As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

Source link

present

Another year, another Crypto Holiday special from our team at NewsBTC. In the coming week, we’ll be unpacking 2023, its downs and ups, to reveal what the next months could bring for crypto and DeFi investors.

Like last year, we paid homage to Charles Dicke’s classic “A Christmas Carol” and gathered a group of experts to discuss the crypto market’s past, present, and future. In that way, our readers might discover clues that will allow them to transverse 2024 and its potential trends.

Crypto Holiday With Blofin: A Deep Dive Into 2024

We wrapped up this Holiday Special with crypto educational and investment firm Blofin. In our 2022 interview, Blofin spoke about the fallout created by FTX, Three Arrows Capital (3AC) collapse, and Terra (LUNA). At the same time, the firm predicted a return from the ashes for Bitcoin and the crypto market. The resurrection seems well underway, with Bitcoin surpassing the $40,000 mark. This is what they told us:

Q: In light of the prolonged bearish trends observed in 2022 and 2023, how do these periods compare to previous downturns in severity and impact? With Bitcoin now crossing the $40,000 threshold, does this signify a conclusive end to the bear market, or are there potential market twists investors should brace for?

Blofin:

Compared to previous crypto recessions, the 2022-2023 bear market appears milder. Unlike previous cycles, in the last bull market, the widespread use of stablecoins and the entry of massive traditional institutions brought more than $100 billion in cash liquidity to the crypto market, and most of the cash liquidity did not leave the crypto market due to a series of events in 2022.

Even in Mar 2023, when investors’ macro expectations were the most pessimistic, and in 2023Q3, when liquidity bottomed out, the crypto market still had no less than $120 billion in cash liquidity in the form of stablecoins, which provides sufficient support and risk resistance for BTC, ETH and altcoins.

Similarly, due to abundant cash liquidity, in the bear market of 2022-2023, we did not experience a “liquidity dryness” situation similar to March 2020 and May 2021. In 2023, with the gradual recovery of the crypto market, liquidity risks were significantly reduced compared to 2022.

The only troubling thing is that in the summer and autumn of 2023, risk-free returns of more than 5% have caused investors to focus more on the money market and brought about the lowest volatility in the crypto market since 2019.

However, low volatility does not indicate a recession. The performance of the crypto market in the fourth 2023Q4 proves that more investors are actually holding on to the sidelines. They are not leaving the crypto market but are waiting for the right time to enter.

Currently, the total market cap of the crypto market has recovered to more than 55% of its previous peak. It can be considered that the crypto market has emerged from the bear market cycle, but the current stage should be called a “technical bull market” rather than a “real bull market.”

Again, let’s start our explanation from a cash liquidity perspective. Although the price of BTC has reached $44k once, the size of cash liquidity in the entire crypto market has only rebounded slightly, reaching around $125b. $125b in cash supports over $1.6T in total crypto market cap, implying an overall leverage ratio of over 12x.

Additionally, many tokens have seen significant increases in their annualized funding rates, even exceeding 70%. High overall leverage and high funding rates mean that speculative sentiment has as much impact on the crypto market as improving fundamentals. However, the higher the leverage ratio, the lower the investors’ risk tolerance, and the high financing costs are difficult to sustain in the long term. Any bad news could trigger deleveraging and cause massive liquidations.

Furthermore, real improvements in liquidity are yet to come. The current federal funds rate remains at 5.5%. In the interest rate market, traders expect the first rate cut by the Federal Reserve to occur no earlier than March and the European Central Bank and Bank of England to cut interest rates for the first time no earlier than May. At the same time, central bank officials from various countries have repeatedly emphasized that interest rate cuts “depend on the data” and “will not happen soon.”

Therefore, when liquidity levels have not really improved, the recovery and rebound of the crypto market are gratifying, but the “leverage-based” recovery is significantly related to investors’ financing costs and risk tolerance, and the potential callback risk is relatively high. In fact, in the options market, investors have begun to accumulate put options after experiencing a rise in December to deal with the risk of any possible pullback after the start of 2024.

Q: Right now, we are seeing Bitcoin reach new highs. Do you think we are in the early days of a full bull run? What has changed in the market that enabled the current price action; is it the Bitcoin spot ETF or the US Fed hinting at a loser policy or the upcoming Halving? What is the big narrative that will go on in 2024?

Blofin:

As stated above, we are still some way away from the early stages of a full-blown bull market. “Technical bull market” better describes the current market status. This round of technical bull market started with improved expectations: the spot Bitcoin ETF narrative triggered investors’ expectations for the return of funds to the crypto market, while the peak of the federal funds rate and expectations for an interest rate cut next year reflected the improvement at the macro environment level.

In addition, some funds from traditional markets have tried to be the “early birds” and make early arrangements in the crypto market. These are all important reasons why BTC’s price is back above $40k.

However, we believe that changes in the macro environment are the most important influencing elements among the above factors. The arrival of expectations of interest rate cuts has allowed investors to see the dawn of a return to the bull market in risk assets. It is not hard to find that in November and December, not only Bitcoin experienced a sharp rise, but Nasdaq, the Dow Jones Index, and gold all hit all-time highs. This pattern typically occurs at or near the end of each economic cycle.

The beginning and end of a cycle can significantly impact asset pricing. At the beginning of a cycle, investors typically convert their risky assets into cash or treasury bonds. When the cycle ends, investors will take cash liquidity back to the market and buy risk-free assets without distinction. Risk assets typically experience a “widespread and significant” rise at this time. The above situation is what we have experienced in 2023Q4.

As for the Bitcoin halving, we prefer that the positive effects it brings result from an improvement in the macro environment rather than the result of the “halving.” Bitcoin had not become a mainstream asset with institutional acceptance when the first and second halvings occurred. However, after 2021, as the market microstructure changes, institutions have gained sufficient influence over Bitcoin, and each halving coincides with the economic cycle to a higher degree.

In 2024, we will witness the end of the tightening cycle and the beginning of a new easing cycle. But compared with every previous cycle change, this cycle change may be relatively stable. Although the period of high inflation is over, inflation is still “one step away” from returning to the target range.

Therefore, all major central banks will avoid releasing liquidity too quickly and be wary of the economy overheating again. For the crypto market, a solid liquidity release will lead to a mild bull run. Perhaps it is difficult for us to have the opportunity to see a bull market similar to that in 2021, but the new bull market will last relatively longer. More new chances will also emerge with the participation of more new investors and the emergence of new narratives.

Q: Last year, we spoke about the most resilient sectors during the Crypto Winter. Which sectors and coins will likely benefit from a new Bull Run? We are seeing the Solana ecosystem bloom along with the NFT market; what trends could benefit in the coming months?

Blofin:

What is certain is that exchanges (whether CEX or DEX) are the first beneficiaries when the bull market returns. As the trading volume and user activities begin to rebound again, it can be expected that their income (including the exchange’s fee income, token listing income, etc.) will increase significantly, and the performance of the exchange tokens may also benefit from this.

At the same time, infrastructure related to transactions and capital circulation will also benefit from the new bull market, such as public chains and Layer-2. When liquidity returns to the crypto market, crypto infrastructure is an indispensable part: liquidity must first enter the public chain before it can be transferred to various projects and underlying tokens.

In the last bull market, the congestion and high gas cost of the Ethereum network were criticized by many users, which became an opportunity for the emergence and development of Layer-2 and also promoted the development and growth of many non-Ethereum public chains, while Solana and Avalanche are some of the biggest beneficiaries.

Therefore, with the arrival of a new bull market, more usage scenarios and possibilities for Layer 2 and non-Ethereum public chains will be discovered. Ethereum will also naturally not be far behind; we may witness a new boom in public chain ecosystems and tokens in 2024.

In addition, as an exploration of the latest applications of BTC, the development of BRC-20 cannot be ignored. As a new token issuance standard based on the BTC network that emerged in 2023, BRC-20 allows users to deploy standardized contracts or mint NFTs based on the BTC network, providing new narratives and use cases for the oldest and most mature public chain.

With the return of liquidity, the exploration and development of BRC-20-related applications may gradually begin, and together with other public chain ecosystems, they will make great progress in the new “moderate but long-term” bull market.

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

A Crypto Christmas Special With Material Indicators: Past, Present, And Future

Nobody could argue that 2022 was anything but a bear market. After Bitcoin reached an ATH in November of 2021 we saw the bear market develop in classic fashion by losing support at key technical levels. While the bear was playing out in somewhat predictable fashion, the market was caught off guard by the events that led to the FTX crash in November 2022. Because the contagion from FTX had a devastating ripple effect that was felt by the largest institutions with crypto exposure as well as banks, I actually expected prices to fall even lower.

At the time, fear and fighting among institutional players like Galaxy, Gemini and Grayscale (under DCG) who were among SBF’s largest institutional victims added to the concern that price would grind down towards the lower teens, yet somewhat remarkably and perhaps not so coincidentally on January 1, 2023 Bitcoin started to rally. What was first considered weekend whale games evolved long past the weekend, and in fact, through Q1/2023 I identified an entity on FireCharts which I nicknamed “Notorious B.I.D.” that was double stacking large blocks of bid liquidity to push price higher. There was a pattern to the behavior that made it somewhat predictable and tradable. Those moves were well documented in my X feed during that period of time. Once price reached $25k that entity disappeared. Even without the help of that manipulation pushing price up, and despite the fact that the macroeconomic situation was horrible, the geopolitical situation went from bad to worse and the US political situation evolved from a dysfunctional sh*t show to a full blown circus, the market continued to rally.

Now, nearly 12 months and > 150% from the day the rally began, the debate between bulls and bears over whether this is a confirmed bull market or a sequence of bear market distribution rallies literally continues today. While it’s understandable that someone could look at 150% and immediately assume bull market, it does require a deeper understanding of what distribution and accumulation look like. From my view, that still isn’t as clear as one would expect. Historically, the Purple Class of Whales with orders in the $100k – $1M range have had the most influence over BTC price direction. The order flow data I’ve been monitoring on Binance shows that through most of the year they (along with larger MegaWhales) have been buying dips and distributing significantly more than they bought on those dips on the uptrends that followed.

Only recently have we seen an uptick that could be an indication that the trend is shifting. Parallel to that, some on-chain data providers are showing an increase in the number of wallets holding BTC which is also an indication that we could be transitioning from a distribution phase to an accumulation phase and I’m looking for more clear evidence of that. One of the things I look for to get a sense of that is bid liquidity. I believe that “Liquidity = Sentiment,” and it’s no secret that order books have been thin on both sides of price through most of the year, however in the last 3 weeks or so, we’ve started seeing more institutional sized bid ladders coming into the order book and that fact supports a bullish thesis, as long as they don’t dump through the next pump.

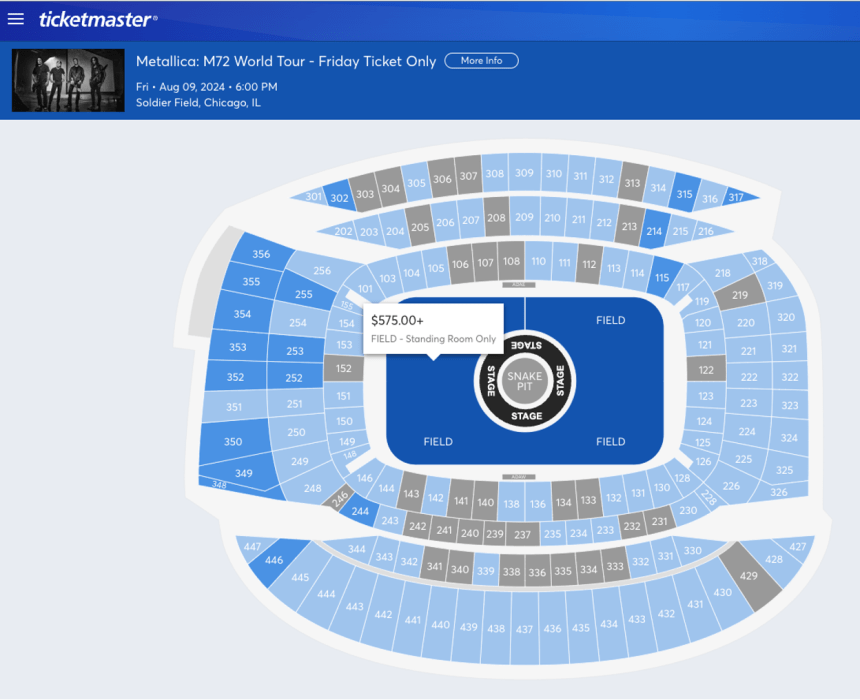

With all of the above in mind, there are most certainly turns and twists that investors should look out for. Sure we are starting to see some improvements on the U.S. inflation and unemployment numbers, but something in those reports doesn’t jive with reality. For most middle and lower income Americans, credit card debt is climbing to new highs, rents have soared, home ownership is unattainable, grocery prices are high and a Metallica “Standing Room Only” Field ticket is $575. So in my mind, we still have a percolating macroeconomic problem and the geopolitical and U.S. political issues seem to get worse by the day.

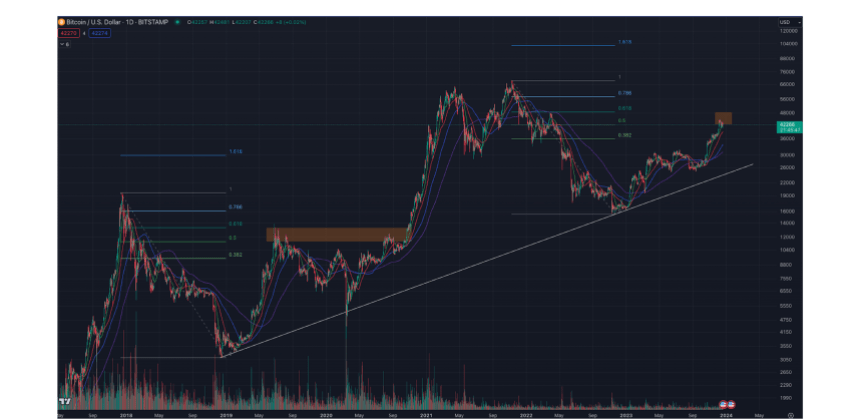

Aside from that, the RSI has been over cooked for an extended period of time and we just had 8 consecutive green weekly candles. Both of those factors have historically led to corrections. I could give you the “History doesn’t have to repeat itself…” spiel or I can show you what historically happens after moves like this and let you decide.

Another potential twist to consider is that the current PA has a striking resemblance to the first leg of the 2019 rally that turned out to be a Fib retracement, that ultimately got rejected from the top of the Golden Pocket at .618 Fib. That led to a 53% correction before the Covid Crash took it down more than 70% from the .618 Fib.

At this stage, I’d be surprised to see a downside move that deep without the aid of a Black Swan, but we are currently having some interaction with the Golden Pocket that seems familiar. While it is reasonable to expect some resistance entering and exiting the Golden Pocket, there is one very weird twist to what we are seeing and that is a strange pattern I’ve noticed occurring on or around December 17th. Every year since 2017 there has been a move on December 17th that had Macro implications. The only exception to that is last year when it happened on December 20th. On each occasion the price action led to a macro breakout or breakdown. It’s too soon to tell if this move will validate the pattern on the day of writing (Dec 19th), but on the 17th we saw BTC get rejected from the lower end of the Golden Pocket and also lose the 21-Day moving average. Price has been flirting with both of those levels ever since so we’ll have to wait to see how it plays out over time. Aside from those things I’m watching the upcoming ETF window very closely. I think that the market is numb to SEC delays on these decisions, but there is so much anticipation that this time we’ll see an approval, that a flat out rejection has the potential to be the catalyst that triggers a correction.

Regardless of where you side on whether we are or are not in a confirmed bull market, we’re seeing a lot of evidence that if we are not in it, we’re close to it. If you’re a long term investor and you haven’t already started building a position, it’s a good time to identify some targets to start scaling into one. This of course depends on your time horizon and risk appetite, but if you have a long term outlook and 6 figure targets for BTC it’s still early enough to get in, but it’s also a good idea to save some dry powder for a correction because in my opinion, it’s not a matter of if it will come, but when.

Q: Right now, we are seeing Bitcoin reach new highs. Do you think we are in the early days of a full bull run? What has changed in the market that enabled the current price action; is it the Bitcoin spot ETF or the US Fed hinting at a loser policy or the upcoming Halving? What is the big narrative that will go on in 2024?

Despite the ongoing debate between bulls and bears over whether or not we’ve been in a bull market, I can say that despite the uptrend, there has been no clear confirmation that we’ve been in a bull market through most of the year. However, the fact that we’ve recently started to see more institutional sized bid ladders coming into the order book along with the on-chain data that indicates more wallets holding for longer and the recent buying after the R/S flip at $40k are indications that we may be on the verge of a breakout.

There’s no doubt in my mind that a lot of the momentum we’ve been seeing is related to the next ETF decision window opening January 5-10 and the April 2024 Halving. The FED’s recent decision to pause rate hikes and hint at a pivot to cuts in 2024 certainly added fuel to that momentum that pushed price above $40k. In typical crypto form, we also had some help in late October through early December when I noticed some familiar patterns in the order book. I can’t confirm with absolute certainty if it was the Notorious B.I.D. spoofer we saw in Q1 returned, but it was the same game I identified through Q1 being executed and there is no question that it helped push price up through the $35k – $40k range before it disappeared.

(…) As much as I’d like to see a correction come before we get there (the Bitcoin spot ETF decision), the market doesn’t care what I want. I would expect it to come before the Halving. Whether it comes before or after the ETF decision window closes remains to be seen. In the meantime, I’ll continue to watch order book and order flow data and trade what’s in front of me.

Q: Last year, we spoke about the most resilient sectors during the Crypto Winter. Which sectors and coins will likely benefit from a new Bull Run? We are seeing the Solana ecosystem bloom along with the NFT market; what trends could benefit in the coming months?

A Crypto Christmas Special With Jlabs Digital: Past, Present, And Future

Another year, another Crypto Christmas special for our team at NewsBTC. In the coming week, we’ll be unpacking 2023, its downs and ups, to reveal what the next months could bring for crypto and DeFi investors.

Like last year, we paid homage to Charles Dicke’s classic “A Christmas Carol” and gathered a group of experts to discuss the crypto market’s past, present, and future. In that way, our readers might discover clues that will allow them to transverse 2024 and its potential trends.

Crypto Christmas: What’s Behind The Bitcoin Rally, And Which Coin Has The Most Potential?

Since 2022, the team at JLabs Digital has been expanding as they bring in new analysts, educational tools, and new ways to share their insights. Last year, we spoke to one of its founders, Ben Lilly, who was betting on crypto becoming “better” and more mature due to the lessons left by the fall of FTX and others.

JJ walked us through the differences between this rally and previous years, the most undervalued coin in the sector, the potential twists in the market, and more.

Q: In light of the prolonged bearish trends observed in 2022 and 2023, how do these periods compare to previous downturns in severity and impact? With Bitcoin now crossing the $40,000 threshold, does this signify a conclusive end to the bear market, or are there potential market twists investors should brace for?

JJ:

So with Bitcoin now crossing over the $40,000 threshold, does this signify a conclusive end to the bear market (…) I’m leaning towards the twist portion of that. I think most of this rally was really driven by disbelief and people shorting it to each pump, especially as we neared $30K, there was just a huge washout of shorts that had ated over the past year between options and derivatives. So that forced buying is really what set us up over $40,000 in my opinion. So now to sustain this, there’s going to have to be continued spot buying to see the price above, say $48,000 to $52,000.

I think it’s possible we get up to that range, but I don’t think we’re just going to get to that range and keep ripping. I think sooner or later we’re going to come back down and retest that $30,000 mark. So that’s an eye investors and traders should have their eye on into 2024. I do think you’ll inevitably get that large leverage washout as is very typical in Bitcoin.

Q: Right now, we are seeing Bitcoin reach new highs. Do you think we are in the early days of a full bull run? What has changed in the market that enabled the current price action; is it the Bitcoin spot ETF or the US Fed hinting at a loser policy or the upcoming Halving? What is the big narrative that will go on in 2024?

JJ:

I do think we’re entering a new bull market, but that said, there’s always going to be twists and turns and leverage liquidations. Keep that level in mind. $28K to $32K, think will be as good an entry as any if we get that opportunity in 2024.

Anytime we see those big breakouts we saw in October, it’s just so typical Bitcoin to come back and retrace it. But what it first wants to do is engineer liquidity. So you have to realize the people that paint these charts are very sophisticated and they want to make you enter at less than optimal prices and sell less than optimal prices. So how they do that, they kind of coax you into buying at $40K. (They make you think) It’s never going to go back down again. And then next thing you know you’re holding onto those buys and it’s at $28,000 and you’re being forced to sell.

I think this (rally) is much different. Basically if you look at 2021, we had (Microstrategy’s Michael) Sailor and Tesla buying (BTC), but outside of that, as we know, it was a lot of leverage to (investors) such as Three Arrows Capital, Grayscale, the Digital Currency Group that was overlooking it. All these people were getting access to massive amounts of leverage due to how cheap it was to borrow the dollars at the time, due to the interest rates being zero, they were using that to leverage themselves and basically pump Bitcoin artificially. And then we all saw that washout last year and as opposed to what we see now, this is actual institutional buying.

So there’s been no doubt that I’m sure BlackRock, Fidelity, et cetera, they’re not buying now, they were buying below $20,000, they were buying throughout the $20,000 range. They’re not buying above $35,000 to $40,4K. So we do see a bit more strength at the bottom of the market, which is going to form a better base for 2024.

But that said, there’s always going to be those ups and downs, but I think long-term, the fact that we saw that capitulation from kind of the leverage deigns to institutional players who know how to organize and manage these trades more efficiently, I think it’s very bullish for Bitcoin and definitely regime shift.

I think it’s kind of forming. I mean as of right now, the future’s kind of unpredictable, but the things I see, we have this ETF coming. Do I think it’s going to be like the moment it’s approved, Bitcoin’s just going to take off? No, there’s a lot of complications with that. Like the Grayscale BTC trust, I think they hold over 600,000 BTC that’s going to have to get distributed. I’m not sure that there’s enough demand as of yet to just soak up all that supply that’ll be coming onto the market. But as we go down the line a few months later, these ETFs are rolling. BlackRock has their team of thousands of advisors out there selling this because they’re incentivized to. And at the same time we have “The Halving” where supply cuts down on the amount of emissions miners able to readily sell as supply.

So you’ll have this massive influx. It’s very hard to be overstated the amount of new demand that will be coming online because of the ETF. At the same time we have “The Halving” event which is going to cut down on the amount of supply available for sale. I think that’s kind of forming a perfect storm in of itself. And then you look at the dollar, the DXY index, this is something I hit on a lot in my articles and the videos that we do on YouTube, and you see it’s (the DXY) been on a downtrend throughout 2023. It looks like it’s getting worse into 2024.

We just had the Fed signaling that they’re thinking about rate cuts, which is usually as good a sign as any that those rate cuts will be happening. So the dollar will be weakening. At the same time we have this massive new demand for Bitcoin. At the same time the supply of Bitcoin’s dropping down. So you can see that all the stars are aligning for new all time highs, a hundred thousand plus targets. But it’s going to be a tricky road there.

Like I said, I think we’re going to inevitably go back down to that $28 to $30K range, and then probably in the second half of the year we’ll really see it defy expectations to the upside.

Q: Last year, we spoke about the most resilient sectors during the Crypto Winter. Which sectors and coins will likely benefit from a new Bull Run? We are seeing the Solana ecosystem bloom along with the NFT market; what trends could benefit in the coming months?

JJ:

It’s hard to say. As of right now, the narratives that’ll take hold, there’s going to be some crazy pumps on things and there’s going to be wild narratives like we saw with DeFi in 2021, what those are right now, we could guess, but there’s nothing definitive in my mind that it seems like, I think a lot of it’s being priced in now, actually. You see kind of these wild altcoin pumps over the past month. I don’t know how sustainable that is over the near term, but I think one thing people are overlooking is if this BTC ETF gets approved, we’ve kind of set the legal precedent that what the SEC did in approving the Bitcoin ETF, the futures ETF, but not approving the spot was illegal.

They’ve already approved Ethereum futures ETFs and now there’s a bunch of spot Ethereum ETFs open for application. So I think it’s inevitable that those will get approved and I think Ethereum is wildly underpriced. Not to say we won’t get pullbacks from here, but those are pullbacks you should be looking to buy because I think an Ethereum spot ETF is almost a hundred percent likely in the second half of 2024. And I think we’ll see some coins that were probably overpriced compared to Ethereum. If you factor that in, and I think we’ll see Ethereum and its use cases really start to take life in 2024. You see a flight to value at some point there, rather than the wild speculation that happens on other alts.

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

As Sam Bankman-Fried‘s fraud trial nears its conclusion, federal prosecutors delivered forceful closing arguments accusing the FTX founder of lying and stealing from customers.

Inner City Press, which has reported live from the courtroom since the beginning of Bankman-Fried’s trial, reported Assistant US Attorney Nicolas Roos told the jury that the simple fact was that billions in customer deposits had gone missing because Bankman-Fried stole them. “Almost a year ago, people started to withdraw from FTX. Millions to billions” he said. “Thousands tried to withdraw their nest eggs. But they were not processed.”

Roos alleged this was because “The defendant spent his customers’ money and lied about it. It went to cover expenses, to purchase property, and to make political donations. This was a pyramid of deceit, all to get money. Eventually, it collapsed, leaving countless victims in its wake.”

The crux of the matter, the government argued, had nothing to do with the complexities or fundamentals of cryptocurrency and instead attributed Bankman-Fried’s behavior to simple fraud:

“$10 billion were missing. And the defendant was responsible. You’re heard about Bitcoins and blockchains, so-called Korean accounts. Here’s the thing. This is not about complicated issues of cryptocurrency. It’s about lies and stealing and greed.”

The statements reflect arguments outlined in previous SBF trial coverage, noting he faces charges of wire fraud, conspiracy, and campaign finance violations related to the implosion of FTX in November 2022.

Bankman-Fried has maintained he did not act with ill intent, instead making poor business decisions. The trial’s outcome rests on whether the jury accepts his narrative or the prosecution’s assertions of willful fraud and deception.

Roos directly told the jury, “The core dispute here is whether the defendant knew that taking the money was wrong. He knew. He did it anyway. He thought he was smarter and could walk his way out of it. Today, with you, that ends.”

As the high-profile SBF case nears a verdict, the prosecution aimed to convince jurors of criminal intent through its condemnatory closing statement. Roos asserted SBF intentionally defrauded FTX customers, stating, “This man, Samuel Bankman-Fried… spent his customers’ money and lied about it.”

Sam Bankman-Fried’s trial is ongoing.

Sam Bankman-Fried takes the stand with jury present in second day of testimony

Sam Bankman-Fried, the co-founder and former CEO of FTX, continued to provide testimony in his criminal case on Oct. 27, in which he described how FTX and its sister firm, Alameda Research, began as small but ambitious operations that eventually collapsed.

Bankman-Fried testified that he launched Alameda because of the growing popularity of cryptocurrency even though he knew “basically nothing” about it, saying:

“Crypto was getting public. In 2017, I’d seen two people talking excitedly and it was probably about crypto … crypto seemed like a place with a big demand for an arbitrage provider.”

He told the court that Alameda operated out of a small Airbnb in North Berkeley, California, in order to keep a low profile. When asked to explain the firm’s name, he said that he wanted to “stay under the radar” and “didn’t want to call it Sam’s crypto trading firm.”

Jury returns to hear testimony

Up to this point, Bankman-Fried had been made to give his testimony in the absence of the jury at the request of government prosecutors.

As jurors returned to hear the remainder of his testimony, Bankman-Fried stated that Alameda Research continued to serve as a market maker for FTX as the latter firm went live. He explained that risk could spill between companies, stating:

“We increased the number of servers for the risk engine. But we learned that if there was an erroneous liquidation of Alameda, or any other large account … it would be catastrophic for FTX.”

Bankman-Fried said that he eventually told FTX co-founder Gary Wang to take measures to stop possible liquidations of that type. He said that he now knows that those measures consisted of allowing account balances to go negative, as described in Wang’s testimony.

Bankman-Fried added that Alameda’s line of credit “grew over time to billions” of dollars. He testified that he had discussed Alameda with Wang and FTX’s former director of engineering, Nishad Singh, and said that they decided to increase the line of credit.

He once again downplayed his awareness of the full financial situation, stating:

“At the time I wasn’t entirely sure what was [happening]. I thought the funds were being held in a bank account or sent to FTX in stablecoins. If Alameda was keeping it, I figured it would be reflected as a negative number on FTX.”

Bankman-Fried briefly touched on a number of other operational matters, including his use of the Signal messaging app, FTX’s terms of service, and FTX’s FTT token.

FTX goes to the Bahamas

Earlier in his testimony, Bankman-Fried said that FTX and Alameda had moved to Hong Kong for the region’s “better regulatory environment.” However, both companies soon left due to COVID-19 quarantines and domestic disputes with China.

Bankman-Fried said that FTX instead moved to the Bahamas, which had “suitable” regulations. The firm’s employees moved into an apartment for ten, he said.

He also described his break-up with former Alameda Research CEO Caroline Ellison, stating that “she wanted more than I could give … it wasn’t the first time with me.” Ellison described a significantly more strained relationship in her own testimony, stating that Bankman-Fried had blamed and yelled at her for the company’s issues.

SBF describes company spending

Bankman-Fried described his marketing activities, including the purchase of Miami-Dade Arena and investments in emerging projects such as Solana. He further detailed his investments in the VC firm K5 for its “promising incubations” and “celebrity contacts.”

He also described his decision to invest in political candidates and groups, stating:

“I was interested in pandemic prevention. So I thought policy was important, [as well as] Congress and the Executive Branch. Some [donations] were by FTX for cryptocurrency lobbying … some, not most … [for] a U.S. regulatory structure.”

Bankman-Fried admitted that those donations came from loans from Alameda Research. He said that FTX executives Nishad Singh and Ryan Salame made donations as well. In his own testimony, Singh said that his name was merely associated with some donations but nevertheless pleaded guilty to campaign financing charges in his plea deal.

Bankman-Fried was still on the witness stand at the time of writing. His defense’s ultimate argument is still unclear. CryptoSlate’s coverage of the case will continue.

Kenny Schachter reflects on blockchain art’s past, present and future

With crypto in a state of turbulent flux, a demographic of nonfungible token (NFT) detractors in the fine art world might feel trigger-happy to, at last, declare the industry down for the count.

Meanwhile, artist, critic, dealer, educator and outspoken NFT proponent Kenny Schachter is celebrating the conclusion of Slow Food — his first New York City art exhibition in 25 years — at The NFT Gallery on Manhattan’s Lower East Side, fresh off the heels of headlining NFT Art Day ZRH in Zurich, Switzerland, coinciding with the iconic annual Art Basel art fair, less than 50 miles away.

In June 2022, Schachter had just presented the first-ever NFT booth wall at Art Basel with Galerie Nagel Draxler, expanding the acceptance of NFTs just before profile pictures became the face of their demise. Soon after, Schachter was spotted among the art world elite in Hydra, Greece, celebrating zeitgeist sculptor Jeff Koon’s first token drop with Pace Gallery.

Schachter told Cointelegraph that while his commitment to the intersection of blockchain and art hasn’t faltered since then, “it’s hardened.” The contentious art-world rabble rouser hails from a working-class Long Island, New York family. He studied philosophy, then law — worked in fashion and on the stock market floor — all before stepping foot in his first art gallery in his late 20s or making his name as an art market reporter. Schachter became an artist before the millennium turned, exhibiting his first computer animation in 1993 and producing digital prints as the decade ensued.

“As far as I’m concerned, I’m involved in art,” Schachter said. “That’s all I care about, more than pretty much everything, except for perhaps my kids.” Rather than encapsulating Schachter’s full oeuvre, Slow Food, which closed on June 17, focused on the artist’s most recent blockchain forays: a collaborative, evolving rumination titled Open Book, his new blockchain-based game Pop Principle, and a sculpture about the insidious trend of dinosaur bones being sold through art auction houses. An NFT accompanied each artwork — underpinning them all.

Riding out the booms and busts

When Schachter caught wind of NFTs in 2020, he brushed them off as another form of money before recognizing solutions for difficulties dogging his practice — wrapped in a blockchain bow.

Of course, digital art had long languished in the absence of a practical means to sell and trade it. A number of galleries offering digital artworks in their booths at Art Basel as of 2022 still handed the pieces off after purchase as a file on a flash drive, authenticated based on file size.

Even before NFTs, digital art had been pigeonholed in the manner of other mediums, like performance. Although NFTs gained fame only once artists started making big money, Schachter saw a greater chance to expand his audience beyond the narrow-minded art world.

Several standalone artworks complemented Schachter’s larger projects across Slow Food, like “NFT Gimmicks,” a two-part piece including a fine art print that immortalized a snide tweet Schacter made in reply to Dot Pigeon’s April announcement that the artist was quitting NFTs due to rampant speculation — alongside the actual balaclava Schachter is seen wearing in the post.

“First of all, he’s made millions, probably, off his NFTs,” Schachter told Cointelegraph of Pigeon’s headline-making move. “If I sell an NFT, whether it was $5 or $25,000, that’s a social contract between me and the collector. I have an obligation to support what I’ve done.” He noted that Crypto Mutts, a profile picture collection Schachter founded to mock Bored Ape Yacht Club, will likely end up in his will, to ensure the project survives after he’s not around to maintain it.

Money is nice, but Schachter swears up and down it’s not driving him — he recently opted to forego royalties from resales. Instead, the artist emphasized that his faith relies on the community that NFTs build around his practice and the connections the space lends itself to.

Recent: The Hinman docs: Implications for XRP, SEC credibility and more

The artist had to learn fast about blockchain in his efforts to get involved. He initiated a virtual mentorship with an avid NFT collector and Google executive based in Singapore. “Every two or three weeks, I would sit there like a child with a pen and a paper,” Schacter recalled of their sessions. “I ended up making an artist out of him, putting him in an NFT show I curated at Nagel Draxler in Cologne in 2021.”

Similarly, Schachter’s more far-reaching projects across “Slow Food” require people to make them function. Open Book began last summer while he was co-authoring The NFT Book. Inspired by the social media responses he got for input while helping pen the book, Schachter curated 20 disparate artists to contribute stances on NFTs — some positive, some critical — for Open Book. Those quotes oscillated on screens across Slow Food, with some from Schachter himself. The show allocated a room where guests could contribute before it goes live on NFT market Async Market this month.

Schachter calls the project “a book that doesn’t have an ending, nor a middle for that matter. But there’s a beginning. It tells a story of a field radically transforming in real time.”

Playing further

His blockchain game, Pop Principle, runs on the high-end digital art streaming service and collecting source Daata. It took shape in early 2022. Originally titled Digital Duel: Crypto vs Canvas, the game’s new iteration pits teams of vocal NFT supporters and detractors from the fine art world — artists, writers, curators, dealers and influencers — all against each other.

Each round of Pop Principle will introduce new teams with new characters on either side, all available to mint in open editions. Collectors mint as many of their favorite characters as they can afford to in order to support that figure and their team. Whichever team gets the most mints wins, but the real crown goes toward whichever collector holds the most copies of the winning character — that collector gets a unique Schachter sculpture in real life. To celebrate Pop Principle’s inaugural round, which goes until June 23, the top 50 holders all received an airdropped NFT.

“The concept changed from a battle to a reflection of the fact that life — in art and beyond — has been reduced to a popularity contest,” Schachter said, “measured by likes, followers and money.” While there’s no role-playing or hand-to-hand combat, it was fun to watch art dealer Larry Gagosian, whose gallery some regard as the art world’s evil empire, lob stacks of bills at opponents like famed artists Refik Anandol and Beeple, in a montage on view at Slow Food.Sculptures of this round’s protagonists punctuated the show — Beeple greeted visitors, while teammates Anandol and Nigerian artist Osinachi conversed with the round’s sole neutral party, curator Hans Ulrich Obrist, near the show’s rear.

The figures all had big eyes, attention to detail and a real sense of life. They felt like Schachter’s distinct take on the infamous artist KAWS’s signature style, although artists are notoriously crabby about being compared with each other. Schachter’s go-to fabricator in China brought his digital designs to freestanding, 3D existence.

Perhaps surprisingly, David Hockney hasn’t yet factored into Pop Principle. In 2021, Hockney, the highest-valued painter alive, called NFTs “silly little things” for “crooks and swindlers.”

However, Hockney’s recent series of iPad drawings — the subject of a hyped Pace Gallery exhibition in Chelsea, Manhattan, in winter 2022 — would likely benefit from blockchain elements.

“Would you rather own a $100,000 outputted photograph,” Schachter asked, “or would you rather own the high res file from which he made it, in which case you could make a tapestry, you could make a painting in China for $100, you can make a photograph or a lightbox or projection or keep it on your phone, do whatever you want?”

That’s precisely how “Missionary Position,” a tapestry featured in Slow Food depicting Mother Theresa in a robe adorned with Ethereum insignias, came to be. Schachter got in touch with an Albanian artisan through his network, who wove his digital design into an art object.

Fine art recoils — even from practical applications

NFT art might never boom at quite the same pitch it once did. Schachter says that’s a good thing. It could benefit the space by taking the focus off the very behaviors from the traditional art and finance spheres that NFT proponents claim they’re trying to buck — placing the focus back on the possibilities. Blockchain offers many practical applications relevant to fine art beyond just hype, revenue, new audiences and new understandings of art as an idea rather than an object.

For example, it can create an irrevocable record of provenance, which could foster a little more transparency about how many — and maybe whose — hands an artwork has passed through.

Why, then, are some art industry figureheads raring to dance on the blockchain’s grave?

“The art world is like a smelly dog pissing on a tree,” Schachter said. “When they see another dog coming by, the first thing they want to do is piss on the piss that the other dog just did. When the art world sees a new means, a new technology, they see platforms that fully function without their input, they get very defensive and very territorial.”

“Art is a zero-sum game, generally speaking, where one person or entity succeeds at the expense of another.”

More money for Nifty Gateway means less money for galleries — unless they’re creating new audiences. But art is ephemeral, relational. Prices are based on previous prices, and acclaim comes from proximity to superstars. There’s a lot at stake in the ruse that these emperors are clothed.

“When I found out about the art world, the first impression I had was people swinging from the chandelier, drinking absinthe and going to orgies,” he said. “Boy, was I in for a slap in the face.”

Magazine: Opinion: GOP crypto maxis almost as bad as Dems’ ‘anti-crypto army’

No matter, though. Schachter’s pressing forward. “Slow Food,” he said, was a dry run for his debut solo museum exhibition at the Francisco Carolinum in Linz, Austria, opening in September.

“Nobody offered me a fucking show when I was in the art world for 30 years,” Schachter balked. “I got offered a show and had success in the NFT space. In the art world, success affirms success. By any means necessary, will I pursue my interest and my goals.”