Cryptocurrency exchange Coinbase says bitcoin dips are likely to be “more aggressively bought compared to previous cycles, even as volatility persists during price discovery.” The crypto firm noted that the impact of U.S. spot bitcoin exchange-traded funds (ETFs) and the larger inflow of institutional demand can be seen in the open interest of bitcoin futures. […]

Cryptocurrency exchange Coinbase says bitcoin dips are likely to be “more aggressively bought compared to previous cycles, even as volatility persists during price discovery.” The crypto firm noted that the impact of U.S. spot bitcoin exchange-traded funds (ETFs) and the larger inflow of institutional demand can be seen in the open interest of bitcoin futures. […]

Source link

previous

Bitcoin Technical Analysis: BTC Eyes Previous Zeniths With Renewed Vigor

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

Source link

How bitcoin’s upcoming halving differs from the crypto’s previous cycles

Bitcoin halvings have historically been viewed as a bullish event for the cryptocurrency — and the upcoming one, expected in April, could benefit from an even more ideal setup than in previous cycles, according to crypto-market observers.

Halving is a mechanism written into the Bitcoin blockchain’s algorithm to control the coin’s supply, which has a cap of 21 million. At halvings, the reward for bitcoin mining is cut in half, meaning miners will receive 50% fewer bitcoins for verifying transactions.

Halvings are scheduled to happen after every 210,000 blocks that are mined — or about every four years — until the maximum supply of bitcoin is all released.

Bitcoin

BTCUSD,

tends to see price appreciation in the months after halvings, according to historical data. The next halving is expected to happen on April 19, according to a projection by bitcoin investment platform Swan Bitcoin.

But this particular halving comes at the first time in bitcoin’s history where the cryptocurrency faces a confluence of factors impacting both its supply and demand side, according to Cosmo Jiang, portfolio manager at crypto asset manager Pantera Capital.

As halvings control bitcoin supply, bitcoin exchange-traded funds are bringing in “steady daily inflows” into the crypto from the demand side, Jiang said in a call. In January, the U.S. Securities Exchange and Commission approved 10 bitcoin ETFs for the first time in history.

Read: 5 ways bitcoin ETFs are already changing how crypto is traded

Increased institutional participation recently pushed bitcoin to a level near its record high, less than 50 days before the expected date of the halving. Bitcoin has rallied more than 40% so far this year to roughly $62,600, and is now less than 10% off of its all-time high of $68,990, reached in November 2021.

This run-up is different from bitcoin’s historical pattern before halving, according to Martin Leinweber, digital-asset product strategist at MarketVector Indexes. Historically, bitcoin’s performance has been relatively muted in the two to three months before halving, Leinweber noted.

Meanwhile, the Bitcoin blockchain is more secure now than it has been during previous halvings, according to Adam Swick, chief growth officer at bitcoin-mining company Marathon Digital Holdings Inc.

MARA,

Bitcoin’s total hash rate, or the total computational power securing the blockchain, hit a record high of around 600 million terahashes per second in February, according to data from Blockchain.com.

That helps alleviate some concerns around the security of the Bitcoin blockchain after the halving, as some miners may be forced to go offline when the rewards they get are cut in half, noted Swick.

While halving is generally a boon for bitcoin’s value, the crypto’s price tends to be highly volatile while macroeconomic conditions are uncertain. That may apply in the current climate, as some investors are worried that progress in disinflation may stall, while it remains unclear when the Federal Reserve will start cutting interest rates.

Michael Novogratz, chief executive at crypto investment firm Galaxy Investment Partners, recently told Bloomberg TV that bitcoin may see “some corrections” to its price before rallying to new record highs.

February’s Bitcoin ETP net inflows close to total of previous three months

Quick Take

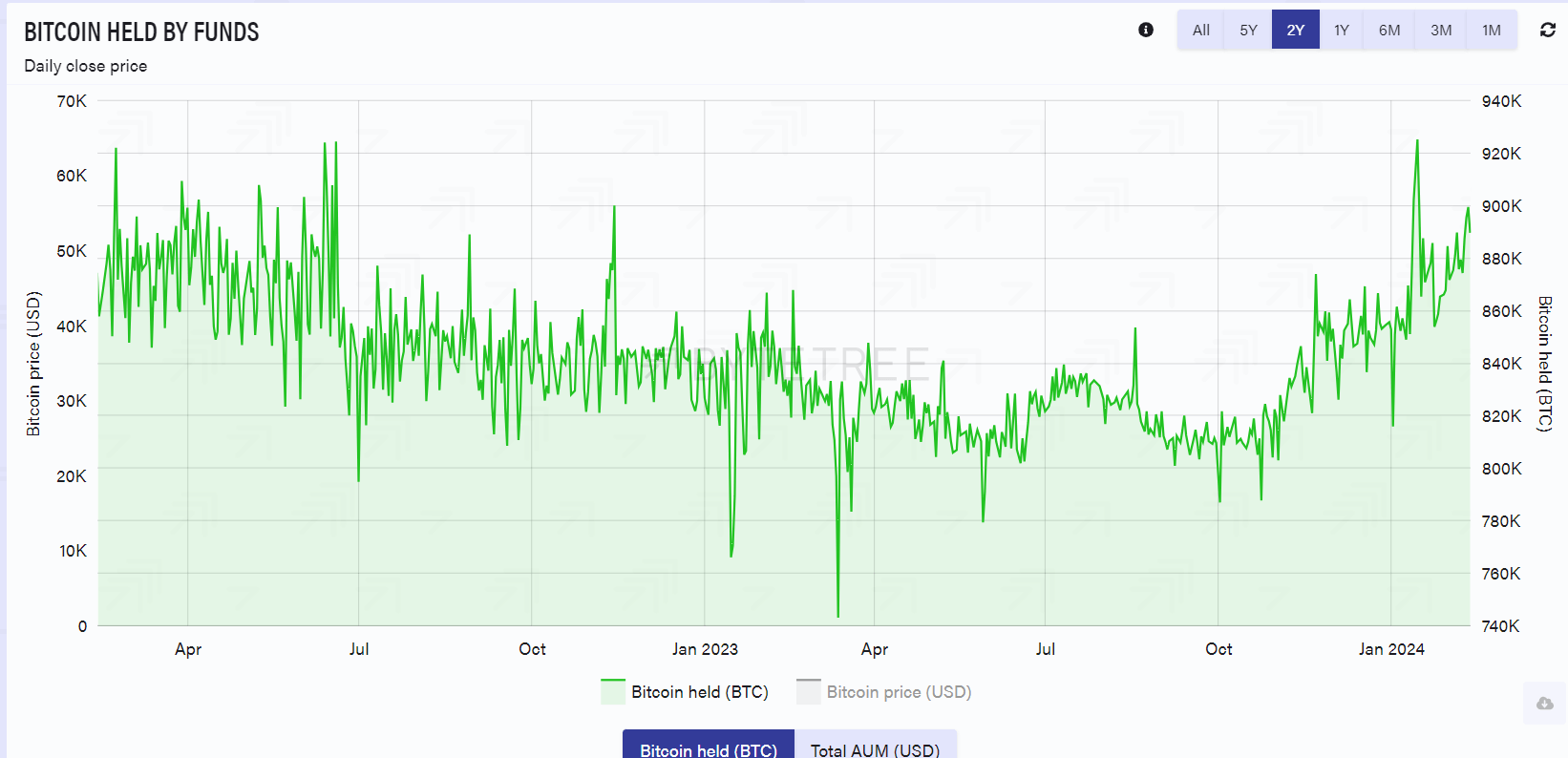

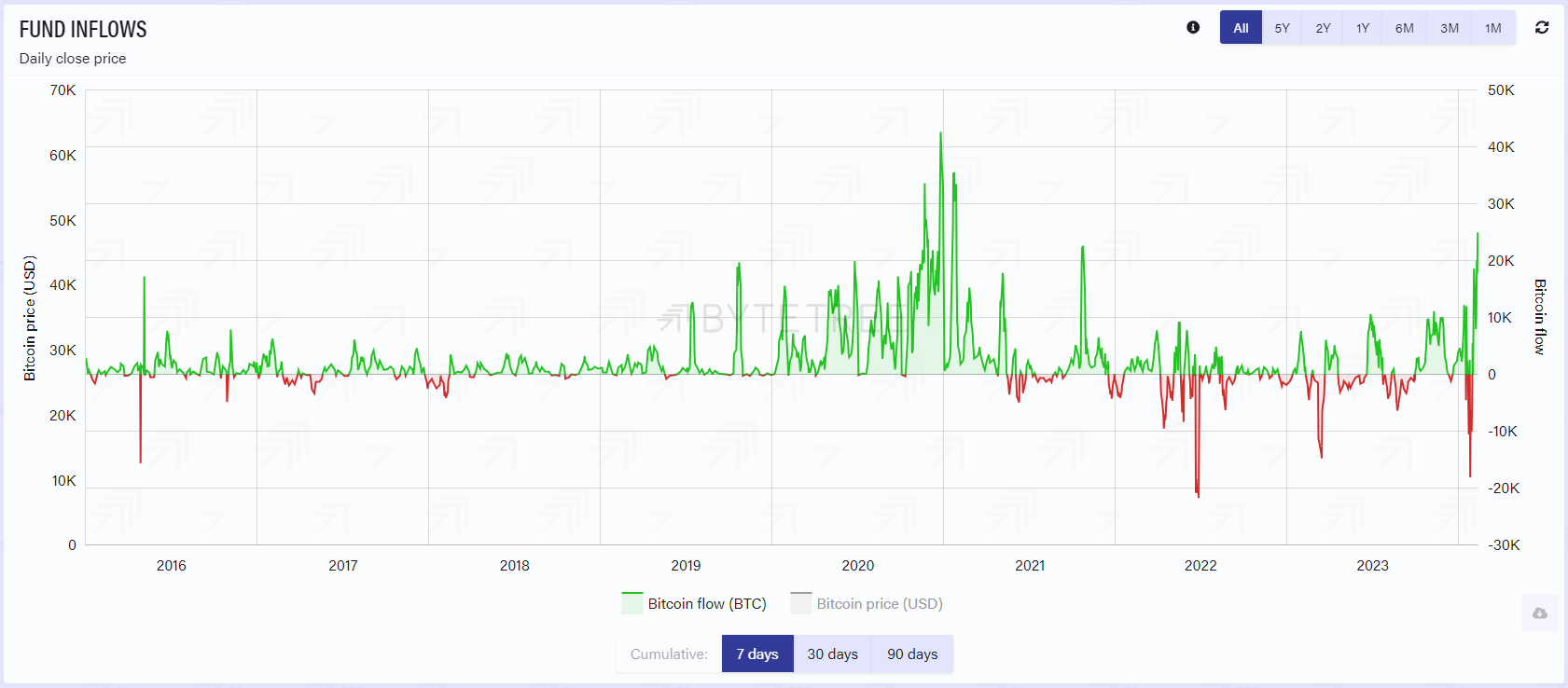

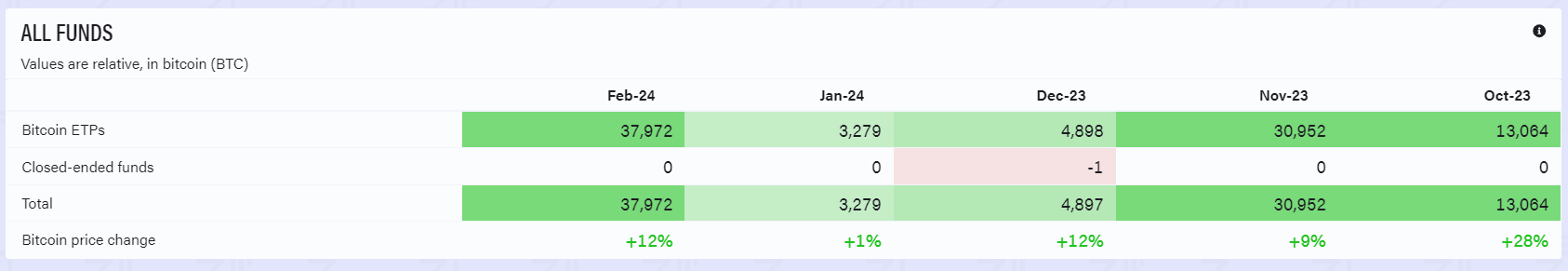

ByteTree has reported a massive influx in the global allocation of Bitcoin among exchange-traded products (ETPs) since October 2023, adding roughly 100,000 BTC.

According to ByteTree data, approximately 890,000 BTC are currently held in varying ETPs worldwide, which is about 4.56% of the circulating supply of Bitcoin. Interestingly, the start of 2024 has seen an increase of about 80,000 BTC in the ETP space, primarily attributed to US-based Bitcoin ETFs.

Within the last seven days alone, global Bitcoin ETPs underwent an influx of roughly 25,000 BTC, marking the most significant weekly increase since the early part of 2021.

February alone contributed an impressive 38,000 BTC net inflow into ETPs, roughly equal to the combined flow for November, December, and January.

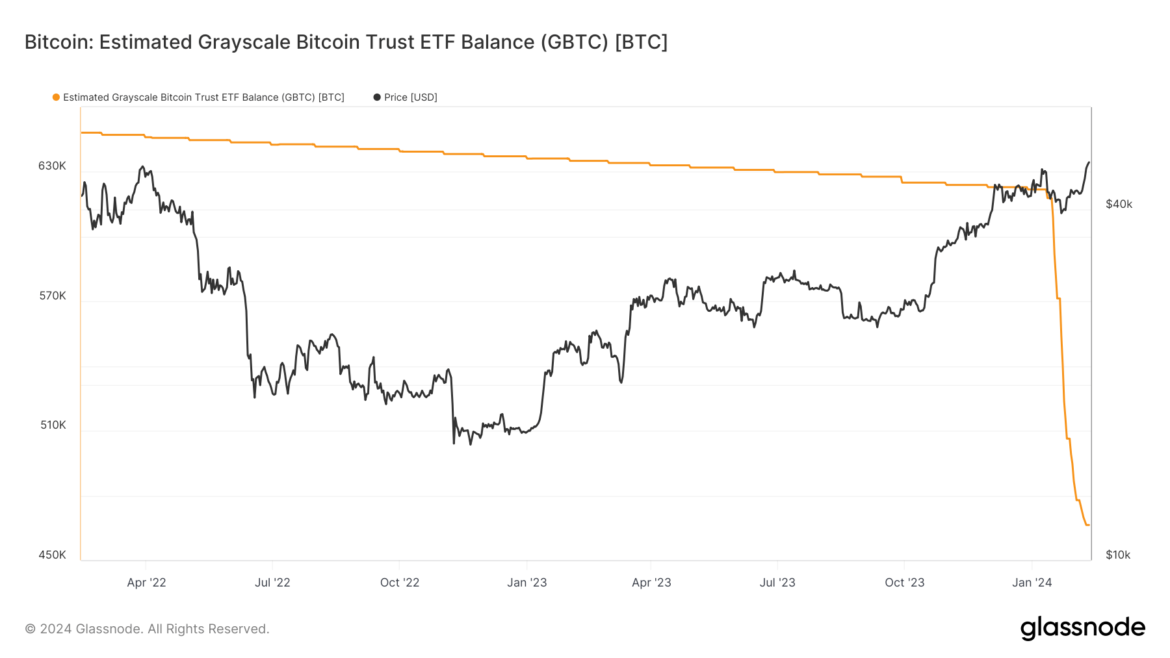

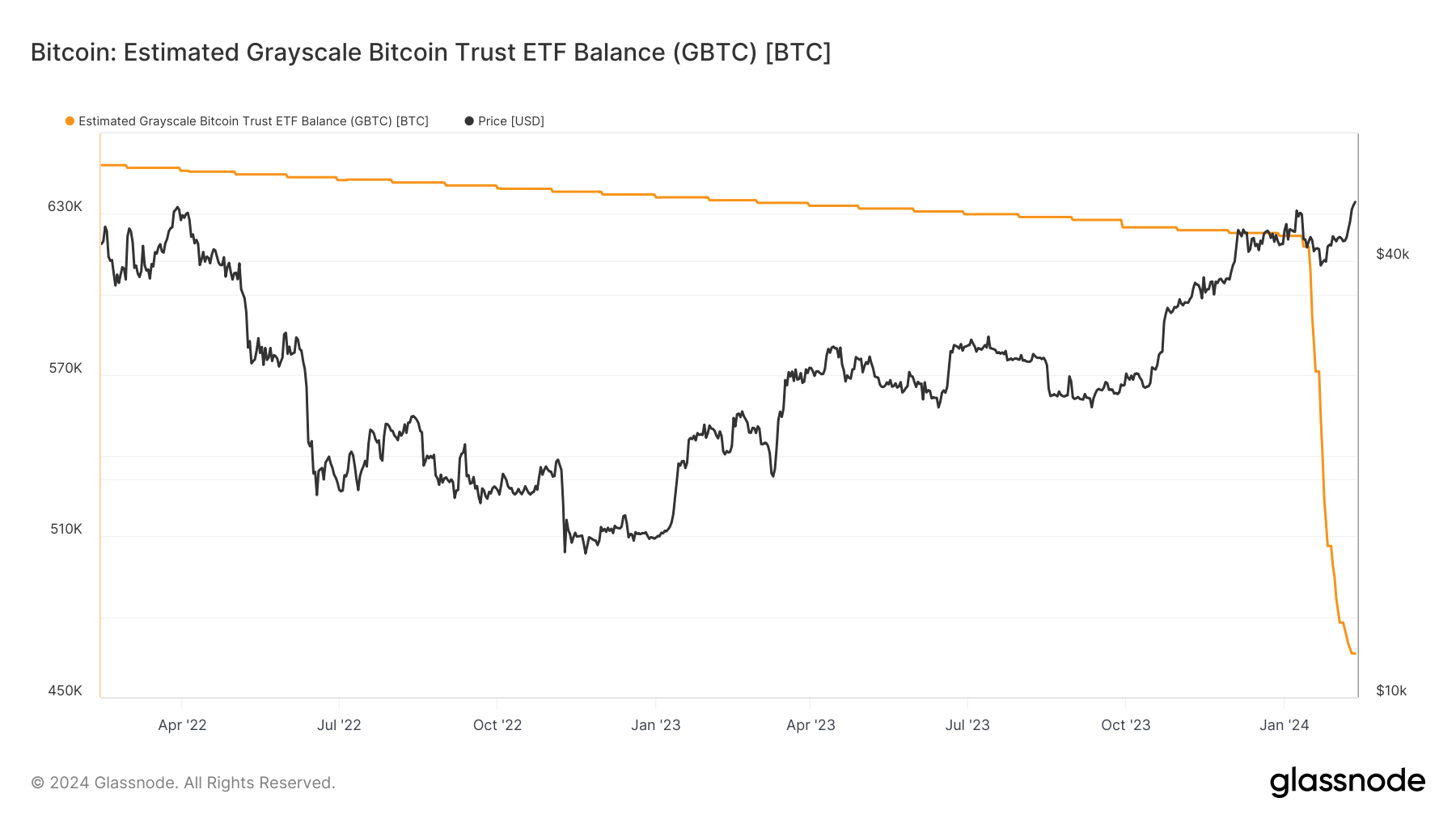

Glassnode data reports that Grayscale Bitcoin Trust (GBTC) currently holds approximately 466,000 Bitcoin, a significant 30% decline from its peak holdings of about 622,000 Bitcoin before Bitcoin ETFs began trading.

The post February’s Bitcoin ETP net inflows close to total of previous three months appeared first on CryptoSlate.

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

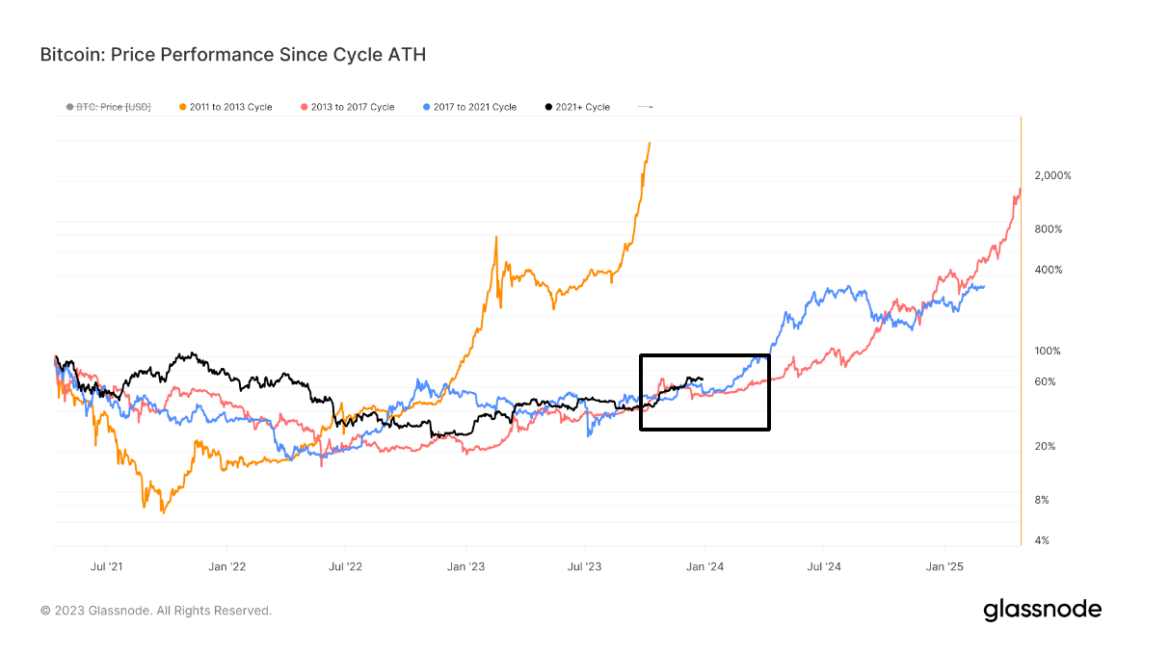

Current Bitcoin cycle outpaces previous market trends while cautiously eyeing historical retracement risks

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

File-sharing protocol LBRY, once vanquished by the SEC, files to appeal previous rulings

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.