Rich Dad Poor Dad author Robert Kiyosaki has urged investors to ditch the U.S. dollar and buy bitcoin alongside gold and silver. He warned that “baby boomers’ retirements are going broke as paper assets crash.” The famous author stressed: “I do not trust anything that can be printed.” Robert Kiyosaki’s Latest Warnings and Advice The […]

Rich Dad Poor Dad author Robert Kiyosaki has urged investors to ditch the U.S. dollar and buy bitcoin alongside gold and silver. He warned that “baby boomers’ retirements are going broke as paper assets crash.” The famous author stressed: “I do not trust anything that can be printed.” Robert Kiyosaki’s Latest Warnings and Advice The […]

Source link

Paper

New Research Paper Sheds Light on Alleged Conflicts of Interest in FTX’s Chapter 11 Filing

A recent research paper on SSRN by legal scholars scrutinizes the ethical quandaries and potential conflicts of interest surrounding Sullivan & Cromwell LLP’s involvement in FTX’s Chapter 11 bankruptcy filing. Study Highlights Legal Ethics From FTX Bankruptcy Proceedings The SSRN research paper entitled “Conflicting Public and Private Interests in Chapter 11” meticulously explores the controversial […]

A recent research paper on SSRN by legal scholars scrutinizes the ethical quandaries and potential conflicts of interest surrounding Sullivan & Cromwell LLP’s involvement in FTX’s Chapter 11 bankruptcy filing. Study Highlights Legal Ethics From FTX Bankruptcy Proceedings The SSRN research paper entitled “Conflicting Public and Private Interests in Chapter 11” meticulously explores the controversial […]

Source link

Arm’s stock surge burns short sellers, to tune of $445 million in paper losses

Arm Holdings PLC’s stock easily had its best day on record Thursday, and its 48% daily surge scorched short sellers in the process.

Shorts racked up $445 million in paper losses as Arm’s stock

ARM,

exploded higher in the wake of earnings, according to S3 Partners. The action highlighted how shorting semiconductor stocks “has not been a profitable trade” this year, S3’s Ihor Dusaniwsky said in a report.

Those who’ve made bearish bets against the sector are down more than $7 billion in mark-to-market losses so far this year, he noted, and about a fifth of those losses came Thursday alone.

See also: Arm’s stock explodes 50% higher as company proves itself an early AI winner

While a sizable chunk of Thursday’s paper losses in the chip sector related to Arm, daily paper losses for those short Broadcom Inc.

AVGO,

Taiwan Semiconductor Manufacturing Co. Ltd.

TSM,

and Monolithic Power Systems Inc.

MPWR,

were each in excess of $100 million, according to S3.

Dusaniwsky flagged that Arm short interest is $957 million, with about 12.4 million shares shorted and those representing roughly 1.22% of the float. Arm ranked 14th by short interest within the semiconductor sector.

“We should expect a reversal of the short-selling trend we have seen in ARM in 2024 as short sellers get squeezed out of their positions,” said Dusaniwsky, the managing director of predictive analytics at S3. “Short covering during today’s rally should continue for the next few days as short sellers look for a slight rebound to the upside to recoup some of their mark-to-market losses as they trim exposure.”

Arm, a chip designer, stunned investors late Wednesday with better-than-expected results that highlighted momentum for the company’s new architecture as well as traction related to the artificial-intelligence frenzy.

Don’t miss: Cloudflare’s stock catapults higher as earnings beat captures ‘robust momentum’

“The rise/adoption of accelerated compute/AI workloads in the data center, edge and endpoints is driving the requirement for significantly more compute capability and power efficiency per device and motivating ARM’s customer to adopt their highest-performance compute” intellectual property, JPMorgan’s Harlan Sur wrote in a note to clients.

Ripple is currently working with over 20 central banks from around the world, helping them to develop digital versions of their national currency.

Blockchain-based payment solutions provider Ripple has reaffirmed its support for central bank digital currencies (CBDC). In a 23-page white paper released on December 14, the firm explains the basics of CBDCs, their potential benefits, risks, and barriers to mainstream adoption. It also stresses the need for governments and private sector players to collaborate in addressing challenges.

Citing a report by global management consulting firm McKinsey, Ripple presents CBDCs as an aid to ensuring financial inclusion, reducing fraud and money laundering, stimulating payment innovation, and reinforcing monetary policy control.

The document also highlights the role of central bank digital currencies in tokenization, stating:

“CBDCs are needed to support the most significant positive impacts of asset tokenization, an increasingly targeted mechanism for transforming tangible assets into digital tokens stored on the blockchain. With tokenization, anyone can view the process of asset transfer through ownership,” the paper reads in part, adding that “tokenization improves privacy and agility as assets move peer-to-peer without the need for centralized intermediaries within decentralized networks.”

The whitepaper goes on to mention some barriers to widespread CBDC adoption including lack of end-user adoption, little-to-no consumer education, fears about privacy and security protections, digital identity verification, lack of interoperability among CBDCs and offline access to transactions. The firm reasons that these issues are not “unsolvable,” adding that they must be solved at scale and often through collaborative efforts among countries and jurisdictions.

Ripple is currently working with over 20 central banks from around the world, helping them to develop digital versions of their national currency. These include The Royal Monetary Authority (RMA) of Bhutan, Colombia’s Banco de la República, and the Central Bank of Montenegro.

Columbia’s Minister of Information and Communication Technologies Mauricio Lizcano comments:

“Potential efficiencies can be evaluated through the results obtained in the development of a solution with blockchain technology. In turn, this manages to improve and complement the processes in the entities in a safe and efficient way. In addition, it will provide a technological solution. This solution will allow simulations of different use cases in the high-value payment system.”

The paper concludes by re-emphasizing the need for cross-government collaboration. It notes although central banks are moving at different paces in CBDC development, they are “extraordinarily interdependent”. It adds that the global adoption of sovereign-backed digital assets will need agreement on common standards and protocols that will enable interoperability.

It is estimated that $5 trillion worth of CBDCs from around the globe will circulate through major economies over the next 10 years – further incentive for governments and private sector participants to work together towards addressing challenges.

next

Altcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Bitcoin recent rally pushes MicroStrategy into over $110M in paper profit

MicroStrategy’s Bitcoin (BTC) investment is now in the green, boasting over $110 million in unrealized profits after the flagship asset jumped above $30,000 earlier today, according to CryptoSlate’s data.

Saylortracker, a dedicated platform for monitoring MicroStrategy’s BTC holdings, confirms that BTC’s current value surpasses the firm’s average purchase price.

Data from the website shows that MicroStrategy had acquired its 158,245 Bitcoin bag at an aggregate purchase price of $4.83 billion and an average of $29,870.14 per coin.

With the top cryptocurrency trading for $30,493 as of press time, the company is profiting more than $600 on each BTC as its holdings are now worth $4.84 billion.

Over the years, MicroStrategy has consistently expanded its holdings, with its most recent purchase being the acquisition of 5,455 units between Aug. 1 and Sept. 24. The company holds 14 times more BTC than the closest public company, Marathon Digital, according to data from Bitcoin Treasuries.

Michael Saylor, the business intelligence company’s chairman, remains a vocal proponent of BTC. On Oct. 21, he shared data showing that BTC has outperformed traditional assets like gold, Nasdaq, Silver, and bonds since MicroStrategy adopted the Bitcoin strategy in 2020.

Meanwhile, MicroStrategy’s MSTR stock is also performing well, rising by 1.62% to $353.67 at pre-market trading, according to Tradingview data. The asset has recorded an impressive year-to-date increase of 138.92%.

ETF buzz keeps BTC rising

Bitcoin’s recent price surge is closely tied to growing interest in spot-based Exchange-Traded Funds (ETFs) in the United States.

The leading cryptocurrency rallied past $30,000 just last week following erroneous reports that the Securities and Exchange Commission (SEC) had given the green light to BlackRock’s ETF proposal.

Market analysts view this reaction as a clear indication of investor optimism for ETF approval. According to insights from crypto research firm Matrixport, Bitcoin’s value could surpass $50,000 if the SEC approves an ETF application.

The post Bitcoin recent rally pushes MicroStrategy into over $110M in paper profit appeared first on CryptoSlate.

“Paper BTC” Is Counteracting A Bullish Bitcoin Supply Shock, Analyst Explains

An analyst has explained how the growth in “paper BTC” could be counteracting a bullish Bitcoin supply shock from taking effect.

Liquid Bitcoin Supply Has Dropped, But Paper BTC Is Still At Significant Levels

In a new post on X, analyst Willy Woo shared insight into how the paper BTC compares against the real BTC being traded. According to the analyst, “paper BTC” refers to the combined futures open interest value.

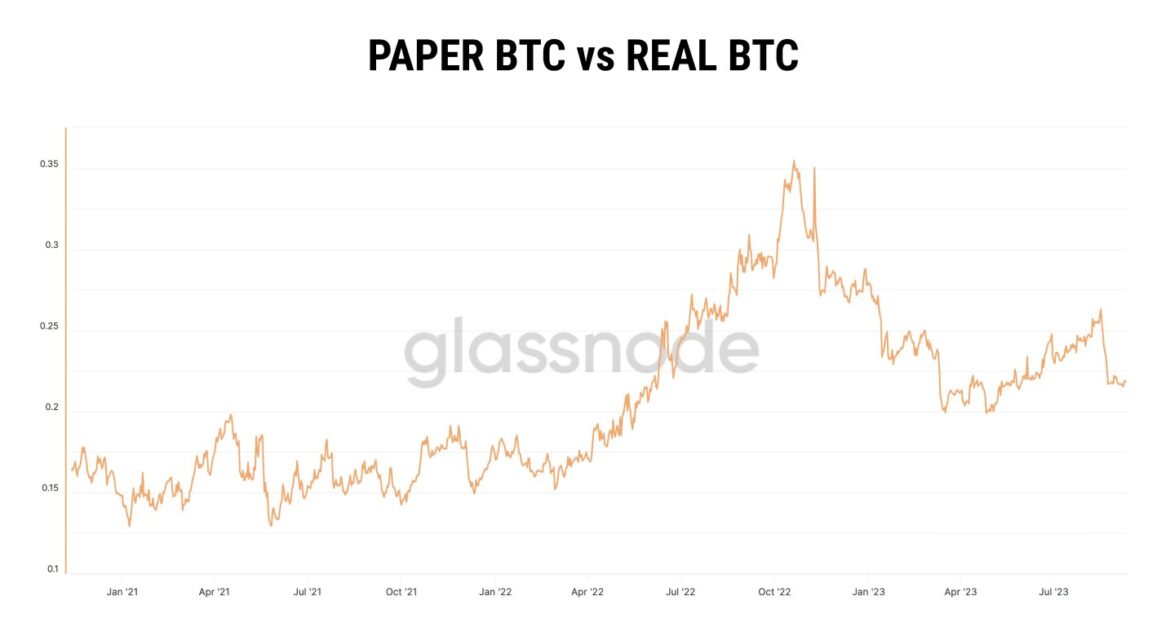

Here is a chart that shows the trend in the ratio between the two types of Bitcoin over the past couple of years:

The data for the paper vs real BTC ratio since January 2021 | Source: @woonomic on X

The graph shows that the ratio’s value has fluctuated between 0.2 and 0.3 in recent months, suggesting that the paper Bitcoin has been 20 to 30% more than the real coins during this period.

The real supply of the cryptocurrency may be divided into three categories: illiquid, liquid, and highly liquid. The on-chain analytics firm Glassnode puts coins into these divisions based on the behavior of the investors holding them.

To be more precise, the ratio between the cumulative outflows and inflows of the investor since they entered the market is used to define their liquidity. This ratio’s value approaches zero for the illiquid supply, as holders of this cohort rarely move coins out of their addresses.

Similarly, the value becomes close to 1 for the highly liquid supply, as investors of this class tend to shift their coins quickly. In the above ratio, Woo has only used this highly liquid supply as a measure of the “real BTC.”

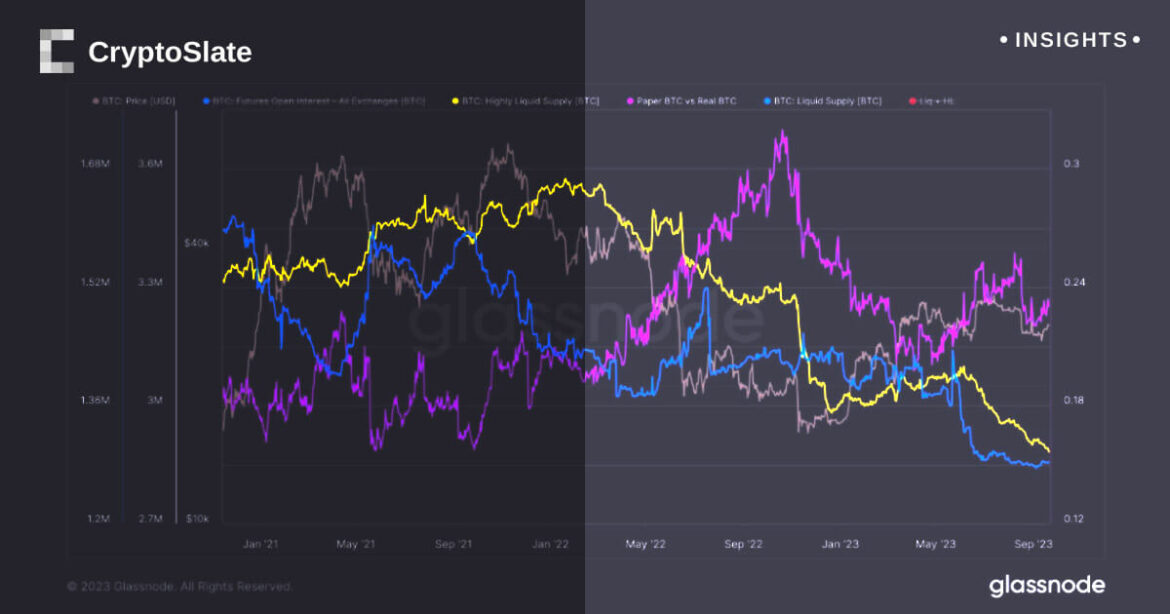

As the chart below shows, this highly liquid Bitcoin supply has been going down recently.

Looks like the value of the metric has been going down in recent years | Source: @woonomic on X

The analyst notes that the less the number of coins in this supply, the more bullish is the outlook for Bitcoin since there are a lesser amount of coins available to be bought.

Another analyst, James V. Straten, replied to Woo’s post with a chart that combines the liquid supply into the ratio, which, while less fluid than the highly liquid supply, still constitutes a notable part of the BTC traded supply.

The paper vs real BTC ratio with liquid supply accounted for | @jimmyvs24 on X

According to Straten, the liquid and highly liquid supplies have observed a combined drawdown of 500,000 BTC (around $13.3 billion at the current exchange rate) since May 2023.

However, as the paper BTC is still significantly more than the real BTC, any “supply shock” effects being created out of the real supply becoming less liquid are being more than made up for by the increase in the paper supply.

BTC Price

Bitcoin has registered a sharp decline in the past day, as the coin has lost the $27,000 level and is currently floating around the $26,500 mark.

BTC has dropped during the last 24 hours | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Quick Take

A recent analysis by Willy Woo draws attention to the rising dominance of paper Bitcoin (futures open interest value) over the real, liquid Bitcoin traded daily.

According to Woo, we are witnessing a period where the trading of paper Bitcoin exceeds that of liquid Bitcoin by 20-30%. This surge in paper Bitcoin trading effectively mitigates any potential supply shock, even as there has been a noticeable drop of approximately 500,000 in both liquid and highly liquid Bitcoin supply in recent months.

This development mirrors a similar situation in the gold market, where the prevalence of a paper or derivatives market has often been viewed as a vulnerability. This is primarily because it provides an avenue for suppressing gold’s value. With Bitcoin seemingly following a similar path, this could suggest an increasing influence of derivative markets on the intrinsic value of cryptocurrencies.

While the long-term impact of such a shift is uncertain, it underlines the evolving dynamics of the cryptocurrency market, which continues to mirror traditional financial systems unexpectedly.

The post Paper Bitcoin trading volume outstrips traded Bitcoin appeared first on CryptoSlate.

(Bloomberg) — US Treasuries are seen globally as the world’s favored haven asset. Yet it’s short maturities that best fit that definition, according to a Federal Reserve Bank of Dallas paper.

Most Read from Bloomberg

“Not all Treasury securities are equally safe,” according to the paper published Tuesday by economist J. Scott Davis. “Long-term Treasury bonds may have no default risk, but they have liquidity risk and interest-rate risk — when selling the bond prior to maturity, the sales price is sometimes uncertain, especially in times financial market stress.”

“Short-term US safe assets are the assets that are truly safe, and safe haven flows lead to an increase in these short-term inflows, even while long-term inflows fall,” Davis concluded.

These risks were underscored in March amid the US regional banking crisis, when losses on long-term Treasuries and other government-related debt became key forces that brought down several regional banks. There was of course a run on deposits, yet clients’ realization that banks were sitting on large unrealized losses on long-term government debt helped spark the tumult.

World’s Favorite Risk-Free Asset Is Looking Riskier After SVB

The US has a large external debt, particularly in safe assets, Davis writes. In times of crisis, investors view US debt – especially short-term Treasuries — as a harbor.

“In a crisis, when investors prize safety and liquidity, they flock to safe short-term T-bills,” Davis wrote. He laid out how in two recent major financial crises, from 2007 to 2009 and during the onset of the pandemic in 2020, “long-term US portfolio debt inflows fell but short-term portfolio debt inflows increased.”

Supporting US assets overall during these turbulent periods is the fact that the dollar is the world’s reserve currency, tending to appreciate during crises, the economist writes.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.