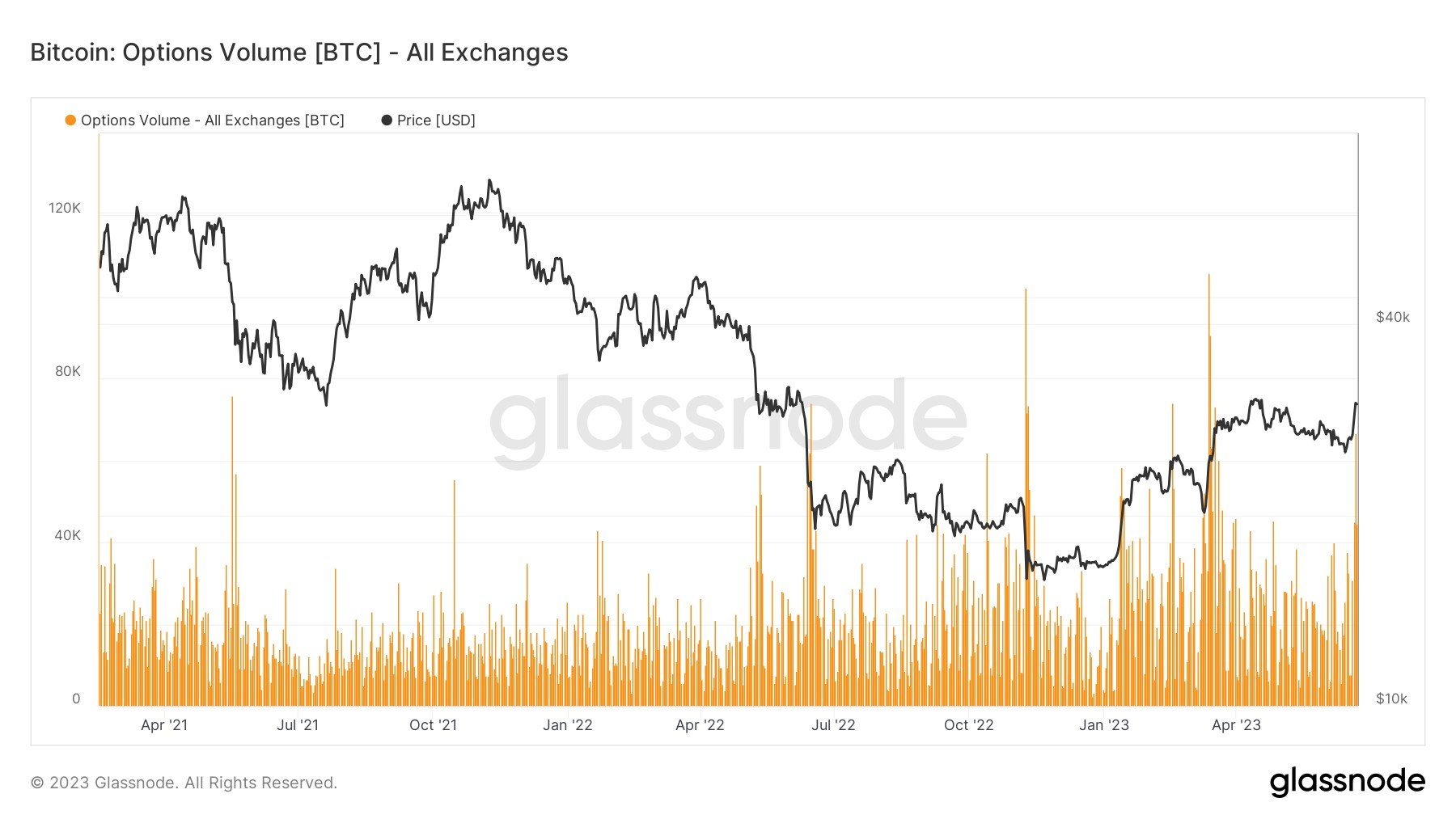

On June 21, the volume of Bitcoin (BTC) options soared to a level not seen in the last three months. Around 67,000 Bitcoin were involved in options contracts, indicating substantial participation in this type of digital asset trading.

Market analyst Alessio Urban believes the recent surge of Bitcoin to $30,000 is mainly due to a notable increase at the $30,000 strike price. This significant rise has undoubtedly played a pivotal role in reshaping the existing cryptocurrency market.

A deeper look into the market shows that the total worth of open-interest contracts was an impressive $10.8 billion. This statistic enhances our understanding of Bitcoin’s current market performance.

An additional key point to note is the massive options expiration set for the end of June, worth over $4.3 billion. Given the current put-to-call ratio standing at 0.5 and the max pain price set at $25,000, this upcoming event is likely to have a substantial effect on the market activity of Bitcoin as we approach the end of the month.

The post Bitcoin options volume skyrockets as June expirations loom appeared first on CryptoSlate.