“His portfolio is still down from the April slump when everybody else’s accounts have gone up.”

Source link

portfolio

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio?

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is a legend in the investing world. Since taking over the failing textile business in 1965, Buffett has given investors nearly 20% returns annually. Put differently, a $100 investment in the company back then would be worth nearly $4.4 million today.

Berkshire’s long track record of success has drawn much attention, which is why investors eagerly track the company’s investment portfolio like a hawk. However, because of the popularity of Berkshire’s investments, the conglomerate occasionally requests confidential treatment when building an equity position so it doesn’t tip off the markets until it’s finished buying.

In the last two quarters of last year, Berkshire Hathway accumulated an estimated $5.3 billion stock position, with investors speculating about what it could be. One company on my short list has earned high praise from Buffett and his longtime partner Charlie Munger and has other connections to Berkshire.

Berkshire bought around $5 billion in one company’s stock last year

In the second quarter, Berkshire reported $23.5 billion in investments in “banks, insurance, and finance.” This amount increased to $27.1 billion by the end of the year, or a $3.6 billion increase. Berkshire also eliminated equity positions in Globe Life and Markel, so the investment is around $5.3 billion.

Another thing we know is that if Berkshire’s ownership stake exceeded 5% of shares outstanding, it would be required to report this to the Securities and Exchange Commission. With this in mind, Berkshire likely invested in a company with a large market capitalization of $100 billion or more, significantly narrowing down the list of potential candidates.

Progressive has earned high praise for Berkshire Hathway’s leaders

One company that could fit the Berkshire Hathaway criteria is Progressive (NYSE: PGR), the second-largest automotive insurer in the U.S. behind State Farm. GEICO, wholly owned by Berkshire Hathaway, rounds out the top three.

When it comes to the automotive insurance industry, Buffett sees it as a two-horse race between Progressive and GEICO. He has said:

I have always thought for a very long time [that] Progressive has been very well run. They have an appetite for growth. Sometimes they copy us. Sometimes we copy them. And I think that will be true five years from now, ten years for now.

Buffett’s right-hand man, the late Charlie Munger, also praised Progressive, saying, “In the nature of things, every once in a while, somebody is a little better at something than we are.”

Progressive’s underwriting advantage

Thanks to its stellar underwriting ability, Progressive has gotten Buffett’s and Munger’s attention over the years. The company has committed to underwriting profitable insurance policies since 1971, when it went public. At the time, it was common to think that insurers should break even on their policies and make their actual returns from their investment portfolios.

CEO Peter Lewis bucked the trend then and prioritized achieving a combined ratio of 96, meaning the company would earn $4 of profit for every $100 in premiums written. This goal has been core to Progressive’s disciplined underwriting and is a big reason for the stock’s long-term outperformance.

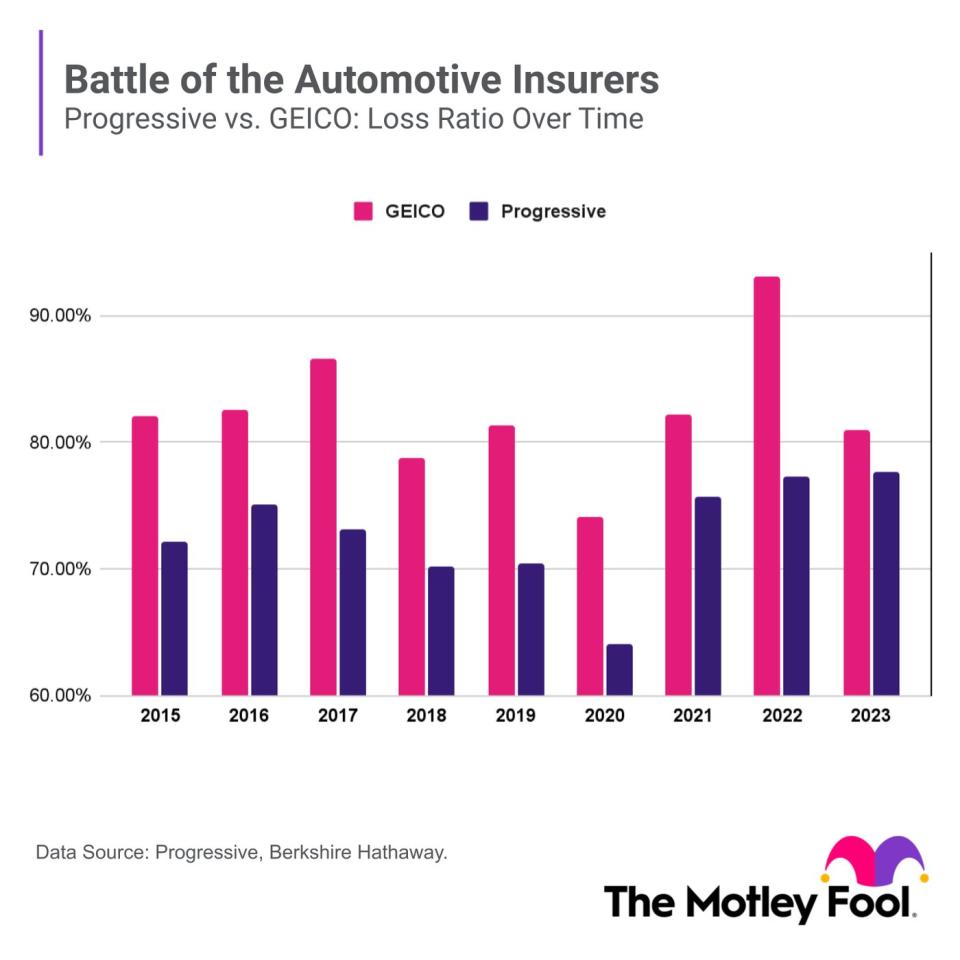

One way to assess Progressive’s stellar performance is to examine its loss ratio. This is one component of the combined ratio and the ratio of losses to premiums earned. Over the last nine years, Progressive’s loss ratio has averaged 73%, an excellent number in the highly competitive auto insurance industry. GEICO, also a solid underwriter, averaged 82% over that period.

Berkshire’s other connection to Progressive

Progressive could also be a candidate for Berkshire Hathaway because of Todd Combs’s connection to the insurer. Combs works alongside Ted Weschler to help manage Berkshire’s investment portfolio with Buffett. Combs worked at Progressive as a pricing analyst in the late ’90s and is quite familiar with the company.

During an interview on the “Art of Investing” podcast, Combs recounted talking to Buffett in 2010 before being offered a job at Berkshire Hathaway. Buffett asked Combs his opinion on Progressive vs. GEICO, and Combs told him that GEICO excelled at marketing and branding, but Progressive’s focus on data would drive its long-term success. Combs was right about Progressive’s data advantage — the stock has crushed it over the past few decades.

A quality company for long-term investors

Berkshire Hathaway has long had its eye on Progressive as a competitor, and the conglomerate may have seen an excellent opportunity to scoop up the insurer at the end of last year. Progressive continued its profitable underwriting streak, maintaining an annual combined ratio below 96 for the 23rd consecutive year. The stock has climbed 28% since the start of the year.

We won’t know if Berkshire is buying Progressive until its 13-F filing for the first quarter is made available in mid-May, assuming it’s not marked as confidential again. Regardless, Progressive has been an excellent stock for long-term investors. Even if Berkshire isn’t buying it, it can make a solid addition to your portfolio today.

Should you invest $1,000 in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Berkshire Hathaway and Markel Group. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio? was originally published by The Motley Fool

Almost Half of Warren Buffett’s $369 Billion Portfolio Is Invested in Only 1 Stock

There’s no denying Warren Buffett’s remarkable track record. As the CEO of Berkshire Hathaway, he has done an amazing job compounding capital at high rates over multiple decades. This is why the average investor closely watches what the Oracle of Omaha owns.

Berkshire’s massive $369 billion portfolio has dozens of stocks. But Apple (NASDAQ: AAPL), which represents 41.4% of the overall portfolio, stands out as the single largest holding. The FAANG stock has soared 542% since the start of 2016 (as of April 2), which is around the time Buffett first started buying the business.

Before investors contemplate whether it’s a good idea to scoop up shares today, it’s important to understand the factors that first drew Buffett to Apple.

Apple’s wonderful qualities

Even in early 2016, Apple had one of the world’s strongest brands, boosted by its lineup of incredibly popular hardware products. This gave the company pricing power. Consumers want to continue paying up for new devices.

Buffett appreciates businesses that can consistently ask their customers to pay more without hurting demand. Another top Berkshire holding is Coca-Cola, which certainly fits this category.

Apple is a financial powerhouse. In fiscal 2015, the business posted an operating margin of 30%. And it generated $70 billion of free cash flow (FCF) that year.

This type of profitability continues today. Apple produced $100 billion of FCF in fiscal 2023. Management used this windfall to pay $15 billion in dividends and to repurchase $83 billion worth of outstanding stock.

In addition to strong financial performance, valuation is another top factor that Buffett looks at. During the first three months of 2016, Apple shares traded at an average price-to-earnings (P/E) ratio of 10.6. Given some of the sky-high valuations in the market today, this was an absolute steal for such a dominant company. Buffett took full advantage of the buying opportunity.

Should you buy Apple stock right now?

While Apple has obviously worked out as a tremendous investment for Berkshire and Buffett, investors shouldn’t just automatically buy the stock right now. I think it’s best to view the current situation with a fresh perspective.

If investors can agree on one thing today, it’s that Apple is no longer the screaming bargain that it was about eight years ago when Buffett first bought shares. In my opinion, this is an expensive stock right now, which makes sense given its impressive performance over the years.

Apple shares trade at a current P/E ratio of 26.3. To be fair, this has come down from the 32.3 it was less than four months ago. But it’s still pricey.

That’s because Apple certainly doesn’t have the same growth potential that it did several years ago. This is a far more mature enterprise today.

In fact, the business saw its sales decline slightly in fiscal 2023. And over the next three years, Wall Street analysts expect revenue and earnings per share to rise at annualized clips of 4.4% and 8.3%, respectively. Paying such a high valuation multiple doesn’t seem like a smart move considering these weak forecasts.

We can’t read his mind. However, I suspect Buffett still owns the stock because he doesn’t want to trigger a taxable event. Or maybe he simply wouldn’t know what to do with all the cash, a problem that Berkshire has already been dealing with.

Apple has been a huge winner historically. But based on where things stand today, it’s best to pass on the stock.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Almost Half of Warren Buffett’s $369 Billion Portfolio Is Invested in Only 1 Stock was originally published by The Motley Fool

A hypothetical stock portfolio has taken hands-off investing to a whole new level.

Jeffrey Ptak, a chartered financial analyst (CFA) for Morningstar, recently devised a passive investment portfolio that’s based on the composition of the S&P 500. But instead of replacing stocks with new companies as they’re delisted from the index, Ptak’s strategy takes an alternative approach: it does nothing.

A financial advisor can help you select investments aligned with your financial goals. Find a fiduciary advisor today.

This laissez-faire approach to investing produced some compelling hypothetical returns: the portfolio would have beaten the S&P 500 by 5.6% during the 30-year period of March 1993 to March 2023. Here’s how it works, as well as some important lessons you can take from it.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

About the Do Nothing Portfolio

Appropriately, Ptak has dubbed this super-passive approach the “Do Nothing Portfolio.” The strategy started with a simple hypothetical: “Imagine you bought a basket of stocks 10 years ago and then you didn’t trade them, not even to rebalance,” he wrote on Morningstar.com. “You just let ’em sit. How would you have done?”

To find out, Ptak compiled the S&P 500’s holdings as of March 31, 2013, and then calculated each stock’s monthly returns going back 10 years. Over 100 of those holdings were no longer in the index 10 years later, many of which were acquired by other companies, according to Ptak. What was left at the end of the 10 years was a portfolio of surviving stocks and cash that had built up over the years following company acquisitions.

The Do Nothing Portfolio would have generated a 12.2% annual return during those 10 years – practically identical to the S&P 500’s return during that time. That caught Ptak’s attention, considering 5.5% of the Do Nothing Portfolio’s assets were cash. By comparison, the S&P 500 was fully invested. The Do Nothing Portfolio was also less volatile during that period and produced better risk-adjusted returns than the index, Ptak wrote.

Ptak took his experiment several steps further and tested the Do Nothing Portfolio in two other non-overlapping 10-year periods – March 31, 1993 to March 31, 2003, and March 31, 2003 to March 31, 2013. The portfolio beat the index by nearly one percentage point during the first 10-year stretch and nearly matched it in the second, all while offering better risk-adjusted returns.

In total, the Do Nothing Portfolio would have outperformed the index over the full 30-year period and been less volatile. For example, Ptak found that $10,000 invested in the Do Nothing Portfolio at the end of March 1993 would have grown to $172,278 within 30 years, while the same investment in the S&P 500 would have been worth $163,186.

How could this hands-off approach produce such impressive returns compared to the S&P 500? Ptack surmised that the Do Nothing Portfolio’s cash position – which would have grown over the years – would have helped an investor weather the stock sell-offs of 2000 and 2008. Since stocks were not replaced when they were delisted over that 30-year stretch, the Do Nothing Portfolio would have also been more heavily concentrated in winning stocks like Apple.

“What looks to have made the difference is the way the portfolio let its winners run and refrained from entering new positions,” Ptak wrote. “Because the Do Nothing Portfolio doesn’t have to immediately make room for new index additions, such as Tesla (TSLA) and Meta Platforms (META), or replace names that have left the portfolio (through delisting), it gives stocks like Apple the ability to run further than they otherwise could. This can be a competitive advantage, as larger institutions, like mutual funds, lack the same ability to concentrate to this extent.”

Lessons from the Do Nothing Portfolio

You may not scrap your investment plan altogether in favor of this novel strategy, but there are several lessons Ptak says can be learned from the experiment.

Let winners run. Ptak acknowledges this won’t suit all investors, especially those who are uncomfortable with concentrated portfolios, but a large part of the Do Nothing Portfolio’s success can be attributed to the dominance of its top 10 holdings, especially Apple.

You don’t need to be fully invested all of the time. Instead of rushing to replace delisted stocks with newcomers, the Do Nothing Portfolio lets cash build slowly over the years. As Ptak notes, “the fewer decisions we have to make, the better.” The cash acts as a ballast for a portfolio that is more concentrated in its top stocks than the S&P 500 would be otherwise.

Don’t try to intuit your way to portfolio growth. “The responsible voice in our head tells us that a strategy of doing nothing can’t possibly work,” Ptak concluded. “Yet, markets repeatedly upend our expectations, which we often form by attempting to decode recent events and their future implications.” Instead, opt for “patience and humility” over “action and good intentions,” he says.

Bottom Line

Morninstar’s Jeffrey Ptak recently conducted an interesting experiment, in which he explored how an investor would fare if they bought a basket of stocks and then refrained from any further buying or selling. Ptack found that this hypothetical Do Nothing Portfolio would have performed quite well during recent 10-year periods and outperformed the S&P 500 between March 1993 and March 2023. By slowly amassing cash, not replacing delisted stocks and letting winners run, the Do Nothing Portfolio would have been a winning strategy.

Investing Tips

-

While the Do Nothing Portfolio doesn’t need to be rebalanced, your investment strategy may benefit from periodic rebalancing. SmartAsset’s asset allocation calculator can help you determine how much of your portfolio should be in stocks, bonds and cash based on your risk tolerance.

-

A financial advisor can help you select investments and provide ongoing portfolio management for a fee. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/Chinnapong, ©iStock.com/John Kevin, ©iStock.com/hobo_018

The post How This ‘Do Nothing Portfolio’ Can Beat the S&P 500: Sit Back and Get Rich appeared first on SmartAsset Blog.

44% of Warren Buffett’s $366 Billion Portfolio Is Invested in 3 Widely Owned Artificial Intelligence (AI) Stocks

For the better part of six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been putting on a show for Wall Street and the investing community. Despite being fallible just like every other investor, the “Oracle of Omaha,” as he’s affably known, has overseen a monstrous aggregate gain in his company’s Class A shares (BRK.A) of 4,995,105%, as of the closing bell on March 15.

Extensive books have been written detailing the “recipe” Buffett has used to vastly outperform the benchmark S&P 500. Typically, this means seeking out brand-name businesses with sustainable competitive advantages and trusted management teams.

But you might be surprised to learn that three of the 45 stocks Buffett and his investment team are currently holding in Berkshire Hathaway’s $366 billion portfolio are cutting-edge artificial intelligence (AI) stocks. According to estimates from PwC, AI solutions — i.e., software and systems handling tasks that would normally be assigned to humans — can add $15.7 trillion to global gross domestic product by the end of the decade.

As of March 15, 44% ($159 billion) of the $366 billion portfolio Buffett oversees at Berkshire Hathaway was being put to work in three widely owned AI stocks — and no, Nvidia isn’t one of them.

Apple: $156,317,767,200 (42.8% of invested assets)

The lion’s share of Buffett’s “AI holdings” can be traced to the largest position in Berkshire’s investment portfolio: tech stock Apple (NASDAQ: AAPL). Apple accounts for more than 4 times the weighting of Bank America, which is Berkshire’s second-largest holding (10% of invested assets).

Although Apple isn’t developing the infrastructure that’s made Nvidia the foundation of the AI movement, AI solutions are embedded in virtually all of its products and are critical to the company’s long-term growth strategy. Apple uses AI to improve the autocorrect and word suggestion capabilities of its U.S. market-share-leading iPhone, and recently launched its mixed-reality Vision Pro headset, which incorporates eye- and hand-tracking using AI.

While artificial intelligence solutions are staples in Apple’s products, Buffett and his top investment aides, Ted Weschler and Todd Combs, undoubtedly purchased shares of Apple for different reasons.

One of the primary lures of Apple is its exceptional customer loyalty. It’s one of the most well-known and valuable global brands. Sustaining a 50% or greater share of the U.S. smartphone market means consumers eagerly await the annual launch of a new iPhone.

The Oracle of Omaha is likely also enamored with Apple’s top-notch management team. In addition to constantly improving the functionality of iPhone and developing the Apple Watch, Apple CEO Tim Cook is spearheading a transformation that’s seen his company become more services oriented. Emphasizing subscription services should steadily improve Apple’s margins, smooth out the sales fluctuations observed during the tail end of major iPhone upgrade cycles, and encourage consumers to stay within Apple’s ecosystem of products and services.

The other reason Buffett is a big fan of Apple is the company’s unmatched capital-return program. Apple returned just a hair over $15 billion in dividends to its shareholders last year, and has repurchased a jaw-dropping $651 billion worth of its common stock since the start of 2013. This means Berkshire is steadily becoming a larger stakeholder in Apple without having to lift a finger.

Amazon: $1,744,200,000 (0.5% of invested assets)

A second artificial intelligence stock you’ll find nestled in Warren Buffett’s $366 billion portfolio at Berkshire Hathaway is none other than e-commerce kingpin Amazon (NASDAQ: AMZN).

Amazon is utilizing AI in more ways than can be counted here. Some examples include analyzing what you’re purchasing and putting in your shopping cart to recommend new products, as well as allowing its Amazon Web Services (AWS) customers to build applications using generative AI to tailor advertisements and improve customer interactions.

Additionally, Amazon is developing its own graphics processing units (GPUs) for its in-house data centers that could complement, or even replace, the GPUs from Nvidia that have taken the AI movement by storm.

While most people are familiar with Amazon because of its overwhelmingly dominant online marketplace, it’s actually the company’s ancillary operating segments that do a majority of the heavy lifting. Arguably no segment is more important than AWS.

Last year, AWS accounted for about a sixth of Amazon’s net sales, but was responsible for two-thirds of the company’s operating income. Enterprise cloud spending still appears to be in its relatively early innings of expansion, which suggests AWS has many years of double-digit sales growth ahead. As of September 2023, AWS led all other cloud infrastructure service platforms with a 31% share of global spend.

Interestingly enough, Amazon is fairly inexpensive, too. Shares can be scooped up right now for a greater than 40% discount to its average multiple to cash flow over the trailing-five-year period. While this may not be the traditional “value stock” Buffett looks for, it’s certainly something that has piqued the interest of one or both of his top investment aides.

Snowflake: $961,500,271 (0.3% of invested assets)

The third AI stock that, collectively with Apple and Amazon, accounts for approximately 44% of Berkshire Hathaway’s invested assets is cloud data-warehousing company Snowflake (NYSE: SNOW). This is another Berkshire holding that was almost certainly added because of the influence of Weschler or Combs.

Snowflake really put itself on the map of AI investors this past summer when it announced a collaboration with Nvidia that would allow Snowflake accounts to utilize Nvidia’s high-powered GPUs. Snowflake is also making generative AI solutions available to its customers to assist with training, customizing, and deploying large language models.

What’s really drawn investors to Snowflake since it went public in September 2020 is its well defined competitive advantages. For instance, it can be challenging for users of competing cloud infrastructure service platforms to share information. Since Snowflake built its infrastructure atop the most popular cloud platforms, sharing and transferring data is seamless.

Customers also seem to appreciate Snowflake’s transparent pricing policy. Instead of utilizing subscription pricing like many of its peers, Snowflake has opted to charge users based on how much data they store and how many Snowflake Compute Credits they use.

But in spite of these well-defined competitive edges, justifying Snowflake’s premium valuation has been challenging. Its days of triple-digit sales growth are long gone. With businesses still cautious about the near-term outlook for the U.S. economy, Snowflake’s annual sales growth is expected to slow to approximately 22% in the current fiscal year. At north of 160 times estimated earnings per share, investors might be wise to keep their distance and allow Snowflake to grow into its current valuation.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Bank of America. The Motley Fool has positions in and recommends Amazon, Apple, Bank of America, Berkshire Hathaway, Nvidia, and Snowflake. The Motley Fool has a disclosure policy.

44% of Warren Buffett’s $366 Billion Portfolio Is Invested in 3 Widely Owned Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

Vanguard CEO says Bitcoin ETFs do not ‘belong in a long-term portfolio’

Vanguard CEO Tim Buckley said Bitcoin needs to “change as an asset class” for the investment firm to consider it as a viable option and has no intention of changing its mind about spot Bitcoin ETFs until that happens.

Buckley made the statement in a preview clip of an upcoming webcast posted on March 15. The full conversation with CIO Greg Davis will be published on March 19.

Too volatile

Buckley said that Vanguard does not intend to change its stance toward the spot Bitcoin ETFs, primarily because it does not believe they belong in long-term and retirement portfolios. He added:

“Something like bitcoin is just too volatile and it’s not a store of value — it hasn’t been… It is speculative, really tough to think about how it belongs in a long-term portfolio.”

The Vanguard CEO said that Bitcoin prices recently fell alongside stock prices, and it is difficult to predict the flagship crypto’s growth. These factors make it difficult to determine how to include Bitcoin ETFs in portfolios.

Buckley said the firm focuses on investing in asset classes with underlying cash flows, such as stocks or bonds, which are easier to value and model.

Buckley plans to retire before the end of 2024 but his departure is unlikely to change Vanguard’s stance as the beliefs are part of the firm’s investment philosophy.

Vanguard’s past complaints

Vanguard previously confirmed that it would not offer access to spot Bitcoin ETFs shortly after the funds gained approval in January 2024. The company commented more extensively on its concerns later in the month and said that Bitcoin was an “immature asset class.”

Vanguard’s Global Head of ETF Capital Markets and Broker and Index Relations, Janel Jackson, notably commented that crypto “can create havoc within a portfolio” due to its short history and lack of inherent value and cash flow.

Meanwhile, the firm’s Head of Brokerage & Investments, Andrew Kadjeski, explained that the firm aims to serve long-term, buy-and-hold investors.

The company’s history of avoiding short-term market trends, including steering clear of internet funds in the 1990s and removing access to leveraged and inverse funds and ETFs in 2019 and over-the-counter stocks in 2022, illustrates a historic strategy of prioritizing long-term stability over short-term gains.

Vanguard’s stance has generated significant discussion within the investment community, with some clients expressing frustration over the firm’s reluctance to include Bitcoin in its investment offerings.

Despite the controversy and potential market pressure, Vanguard remains steadfast in its traditional investment approach, focusing on asset classes it deems fundamental for sustained investment success.

Latest Alpha Market Report

Microstrategy’s Bitcoin Portfolio Value Soars to $13.2 Billion, Marking a 116% Gain

According to the latest figures, Microstrategy’s investment in bitcoin has doubled, showing a 116% increase after the cryptocurrency’s value experienced a significant rise this past week. The company, specializing in business intelligence, has acquired a total of 193,000 bitcoins at an expenditure of $6.122 billion, with the current market value of their holdings soaring to […]

According to the latest figures, Microstrategy’s investment in bitcoin has doubled, showing a 116% increase after the cryptocurrency’s value experienced a significant rise this past week. The company, specializing in business intelligence, has acquired a total of 193,000 bitcoins at an expenditure of $6.122 billion, with the current market value of their holdings soaring to […]

Source link

78% of Warren Buffett’s $369 Billion Portfolio Is Invested in Just 6 Stocks

For nearly six decades, Warren Buffett has put on a master class in how to beat Wall Street. Since taking over as CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in the mid-1960s, he’s led his company’s Class A shares (BRK.A) to a jaw-dropping aggregate return of 4,961,342%, as of the closing bell on March 1.

Extensive books have been written discussing the investing philosophies that have allowed the Oracle of Omaha to trounce Wall Street’s benchmark index, the S&P 500. These traits include buying stakes in brand-name businesses with strong management teams, as well as investing with a long-term mindset.

But if there’s one catalyst to Buffett’s undeniable investing success that doesn’t get nearly enough credit, it’s his penchant for portfolio concentration. Both he and the recently departed Charlie Munger, who Buffett described as the “Architect of Berkshire Hathaway” in his annual letter to shareholders, have firmly believed that their top investment ideas deserve added weighting. If these top holdings perform well, it likely means Berkshire Hathaway stock can head even higher.

Based on closing values from March 1, 78% — $290 billion — of the $369 billion investment portfolio Warren Buffett oversees at Berkshire Hathaway was invested in only six stocks.

1. Apple: $162,692,909,600 (44% of invested assets)

Any question investors may have had about the Oracle of Omaha’s desire to concentrate his company’s portfolio is answered by looking at Berkshire’s mammoth stake in tech stock Apple (NASDAQ: AAPL). Even after Buffett and his team reduced their company’s stake in Apple by roughly 1% during the December-ended quarter, it still accounts for 44% of invested assets.

Apple’s innovation has driven the outperformance of its stock for years. Since introducing a 5G-capable iPhone during the fourth quarter of 2020, it’s pretty consistently held a 50% or greater share of the U.S. smartphone market.

But this innovation extends well beyond its well-known physical products. For years, CEO Tim Cook has been overseeing a transformation that’s emphasized subscription services. To be clear, Apple isn’t forgetting about the physical products, like the iPhone, Mac, and iPad, that brought it fame. Rather, it’s evolving into a platforms company that’ll further enhance customer loyalty and keep these customers within its ecosystem of products and services.

The Oracle of Omaha is also, undeniably, a fan of Apple’s world-leading capital-return program. Since introducing a share repurchase program in 2013, Apple has bought back more than $600 billion worth of its common stock.

2. Bank of America: $35,478,466,406 (9.6% of invested assets)

Another company that Warren Buffett and his investment aides, Todd Combs and Ted Weschler, clearly love is Bank of America (NYSE: BAC). Berkshire owns more than 13% of the outstanding shares of BofA, which equates to almost $35.5 billion in market value.

The lure of financial stocks for the Oracle of Omaha has always been the cyclical nature of the industry. Even though recessions are an inevitable part of the economic cycle, economic downturns pass quickly. Whereas no recession since the end of World War II has lasted longer than 18 months, two periods of growth over the same span stuck around for at least a decade. Companies like Bank of America should be able to successfully grow their loan portfolios over time as the U.S. economy expands.

Interestingly enough, Bank of America also holds an advantage in the current economic climate as the most interest-sensitive of all U.S. money-center banks. In other words, no bank will see its net-interest income shift more with changes to interest rates. The Fed’s most aggressive rate-hiking cycle since the early 1980s has added billions of dollars in net-interest income to BofA’s bottom line each quarter.

To boot, BofA typically returns in excess of $20 billion to shareholders each year via dividends and buybacks when the U.S. economy is firing on all cylinders.

3. American Express: $33,302,806,362 (9% of invested assets)

Even though a tech stock accounts for the leading stake in Berkshire Hathaway’s portfolio, there’s not a sector Buffett enjoys putting his company’s cash to work in more than financials. It’s why American Express (NYSE: AXP) is the second financial stock in Berkshire’s top-three holdings.

The not-so-subtle secret to AmEx’s continued success is its willingness to play on both sides of the transaction aisle. In the U.S., which is the top market for consumption globally, it’s the clear No. 3 in credit card network purchase volume.

But in addition to facilitating transactions and collecting a fee from merchants, American Express is also acting as a lender to consumers and businesses in which it earns annual fees and interest income. During extended periods of economic growth, AmEx’s ability to double-dip allows it to thrive.

The other factor that makes American Express a top-notch investment is its success in luring well-to-do consumers. People with higher incomes are less likely than the average earner to alter their spending habits during minor periods of economic disruption. On paper, this should help AmEx navigate challenging economic climates better than most lending institutions.

4. Coca-Cola: $23,812,000,000 (6.4% of invested assets)

The fourth-largest holding is the longest-tenured stock in Buffett’s portfolio, beverage company Coca-Cola (NYSE: KO). Shares of Coca-Cola have been held since 1988.

What’s more, Berkshire Hathaway is netting a roughly 60% annual yield on its Coke shares thanks to a minuscule cost basis of $3.2475 per share. Coca-Cola recently increased its base annual payout for a 62nd consecutive year.

A big reason the Oracle of Omaha and his investment team view Coca-Cola as a core holding is its consistency. According to Kantar’s annual Brand Footprint report, Coca-Cola has been the most-chosen brand from retail shelves for 10 years running (as of 2022). Since it’s selling consumer staples that’ll be purchased in any economic climate, Coca-Cola’s cash flow and profits tend to be highly predictable.

Coca-Cola also enjoys virtually unsurpassed geographic diversity. With the exception of Cuba, North Korea, and Russia, it has existing operations in every other country. This allows it to generate that aforementioned predictable cash flow in developed markets, while moving the organic growth needle via emerging markets.

5. Chevron: $19,268,321,146 (5.2% of invested assets)

Throughout much of this century, energy stocks have played little or no role in Berkshire Hathaway’s portfolio. Over the past two years and change, we’ve witnessed a sizable shift in sentiment from Berkshire’s brightest minds. Integrated oil and gas giant Chevron (NYSE: CVX) currently holds the No. 5 spot in the $369 billion portfolio the Oracle of Omaha oversees.

Having more than $19 billion invested in a leading oil and gas stock is a pretty clear indication that Buffett and his team believe the spot price of crude oil will remain above historic norms. Supporting this thesis is multiple years of capital underinvestment by major energy companies during the COVID-19 pandemic. This underinvestment has led to energy commodity supply constraints that should provide a healthy lift to the spot price of crude oil and push profits for drillers higher.

The “integrated” aspect of Chevron’s operating model is also important. Although drilling generates its juiciest margins, Chevron owns transmission pipelines, chemical plants, and refineries. If the spot price of crude oil declines, the company’s midstream and downstream assets act as a hedge that stabilizes its cash flow.

The icing on the cake here is that Chevron doles out a 4% yield and has raised its base annual dividend for 37 consecutive years.

6. Occidental Petroleum: $15,218,392,334 (4.1% of invested assets)

Warren Buffett’s $369 billion portfolio at Berkshire Hathaway only has two energy stocks, but they occupy the fifth and sixth spots in terms of portfolio concentration. The 248 million shares of Occidental Petroleum (NYSE: OXY) held by Berkshire, worth $15.2 billion on March 1, have all been added since the start of 2022.

While the macro catalysts described with Chevron align similarly with integrated oil and gas operator Occidental, there are some very defined differences between these two companies.

For example, Occidental brings in the lion’s share of its revenue from its upstream drilling segment. This means its operating cash flow is highly sensitive to shifts in the spot price of crude oil. While it’ll benefit more than other integrated operators (including Chevron) if oil prices increase, the reciprocal is also true — Occidental will struggle mightily if the spot price for crude oil significantly declines.

The other big difference between Chevron and Occidental can be seen on their balance sheets. Whereas Chevron has what’s arguably the best balance sheet among oil majors with a low debt-to-equity ratio, Occidental is still lugging around $18.5 billion in net debt. Unlike Chevron, Occidental needs the spot price of crude oil to remain high to continue reducing its outstanding debt.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Bank of America and American Express are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

78% of Warren Buffett’s $369 Billion Portfolio Is Invested in Just 6 Stocks was originally published by The Motley Fool

Donald Trump’s Crypto Portfolio Soars to $7.5 Million, Fueled by TRUMP Coin’s Ascension and Ethereum Gains

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

Source link