“When one friend made a fuss over wanting to fly business class, I threatened to cancel completely.”

Source link

prices

South Korea’s Crypto Market Continues to Defy Global Trends With Premium Prices

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Source link

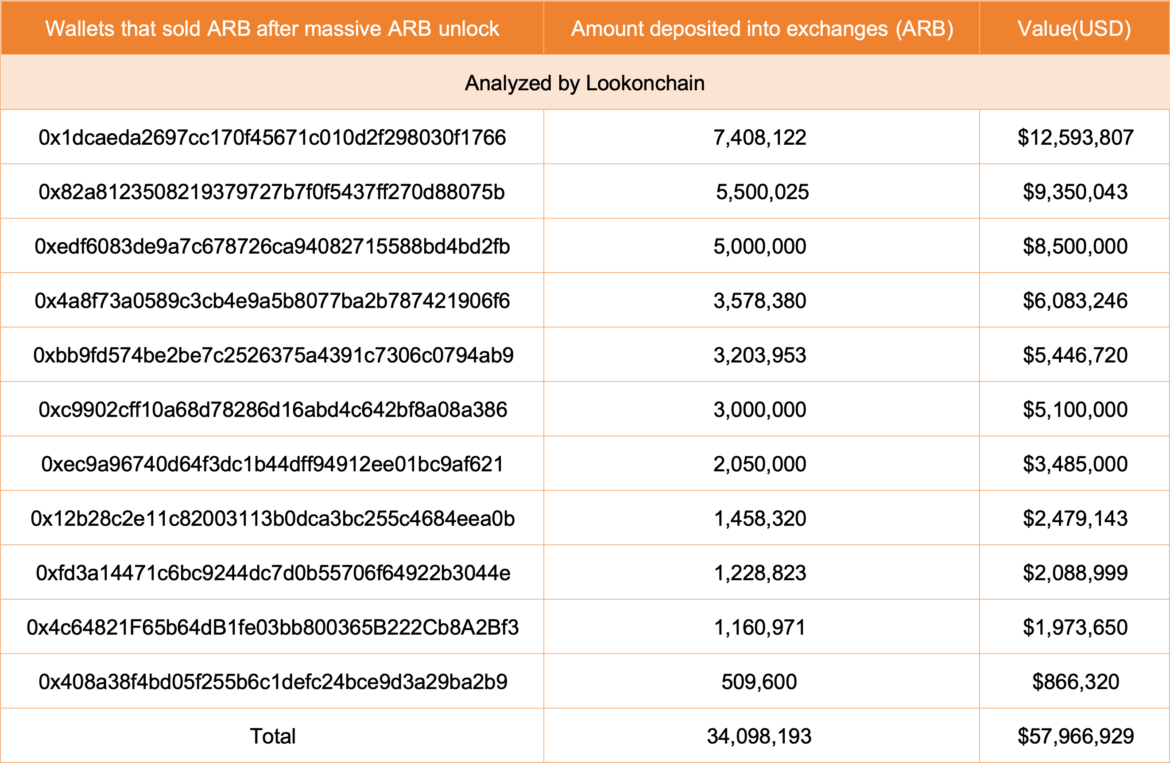

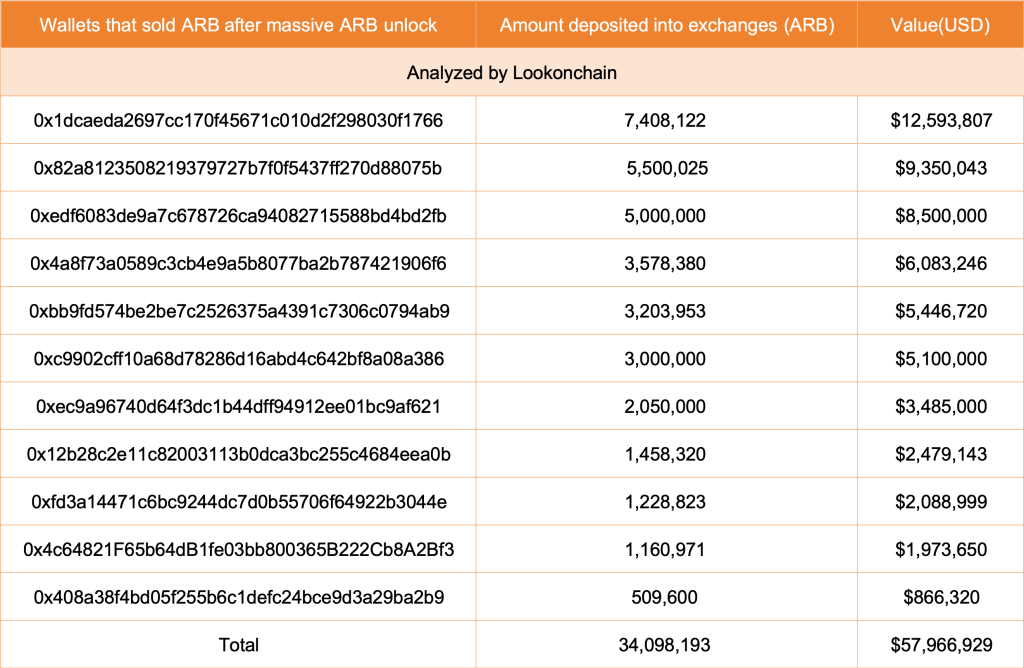

While the recent unlocking of ARB triggered fears of a sell-off, Lookonchain data suggests a different story. On March 18, the analytics platform showed that a mere 58 million ARB, representing only a tiny portion of the 1.1 billion tokens unlocked on March 16, were sent to exchanges by just 11 large-scale investors, commonly called “whales.”

Are Whales Bullish On ARB?

This transfer indicates that despite some profit-taking, other whales are HODLing on to their ARB, reflecting continued confidence in the project’s future.

On March 16, Arbitrum sent 1.1 billion ARB to investors, team members, and advisors in a “Cliff Unlock.” Analysts describe a “Cliff Unlock” as a situation in which all allocated tokens for that event are released simultaneously.

Arbitrum chose to release all tokens at once. 673.5 million were sent to advisors and the team. Meanwhile, the remainder, 438.25 million, was sent to investors. The unlocking event, as expected, was a source of concern that some receivers would choose to sell in the secondary market.

As expected, ARB prices have decreased, reflecting the general sentiment across the crypto market board. So far, ARB is down 24% from March 2024 highs. However, what’s clear is that the uptrend remains, and buyers remain in charge despite the selling pressure.

Based purely on price action, ARB bulls have a chance if prices are above the $1.6 to $1.65 support zone. Conversely, any upswing above this level might drive prices to the upper end of the range at around $2.20. Further upswings will continue the sharp expansion from October 2023. At the time of writing, ARB is up 125% from Q4 2023 lows.

Arbitrum To Benefit From Dencun, Cementing Its Layer-2 Dominance

Lookonchain data shows that only a few tokens were sent to exchanges less than a week after the unlocking event, suggesting investors and whales are bullish about the project.

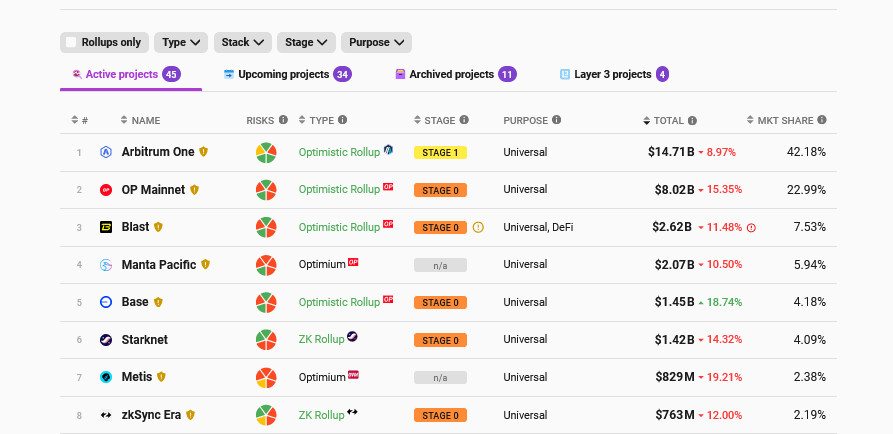

L2Beat data shows that Arbitrum, a layer-2 scaling solution for Ethereum, is the largest in that category by total value locked (TVL). By March 18, Arbitrum managed $14.7 billion worth of assets, nearly 2X that of Optimism.

While ARB is under pressure, the broader Ethereum and crypto community remains bullish. Last week, the “Dencun” update was released to the mainnet.

This update is significant as it further slashes transaction fees, making layer-2s, including Arbitrum, more attractive for users. This upgrade is especially appealing to developers and users seeking to enjoy the high on-chain activity on Ethereum without struggling with high gas fees and low scalability. As Layer-2 solutions find adoption, Arbitrum could benefit from this influx.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Speculation Rises on Whether Bitcoin’s Halving Is Reflected in Current Prices

Bitcoin has witnessed new highs in its price lately, with the premier cryptocurrency experiencing an over 60% increase since the beginning of the year. Meanwhile, the crypto community is abuzz with debates on whether the impending halving event is already reflected in the price. There’s a prevailing suspicion that despite bitcoin’s climb against the U.S. […]

Bitcoin has witnessed new highs in its price lately, with the premier cryptocurrency experiencing an over 60% increase since the beginning of the year. Meanwhile, the crypto community is abuzz with debates on whether the impending halving event is already reflected in the price. There’s a prevailing suspicion that despite bitcoin’s climb against the U.S. […]

Source link

California is home to some of the highest gas prices in the United States, according to AAA.

The national average for a gallon of regular unleaded was $3.40 as of Thursday, according to the organization’s data. In California, the average was $4.87, more than any other state.

Several factors go into what drivers pay for gas, including refining costs, taxes, distribution and marketing, and crude oil prices, according to the U.S. Energy Information Administration.

High taxes are partly to blame in California. The state has the highest gasoline taxes in the nation, according to EIA.

But there’s more to the story.

An isolated market and a special fuel blend

California requires a special blend of gasoline that reduces pollution — and costs more money.

“California also has seen a drop of 66% in the amount of refineries in operation from where we were 40 years ago,” said Patrick De Haan, head of petroleum analysis for GasBuddy. “So there are fewer refineries producing this special blend of gasoline.”

More from Personal Finance:

Many think pensions key to achieving American Dream

How to avoid unexpected fees with payment apps

‘Ghosting’ gets more common in the job market

California has an isolated refinery market. The special fuel blend that is consumed in California is produced by 11 major refineries within the state, according to the California Energy Commission.

“Not many other states use the same blend of fuel, which limits California’s supply when there’s an outage, when there’s an issue at one of our refineries,” Anlleyn Venegas, a senior public affairs specialist at AAA, told CNBC.

The isolated market means that any outages will lead to volatility in prices at the pump.

“Part of the reason why prices have been so high is that California has really restricted the ability for refineries to expand and grow,” said De Haan. “California has been rather hostile to refinery expansions or oil industry investments, trying to push them away and transition California to more electric vehicles.”

California plans to ban the sale of new gas-powered cars by 2035 as it transitions to cleaner vehicles. A quarter of new cars sold in California in 2023 were zero-emission vehicles, according to the California Energy Commission.

“The high price of gasoline does encourage more EV adoption,” De Haan said. “Americans getting hit with $5 and $6 [per] gallon prices in California is likely accelerating the shift away.”

In 2023, California Gov. Gavin Newsom signed a new law to combat alleged price gouging at the pump. The law aims to increase transparency in the oil and gas industry and created an independent watchdog called the Division of Petroleum Market Oversight.

“There hasn’t really been much impact,” De Haan said. “But I do believe that in the months ahead, there probably will be more … talk on this subject.”

Driving behaviors, smart shopping can cut fuel costs

Families are spending thousands of dollars on gasoline each year. In 2022, the average annual spending per consumer unit on gasoline and other fuels was $3,120, according to the Bureau of Labor Statistics. That tally was up 45.3% from 2021, as more people resumed commuting after the pandemic and fuel prices rose.

“Adopting new and improved driving behaviors can contribute to significant savings,” Venegas said.

For drivers who aren’t going electric, here are a few ways to save on gas, according to AAA:

- Plan your route before you go

Watch the video above to learn more about what is driving gas prices higher and what drivers can do about it.