A shocking exposé by the public-interest media group ProPublica reveals just what can happen to you in America if you get old and you don’t have the right system and paperwork in place to protect yourself.

Source link

place

Kevin O’ Leary Says You Need Millions On Hand To Survive — ‘You Have To Get To A Place Where You Have $5 Million In The Bank’

Kevin O’Leary, Shark Tank star and investor, sparked significant discussion with his assertion that individuals need $5 million in their bank accounts to ensure lifelong financial stability.

In an August 2023 YouTube video, O’Leary said, “You have to get to a place where you have $5 million in the bank,” emphasizing the importance of this amount to “survive the rest of your life, no matter what happens.” This statement, along with his detailed financial advice, has been a subject of both support and criticism among viewers and financial experts.

This amount, when invested to yield an annual return of 6% to 7%, can generate $300,000 to $350,000 in passive income, significantly above the median household income.

Don’t Miss:

He suggests setting aside this $5 million as untouchable money, using additional income for investments or riskier ventures without compromising the stability of the income-generating $5 million.

In response to his advice, one user summarized the core message of having ample funds for security with a touch of sarcasm: “‘Have enough money to not worry about money’ … got it.” Another humorously acknowledged the challenge O’Leary’s advice presents: “Great advice! I was doing it wrong this whole time. I just need 5 mill.”

To achieve this financial goal, O’Leary recommends several strategies. Building a business can be a lucrative avenue, but it comes with inherent risks. Focusing on cash flow, such as investments that produce actual income like dividends, is crucial. This echoes Warren Buffett’s principle: “The first rule of an investment is don’t lose money.”

Avoiding uncalculated risks, asking for fair compensation and being selective with investments are other key pieces of advice from O’Leary.

O’Leary stresses the importance of investing early. He suggests saving 10% of your income and investing in bonds and dividend-paying stocks.

He emphasizes discipline in saving, having a long-term investment strategy and understanding the difference between speculation and investing.

For retirement planning, O’Leary advises contributing at least 15% of your salary into a 401(k) account. This strategy, coupled with the power of compound interest, can potentially accumulate $1.5 million in the bank by retirement. He emphasizes adjusting lifestyle to save more and highlights the availability of investment apps that make stock market investing more accessible.

Financial advisers can play a key role in helping individuals achieve their financial goals, including reaching O’Leary’s recommended $5 million mark. They can provide personalized advice, guide investment choices and help navigate the complexities of financial planning to secure a comfortable retirement.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Kevin O’ Leary Says You Need Millions On Hand To Survive — ‘You Have To Get To A Place Where You Have $5 Million In The Bank’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Laguna Beach, California

Luciano Lejtman | Moment | Getty Images

When most people think of Laguna Beach, California, they think of its scenic coves and beaches.

But the small coastal city — with a population of around 22,600 — is also pioneering a new model for elder care.

About 77% of adults ages 50 and up hope to stay in their homes long term, according to AARP. In Laguna Beach, the rate is even higher, with about 90% of residents, according to Rickie Redman, director of the city’s aging-in-place services, dubbed Lifelong Laguna.

The program, which provides services through a hometown nonprofit, was piloted in 2017. Lifelong Laguna is based on the Village movement, where aging in place is encouraged with community support.

The Laguna Beach program aims to fulfill a specific need for a city where approximately 28% of residents are age 65 and over, while local assisted living and memory care services are scarce.

More from Personal Finance:

What happens to your Social Security benefits when you die

This purchase may be a ‘grenade’ in your otherwise well-planned retirement

Will there be a recession in 2024? Here’s what experts say

Many of the older residents have lived in the city since they were in their 20s and 30s, and now find themselves in their 70s and 80s, according to Redman. Many of them trace back to the city’s artistic roots, she said.

“They make this city unique,” Redman said. “They’re the placeholders for the Laguna that we now know.”

Notably, there is no cost for the city’s older adults to participate in most of the services.

The program, which currently has around 200 participants, relies on grants and local fundraising, according to Redman. Its services address a wide range of needs, including a home repair program the city operates in collaboration with Habitat for Humanity, nutrition counseling and end-of-life planning.

Other cities have also adopted community support models for residents who age in place through the Village movement. That includes tens of thousands of older adults in 26 states and Washington, D.C., according to Manuel Acevedo, founder and CEO of Helpful Village, which provides technology support to seniors and participating communities.

Retirees confront high costs to stay at home

The high costs of aging in place are one of the biggest obstacles that prevents older adults from fulfilling their desire to stay put, experts say.

About 10,000 baby boomers are expected to turn age 65 every day until 2030. An estimated 70% of those individuals will need long-term care services at some point, according to Genworth Financial.

In 2021, the highest year-over-year increase in cost was in home-care services, Genworth’s research found. The median annual cost for in-home care was $61,776 for a home health aide to provide hands-on personal care and $59,488 for homemaker services to help with household tasks.

Those costs have been influenced by supply and demand, according to Genworth.

As more people age and require care, the Covid pandemic led to an insufficient supply of professionals to meet care needs, as well as a high turnover rate.

Preferences for aging in place are also showing up in the real estate market.

Baby boomers currently represent the biggest portion of home buyers, according to Jessica Lautz, deputy chief economist and vice president of research at the National Association of Realtors. More than half of boomers are saying that the property they are purchasing now is where they plan on living for the rest of their lives, a sentiment that has increased since the Covid pandemic.

“There definitely is a mindset change, where people are saying, ‘I do want to stay put, I don’t necessarily want to move into a nursing home or into assisted care,'” Lautz said.

‘Forever grateful’ for community

Sylvia Bradshaw, an 84-year-old Laguna Beach resident who moved to the city in 1983, describes it as “paradise.”

She has lived there since that time, apart from a stint when she and her husband relocated to Ireland. Still, the couple held on to their home, the city’s third-oldest house, which was built in 1897.

“My husband had ideas about selling our home,” Bradshaw said. “But I would never sell it, because I said ‘Once it’s gone, it’s gone forever.'”

Bradshaw’s husband was a teacher in the city’s high school and later became a lawyer. More recently, he had health struggles that made it difficult for the couple to keep up with yard work, Bradshaw said.

As members of the Laguna aging-in-place community, they had access to help.

Redman helped arrange for a team of workers to come to clean up the yard, which included removing 17 bags of scraps and trimming a roughly 30-year-old fig tree.

“Now people can see that there’s a house there; they just couldn’t see it [before],” said Bradshaw, who said she is “forever grateful” for the gesture.

The support of the community also was especially helpful in sorting through the hospice care issues prior to her husband’s recent death.

“Anything that I’ve needed, I’ve gotten help,” Bradshaw said.

That has included help sorting through insurance choices, legal advice, transportation assistance and classes and social events, said John Bradshaw, Sylvia’s son.

Having the elder community support his parents is a “big comfort,” John said, particularly as he no longer lives in Laguna Beach.

“It is just such a wonderful relief,” John said. “It’s like having a second family, this team of people really supporting my parents, and others like them, to be able to stay and enjoy this part of the country.”

What to do if you want to age in place

If you want to age in place, it helps to start planning early to make sure it’s feasible, said Carolyn McClanahan, a physician and certified financial planner who is the founder of Life Planning Partners in Jacksonville, Florida.

“We actually start bringing it up with clients in their 50s and 60s: Where do you want to live out the end of your life?” McClanahan said. “Of course, most people do say, ‘I want to live in my home.'”

It’s important to be realistic about those plans.

Ask yourself whether the decision to age in place is just “rationalized inertia,” or giving yourself an out when it comes to confronting other important aging decisions, said Tom West, senior partner at Signature Estate and Investment Advisors in Tysons Corner, Virginia.

If you do decide staying in your home is the best option, be prepared to make changes to your home, he said. That may include wider doorways to accommodate wheelchairs or walkers, as well as grab bars to help prevent falls.

Like the aging-in-place models established in Laguna Beach and elsewhere, it helps to have community support. McClanahan recommends developing strong relationships with your neighbors where you agree to look out for each other.

It also helps to set certain boundaries for when staying at home no longer makes sense.

For example, it may cost $240,000 a year to stay home if you need 24-hour care, McClanahan said.

“Even if you’re super rich, a lot of families hate seeing that much money go out the window, when you would pay half the cost to actually go into a facility,” McClanahan said.

Further, be sure to outline your wishes in all potential circumstances. While you may want your children to promise not to put you in a nursing home, it may come to a point where it is more cost effective and safer to go to a care unit, McClanahan said.

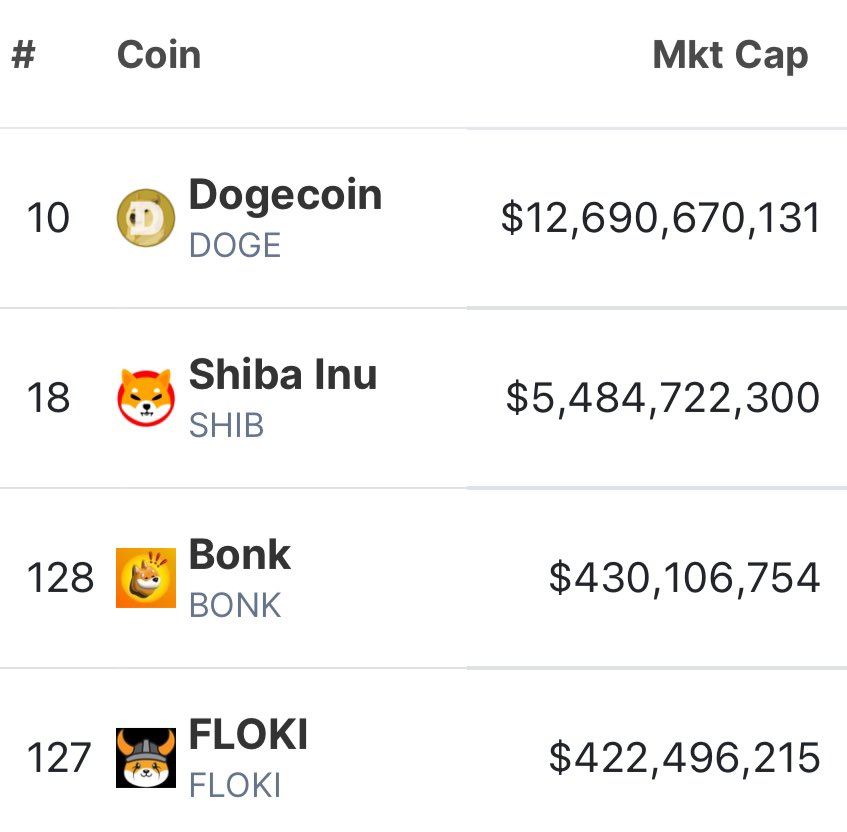

Solana’s BONK Climbs To 3rd Place In Dog Coin Market Cap, Leaving FLOKI Behind

In recent weeks, the Solana (SOL) blockchain has been making waves in the crypto world, with its native token SOL experiencing a remarkable uptrend of 46% over the past 30 days. Alongside this surge, Bonk Inu (BONK), the first Solana-based meme coin, has gained significant traction, solidifying its position as the third-largest dog coin by market capitalization, surpassing Floki Inu (FLOKI).

BONK Rockets To New Heights With 845% Surge In 30 Days

The staggering growth of Bonk Inu is evident in its recent performance, achieving an impressive 845% gain over the past 30 days. The meme coin’s remarkable ascent has propelled it to new yearly highs, while SOL experienced a slight pullback from its peak of $65 on December 2.

Despite the temporary setback for SOL, the bullish momentum and renewed interest in Bonk Inu have caught the attention of market participants.

As of now, BONK is trading at $0.0000069712, outperforming the broader crypto market with a remarkable 22.4% uptrend in the past 24 hours, aligning with the positive sentiment surrounding Bitcoin (BTC) and the overall market.

With a market capitalization of approximately $430 million, Bonk Inu currently sits in third place among dog coins, trailing behind the likes of Shiba Inu (SHIB) and Dogecoin (DOGE), which boast market caps of $5 billion and $12 billion, respectively.

CoinGecko data reveals that BONK has witnessed a significant 24-hour trading volume of $65,235,205.16, indicating strong investor interest and active participation in the market.

The future trajectory of Bonk Inu’s uptrend and its potential for further gains remains uncertain. However, should BONK continue to attract investors, it has the potential to dethrone Pepecoin (PEPE) in terms of market capitalization. As of the latest update, PEPE has achieved a market cap of $592 million.

However, it is important to note that Bonk Inu still has a significant gap to bridge to catch up with the largest dog coins in the market in terms of market capitalization, namely SHIB and DOGE. SHIB and DOGE have demonstrated substantial gains and already possess staggering market capitalizations.

Dog Coins Make Strong Push For Year-End Gains

The altcoin SHIB, built on the Ethereum platform and known for its Shiba Inu mascot, continues to demonstrate consistent gains across various time frames.

Notably, SHIB has seen a 14% increase over the past fourteen days and an 18% surge over the past thirty days. These positive trends have allowed the dog coin to achieve a slight year-to-date profit of 0.2% after experiencing a significant downturn in 2022.

Presently, SHIB is trading at $0.00000946, representing a decline of more than 89% from its all-time high (ATH) of $0.00008616, reached in October 2021.

Meanwhile, the meme coin DOGE, which has the backing of Elon Musk, is currently trading at $0.09058. It has witnessed an 18% rise over the past fourteen days and nearly 30% growth over the past thirty days, following a sustained upward trend that began on November 21.

However, in contrast to SHIB’s price action, DOGE has experienced a 12% decline year-to-date and an 87% drop from its ATH of $0.731578 reached in May 2021.

It remains to be seen whether the dog coins will continue to experience further gains throughout the remainder of the year or if a healthy pullback will occur to surpass upper resistance levels for another upward movement.

Featured image from Shutterstock, chart from TradingView.com

CZ, Buterin, Dorsey top crypto social media popularity charts as SBF clings to 10th place

A mix of highly influential and controversial characters make up the latest list of the 10 most popular crypto entrepreneurs based on their social media presence, with Binance CEO Changpeng “CZ” Zhao leading the pack in first place and convicted fraudster Sam Bankman-Fried trailing in 10th.

The top 10 list was compiled by CoinLedger after shortlisting CryptoWeekly’s 30 most influential people in cryptocurrency in 2023, combined with their respective social media followings to determine the most widely followed crypto personality worldwide.

Sitting at the cool kids’ table with CZ are Ethereum co-founder Vitalik Buterin and Twitter co-founder and Block CEO Jack Dorsey, occupying the top three spots, in that order. In CoinLedger’s study, CZ emerged as the most popular personality in cryptocurrency, with nearly 9.1 million followers on X (formerly Twitter) and Instagram combined.

Buterin and Dorsey followed CZ with combined Twitter and Instagram followers of 7.7 million and 6.4 million, respectively.

MicroStrategy co-founder Michael Saylor and ARK Invest founder and CEO Cathie Wood sit in fourth and fifth place, respectively. Saylor has around half of Dorsey’s following at nearly 3.25 million, while Wood has just over 1.6 million followers.

Venture capitalists Chamath Palihapitiya and Marc Andreessen reached the sixth and seventh places, with 1.6 million and 1.3 million followers, respectively. Digital Currency Group CEO Barry Silbert and Coinbase CEO Brian Armstrong nabbed the next two spots with 1.25 million and 1.2 million followers.

Related: Slumdog billionaire 2: ‘Top 10… brings no satisfaction’ says Polygon’s Sandeep Nailwal

The 10th spot on the list was bagged by Sam “SBF” Bankman-Fried, the founder and former CEO of the defunct crypto exchange FTX. SBF still has a following of 1.06 million across X and Instagram, a year after the FTX collapse.

During the FTX implosion, SBF’s overall followers increased from roughly 780,000 to over 1.1 million and have settled at the one million mark ever since, according to Socialblade data.

Magazine: Breaking into Liberland: Dodging guards with inner-tubes, decoys and diplomats

Sam Altman returned to OpenAI HQ and could be reinstated as CEO soon. Elon Musk says ‘the public should be informed’ why he was fired in the first place

It’s been a tumultuous weekend for OpenAI and anyone who follows the field of artificial intelligence. After the OpenAI board fired CEO Sam Altman on Friday, investors who’d been taken off guard by the move raced to reinstate him.

On Sunday afternoon, Altman was back in the OpenAI headquarters, Bloomberg reported, and the decision to reinstate him could be made shortly. Altman shared a photo of himself on X wearing a guest badge and making a face, writing, “first and last time i ever wear one of these.”

But even if he is reinstated, questions remain about why the board fired him in the first place. The board gave only vague reasons on Friday.

Among those wanting to know is Tesla CEO Elon Musk, who wrote on X: “Given the risk and power of advanced AI, the public should be informed of why the board felt they had to take such drastic action.”

When an X user said it felt as if there were a “bombshell variable” the public was unaware of behind Altman’s firing, Musk replied, “Exactly.”

And AI expert Gary Marcus worried that it did not bode well that the OpenAI board—presumably in control of the capped-profit company and with an eye on the nonprofit mission—was apparently overpowered as investors raced to get Altman back into his role.

OpenAI Chief Operating Officer Brad Lightcap told Bloomberg, “we have had multiple conversations with the board to try to better understand the reasons and process behind their decision,” which took him and others at the company by surprise.

Eric Newcomer, who hosts a technology podcast, wrote in his newsletter that Altman should not be given too much power.

“The public should not want, nor should the OpenAI board give Altman unbridled power to run OpenAI as he pleases,” he wrote. “Altman has a history of fractious corporate breakups…These board members are not the first people to question Altman’s integrity. They’ve just done so in public.”

He mentioned among others the power struggle with Musk, who was an OpenAI cofounder in 2015 and helped attract key talent, but left a few years later on a sour note. Musk later complained about the onetime nonprofit that he meant to serve as a counterweight to Google becoming a “closed source, maximum-profit company effectively controlled by Microsoft. Not what I intended at all.”

Musk was key to recruiting Ilya Sutskever, the chief scientist at the center of OpenAI’s leadership shakeup. Sutskever is on the current board and is the one who informed Altman of his dismissal, according to Greg Brockman, who quit as president in protest of Altman’s firing.

The board agreed to step down, Bloomberg reported, and was vetting new candidates to serve as directors.

How the board might be reshaped remains to be seen. According to sources Bloomberg spoke with, among the new members will be Bret Taylor, the former co-CEO of Salesforce.

Another possibility is a board seat going to Microsoft, whose CEO Satya Nadella was reportedly blindsided by the decision to fire Altman.

The software giant has committed at least $13 billion to OpenAI since 2019 but only delivered some of that. It’s questionable whether OpenAI could continue operating without the continual cash infusions and computing power provided by Microsoft, which means Microsoft wields considerable power with or without a presence on the board.

This story was originally featured on Fortune.com

Billionaire Mark Mobius Says Emerging Market Stocks Are the Place to Be Right Now; Here Are 2 Names That Analysts Like

Since the end of the Second World War, the US has been the 800-pound gorilla of the world economy – the largest in monetary terms, the largest producer, the largest innovator, the largest financial market. That dominance has been challenged in the last couple of decades, with the rise of China to become the world’s second-largest economy, the expansion of Taiwan’s semiconductor chip industry to global leadership, the ingenuity of South Korean tech firms – especially in AI, and the expansion of India’s economy as that country has become the world’s largest by population.

For billionaire hedge manager Mark Mobius, the emergence of new players among the world-leading economies opens up new opportunities for a more diversified portfolio – and the famously successful investor recently acknowledged that his own portfolio is completely divested from US-based companies. Mobius isn’t just boosting and promoting emerging economies and markets – he’s putting his money where his mouth is, and going all-in.

Mobius is particularly intrigued by the potential of Taiwan, South Korea, and India. In a recent interview, he emphasized, “We are seeking companies that have established international diversification, and we’ve come across numerous enterprises with remarkable technological prowess that enables them to broaden their investor outreach.” Mobius goes on to cite the booming high-tech in Taiwan and South Korea, and India’s fast GDP growth of 7% and population of 1.40 billion. Mobius sees all three of these countries as economic leaders for the coming decades.

Wall Street’s analysts are finding plenty to agree with in that assessment, and they’ve been picking out emerging market stocks that are poised to gain going forward from here. Using TipRanks’ database, we pinpointed two such names that are considered ‘Strong Buys.’ Not to mention considerable upside potential is on the table here. Let’s take a closer look.

Taiwan Semiconductor (TSM)

Taiwan has become the world’s leader in semiconductor chip output, providing some 60% of the global supply of these vital computer components, and Taiwan Semiconductor is one of the country’s largest chip makers. The company operates primarily as a foundry, an advanced production plant that takes third-party contracts to manufacture semiconductor chips in mass runs. The client firms handle the design work and prototypes, while TSM handles the regular production; the model has proven successful for the industry.

It’s proven successful for TSM, specifically, too. The company has approximately 58% market share of Taiwan’s chip foundry business, and a market cap of more than $514 billion.

Taiwan Semiconductor’s financial results showed several quarters of positive results, and consistent gains, coming out of the pandemic period and through the end of last year. The company found support in increased product demand post-COVID. This year, however, slowing chip demand – caused by a combination of continued supply chain disruptions, a slower-than-hoped reopening in China, higher interest rates causing a tighter credit environment, and increased inflation forcing consumers to pare back spending – has impacted the chip foundry’s top and bottom lines.

In the last reported quarter, 2Q23, TSM showed revenues of US$15.68 billion. While this was down 13.7% from 2Q22, it beat the analyst expectations by US$300 million. The bottom line figure, an EPS of $1.14 in US currency, also fell 26% year-over-year, but came in better than expected, by 6 cents per share.

Mehdi Hosseini, a 5-star analyst from Susquehanna, highlights TSM’s strong position in the industry and its adeptness in leveraging this advantage to drive further market share growth. These qualities lie at the core of his assessment of the stock, where he presents a compelling long-term outlook based on the following factors: “1) COWOS capacity is expected to roughly double contributing to margin and revenue accretion. 2) New product ramps such as AWS Graviton and eventually Meteor Lake, Grace, Genoa/Sapphire Rapids are driving growth into 2024. 3) Server AI processors (CPU, GPU, and AI accelerators for training and inference) account for ~6% of TSM’s revenue and are expected to grow to account for a low teens % of revenue. 4) N3e starts to scale in 2024 thanks to higher EUV throughput from ASML’s 3800E. 5) Earning power in the next up cycle is estimated in the $8-$10 range, or ~2x that of CY23 EPS estimate.”

Quantifying this stance, Hosseini gives TSM shares a Buy rating with a 36% one-year upside based on a $135 price target. (To watch Hosseini’s track record, click here)

Overall, this major chip maker has picked up 5 recent analyst reviews, with a 4 to 1 breakdown favoring Buys over Holds for a Strong Buy consensus rating. The stock is trading for $99.15, and its $125 average price target implies a one-year upside potential of ~26%. (See TSM stock forecast)

WNS Limited (WNS)

WNS is a global business process management firm based in Mumbai, India. Strategically positioned in a country that has become an economic powerhouse over the last decade, WNS serves enterprise clients in 10 industries worldwide. With operations in 13 countries across 4 continents, the company’s success is fueled by a combination of technology and digital analytics, boasting over 400 clients and employing more than 59,000 people.

The general economic uncertainty of recent months – the combination of high interest rates and high inflation, the increased chances of a US recession, China’s slow reopening – have put a premium on business efficiency, exactly the sort of issue to which WNS promises solutions. The company has seen a modest upward trend in both revenues and earnings for the past several quarters.

The last quarterly report, for Q1 of fiscal year 2024, showed this trend continuing. The company had a revenue total of $317.5 million at the top line, for increases of 15.5% year-over-year – and beat the forecast by $12.9 million. At the bottom line, WNS’ $1.01 non-GAAP EPS beat expectations by 8 cents per share, and was up from 90 cents in the year-ago period.

The company’s solid growth in a difficult global environment caught the eye of Needham analyst Mayank Tandon, who wrote of WNS, “We remain bullish on WNS given the healthy operating environment and strong execution from management despite the uncertain macro conditions. We believe that WNS’ mission critical solutions become even more important during times of economic strain, and expect management to drive double-digit revenue and EPS growth despite the challenging macro. With the shares trading at an ex-cash P/E multiple of 15x our FY25 estimate, we view the risk-reward as compelling. WNS remains our top pick for 2023.”

Looking ahead, Tandon rates this ‘top pick’ as a Buy, and his $115 price target implies an upside potential of 66% for the year ahead. (To watch Tandon’s track record, click here)

Overall, all 7 of the recent analyst reviews on WNS are positive, for a unanimous Strong Buy consensus rating on the stock. The average price target of $96.43 and trading price of $61.11 combine to suggest a 12-month upside potential of 39.5%. (See WNS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The movie “Field of Dreams” famously asked if Iowa was heaven. While it may not be heaven, it’s now seen as the best state to retire in, according to a BankRate study.

Bumping Florida out of the top spot, Iowa ranked well in areas such as affordability, crime levels, and quality and cost of healthcare.

“Don’t rule out unlikely places for retirement,” said BankRate analyst Alex Gailey. “The economy has changed so drastically and inflation has had long-term effects. More than half of working Americans feel behind on their retirement. Affordability is really important, especially for those on a fixed income.”

Iowa, which ranked 14th last year, also showed strong rankings this year in terms of cost of living, state health system performance, cost of healthcare per capita by state, adults 65 and older per capita, and combined state and local sales tax, BankRate said.

Rounding out the top five, the other best places to retire included Delaware, West Virginia, Missouri and Mississippi.

“People may be surprised not to see Florida, Georgia and Arizona in the top spots. But the states that were once popular for retirement have seen their cost of living rise so drastically. The housing market is so competitive in those states that it’s unaffordable for many,” Gailey said.

Florida ranked eighth in this year’s study, down from first place last year.

Read: I want to retire somewhere scenic with low taxes and near a big airport. Where should I go?

Gailey suggested the top rankings serve as a starting point for soon-to-be retirees and retirees to explore some different locations.

With states in the Midwest and South ranking as more affordable, retirees looking to stretch their budgets may want to consider them over the higher cost of living in the northeast and west.

Read: I live in the South and don’t want to retire here. I’m seeking four seasons, diversity and outdoor living. Where should I retire?

“Everyone’s personal situation is going to be very different. You may have a paid-off home in a high-cost area so affordability may be less of a factor for you and your budget. Or maybe you sell that house, and use that income to move to a low-cost area. It’s all unique to the person,” Gailey said.

Among specific metrics, West Virginia came in on top in terms of affordability, while Colorado ranked first for quality and cost of healthcare. Hawaii ranked first for both well-being and weather, and New Hampshire ranked first for least crime, BankRate said.

BankRate said it did not specifically factor in climate change, but it did look at weather patterns such as average temperatures and natural disasters. Those issues had about a 10% weighting in the study. Affordability was the biggest factor at 40% weighting.

Read: We want to retire somewhere with pleasant winters. Our budget is $600,000-$700,000. Where should we go?

The worst states to retire in? Alaska scored last, with poor rankings in weather, crime, affordability, quality and cost of healthcare, and well-being. New York, California, Washington and Massachusetts rounded out the bottom of the list.

“In our overall ranking, the best and worst states for retirees are split geographically. The Midwest and the South claim the top five states, while the Northeast and West claim the bottom five states, primarily because of the differences in cost of living,” Gailey said.

“For many Americans, a comfortable retirement may feel out of reach,” Gailey says. “If you’re considering a late life move to lower your cost of living in retirement, our rankings provide some food for thought.”

In mid-April 2023, a frog memecoin called Pepe dominated discussions in crypto circles after going up parabolically in the span of a few hours, going up by as much as 21,000%. Pepe follows a long list of memecoins led by Doge and Shiba Inu that made millions for some and lost even more money for others.

In early April 2023, Elon Musk temporarily made the Dogecoin logo the face of Twitter. Again, the value shot up, then went back down again after.

Critics point to the memecoins as the worst of the tokens that have absolutely no underlying and redeeming value. Rightfully so, these memecoins might suddenly skyrocket parabolically, but then just crash down and burn spectacularly. There is no buy-and-hold strategy for memecoins. You don’t really hold these.

I hold zero memecoins and am merely examining these from a cultural perspective. I do agree these have no underlying value. These simply reflect a very short time in history when these are valued, but that value is only because it could make money for the holder. There is no emotional attachment to memetokens.

What possible use could memecoins have?

The only possible use that meme coins can have (and this in no way should encourage people to purchase these risky tokens) is these memes make blockchain and crypto less scary.

Take for example Ethereum (I own some) and the new layer-2 scaling solutions like Optimism, Arbitrum, zkEVM, zkSync, Linea, Base, Starkware, MATIC and others (that I don’t own). Personally, I do not really grasp how these things really work. I do know these have future potential for migrating a lot of Web2 functions owned by giant centralized companies to decentralized Web3.

Join the community where you can transform the future. Cointelegraph Innovation Circle brings blockchain technology leaders together to connect, collaborate and publish. Apply today

But other than a high level of understanding, I don’t really know how these work. All I know is they help speed up Ethereum and have lower gas fees.

The terms sound too technical, and too nerdy. I consider myself fairly proficient with technology, but what about the rest of humanity that we claim we want to encourage to migrate to the blockchain? The tribal culture seems almost like a religion or a secret society that has its own jargon, practices and other customs. Seriously, how can ordinary folks adopt it?

Memecoins fill a cultural need. People may not understand zero-knowledge succinct argument of knowledge (SNARK) scaling solutions, but they might own dogs, cats or other pets. It gets through the emotional part of our psyche, not the logical part — especially with cute pets as memes.

Putting a cute face to this technology might be one way to encourage people to experiment with it. Wallets are already too clumsy to use because of hexadecimal wallet addresses. Remembering not to send ETH to a BTC wallet and vice versa is another thing to keep track of for those new to the space. There is actually lots of things you need to learn and remember. Most people will shrug it all off and say, “Why bother?”

Mind you, experimentation could mean buying a few dollars worth. Not plunking several hundred or thousand which is really a gamble on your part. More like buying a few tokens in an amusement park to have a good time. That’s all.

Again, I do not encourage jumping into meme coins. Unlike crypto blockchain infrastructure tokens like Bitcoin, Ethereum, Solana and others, these memecoins tend to be pump-and-dump tokens. Sure you might make a hundred to even a thousand times your money if you enter at the right time, but most people will end up losing their money, so it’s really a gamble.

Looking at the big picture, however, they may help get people into the space. A small way to get their feet wet, before they take the plunge into more serious crypto.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Zain Jaffer is the CEO of Zain Ventures focused on investments in Web3 and real estate.

This article was published through Cointelegraph Innovation Circle, a vetted organization of senior executives and experts in the blockchain technology industry who are building the future through the power of connections, collaboration and thought leadership. Opinions expressed do not necessarily reflect those of Cointelegraph.

Learn more about Cointelegraph Innovation Circle and see if you qualify to join

I’m looking for a place that has year-round mild, sunny weather and is near or on the water, and my budget is $125,000 — where should I retire?

Dear MarketWatch,

I’m looking for a place that has year-round mild, sunny weather, ideally with low humidity, and is near or on the water. It should be relatively remote — something like a warm, sunny version of Alaska. I have $125,000 to spend.

Esta

Dear Esta,

There are definitely remote spots and small towns in the U.S. that meet your description of a warm, sunny version of Alaska. But add to that your desire to be near or on water, and it becomes harder to find an ideal place to escape to, especially one that’s within your budget. You may need to make some adjustments in your requirements for year-round mild, sunny weather or your preference for low humidity.

If you’re willing to accept some winter weather, recommendations from MarketWatch’s Where to Retire tool include the small towns of North Hero, Vt., which is on Lake Champlain, and Penn Yan, N.Y., which is on one of the Finger Lakes. Both towns offer homes within your budget.

If you’re firm on wanting warmer weather but can be flexible on the humidity factor, you have more choices. Oceanfront spots on the coasts are likely out of your price range, but the following small towns have river or lake access.

Washington, N.C.

Sometimes called “Original Washington” or “Little Washington,” this town in Beaufort County is located at the junction of the Tar and Pamlico rivers, the gateway to the Albemarle-Pamlico sounds, which make up the second-largest estuary on the East Coast. It takes about an hour and 40 minutes to drive to North Carolina’s Atlantic Beach.

If you’re into old architecture, Washington features Victorian-era homes and commercial buildings, as well as antebellum structures that survived fires in 1864 and 1900. The population was under 10,000 as of 2021.

Yes, it will be humid in the summer.

Winchester, Tenn.

Located on Tims Ford Lake, this Franklin County town also has fewer than 10,000 residents. It boasts an Art Deco courthouse, a historic theater and quaint shops and restaurants, along with community events like concerts and wine tastings. But if people aren’t your thing, you can also get away and just enjoy the lake.

Winchester, Tenn., on Tims Ford Lake, has fewer than 10,000 residents.

Getty Images/iStockphoto

Camdenton, Mo.

This Camden County town is on the Lower Niangua arm of the Lake of the Ozarks, one of the country’s largest manmade lakes. Camdenton has a population of about 3,700. It’s also near Ha Ha Tonka State Park and Bridal Cave, known for its stalactite and stalagmite formations.

Camdentown, Mo., is on the Lake of the Ozarks near Ha Ha Tonka State Park.

Getty Images/iStockphoto

If none of these spots meets your needs, you might think about a houseboat that you could dock in the location of your choosing. It’s possible to find a small used houseboat within your budget. Annual costs would include mooring fees — which can vary greatly depending on where you decide to dock — as well as things like insurance, fuel, maintenance and pump-out fees.

Readers, where should Esta move? Leave your suggestions in the comments section.

More from MarketWatch’s “Where Should I Retire” column:

We want to retire somewhere in North Carolina or South Carolina on $3,400 a month in Social Security — where should we go?

I want year-round outdoor living — dry summers and no snow — on $4,000 a month. Where should I retire?

‘Work and a few vacations each year is all we’ve done for the past 34 years’ — This couple has $2.6 million and no idea where to retire