U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

Source link

outflows

Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow

Quick Take

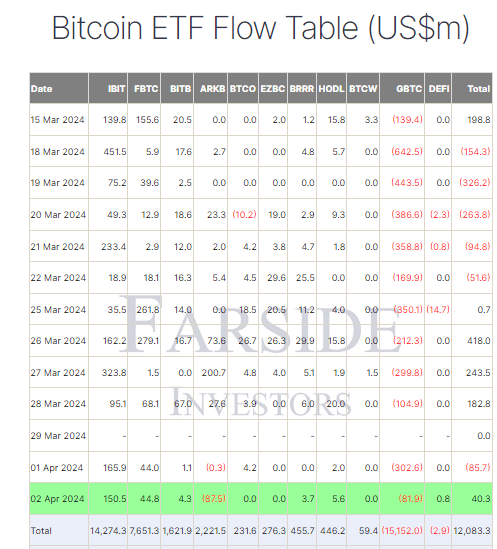

Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 2 experienced a moderate net inflow of $40.3 million, according to Farside data. Particularly noteworthy is the Grayscale Bitcoin Trust (GBTC), which saw a relatively smaller outflow of $81.9 million, signaling a significant slowdown from previous outflows. GBTC has now totaled $15,152.0 billion in net outflows.

Farside data reports that the ARK ETF (ARKB) recorded its largest single-day outflow of $87.5 million, yet it has accumulated total inflows of $2,221.5 billion. On the other hand, BlackRock’s (IBIT) Bitcoin ETF attracted a healthy inflow of $150.5 million, boosting its total net inflow to an impressive $14,274.3 billion. In a positive turn, the Hashdex Bitcoin ETF (DEFI) saw its first net inflow since Feb. 21 of $0.8 million, reducing its total outflows to just $2.9 million.

According to Farside data, cumulative net inflows across all Bitcoin ETFs now stand at $12,083.3 billion.

The post Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow appeared first on CryptoSlate.

Grayscale Bitcoin ETF Sees Drastic 60% Drop In Outflows, Why This Is Important

The outflows from the Grayscale Bitcoin ETF rocked the market hard last week, leading to a dramatic decline in the BTC price. However, with the new week, there has been a change in direction as investors begin to get bullish on Bitcoin once more. As a result, the outflows from the Grayscale ETF have slowed down, reaching one of its lowest points for the month.

Grayscale Bitcoin ETF Outflows Drop 60%

Grayscale outflows ramped up last week, spearheading what would turn out to be a full week of outflows from Spot Bitcoin ETFs for the first time ever. The outflows rose rapidly over the week, even moving into the new week. However, inflows into Spot Bitcoin ETFs have been on the rise, which have overshadowed the outflows from GBTC.

Despite the outflows from the GBTC continuing, it has begun to spin into a more positive narrative as the number of BTC flowing out of the fund is declining fast. To put this in perspective, data shows there was 299.8 BTC moved out of the fund on Wednesday, March 27, and on Thursday, March, 20204, this figure dropped to 104.9 BTC, representing a 60% drop.

This marks the second day with the lowest outflows from the Grayscale Bitcoin ETF right behind the March 12 outflows of 79 BTC. It also points to a decline in the volume of outflows as investors start to level out and find their footing elsewhere.

Nevertheless, the GBTC has remained the loser of the Spot Bitcoin ETF race, nursing a full month of outflows so far. Since the ETFs were first approved in January until now, there has been more than $14.6 billion moved out of the fund, which accounts for around 50% of its total balance. These BTC have presumably found a home in other Spot ETF funds which have been seeing massive inflows.

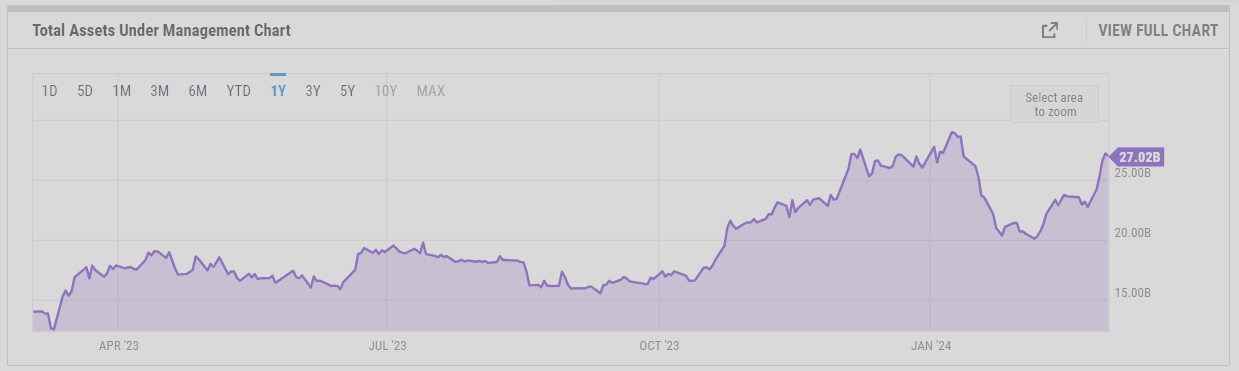

Unlike last week, inflows have also dominated Spot Bitcoin ETFs this week. Total inflows for the week crossed above $800 million, bringing the total Assets Under Management (AuM) to almost $57 billion in less than three months.

Why This Could Trigger A BTC Price Rally

The last time that GBTC outflows saw a slowdown after rising for about a week, it triggered a response from the Bitcoin price in the form of a rally. Inflows also continued to dominate for the next couple of weeks and during this time, the BTC price enjoyed a long stretch of recovery. It went from $40,000 to over $70,000 in the space of two months.

If this trend repeats itself this time around, then another massive BTC price rally could be around the corner. A similar price increase would also put Bitcoin right above $100,000 in the next few months. In this case, the uptrend would be far from over.

At the time of writing, Bitcoin is still struggling to break $70,000 after a 1% drop in the last day.

BTC price jumps above $70,000 | Source: BTCUSD on Tradingview.com

Featured image from Which.co.uk, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

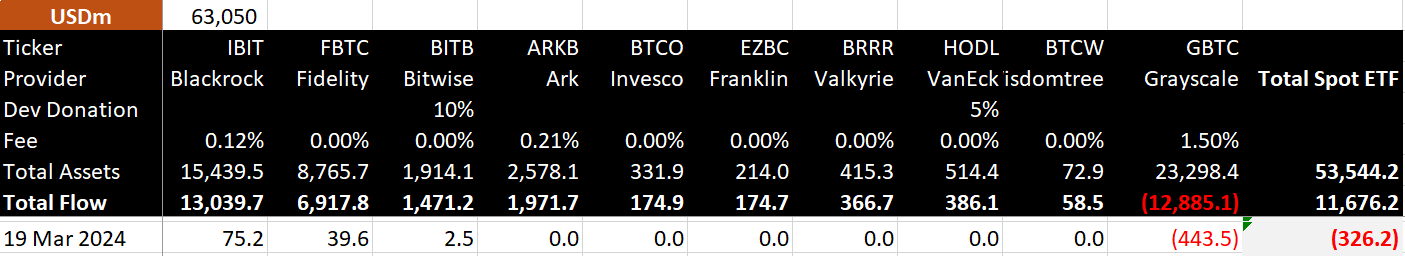

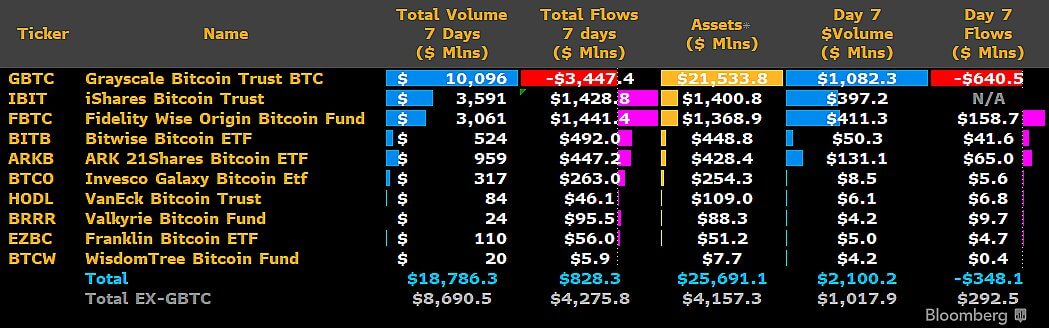

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

Grayscale introduces ‘mini’ Bitcoin ETF to alleviate investor tax burdens and curb outflows

Grayscale, the issuer of the world’s largest Bitcoin exchange-traded fund (ETF), has applied for a smaller version of its popular Grayscale Bitcoin Trust (GBTC) ETF under the “BTC” ticker, according to a Mar. 12 filing with the US Securities and Exchange Commission (SEC).

Grayscale said:

“This would be net-positive for existing GBTC investors, who would benefit from a lower blended fee with the same exposure to Bitcoin, spanning ownership of shares of both GBTC and BTC.”

If approved, the proposed ETF will debut a cost-effective iteration of its GBTC ETF. It will be seeded through an undisclosed percentage of GBTC, and shareholders of the current GBTC will seamlessly transition to holding shares in both GBTC and BTC, ensuring no taxable implications.

The proposed ETF will be listed on the New York Stock Exchange, operating independently from Grayscale’s GBTC fund.

Why did Grayscale file for a ‘mini’ ETF?

James Seyffart, an ETF analyst at Bloomberg, explained Grayscale’s maneuver as a savvy move to compete against rivals without compromising on fees for its profitable GBTC investment offering.

Besides that, Seyffart pointed out that the new trust could offer GBTC investors tax-free exposure to the flagship digital asset. He said:

“[The Mini ETF] definitely helps out long term GBTC holders — particularly the taxable ones who were sorta stuck with potential capital gains tax hits. Not a full solution. But way more helpful than launching a standalone product from scratch.”

Furthermore, introducing a miniature version could prevent customers from migrating to more cost-effective alternatives.

GBTC, since its inception in January, has witnessed outflows exceeding $11 billion. This trend is primarily attributed to its high fees of 1.5%, notably higher than competitors charging 0.3% or even less.

Eric Balchunas, Bloomberg senior ETF analyst, opined:

“This way, [Grayscale] can keep some of that juicy 1.5% assets while placating a bit of investors with this treat. Also, BTC then gives something competitive for their salespeople to have when talking to advisors who probably find a 1.5% fee an instant dealbreaker.”

The post Grayscale introduces ‘mini’ Bitcoin ETF to alleviate investor tax burdens and curb outflows appeared first on CryptoSlate.

Coinbase slips to third in Bitcoin reserves following massive outflows – CoinGlass

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows

Quick Take

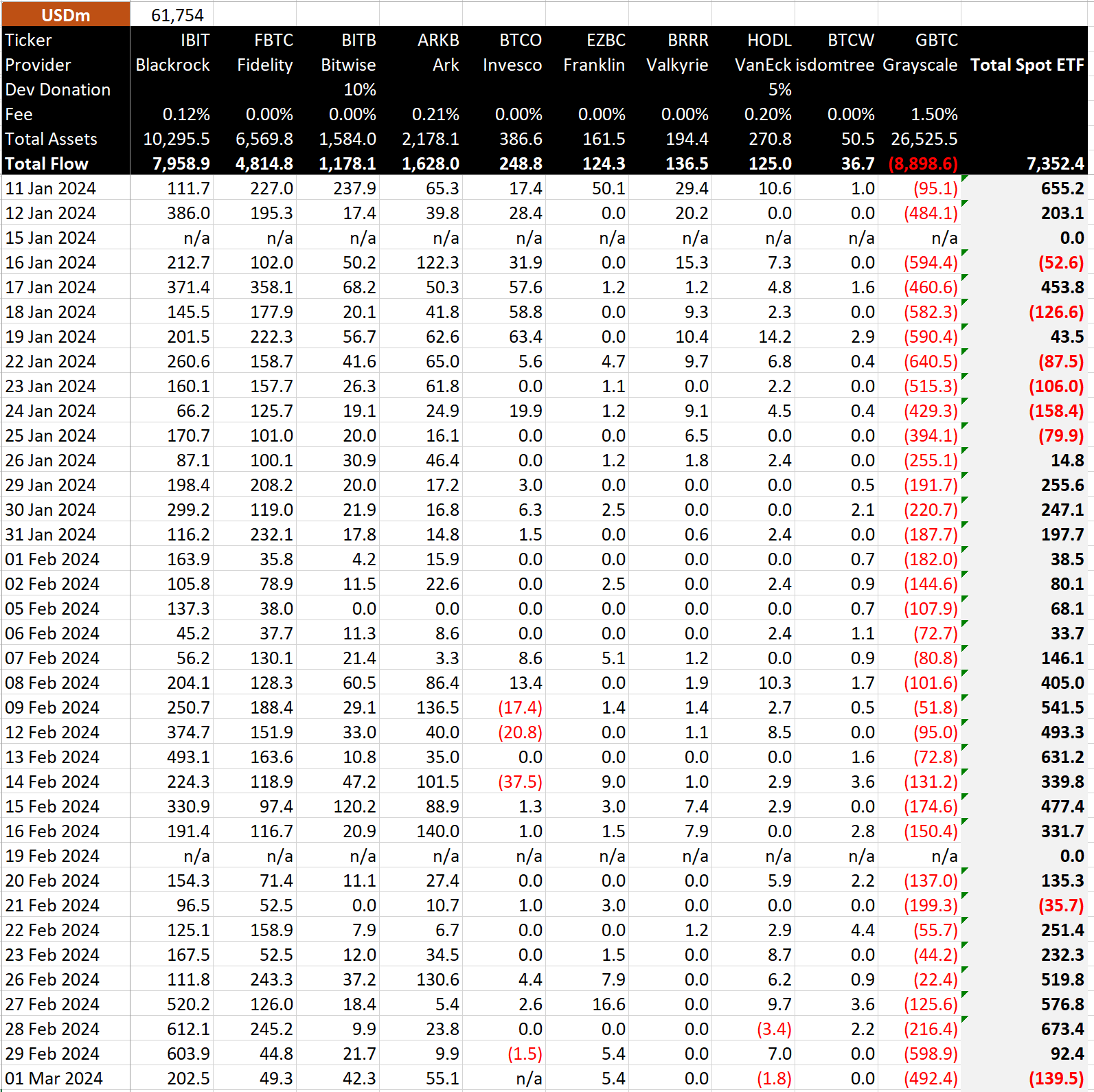

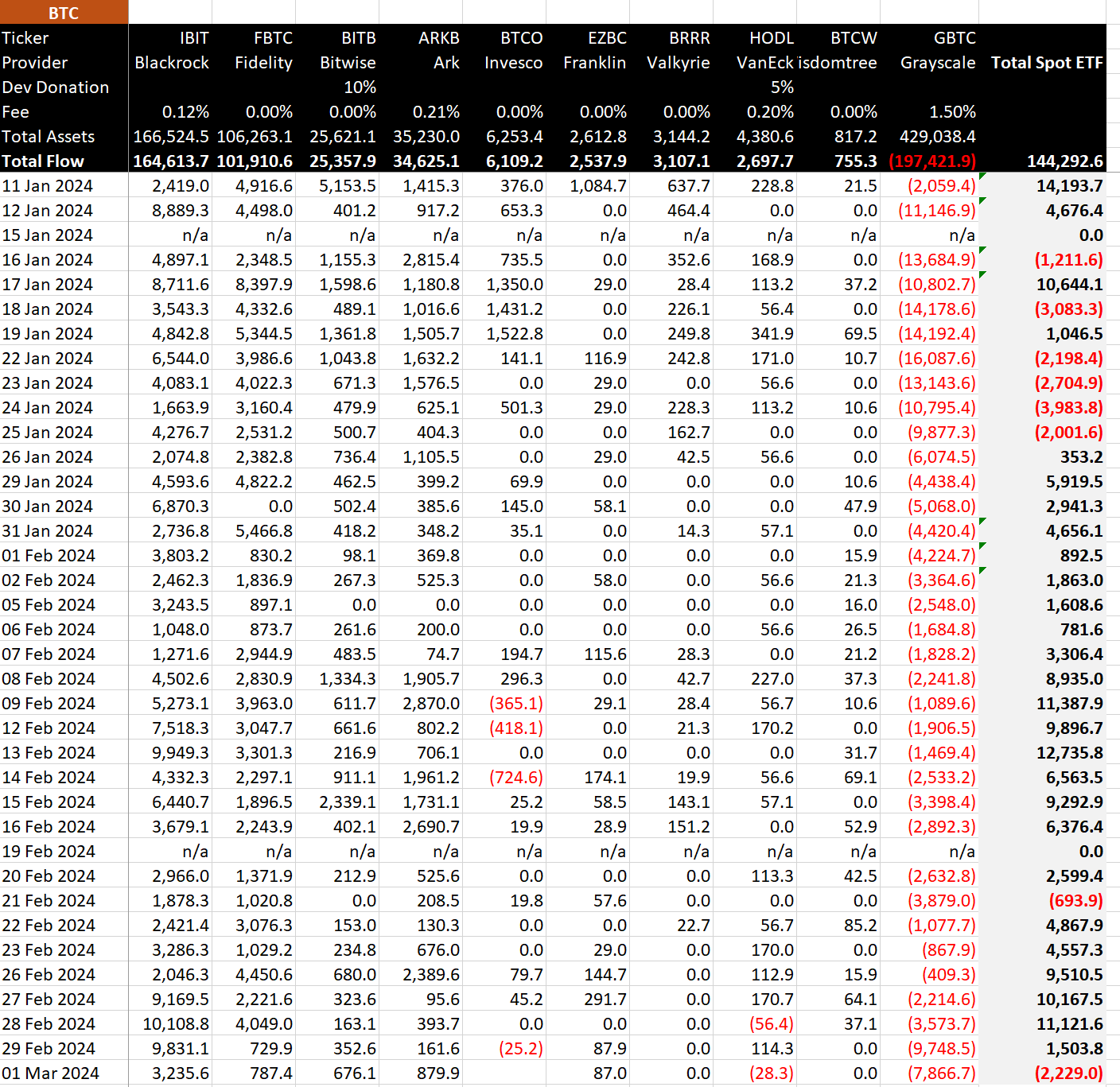

Data from BitMEX shows March began with the first total outflow since Feb. 21. The day saw an outflow of $140 million, significantly impacted by a massive $492 million outflow from the Grayscale Bitcoin Trust (GBTC), marking one of the largest single-day outflows.

According to BitMEX data, the Grayscale Bitcoin Trust (GBTC) has experienced outflows totaling $8.9 billion. Despite this significant outflow, the assets under management (AUM) of GBTC only decreased by $1.6 billion, moving from $28.6 billion to $27 billion, as reported by ycharts.

This relatively small decrease in AUM, in the face of large outflows, can be attributed to the increase in Bitcoin’s price, which rose from $49,000 to $65,000 since the ETF was launched on Jan. 11.

Despite these outflows, GBTC maintains a strong market presence with a 55% share, though down from 100% two months ago, as noted by ETF Store President Nate Geraci.

Furthermore, GBTC’s annual fee revenue stands at a significant $398 million, dwarfing the $53 million from the nine new ETFs, not including fee waivers, according to Geraci.

Meanwhile, BlackRock’s IBIT saw much quieter inflows of $203 million on Mar. 1, following consecutive record-breaking days. These inflows have taken their total net inflow to $8 billion, roughly equivalent to holding 165,000 Bitcoin, according to BitMEX.

BitMEX has noted that Invesco Galaxy Bitcoin ETF (BTCO) has not disclosed its data for Mar. 1.

The post GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows appeared first on CryptoSlate.

Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market

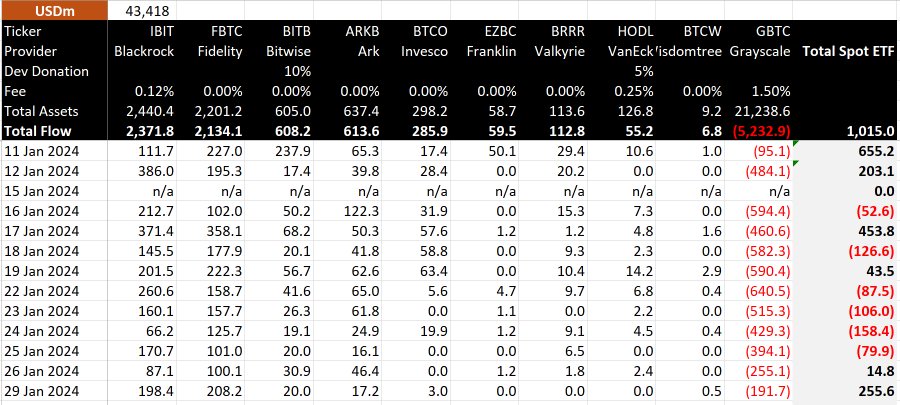

Grayscale’s Bitcoin Trust (GBTC) is experiencing a slowdown in outflows, with just under $200 million withdrawn from the fund on Jan. 29.

Data from BitMEX Research indicates a total outflow of around $192 million during this reporting period. Notably, this marks the lowest outflows since the fund’s inception, surpassing only the initial day of trading when withdrawals amounted to $95 million.

Meanwhile, a look at the newborn nine shows that the inflows into the funds keep offsetting that of Grayscale.

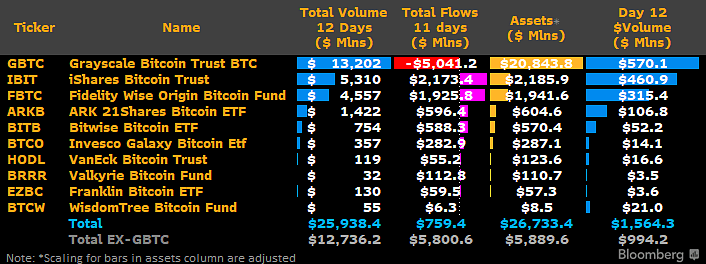

The Fidelity Wise Origin Bitcoin Fund (FBTC) emerged as a standout, concluding the twelfth trading day with the highest inflow at $208 million. In comparison, other funds, including BlackRock’s IBIT, experienced a $198 million inflow. ETFs such as BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, while others reported zero inflows.

The robust trading activities contributed a net inflow of $255.6 million during the twelfth trading day.

GBTC maintains ‘liquidity crown’

However, Grayscale’s GBTC remains the top cryptocurrency ETF in liquidity, as Bloomberg Intelligence analyst James Seyffart observed.

Despite recent outflows, GBTC’s trading volume reached $570 million on Jan. 29, surpassing BlackRock’s IBIT by $110 million and reaffirming its market dominance.

Following its recent conversion, Grayscale’s ETF has experienced substantial outflows totaling more than $5 billion. Analysts attribute the outflows to profit-taking maneuvers by investors exposed to its previous net asset value discount.

Furthermore, the fund’s relatively high 1.5% management fee is cited as a factor that has led some investors to shift towards competing ETF providers such as BlackRock and Fidelity, who charge a lower fee of 0.25%.

As of Jan. 29, the outflows have resulted in Grayscale’s ETF’s Assets Under Management (AUM) dropping to approximately $21.431 billion (equivalent to 496,573 BTC) from its year-to-date peak of nearly $29 billion (623,390 BTC), as reported by the fund’s official website. This data indicates that fund users have divested over 100,000 units of the leading cryptocurrency since the approval of the ETF conversion.

Grayscale Bitcoin Trust hits new low for outflows with $429 million leaving fund

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows

Bitwise chief investment officer Matt Hougan attributed the recent decline in the crypto market to overinflated expectations regarding the potential impact of the newly launched Bitcoin exchange-traded funds (ETFs).

In a Jan. 23 post on X (formerly Twitter), Hougan explained that the current market sell-off is driven by what he terms an “ETF Expectations-led” phenomenon.

According to him, investors anticipating “larger net flows into (these) ETFs” front-ran the approval news by piling into both spot and derivatives positions on the flagship digital asset. However, with the expected inflows not materializing, these investors are now “unwinding that bet,” prompting the current market situation.

“Just as the market overestimated the short-term impact of ETFs, it is underestimating the long-term impact,” Hougan concluded.

Since the Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs in the U.S., the value of the top cryptocurrency has been on a downturn. The digital asset fell to as low as under $39,000 on Jan. 23 but has recovered to $40,389 as of press time, according to CryptoSlate’s data.

This downward trend raised concerns within the crypto community, with some attributing it to the outflows from Grayscale’s Bitcoin Trust ETF (GBTC).

Contrary to this sentiment, analysts, including CryptoQuant founder Ki Young Ju, share a perspective aligned with Hougan’s.

Young Ju recently emphasized that Bitcoin operates in a futures-driven market, making it less susceptible to spot-selling activities from GBTC-related issues.

“BTC falls due to derivative market selling, not GBTC. OTC (over the counter) markets are very active, but no price impact,” he added.

ETFs are BTC net buyers.

Meanwhile, the Bitwise investment chief also clarified that the recently launched ETFs are net buyers of Bitcoin despite the outflows emanating from GBTC.

Hougan pointed out that while GBTC functions as a net seller, the cumulative BTC acquisitions from the new ETFs surpass that being offloaded by Grayscale.

Bloomberg data corroborates Hougan’s view. As of Jan. 23, GBTC’s outflows stood at $3.45 billion, while the newly introduced nine ETFs had a combined inflow of more than $4 billion in assets under management.

This data stresses a compelling narrative—that the ETFs have seen substantial interest from the community, leading to a swift and significant accumulation of the leading cryptocurrency.