As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

Source link

Potential

Charles Edwards, the founder of Capriole Investments, has sparked significant interest and debate within the cryptocurrency community. He heralded Ethena (ENA) as “the Luna of this cycle,” but with a crucial difference: its economic fundamentals are deemed sustainable.

Edwards elaborated, “It’s 100% collateralized and the yield is variable based on market forces. Two things Luna wasn’t.” He also noted that at its zenith, Luna’s valuation exceeded ENA’s current market cap by more than twenty-fold, yet he cautioned, “ENA is not risk-free, custody and execution risk exist.”

Ethena is the Luna of this cycle, except the underlying economics are actually sustainable. It’s 100% collateralized and the yield is variable based on market forces. Two things Luna wasn’t. At it’s peak LUNA was over 20X bigger than what ENA is now. ENA is not risk free, custody…

— Charles Edwards (@caprioleio) April 10, 2024

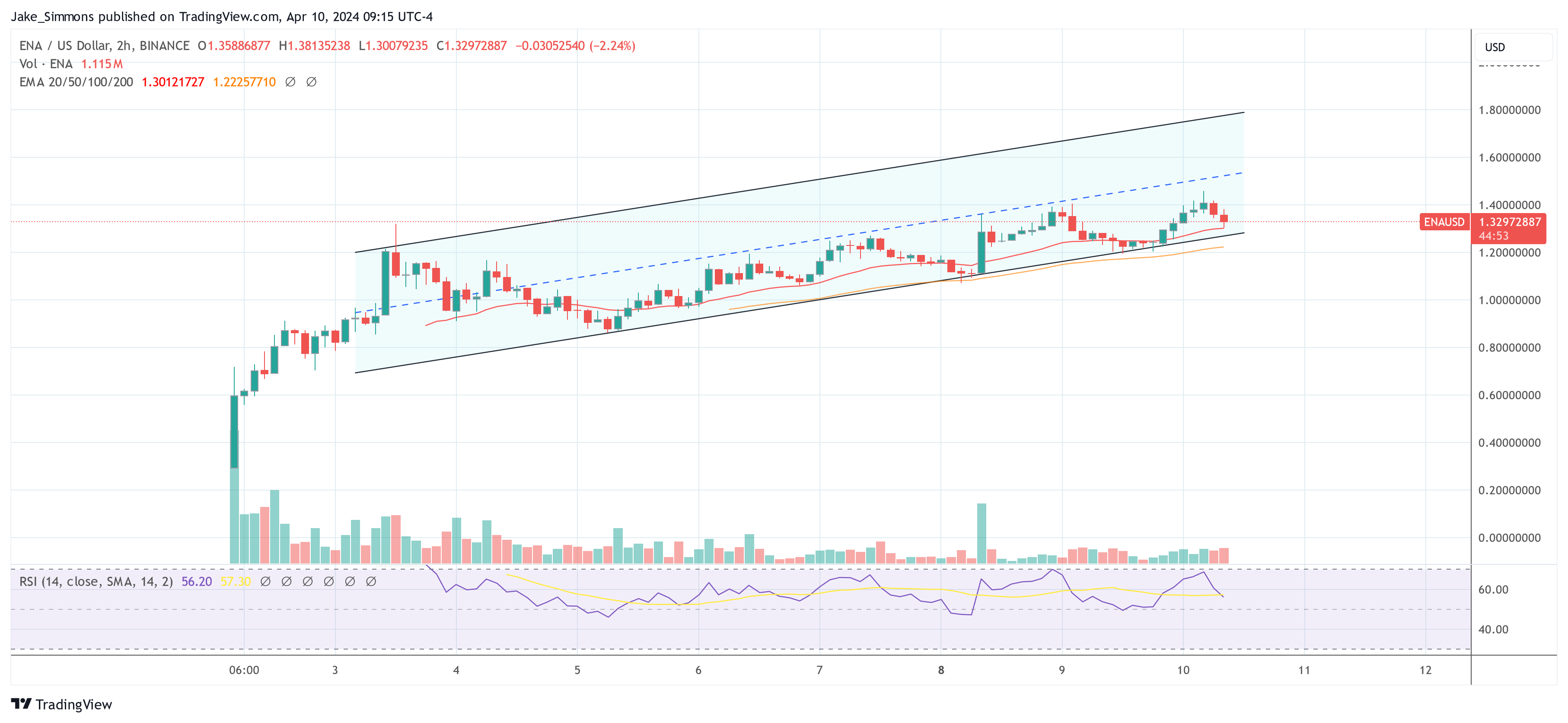

Since its launch on April 2, ENA has seen a meteoric rise from under $0.30 to a high of $1.45. This rally is largely attributed to Ethena Labs’ strategic enhancement of its rewards program, now in its “Season 2,” which offers a 50% reward boost for users locking their ENA tokens for at least seven days. This move aims to bolster user engagement and loyalty, fostering a sustainable ecosystem for the Ethena platform.

A remarkable aspect of this ecosystem is the rapid growth of its stablecoin, USDe, which has outstripped the supply growth of established counterparts such as USDT, USDC, and DAI, reaching a $2 billion supply in just over 100 days.

USDe is the fastest growing USD denominated asset in the history of crypto pic.twitter.com/xgiRJjf96t

— G | Ethena (@leptokurtic_) April 8, 2024

However, the project’s high yields which are generated by harnessing the derivative markets and staked Ethereum have stirred skepticism among industry experts. Fantom founder Andre Cronje, among others, has raised concerns about the sustainability of these yields, which are the highest in the entire crypto industry.

Risks Involved With Ethena

Noteworthy, ENA is often compared to Terra Luna (LUNA), but the differences could not be much bigger, as Edwards also noted. While ENA is not risk free, a demise like the one of LUNA is highly unlikely. Despite that, investors need to be aware of other risks involved with ENA.

Diving deeper into the discussion of risks, CL (@CL207) from eGirl Capital offers an intriguing perspective on the behavior of derivatives traders. She clarifies, “It appears Ethena is making many people who don’t trade derivatives have a really hard time wrapping their heads around the fact that derivatives traders are so genuinely retarded that we’re willing to pay like 50%+ APR to enter a position.”

Notably, last cycle crypto traders were bidding futures so high that Bitcoin quarterlies earned “a locked-in >50% apr. She added, “just 50 days into 2021, we collectively paid 2,400,000,000$ in funding rates by the end of 2021, the market has paid as much as a decently sized country’s GDP.”

Monetsupply.eth (@MonetSupply) from Block Analitica provides a granular analysis of the risks Andre Cronje highlighted. Through his examination, several key areas of concern are outlined:

- Oracle Risk: The potential impact on exchange positions due to Ethena providing inaccurate quotes on minting or redeeming operations. However, MonetSupply notes, “there’s rate limits on this tho so max loss is constrained and counterparties are all whitelisted (can’t just run away with the money).”

- Liquidation Risk: Deemed not a significant factor as the portfolio is leveraged less than 1x, suggesting a conservative approach to borrowing and leverage.

- Spread Risk: The possibility of increased basis leading to higher funding revenue, which should theoretically attract inflows. Conversely, a negative basis might cause outflows, but Ethena could benefit from closing hedged positions profitably.

- Collateral Ratio Risk: Even though liquid staking tokens (LSTs) are given less than 100% weight on centralized exchanges (CEX), the overall low leverage mitigates this risk. The proportion of LST in spot collateral is relatively minor.

- Custody Risk: Highlighted as one of the more significant concerns, given the reliance on custodians with a good track record and the distribution of assets across multiple entities.

- Exchange Solvency Risk: This risk could lead to the loss of unsettled profit and loss (PnL) and some trading costs to rehedge on other exchanges. However, MonetSupply adds, “the Binance/ceffu nexus might change this assessment though, are they actually independent?”

- Ethena Entity Risk: The internal risk related to Ethena’s keys or authentication tokens being compromised, or a team member acting maliciously.

MonetSupply concludes that despite these risks, the framework of overcollateralization on platforms like Morpho, the Maker surplus buffer, and the MKR backstop, supported by a substantial Proof of Liquidity (POL), serves as a robust mitigating factor.

At press time, ENA traded at $1.329.

Featured image from Bitget, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

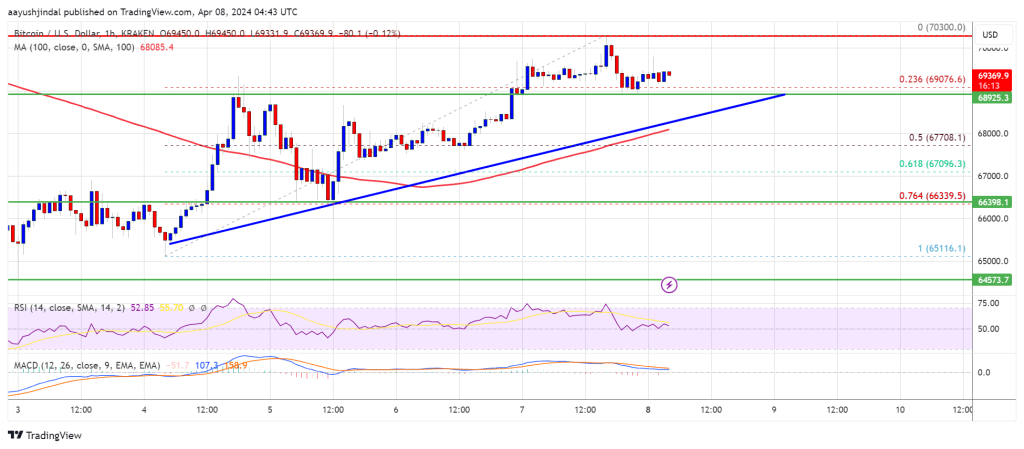

Bitcoin price is showing a few positive signs above the $68,500 resistance. BTC must settle above the $70,000 resistance to continue higher in the near term.

- Bitcoin is eyeing a steady increase above $69,500 and $70,000 levels.

- The price is trading above $68,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support near $68,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $68,000 support zone.

Bitcoin Price Holds Support

Bitcoin price started a decent increase above the $67,500 resistance zone. BTC cleared the $68,500 and $68,800 resistance levels to move into a positive zone.

The price even spiked above the $70,000 resistance zone. A high was formed near the $70,300 level and the price is now correcting gains. There was a move below the $70,000 level. There was a move below the 23.6% Fib retracement level of the upward move from the $65,116 swing low to the $70,300 high.

Bitcoin is now trading above $68,000 and the 100 hourly Simple moving average. Immediate resistance is near the $69,800 level. The first major resistance could be $70,000.

Source: BTCUSD on TradingView.com

The next resistance now sits at $70,300. If there is a clear move above the $70,300 resistance zone, the price could start a fresh increase. In the stated case, the price could rise toward $71,200. The next major resistance is near the $72,000 zone. Any more gains might send Bitcoin toward the $73,500 resistance zone in the near term.

Are Dips Limited In BTC?

If Bitcoin fails to rise above the $70,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $69,000 level or the trend line.

The first major support is $67,800 or the 50% Fib retracement level of the upward move from the $65,116 swing low to the $70,300 high. The next support sits at $66,500. If there is a close below $66,500, the price could start a drop toward the $65,350 level. Any more losses might send the price toward the $62,500 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $68,800, followed by $67,800.

Major Resistance Levels – $69,800, $70,000, and $71,200.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Although the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all reached record highs in 2024, getting to this point has been an adventure. Since this decade began, all three major stock indexes traded off bear and bull markets on a couple of occasions.

When uncertainty picks up on Wall Street, both professional and retail investors have a tendency to seek out the safety and historic outperformance of industry-leading businesses. It’s why the “FAANG stocks” have been so popular over the last decade. But for the past three years, investors have really gravitated to stocks enacting splits.

Investors of all walks have piled into stock-split stocks

A stock split is a purely cosmetic event that allows publicly traded companies to adjust their share price and outstanding share count by the same magnitude. The key with stock splits is they have no impact on market cap or operating performance. Their purpose is to make shares more nominally affordable for investors who may not have access to fractional-share purchases with their online broker (a forward stock split), or to increase a company’s share price to ensure continued listing on a major stock exchange (a reverse stock split).

Though there are a few examples of successful reverse stock splits, such as online travel company Booking Holdings, most investors tend to focus on companies enacting forward stock splits. That’s because companies enacting forward splits are usually highfliers with well-defined competitive advantages.

Since the midpoint of 2021, close to a dozen top-notch businesses have conducted forward splits, including the infrastructure backbone of the artificial intelligence (AI) movement, Nvidia; leading global internet search engine parent Alphabet; and North America’s top electric vehicle manufacturer, Tesla.

Thus far in 2024, two exceptionally successful businesses with well-defined competitive advantages have joined the club:

-

Walmart (NYSE: WMT) completed a 3-for-1 stock split in late February; and

-

Chipotle Mexican Grill is on track to enact a 50-for-1 forward split by late June, assuming its shareholders approve the move when the company holds its annual meeting.

Despite its competitive advantages, investors can leave Walmart on the shelf

Walmart kicked things off in late January when it announced plans to conduct its first split since March 1999.

Walmart President and CEO Doug McMillon noted in a company press release that, “Given our growth and our plans for the future, we felt it was a good time to split the stock and encourage our associates to participate in the years to come.” Specifically, this move should help over 400,000 associates purchase whole shares of Walmart stock, rather than fractional shares.

If there’s one factor that exemplifies why Walmart has been such a phenomenal investment for decades, look no further than its size. Walmart’s deep pockets allow it to buy products in bulk, which in turn lowers its per-unit costs. The company has consistently been able to undercut grocery chains and local retailers on price.

To add, Walmart almost always carries a broader assortment of goods, including groceries, than traditional grocers and retailers. A generally cheaper and broader selection has been a winning formula.

But even winners have their limits.

Following its post-split run-up, Walmart stock is now valued at 23 times forward-year earnings. Though this is more or less right in line with its forward-year earnings multiple over the last five years, it’s a reach for a company whose growth rate is slowing and struggling to outpace the prevailing rate of inflation.

In fiscal 2024 (Walmart’s fiscal year ended on Jan. 26, 2024), consolidated sales rose by just 4.9% on a constant-currency basis, which excludes any gains or losses from foreign currency conversion. In the current fiscal year, Walmart’s constant-currency sales growth is expected to slow to just 3% to 4%. Mind you, the trailing-12-month inflation rate in the U.S. is 3.2%. Walmart is simply treading water in the current climate.

While long-term investors in Walmart should be just fine, there are other potential stock-split stocks that are considerably cheaper and smarter buys.

Broadcom

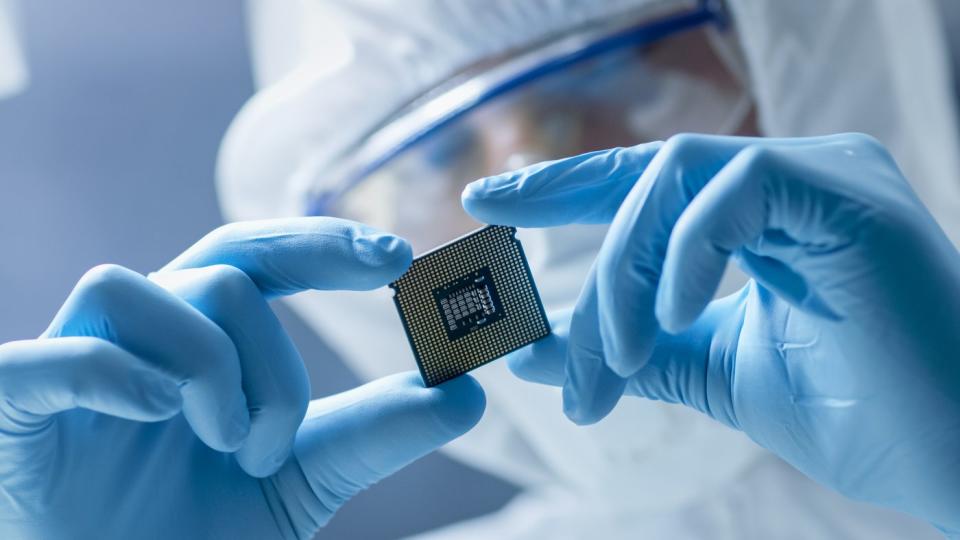

The first company primed for a stock split that’s markedly cheaper than Walmart is semiconductor stock Broadcom (NASDAQ: AVGO). Though Broadcom enacted three splits prior to being acquired by Avago Technologies (which kept the Broadcom name) in 2016, Avago itself has never undertaken any stock splits. Broadcom ended the trading session on April 2 at nearly $1,339 per share.

At the moment, Broadcom is being fueled by the AI revolution. The company’s Jericho3-AI chip, which was unveiled last April, is designed to scale connectivity in high-compute enterprise data centers and can connect up to 32,000 graphics processing units. This is just the type of innovation needed to train large language models and power generative AI solutions.

But Broadcom has fallbacks that extend well beyond AI. For example, it’s a leading provider of wireless chips and accessories used in next-generation smartphones. Carriers upgrading their networks to support 5G download speeds have provided Broadcom with steady demand as businesses and consumers replace their older wireless devices.

To add to the above, Broadcom has other operating segments that benefit from increased digitization. For instance, the company’s automotive solutions address everything from advanced driver assistance systems to battery management in next-generation vehicles. Meanwhile, it offers financial services software and infrastructure designed to improve the digital banking experience for consumers and employees.

While Broadcom’s forward-year price-to-earnings (P/E) ratio of 23.5 is effectively in line with Walmart’s, its estimated annualized earnings growth rate over the next five years of 14.4% is considerably higher. Thus, Broadcom’s price/earnings-to-growth ratio (PEG ratio) is far more attractive than Walmart’s.

Meta Platforms

The second potential stock-split stock that makes for a considerably cheaper and smarter buy than Walmart is none other than social media maven Meta Platforms (NASDAQ: META). Meta hasn’t split since becoming a public company in 2012 and recently hit an all-time high of a little north of $520 per share.

If you’re wondering what makes Meta “tick,” take a closer look at its social media assets. Facebook is the most-visited social site globally, with 3.07 billion monthly active users (MAUs) in the December-ended quarter. Adding in Meta’s other exceptionally popular platforms, including WhatsApp, Instagram, Threads, and Facebook Messenger, brings the company’s unique MAU count to 3.98 billion for the fourth quarter. It’s not difficult to attract advertisers and command strong ad-pricing power when more than half of the world’s adult population is visiting at least one of your owned assets each month.

Another reason Meta is such an amazing company is its cash generation. Last year, it generated $71.1 billion in net cash from its operations and closed out 2023 with $65.4 billion in cash, cash equivalents, and marketable securities. This war chest gives it plenty of financial flexibility with regard to acquisitions and innovations.

Meta Platforms is also attempting to become a leader in augmented reality (AR)/virtual reality (VR), with a longer-term goal by CEO Mark Zuckerberg to be a key on-ramp to the metaverse. Though the company’s investments in its Reality Labs segment are probably years away from being a meaningful percentage of total sales, Meta looks well positioned to be a leader in AR and VR.

Lastly, the valuation is extremely compelling when placed side-by-side with Walmart. While Meta’s forward P/E of 21 might not sound like that much of a discount, its annualized earnings growth rate over the coming five years is expected to be 26%! This works out to a PEG ratio of less than 1, which signals a potentially undervalued stock-split candidate.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Booking Holdings, Chipotle Mexican Grill, Meta Platforms, Nvidia, Tesla, and Walmart. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Forget Walmart: These 2 Potential Stock-Split Stocks Are Cheaper and Smarter Buys was originally published by The Motley Fool

Ethereum investors are navigating the second quarter of 2024, cautiously embracing optimism, leveraging insights from historical trends and market data to anticipate potential gains.

Santiment’s recent analysis reveals that the number of Ethereum addresses holding coins has reached highs of more than 118,000, with midterm MVRV suggesting a mild bullish signal. These indicators, combined with past data indicating Ethereum’s tendency for robust performance during Q2, fuel hopes for another season of positive returns.

Ethereum: Historically Strong Q2 Performance

Crypto analyst Ali Martinez recently shared a screenshot of Ethereum’s quarterly returns on social media platform X, highlighting the cryptocurrency’s significant spikes during previous second quarters, notably in 2017 and 2019. These spikes, with increases of 450% and over 100% respectively, have intrigued investors and led them to closely monitor Ethereum’s performance in the current quarter.

Q2 has historically been very bullish for $ETH!

However, we must consider the high probability that the @SECGov will delay the approval of a spot #Ethereum ETF, which may cause turbulence in the market. pic.twitter.com/TlZ3KZhr4e

— Ali (@ali_charts) April 1, 2024

Several key financial players, including BlackRock, Fidelity, and Grayscale, have expressed interest in launching a spot Ethereum ETF. However, the regulatory hurdles present significant challenges, raising questions about Ethereum’s integration into traditional financial markets.

Market indicators reflect Ethereum’s current state, with nearly 5% decline in the last 24 hours, trading at $3,380. Despite this dip, Ethereum briefly surpassed $3,500 over the weekend, showcasing resilience amidst market fluctuations.

Ethereum price action in the last three months. Source: Coingecko

While market indicators point towards a potentially bullish period for Ethereum, uncertainty looms over the regulatory landscape, casting a shadow of caution over investors’ optimism.

The impending decision by the Securities and Exchange Commission regarding the approval or rejection of the spot Ethereum ETF by May 23 is eagerly anticipated. Analysts cautiously estimate a modest 25% likelihood of approval, acknowledging the regulatory complexities surrounding cryptocurrency investment vehicles.

Ether market cap currently at $406 billion. Chart: TradingView.com

ETF Approval: Boon For Ether?

Approval of the ETF could herald a new era for Ethereum, opening the floodgates for increased institutional investment and potentially igniting heightened market demand.

Institutional investors, previously hindered by regulatory uncertainties and limited investment avenues, would gain access to a regulated and transparent platform, thus bolstering Ethereum’s legitimacy within traditional finance. Such a development could fuel a surge in Ethereum’s market value, attracting both seasoned investors and newcomers alike.

Related Reading: Get Ready For A Bitcoin Cash Revolution: Analyst Forecasts Historic Breakout

Conversely, a rejection or further delay in approval may deliver a blow to Ethereum’s short-term prospects, potentially triggering short-term volatility and denting investor sentiment. The market, accustomed to swift movements and rapid changes, may experience a period of turbulence as investors reassess their strategies in light of regulatory setbacks.

Ethereum’s second quarter outlook is marked by a delicate balance between historical performance patterns, regulatory uncertainties, and market dynamics. While past trends hint at potential gains, the pending decision on the spot Ethereum ETF introduces a level of unpredictability to the market.

Featured image from Gary Bendig/Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Technical Analysis: BTC Consolidation Points to Potential Shifts Ahead

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

Source link

Bitcoin Market Cap Hints at Potential Price Surge After Retesting 2021 Highs

A crypto analyst on X is confident that Bitcoin has bottomed and is poised for major gains in the sessions ahead. Interestingly, the bullish outlook hinges on the Bitcoin market cap retesting all-time highs at press time.

Will BTC Rally? Market Dynamics Changing

So far, the Bitcoin price is around 2021 highs in USD terms but recently broke all-time highs, peaking at around $73,800. This fluctuation is also reflected in its market cap. It currently stands at $1.25 trillion, down 5% in the past 24 hours.

Notably, it is at the same price level as in 2021, when Bitcoin prices peaked, recording new all-time highs.

While optimism abounds and the trader expects more sharp price expansions in the days ahead, it is not immediately clear whether the coin will rip higher, aligning with this forecast. Bitcoin is volatile and has remained so despite changing market dynamics.

At the same time, unlike in the past, Bitcoin prices are driven not only by retail forces but by institutions. These institutions are regulated by the United States Securities and Exchange Commission (SEC), which also approved the spot Bitcoin exchange-traded fund (ETF).

This Bitcoin derivative product has been the primary driving force in the past ten weeks. This is from looking at how prices have evolved since its approval in mid-January 2024.

However, since BlackRock and Fidelity are regulated by the United States SEC, unlike retailers, they cannot act as they wish. Considering the millions and billions of dollars at play, their comments or assessments on the coin, now and in the future, can greatly impact sentiment.

Sentiment Is Dented, BTC Facing Headwinds

Sentiment has been dented when writing. Even with the United States Federal Reserve (Fed) ‘s decision to hold rates at 5.5%, the highest in 2023, lifting prices, there has been no solid follow-through in price action. The coin remains steady below $70,000.

Whether prices will rally over the weekend remains to be seen. However, for now, there are some headwinds to consider.

First, there has been a slowdown in inflows to spot BTC ETFs. At the same time, outflows from the Grayscale Bitcoin Trust (GBTC) have increased. Second, after rallying sharply from October 2023, a cool-off before halving might see the coin trend lower.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

LBank Labs Invests in QED: Unleashing Bitcoin’s Full Potential with Zero-Knowledge Proofs

PRESS RELEASE. LBank Labs has achieved a new milestone by participating in the $3 million funding round for QED. This innovative venture is poised to revolutionize the Bitcoin ecosystem with its groundbreaking zk-Native blockchain protocol. The funding round, spearheaded by Arrington Capital, saw contributions from renowned venture capital firms such as Starkware, Draper Dragon, Blockchain […]

PRESS RELEASE. LBank Labs has achieved a new milestone by participating in the $3 million funding round for QED. This innovative venture is poised to revolutionize the Bitcoin ecosystem with its groundbreaking zk-Native blockchain protocol. The funding round, spearheaded by Arrington Capital, saw contributions from renowned venture capital firms such as Starkware, Draper Dragon, Blockchain […]

Source link