Binance’s chief executive has shared his company’s future direction and areas of focus following its settlement with U.S. authorities, including the Department of Justice (DOJ). “We have moved past that as the company move into greater maturity,” he insisted, adding that the crypto firm is focusing on “sustainability.” ‘The Direction of Travel Is Very Clear’ […]

Binance’s chief executive has shared his company’s future direction and areas of focus following its settlement with U.S. authorities, including the Department of Justice (DOJ). “We have moved past that as the company move into greater maturity,” he insisted, adding that the crypto firm is focusing on “sustainability.” ‘The Direction of Travel Is Very Clear’ […]

Source link

Plan

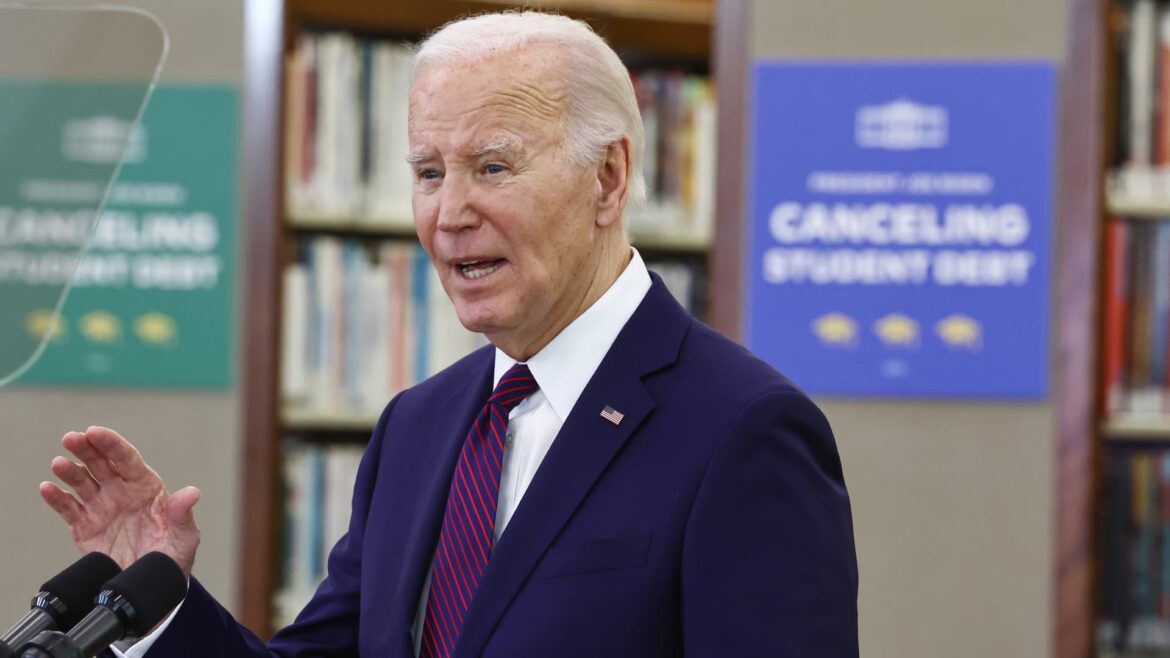

Biden administration will roll out new student loan forgiveness plan

U.S. President Joe Biden delivers remarks on canceling student debt at Culver City Julian Dixon Library on February 21, 2024 in Culver City, California.

Mario Tama | Getty Images

A narrower aid package Biden hopes will survive

Immediately after the Supreme Court struck down Biden’s $400 billion student loan forgiveness plan last June, his administration began working on a revised assistance package.

The Biden administration believes its updated plan will survive legal challenges this time for several reasons. One, it’s far narrower than its first attempt, which would have impacted as many as 40 million Americans.

“I think it would be easier to justify in front of a court that is skeptical of broad authority,” said Luke Herrine, an assistant professor of law at the University of Alabama, in an earlier interview with CNBC.

Student debt relief activist rally in front of the U.S. Supreme Court on June 30, 2023 in Washington, DC. The Supreme Court stuck down the Biden administration’s student debt forgiveness program in Biden v. Nebraska.

Kevin Dietsch | Getty Images

It is also using a different law — the Higher Education Act rather than the Heroes Act of 2003 — as its legal justification.

The HEA was signed into law by President Lyndon B. Johnson in 1965, and allows the education secretary some authority to waive or release borrowers’ education debt.

The Heroes Act was passed in the aftermath of the 9/11 terrorist attacks, and grants the president broad power to revise student loan programs during national emergencies.

The conservative justices didn’t buy that argument.

″’Can the Secretary use his powers to abolish $430 billion in student loans, completely canceling loan balances for 20 million borrowers, as a pandemic winds down to its end?'” Chief Justice John Roberts wrote in the majority opinion for Biden v. Nebraska. “We can’t believe the answer would be yes.”

Lastly, the Biden administration has now turned to the rulemaking process to deliver its relief. The president previously attempted to cancel the debt through executive action.

As part of the rulemaking process, a team of negotiators met four times to try to establish the new parameters of the updated policy. The final session concluded in February.

Based on the timeline of regulatory changes, the proposal will likely become public within weeks, Kantrowitz said.

“Typically at the end of the negotiated rulemaking, a month or so later you have publication of the proposal,” he said.

There will then be a public comment period, which is likely to last for at least 30 days.

Don’t miss these stories from CNBC PRO:

Predicting Bitcoin’s Bull Run Values: Plan B’s S2F Model and Ledn CIO’s $92,000 Target

As bitcoin hovers around the $67,000 mark on March 18, 2024, there’s still widespread speculation about the potential for its price to climb even higher. The analyst Plan B continues to shed light on his well-known stock-to-flow (S2F) model, which suggests that “exponential growth” is expected to “continue.” Plan B: ‘S2F = Exponential Growth’ The […]

As bitcoin hovers around the $67,000 mark on March 18, 2024, there’s still widespread speculation about the potential for its price to climb even higher. The analyst Plan B continues to shed light on his well-known stock-to-flow (S2F) model, which suggests that “exponential growth” is expected to “continue.” Plan B: ‘S2F = Exponential Growth’ The […]

Source link

MicroStrategy’s stock sinks after plan to offer convertible debt to buy bitcoin

Shares of MicroStrategy Inc. slumped Tuesday, as the business-analytics software company and bitcoin play’s plan to offer convertible debt gave investors a reason to take a breather following the stock’s recent sprint to a 24-year high.

Also weighing on MicroStrategy’s stock

MSTR,

bitcoin dropped 1.5%, after rallying into record territory earlier in the session. That followed a 34% run-up in bitcoin

BTCUSD,

over the previous six sessions.

MicroStrategy said late Monday that the $600 million in senior notes due 2030 it plans to offer can be converted into shares of common stock, cash or a combination of both.

The notes will be part of a private offering, in which only people believed to be “qualified institutional buyers” can participate.

“MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes,” the company stated.

The stock sank 10.5% in morning trading, after closing Monday at the highest price since March 17, 2000. That puts the stock in danger of suffering its biggest one-day selloff since it tumbled 19.6% on Nov. 9, 2022.

The pullback comes after the stock rocketed 94.1% amid a six-day win streak, which was the longest win streak in four months and the biggest six-day gain in three years.

Read: MicroStrategy stock rises 24% — tops $1,300 for first time in 24 years as bitcoin soars.

MicroStrategy’s market capitalization ballooned by about $11 billion over the past six days, to $22.6 billion at Monday’s close.

The company said in its annual report filed in February that as of Dec. 31, it had $2.21 billion in debt.

S&P Global Ratings rates MicroStrategy’s credit at CCC+, which is seven-notches deep into speculative grade, or “junk,” territory.

The company said the interest rate, conversion price and other items related to the latest debt offering will be determined when it prices, which is still unknown.

MicroStrategy’s stock has hiked up 89%, while bitcoin has climbed 59.5%, the SPDR S&P Software & Services ETF

XSW

has slipped 0.9% and the S&P 500 index

SPX

has gained 6.6%.

For years now, rumors have been flying that Social Security is on the verge of going away. But thankfully, those rumors are bogus.

Social Security is not in danger of disappearing completely for one giant reason — its primary source of funding is payroll tax revenue. And as long as workers continue to get taxed on their earnings to fund the program, Social Security can continue to exist.

That doesn’t mean that Social Security will be able to afford to keep up with scheduled benefits, though. In the coming years, the program is expected to owe more to retired and retiring seniors than what it collects via labor force contributions. And while Social Security can tap its trust funds to keep up with scheduled benefits for a while, in time, those funds are apt to run dry.

Image source: Getty Images.

In fact, recent projections have Social Security’s trust funds running out of money in 2034 — just 10 years from now. So lawmakers have limited time to come up with a solution to prevent those cuts from happening. That’s why it’s a good idea to come up with a plan for dealing with those cuts — whether you’re currently receiving Social Security or are still working.

Set yourself up with a game plan

Social Security cuts aren’t guaranteed to happen. But the fact that lawmakers have yet to arrive at a preventive solution doesn’t bode so well. So it’s a good idea to figure out how you’ll cope with less money from Social Security should that situation come to be.

If you’re already retired, one option to look at may be going back to work. Earnings from a part-time job could replace the portion of your monthly Social Security check that’s at risk of going missing.

Another option is to downsize your home, and possibly your lifestyle. If you’re able to sell a larger home and buy a replacement one at half the cost, you can pocket the difference and use it as income. Plus, downsizing might mean spending a lot less on expenses like property taxes and maintenance. Along these lines, cooking more at home versus dining out frequently could help you conserve cash.

You can also look to move to a part of the country where living costs are generally lower. Just be mindful of the fact that certain states tax Social Security benefits.

Meanwhile, if you’re still working, your best course of action for dealing with Social Security cuts is to save, save, and save some more. The larger a nest egg you manage to bring with you into retirement, the less likely you’ll be to struggle financially on a smaller Social Security benefit.

In fact, let’s say you’re 35 years old with $15,000 in savings to date. If you contribute $500 a month to your retirement plan over the next 30 years, and your portfolio delivers an 8% average annual return, which is a bit below the stock market’s average, you’ll end up with over $830,000.

Nothing’s set in stone

Social Security has been bailed out by lawmakers before in the context of potential cuts, so that may very well happen again this time around. But your best bet is to put a plan in place in case you end up with less money from the program than expected down the line.

Opinion: Here’s what people about to retire really need their 401(k) plan to provide

“Any financial professional or organization that gives rollover-related advice would have to adhere to the fiduciary standard.”

Baby boomers and Gen Xers will leave the workforce by the millions over the coming decade. Yet many have no idea whether the money they’ve saved in their retirement plans over the years will be enough to let them live the way they want to during retirement.

It’s a huge question, and it often goes unanswered because retirement-plan sponsors can’t possibly analyze an employee’s future cash flows, potential investment returns or tax strategies. Plan sponsors are typically more focused on convincing retiring employees to move their retirement plan money into their firm’s proprietary IRAs and annuities. Therein lies the conflict.

The U.S. Department of Labor believes that the best way to address employees’ retirement planning needs is to propose a new set of rules designed to rein-in unethical rollover-related product recommendations.

No one doubts the DOL’s good intentions. After all, a rollover is one of the biggest financial decisions most people will ever make. Retire and keep the money in the 401(k)? Roll the money over to an IRA? What’s the right allocation for stocks and bonds? What are the downsides and costs to annuities that promise income forever? What about taxes in retirement?

These are not trivial questions. The DOL has always required retirement plan sponsors to provide educational resources to broadly explain the pros and cons of these various options.

But in terms of personalized rollover advice, employers tend to lean on the plan’s recordkeepers and service providers. Most of which are owned by commission-driven broker-dealers, asset managers, banks and insurance companies armed with teams of salespeople whom employees believe are “retirement planning experts.”

Their overriding mandate? Keep retirement assets in-house.

You don’t need to be a Wall Street compliance guru to see the glaring conflicts of interest here. Would any broker recommend that a retiree move their 401(k) money into an IRA with a different (competing) custodian? What kind of insurance agent wouldn’t advise a participant to put some or all of their nest egg into annuities?

The DOL wants to nip these questionable practices in the bud by requiring any financial professional or organization that gives rollover-related advice to adhere to the fiduciary standard. In other words, those making product recommendations must clearly demonstrate that their recommendations align with each participant’s best interests.

If this all sounds familiar, it is. Remember Reg BI? It was the SEC’s attempt to require brokers to act as fiduciaries when providing investment advice.

But rigorous opposition from broker-dealers watered down the rules so much that in many cases all a broker needs to do to fulfill the letter of the law is to document their unavoidable conflicts of interest (often buried in hundred-page disclosures).

“The proposals don’t even come close to addressing the most crucial financial questions that keep most soon-to-be-retirees up at night.”

Considering the complex networks of recordkeepers, asset managers, insurance agents, advisors, third-party administrators and payroll companies that work together to design and service retirement plans, it will be a Sisyphean challenge for the DOL’s new rules to cover all of these rollover-related fiduciary bases.

And when breaches of the rules inevitably occur, angry participants will take employers to court. Most importantly, consider the typical employee who’s about to retire. The DOL’s proposals don’t even come close to addressing the most crucial financial questions that keep most soon-to-be-retirees up at night.

Don’t miss: MarketWatch’s “Help Me Retire” columns

Here’s what people about to retire tell me: They’re worried about their future cash flows; when to start taking Social Security, and how to keep track of required minimum distributions and minimize their taxable impact.

They want to know if and when they should convert to a Roth IRA, and how to pass these assets on to their heirs or donate them to charities. They need professional advice for the rest of their lives that also encompasses the needs of their partners or spouses. And many believe that the rollover recommendations coming from the plan’s service providers are objective and unencumbered by self-interests.

The simple solution is to give employees access to advice from from highly-qualified, independent registered investment advisers who are already held to the fiduciary standard, not because they’re forced to comply, but because they’ve elected to take on this fiduciary responsibility.

Unfortunately, most of these plans’ in-house rollover consultants and brand name brokerage service providers can’t provide this kind of help because they’re not highly qualified fiduciary advisers. But rather than try to force a plan’s financial salespeople to act like fiduciaries, the DOL should instead provide resources and incentives that encourage employers to offer retirees access to vetted independent, state or SEC registered fee-only fiduciary investment advisers and financial planners.

To help retirees find these advisers, employers could provide links to reputable organizations and vetted partners that connect individuals with these fiduciary advisors.

Providing access to these fee-only advisers won’t prevent employees from working with their plan’s existing rollover consultants if they want to. Instead, it will simply provide a different advice option that they might not be aware of.

It’s critical that we take a step back and ask what is the actual problem we’re trying to solve? If providing better retirement advice is truly the goal, adding fiduciary advice to the rollover menu is a far better option and, at the same time, will help employers reduce their exposure to lawsuits.

Companies that embrace this initiative can meet their rollover-related fiduciary obligations far more effectively than having to jump through yet another confusing set of DOL regulatory hoops. After all, making it easier to help employees plan for their retirement is in everybody’s best interests.

Pam Krueger is the founder and CEO of Wealthramp, a fee-only financial adviser matching service. She is also the creator and co-host of the award-winning MoneyTrack investor-education TV series, seen nationally on PBS, and the Friends Talk Money podcast.

Also read: I’m 73 and just took my first RMD. Can I roll over my IRA into my 401(k)?

More: If retirement is all about money, you might not be ready to stop working

Genesis’ bankruptcy plan faces pushback from parent company DCG over creditor payouts

Digital Currency Group (DCG), the parent company of the defunct crypto lender Genesis, has filed an objection against the approval of its subsidiary’s bankruptcy plan, which was created via a “clandestine approach.”

In a Feb. 5 court filing, DCG argued that Genesis’ plan aims to exceed legal obligations by overcompensating creditors. According to the firm, such action constitutes a breach of the bankruptcy code and reflects a lack of good faith.

The crypto company contends that the plan unfairly disadvantages it while eroding its fundamental economic and corporate governance privileges.

“The Debtors (Genesis), in concert with the UCC and Ad Hoc Group, have devised a cramdown plan that pays unsecured creditors hundreds of millions of dollars more than the full amount of their petition date claims—and which disproportionately favors a small controlling group of creditors over others—in violation of the Bankruptcy Code,” DCG added.

Consequently, DCG urged the court to dismiss the proposed plan, emphasizing its inability to endorse such “complex and convoluted Distribution Principles.”

Meanwhile, DCG pointed out that it was willing to “fully support a plan that provides a 100% recovery for creditors—par plus post-petition interest” if all of its concerns were met.

This is not the first time both companies have been involved in a face-off. Last year, Genesis took legal action against DCG to recoup a substantial loan exceeding $700 million, encompassing both fiat and cryptocurrency repayments slated for May 2023.

Despite DCG’s public assertion of settling the $700 million debt, a faction of the lender creditors have insisted that it remains obligated to the failed firm.

Genesis, alongside several cryptocurrency lending firms like Celsius, succumbed to the 2022 bear market turmoil. The company filed for bankruptcy in January 2023 following the suspension of withdrawals triggered by the FTX collapse in November 2022.

Since then, the lender has continued with its bankruptcy process and recently moved to liquidate $1.4 billion of its assets held in Grayscale Bitcoin Trust (GBTC), which recently converted to a spot exchange-traded fund (ETF).

Plan to retire? 20% of young Americans say they don’t think they can.

Not everyone believes they will retire one day: 15% of Americans overall said they don’t plan to retire at all, and younger people as a group were less confident than their fellow workers, a new study found.

More than one in five younger Americans have no plans to retire, and 21% of Hispanic participants said the same, according to TIAA Institute’s latest report, “State of Financial Preparedness in a Diverse America.”

The biggest reason to skip retirement? The inability to save enough. Social reasons, such as having a sense of purpose, avoiding boredom and career enjoyment, were also reasons not to retire, participants said.

“If most people are planning for retirement but can’t follow their plans, that’s a call to action for employers, policymakers, financial advisors, retirement services providers and others. We need to better identify the steps we must take to give people the resources they need,” Surya Kolluri, head of the TIAA Institute, said in a statement.

Source: TIAA Institute

Less than half of people still working were confident they’d retire one day. Young Americans and Hispanics were tied for lowest confidence, with more than a third in each demographic responding as such.

The survey included responses from 1,684 adults between the ages of 22 and 75 years old, who represented a mix of demographics, including age and racial and ethnic groups.

TIAA Institute also found Americans had little to no liquid investable savings — 26% of Black participants, 26% of Native American participants and a quarter of Hispanic Americans have none, the survey found — and three in 10 respondents said they’d be unable to pay for a $2,000 emergency. People are more likely to have no liquid investable assets (15%) or under $50,000 (29%) than to have more than $500,000 (19%), the survey found.

Read: Retirement planning for Gen X and millennials: To make it effective, make it bite-sized

For about three-quarters of current retirees, Social Security was the top retirement source, followed by more than half who said employer pensions. But that may not be the case for younger workers — almost half of participants between 22 and 34 years old said they don’t expect to take advantage of Social Security or pensions when they retire.

Two-thirds of people did have a retirement account, such as the 401(k), but almost a quarter of people didn’t know how much they had saved, including 24% of those currently retired and 22% planning to retire.

Core Scientific wins court approval to enact reorganization plan, exit bankruptcy

The Bitcoin mining firm Core Scientific announced on Jan. 16 that it has obtained court approval to proceed with its reorganization plan.

Core Scientific noted that this reorganization plan will allow it to emerge from Chapter 11 bankruptcy proceedings in the coming days.

Adam Sullivan, Core Scientific’s CEO, said:

“Today’s plan confirmation is a defining moment in our reorganization; we’re poised to emerge by the end of this month as an even stronger company, with a highly motivated team that is aligned for success.”

Sullivan noted that demand for Bitcoin and “high-value compute” is rising and said that the company aims to create value for shareholders amidst that demand.

The press release added that the plan will see shareholders receive shares of Core Scientific’s new common stock and warrants, which constitute about 60% of the company’s new equity. The release also stated that Core Scientific’s existing debt is expected to be paid in full with the execution of the plan, marking a reduction of $1 billion from its debt balance before the reorganization plan.

Bloomberg suggested in a separate report that the plan will eliminate $400 million in debt from Core Scientific’s balance sheet. Bloomberg also indicated that the firm’s precise re-listing date on Nasdaq is Jan. 24, 2024.

Core Scientific was in bankruptcy for one year

Core Scientific filed for Chapter 11 bankruptcy in December 2022 but continued to operate throughout the bankruptcy process.

Notably, the company secured a multi-million dollar loan from BlackRock and other creditors shortly after its bankruptcy filing in order to continue its activities.

More recently, Core Scientific reached an expansion deal with Bitmain in September 2023. That agreement that saw Bitmain invest $54 million in Core Scientific and provide the company with 27,000 Bitcoin mining devices.

Core Scientific stock (CORZQ) is currently worth $1.18, down 14.49% today. The stock’s price is considerably higher than it was throughout most of 2023, but is considerably lower than its all-time high of $14.32 on Nov. 19, 2021.