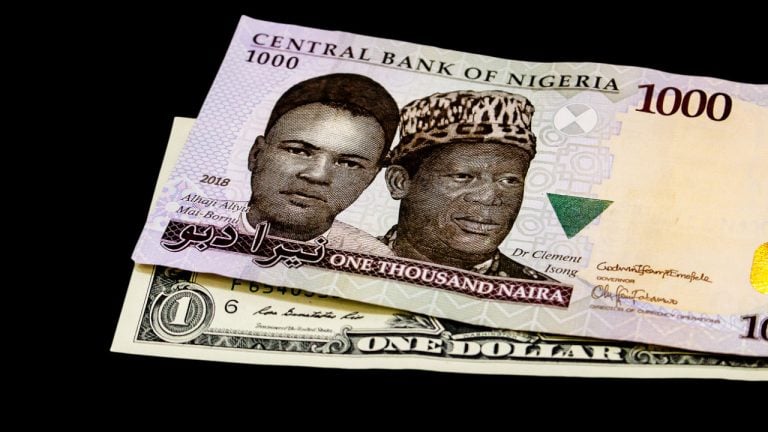

Bayo Onanuga, a special adviser to the Nigerian president, has leveled accusations against Binance, blaming it for exacerbating the local currency’s depreciation against major currencies. Onanuga called for immediate action against Binance, warning that its activities could potentially undermine the economy. Binance, however, has refuted these allegations, attributing the naira’s depreciation to “complex factors” that […]

Bayo Onanuga, a special adviser to the Nigerian president, has leveled accusations against Binance, blaming it for exacerbating the local currency’s depreciation against major currencies. Onanuga called for immediate action against Binance, warning that its activities could potentially undermine the economy. Binance, however, has refuted these allegations, attributing the naira’s depreciation to “complex factors” that […]

Source link

Presidential

After Donald Trump’s decisive win in the Iowa caucus and two opponents dropping out and endorsing him – Vivek Ramaswamy and Ron Desantis – it’s becoming clear who the Republican nominee will be. All the while, two stocks have seen strong rallies on Trump’s chances to make his return to the White House, and they could continue higher following the New Hampshire primary, where Trump is the hands-down favorite.

Let’s take a look at each.

Digital World Acquisition Corp.

Digital World Acquisition Corp. (NASDAQ:DWAC) is a special purpose acquisition corporation (SPAC) that is trying to merge with the former president’s Trump Media & Technology Group, which is behind the Truth Social app.

Digital World’s stock has surged over 175% since Trump’s win in Iowa, including a rally of over 88% yesterday. While the valuation of the combined company may be getting a bit rich, there’s no telling where traders could take it going forward, especially if the merger with Truth Social closes.

Don’t Miss:

Rumble Inc.

Rumble Inc. (NASDAQ:RUM) is an online video-sharing platform that has set itself apart from competitors by allowing people to share anything that they believe in without the fear of being restricted or taken down. This has resonated well with conservative voices who said they were removed or shadow-banned on other platforms.

Rumble’s stock has surged more than 60% since Trump’s win in Iowa, including a rally of more than 15% at the start of trading today. Yesterday’s rally of more than 36% was helped by announcement of a partnership with Barstool Sports.

Read Next:

Image Credit: Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 2 Stocks Surging on Donald Trump’s Presidential Bid originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Another pro-crypto presidential candidate suspends campaign for office

Pro-crypto presidential hopeful Vivek Ramaswamy has suspended his campaign for office on Jan. 16.

In a post on the social media platform X (formerly Twitter), Ramaswamy revealed he was suspending his campaign to support former President Donald Trump’s bid to return to the Oval Office, saying:

” I am suspending my campaign and endorsing Donald J. Trump and will do everything I can to make sure he is the next U.S. President.”

According to recent polling data, President Trump is the top GOP candidate for the Oval Office. Despite his previous anti-crypto rhetoric, the former president has introduced several non-fungible tokens (NFTs) projects whose value has been impacted by his actions.

Meanwhile, Ramaswamy is not the only pro-crypto candidate to suspend his campaign for office. In August last year, the Mayor of Miami, Francis Suarez, suspended his campaign for the Presidential seat.

Ramaswamy’s pro-crypto moves

Ramaswamy emerged as a notable figure in the crypto community during his campaign due to his pro-crypto tendencies.

Notably, he is a staunch critic of the U.S. Securities and Exchange Commission’s (SEC) regulation by enforcement approach. Ramaswamy contends that the actions of the SEC often exceed reasonable bounds, needing the court to act as the primary defender against these perceived rogue behavior.

Additionally, Ramaswamy unveiled a comprehensive crypto policy framework designed to reshape the country’s regulatory landscape. Central to his plan was the cessation of the SEC’s regulation by enforcement strategy, coupled with a commitment to safeguarding developers’ code as a form of expression under the protection of the First Amendment.

Ramaswamy argued that his crypto policy would not only pave the way for a dynamic future in the industry but also provide economic freedom for Americans seeking an alternative financial system.

The post Another pro-crypto presidential candidate suspends campaign for office appeared first on CryptoSlate.

Goldman Sachs Says Utilities and Consumer Staples Stocks Are Set to Outperform as the Presidential Election Approaches — Here Are 2 Names the Banking Giant Likes

Almost exactly a year from now, Americans will cast their ballots and vote for a President, doing so for the 60th time since 1788. The election process will kick off in earnest on January 15th when the Iowa Republican caucuses mark the official commencement of primary season.

Right on time, says Goldman Sachs’ Chief U.S. Equity Strategist David Kostin, investors have started asking how the 2024 election will impact the stock market.

Going by the history books, it’s not going to be a vintage year. In the 12 months heading into an election, since 1932, the S&P 500 has averaged a return of 7%, below the 9% average return seen in non-election years. In fact, recent performance has been even worse; since 1984, the S&P 500 has posted an average return of only 4% in the preceding 12 months of an election.

So, what should investors specifically focus on during the next year? “Profit growth is typically strong in election years while valuations move sideways,” Kostin noted. “Info Tech has usually been the worst performing sector in the year ahead of the election. Defensive sectors tend to perform best, led by Utilities and Consumer Staples.”

Against this backdrop, Goldman Sachs analysts have pinpointed two stocks in these defensive sectors worth examining closely. We’ve decided to give them a closer look and for a fuller view of their prospects we ran them through the TipRanks database. Here’s what we found.

Don’t miss

Sempra (SRE)

Starting with the Utilities sector, we’ll explore Sempra, an energy infrastructure company that ranks among the largest regulated providers of electricity and natural gas services in the United States. Sempra primarily serves approximately 40 million customers in Southern California and Texas.

The company’s operations are organized into distinct segments, which include San Diego Gas and Electric Company (SDG&E), Southern California Gas Company (SoCalGas), Sempra Texas Utilities, Sempra Mexico, and Sempra LNG. By the numbers, at the end of 2022, the company boasted of $79 billion in total assets while Sempra oversees a 20,000-strong workforce spread across its family of businesses.

The company only recently released its Q3 earnings report, showing mixed results. On the one hand, revenue fell by 8% year-over-year to $3.33 billion, while missing the Street’s forecast by $350 million. However, Sempra fared much better at the other end of the equation, with Q3 adj. earnings rising from $622 million in the year-ago period, or 0.98 per diluted share, to $685 million, or $1.08 per diluted share, thereby outpacing analyst expectations by $0.07.

On the back of the strong performance seen during the first 9 months of the year, for the full year, the company now expects adj. earnings to come in above or at the high-end of its guided range of $4.30 to $4.60 vs. Street expectations of $4.49.

Scanning these results, Goldman Sachs analyst Carly Davenport finds plenty to like about the latest display whilst noting the catalysts ahead.

“This quarter increased our conviction that SRE’s Texas utility Oncor is a material strength for the company. The reduction of regulatory lag, potential increase in capex, and a clear runway for organic load growth in the region all highlight why we have viewed Oncor as an underappreciated asset for SRE. We believe SRE has several key catalysts ahead, including the aforementioned capex raise, the conclusion of the California GRC (general rate case), and the announcement of FID for the Cameron expansion and Port Arthur Phase 2 in 2024. SRE continues to trade at a 0.7x discount to our coverage group on our 2025 numbers, which we view as unwarranted given these strengths,” Davenport opined.

These comments underpin Davenport’s Buy rating while her $89 price target suggests shares will climb 24% higher in the months ahead. (To watch Davenport’s track record, click here)

Overall, the analyst consensus rates SRE shares a Moderate Buy based on a mix of 6 Buys and 4 Holds. The forecast calls for one-year returns of 11%, considering the average target stands at $80.56. The company also pays a regular dividend. The latest div payout reached $0.59 per share, providing a ~3.25% yield.

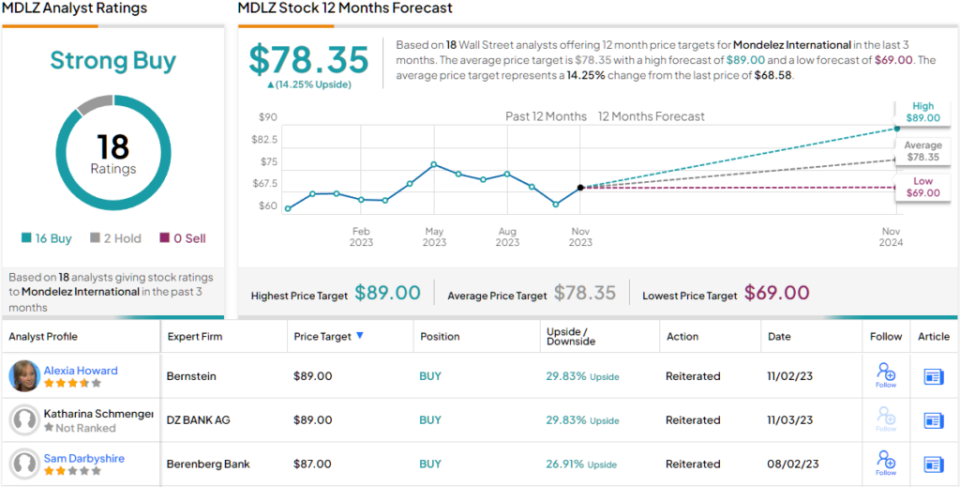

Mondelez International (MDLZ)

Let’s now turn to the Consumer Staples sector and check the details on global snack powerhouse Mondelez International. The company was created in 2012 when spun off from Kraft Foods and boasts a diverse range of iconic products, including Oreos, Cadbury, Toblerone, Ritz, and Trident, to name just a few. With a presence in more than 150 countries, Mondelez is one of the world’s biggest snack companies, claiming first global spot in biscuits (cookies and crackers) ands second in chocolate.

Last year, global net revenues reached around $31.5 billion, and the company appears on track to exceed that figure this year. In fact, in the recently released Q3 report, despite substantial reinvestment endeavors, the company bettered expectations on several fronts. Revenue reached $9.03 billion, representing a 16.4% YoY increase while beating the consensus estimate by $220 million. On the bottom-line, adj. EPS of $0.82 outdid the forecast by $0.04.

And looking ahead, the company delivered, too. Mondelez increased its FY23 organic net sales growth outlook from 12%+ beforehand to +14-15% vs. the consensus estimate of +13.8% and boosted the adj. EPS growth outlook to ~16% compared to the prior 12%.

Goldman Sachs analyst Jason English expects that strong performance to persist. “We continue to believe the company is well positioned to see widening fundamental outperformance versus Staples peers,” English said. “It is aggressively investing in both marketing and commercial activation with a long runway of distribution growth still ahead of it in markets such as Mexico, Brazil, China, India and other Southeast Asian markets. We expect this to sustain its momentum in the foreseeable future and reiterate our Buy rating in this context.”

That Buy rating is accompanied by an $82 price target, which makes room for one-year growth of 20%. (To watch English’s track record, click here)

Overall, Mondelez gets plenty of support on Wall Street. The stock claims a Strong Buy consensus rating, based on 16 Buys vs. just 2 Holds. Over the next year, shares are expected to appreciate by 14%, considering the average target stands at $78.35. Investors can also enjoy a dividend here. The latest payout stood at $0.42/share, and that offers a yield of ~2.45%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Argentine presidential candidate wants CBDCs to ‘solve’ hyperinflation

Argentine presidential candidate Sergio Massa has pledged to launch a central bank digital currency (CBDC) if elected to “solve” Argentina’s long-lasting inflation crisis.

“I am clear that inflation is a huge problem in Argentina,” the country’s second-leading candidate said in an Oct. 2 presidential debate before outlining how he plans to solve the country’s devastating inflation:

“We are going to launch the digital currency in Argentina. […] We are going to do it globally for all of Argentina accompanied by a laundering law that allows those who have money abroad to bring it and use it freely without new taxes in parallel.”

Massa, who currently serves as the Minister of Economy, shut down the idea that Argentina should move to the United States dollar:

“Dollarization is what generates the temptation of the dollar. Be patriots [and] defend our currency, do not promote the use of it [the U.S. dollar],” he said.

Argentina’s general election will take place on Oct. 22.

Two of three major voting polls suggest Massa is ever so slightly trailing Javier Milei, a pro-Bitcoin (BTC) and anti-central bank candidate who won Argentina’s primary election in August.

Data from American think tank AS/COA suggests that Massa will likely receive the most support in the Buenos Aires province — home to 16.6 million of the country’s 46 million residents — while Milei has majority backing in the more rural parts of the country.

Milei has previously signaled wanting to adopt the United States dollar as Argentina’s currency. As an economist and libertarian, Milei has long been a skeptic of central banking. Part of his campaign promise is to abolish Argentina’s central bank.

Milei previously referred to Bitcoin as a reaction against “central bank scammers” and said that the Argentine peso allows politicians to scam Argentines with inflation.

Related: Argentines turn to Bitcoin amid inflation worries: Report

Argentina’s third-leading presidential candidate, Patricia Bullrich, would reportedly pursue a currency regime where the Argentine peso and U.S. dollar co-exist as legal tender if she wins the election.

The Argentine peso has fallen over 99% against the U.S. dollar since December 2003.

Most data suggests Argentina’s inflation is the third highest globally, only trailing Venezuela and Lebanon.

Magazine: Should you ‘orange pill’ children? The case for Bitcoin kids books

Pro-Bitcoin U.S. presidential candidate Francis Suarez suspends campaign

Francis Suarez, the pro-Bitcoin (BTC) Mayor of Miami, suspended his campaign for the Presidential seat on Aug. 29, according to a post on his official X account. He wrote:

“I have decided to suspend my campaign for President, [however] my commitment to making this a better nation for every American remains.”

While noting that running for the president’s seat was one of the greatest honors of his life, Suarez promised to keep in touch with other Republican presidential candidates and support any strong nominee his party puts forward.

Meanwhile, Suarez’s statement did not specify the reason for his withdrawals. However, media reports have suggested that his decision was linked to his campaign’s inability to secure a spot in the initial GOP primary debate.

Bitcoin support

Considering his pro-crypto history, Suarez’s short campaign for office had drawn interest from the cryptocurrency community. The Mayor was one of the three Republican candidates believed to support the emerging industry.

Suarez was one of the first U.S. politicians to take a salary in Bitcoin and also led Miami’s development of the MiamiCoin(MIA), the city’s native cryptocurrency, which seeks to fund municipal projects by generating additional yields.

In June, Mayor Suarez revealed that his campaign was receiving donations in the flagship digital asset from his supporters. As of press time, his website showed it was still accepting donations in several cryptocurrencies.

The Mayor’s campaign team has yet to respond to CryptoSlate’s request for comment on how much they raised via crypto donations.

Meanwhile, the former presidential aspirant has also expressed strong displeasure towards central bank digital currencies (CBDCs). Suarez had said he would ban these currencies because they violated Americans’ privacy rights.

The post Pro-Bitcoin U.S. presidential candidate Francis Suarez suspends campaign appeared first on CryptoSlate.

Bitcoin-Friendly Javier Milei Wins Presidential Primaries In Argentina

Argentine libertarian Presidential candidate and Bitcoin enthusiast Javier Milei has shocked the world by emerging victorious in Argentina’s recent primary elections. The pro-Bitcoin advocate scored the majority of the votes, making a stinging win during the Primaries on August 13.

Javier Milei Demolishes Electoral Competition

Javier Milei, an outspoken Argentine economist, is known for his sharp criticism of traditional politics and his fervent support of cryptocurrencies, including Bitcoin. Due to this, previous poll predictions had stated that Milei would score no higher than third place in the recent elections.

However, Milei decimated the August elections with a stunning display of voter support, accumulating over 30% of the 90% of votes counted. Milei leads the libertarian party, “La Libertad Avanza” and the party is dominating with 32% of votes.

In comparison, Argentine presidential candidates like Patricia Bullrich in “Juntos por el Cambio” (Together for Change) party received 28.14% votes, and Sergio Massa in “Unidos por la Patria” (Union for the Homeland) party received 26.84% votes.

From the onset, Milei has attracted the attention of the Argentine population through his outspoken support of cryptocurrency, lack of political interventions, and the abolishment of the country’s central bank.

Milei has stated that the country’s central banks should be destroyed to eliminate corrupt political authorities that influence the country’s economy and inflation rates. He has also said that Argentina’s adoption of bitcoin cryptocurrency would help create a more stable and accountable government, reducing government bureaucracy and improving the country’s declining economy.

“The central bank is a scam, a mechanism by which politicians cheat the good people with inflationary tax,” Milei stated.

BTC price recovers after brief dip | Source: BTCUSD on Tradingview.com

Argentina Grapples with Spiraling Economic Crisis

The daily reality of the Argentine country is filled with significant growth fluctuations, high inflation, and a deteriorating GDP. Argentina’s inflation is the third highest in the world, following Venezuela and Lebanon. Reports also state that the country faces one of the worst economic crises since the depression from 1998 to 2002.

Recently, Argentina has hit new record lows against the dollar weekly. Since the beginning of 2023, the Argentine peso has lost 24% in value against the dollar, resulting in black market rates selling one dollar for 500 pesos. Argentina is also in debt, owing the International Monetary Fund (IMF) an astonishing $44 billion.

Milei’s approach toward adopting cryptocurrency triggers several governmental agencies, including the IMF, which strongly opposes Bitcoin cryptocurrency. Milei’s manifesto includes plans to dollarize the country’s economy, which aims to stabilize the country’s native currency.

Argentina’s current economic crisis has also struck a nerve in Argentines, with many young citizens strongly supporting Milei’s views and commitment to free-market policies.

Although Milei’s victory in the primaries is a positive step forward toward the general elections coming up on October 22, his success is not without controversy, as critics publicly oppose his policies and views.

Milei’s win in the August primary election also does not guarantee a win in the general election. However, his victory has undoubtedly upended the country’s political system and sparked conversations about Argentina’s future.

Featured image from Merco Press, chart from Tradingview.com