TBD, a subsidiary of Block, owned by Jack Dorsey, has formed a partnership with Chipper Cash, an Africa-focused fintech company. This partnership aims to expedite consumer remittances and make them more affordable. According to a statement, Chipper Cash plans to use the decentralized exchange protocol of TBD. This will enable trusted transactions that comply with […]

TBD, a subsidiary of Block, owned by Jack Dorsey, has formed a partnership with Chipper Cash, an Africa-focused fintech company. This partnership aims to expedite consumer remittances and make them more affordable. According to a statement, Chipper Cash plans to use the decentralized exchange protocol of TBD. This will enable trusted transactions that comply with […]

Source link

partners

NextEra Energy Partners Investors Should Be Watching This Acquisition Very Closely. Here’s Why.

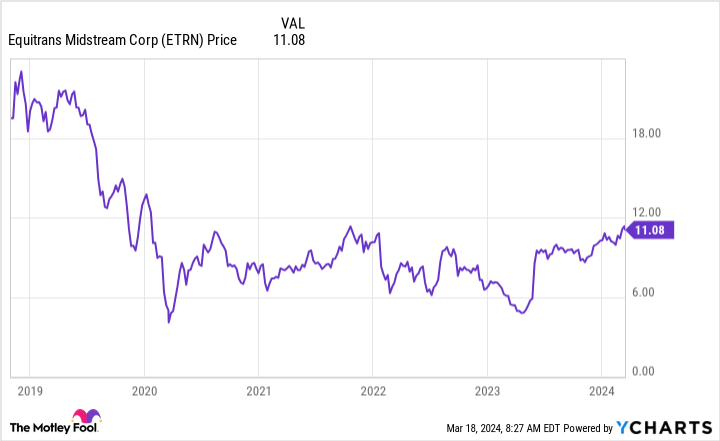

NextEra Energy Partners (NEP 1.29%) is showing up on high-yield screens today thanks to its huge 12%+ distribution yield. This wasn’t always the situation, noting that the yield was closer to 4% at the end of 2022. The steep unit price decline that pushed the yield higher is worth examining, but the potential fallout from that decline is also worth considering. To get an idea of why the latter consideration is important, just look at what’s happening with Equitrans Midstream (ETRN 1.31%) today.

What went wrong at NextEra Energy

NextEra Energy Partners was created by NextEra Energy (NEE 0.68%), one of the largest utilities in the United States. In addition to being a large regulated utility, NextEra Energy is also one of the largest producers of solar and wind power in the world. To take advantage of Wall Street’s once hot demand for anything related to clean energy, NextEra Energy created a master limited partnership (MLP) to own clean energy assets.

Image source: Getty Images.

NextEra Energy Partners is basically a funding vehicle for its parent, NextEra Energy. The parent sells clean energy assets, or “drops them down,” in industry lingo, to the MLP. The MLP buys the assets by issuing units and taking on debt. NextEra Energy uses the cash from the asset sales to fund future investments. NextEra Energy Partners uses the cash flow from the assets it buys to pay distributions to unitholders.

But investors have soured on the clean energy space, leading to a notable decline in the price of NextEra Energy Partners. That makes it more expensive to sell units. Making matters worse, rising interest rates increased the cost of debt capital, too. At this point, it isn’t nearly as attractive for NextEra Energy to sell assets to NextEra Energy Partners. And, as you might expect, NextEra Energy has announced plans to pull back on drop downs. That, in turn, will lead to slower growth at NextEra Energy Partners.

What does this have to do with Equitrans Midstream?

The big story for Equitrans Midstream is that EQT Corp. (EQT), the company that created the MLP, is buying it back. This isn’t the first time that a parent company of an MLP has bought back the MLP it created. The list includes utilities like Dominion Energy and pipeline operator Kinder Morgan, among others.

As you might expect, EQT is pitching its purchase of Equitrans Midstream as a positive. In fact it called the transaction “transformative,” even though it is, in many ways, just recreating the company as it was before Equitrans Midstream was spun off. The real story is that Equitrans Midstream is being bought back at a price that is far below the price at which it was spun off.

Now think back to NextEra Energy Partners. The purpose of that MLP is to be a funding vehicle for NextEra Energy, but it just isn’t as valuable as it once was on that front. With the unit price dramatically lower than it was, there’s a very real possibility that NextEra Energy simply buys the MLP back on the cheap.

To be fair, the runway for growth in the clean energy sector is more attractive than the growth opportunity in the pipeline sector. That suggests that NextEra Energy might want to wait longer to see what happens with NextEra Energy Partners before doing anything rash. But there are multiple examples of MLP spinoffs being bought back once they have outlived their usefulness. If you own NextEra Energy Partners you should keep the Equitrans Midstream situation in the back of your mind.

Buy with at least a little caution

The real concern here, however, should be for investors who are considering adding NextEra Energy Partners to their portfolio because of its hefty 12%+ distribution yield. While that yield is backed, to some degree, by a strong parent, NextEra Energy could just as easily decide to buy the MLP, effectively making what was an attractive yield quickly go away. Equitrans Midstream, among others, shows that this is, in fact, a very real possibility and a risk dividend investors shouldn’t ignore.

Reuben Gregg Brewer has positions in Dominion Energy. The Motley Fool has positions in and recommends EQT, Kinder Morgan, and NextEra Energy. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

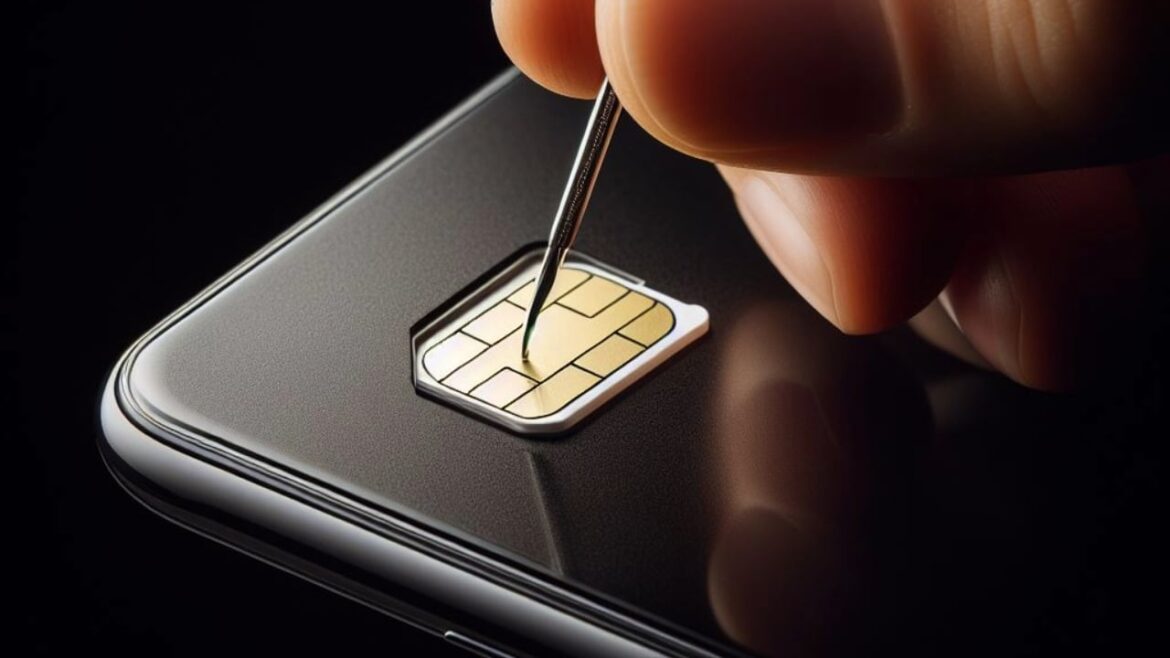

Telefonica, one of the world’s largest telecom companies, has partnered with Chainlink, a decentralized oracle provider, to improve security in Web3 environments. Through the use of Chainlink functions and Telefonica’s SIM Swap API implementation, Polygon apps would be able to check if the SIM of a mobile phone has changed in a given period. Telefonica […]

Telefonica, one of the world’s largest telecom companies, has partnered with Chainlink, a decentralized oracle provider, to improve security in Web3 environments. Through the use of Chainlink functions and Telefonica’s SIM Swap API implementation, Polygon apps would be able to check if the SIM of a mobile phone has changed in a given period. Telefonica […]

Source link

Peloton Interactive Inc. shares surged Thursday after the connected-exercise platform announced an exclusive partnership with TikTok.

The deal will create a dedicated Peloton hub on the video-based social network with custom Peloton content, the companies said in a joint statement. TikTok users will be able to access live Peloton classes, instructor series, celebrity collaborations and more. The hub will be available in the U.S., Canada and the U.K.

“Our team is excited to complement TikTok’s already burgeoning fitness content by introducing the magic of Peloton to new audiences, and in completely new ways,” Oli Snoddy, Peloton’s vice president of consumer marketing, said in a statement.

Peloton shares

PTON,

jumped 14% on Thursday after the deal was announced, and rose an additional 7.5% in after-hours trading.

Last May, Peloton rebranded itself as a fitness platform, moving beyond exercise hardware and focusing on content and subscriptions as it looked to revive dwindling sales.

After skyrocketing during the pandemic, Peloton shares have fallen back to Earth in a hard way, dropping about 96% from their high of $167.42 in January 2021.

In November, the company reported disappointing fiscal first-quarter earnings, posting a worse-than-expected net loss of $159 million, or 44 cents a share. Chief Executive Barry McCarthy told shareholders at the time that Peloton had been “less successful at engaging and retaining free users and converting them to paying memberships than we expected,” adding that a turnaround will be a “long-term” process.

Peloton shares are down 29% over the past 12 months, compared to the S&P 500’s

SPX

23% gain over that time.

Stablecoin Issuer Circle Partners SBI Holdings for USDC Adoption in Japan

In addition to securing a new banking partner for its USDC stablecoin, Circle said that SBI will adopt its other business offerings, providing end-to-end development, deployment, and operations platforms for building and operating Web3 apps across blockchains.

Circle Financial, one of the leading stablecoin issuers in the crypto industry and a financial technology company, has partnered with SBI Holdings to expand its presence in Japan.

In an announcement on November 27, the company stated that it had signed a memorandum of understanding (MoU) with Tokyo-based SBI Holdings, a financial services conglomerate, to broaden the adoption of its USDC stablecoin and the Web 3 ecosystem outside the United States, where Circle is headquartered.

Circle Secures New Partner for USDC Adoption

The move follows the Japanese government’s introduction of its revised payment services act on June 3 to establish a clear regulatory framework for the issuance and usage of stablecoins in the country. According to authorities, the amended law is expected to stimulate and advance the country’s adoption of the crypto industry as well as the Web3 economy.

With the rules in place, both Circle and SBI Holdings have joined forces to “underpin the work ahead,” which includes ensuring the circulation of the USDC stablecoin in the Japanese market.

Jeremy Allaire, the co-founder and CEO of Circle, said the collaboration with SBI Holdings represents a shared vision for the future of digital assets.

“Our partnership with SBI Holdings represents a shared vision for the future of the digital currency and is a significant milestone in Circle’s expansion plans in Japan and the Asia Pacific. We are excited to collaborate with SBI towards setting new standards in the financial sector in Japan,” he said.

SBI to Register as a Payment Service Company in Japan

SBI will also serve as Circle’s new banking partner, enabling USDC access and liquidity for Japan-based businesses and users. The company’s subsidiary, SBI VC Trade Co., is currently seeking to register with Japanese financial authorities as an electronic payment instrument services provider to legally provide banking services to its new partner, Circle. However, the application is subject to approval by the appropriate authorities in charge of issuing crypto-related licenses. Both companies also plan to work with Japanese authorities to ensure adequate compliance with stablecoin-related legislation in Japan.

Exploring Additional Business Opportunities

In addition to securing a new banking partner for its USDC stablecoin, Circle said that SBI will adopt its other business offerings, providing end-to-end development, deployment, and operations platforms for building and operating Web3 apps across blockchains.

The company disclosed that SBI plans to explore its other business offerings, including its programmable crypto wallet, blockchain infrastructure, and smart contract management tools, as part of its digital asset portfolio strategy.

SBI Group’s representative director, chairman, and CEO Yoshitaka Kitao said the financial conglomerate is committed to exploring new financial possibilities using Circle and its stablecoin, USDC.

“SBI Group is committed to wholeheartedly working towards realizing new financial possibilities using stablecoins,” said Kitao.

Circle has been in business since October 2013, servicing its US-based customers and users worldwide with a suite of financial services products. The company’s USDC has emerged as the second-largest stablecoin in the industry, with a market capitalization of $24.6 billion, according to CoinGecko data.

Although based in the United States, Circle’s CEO mentioned earlier this year that 70% of USDC adoption has been recorded outside the country, with Asia topping the charts. The crypto asset is currently used in more than 190 countries worldwide.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

The announcement of KPMG Canada’s partnership with Chainalysis coincides with broader industry efforts to tackle fraud associated with crypto.

The KPMG Canada has announced a strategic partnership with blockchain analytics firm Chainalysis in response to the escalating threats of exploits and fraud within the crypto sector.

Kunal Bhasin, Partner and Cryptoassets and Blockchain Co-leader at KPMG Canada, emphasized that “this collaboration will help to further solidify KPMG’s expertise in forensic investigations and cryptoassets and blockchain technology.”

The KPMG Canada and Chainalysis Approach

As the digital assets ecosystem expands, so does the threat of fraud and criminal activities. The decentralized and pseudonymous nature of blockchain technology has made it an attractive platform for illicit activities such as money laundering, ransomware attacks, and fraud.

Companies operating in the digital assets space face the daunting task of safeguarding their platforms and transactions against these evolving threats. According to the Chainalysis 2023 Crypto Crime Report, crypto-based illicit transaction volume reached an unprecedented $20.6 billion last year.

Notably, the sector faces increasingly sophisticated threats, such as wallet hacks and SIM swaps. A recent high-profile incident saw crypto exchange Poloniex lose approximately $114 million when hackers targeted its hot wallets. besides Poloniex, other platforms have also suffered one form of exploit or the other in the past year.

In response to these escalating threats, KPMG, a renowned global consulting giant, is leveraging its expertise to fortify the defenses of companies operating in the crypto ecosystem. Through this strategic partnership, KPMG aims to provide comprehensive solutions to identify, prevent, and mitigate fraud risks associated with digital assets.

The collaboration is not only geared towards preventing fraud but also towards ensuring regulatory compliance within the digital assets sector. As governments around the world grapple with developing appropriate regulations for the growing crypto market, companies face the challenge of aligning their operations with evolving compliance standards. The collaboration, therefore, seeks to improve their Anti-Money Laundering (AML) compliance processes.

Industry-Wide Collaboration against Crypto Fraud

Meanwhile, the announcement of KPMG Canada’s partnership with Chainalysis coincides with broader industry efforts to tackle fraud associated with crypto. Mastercard Inc (NYSE: MA), in a recent report, revealed its partnership with Feedzai, a regulatory technology platform that employs Artificial Intelligence to combat online money laundering and financial fraud.

Through this collaboration, Feedzai will integrate with Mastercard’s CipherTrace Armada platform, monitoring transactions from over 6,000 crypto exchanges for potential fraud, money laundering, and other suspicious activities.

Remarkably, KPMG Canada has been actively involved in the crypto sector, showcasing its dedication to embracing emerging technologies. Last year, the firm entered the metaverse by establishing its first collaboration hub between its US and Canadian units.

Additionally, KPMG added Bitcoin (BTC) and Ethereum (ETH) to its balance sheet, demonstrating a forward-looking approach to incorporating digital assets into traditional financial strategies. The firm also ventured into the realm of Non-Fungible Tokens (NFTs), purchasing digital art from the World of Women (WoW) NFT collection.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

The collaboration between READYgg and Aptos Labs fosters a sense of community and collaboration within the gaming ecosystem.

The gaming industry is on the verge of a revolutionary transformation, thanks to the dynamic collaboration between READYgg with Aptos Labs to usher in millions of Web2 gamers into the realm of Web3 gaming.

READYgg and Aptos Labs to Fuel Migration from Web2 to Web3

This collaboration leverages READYgg’s extensive network and Aptos, a blockchain platform renowned for its unparalleled time-to-finality, ensuring a seamless and immersive gaming experience.

To kickstart this transformative journey, READYgg is now offering players the opportunity to be whitelisted for early access to the new releases set to launch on December 6. This step is expected to accelerate the migration of up to 15 million Web2 gamers to the Aptos blockchain, resulting in a dramatic upheaval in the gaming scene.

READYgg’s impressive portfolio already includes partnerships with over 20 major Web2 publishers, boasting a library of 2,000 games that engage a staggering 200 million monthly active users. As part of this collaboration, four of these web2 publishers will transition to the Aptos blockchain by the close of 2023, with a commitment to bring at least a dozen more on board next year.

The gaming titles under the Aptos umbrella promise an exciting blend of Web2 favorites with innovative Web3 elements. From the roguelike dungeon crawler “Runestone Keeper” to the first-person action game “Rescue Robots Sniper Survival,” and the hypercasual platform “Minijuegos,” to the browser-based social gaming portal “ToroFun,” each title will feature Web3 elements, including Non-Fungible Tokens (NFTs).

David S. Bennahum, CEO and co-founder of READYgg, expressed enthusiasm about the partnership, stating, “Bridging Web2 games to web3 has always been our goal. We’ve built a range of tools traditional publishers can use to seamlessly reach a web3 audience and bring their typical users into the world of on-chain gaming.”

Benefits of Web3 Gaming

Web3 gaming offers a plethora of advantages over its predecessor. With decentralized platforms like Aptos, players can enjoy true ownership of in-game assets, ensuring a transparent and trustless environment. Smart contracts, powered by blockchain technology, enable secure and seamless transactions, mitigating issues such as fraud and unauthorized alterations.

Moreover, the collaboration between READYgg and Aptos Labs fosters a sense of community and collaboration within the gaming ecosystem. Players can engage in peer-to-peer transactions, trade assets seamlessly, and participate in decentralized governance models, giving them a direct stake in the evolution of the gaming platform.

Publishers joining the READYgg/Aptos ecosystem will not only benefit from the capabilities of a performant blockchain but will also have access to potential funding or grants through the READYgg $RDYX token, known as “The Gamer’s Token”. This unique token, coupled with predictable Aptos usage fees, empowers publishers to incorporate Web3 components with reduced exposure to price volatility.

Mo Shaikh, co-founder and CEO of Aptos Labs, highlighted the transformative impact of the partnership, stating, “This partnership with READYgg will accelerate the delivery of studio-quality Web3 games, user experiences, and compelling ownable assets.”

next

Blockchain News, Cryptocurrency News, Gaming News, News, Technology News

You have successfully joined our subscriber list.

Mastercard Partners with Feedzai to Leverage AI Tech to Detect and Tackle Crypto Fraud

Mastercard’s partnership with Feedzai aims to address concerns around crypto fraud and money laundering by leveraging artificial intelligence to differentiate between legitimate and fraudulent transactions.

Mastercard Inc (NYSE: MA) is strengthening its efforts to identify and prevent fraud associated with crypto exchanges. In an exclusive statement to CNBC, the company revealed a partnership with Feedzai, a regulatory technology platform leveraging artificial intelligence to combat online money laundering and financial scams. Through this collaboration, Feedzai will directly integrate with Mastercard’s CipherTrace Armada platform, which monitors transactions from over 6,000 crypto exchanges for potential fraud, money laundering, and other suspicious activities.

The integration involves embedding CipherTrace Armada directly into Feedzai’s technology, facilitating real-time alerts for suspicious cryptocurrency transactions without relying on an API (application programming interface). Speaking on the development, Feedzai CEO and co-founder Nuno Sebastio said:

“This will increase fraud detection by protecting unwary consumers, but will also detect potential money laundering activity and mule accounts.”

Fraudsters exploit mule accounts, which are accounts belonging to users, to launder illicitly obtained funds. According to Feedzai data, approximately 40% of scam transactions involve the direct transfer of funds from a bank account to a cryptocurrency exchange.

The collaboration between Mastercard and Feedzai will also provide Mastercard with access to Feedzai’s artificial intelligence capabilities. Besides, Feedzai’s software can swiftly identify and block suspicious transactions in nanoseconds while also accurately recognizing legitimate transactions.

With its RiskOps platform analyzing transactions totaling over $1.7 trillion annually, Feedzai holds nearly 100 patents and also consistently secures an average of 10 patents per year to protect its technology. Sebastio said:

“Numerous banks that believe they are preventing illegitimate cryptocurrency transactions are, in fact, only blocking transactions involving the widely recognised and regulated entities within the crypto space and omitting the rest.”

Will Mastercard Make Crypto Mainstream?

Mastercard’s latest collaboration with Feedzai signifies the company’s commitment to integrating cryptocurrency into mainstream financial assets, subjecting them to established rules and compliance frameworks.

While banks and major financial institutions have expressed interest in experimenting with crypto, incorporating crypto products into their core offerings has posed challenges. Concerns about the lack of comprehensive regulations and susceptibility to fraud and scams have made banks cautious.

Speaking to CNBC, Ajay Bhalla, president of cyber and intelligence solutions for Mastercard said that the “interconnectedness of life today and increasing digital penetration of finance has brought risk as well as opportunity.”

Mastercard’s partnership with Feedzai aims to address these concerns by leveraging artificial intelligence to differentiate between legitimate and fraudulent transactions, particularly in the crypto space, where fraud rates are reportedly five times higher than in regular fiat transactions.

This collaboration follows Mastercard’s acquisition of CipherTrace in 2021, reinforcing the company’s efforts to enhance security and compliance in the cryptocurrency field.

next

Artificial Intelligence, Blockchain News, Business News, Cryptocurrency News, FinTech News

You have successfully joined our subscriber list.

Texas, Alabama securities regulators allege fraud against GS Partners in multiple crypto schemes

Securities regulators in Texas and Alabama have accused a group of companies tied to a metaverse real estate project of fraudulently raising millions from investors.

The Texas State Securities Board last week issued an emergency cease and desist order against GS Partners, Swiss Valorem Bank, and several related entities controlled by Josip Heit.

The Alabama Securities Commission has also filed its own cease and desist order targeting Heit and GS Partners for illegally selling securities in the form of “MetaCertificates.”

Regulators in both states allege the companies operated illegal securities schemes involving digital assets tied to virtual real estate in a metaverse project called Lydian World.

According to the orders, GS Partners sold blockchain-based tokens that represented fractional ownership in a virtual 36-story skyscraper called G999 Tower located in the metaverse. The company claimed it had acquired rights to resell units in the skyscraper and promised investors returns from leasing income.

The Texas order says GS Partners raised an unknown amount selling the tokens during 2021 and 2022 but failed to raise a targeted $175 million.

The Alabama order accuses the company of guaranteeing unrealistic returns of up to 5% per week to investors in that state who purchased MetaCertificates.

According to the Alabama regulator, GS Partners markets and sells the MetaCertificates in the state through WealthBuilders Worldwide. Customers purchase the MetaCertificates by paying a fixed amount each month and can earn additional returns by recruiting new customers.

A GS Partners representative told Alabama investors the MetaCertificates were “the same as a bank certificate of deposit but better” and claimed a $5,000 investment could earn over $60,000 in 18 months, the order states.

Regulators say many investors have likely lost most of their investment in the metaverse real estate scheme and MetaCertificates.

In addition, both states allege GS Partners and Swiss Valorem Bank sold fraudulent certificates tied to cryptocurrencies. The Texas order says the companies used misleading sales materials touting high returns in U.S. dollars when profits were actually paid in obscure internal tokens.

The companies are controlled by Josip Heit, a German businessman previously suspected of running illegal cryptocurrency schemes. The firms are not registered to sell securities in Texas or Alabama.

Regulators ordered the companies to cease all offerings and sales of illegal securities immediately. The emergency actions remain in place for up to 31 days in Texas and 60 days in Alabama before they must be challenged at a hearing or become permanent.

The entire world of finance (both traditional and crypto) is eagerly waiting for the US SEC to approve spot Bitcoin ETF.

Preparations are in top gear as Cathie Wood’s Ark Invest is moments away from launching a new “suite” of exchange-traded funds (ETFs). In line with this ambition, the asset management company has partnered with the world’s largest crypto ETP issuer 21Shares.

According to Ark Invest, the suite will open up an array of options to investors who are looking to diversify their portfolios. 21Shares also shares similar sentiments with Ark Invest about the upcoming suite, which it says will enable clients to carry out strategic investments. The firm’s statement reads:

“The suite aims to deliver long-term capital appreciation through strategic investments in Bitcoin and Ethereum futures contracts, and the application of blockchain technologies.”

Company prospectuses reveal that the suite is made up of five products, and will begin trading on the Chicago Board Options Exchange (Cboe) next week.

About the ETFs, Ark has confirmed that they would not directly invest in any digital assets. The firm advised any investor looking for direct exposure to any digital asset to look elsewhere. Its statement reads:

“Neither the funds nor the underlying ETF invest directly in bitcoin or other digital assets or maintain direct exposure to spot bitcoin.”

21Shares has also hinted at what to expect from the funds. According to a statement from its website, the products would only invest in Bitcoin and Ether futures contracts, alongside a mix of “public equities of companies engaged in the blockchain industry.”

Anticipating Spot Bitcoin ETF Approval

It might be worth mentioning that Ark’s upcoming ETFs are coming at a time of such great anticipation. The entire world of finance (both traditional and crypto) is eagerly waiting for the United States Securities and Exchange Commission (SEC) to approve a spot Bitcoin ETF. However, the approval continues to lag even though the regulator has approved funds that invest in Bitcoin futures.

Nonetheless, there have been reports that approval is imminent, and even the price of Bitcoin has surged on the same expectation.

Interestingly, this is not the first partnership between Ark and 21Shares. The duo are also pursuing a joint spot ETF – the ARK 21Shares Bitcoin ETF. In June, 21Shares refiled an amended application for the ETF.

next

Bitcoin News, Blockchain News, Cryptocurrency News, Funds & ETFs, Market News

Mayowa is a crypto enthusiast/writer whose conversational character is quite evident in his style of writing. He strongly believes in the potential of digital assets and takes every opportunity to reiterate this.

He’s a reader, a researcher, an astute speaker, and also a budding entrepreneur.

Away from crypto however, Mayowa’s fancied distractions include soccer or discussing world politics.

You have successfully joined our subscriber list.