The industrial giant was praised as a “premium large-cap name” in commercial aerospace.

Source link

outperform

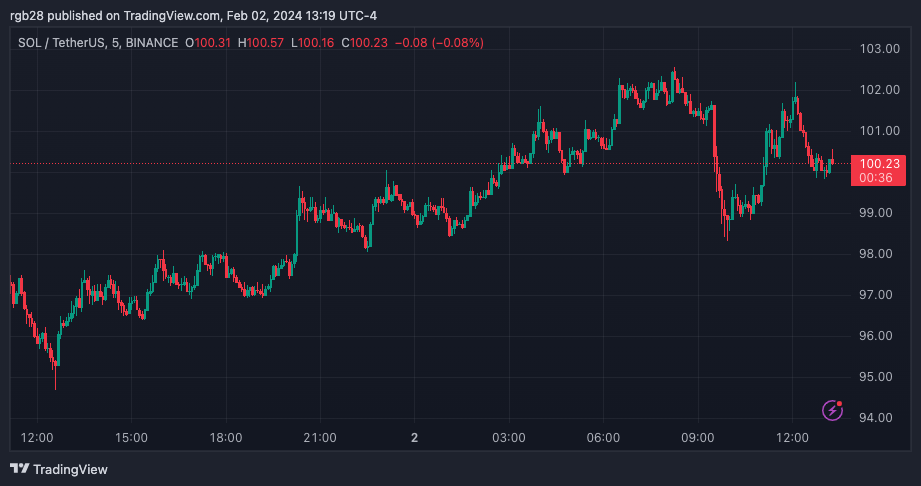

Recent data shows that Solana-based decentralized exchanges (DEXs) have taken Ethereum’s spot in a key metric, creating expectations and positive sentiment for the Solana (SOL) ecosystem.

Solana DEXs Outperform Ethereum

According to data from DeFiLlama, Solana-based decentralized exchanges (DEXs) have flipped Ethereum in daily trading volume. Over the last 24 hours, Solana’s $1.14 billion trading volume surpasses Ethereum DEX’s $1.133 billion trading volume.

This accomplishment occurred for the first time in December of 2023 when Solana’s daily DEX volume reached $1.475 billion, surpassing Ethereum’s $1.164 billion, and hit a growing interest by traders in the SOL ecosystem.

Solana surpasses Ethereum in the DEX 24-hour volume. Source: DeFiLlama

Solana also saw a weekly change of +37.67% in its trading volume. However, the data shows that Ethereum is still above Solana in the 7-day volume metric, with $7.852 billion and $ 6.113 billion, respectively.

Additionally, data from CoinGecko shows that Solana-based DEXs Jupiter and Orca are among the 3 largest decentralized exchanges by volume in the last 24 hours. As the chart below displays, Jupiter has a daily volume of $ 614 million, while Orca shows a volume of $380 million, occupying the second and third spots, respectively.

Ethereum’s Uniswap V3 topped the chart with a daily volume of $636 million. The data also shows Raydium among the top 10 DEXs by volume in the last 24 hours.

Jupiter and Orca are among the top 3 decentralized exchanges in the 24H trading volume. Sorce: CoinGecko

Research platform SoSo Value pointed out on X (formerly known as Twitter) the recent Jupiter’s rise in popularity and monthly users’ increase as a key contributor to the Solana ecosystem’s boost in activity, bringing considerable attention and trading activity into the ecosystem.

These recent achievements hint at a healthy growth and development of Solana’s DeFi ecosystem.

Solana’s Price Action

The surge in interest in Solana has been driven by its meme coin sector, the airdrops, and fast transactions offered to its users. As a result, its native token managed to reclaim previously lost territory.

However, while Solana surpassed Ethereum’s DEX on low timeframes, the second crypto by market cap remains king of the DeFi sector. The chart above shows that the Ethereum-based DEX holds over $6 billion in Total Value Locked (TVL).

This piece of data indicates the resilience of the ETH ecosystem in maintaining its position as king of DeFi but holds promise for Solana. The fast-growing blockchain could attract further attention and interest if the daily trend extends.

Despite some fluctuation in the last few weeks, Solana’s price has surfaced in the $90-$100 price range in the last month. According to CoinGecko data, SOL’s price has surged 1.9% in the last 24 hours and 6.3% in the previous 7 days.

SOL is trading at $100.23 in the hourly chart. Source: BTCUSDT on Tradingview.com

Featured image from Unsplash.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

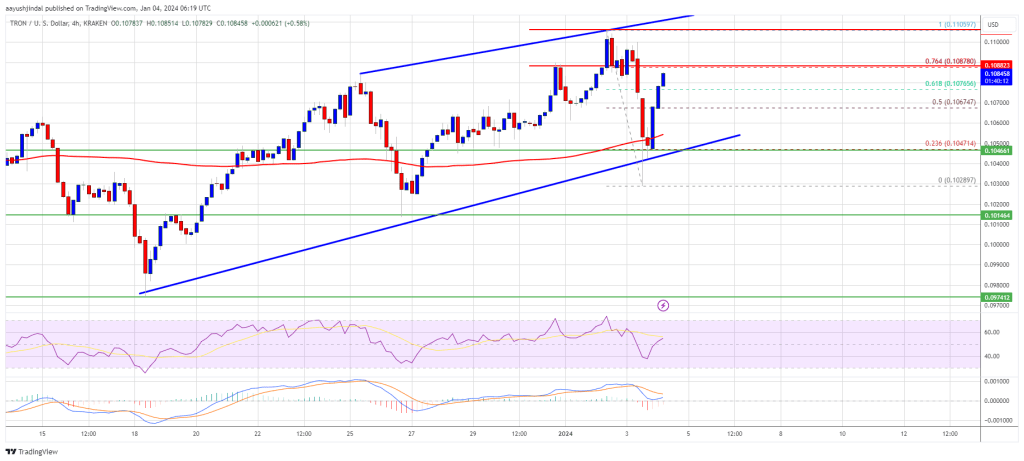

Tron price is holding gains above the $0.1050 support against the US Dollar. TRX is outperforming Bitcoin and could rise further above $0.1105.

- Tron is moving higher above the $0.1050 resistance level against the US dollar.

- The price is trading above $0.1065 and the 100 simple moving average (4 hours).

- There is a key rising channel forming with support at $0.1052 on the 4-hour chart of the TRX/USD pair (data source from Kraken).

- The pair could continue to climb higher toward $0.1105 or even $0.1200.

Tron Price Regains Strength

Recently, Bitcoin and Ethereum saw a major drop below $43,500 and $2,200. However, Tron price remained stable above the $0.1000 support. TRX formed a base above $0.1020 and started a fresh increase.

There was a move above the $0.1050 and $0.1055 resistance levels. The bulls pushed it above the 50% Fib retracement level of the downward move from the $0.1059 swing high to the $0.1028 low. TRX is now trading above $0.1065 and the 100 simple moving average (4 hours).

There is also a key rising channel forming with support at $0.1052 on the 4-hour chart of the TRX/USD pair. The current price action suggests more upsides.

On the upside, an initial resistance is near the $0.1088 level. It is near the 76.4% Fib retracement level of the downward move from the $0.1059 swing high to the $0.1028 low. The first major resistance is near $0.1105, above which the price could accelerate higher.

Source: TRXUSD on TradingView.com

The next resistance is near $0.1150. A close above the $0.1150 resistance might send TRX further higher toward $0.1200. The next major resistance is near the $0.1124 level, above which the bulls are likely to aim for a larger increase toward $0.1320.

Are Dips Limited in TRX?

If TRX price fails to clear the $0.1105 resistance, it could start a downside correction. Initial support on the downside is near the $0.1065 zone.

The first major support is near the $0.1050 level or the trend line, below which it could test $0.1020. Any more losses might send Tron toward the $0.0975 support in the coming sessions.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.1065, $0.1050, and $0.0975.

Major Resistance Levels – $0.1088, $0.1105, and $0.1150.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Many tech stocks stumbled in 2022 as rising interest rates and other macro headwinds rattled the markets. However, many of those stocks also bounced back in 2023 in anticipation of lower rates and a stabilizing macro environment.

That bullishness should persist in 2024 as the PC market recovers, the smartphone market stabilizes, and the artificial intelligence (AI) market expands. I personally believe Intel (INTC -0.28%), HP (HPQ -0.30%), and Micron (MU -0.64%) will all be lifted higher by those tailwinds and outperform the S&P 500 over the next 12 months.

Image source: Getty Images.

Intel

Intel is the largest producer of x86 central processing units (CPUs) for PCs and data centers. It experienced a growth spurt during the pandemic as consumers bought new PCs for remote work, online classes, and gaming. Data centers also upgraded their servers with new chips to handle the increased usage of their cloud-based services.

However, Intel suffered a severe slowdown over the past two years as the pandemic ended, and macro headwinds drove companies to rein in their spending. Intel also fell behind Taiwan Semiconductor Manufacturing (TSMC) (TSM -0.67%) in the process race to manufacture smaller and denser chips. So, its smaller rival, AMD (AMD -0.91%) — which outsourced its production to TSMC — pulled ahead of Intel with more power-efficient chips. That’s why Intel’s revenue has declined year over year for seven consecutive quarters.

That situation might seem bleak, but Intel’s revenue actually grew sequentially over the past two quarters as the PC market gradually stabilized. Intel also believes its own foundries can catch up to TSMC in the process race in the near future, which would widen its competitive moat against AMD.

Analysts expect Intel’s revenue and adjusted earnings to grow 13% and 99%, respectively, in 2024 as those tailwinds kick in. Intel’s stock might not seem like a bargain at 30 times next year’s earnings, but its rising profits should quickly compress its forward valuations as the PC market heats up again.

HP

HP, one of the world’s largest producers of PCs and printers, experienced a similar boom and bust cycle as Intel. Its revenue has declined year over year for six consecutive quarters as its sales of consumer PCs and printers slipped after the pandemic and macroeconomic headwinds curbed its sales of commercial hardware.

However, HP’s sales of personal systems (PCs and workstations) still rose sequentially over the past two quarters. Its sales of printers also grew sequentially last quarter.

That stabilization suggests the company has finally reached its cyclical trough — and analysts expect its revenue and adjusted earnings per share (EPS) to rise 2% and 5%, respectively, in fiscal 2024 (which ends in October 2024). Those growth rates might seem low, but its stock is dirt cheap at eight times forward earnings and pays an attractive forward yield of 3.7%.

Looking ahead, the company plans to lay off 7%-10% of its workforce by the end of fiscal 2025, streamline its PC portfolio, and launch new products for the higher-growth hybrid work, gaming, industrial graphics, and 3D printing markets. It also intends to roll out new subscription services to expand its gross margins. Those ambitious plans could breathe fresh life into HP’s aging business and make it an attractive stock for long-term investors again.

Micron

Micron is one of the world’s largest producers of DRAM and NAND memory chips. The end of the 5G upgrade cycle in smartphones, the slowing PC market, and macro challenges for other markets all took a toll on its growth over the past year.

But in the first quarter of fiscal 2024 (which ended on Nov. 30), Micron’s revenue rose 16% year over year and finally ended its five-quarter streak of declining revenue. It expects an acceleration to 44% revenue growth in the second quarter, which clearly indicates its cyclical slowdown is over.

Micron attributes that recovery to the expansion of the generative AI market, the robust growth of the automotive chip market, and the stabilization of the smartphone market. Analysts expect its revenue to rise 32% for the full year as it significantly narrows its net losses. For fiscal 2025, they expect its revenue to rise 41% as it returns to profitability.

Micron trades at just 14 times next year’s earnings, which suggests the market hasn’t fully priced in its cyclical recovery yet. It could head much higher in 2024 as more investors realize that brighter days are ahead for this memory chipmaker.

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, HP, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

The sixth largest cryptocurrency Solana (SOL) has all chances to enter the Top 5.

Solana (SOL) is threatening to replace XRP among the world’s top five leading cryptocurrencies by market capitalization, driven by an increased surge of activities within the Solana ecosystem.

According to CoinMarketCap data, currently ranked as the sixth-largest token in the industry, SOL has the potential to surpass XRP’s market cap. At press time, SOL is trading around $76.91, with a market capitalization of $32,898,753,885, closely following XRP at $33,009,755,118.

SOL Could Reach New Highs of $80

Interest in the Solana ecosystem has surged recently as the industry regained momentum following the 2022 bear market. SOL’s price has maintained a consistent trading pattern since the beginning of the previous quarter and is on the brink of entering a consolidation phase.

Market experts believe that the price will sustain an upward consolidation trend until reaching new peaks at $80. However, there might be a slight retreat below key levels, testing around $65 after the potential surge. Upon entering the liquidity zone, a rebound is anticipated, potentially propelling the price to surpass $90 in the initial days of 2024, ultimately overtaking XRP.

BONK Flips PEPE and EOS

One of the contributing factors to the SOL price surge is the resurgence of dog-themed memecoins. A new memecoin project, BONK, built atop the Solana ecosystem, has recently gained attention from the crypto community.

This followed a successful distribution of an airdrop to users contributing to the launch of the protocol. Qualifying for the airdrop involved purchasing Solana’s mobile phone, Saga, leading to increased adoption of the smartphone despite initial poor sales.

BONK received support from major exchanges, including Binance and Coinbase, resulting in an astonishing 1,100% surge in the past month. This propelled the token to become the third-largest memecoin, surpassing the market cap of its major rival, Pepe.

Additionally, BONK achieved a remarkable feat of flipping EOS in market capitalization, further amplifying attention and driving the surge even higher.

XRP Demonstrates Resilience

In the face of increasing competition from Solana, XRP has showcased remarkable resilience within the market. Earlier this week, the crypto token briefly surpassed Binance Coin (BNB) in market capitalization, reaching an approximate value of $36.09 billion.

The token overtook BNB position as the fourth-largest cryptocurrency by market capitalization before shortly retracing back to its fifth position.This fleeting accomplishment highlights XRP’s consistent presence in the market, often overlooked in comparison to industry giants like Bitcoin (BTC) and Ethereum (ETH).

The distinctive position held by XRP is further amplified by its legal standing in the US, where it has been officially deemed a non-security following a pivotal court ruling. This legal classification sets XRP apart from numerous other digital tokens and could serve as a crucial factor influencing its market performance.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Goldman Sachs Says Utilities and Consumer Staples Stocks Are Set to Outperform as the Presidential Election Approaches — Here Are 2 Names the Banking Giant Likes

Almost exactly a year from now, Americans will cast their ballots and vote for a President, doing so for the 60th time since 1788. The election process will kick off in earnest on January 15th when the Iowa Republican caucuses mark the official commencement of primary season.

Right on time, says Goldman Sachs’ Chief U.S. Equity Strategist David Kostin, investors have started asking how the 2024 election will impact the stock market.

Going by the history books, it’s not going to be a vintage year. In the 12 months heading into an election, since 1932, the S&P 500 has averaged a return of 7%, below the 9% average return seen in non-election years. In fact, recent performance has been even worse; since 1984, the S&P 500 has posted an average return of only 4% in the preceding 12 months of an election.

So, what should investors specifically focus on during the next year? “Profit growth is typically strong in election years while valuations move sideways,” Kostin noted. “Info Tech has usually been the worst performing sector in the year ahead of the election. Defensive sectors tend to perform best, led by Utilities and Consumer Staples.”

Against this backdrop, Goldman Sachs analysts have pinpointed two stocks in these defensive sectors worth examining closely. We’ve decided to give them a closer look and for a fuller view of their prospects we ran them through the TipRanks database. Here’s what we found.

Don’t miss

Sempra (SRE)

Starting with the Utilities sector, we’ll explore Sempra, an energy infrastructure company that ranks among the largest regulated providers of electricity and natural gas services in the United States. Sempra primarily serves approximately 40 million customers in Southern California and Texas.

The company’s operations are organized into distinct segments, which include San Diego Gas and Electric Company (SDG&E), Southern California Gas Company (SoCalGas), Sempra Texas Utilities, Sempra Mexico, and Sempra LNG. By the numbers, at the end of 2022, the company boasted of $79 billion in total assets while Sempra oversees a 20,000-strong workforce spread across its family of businesses.

The company only recently released its Q3 earnings report, showing mixed results. On the one hand, revenue fell by 8% year-over-year to $3.33 billion, while missing the Street’s forecast by $350 million. However, Sempra fared much better at the other end of the equation, with Q3 adj. earnings rising from $622 million in the year-ago period, or 0.98 per diluted share, to $685 million, or $1.08 per diluted share, thereby outpacing analyst expectations by $0.07.

On the back of the strong performance seen during the first 9 months of the year, for the full year, the company now expects adj. earnings to come in above or at the high-end of its guided range of $4.30 to $4.60 vs. Street expectations of $4.49.

Scanning these results, Goldman Sachs analyst Carly Davenport finds plenty to like about the latest display whilst noting the catalysts ahead.

“This quarter increased our conviction that SRE’s Texas utility Oncor is a material strength for the company. The reduction of regulatory lag, potential increase in capex, and a clear runway for organic load growth in the region all highlight why we have viewed Oncor as an underappreciated asset for SRE. We believe SRE has several key catalysts ahead, including the aforementioned capex raise, the conclusion of the California GRC (general rate case), and the announcement of FID for the Cameron expansion and Port Arthur Phase 2 in 2024. SRE continues to trade at a 0.7x discount to our coverage group on our 2025 numbers, which we view as unwarranted given these strengths,” Davenport opined.

These comments underpin Davenport’s Buy rating while her $89 price target suggests shares will climb 24% higher in the months ahead. (To watch Davenport’s track record, click here)

Overall, the analyst consensus rates SRE shares a Moderate Buy based on a mix of 6 Buys and 4 Holds. The forecast calls for one-year returns of 11%, considering the average target stands at $80.56. The company also pays a regular dividend. The latest div payout reached $0.59 per share, providing a ~3.25% yield.

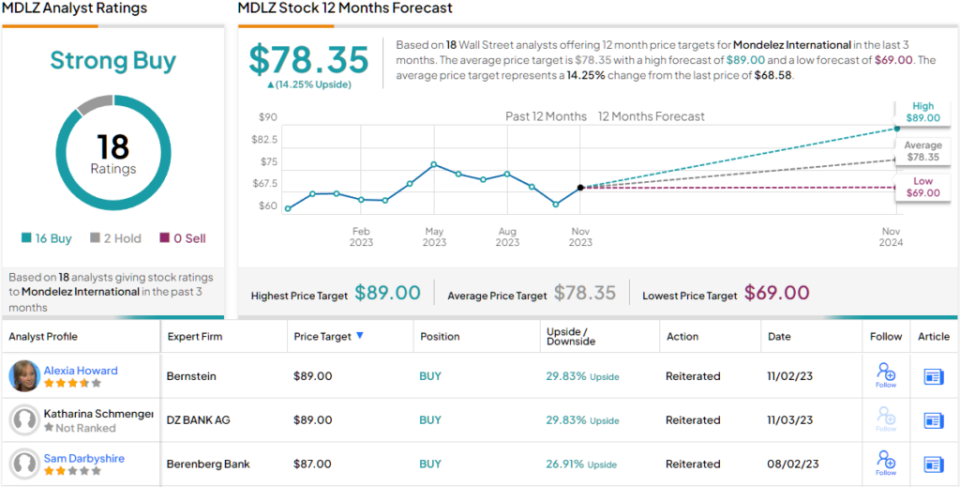

Mondelez International (MDLZ)

Let’s now turn to the Consumer Staples sector and check the details on global snack powerhouse Mondelez International. The company was created in 2012 when spun off from Kraft Foods and boasts a diverse range of iconic products, including Oreos, Cadbury, Toblerone, Ritz, and Trident, to name just a few. With a presence in more than 150 countries, Mondelez is one of the world’s biggest snack companies, claiming first global spot in biscuits (cookies and crackers) ands second in chocolate.

Last year, global net revenues reached around $31.5 billion, and the company appears on track to exceed that figure this year. In fact, in the recently released Q3 report, despite substantial reinvestment endeavors, the company bettered expectations on several fronts. Revenue reached $9.03 billion, representing a 16.4% YoY increase while beating the consensus estimate by $220 million. On the bottom-line, adj. EPS of $0.82 outdid the forecast by $0.04.

And looking ahead, the company delivered, too. Mondelez increased its FY23 organic net sales growth outlook from 12%+ beforehand to +14-15% vs. the consensus estimate of +13.8% and boosted the adj. EPS growth outlook to ~16% compared to the prior 12%.

Goldman Sachs analyst Jason English expects that strong performance to persist. “We continue to believe the company is well positioned to see widening fundamental outperformance versus Staples peers,” English said. “It is aggressively investing in both marketing and commercial activation with a long runway of distribution growth still ahead of it in markets such as Mexico, Brazil, China, India and other Southeast Asian markets. We expect this to sustain its momentum in the foreseeable future and reiterate our Buy rating in this context.”

That Buy rating is accompanied by an $82 price target, which makes room for one-year growth of 20%. (To watch English’s track record, click here)

Overall, Mondelez gets plenty of support on Wall Street. The stock claims a Strong Buy consensus rating, based on 16 Buys vs. just 2 Holds. Over the next year, shares are expected to appreciate by 14%, considering the average target stands at $78.35. Investors can also enjoy a dividend here. The latest payout stood at $0.42/share, and that offers a yield of ~2.45%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Tron price is holding gains above $0.0825 against the US Dollar. TRX is outperforming Bitcoin and could rise further toward $0.095.

- Tron is moving higher above the $0.0825 resistance level against the US dollar.

- The price is trading above $0.0830 and the 100 simple moving average (4 hours).

- There is a short-term contracting triangle forming with resistance near $0.0844 on the 4-hour chart of the TRX/USD pair (data source from Kraken).

- The pair could continue to climb higher toward $0.088 or even $0.095.

Tron Price Eyes Upside Break

In the last Tron price prediction, we discussed how TRX outperformed Bitcoin against the US Dollar. TRX remained stable and was able to settle above the $0.080 pivot level.

There was a decent increase above the $0.0825 and $0.0832 resistance levels. A high was formed near $0.0849 and the price recently corrected lower. There was a minor decline below the $0.0835 level. However, the bulls were active near the $0.0830 support.

The price found support near the 23.6% Fib retracement level of the upward move from the $0.0770 swing low to the $0.0849 high. TRX is now trading above $0.0825 and the 100 simple moving average (4 hours). There is also a short-term contracting triangle forming with resistance near $0.0844 on the 4-hour chart of the TRX/USD pair.

On the upside, an initial resistance is near the $0.0844 level. The first major resistance is near $0.0850, above which the price could accelerate higher. The next resistance is near $0.088.

Source: TRXUSD on TradingView.com

A close above the $0.088 resistance might send TRX further higher toward $0.0920. The next major resistance is near the $0.095 level, above which the bulls are likely to aim for a larger increase toward $0.095.

Are Dips Limited in TRX?

If TRX price fails to clear the $0.085 resistance, it could slowly move lower. Initial support on the downside is near the $0.083 zone. The first major support is near the $0.082 level or the 100 simple moving average (4 hours).

The next major support is near $0.080 or the 61.8% Fib retracement level of the upward move from the $0.0770 swing low to the $0.0849 high, below which the price could accelerate lower. The next major support is $0.0770.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.083, $0.082, and $0.080.

Major Resistance Levels – $0.085, $0.088, and $0.095.

Real-world asset protocols outperform DeFi blue chips due to tokenization wave

Real-world asset (RWA) protocols have become a hot trend within decentralized finance (DeFi) circles.

An RWA protocol is a decentralized application that allows entities to tokenize and trade real-world assets. These assets range from stocks and government bonds to real estate and commodities. They are also known as asset tokenization protocols.

DeFi provides certain advantages over TradFi by making the smart contracts transparent and enabling a wide degree of financialization of assets by making them divisible, transferable and tradable on decentralized platforms.

The top uncollateralized lending protocols for institutions, TrueFi and Maple, have increased by 26.6% and 117.8%, respectively, in 2023. Centrifuge, a real-world asset tokenization platform, has surged by 32% year to date.

In comparison, the gains recorded by the DeFi pulse index in the same period were 13%. Glassnode’s index of DeFi blue-chip tokens has lost 7% since the year’s start.

Recent data from Nansen found that the governance tokens of RWA protocols surged significantly in January and April thanks to the rising interest in them.

Previously, experts had suggested that many DeFi veterans were already implementing RWA-based strategies but that the lack of sufficient RWA on-chain was hindering the ecosystem’s development.

This is changing due to increased tokenization of real-world assets.

TradFi interest boost RWA activity

The top RWA protocol by total locked value, Ondo Finance, is a DeFi platform that enables stablecoin holders to directly invest in exchange-traded funds managed by top-tier asset managers like BlackRock and Pimco. United States bonds of more than $100 million have been issued via Ondo, per DefiLlama data.

Goldman Sachs, Microsoft and Deloitte have eyed digital asset tokenization by partnering with the blockchain startup Digital Asset. German technology giant Siemens issued a digital bond on a public blockchain worth $64 million in February 2023.

The RWA assets account for 25% of the largest decentralized stablecoin Dai’s (DAI) collateral, having increased from zero before the start of the year.

MakerDAO, the community-led decentralized autonomous organization, has approved the conversion of centralized stablecoins like USD Coin (USDC) to U.S. Treasury bonds. The DAO accepts tokenized government and corporate bonds and commodities as collateral for minting DAI.

So far, debt market protocols like Maple Finance, TrueFi, Goldfinch and Clearpool have led the price action and activity among RWA protocols. These protocols enable non-collateralized lending for institutions.

Some of the top-ranked RWA protocols by total value locked, like Ondo Finance, MatrixDock and RealT, do not have a governance token attached to them. Nevertheless, these protocols have attracted usage thanks to the chances of a potential airdrop in the future.

Related: DeFi securitization of real-world assets poses credit risks, opportunities: S&P

Notably, the non-collateralized lending protocols carry the risk of debt default. FTX’s collapse led to a significant decline in Maple Finance’s price and pushed the protocol to the brink of insolvency.

The yields of the U.S. Treasury bonds are also set to fall once the Fed starts cutting its benchmark interest rate, which could make these assets less attractive.

Nevertheless, it is encouraging to see the increasing tokenization of real-world assets and their financialization through DeFi finally catching positive momentum as they gain institutional support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.