NSA whistleblower Edward Snowden has warned that the National Security Agency (NSA) is on the verge of significantly expanding its surveillance capabilities through a new bill amending Section 702 of the Foreign Intelligence Surveillance Act (FISA), potentially allowing the government to compel a wide array of businesses and individuals to assist in NSA surveillance operations. […]

NSA whistleblower Edward Snowden has warned that the National Security Agency (NSA) is on the verge of significantly expanding its surveillance capabilities through a new bill amending Section 702 of the Foreign Intelligence Surveillance Act (FISA), potentially allowing the government to compel a wide array of businesses and individuals to assist in NSA surveillance operations. […]

Source link

plans

Bitcoin Cash (BCH) has registered a sharp 15% rally in the past 24 hours after plans of a futures listing on Coinbase have surfaced for the asset.

Coinbase Plans To Launch Bitcoin Cash Futures Product On 1 April

As an X user has pointed out, the cryptocurrency exchange Coinbase appears to have filed certifications with the Commodity Futures Trading Commission (CFTC) to list futures products for three coins on its platform: Bitcoin Cash (BCH), Dogecoin (DOGE), and Litecoin (LTC).

Coinbase Derivatives LLC quietly filed certifications with CFTC to list US regulated futures for Dogecoin, Litecoin and Bitcoin Cash.

They filed them on March 7 and surprisingly nobody seemed to notice.

Futures are set to start trading on April 1 if there are no objections from… pic.twitter.com/DYbWjuS6G2

— Summers (@SummersThings) March 20, 2024

As per the CFTC filing, all of these products were certified on March 7, and they are set to go live on trading on the first of the month.

The BCH, LTC, and DOGE futures contracts were all certified earlier in the month | Source: CFTC

Interestingly, all three of these digital assets happen to be based on the original cryptocurrency: Bitcoin. Bloomberg analyst James Seyffart has hinted that this may be why Coinbase has chosen them.

This is interesting… wonder if the SEC objects to these being classified ‘commodities futures’ vs ‘securities futures’. These all forked from Bitcoin so “these are securities” claims would be hard to make after spot #Bitcoin ETF approvals. Might be why Coinbase chose them🤔

— James Seyffart (@JSeyff) March 20, 2024

Unlike LTC and DOGE, which are based initially on BTC’s code, BCH is a direct fork of the cryptocurrency made to fulfill BTC’s original purpose as a fast and cheap form of currency that may be used for regular purposes (hence the name).

The filling made by Coinbase on Bitcoin Cash reads:

The market position of Bitcoin Cash reflects its role as an alternative to Bitcoin that prioritizes transaction efficiency. While it has not matched Bitcoin in terms of market capitalization or price, Bitcoin Cash has established itself as a significant player in the cryptocurrency space, with a dedicated user base and ecosystem.

BCH Has Enjoyed A 14% Surge During The Last 24 Hours

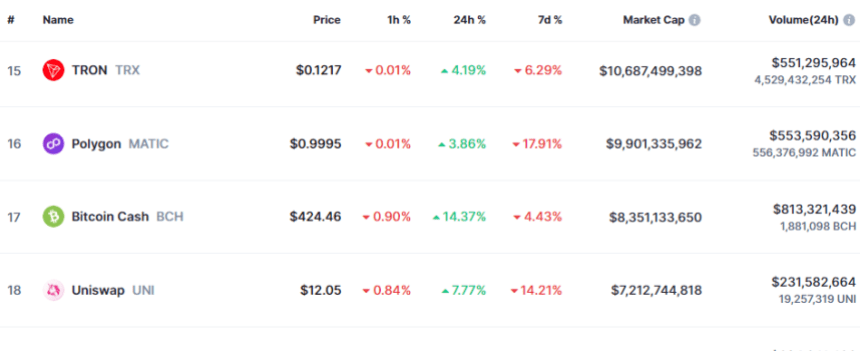

The cryptocurrency sector has been up in the past day, but two coins in particular have stood out among the top 20 assets by market cap: Bitcoin Cash and Dogecoin.

Both of these have managed more than 14% returns in this period, notably outperforming their peers. Bitcoin itself has only been able to put together a rally of about 6%.

Given that the Coinbase filling has been making the rounds in this window, it would appear likely that it was at least partially responsible for the extraordinary surges of these coins.

Even though Litecoin is also planned to see its futures contract launch on the same day as the other two, its price performance has been more or less in line with the rest of the market with its profits sitting at just 4%.

Following the sharp rally, Bitcoin Cash has now arrived at the $424 level. The chart below shows how the cryptocurrency’s trajectory has looked in the last few days.

Looks like price of the asset has shot up over the past day | Source: BCHUSD on TradingView

Regarding the market cap, Bitcoin Cash is currently the 17th largest asset. While there is some distance to Polygon (MATIC) in 16th place, LTC may be able to catch it if it can keep up this rally.

The BCH market cap seems to be $8.3 billion at the moment | Source: CoinMarketCap

Featured image from Shutterstock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Disney‘s ESPN is at a crossroads.

For more than 40 years, the world’s largest all-sports network has grown annual revenue by increasing cable subscription fees. ESPN first charged pay-TV distributors less than $1 per month per subscriber in the 1980s. In 2023, ESPN’s monthly carriage fee was $9.42 per subscriber, according to data from S&P Global Market Intelligence.

That business model is eroding. Since 2013, tens of millions of Americans have canceled their cable TV subscriptions, raising questions about ESPN’s future in an increasingly fragmented media landscape. CNBC spoke with multiple current and former Disney and ESPN executives about the network’s path ahead as part of the digital documentary “ESPN’s Fight for Dominance.”

ESPN reported domestic and international revenue grew just 1% to $4.4 billion in its most recent fiscal quarter. The network can no longer rely on price increases to make up the difference as the number of cable customers declines.

The company has a new two-part streaming plan to reinvigorate growth. First, this fall, Disney will make ESPN available outside the traditional cable TV bundle for the first time as part of a joint venture with Warner Bros. Discovery and Fox. The service, which does not yet have a price, will target noncable customers who want to watch sports but don’t want to pay $80 or $100 a month for a full bundle of networks.

Second, in fall 2025 ESPN will launch its flagship streaming service that will include everything ESPN has to offer, both live and on demand. It will include unprecedented personalization and will interact with ESPN Bet, the company’s licensed online sportsbook, and fantasy sports to cater to younger fans. The product will go well beyond ESPN+, which exists as a $10.99 streaming service that doesn’t include ESPN’s most expensive programming, such as all of “Monday Night Football.”

ESPN Chairman Jimmy Pitaro

Steve Zak Photography | FilmMagic | Getty Images

“The industry is in a transition phase right now,” ESPN Chairman Jimmy Pitaro said in an interview as part of CNBC’s documentary.

“We’re seeing declines in the traditional ecosystem, cable and satellite universe,” Pitaro said. “There’s a transition to digital. That is by far the biggest component of our future.”

Pitaro and head of programming Roz Durant defended ESPN’s growth plan to CNBC, while former Disney and ESPN executives Bob Chapek, John Skipper and Mark Shapiro noted the so-called Worldwide Leader in Sports faces multiple potential obstacles while it charts its path forward.

Watch the documentary for the full story.

Don’t miss these stories from CNBC PRO:

Nio holds a product event in Shanghai on Sept. 21, 2023.

Evelyn Cheng | CNBC

BEIJING — Chinese premium electric car company Nio said Thursday it plans to reveal its mass market brand in May.

Executives confirmed the new brand will be named “Le Dao” in Chinese, and said the name is meant to reflect families — the target consumer segment — having a happy time together.

Nio, founded in late 2014, has so far focused on the higher end of the market with SUVs and sedans that can cost more than Tesla’s Model S or Model Y, but come with a suite of services such as access to user clubhouses known as Nio Houses.

Monthly car deliveries, however, have remained modest versus the rapid growth of some competitors.

Earlier this month Nio said its mass market brand would debut in the second quarter, with the first product launch in the third quarter and large-scale deliveries the following quarter.

Another Chinese electric car startup called Xpeng said last summer it plans to develop a new mass market brand that will target the 150,000 yuan ($20,580) price range. The company said it would develop the brand through a strategic partnership with Didi.

Packages move along a conveyor at an Amazon fulfillment center on Cyber Monday in Robbinsville, New Jersey, on Nov. 29, 2021.

Michael Nagle | Bloomberg | Getty Images

Amazon will host a spring sale next week with discounts on seasonal items, and this one is not restricted to Prime members.

Amazon said Thursday that the event, which it’s calling the “Big Spring Sale,” will run for six days starting March 20, in North America. Unlike the Prime Day discount bonanza typically held in the summer, next week’s event will be open to shoppers who don’t pay for a Prime membership. The subscription program costs $139 per year, or $14.99 a month, in the U.S., and perks include free, speedy shipping; video streaming; and access to exclusive Prime Day deals.

Spring fashion, fitness products, outdoor furniture, Amazon-branded devices and other “warm weather essentials” are among the categories that will be discounted, Amazon said. It’s the first time Amazon has held such an event in the first quarter.

In recent years, Amazon has added shopping events, including a “Prime Big Deal Days” in the fall, a 48-hour “Pet Day” and a beauty-focused sale ahead of the holiday shopping season.

The company is launching its spring event as shoppers, grappling with high inflation, remain hungry for discounts. Inflation has receded from its 40-year highs in mid-2022, but it remains above the Federal Reserve’s 2% goal. Consumer prices rose more than expected last month, increasing 3.2% in February from a year earlier, the U.S. Department of Labor said Tuesday.

Amazon also faces rising competition from low-cost retailers Temu and Shein, which have been on an ad-spending blitz to attract American shoppers. Shein mostly offers deeply discounted apparel and accessories. Temu is akin to an online flea market and has seen its popularity boom due to its rock-bottom prices and a gamified shopping experience.

Don’t miss these stories from CNBC PRO:

Kremlin Reveals Plans to Create a “Politics-Free” BRICS Blockchain-Based Payments System

Yury Ushakov, an aide of Russian president Vladimir Putin, revealed plans to create a digital blockchain payment system for the BRICS bloc. Ushakov remarked that the countries of the group would benefit from implementing such a system for the use of governments, common people, and businesses, stating that it would be convenient, cost-effective, and “free […]

Yury Ushakov, an aide of Russian president Vladimir Putin, revealed plans to create a digital blockchain payment system for the BRICS bloc. Ushakov remarked that the countries of the group would benefit from implementing such a system for the use of governments, common people, and businesses, stating that it would be convenient, cost-effective, and “free […]

Source link

The artificial intelligence (AI) market is full of hype and speculation, with early AI leaders like Nvidia or Microsoft trading at nosebleed valuations. Whether the AI market darlings deserve their rich valuations or not, three Fool.com contributors believe it’s time to look beyond the usual suspects.

They put their heads together to uncover existing tech giants like International Business Machines (IBM 1.71%), Cloudflare (NET 1.40%), and Salesforce (CRM 2.61%) — three great companies with deep AI expertise. This trio offers compelling value and potentially significant long-term returns from their AI initiatives.

Investing is a marathon. IBM, Salesforce, and Cloudflare have been running the AI race for years, and they won’t stop anytime soon.

IBM is the big, blue AI workhorse

Anders Bylund (IBM): Generative AI tools and flashy consumer tech often dominate the headlines. Meanwhile, good old tech titan IBM is quietly positioning itself as the backbone of enterprise-grade AI solutions.

The company’s hybrid cloud focus, emphasis on explainability and trackable data sources, and deep industry relationships might not seem as sexy as the latest ChatGPT upgrade, but these are the very elements that should make IBM an enduring force in the AI space.

IBM’s focus on long-term partnerships and sustainable solutions aligns with the needs of businesses wanting to use AI in an impactful yet responsible way. As concern grows around AI systems’ potential for harmful biases, misleading output, and black-box decision-making, IBM’s approach inspires a deeper trust.

The long-term contracts Big Blue signs with enterprise-class customers will depend on that professional-grade trust. “Hallucinations” and data mishaps are common themes in today’s large language models (LLMs), but IBM isn’t interested in playing that game. The likes of OpenAI, Microsoft, and Alphabet don’t seem ready to compete from the transparency and quality angle so far.

Critics might argue that IBM’s “slow and steady” approach is a disadvantage. But in the realm of enterprise solutions, patience and thoroughness should be seen as strengths. The slow and heavy vetting IBM’s prospective clients apply to the Watson AI systems today will result in lucrative, hard-to-replace, multiyear contracts.

“The early work for clients around data architecture, security, and governance is critical and hard, and we think consulting expertise is going to be crucial here,” CEO Arvind Krishna said in the recent fourth-quarter earnings call.

Moreover, IBM’s current valuation presents a potential value opportunity compared to some of the AI market’s highfliers. The stock trades at a modest 2.7 times sales and 13 times free cash flow, making even Alphabet look expensive in comparison with the same ratios clocking in at 5.6 and 25, respectively.

If the company can continue to prove that its AI solutions add tangible, measurable value to businesses, investors who focus on long-term potential may find IBM to be the unsung workhorse of the AI revolution. If nothing else, you’re looking at a generous dividend payer with torrential cash flows and a centennial business history.

IBM’s big AI bet is starting to pay off right now, but even if the business-grade AI strategy fizzles, it’s still a great income-generating stock to own in the long run. That’s a big “if,” though. AI and hybrid cloud computing have emerged as leading growth drivers for the ultra-experienced tech giant. I expect good things and big wins from Big Blue’s AI business in the coming years.

Could this edge computing play be an under-the-radar AI star?

Billy Duberstein (Cloudflare): The past 18 months in artificial intelligence have been all about training, which is the act of building extremely large language models out of billions of data parameters. But now the AI industry is moving to an “if you build it, they will come” phase. In layman’s terms, companies are now actually putting these models to work.

When a trained model is prompted and then goes to work on finding answers or completing a task, that’s called inferencing. And inferencing applications are about to take off.

To see how that shift is unfolding, look no further than Nvidia’s recent earnings report. CEO Jensen Huang said he estimates about 40% of Nvidia’s data center revenue over the past year was actually for inference, not training. That’s somewhat surprising, as Nvidia is thought to be the only game in town for training, whereas it’s possible inferencing could be done with some lower-power processors from competitors.

One company that could be an under-the-radar inference play is Cloudflare, which began as a software company that helped speed up websites, software applications, and content delivery.

But Cloudflare’s management was forward-thinking, taking the time and cost to build an integrated software stack from the beginning, whereby all of its new products and services can be run on the same type of commodity hardware. That has paid off in the form of an ever-increasing portfolio of products, including cybersecurity, network management, and developer platforms that run on its lightweight servers in internet service provider data centers close to customers at the edge.

Today, Cloudflare’s servers are in 310 cities in over 120 countries connecting 13,000 networks, with its network now within 50 milliseconds of 95% of the world’s population. And that makes Cloudflare a potentially ideal place for businesses to run their inference workloads. That’s because inference workloads are likely too computing-intense to run on end devices such as PCs or phones, but are likely “lightweight” enough so that they don’t have to be run all the way back in a large, cloud-based data center.

Management began to capitalize on this potential last September when Cloudflare released Workers AI, an inferencing-as-a-service platform for developers in Cloudflare’s servers, which could potentially put Cloudflare up against the big cloud computing players for inference workloads.

And the new offering is showing early signs of success, with Workers AI requests growing 9x between September and December, according to Cloudflare’s recent fourth-quarter conference call with analysts. And even though the new inference offering just came out and contributes little to revenues today, Cloudflare still saw a very healthy 32% revenue growth in the last quarter, driven by its core products. Of note, Cloudflare is really penetrating larger enterprise customers now, with the company recording its largest customer win, as well as its largest customer renewal ever last quarter.

With much-loved offerings across its core content delivery, network, and cybersecurity markets that are still growing strong, Cloudflare’s new inference products could bolster its already-strong growth rate for years to come.

A transition from growth to value

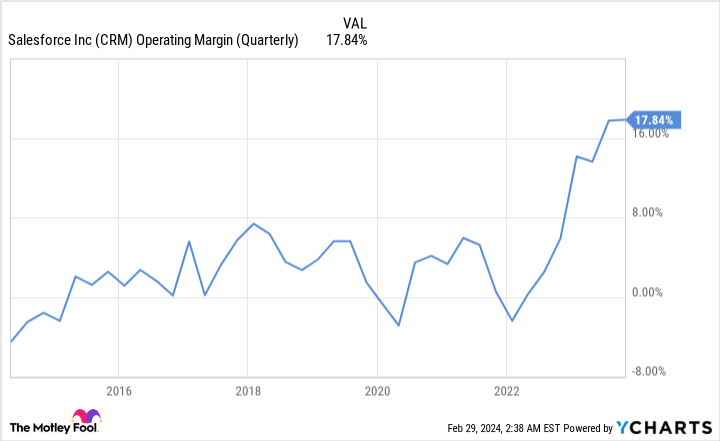

Nicholas Rossolillo (Salesforce): After a couple of years of unwinding out-of-control spending that cropped up during the pandemic, customer data and relationship management platform Salesforce (CRM 2.61%) is totally back. The software giant reported revenue growth of 11% this past year, despite a big slowdown in corporate spending as companies looked to tighten up as the economy slowed. Salesforce is predicting some of this soft spending among its users will continue, but is still nevertheless predicting revenue growth of about 9% for 2024 (fiscal year 2025 for Salesforce).

As the business has matured, Salesforce made a quick pivot from all-out growth (it had been putting up 20%-plus sales growth for the duration of its existence as a publicly traded stock over the last two decades) to a more value-generating business. CEO Marc Benioff and the top team ratcheted up generally accepted accounting principles (GAAP) operating profit margins this last year to 14.4%, and expects that figure to jump to 20.4% for full-year fiscal 2025.

Data by YCharts.

Along the way, Salesforce started repurchasing its own stock as part of a new strategy to begin returning cash to shareholders. And starting this year, Salesforce will also begin paying a quarterly dividend — which, as of this writing, is worth 0.5% in annualized yield. That’s not too exciting, but it nevertheless signals this data management software company’s successful evolution into a more mature business.

Of course, customer data is more important than ever in a new era of AI-fueled computing technology. Salesforce’s own development of AI throughout its platform isn’t translating into any pick-up in growth just yet. However, that tees up the possibility of management underpromising and overdelivering this year on financial guidance. Plus, Benioff and company said its own internal use of its AI tools should fuel the profit margin expansion story for years to come.

Salesforce stock now trades for about 45 times expected GAAP earnings per share (EPS), or about 30 times EPS on an adjusted basis (which corresponds a bit more closely to free cash flow). Shares have been on a hot run in the last year, but there are still years’ worth of profitable returns left in the tank for this cloud software leader. I’m happy to keep holding.

We’re doctors with 457(b) plans that we can’t roll over into IRAs. What now?

My wife and I are both physicians and we have been contributing to our employer-retirement plans since residency training. This includes Roth 403(b), tax-deferred 403(b) and tax-deferred 457(b) plans. I am 60 and my wife is 56, and we expect to continue working until our 70s.

I am just now looking at the 457(b) plan rules and, as this is not a governmental 457(b), the distribution options are limited, and include a lump sum, fixed amount over a set number of years, or single- or joint-life annuities. The main issue with these plans is once you make a distribution decision, it can never be changed.

I don’t know if there are exceptions, but according to our plan representatives, it’s basically set in stone. I think there are also RMD requirements, but our plans also require that we begin distributions at age 70 1/2. It’s unclear whether or not these hold if we stay employed past 70 years old.

If we keep saving at our current rate, I expect that our retirement savings will be distributed as follows: 20% in our 457(b)s, 40% in other tax-deferred plans, 20% in Roth plans, and 20% in an after-tax brokerage account.

We are not allowed to roll over into an IRA. One option is to use the plan early and distribute all the money within five to 10 years. Another option is to use the plans as a quasi-indexed annuity and withdraw the money over 20 to 25 years and, of course, we could pick the joint annuity option.

If we do choose a life annuity or a long duration for withdrawals, how does that affect our RMD calculations for the other tax-deferred accounts?

One final caveat is the money belongs to the employer until it is completely distributed so, in theory, if the employer goes bankrupt, we could lose the balance of the accounts. I have very low concern that this could happen but it’s certainly out there.

Since our 457(b) plans are so restrictive, could you give advice on the best way to utilize these plans?

See: We have $3.9 million in retirement and cash, but face a $60,000 annual college bill for our child over 5 years. Can I retire if my wife keeps working?

Dear Reader,

Having a diversified array of accounts will help you tremendously in your later years. As for your question, the answer boils down to the type of income you’ll need in retirement, and equally as important, the tax implications.

It’s wonderful that you have such a keen eye on the 457 plan, as it can heavily impact how the rest of your income plan goes in retirement. Distributions from 457 plans are considered “deferred salary,” so they are fully taxable, and will be added to any other taxable income you have in retirement, including annuities, required minimum distributions and Social Security, according to FI Physician, a site dedicated to retirement planning for physicians.

Lump sums can feel overwhelming. You get a huge sum of money, you expect your tax bill to go through the roof, and you have to allocate the money wisely so that it works for you in the future.

If you go the lump-sum route, you could pick your own annuity to put some of the money in, as annuities are a form of “guaranteed income.” (Before you do that, compare any annuity you may be interested in to what the plan offers, as sometimes plans have more favorable rates and terms.)

And if you aren’t interested in an annuity — or if you simply don’t need one because of other sources of retirement income — there’s always the investment-portfolio option. You could work with a qualified financial planner, such as a certified financial planner, to create an investment portfolio that rides the waves of market volatility and works for you for the next few decades. It should also meet other specific financial goals like leaving behind an inheritance to loved ones or to charity.

Timing your distributions

The distribution over five to 10 years only makes sense if you have really finished working when you leave this employer, because otherwise you’d have that income on top of your salary, and that puts you at risk of a higher tax bracket. “This is why waiting to fund one of these plans is essential until you are sure of your traditional or early retirement plans,” according to FI Physician. “It doesn’t do any good to defer income now just to take it soon while still earning income.

Three more things: First, check again about the required minimum distribution age for your account as most plans don’t need to begin distributions until age 73, including 457(b) plans, according to the Internal Revenue Service.

Second, I know you said you’re not worried about your employer going bankrupt and thus you losing any of this money, but it is still important to check the fiscal health of your employer, just to be on the safe side. What you find may change the approach you’re going to take. And if you do have another decade to go before retirement, be sure to regularly check on that fiscal health, in case you need to adjust your plans.

Third, you both have your own accounts, so you could always choose different avenues for each of them. For example, maybe one of you takes the annuity option, and another opts for the lump sum. It’s another way to diversify.

Given your intentions to keep working until your 70s, you do have time to make your decisions around distributions, but it’s great you’re getting a head start. To really maximize your benefits, take this time instead to think critically about what you’ll need to spend in retirement and be sure to include healthcare and emergencies (in other words, be extra conservative in your estimates).

You already have a breakdown of how you anticipate making up your retirement income, but now run the numbers for each type of 457(b) plan distribution — that is, what would your income look like if you took a lump sum and created an investment portfolio? What would it look like if it were divided over five to 10 years? Does it still make up 20% of your retirement income as you anticipated, or does it shift the allocation of withdrawals?

Would you want to use some more of your non-taxable distributions, such as Roth assets, to offset your tax liabilities until the periodic distributions end? And what would your tax bill look like if you went the annuity path after all?

You have all of the pieces in place, and you and your wife have been diligent in preparing for the future. Keep on truckin’.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Also see: I’m 60 and want to withdraw $250,000 from my 401(k) to pay off the mortgage and bills. Is that a smart thing to do?