According to a regional report, Sony Bank of Japan is currently exploring the potential of a stablecoin tied to the yen that could be utilized by Sony Group along with its associated entities. Insiders revealed that this endeavor’s testing phase employs the Polygon blockchain, with the crypto firm Settlemint lending its support. Polygon and Settlemint […]

According to a regional report, Sony Bank of Japan is currently exploring the potential of a stablecoin tied to the yen that could be utilized by Sony Group along with its associated entities. Insiders revealed that this endeavor’s testing phase employs the Polygon blockchain, with the crypto firm Settlemint lending its support. Polygon and Settlemint […]

Source link

Polygon

Polygon Labs CEO sees layer-3s like new Degen Chain as a risk to Ethereum

Polygon’s CEO Marc Boiron emphatically stated that the layer-2 network was not considering developing layer-3 protocols because of the potential risks they pose to Ethereum’s security.

Boiron made this statement on the back of the early success of Degen Chain, a layer-3 network running on the Coinbase-backed scaling solution Base.

Layer 3 protocols enhance scalability by building upon Layer 2 infrastructure, allowing developers to tailor application-specific blockchains to their requirements.

Degen Chain

Degen Chain is a layer-3 network built using Arbitrum Orbit for the DEGEN token. The digital asset has swiftly emerged as the primary community token among Farcaster users, the rapidly expanding web3 social media platform.

Since its launch on March 28, the network has captured substantial attention and transactional activity within the crypto industry, witnessing an impressive surge of over 200% in the past week.

Available data indicates that the network has facilitated the bridging of more than $30 million, alongside powering over 3.5 million transactions as of March 30.

Community debates layer-3

Degen Chain’s early successes have attracted debates from the crypto community, who hold differing views about the network.

In a March 31 post on X (formerly Twitter), Boiron asserted that layer-3 networks divert value from Ethereum onto the layer-2 platforms hosting them.

According to him, such a trajectory doesn’t align with Polygon’s commitment to Ethereum’s scaling, which the company already addresses through its proof-of-stake (PoS) and zero-knowledge Ethereum Virtual Machine (zkEVM) chains.

Additionally, Boiron pointed out the potential adverse effects of layer-3 adoption, highlighting their minimal performance enhancements and the looming threat to Ethereum’s security. He said:

“If all L3s settled to one L2, then Ethereum would capture basically no value and, thus, Ethereum security would be at risk.”

He added:

“If Ethereum earns no fees and has no prospect of earning fees other than a tiny amount of fees from this one L2, then the value of ETH will drop and, when it is clear that it’ll continue to drop because there is no economic future for it, validators will no longer be willing to hold ETH and, thus, no longer be willing to secure the network.”

Meanwhile, blockchain expert Cygaar explained that layer-2 networks are not yet “matured” and have yet to inherit Ethereum’s security level because of existing challenges like network centralization, upgradeable bridge contracts, and developing proving systems.

Consequently, he argued that integrating layer-3 networks atop layer-2s could exacerbate risks and compromise the security of these blockchain networks.

Mentioned in this article

Latest Alpha Market Report

Nomura Bank launches Libre with Polygon for on-chain tokenization of alternative assets

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

The Polygon Vesting Contract Is Officially Empty, Will This Send MATIC Price To $3?

Like many other crypto projects, the native token of the Polygon network, MATIC, was launched with some portion of the supply vested for the team over a period of time. In the case of Polygon, the vesting was for five years, and since 2019, there have been periodic token unlocks. However, the unlocks, which have often been a deterrent for investors, are now over, as the last batch was just released to the team.

Polygon Last Unlock Goes To Team

On Wednesday, February 21, the Polygon Foundation received the very last portion of their vested tokens from the vesting contract. In total, 273,304,816 million MATIC tokens valued at $260 million were released to the Foundation’s wallet.

This unlock marks the very last unlock that the Foundation will receive, meaning that almost all of the available supply of MATIC is now in circulation. The latest unclog brings the circulating supply of the cryptocurrency to 9,618,318,574 out of its 10,000,000,000 maximum supply. As a result of this, the market cap of Polygon is sitting just above $9.14 billion with a fully diluted valuation (FDV) of approximately $5 billion.

The entirety of the MATIC supply has been unlocked, which means that there will be no more tokens being brought into circulation. This is a huge milestone for the project, whose investors have waited years for the vested tokens to finally run out.

Polygon trending below $1 | Source: MATICUSDT on Tradingview.com

How Will This Affect The MATIC Price?

The fact that the entirety of the MATIC supply is now in circulation is bullish for the digital asset, especially in the long term. Inflation is a factor that tends to drive investors away and keep them from holding their coins due to the fear of more tokens coming into circulation, causing supply to exceed demand.

Now that the entirety of the supply is now in circulation, it gives the MATIC price a chance to enter into price discovery. However, there is still some concern about when the Polygon Foundation might start selling their coins as the entirety of the unlocked tokens still sit in the Foundation’s wallet.

If they do decide to sell, though, it is likely that the foundation would do so through OTC (over-the-counter) deals to minimize the impact of such a sale on the token price. As a result, the MATIC price might not suffer much.

At the time of writing, the MATIC token is trading at $0.95 with a 24-hour increase of 1.11%. Although its performance has been far from encouraging, the token is sitting only 67% below its 2021 all-time high of $2.92.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The play-and-own mobile gaming platform GAMEE suffered an exploit of its GMEE token contracts on Polygon that led to the theft of 600 million GMEE tokens and left the crypto community pondering questions.

GAMEE Confirms $15M Exploit On Polygon

On January 22, GAMEE Token’s official X (formerly Twitter) account advised its users to refrain from engaging with the digital asset while their team investigated the GMEE token-related security comprise it had just suffered.

The GMEE token is an ERC-20 utility token “designed to be the currency of access, action, and governance within the GAMEE ecosystem,” as their website states.

🚨 $GMEE | URGENT

There has been a security incident involving the GMEE token. As a precautionary measure, we advise all users to refrain from engaging with $GMEE until further notice.

Our team is actively investigating the situation, and updates will be provided soon.

— GMEE Token (@GAMEEToken) January 22, 2024

Before the official announcement, crypto users quickly noticed the token’s sudden price crash and the transactions behind it. This left GAMEE users and the general crypto community wondering if an exploit had occurred.

In the early hours of January 23, GAMEE’s team returned to the X platform to explain what happened and the steps to come.

The thread explains that their preliminary investigation indicated that the GMEE token contracts on Polygon had been compromised via unauthorized GitLab access.

This compromise resulted in the theft of 600 million GMEE tokens worth approximately $15.28 million at the time of the exploit. The compromised tokens were immediately converted to ETH and MATIC and exchanged via various decentralized exchanges (DEXs) in the following hours, drastically impacting the GMEE token price.

The team behind GAMEE explained that after noticing the Polygon GMEE deployer address was compromised, they secured the token contract ownership and all associated contracts by transferring ownership to a “new secure address.”

The team also clarified that only proprietary team token reserves were affected, and the exploit did not affect assets owned by the community, as “GAMEE does not custody or manage any community-owned assets.”

GAMEE expressed its understanding of how the impact of the unauthorized transactions could have affected the GAMEE community, as it led to price volatility and limited use of the GMEE token while investigations were taking place.

The next steps for GAMEE will consist of an impacted user identification process to evaluate the best way to support the affected part of the community. Additionally, they plan to provide a real-time update on the details that further investigations will provide as an effort to keep trust and transparency.

Lastly, the user was advised to exercise caution “given the volatile market conditions and potential liquidity impacts driven by CEX measures.”

GMEE’s Violent Price Drop

Around the time of the exploit, the GMEE token had been trading at $0.02554112, according to CoinGecko’s data, and it had been previously sitting at the $0.027-$0.026 range throughout the weekend.

Shortly after the exploit, the prince crashed to $0.01155577, reaching its lowest point of $0.00897251 in the early hours of today.

It’s worth noting that many saw the price crash as a possibly once-in-a-lifetime opportunity to profit. Various users shared that they had bought the dip and even advised others to do it. One X user said, “One man’s trash is another man’s treasure.”

At writing time, the GMEE token trades at $0.016999, a 31.5% decline in the last 24 hours.

GAMEE is currently trading at $0.016999 in the hourly chat. Source: GMEEUSDT on TradingView.com

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Polygon (formerly Matic Network) is a game-changing Layer 2 scaling solution that addresses Ethereum’s scalability challenges. It empowers developers to create and deploy scalable, interoperable decentralized applications (dApps) by utilizing sidechains, plasma chains, and innovative scaling techniques.

If you’re unfamiliar, sidechains are unique blockchains that are bound to the main Ethereum blockchain and are effective in supporting many Decentralized Finance (DeFi) protocols available on the Ethereum network. This enables rapid transaction speed and cost-effectiveness while maintaining the security and decentralization of the Ethereum network.

As a Layer 2 solution, Polygon operates in parallel to the Ethereum blockchain. Rather than individually validating each transaction, batches of transactions are sent to the Ethereum blockchain, significantly accelerating the validation process and reducing fees.

Polygon implements a proof-of-stake consensus mechanism wherein users can stake tokens for a predetermined duration to validate transactions. In return for their staking activities, participants are rewarded with MATIC tokens.

To ensure robust security, Polygon implements the advanced technique of “commit-chain” or “checkpointing.” It securely anchors the state of Polygon chains onto the Ethereum mainnet at regular intervals, enhancing data integrity and leveraging Ethereum’s inherent security. By capitalizing on Ethereum’s proven security measures, Polygon provides users with a reliable and resilient platform for their transactions and dApps.

The Polygon Network offers a comprehensive set of features that address scalability, security, and developer-friendliness. In this article, we will delve into the key attributes of the Polygon network and assess its substantial potential within the Ethereum ecosystem.

Features Of The Polygon Network

Cross-Chain Connectivity

Polygon network offers bridges that enable smooth transfers of assets and data across diverse blockchains. This fosters interoperability between chains, empowering users to leverage the advantages of multiple blockchain networks and access a broader array of decentralized finance (DeFi) protocols and applications.

Polygon presents a Layer 2 scaling solution for Ethereum by leveraging sidechains to address scalability challenges. This solution facilitates quicker and more economical transactions, alleviating congestion and mitigating high fees on the Ethereum network

Ethereum Compatibility

Polygon seamlessly integrates with the Ethereum Virtual Machine (EVM), enabling developers to effortlessly migrate their existing Ethereum decentralized applications (dApps) to the Polygon network. This compatibility guarantees a seamless transition and adoption of Polygon while leveraging the extensive Ethereum ecosystem and developer tools.

Commit-Chain Checkpointing

Polygon employs commit-chain checkpointing, securing the state of its chains by anchoring them onto the Ethereum mainnet. This approach guarantees the integrity of data, harnesses Ethereum’s robust security measures, and safeguards against any unauthorized alterations or tampering of the sidechain data.

Ethereum Network Security

Leveraging Ethereum as its anchor chain, Polygon leverages the inherent security and decentralization of the Ethereum network. This integration fortifies the overall security of the Polygon ecosystem, ensuring users have access to a reliable and resilient platform for transactions and decentralized applications (dApps).

Developer-Centric Environment

Polygon provides an array of developer tools and infrastructure that empower developers to create and deploy decentralized applications (dApps) seamlessly. The Polygon Software Development Kit (SDK) offers a streamlined framework for building scalable applications on the network, simplifying the development process.

Polygon also prioritizes the needs of developers by offering extensive documentation, guides, and resources. This ensures that developers have access to the necessary information and support to comprehend and harness the platform effectively. The availability of comprehensive resources fosters a vibrant developer community, encouraging collaboration and driving innovation on the network.

MATIC Token Utility And Exchange Availability

Polygon’s rebranding decision resulted in the retention of MATIC as its token ticker symbol. MATIC, an ERC-20 token, ensures compatibility with numerous Ethereum projects. Within the Polygon network, users rely on MATIC to secure and govern the network and cover transaction fees.

The MATIC token serves multiple purposes within Polygon’s ecosystem. Users can utilize MATIC for fee payments during transactions on the Polygon platform. MATIC can also be staked to contribute to the network’s security and earn rewards.

Furthermore, MATIC holders have the ability to engage in governance activities by voting on proposed modifications, influencing the evolution of the network.

In terms of exchange availability, MATIC can be traded on various platforms, including prominent exchanges like UniSwap. This wide accessibility on exchanges enhances liquidity and provides individuals with convenient access to acquire or trade MATIC tokens.

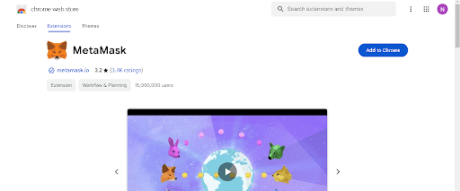

How To Get Started On The Polygon (MATIC) Network

To engage in token transactions on the Polygon network, users must acquire a MetaMask wallet. MetaMask, a widely used browser extension wallet, provides a seamless interface for interacting with blockchain networks, including Ethereum. This user-friendly wallet is accessible as a browser extension for popular browsers like Google Chrome.

To ensure your MetaMask Wallet is added to your browser as an extension, click on the ‘Add to Chrome’ icon located at the top right corner, as depicted below:

After installation and setup, MetaMask enables users to effectively manage their cryptocurrency wallets, seamlessly interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks, all directly from within their web browsers.

Remember to diligently write down your seed phrase on a physical sheet of paper and store it in a secure location. Avoid storing it online or on any electronic device to ensure maximum security.

For the next step, add the Polygon (MATIC) network to your Metamask wallet by following the instructions provided on the Metamask website here.

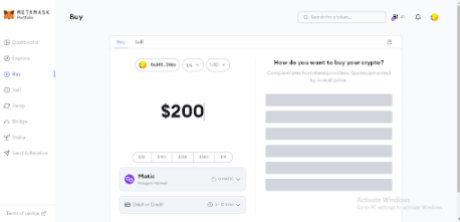

Trading On The Polygon (MATIC) Network

In order to execute trades on the Polygon (MATIC) network, you will need to fund your wallet with MATIC so as to enable you to cover gas fees. These fees cover the expense associated with utilizing computational resources related to transaction processing and validation.

To purchase MATIC tokens, you can utilize centralized exchanges like Binance. Simply copy your wallet address from MetaMask and proceed to transfer MATIC tokens from your Binance account to your MetaMask wallet.

In addition, it is possible to acquire MATIC directly within the MetaMask wallet by utilizing conventional payment methods such as credit or debit cards and other similar options.

Simply click on the “Buy/Sell” button within the MetaMask interface to access the designated section. Within this interface, you can specify the desired amount of MATIC (or any other token) you wish to purchase in terms of US dollars. Additionally, you can select your preferred payment method before finalizing the transaction by clicking on the “Buy” button.

It’s imperative for users to be aware that when purchasing cryptocurrencies directly within MetaMask, you will be required to provide information such as your country and state. However, rest assured that this process is simple and can be completed within a minute.

You can expect your MATIC tokens to arrive in your wallet within a few minutes at most. Once they have arrived, you are ready to start trading tokens on the Polygon network. To begin your trading journey, navigate to UniSwap and commence your trading activities.

How To Trade Tokens On The Polygon Network Using UniSwap

Uniswap is an Ethereum blockchain-based decentralized exchange (DEX) protocol that enables users to trade Ethereum-based tokens from their wallets directly, eliminating the necessity for intermediaries or conventional order books. Uniswap provides users with a hassle-free method to purchase and sell various tokens.

To safeguard your wallet against fraudulent activity, ensure that you are accessing the legitimate Uniswap website.

Begin by clicking on the “Launch App” button located in the top right corner, as depicted in the image below:

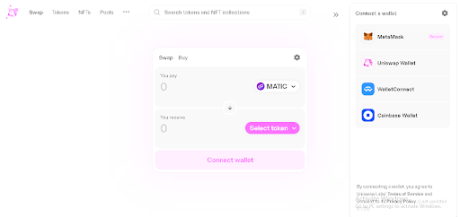

Next, proceed by selecting the “connect” option located at the top right corner of the UniSwap interface, as depicted in the provided image below:

Establish a connection with your preferred wallet, as shown in the image below. In this instance, the suggested wallet is Metamask:

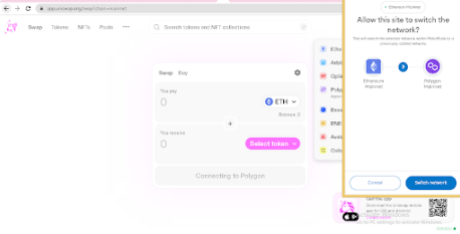

After establishing the connection, adjust your Metamask settings to the Polygon (MATIC) network. (If you are already connected to the Polygon network, there is no need to make any network switches).

Once you have successfully connected MetaMask to the Polygon network, navigate to UniSwap to begin trading on the Polygon network through the platform.

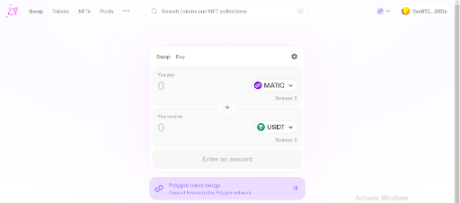

Moving forward, you need to choose your desired tokens within the UniSwap interface. As Uniswap operates on a token-to-token trading model, click on the “Select Token” button to designate the specific trading pair you wish to trade against.

To illustrate, if you intend to purchase USDT using MATIC, simply choose the MATIC – USDT trading pair, specify the desired amount, and click on “Swap” or “Trade Now.” Confirm the transaction in your Metamask wallet, and you will be able to view the tokens in your wallet’s asset list.

Buying And Selling Tokens With Metamask

Metamask extension wallet, connected to the Polygon network, allows users to buy and sell tokens seamlessly. To proceed, ensure that you are connected to the Polygon network and possess MATIC tokens for swapping and covering gas fees.

Then, locate the “Swap” button, as illustrated below. Clicking on it will direct you to the Swap interface within the Metamask wallet.

Using the image above as a guide, users can search for tokens by name or contract address, just like on UniSwap. Enter the amount of MATIC you want to swap, make sure you have the correct token, and click on “Swap”. Once the transaction is confirmed, the tokens you bought will be sent to your wallet.

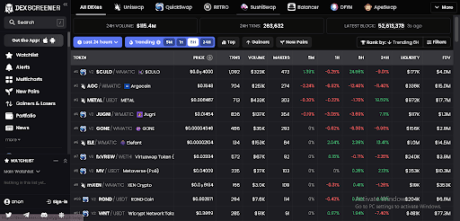

Tracking Token Prices on The Polygon Network

Polygon network users can equip themselves with potential on-chain tools like Dexscreener, which opens up a world of new opportunities for traders. Dexscreener provides users with extensive market insights for specific tokens, ranging from real-time price data to in-depth contract information. It also helps users make well-informed trading decisions based on reliable and up-to-date data.

Stay ahead of the curve on the Polygon network with Dexscreener, keeping track of token metrics and market dynamics.

Dexscreener on the Polygon network offers invaluable features tailored to users. One standout feature is its charting functionality, which provides real-time and historical price data for various tokens.

By utilizing these charts, users can gain valuable insights into price trends, trading volumes, and other important metrics.

Check below for a visual representation:

Conclusion

The Polygon network provides a robust and user-friendly environment for traders to thrive. With its innovative features, growing ecosystem, and commitment to scalability, Polygon is poised to play a pivotal role in shaping the future of decentralized finance.

As Polygon continues to experience growth and wider adoption, we anticipate a broader selection of applications and services tailored to meet the diverse requirements of traders. The network’s dedication to scalability, interoperability, and user satisfaction establishes it as a frontrunner in the ever-evolving blockchain industry.

Featured image from Medium

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Zero-Knowledge infrastructure can secure ‘trillions’ in institutional money in 2024: Interview Polygon Labs

In an exclusive interview with Colin Butler, Global Head of Institutional Capital at Polygon Labs, Butler brings a unique and informed perspective to the table, discussing various pivotal aspects shaping the future of blockchain and cryptocurrency. This interview explores the impact of traditional financial instruments like ETFs on the crypto market, the significant strides made in institutional DeFi in 2023, the evolving role of tokenization in institutional adoption, and Polygon’s strategic position in this rapidly changing landscape. His answers offer a comprehensive look at the current state and future prospects of blockchain technology in the institutional domain, highlighting both the challenges and opportunities that lie ahead.

Butler highlights 2024 as a critical year for institutional adoption of tokenization. He emphasizes the maturity of the underlying infrastructure, capable of supporting immense financial values. The focus is on the significant improvement in security, particularly with Zero-Knowledge technology, which is crucial for traditional finance (TradFi) institutions to engage with blockchain and cryptocurrencies. The integration of ETFs and similar products is expected to significantly enhance trust and legitimacy in cryptocurrencies. Butler foresees a broader investor base, increased market stability, and reduced volatility driven by deeper involvement from traditional financial institutions.

He discusses the challenges and future of tokenization. He mentions the need for institutions to improve infrastructure and supply to meet the growing demand. He predicts rapid growth in areas like tokenized funds and structured products, with physical assets like real estate and art being slower due to inherent challenges.

Butler is uniquely positioned to comment on the institutional perception of DeFi, as the below interview highlights.

You’ve mentioned that big institutions are now tokenizing real-world assets and the implications of on-chain assets becoming institutional in the form of ETFs. Can you elaborate on how this trend might evolve in 2024?

I see 2024 being an extreme inflection point for the institutional adoption of tokenization. The underlying infrastructure is now in a state capable of securely supporting the billions, if not trillions, of dollars worth of value that traditional financial institutions bring with them.

Security has been the blocker to date; you only have to look at the broader crypto and DeFi ecosystems to see the impact of security defects and the potential for significant monetary losses as a result. However, with the implementation of Zero-Knowledge technology, a level of security is in place that even the most hesitant of TradFi proponents can get on board with.

What impact do you foresee ETFs and similar products having on the broader crypto market and investor confidence?

As TradFi deepens its crypto involvement, we’ll witness a substantial increase in overall trust and legitimacy of cryptocurrencies as an asset class. Crypto products will appeal to a broader range of investors, including those who have been previously skeptical. With increased confidence and more consistent investment flows will come greater market stability and a reduction in the volatility characteristic of the crypto markets to date.

You predicted that 2023 would be a pivotal year for institutional decentralized finance (DeFi). What developments have you seen this year that reinforce or challenge this prediction?

2023 was a year of clear progress. We saw the launch of Clearpool’s institutional borrowing platform, allowing lenders to set their own stablecoin loan terms. JPMorgan’s deposit tokens suggest a growing interest from traditional financial institutions in blockchain solutions, though within a regulated framework.

The integration between legacy financial systems and blockchain is a complex one. There has been major advancement and interest, certainly, but also a recognition of the remaining hurdles, particularly around regulation. BlackRock’s embrace of Bitcoin and cautious stance with DeFi epitomizes the institutional desire for clarity amidst regulatory complexities.

How do you think the progress made in 2023 will shape the institutional DeFi landscape in 2024?

With the massive improvements brought by layer-2 networks and ZK technology, we’ve seen the Ethereum network successfully update to a more efficient and cost-effective infrastructure that can make DeFi protocols accessible and appealing to institutional users.

In 2024, I think we’ll see a shift in the user base of DeFi from primarily retail to more institutional participants, driven by the development of more sophisticated financial tools like derivatives. Furthermore, the entry of large entities like BlackRock into DeFi will pave the way for new standards and frameworks that make DeFi a clear win for traditional finance more broadly.

Considering your belief in tokenization as a world-changing phenomenon, what do you think are the key drivers for its widespread adoption by institutions?

I think the institutions building these products need to go out and sell them. You can lay out all of the benefits: 24/7 trading, access to vehicles and assets for which you had no prior access etc. But does this create an order of magnitude better solution that people can clearly see like in front of them? It’s tough to say.

Until now the infrastructure hasn’t existed for the technology to be accessible by the average person, as a result, demand has been low. While the benefits for tokenization are undeniable, the supply and infrastructure has to exist for widespread adoption. That’s the challenge we face as an industry. We’re small in every leg of the stool: infrastructure, supply, and demand. We need institutions to continue to grow their infrastructure and, in time, demand will grow in tandem with supply.

How do you see tokenization evolving in the next year, especially in terms of new asset classes or innovative use cases?

In 2024, I see tokenization growing rapidly in some areas but slowly in others.

Tokenized funds will continue to grow over the next three to six months. Next I see structured products, such as currencies, being tokenized more regularly and private credit will come soon after. These are the most logical use cases for tokenization and because they’re digital the transition on-chain should be fairly smooth.

Bonds and equities are likely to come next. But the last to be tokenized is going to be physical assets like gold, real estate, art, wine, etc. While these physical assets have heaps to gain, due to them not being digital, the transition will take a lot longer. There are a lot of challenges we face to tokenize physical assets, some of which may never be solved.

As the Global Head of Institutional Capital at Polygon Labs, how do you see the platform fitting into and influencing the institutional adoption of blockchain technology?

If you’re an institutional investor you want two things: high liquidity and security. The Polygon networks give you both.

Investors can tap into the entire Ethereum ecosystem through the Polygon networks, providing access to high liquidity. And, the development and adoption of zero-knowledge tech in the Polygon network will increase the security of transactions.

I believe that due to these two factors, institutional investors will be looking towards the Polygon protocols, more often than not, when looking to invest in blockchain technology.

Can you share any insights or case studies where Polygon has been instrumental for institutions in adopting blockchain?

This year Hamilton Lane, one of the leading global investment funds, started allowing individual investors to access their $2.1 billion flagship fund through tokenization on the Polygon PoS network. This reduced the minimum investment required from $5 million to just $20,000. This collaboration between Hamilton Lane and Securitize went so well that they later started offering a new fund with a $10,000 minimum investment.

But this isn’t one case study in isolation, South Korea’s largest financial group, Mirae Asset Securities, also trusts the Polygon network for their adoption of Web3 technologies.

While ABN AMRO became the first Dutch bank to register a green bond on the blockchain, using the Polygon network. And, JPMorgan used the Polygon PoS network as part of the Singapore CBDC project.

The Polygon protocols are playing an instrumental role in institutional adoption of blockchain technology by providing infrastructure that can handle the flow of billions of dollars.

Given your role in educating the institutional investment community about blockchain, what are the key areas of focus or common misconceptions you address?

There’s a common misconception that blockchain and cryptocurrency, particularly Bitcoin, are synonymous. But blockchain encompasses much more than just cryptocurrencies. It’s a foundational technology that offers tokenization, smart contracts, and a wide array of applications.

The transparency offered by public blockchains is a significant feature, often underestimated in their ability to provide real-time visibility into transactions and analyze the risk of each platform’s transactions as they occur. Contrary to popular belief, the incidence of illicit activities in these businesses is minimal, as shown by the analysis of transaction inflows into mainstream exchanges.

Another common misconception is that blockchains are inherently limited by low transaction speeds and scalability issues. Scaling solutions like the Polygon networks for Ethereum are crucial developments in making blockchain technology more viable for widespread institutional use.”

How do you approach the challenge of balancing technical depth with approachability in these educational efforts?

I think it’s important to explain things in as simple terms as possible. Although blockchain emerged thanks to several impressive technological innovations, notably advanced cryptography, it’s important to draw analogies with familiar examples and portray blockchain as an evolution of existing financial systems rather than a radical departure.

For instance, smart contracts can be likened to automated versions of self-executing contractual clauses much like an escrow service in traditional finance, but with automation and predefined rules. Fundamentally, a blockchain is a digital ledger, similar to accounting ledgers in traditional banking, but more advanced and transparent. This ledger records transactions securely, akin to how banks record financial transactions, but with increased transaction speed, and enhanced transparency. The most important aspect of blockchain education is to show how it enhances and improves upon current processes. It didn’t emerge out of nowhere. It came about to solve some of the limitations faced by traditional finance.

Connect with Colin Butler

After a very dull performance over the majority of 2023, the Polygon PoS chain managed to gather considerable pace and demonstrate notable strength in the latter part of the year.

Data indicates that, in addition to the remarkable price performance of MATIC, the Polygon network’s native token, there was a lot of excitement surrounding Polygon’s NFT ecosystem in December of the previous year.

Polygon NFT Surge: Sales Volume Peaks

An increase in the overall number of NFT deals and an upward trend in NFT sales volume, especially during the past seven weeks, are indicators of this expansion.

On December 6, 2023, the spike peaked for six months, ranking the Layer-2 scaling solution third in terms of NFT sales volume, after Ethereum and Bitcoin.

NEW:

Polygon NFT sales volume is surging to levels not seen in over 6 months. pic.twitter.com/M4iWtRTDOe

— Today In Polygon (@TodayInPolygon) January 5, 2024

Polygon has sold nearly $10 million in a single day, according to CryptoSlam data. This is more than twice as much as Solana, which sold a little over $4.1 million.

Flippening began when Solana’s sales volume fell more than 17% in a day, whereas Polygon NFT sales volume increased by 42%.

NFT Collection Rankings by Sales Volume. Source: CryptoSlam

Today In Polygon, a popular X (formerly Twitter) handle, recently tweeted about blockchain’s rise in the NFT market.

According to the post, Polygon’s NFT sales volume was rising to levels not observed for more than half a year. This episode suggested a renewed interest in MATIC NFTs, which in the upcoming months may have a more significant effect on the ecosystem.

NEW: Polygon NFT sales volume has reached $47M in the month of December.

This is the highest monthly volume since February 2023. pic.twitter.com/tD6F8L6c2u

— Today In Polygon (@TodayInPolygon) December 31, 2023

Based on DappRadar statistics, the top Polygon NFTs during the previous 30 days were Genesis WildPas, Collect Trump, The Sandbox, and Gas Hero Coupon NFTs.

In addition, Polygon’s wash sales total is larger than Solana’s, coming in at $858,631 versus $175,493.

The entire sales volume, which includes both normal and wash sales, is $10,845,385 for Polygon NFTs and $4,292,160 overall.

MATIC market cap currently at $7.582 billion. Chart: TradingView.com

MATIC Up Amidst Market Complexity

While this was going on, the token’s price chart turned green, encouraging MATIC bulls to pick up their game. MATIC has increased by more than 3% in the last day alone, according to CoinMarketCap.

With a market valuation of more than $8 billion, it was trading at $0.83 at the time of writing.

Even with these encouraging indicators, certain areas displayed unfavorable patterns, such as a decline in the graph of unique addresses and a drop in the quantity of transactions after a peak on December 25, 2023.

These inconsistent tendencies highlight the intricate mechanisms at work within the Polygon NFT ecosystem, despite the fact that the cryptocurrency market is infamously volatile.

Featured image from Freepik

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Polygon has seen some sharp uptrend during the past day and has now broken above $0.85. Here’s why this break could pave the way for a further rally.

Polygon Has Risen By More Than 6% During The Past 24 Hours

After topping above the $0.94 mark earlier in the month, MATIC had gone on to register some significant drawdowns. In the last few days, though, the asset appears to have hit a bottom around the $0.75 level, as it hasn’t gone below the mark yet.

Something that could add further evidence for this is the fact that bullish momentum has returned for Polygon in the past day, as its price has shot up over 6%.

The below chart shows how the cryptocurrency has performed during the past month:

Looks like MATIC has sharply risen in the past day | Source: MATICUSD on TradingView

With this sharp surge, the cryptocurrency has recovered back above the $0.85 mark. This break could turn out to be significant for Polygon if on-chain data is anything to refer to.

MATIC Has Broken Past A Major Resistance Zone With The Latest Surge

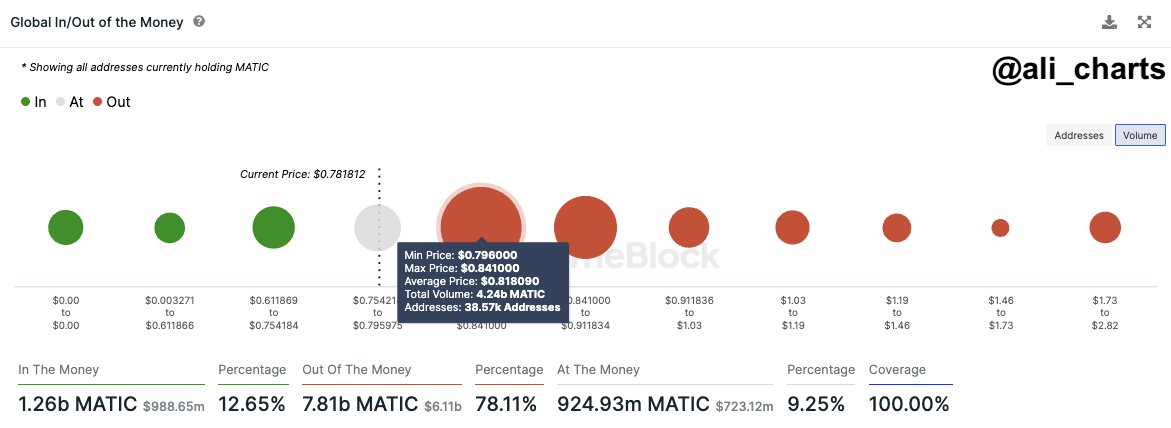

In a post on X, analyst Ali discussed about how Polygon was about to face a major test of on-chain resistance. When the analyst had made the post, the coin was still trading around the $0.78 mark.

Here is a chart that shows how the on-chain support and resistance levels looked like at the time of the post:

The different MATIC price ranges based on the density of cost basis | Source: @ali_charts on X

In on-chain analysis, the potential of any price range to act as support or resistance depends on the number of coins that the investors purchased inside the particular range.

This is because of the fact that holders are more likely to react whenever the price retests their cost basis or acquisition price, as such a retest can flip their profit-loss condition. The more addresses that have their cost basis inside a particular range, the stronger the market reaction when the price retests said range.

From the chart, it’s visible that Polygon’s price had been trading just under the $0.79 to $0.84 range at the time Ali had made the post. This range carried the cost basis of around 38,570 addresses, which bought 4.24 billion MATIC at it.

Generally, whenever the investors are in a loss (as these holders would have been when MATIC was trading under the range), there is a chance that they sell when the price retests their cost basis since they might get desperate to exit the market and break-even would sound like a good opportunity to do so.

As a result of this, price ranges above the spot price that are dense with investors can provide resistance to the cryptocurrency. This had made the aforementioned thick $0.79 to $0.84 range important for Polygon. “For MATIC to embark on a journey to new heights, it’s crucial to break through this level with conviction,” the analyst noted in the post.

Following the latest surge, MATIC has clearly surged past this major obstacle. And as is visible in the graph, there aren’t any ranges this difficult to break anymore, either. It now remains to be seen how the Polygon price develops from here, given the lower on-chain resistance at the levels above.

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

A cryptocurrency analyst has explained that Polygon could be on the brink of a major move due to a pattern in an on-chain indicator.

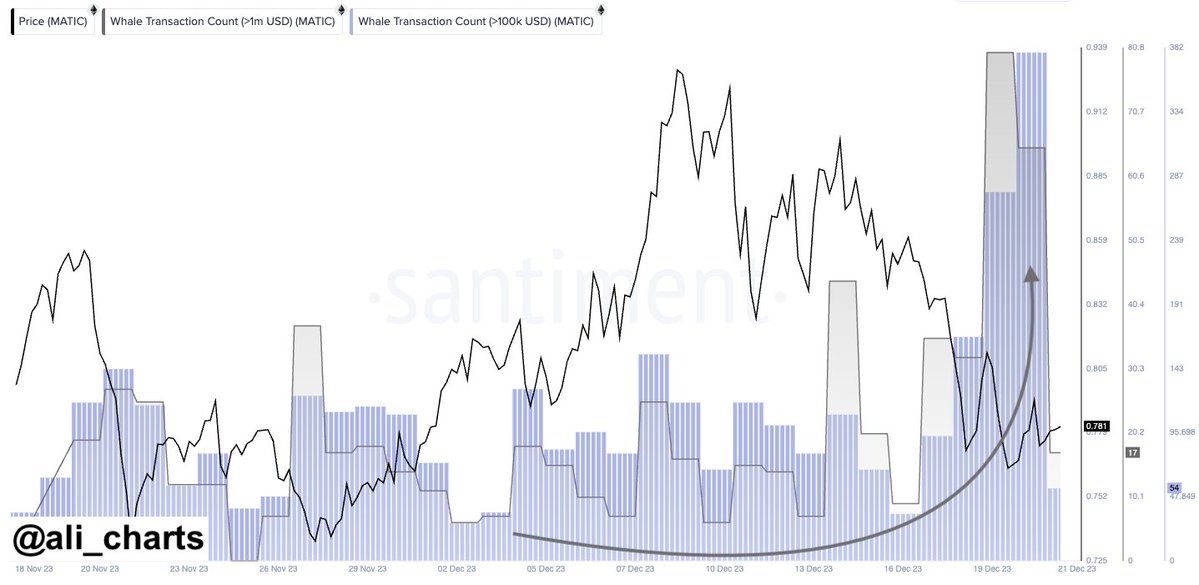

Polygon Whale Transactions Have Shot Up Recently

In a new post on X, analyst Ali has pointed out how the whales have shown a notable surge in activity on the MATIC network recently. The relevant indicator here is the “whale transaction count,” which keeps track of the total number of Polygon transfers happening on the blockchain that exceed a value of $100,000.

When the value of this metric is high, it means that the a large amount of such transactions are taking place right now. Such a trend is a sign that the whale entities have an active interest in trading the cryptocurrency.

On the other hand, the indicator being low implies the whales are potentially not paying much attention to the asset currently, as they aren’t making too many moves.

Now, here is a chart that shows the trend in the Polygon whale transaction count over the past month:

The value of the metric appears to have been quite high in recent days | Source: @ali_charts on X

As displayed in the above graph, the Polygon whale transaction count has observed a sharp rise in the last few days and has attained high levels not seen at any point during the past month.

In the chart, Ali has also attached the data for another version of the metric that keeps track of only the MATIC transactions that are carrying a value of at least $1 million.

These massive transactions are the ones more likely to move the market and it would appear that they have also gone up in number recently, implying that the whales haven’t been shy of moving around large stacks.

“Such significant movements often signal impending price changes,” explains the analyst in the post. “So we could be on the brink of a major MATIC price move!”

Any volatility that may arise of this high whale activity, however, could theoretically go in either direction, as the whale transaction count only tells us whether the whales are active or not, and doesn’t contain any info about whether buying or selling is dominant.

Considering that the transactions have spiked after the price has registered a significant drawdown from its recent local top above $0.94, though, it’s possible that the whales are making these moves to buy at the current relatively low prices.

It now remains to be seen how the Polygon price develops in the coming days given the high amount of trading activity that the whales have been participating in.

MATIC Price

Following the recent plunge, Polygon hasn’t been moving much in the last few days as its price has gone rather stale below the $0.80 level. The below chart shows how the cryptocurrency has performed during the last 30 days.

The price of the coin seems to have gone through a large drawdown just a while ago | Source: MATICUSD on TradingView

Featured image from GuerrillaBuzz on Unsplash.com, charts from TradingView.com, Santiment.net

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.