Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Source link

outflow

Quick Take

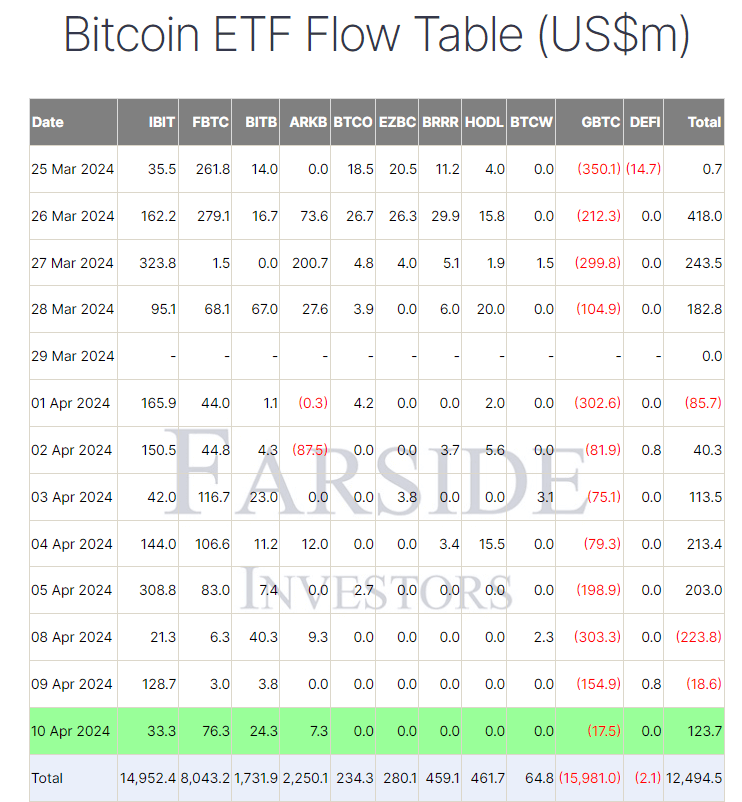

Farside data indicates that Bitcoin (BTC) Exchange-Traded Funds (ETFs) experienced a significant inflow of $123.7 million on Apr. 10, following a period of consecutive outflows. Notably, the Grayscale GBTC ETF saw its lowest outflow at just $17.5 million since launch. However, its total outflows reached $15,981.0 billion.

Farside data highlights that among the BTC ETFs, including BlackRock IBIT, Fidelity FBTC, ARK’s ARKB, and Bitwise BITB, which have seen the most significant inflows, only these four registered positive inflows on Apr. 10. Leading the group was FBTC, with an inflow of $76.3 million, its largest since Apr. 5, pushing its total inflows to $8,043.2 billion. The total net inflows to Bitcoin ETFs now stand at $12,494.5 billion.

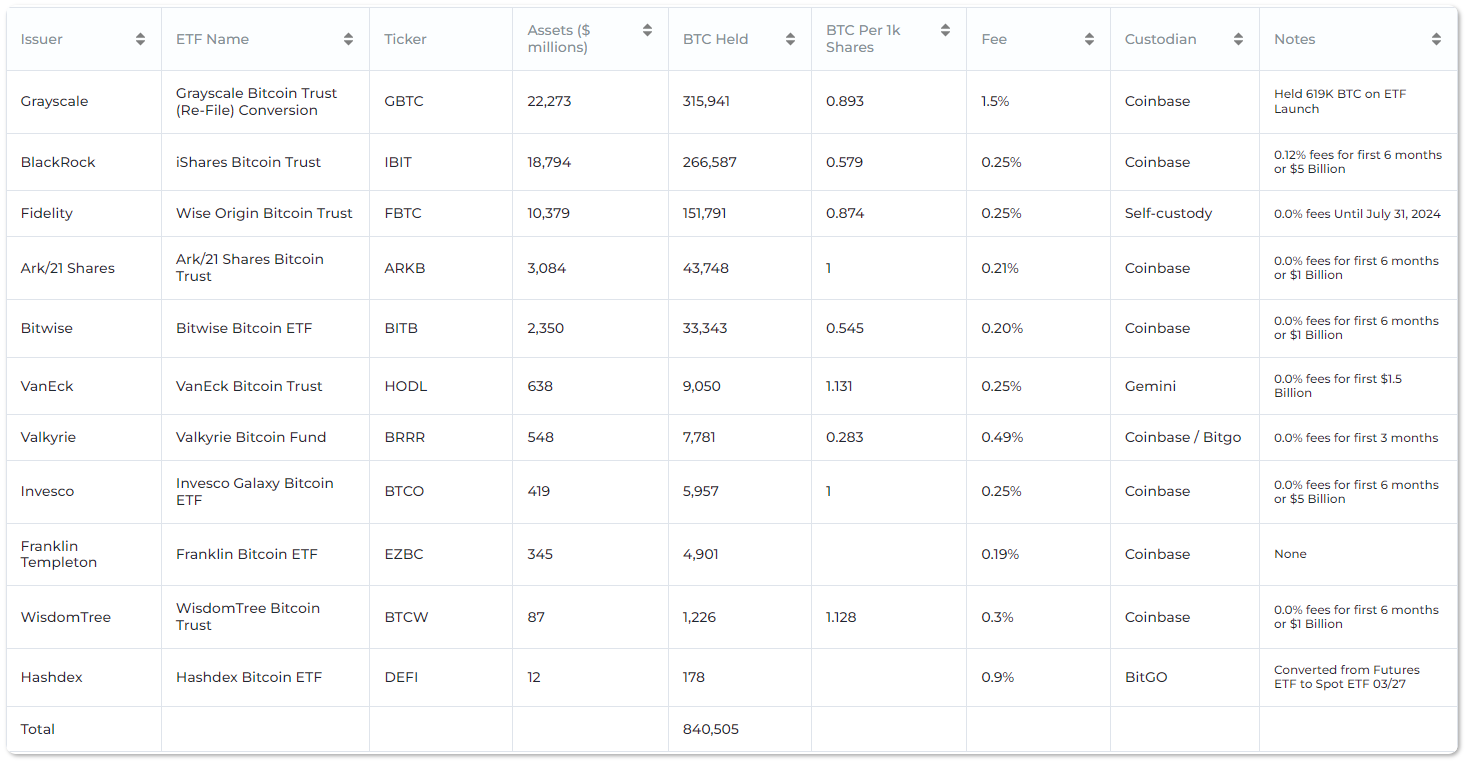

According to Heyappollo data, the eleven US spot BTC ETFs collectively hold 840,505 BTC.

The post GBTC ETF records lowest outflow since launch: $17.5 Million appeared first on CryptoSlate.

US Bitcoin ETFs See $85.7M Outflow After 4 Days of Gains; Grayscale’s GBTC Leads the Dip

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

Source link

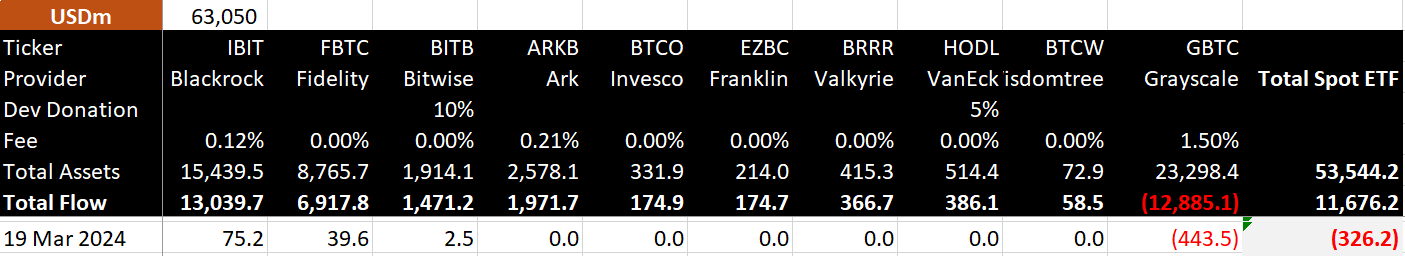

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

Despite $7 billion GBTC outflow, Bitcoin ETFs net $4.9 billion since January

Quick Take

BitMEX’s data analysis presents a clear picture of the recent Bitcoin inflows and outflows into the ETFs. The Bitcoin ETFs experienced a significant inflow of $331 million on Feb. 16, contributing to a weekly net flow of $2.273 billion. This robust inflow marks a continued trend since Jan. 11, with the total net flow reaching a substantial $4.926 billion, according to BitMEX data.

BlackRock IBIT has been a core player leading these inflows, contributing $191 million on Feb. 16 and bringing its total inflows to a hefty $5.4 billion. Conversely, GBTC experienced outflows of $150 million, pushing its total outflows to $7 billion, according to BitMEX data.

In Bitcoin terms, BitMEX reports a net inflow of 6,376 BTC on Feb. 16, 44,865 BTC for the week of Feb 12. to Feb 16, and a total of 102,888 BTC since Jan. 11, 2024.

Meanwhile, according to Bytetree, the global ETPs hold approximately 947,000 BTC. Over the past seven days, ByteTree data indicates an addition of 47,500 BTC.

The post Despite $7 billion GBTC outflow, Bitcoin ETFs net $4.9 billion since January appeared first on CryptoSlate.

Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow

Quick Take

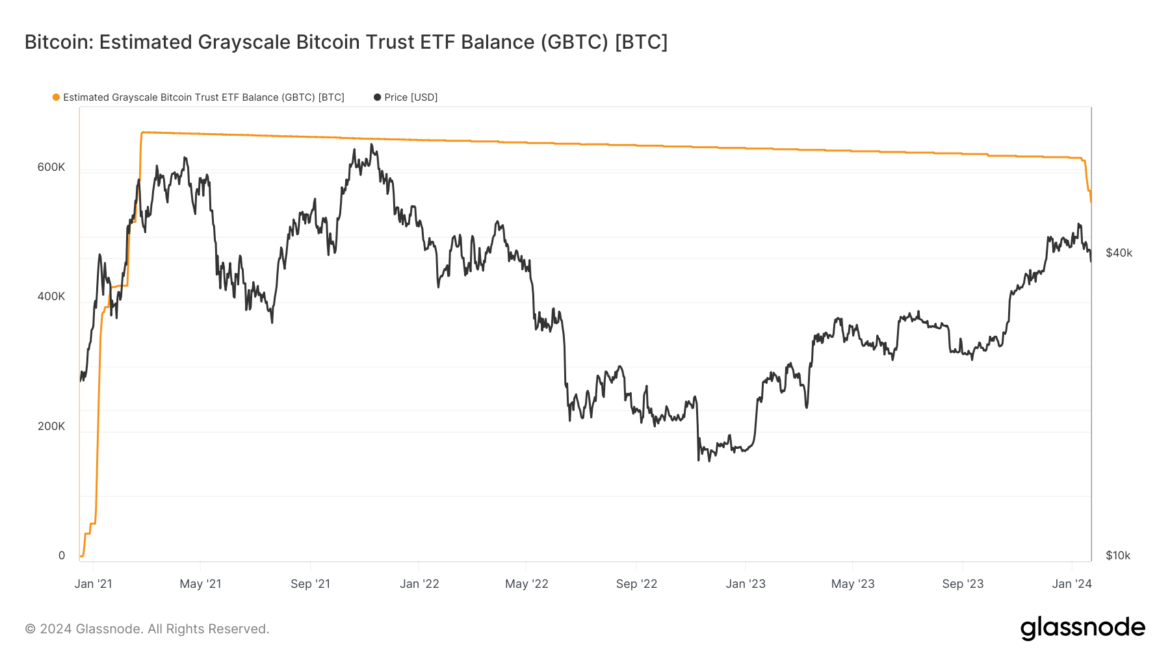

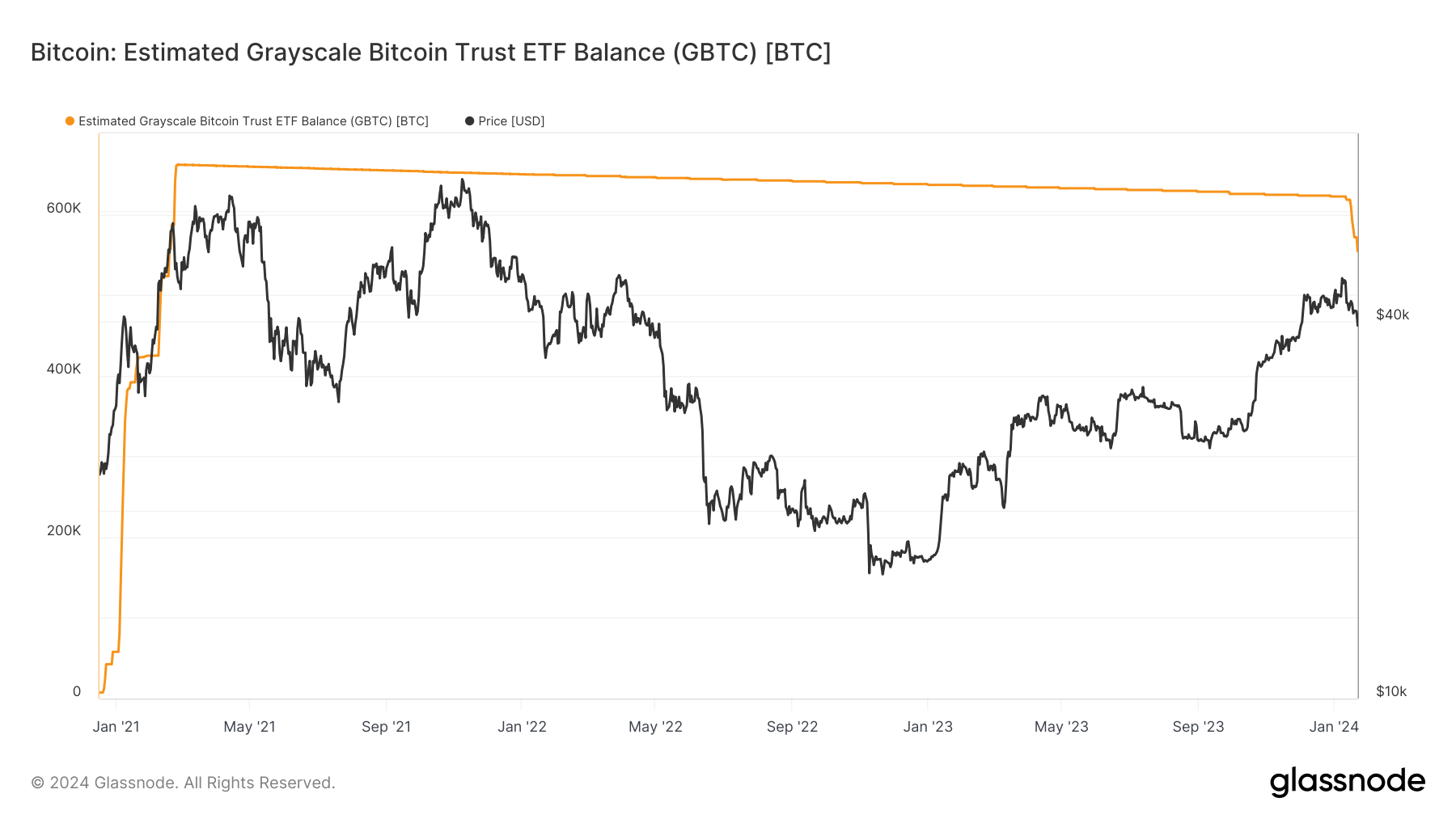

Recent data analysis from Glassnode reveals a substantial decrease in the balance of the Grayscale Bitcoin Trust ETF (GBTC), now estimated at around 553,000 Bitcoin, which is roughly 12% down from its high of 630,000 Bitcoin.

A key contributing factor to this decline appears to be the increasing outflows, which have been estimated at around $3.5 billion over its seven most recent trading days. These outflows are on the rise while the discount to the Net Asset Value (NAV) continues to close, currently roughly -0.11%, according to Y Charts. As this discount continues to narrow, the market may witness a further surge in GBTC selling.

Similarly, the digital asset exchange FTX reports significant sales nearing $1 billion, resulting from FTX’s bankruptcy estate offloading approximately 22 million shares, according to CoinDesk. Some of the outflows from GBTC have been redeemed into spot Bitcoin ETFs, roughly a third, according to Bloomberg analysts. However, it is noteworthy that about a third of the GBTC outflows ended up in USD, not in ETF vehicles, due to the FTX bankruptcy.

The post Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow appeared first on CryptoSlate.

Short-Bitcoin products gain popularity as clampdown-driven crypto outflow persists

Crypto investment products have seen a trend of outflows for five consecutive weeks, as $54 million exited these products in the past week, according to the latest CoinShares weekly report. This extends the total outflow over the last nine weeks to $455 million, underscoring the prevailing bearish sentiment in the market.

US top outflows

CoinShares noted that the United States dominates the outflows, contributing around 77% of these exits due to the seemingly unending regulatory clampdown on crypto-related businesses within the region.

U.S. financial regulatory bodies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have initiated enforcement actions against various crypto entities such as Binance and Coinbase, as well as decentralized finance protocols like Opyn and Deridex.

These regulatory measures have created a challenging environment for crypto companies operating in the United States, as the regulatory landscape remains unclear.

Short-BTC products are ‘most loved’

CoinShares dubbed short-Bitcoin investment products the “most loved,” even though it experienced outflows of $3.8 million in the past week. The company reports that these products have garnered approximately $12 million in inflows for the current month.

Conversely, BTC investment products bore the brunt of last week’s outflows, accounting for 85% of the total at roughly $45 million. Their monthly performance shows a significant negative trend, with withdrawals exceeding $100 million, indicating a consistent exodus of investors.

In a surprising twist, Ethereum, despite its attractive investment opportunities and strong demand for its staking yields, witnessed an outflow of $4.8 million last week. CoinShares had previously categorized this digital asset as the “least loved” among investors.

Despite the prevailing bearish sentiment, select altcoins managed to attract inflows. Solana, Cardano, and XRP recorded inflows of $0.7 million, $0.43 million, and $0.13 million, respectively.

Nonetheless, flows into digital asset products remain positive throughout the year, as it currently stands at $51 million on the year-to-date metric.

The post Short-Bitcoin products gain popularity as clampdown-driven crypto outflow persists appeared first on CryptoSlate.

Quick Take

- Bitcoin jumps to over $31,200, up almost 3% on the day

- A whale outflow from Huobi saw almost 7,500 Bitcoin leave the exchange.

- Huobi now has less than 20,000 Bitcoin on the exchange; this comes after a report by Willy Woo of Huobi collateral continuing to be drained.

The post Whale outflow from Huobi sees Bitcoin over $31K appeared first on CryptoSlate.