Fitch Ratings downgrades China outlook to negative as economic concerns rise

Source link

Outlook

Cardano Latest Technological Updates Unveiled, Analyst Maintains Bullish Outlook on ADA

Cardano (ADA), the proof-of-stake blockchain platform, has made notable progress in technological advancements, according to Input Output Hong Kong (IOHK), the engineering firm behind the Cardano blockchain.

IOHK’s recent announcement highlights crucial improvements across various aspects of the platform, signaling further growth and development for Cardano.

Cardano Smart Contract Optimization

One significant area of improvement lies within the ledger team, which has reportedly enhanced test frameworks and data quality in the Newconstraints phase3. They achieved this by introducing constraints and new types such as Size, SizeSpec, and Sized.

The engineering company has also noted advancements in wallets and services. The Lace team is preparing to release Lace v.1.9, which promises new features and improvements for Cardano users.

In the realm of smart contracts, the Plutus team has included a guide in the documentation, elucidating how to use AsData functionality to optimize scripts. They have also implemented a UPLC optimization pass to minimize the number of forces and delays in the script.

Mithril Team Releases Major Update

Addressing scalability, the Hydra team has restored test compatibility with all networks and reviewed and merged streaming plugins. They have rectified tutorial instructions for downloading the latest Cardano-node and resolved the observed contesters bug.

The Mithril team has released Mithril distribution 2412.0, encompassing critical updates and enhancements. These include support for the Prometheus metrics endpoint in signer, deprecation of the snapshot command in the client CLI, full Pallas-based implementation of the chain observer, and compatibility with Cardano node v.8.9.0.

Moreover, the team has implemented community-requested features to verify the output folder structure created by the client. They continue to investigate and address any sources of “flakiness” in the CI end-to-end test.

Notable Surge In Token Trading Volume

According to DeFiLlama data, Cardano’s total value locked (TVL) currently stands at $422 million, signifying a slight dip of $80 million following the achievement of the $500 million milestone. Cardano boasts a significant figure of $23.3 million in terms of stablecoin market capitalization.

Analyzing Token Terminal data reveals several key market indicators for Cardano. The fully diluted market cap, representing the maximum potential market value of all tokens in circulation, is estimated at $29.20 billion, reflecting a notable 4.9% increase over the past 30 days.

Similarly, the circulating market cap, which considers only the tokens in active circulation, stands at $22.88 billion, with a 5.2% growth rate over the same period.

Long-Term Outlook Remains Bullish For ADA

Regarding price action, crypto analyst “Trend Rider” recently shared insights on ADA’s latest price action in a post on the social media platform X (formerly Twitter).

According to the analyst, ADA’s price experienced a decline after reaching a yearly high of $0.811 on March 14. It is currently trading within the range of a parabolic red line and a rider band.

The parabolic red line represents a significant resistance level, while the rider band indicates a potential support region for ADA’s price. This range-bound movement suggests a period of consolidation for ADA, as the cryptocurrency takes a breather before its next significant move.

Furthermore, the analyst notes that the bullish strength of the trend has weakened over the past two weeks. This could indicate a temporary slowdown in ADA’s upward momentum, potentially leading to consolidation or sideways trading.

However, despite this weakening bullish strength, the analyst stated that the overall trend direction remains bullish, suggesting that ADA’s long-term prospects remain positive.

ADA is trading at $0.652, exhibiting a sideways price action in the last 24 hours. However, over the past seven days, the token has successfully recovered from previous losses and registered a gain of 5.4%.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Snowflake Inc.’s stock was tumbling more than 20% in Wednesday’s extended session after the company underwhelmed with its outlook and announced that its chief executive has left that post.

For the fiscal first quarter, Snowflake

SNOW,

models $745 million to $750 million in product revenue, whereas analysts tracked by FactSet had been calling for $759 million.

Looking at the full fiscal year, Snowflake is calling for $3.25 billion in product revenue, whereas analysts had been modeling $3.43 billion.

The company generated a fiscal fourth-quarter net loss of $169.9 million, or 51 cents a share, compared with a loss of $207.2 million, or 64 cents a share, in the year-before period.

On an adjusted basis, Snowflake earned 35 cents a share, whereas it earned 14 cents a share a year before. Analysts surveyed by FactSet were modeling 18 cents in adjusted earnings per share.

Snowflake’s revenue rose to $774 million from $589 million a year prior, while analysts had been looking for $760 million. The company generated $738 million in product revenue, whereas the FactSet consensus was for $716 million.

“We are successfully campaigning the largest enterprises globally, as more companies and institutions make Snowflake’s Data Cloud the platform of their AI and data strategy,” Chairman Frank Slootman said in a release.

Snowflake announced separately that Slootman has stepped down from the CEO post “effective immediately.” Sridhar Ramaswamy, previously the company’s senior vice president of AI, is taking on the position.

The company had $5.2 billion in remaining performance obligations, up 41% from a year before. Snowflake also called out that 461 customers were doing more than $1 million of trailing-12-month product revenue.

Bitcoin “Outlook Remains Bullish,” As Long As This Stays True: Analyst

An analyst has explained that the outlook for Bitcoin should remain bullish as long as the cryptocurrency’s price remains above this level.

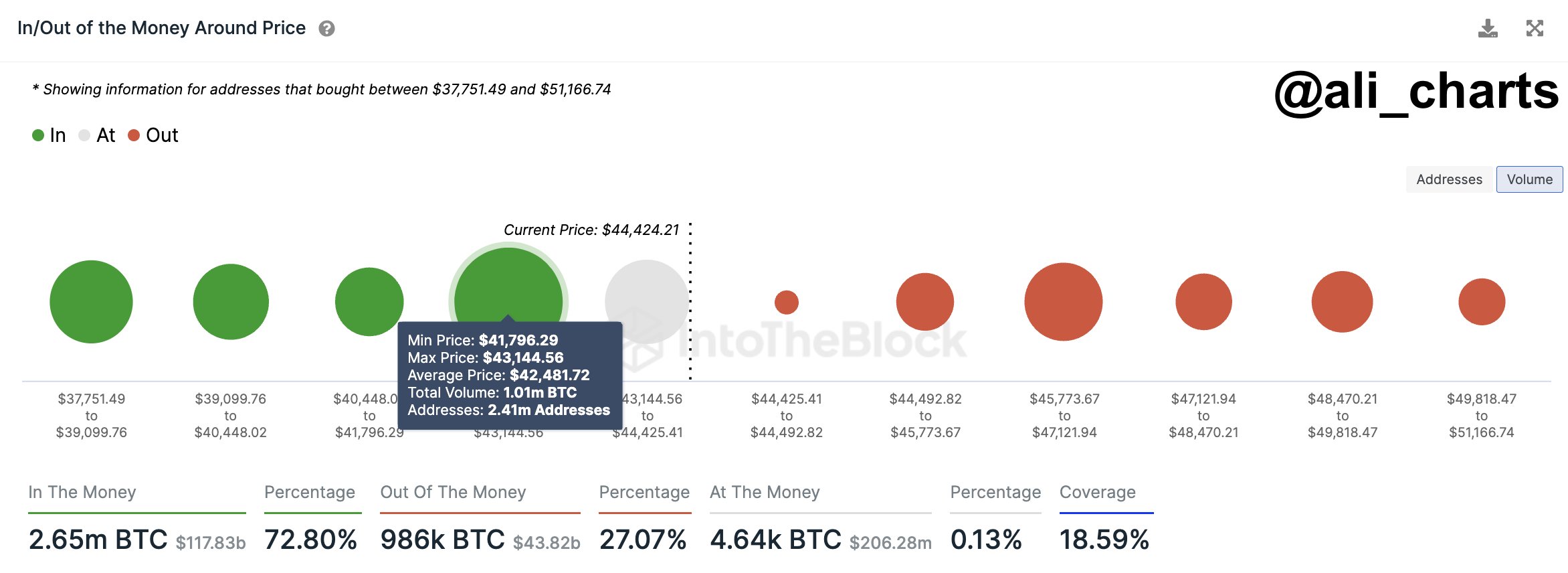

Bitcoin Has Strong On-Chain Support Above $41,800

In a new post on X, analyst Ali talked about the various BTC support and resistance levels from an on-chain perspective. In on-chain analysis, the strength of any support or resistance level depends on the amount of Bitcoin that the investors bought at said level.

The chart below shows what the distribution of the different BTC price ranges currently looks like based on the concentration of holder cost basis that they carry.

How the various price ranges near the current spot price are looking like in terms of support and resistance | Source: @ali_charts on X

As displayed in the above graph, the $41,800 to $43,100 range hosts the acquisition price of most Bitcoin out of all the price ranges listed. To be more specific, about 2.4 million addresses acquired 1 million BTC within this range.

The cost basis is naturally of immense significance for any investor, as the spot price retesting can flip their profit-loss situation. As such, holders become more likely to show some move when a retest like this happens.

A holder in profit before the retest might tend to buy more when the retest happens, as they might believe this same level that proved profitable earlier would do so again.

On the other hand, loss holders might want to sell at their break-even level since they may fear the cryptocurrency going down again, putting them underwater again.

These buying and selling moves aren’t enough to move the market when just a few investors are making them, but if a large number of investors have their cost basis inside a narrow range, the reaction could become significant.

Since those above $41,800 to $43,100 range is dense with investors, it should be an essential on-chain range. The spot price is floating above the range so that these prices could act as a support barrier for the asset. Based on this, Ali explains, “as long as Bitcoin maintains its position above $41,800, the outlook remains bullish.”

The chart shows that the Bitcoin ranges above the price aren’t carrying the cost basis of that many investors. This could imply that there isn’t much resistance ahead for the coin.

The analyst notes that this lack of major resistance also strengthens the potential for the cryptocurrency to stay at the current levels or push towards the higher ones.

BTC Price

Bitcoin has been gradually making its way back up after the recent crash, with its price climbing towards the $43,800 mark. The below chart shows how the asset has performed during the last few days.

BTC has gone through a bit of a rollercoaster since the new year has started | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

No other phrase has defined the 2023 housing market as much as the “mortgage rate lock-in effect” – a phenomenon that brought the industry to a standstill, putting downward pressure on everything from inventory levels to home sales.

The pandemic-era sub-5% mortgage interest rates that 85% of mortgage holders are locked in to kept homeowners from selling their home and buying another at elevated interest rates, which peaked at 7.79% the week ending Oct. 26, according to Freddie Mac.

But will things change this year?

There are signs that market conditions will be improving.

Mortgage rates dropped steadily over the past seven weeks, averaging 6.61 % for a 30-year fixed mortgage, the week ending Dec. 28.

The lower mortgage rates provided a boost to existing-home sales which grew in November, up 0.8% from October and breaking a streak of five consecutive monthly declines, according to the National Association of Realtors.

Year-over-year, sales fell 7.3% (down from 4.12 million in November 2022).

“A marked turn can be expected as mortgage rates have plunged in recent weeks,” says National Association of Realtors Chief Economist Lawrence Yun.

Housing shortages will continue

One thing most experts don’t expect to see is an end to shortage of homes for sale.

“Despite this, households will have more options in 2024 from a small uptick in single-family home construction, and the completion of the large number of multifamily units that are under construction, the vast majority of which are destined to be rental homes,” says Danielle Hale, chief economist for Realtor.com.

The additional inventory of new construction homes and apartments will curb the uptick in home and rental prices even as long-running shortages keep prices from slipping too far.

Today’s acute supply shortage will be hard to undo, says Odeta Kushi, deputy chief economist at First American.

“While single-family housing starts have steadily increased throughout 2023, it will take years of accelerated new home construction to narrow the supply shortage gap from more than a decade of underbuilding,” she says.

Home price growth will vary from market to market

Against this backdrop, nationwide sales are expected to see only a modest uptick in 2024 over 2023’s long-term low. Real estate activity will vary significantly from market to market with some top-growth areas expected to see double-digit increases, according to Hale.

Combined sales and price activity are expected to be highest in two major groups of markets. The first are affordable markets in the Midwest and Northeast like Toledo, Ohio, Rochester, New York, says Hale. The second set are in Southern California where a reduction in mortgage rates could help the area bounce back from a particularly slow 2023.

The median existing-home price for all housing types in November was $387,600, an increase of 4% from November 2022 ($372,700). All four U.S. regions posted price increases.

“Home prices keep marching higher,” Yun says. “Only a dramatic rise in supply will dampen price appreciation.”

Mortgage rates and affordability

Most experts predict the average 30-year mortgage rate to linger anywhere between 6.1% to 7% range in the first quarter, then decline throughout the year.

“Mortgage rates are likely to remain well above pandemic-era record lows because financial markets increasingly believe the country will avoid a recession in 2024,” says Redfin Chief Economist Daryl Fairweather. “Mortgage rates will fall to about 6.6% by the end of 2024. The gradual decline in rates combined with the small dip in prices will bring homebuyers some much-needed relief.”

Election year volatility will make mortgage rates jumpy, so 30-year fixed rate estimates range would be in the mid 6% range, according to Jeff Taylor, founder and managing director at Mphasis Digital Risk.

At a 7.125% rate and current median home prices, it takes $111,000 and $107,000 in household income to buy newly built and existing homes, respectively, with 5% down, says Taylor.

If mortgage rates fell 1% to 6.125% and home prices rose a modest 4% as projected by the Federal Housing Finance Agency in 2024, it would take $105,000 and $99,000 to buy newly built and existing homes, respectively, with 5% down.

New home construction

With a decline for mortgage interest rates and an ongoing housing deficit, Robert Dietz, the chief economist for the National Association of Home Builders is forecasting a gain for single-family housing construction starts in 2024. This will be the first year of increase after declines in 2022 and 2023.

“Due to low existing inventory, new construction has increased to approximately one-third of total single-family inventory in recent months when historically it was only 10% to 15%,” Dietz says.

Multifamily construction will experience a significant decline. Financing conditions are very tight and there are approximately one million apartments under construction, the highest total since 1973.

The level of remodeling activity will be approximately flat in 2024 compared to 2023. The housing stock is aging and requires reinvestment (the typical home in the U.S. is near 40 years old).

Swapna Venugopal Ramaswamy is a housing and economy correspondent for USA TODAY. You can follow her on Twitter @SwapnaVenugopal and sign up for our Daily Money newsletter here.

This article originally appeared on USA TODAY: Housing market projection: Six experts weigh in on real estate in 2024

Health of several key sectors, including the U.S. consumer, plus an outlook from Fed’s Powell on radar this coming week

Recession fears are rising. Nothing beats fear better than good information and that’s what we will get this week. Investors and economists will get good insight into the mood of U.S. consumers and hear the last words of Federal Reserve Chair Jerome Powell ahead of the central bank’s next interest-rate meeting on Dec. 12-13.

November consumer confidence

Tuesday, 10:00 a.m. Eastern

Economists surveyed by the Wall Street Journal expect that consumer’s view on the outlook have soured over the past few weeks. Geopolitical…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

Palo Alto Networks’ Cybersecurity Growth Outlook Disappoints — Here’s What You Need to Know

Palo Alto Networks (PANW 1.12%) just gave the latest indication that the economy is slowing. Much like its large cybersecurity peer Fortinet (FTNT 0.87%), more modest growth is on the way for Palo Alto as customers look to save some cash amid ongoing global concerns, from war to higher interest rates.

Nevertheless, Palo Alto Networks is still in tip-top shape to lead the cybersecurity industry. Is the stock still a great buy right now? Here’s what you need to know.

Palo Alto Networks warns on customer billings

A few weeks ago, Fortinet disappointed investors with another lackluster report that indicated growth is slowing. This is particularly the case for Fortinet and its slant toward hardware-based sales (firewalls, devices that protect a physical location like an office or data center). After several years of booming sales tied to necessary network expansions during the pandemic, that part of Fortinet’s business is now in a downturn.

Palo Alto Networks is also headed for a slowdown, but CEO Nikesh Arora firmly believes this is merely “cosmetic” due to the timing of customers paying invoices.

At any rate, the slowdown is worth noting. First-quarter fiscal 2024 (the three months ended in October 2023) revenue increased 20% year over year to $1.88 billion. This beat the outlook Arora and the top team provided three months ago. However, billings (invoices sent but not yet paid by customers) growth for full-fiscal year 2024 is expected to rise 16% to 17%. This is a downgrade from the previous expectation for fiscal 2024 billings growth of 19% to 20%.

Is the cybersecurity market in trouble?

Despite some concerning trends in customer spending habits, cybersecurity very much remains a secular growth trend. Billings growth may be moderating, but it still indicates that global organizations overall need lots more cybersecurity to combat never-ending attacks. Data theft is rising, and the ransoms paid to bad actors are also up. Palo Alto Networks’ services are thus trending in the right direction.

But the need for more and better digital security doesn’t mean the need for cost savings is out the window. These same at-risk organizations are looking for ways to conserve cash as they manage economic risks, especially from the higher interest rate environment we are now in (higher rates make business projects more expensive to fund). That’s where a company like Palo Alto Networks comes in. It offers big bundles of various security services (bundling can reduce complexity and cost, versus hiring many smaller cybersecurity vendors), as well as loads of AI (a way to automate cybersecurity tasks).

It’s all in the name of “doing more with less,” and as the largest cybersecurity company pure-play by sales and market cap, Palo Alto Networks is primed to continue leading the way forward. The company expects to deliver average annual billings growth in a range of 17% to 19% through fiscal 2026, so even its slowdown for 2024 keeps it within striking distance of this goal.

Is the stock a buy?

Palo Alto Networks stock has soared in the last few years (up nearly 170% over the last 36 months), and after the earnings update, the valuation is higher than it’s been in a while. Shares currently trade for nearly 31 times trailing 12-month free cash flow.

Given the recent downgrade to growth over the next year, I’m hitting pause on this top cybersecurity stock. I already have a full position, so I see no need to add more at this more premium price. Nevertheless, I’m plenty confident in Palo Alto Networks’ ability to grow profitably in the years to come, and am happy to keep it as part of my portfolio.

Nicholas Rossolillo and his clients have positions in Fortinet and Palo Alto Networks. The Motley Fool has positions in and recommends Fortinet and Palo Alto Networks. The Motley Fool has a disclosure policy.

Bitcoin On-Chain Data Points To Bullish Outlook, But There’s A Catch

Santiment, a leading blockchain intelligence platform, has recently provided insights pointing to a favorable short-term scenario for Bitcoin (BTC). However, according to other signals that seem ‘hidden,’ there’s a catch.

These on-chain metrics can serve as the north star for investors looking to strategize their next steps. However, according to another metric, though recent revelations by Santiment might hint at continued positive momentum for Bitcoin, there’s also a possible contrary move that could play out.

Bitcoin Sentiments Bullish On-Chain Indications

Santiment’s recent post revealed a positive narrative for BTC’s immediate future. One of the key metrics supporting this bullish outlook is the significant number of active Bitcoin addresses.

It is worth noting that an increase in active addresses can indicate enhanced adoption, investor interest, and overall network health. Furthermore, a surge in previously dormant tokens moving actively hints at a renewed trader interest.

According to Santiment, such activity has often coincided with bullish trends, making this an essential metric to monitor.

👍 If you’re concerned about a #crypto retrace, note that #Bitcoin still maintains a high pace of active addresses. Additionally, the top market cap asset is seeing a high level of dormant tokens now moving, typically synonymous with #bullish conditions. pic.twitter.com/NvxKkQpkg8

— Santiment (@santimentfeed) October 26, 2023

Given these disclosed metrics by Santiment, Bitcoin may still have more rallies to squeeze out. However, to add another layer of intrigue to the current market scenario is the behavior surrounding meme coins, especially PEPE.

According to Onchain Capital co-founder and Crypto Banter host, Ran Neuner, meme coins, with their viral nature and swift price movements, sometimes act as a barometer for market sentiment, albeit unconventional.

PEPE’s Performance: A Market Temperature Check?

While Santiment’s report offers optimism, some market observers utilize unique indicators to sense potential market shifts. PEPE, a meme coin, has recently caught the attention of several prominent crypto figures.

Ran Neuner recently mentioned that PEPE might act as an indicator of an overheated market. The logic? When traders and investors flock to such tokens, and they see significant price pumps, it might be a sign of excessive optimism in the market. An event to walk with caution.

If you want to know when a pull back is coming, just watch $PEPE. It’s literally an index for when the market is getting overheated. When people are confident enough to go there and it pumps, that’s your sign to exit. Works every time. pic.twitter.com/vMcqiddHwp

— Ran Neuner (@cryptomanran) October 26, 2023

Notably, PEPE has surged by more than 80% in the past week. The meme coin has soared from a low of $0.00000650 seen last Friday, to as high as $0.00000118 at the time of writing. Following the recent increase in price, PEPE is currently down 1.1% in the past 24 hours.

Furthermore, in what seems to complement Neuner’s proposed indicator, Bitcoin has seen quite a notable retrace from its recent spike above $35,000. The asset currently trades at $33,620, at the time of writing down by 1.1% in the past hour.

Featured image from ShutterStock, Chart from TradingView

AT&T Inc. topped free-cash-flow expectations during its latest quarter, and the company is raising its full-year outlook on the closely watched metric.

The telecommunications giant posted $5.2 billion in free cash flow for the third quarter in its Thursday morning report, exceeding the consensus view, which called for $4.8 billion. The company now expects about $16.5 billion in free cash flow for the full year, while it previously called for at least $16 billion.

Free cash flow is of key importance to AT&T

T,

investors given the company’s sizable dividend, and while management has expressed confidence in the 2023 target all year long, Wall Street had been showing a bit more caution, especially earlier in 2023 when AT&T fell short on the metric for the first quarter in a development it owed to misaligned timing expectations.

AT&T logged revenue of $30.4 billion for the latest quarter, up from $30.0 billion a year before. The FactSet consensus was for $30.2 billion.

The company posted net income attributable to common stock of $3.4 billion, or 48 cents a share, down from $6.0 billion, or 79 cents a share, in the year-earlier period. Results from the latest period reflected $600 million in severance charges and an 8-cent per-share negative impact from lower pension credits, among other factors.

Adjusted earnings per share came in at 64 cents, down from 68 cents a year before but above the 62 cents that analysts tracked by FactSet were projecting.

AT&T also recorded third-quarter adjusted earnings before interest, taxes, depreciation and amortization (Ebitda) of $11.2 billion, up from $10.7 billion a year before and above the $11.0 billion FactSet consensus. The company now expects at least 4% growth in adjusted Ebitda for the year, versus an earlier projection of at least 3%.

The company posted 550,000 total postpaid net additions for the quarter, and it pointed to 468,000 postpaid phone net additions. Phone average revenue per user inched up 0.6% to $55.99, reflecting “pricing actions, higher international roaming and a mix shift to higher-priced unlimited plans,” according to the earnings release.

AT&T added a net of 296,000 fiber subscribers to bring its total above 8 million.