Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Source link

Prediction

Fool.com contributor Parkev Tatevosian forecasts where Alibaba‘s (NYSE: BABA) stock could be by the end of the year.

*Stock prices used were the afternoon prices of April 10, 2024. The video was published on April 12, 2024.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $555,209!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

My Alibaba Stock Price Prediction for 2024 was originally published by The Motley Fool

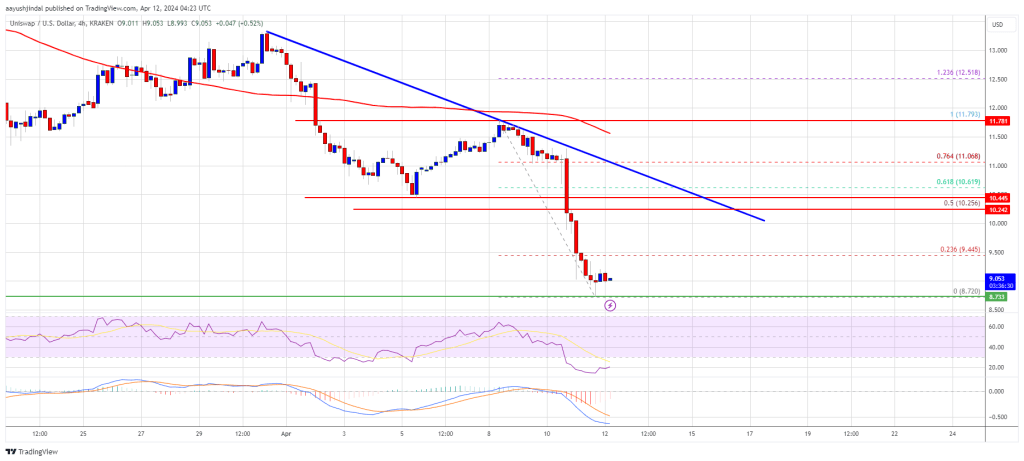

UNI price turned red and declined below the $10.00 support. Uniswap is showing many bearish signs and recoveries could face hurdles near $10.00.

- UNI started a fresh decline below the $10.00 support zone.

- The price is trading below $9.50 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance near $10.25 on the 4-hour chart of the UNI/USD pair (data source from Kraken).

- The pair might recover but the upsides might be limited above $10.00.

UNI Price Takes Hit

After the SEC news, UNI started a major decline. There was an increase in selling pressure on Uniswap below the $12.00 pivot level. The price declined over 15% and traded below the $10.00 support. It also increased some pressure on Bitcoin and Ethereum.

There was also a drop below the $9.20 level. The price traded as low as $8.72 and it is still showing many bearish signs. There is also a key bearish trend line forming with resistance near $10.25 on the 4-hour chart of the UNI/USD pair.

UNI price is now trading well below $10.00 and the 100 simple moving average (4 hours). Immediate resistance on the upside is near the $9.45 level. It is near the 23.6% Fib retracement level of the downward move from the $11.79 swing high to the $8.72 low.

The next key resistance is near the $10.25 level or the trend line. It coincides with the 50% Fib retracement level of the downward move from the $11.79 swing high to the $8.72 low.

Source: UNIUSD on TradingView.com

A close above the $10.25 level could open the doors for more gains in the near term. The next key resistance could be near $11.80, above which the bulls are likely to aim a test of the $12.00 level. Any more gains might send UNI toward $13.50.

More Losses In Uniswap?

If UNI price fails to climb above $9.45 or $9.50, it could continue to move down. The first major support is near the $8.70 level.

The next major support is near the $8.50 level. A downside break below the $8.50 support might open the doors for a push toward $7.65.

Technical Indicators

4-Hours MACD – The MACD for UNI/USD is gaining momentum in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for UNI/USD is below the 25 level.

Major Support Levels – $8.70, $8.50, and $7.65.

Major Resistance Levels – $9.45, $10.00, and $10.25.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

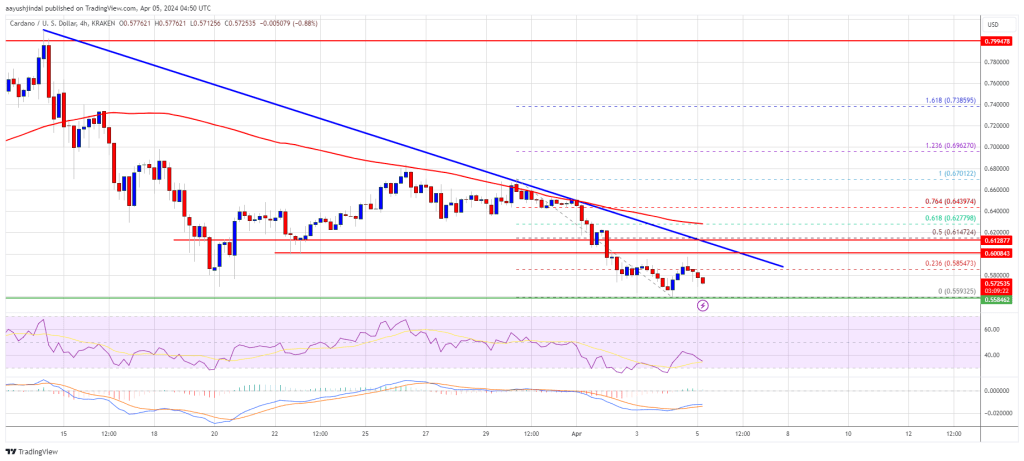

Cardano (ADA) is moving lower below the $0.620 resistance zone. ADA could gain bearish momentum and decline toward the $0.50 support.

- ADA price is slowly moving lower from the $0.670 zone.

- The price is trading below $0.620 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance at $0.6008 on the 4-hour chart of the ADA/USD pair (data source from Kraken).

- The pair could attempt a fresh increase if the bulls remain active above the $0.560 support.

Cardano Price Reaches Key Support

In the past few days, Cardano saw a steady decline from the $0.670 resistance zone, like Bitcoin and Ethereum. ADA price declined below the $0.650 and $0.620 levels to enter a bearish zone.

It even declined below $0.580 and tested $0.560. A low is formed at $0.5592 and the price is consolidating losses. It tested the 23.6% Fib retracement level of the downward move from the $0.6701 swing high to the $0.5592 low.

ADA price is now trading below $0.620 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $0.6010 zone. There is also a key bearish trend line forming with resistance at $0.6008 on the 4-hour chart of the ADA/USD pair.

The first resistance is near $0.6150 or the 50% Fib retracement level of the downward move from the $0.6701 swing high to the $0.5592 low. The next key resistance might be $0.6280. If there is a close above the $0.6280 resistance, the price could start a strong rally.

Source: ADAUSD on TradingView.com

In the stated case, the price could rise toward the $0.6550 region. Any more gains might call for a move toward $0.670.

More Losses in ADA?

If Cardano’s price fails to climb above the $0.6150 resistance level, it could continue to move down. Immediate support on the downside is near the $0.560 level.

The next major support is near the $0.520 level. A downside break below the $0.520 level could open the doors for a test of $0.50. The next major support is near the $0.4880 level.

Technical Indicators

4 hours MACD – The MACD for ADA/USD is gaining momentum in the bearish zone.

4 hours RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.5600, $0.5200, and $0.4880.

Major Resistance Levels – $0.6150, $0.6280, and $0.6700.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Prediction: These Could Be the Best-Performing Fintech Stocks Through 2030

It’s been a tough past couple of years for fintech stocks. Rising interest set the stage for economic lethargy, while an inverted yield curve threatened an outright recession. Such a backdrop makes owning already risky financial technology names even riskier.

A funny thing happened on the road to inevitable doom, however — the global economy didn’t implode. Most regions’ economies are doing reasonably well. The World Economic Forum is calling for a worldwide economic growth rate of 3.1% this year, in fact, before accelerating to a pace of 3.2% next year. The yield curve continues its trek back toward being un-inverted too; each day it makes this progress raises the odds of a so-called soft landing rather than a full-blown meltdown. That’s bullish for most stocks, but it’s particularly bullish for economically sensitive fintech names.

Here’s a closer look at three fintech stocks that could lead the group’s bullish charge all the way through 2030. That’s how long recently rekindled economic growth could last, presuming the world’s banking and political leaders don’t stand in the way.

PayPal

There’s no denying the original fintech name’s very-highest-growth days are in the past. But PayPal (PYPL 1.90%) is hardly a has-been.

PayPal is of course an online payment and mobile wallet platform. It arguably created and defined what a digital payment service should be, in fact, and then became the name in this space to beat.

The thing is, rivals did eventually start creeping onto this company’s turf, and they never really stopped. That’s why PayPal shares performed so poorly beginning in late 2021 after a heroic run-up from their early 2020 low. Not only was the e-commerce boom stemming from the COVID-19 pandemic starting to cool off, but it was also a time when cryptocurrency-based payment platforms began capturing consumers’ as well as investors’ attention. Many investors feared the worst for PayPal.

It’s now clear those fears were mostly unmerited. Last quarter’s revenue was up 8% year over year, capping off full-year top-line growth of 8%. Although the total number of active PayPal users didn’t grow, the number of times these users utilized PayPal’s service to make a payment improved 14% on a year-over-year basis. The analyst community is calling for comparable sales growth this year and next, with earnings growth expected to roll in at around the same pace.

That’s nowhere near the sort of growth PayPal was experiencing in its heyday. The entire online payment and mobile wallet market has matured, making growth tougher to come by.

What this company may lack in future growth potential, however, it more than makes up for in dominance of a market that’s set to expand due to a combination of population growth, the increasing proliferation of web connectivity, and a growing willingness to use purely digital payment options (as opposed to payment cards). Capital One estimates PayPal still controls on the order of a market-leading 45% of the electronic payments market.

SoFi Technologies

Consumers’ growing interest in digital financial services isn’t just a boon for PayPal, however. It’s impacting the entirety of the banking industry. Bank of America reports three-fourths of its customers now routinely use at least one of its digital banking tools, for instance, while roughly half of any product and service sales made to consumer banking customers last quarter happened online. In this same vein, the American Bankers Association says the most common way U.S. consumers now check their bank account balance is with a mobile app. Indeed, data gathered by JP Morgan Chase‘s Chase Bank indicates that 62% of consumers feel they couldn’t live without their banking app, while nearly 80% of these people use their banking app at least once per week.

As was the case with shopping, the world’s moving more and more of its banking business online.

Enter SoFi Technologies (SOFI 2.06%). Not only is it an online bank, it’s only online — there are no branches. This hasn’t limited its offerings, though. Customers enjoy access to every option a consumer would expect to find available at a brick-and-mortar bank, including checking and savings accounts, loans, investments, credit cards, and even insurance.

And people are responding to this relatively new kind of banking. SoFi now boasts a little over 7.5 million customers, more than doubling its count from just a couple of years back. Indeed, the company’s expanded its customer base in every single quarter going all the way back to the first quarter of 2020.

SoFi’s not yet reliably profitable, but analysts expect it to report its first full-year profit in 2024 after swinging to its first quarterly profit in the final quarter of last year. That could prove catalytic for this stock that’s been lethargic for the past couple of years.

MercadoLibre

Last but not least, add MercadoLibre (MELI -1.39%) to your list of fintech stocks that could outperform most of its peers between now and 2030.

Don’t worry if you’ve never heard of it — if you live in North America, you’ve no reason to. That’s because the company strictly serves the Latin American market with its suite of fintech solutions. It’s often called the Amazon of Latin America, in fact, although that description doesn’t do it justice. MercadoLibre is just as akin to the aforementioned PayPal as well as to the online auction site eBay.

Although the internet and mobile phones have existed in South America for about as long as they have anywhere else, neither were as common there as they may have been in other parts of the world until recently. For perspective, Americas Market Intelligence says Latin America’s e-commerce market expanded 36% in 2021 before accelerating to a growth pace of 39% in 2022, as infrastructure growth finally caught up with demand.

The thing is, there’s still lots of room for more of this growth. Americas Market Intelligence is looking for 24% growth in Latin America’s e-commerce market this year, with another 21% growth in the cards for next year.

Helping drive this acceleration is the past and present development of the region’s mobile connectivity. Only 60% of the continent’s residents owned a mobile device capable of connecting to the web as of 2020, according to research outfit GSMA. Even with the ongoing availability and adoption of mobile phones, though, only 67% of Latin America’s population is expected to have regular access to mobile internet by the end of next year.

This of course bodes well for MercadoLibre’s long-term potential … not that investors will have to wait until 2030 for their patience to start paying off. Last year’s revenue was up an impressive 37%, supporting even more earnings growth. This year’s and next year’s projected sales and profit growth are similarly impressive numbers, reflecting the maturation of the region’s digital consumerism.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Bank of America, JPMorgan Chase, MercadoLibre, and PayPal. The Motley Fool recommends eBay and recommends the following options: short July 2024 $52.50 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

Kiyosaki Warns of Big Bubble, Analyst Predicts $330K BTC, Draper’s Wild El Salvador Prediction, and More— Week in Review

Robert Kiyosaki has issued a stark warning about an impending financial disaster, which he believes will devastate baby boomers. A crypto analyst predicts bitcoin could exceed $330,000, defying historical growth patterns through a combination of pattern disruptions and the theory of diminishing returns. Venture capitalist Tim Draper forecasts that bitcoin will dramatically transform El Salvador […]

Robert Kiyosaki has issued a stark warning about an impending financial disaster, which he believes will devastate baby boomers. A crypto analyst predicts bitcoin could exceed $330,000, defying historical growth patterns through a combination of pattern disruptions and the theory of diminishing returns. Venture capitalist Tim Draper forecasts that bitcoin will dramatically transform El Salvador […]

Source link

Wall Street Expert Says $100 XRP Price Prediction Has Expired, What Does This Mean?

Wall Street veteran Shannon Thorp has publicly admitted that her earlier bullish price projections for the XRP price have expired. The forecast, which had previously been a source of speculation and expectation within the XRP community, has fallen short of realization, leading market observers to further reflect on XRP’s price dynamics.

XRP Price Prediction Falls Flat

On Friday, March 1, Thorp took to X (formerly Twitter) to announce that her earlier ambitious forecast of XRP had come to an end. The Wall Street veteran acknowledged that her predictions had fallen flat, describing the unfortunate outcome as a “bittersweet” situation.

Previously, in July 2023, Thorp had made a bold prediction of XRP, projecting that the price of the cryptocurrency would surge between $100 to $500 in four to seven months. The Wall Street expert had provided critical analysis and statistics to back her projections, highlighting XRP’s potential for gaining more liquidity strength and achieving widespread adoption in the financial sector.

Now in March 2024, almost seven months after Thorp’s price prediction and analysis, XRP has failed to attain the projected $100 price mark. At the time of writing, the cryptocurrency is trading below $1 at $0.62, according to CoinMarketCap.

Since last year, the price of XRP has struggled to keep up with the market’s bullish trends and has been consolidating around the price of $0.50 for months. However, recently, the cryptocurrency witnessed a surge in its value after breaking through crucial resistance levels around the $0.6 price mark. The unexpected price gain has heightened anticipation for a significant price movement, suggesting a potential uptrend during this bullish period.

Wall Street Expert Remains Optimistic

After acknowledging the unmet $100 XRP price prediction, Thorp highlighted XRP’s accomplishments, underscoring the cryptocurrency’s resilience in overcoming challenges that could have severely disrupted other digital currencies under similar circumstances.

According to the Wall Street veteran, XRP has shown its immense potential by enduring an extensive lawsuit filed by the United States Securities and Exchange Commission (SEC). She revealed that XRP has continued to prevail, holding its title as one of the top 10 cryptocurrencies despite facing multiple adversaries and regulatory hurdles during its developmental and advancement stages.

“Are we really to believe that XRP will fail? Well, I refuse to believe that because still to this day, I know what I hold,” Thorp stated.

Despite her predictions not coming to fruition, the Wall Street veteran has remained optimistic about XRP’s prospects, staying consistent with her support for the cryptocurrency and its development team.

XRP at $0.62 | Source: XRPUSDT on Tradingview.com

Featured image from Crypto News, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

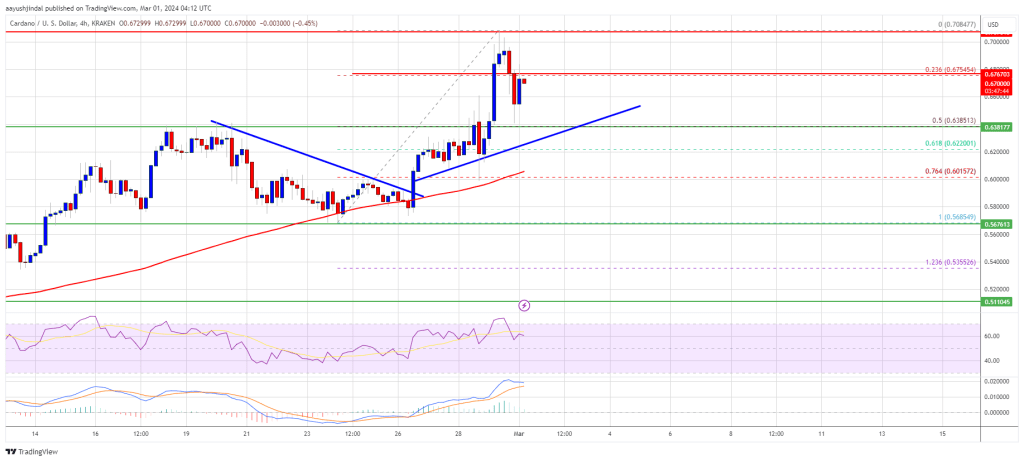

Cardano (ADA) is gaining pace above the $0.635 resistance zone. ADA is consolidating gains and might aim for more upsides above the $0.70 resistance.

- ADA price is holding gains and facing resistance near the $0.70 zone.

- The price is trading above $0.640 and the 100 simple moving average (4 hours).

- There is a key bullish trend line forming with support at $0.6350 on the 4-hour chart of the ADA/USD pair (data source from Kraken).

- The pair could attempt a fresh increase if the bulls remain active above the $0.6220 support.

Cardano Price Eyes Another Increase

After forming a base above the $0.5650 level, Cardano started a fresh increase. ADA price was able to climb above the $0.600 and $0.6220 resistance levels to move into a positive zone, like Bitcoin and Ethereum.

The bulls pushed the pair above the $0.650 resistance zone. However, the bears were active near the $0.700 resistance zone. A high was formed near $0.7084 and the price started a downside correction. There was a move below the $0.6750 level.

The price declined below the 23.6% Fib retracement level of the upward wave from the $0.5685 swing low to the $0.7084 high. ADA price is now trading above $0.640 and the 100 simple moving average (4 hours).

There is also a key bullish trend line forming with support at $0.6350 on the 4-hour chart of the ADA/USD pair. The trend line is near the 50% Fib retracement level of the upward wave from the $0.5685 swing low to the $0.7084 high.

Source: ADAUSD on TradingView.com

The bulls might remain active near the $0.6350 support. On the upside, immediate resistance is near the $0.6750 zone. The first resistance is near $0.692. The next key resistance might be $0.700. If there is a close above the $0.700 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.750 region. Any more gains might call for a move toward $0.80.

Downside Correction in ADA?

If Cardano’s price fails to climb above the $0.6750 resistance level, it could continue to move down. Immediate support on the downside is near the $0.6350 level.

The next major support is near the $0.6220 level. A downside break below the $0.6220 level could open the doors for a test of $0.600. The next major support is near the $0.5680 level.

Technical Indicators

4 hours MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for ADA/USD is now above the 50 level.

Major Support Levels – $0.6350, $0.6220, and $0.6000.

Major Resistance Levels – $0.6750, $0.6920, and $0.7000.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

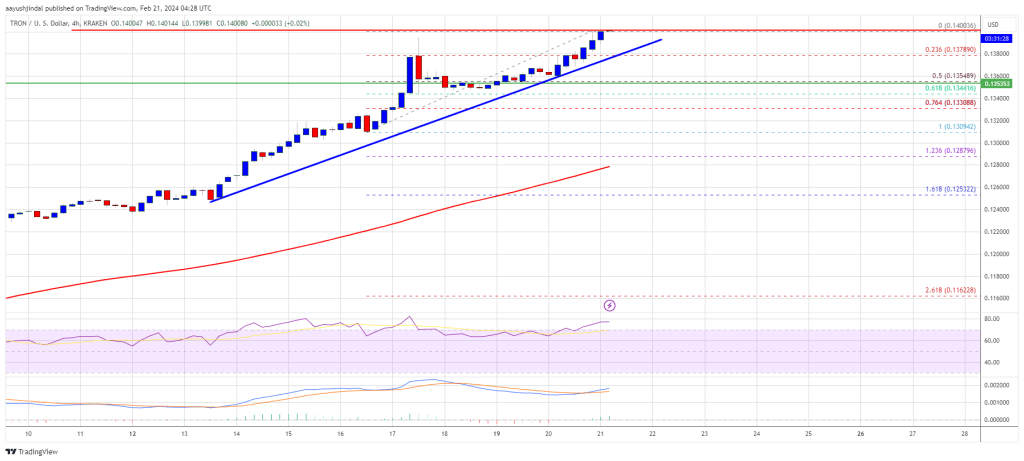

Tron price is gaining pace above the $0.120 resistance against the US Dollar. TRX is outperforming Bitcoin and could rise further above $0.140.

- Tron is moving higher above the $0.122 resistance level against the US dollar.

- The price is trading above $0.1350 and the 100 simple moving average (4 hours).

- There is a key bullish trend line forming with support at $0.1382 on the 4-hour chart of the TRX/USD pair (data source from Kraken).

- The pair could continue to climb higher toward $0.165 or even $0.180.

Tron Price Regains Strength

Recently, Bitcoin and Ethereum saw a decent increase and moved into a positive zone. Tron price also remained well-bid and it slowly moved higher above the $0.120 resistance zone.

There was a steady increase above the $0.128 and $0.132 resistance levels. Finally, TRX traded to a new multi-week high at $0.1400 and is currently consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $0.1309 swing low to the $0.1400 high.

Tron price is now trading above $0.1350 and the 100 simple moving average (4 hours). There is also a key bullish trend line forming with support at $0.1382 on the 4-hour chart of the TRX/USD pair.

Source: TRXUSD on TradingView.com

On the upside, an initial resistance is near the $0.1400 level. The first major resistance is near $0.1420, above which the price could accelerate higher. The next resistance is near $0.1650. A close above the $0.1650 resistance might send TRX further higher toward $0.1720. The next major resistance is near the $0.180 level, above which the bulls are likely to aim for a larger increase toward $0.20.

Are Dips Supported in TRX?

If TRX price fails to clear the $0.140 resistance, it could start a downside correction. Initial support on the downside is near the $0.1380 zone and the trend line.

The first major support is near the $0.1350 level or the 50% Fib retracement level of the upward move from the $0.1309 swing low to the $0.1400 high, below which it could test $0.1320. Any more losses might send Tron toward the $0.1250 support in the coming sessions.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.1380, $0.1350, and $0.1320.

Major Resistance Levels – $0.140, $0.1650, and $0.180.

Finance Expert Drops Grim Prediction For US Economy, Says Bitcoin Is The ‘Parachute’

The United States economy and where it might be headed has been a hot topic of debate among finance experts, with some recommending Bitcoin as a safe haven. One of those who has continued to tout BTC as the answer is renowned finance author Robert Kiyosaki, who has made a gloomy prediction for the US economy.

The Economy Is Coming Down

In a post made on X (formerly Twitter), Robert Kiyosaki, who is widely known for his best-selling finance book titled ‘Rich Dad Poor Dad’, warned investors of an impending crash. According to Kiyosaki, a lot of investors would end up losing their money as they do not know what to do with it.

He compared the current situation to flight students in the US Navy being taught how to fly and also how to crash. However, it seems that there is no easy option for investors going forward, as he calls for a “bail out.”

The finance expert warns that banks as well as the US economy will crash, and “We are not going in for a soft landing.” In light of this, he steers investors toward other forms of wealth preservation, which are Gold, Silver, and Bitcoin.

As much as the finance author expects that the crash will be brutal, he believes that by being in the three assets mentioned above, then investors can have “parachutes for your personal soft landing.”

BTC bulls clear $47,000 resistance | Source: BTCUSD on Tradingview.com

Strong Advocate For Bitcoin

Kiyosaki is not new to pushing Bitcoin as an alternative to traditional cash and investment vehicles. Over the last year, the finance expert has warned that the US economy is headed for doom and as always, pushes the likes of Gold, Silver, and Bitcoin as an answer to the ‘inevitable crash.’

The author has also provided incredibly bullish predictions for the BTC price going forward, which he expects to rise more than 300% from here. According to Kiyosaki, Bitcoin will rise as high as $150,000 post-Spot Bitcoin ETFs approval, and with the price inching toward $50,000 already, it seems Kiyosaki’s prediction may end up playing out.

Kiyosaki has also presented Bitcoin as a safe haven at a time when there is widespread political discontent. He has also publicly declared his dislike for the current President, Joe Biden, who he believes is weak and a terrible president.

In order to fight back, the finance author suggests that investors move their assets into Gold, Silver, and Bitcoin which cannot easily be controlled by the government. He also believes BTC is the “best protection” against hyperinflation, which he expects to happen soon.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.