Nicholas Mui, 22, from Grand Haven, Michigan, has pleaded guilty in the 17th Circuit Court in Kent County to conducting a criminal enterprise, involving the theft and sale of Mperks account access information. Mui is required to forfeit his computer tower and approximately $630,000 in frozen cryptocurrency and cash. He compromised Mperks, a loyalty program […]

Nicholas Mui, 22, from Grand Haven, Michigan, has pleaded guilty in the 17th Circuit Court in Kent County to conducting a criminal enterprise, involving the theft and sale of Mperks account access information. Mui is required to forfeit his computer tower and approximately $630,000 in frozen cryptocurrency and cash. He compromised Mperks, a loyalty program […]

Source link

Program

TON Society Reveals Biometric Proof-of-Personhood Palm Scanning Program

TON Society announced a proof-of-personhood program targeting Telegram users, who can voluntarily scan their palms in exchange for benefits. The organization allocated 1 million TON for this initiative, distributed among 500 million participants in the next 5 years after completing their palm verification using Humancode’s artificial intelligence (AI) biometric tech. TON Society Announces Digital Identification […]

TON Society announced a proof-of-personhood program targeting Telegram users, who can voluntarily scan their palms in exchange for benefits. The organization allocated 1 million TON for this initiative, distributed among 500 million participants in the next 5 years after completing their palm verification using Humancode’s artificial intelligence (AI) biometric tech. TON Society Announces Digital Identification […]

Source link

The smart contracts platform Avalanche recently said it is collaborating with the Chinese payments giant Alipay to launch a Web3-enabled voucher program. The second phase will see the proof of concept being expanded to more than 100 million users from Southeast Asian countries. Web3-Enabled Vouchers Avalanche, a smart contracts platform, has said it is working […]

The smart contracts platform Avalanche recently said it is collaborating with the Chinese payments giant Alipay to launch a Web3-enabled voucher program. The second phase will see the proof of concept being expanded to more than 100 million users from Southeast Asian countries. Web3-Enabled Vouchers Avalanche, a smart contracts platform, has said it is working […]

Source link

Genesis and Gemini’s Earn program closure leads to $2 billion settlement offer for affected users

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Starbucks has said it will discontinue its Odyssey non-fungible token beta program and members “have until March 25, 2024, to complete any remaining journeys.” Starbucks stated on its FAQ page that it will keep its NFT community in mind and is working to find a place for its members to connect in the future. Starbucks […]

Starbucks has said it will discontinue its Odyssey non-fungible token beta program and members “have until March 25, 2024, to complete any remaining journeys.” Starbucks stated on its FAQ page that it will keep its NFT community in mind and is working to find a place for its members to connect in the future. Starbucks […]

Source link

Court upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program

A federal court denied crypto exchange Gemini and Genesis Global Capital’s joint motion to dismiss the SEC’s case regarding their defunct Gemini Earn program, according to a March 13 filing.

The court also denied the companies’ motion to strike the regulator’s requests for permanent injunctive relief and disgorgement.

The court found that the SEC’s complaint “plausibly alleges” that the companies offered and sold securities via Gemini Earn under the Howey and Reves test.

Howey test applied

One prong of the Howey test concerns Gemini Earn’s status as an investment contract. The court determined that the SEC sufficiently alleged common enterprise and horizontal commonality, the latter of which involves tying investor fortunes together through the pooling of assets.

The companies previously argued that Earn’s market rate-based payouts and customers’ ability to exit the agreement at any time ruled out common enterprise and horizontal commonality.

They also argued that the individual treatment of customers and a lack of “skin in the game” among customers did not satisfy that part of the test. However, the court determined that the two firms’ counterarguments were “not persuasive.”

The fact that Gemini Earn agreements stated that loans are intended to act as commercial loans rather than securities does not necessarily make this an economic reality under the test, the court said.

Additionally, the court determined that the SEC had sufficiently proven that Earn investors had expectations of profits via their investments.

The judge denied the companies’ assertion that profits did not directly depend on Genesis’ efforts and its use of borrowed crypto funds because Genesis had advertised the program as an investment with high interest rate yields.

Reves test supports SEC

Under the SEC’s separate Reves test, Genesis failed to challenge the presumption that every note is a security.

According to the filing, Gemini and Genesis’ counterarguments were “in tension with the broad scope of the securities laws” in this area.

This conclusion was based on the motivations of both Genesis and the investors, which were oriented towards investment rather than commercial purposes, with Genesis seeking to generate revenue through lending and investors drawn by the promise of high interest rates.

The wide distribution of the agreements to a broad public segment, coupled with the investors’ reasonable expectations of earning profits from their participation, further supported this classification.

Additionally, the absence of alternative regulatory schemes or other risk-reducing factors solidified the court’s determination that the Gemini Earn agreements, as offered and sold through the Gemini Earn program, constitute securities under the Reves test.

Mentioned in this article

Latest Alpha Market Report

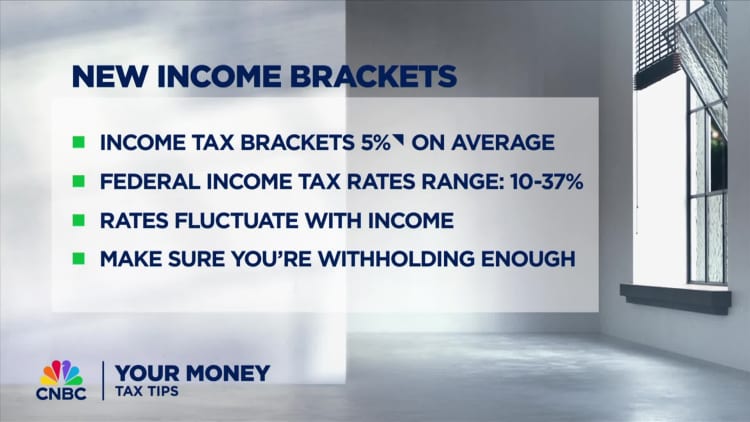

After weeks of testing with roughly 1,500 returns, Direct File, a free tax filing program from the IRS, is now fully open in 12 pilot states, according to the U.S. Department of the Treasury.

While the pilot focuses on “simple tax situations,” the Treasury estimates the pilot could cover about one-third of tax situations for 19 million taxpayers. The Spanish language version opens later on Tuesday at 1 p.m. ET.

“Dozens of countries have provided free tax options to their citizens for years,” Deputy Secretary of the Treasury Wally Adeyemo said during a press call on Monday. “American taxpayers who want to file their taxes for free directly with the IRS should have that option.”

More from Personal Finance:

Trump vs. Biden: What a presidential election rematch could mean for your taxes

Tax pros brace for ‘tidal wave’ of crypto tax scrutiny from the IRS. What investors need to know

IRS targets wealthy ‘non-filers’ with new wave of compliance letters

Treasury officials hope at least 100,000 taxpayers will participate in the Direct File pilot for 2023 filings as the agency makes future decisions about the program, Adeyemo said.

Within five years, the program could save the average filer $160 per year, or a collective $11 billion annually including tax prep fees and time, according to a report from the Economic Security Project released Monday.

IRS Direct File pilot states

The IRS Direct File pilot states include Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington and Wyoming. Alaska was originally included but is no longer part of the pilot.

The soft launch and limited rollout were intentionally designed to capture data to make improvements and decisions for the future, a senior administrative official said.

Direct File pilot doesn’t support state returns, but the software will guide users from Arizona, California, Massachusetts and New York to a state-supported tax-prep tool.

Direct File pilot open to limited filers

You may qualify for Direct File with a simple, straightforward return, with limited types of income, credits and deductions, according to IRS officials.

The pilot will only accept Form W-2 wages, Social Security retirement income, unemployment earnings and interest of $1,500 or less. This excludes filers with contract income reported via Form 1099-NEC, gig economy workers or self-employed filers.

To qualify, you must claim the standard deduction, which is $13,850 for single filers and $27,700 for married couples filing jointly for 2023.

Direct File only accepts a few credits: the earned income tax credit, child tax credit and credit for other dependents. The software also accepts deductions for student loan interest and educator expenses.

Scrutiny of IRS Direct File

The Direct File pilot launch comes amid pushback from the private tax filing industry. There has also been scrutiny from some Republicans who have questioned the agency’s authority to create the program.

When asked about Direct File during a House Ways and Means hearing in February, IRS Commissioner Danny Werfel said the agency has “a responsibility and an authority to offer taxpayers different approaches for how to meet their tax obligation.”

Taxpayers have several free filing options this season, including IRS Free File, Volunteer Income Tax Assistance, Tax Counseling for the Elderly and private company software.

Chainlink Staking Program Exceeds Expectations, Drives LINK Price Up By 12%

In a significant development for the blockchain data-oracle project, Chainlink (LINK) has witnessed a significant response to its enhanced crypto-staking program, amassing over $632 million worth of its LINK tokens within a remarkably short period.

The company announced a recent press release highlighting the “overwhelming demand” during the early-access period, which filled the staking limit in just six hours.

Chainlink Unveils Staking v0.2

Chainlink, recognized as the industry-standard decentralized computing platform, unveiled Chainlink Staking v0.2, the latest upgrade to the protocol’s native staking mechanism.

The Early Access phase has commenced, inviting eligible participants to stake up to 15,000 LINK tokens. This phase will last four days before transitioning into the General Access phase, enabling investors to stake up to 15,000 LINK tokens as long as the staking pool remains unfilled.

Per the announcement, the upgrade introduces an expanded pool size of 45,000,000 LINK tokens, equivalent to 8% of the current circulating supply. This enlargement aims to enhance the accessibility of Chainlink Staking, enabling a more diverse audience of LINK token holders to participate.

Staking forms an integral part of Chainlink Economics 2.0, which brings an additional layer of cryptoeconomic security to the Chainlink Network. Specifically, Chainlink Staking empowers ecosystem participants, including node operators and community members, to support the performance of Oracle services by staking LINK tokens and earning rewards for contributing to network security.

While v0.1 served as the initial phase of the Staking program, v0.2 has been restructured into a fully modular, extensible, and upgradable Staking platform. Building upon the lessons learned from the previous release, the v0.2 beta version focuses on several key objectives.

Chainlink is introducing several new features to enhance its staking program. These include a new unbinding mechanism that provides more flexibility for Community and Node Operator Stakers.

Additionally, security guarantees for Oracle services are being reinforced by slashing node operator stakes. A modular architecture is being adopted to support future improvements and additions, and a dynamic rewards mechanism is being introduced to seamlessly accommodate new external sources of rewards in the future, such as user fees.

Following the conclusion of the Early Access phase on December 11, 2023, the v0.2 staking pool will transition to General Access. At this stage, anyone will have the opportunity to stake up to 15,000 LINK tokens.

LINK Surges To New Yearly High

Given Chainlink’s successful upgrade, LINK, the native token of the decentralized computing platform, experienced a significant surge of 12%, reaching a price as high as $17.305.

This price level has not been seen since April 2022, signifying a new yearly high for the cryptocurrency. However, LINK has retraced slightly and is currently trading at $16.774.

Crypto analyst Ali Martinez has highlighted a critical support zone for Chainlink. Martinez noted that over 17,000 addresses purchased 47 million LINK tokens from $14.4 to $14.8.

This accumulation by many addresses suggests strong buying interest in this price range, potentially acting as a support level for the token.

While the support zone may hold and trigger a rebound in the price of LINK, Martinez cautions that investors should remain vigilant. Any signs of weakness, such as a breach of the support zone or negative market sentiment, could prompt investors to sell their LINK holdings to avoid losses.

It remains to be seen whether LINK can maintain its position above these critical levels and whether the broader cryptocurrency market will enter an accumulation phase or experience a retracement after the significant upward movement witnessed in recent weeks.

Such a retracement could potentially impact LINK’s price and lead to a test of the support above levels. On the other hand, the token faces immediate resistance at $17.483, $18.069, and $18.910. These represent the final hurdles to overcome before LINK reaches the $20 milestone.

Featured image from Shutterstock, chart from TradingView.com

Polygon CDK to power Web3 loyalty program for Indian e-commerce Flipkart

India’s homegrown e-commerce giant Flipkart will use Polygon’s chain development kit (CDK) to launch a Web3 loyalty program.

On Dec. 2, Polygon and Flipkart announced a strategic partnership to effectively position the e-commerce platform into Web3 and the metaverse. This included initiatives such as Flipverse for nonfungible tokens (NFTs), eDAO for metaverse and the FireDrops NFT marketplace.

Building on this partnership, Polygon co-founder Sandeep Nailwal announced on Dec. 7 that Flipkart will use the Polygon CDK to scale its FireDrops Web3 loyalty program.

Main announcement for today@Flipkart, the largest ecommerce and one of the largest payments companies in India is launching an ecosystem chain with @0xPolygon CDK.

This is an game changer for Web3 ecosystem in India. It not only has the potential to attract the top fintech… pic.twitter.com/gItcp4IjqB— Sandeep Nailwal | sandeep. polygon (@sandeepnailwal) December 7, 2023

Flipkart shared plans to use the Polygon CDK as the base to build an Ethereum-based zero-knowledge (ZK) layer-2 network, which can help the e-commerce platform scale future growth and streamline its service.

Flipkart will also use the Polygon CDK to offer a streamlined onboarding experience, dedicated blockspace and low transaction fees to its users, among other services. While announcing the initiative, Nailwal stated:

“This is a game changer for Web3 ecosystem in India. It not only has the potential to attract the top fintech entrepreneurs in India to build Web3, but it also might encourage many other top Enterprise and consumer brands to build their appchains.”

Nailwal also believes that participation from leading organizations will further cement India’s position as a Web3 powerhouse. “Future upgrades to Polygon CDK will also allow for enhanced privacy for transaction data, the ability to run the chain without a token or to use a central bank digital currency and access to liquidity in the greater Polygon and Ethereum ecosystems,” Polygon said.

Related: Polygon blockchain explained: A beginner’s guide to MATIC

Naiwal’s counterpart, Polygon co-founder Jordi Baylina revealed that 2024 will see the amalgamation of Polygon’s various Ethereum layer-2 scaling networks to complete its “Polygon 2.0” cross-chain coordination protocol.

Speaking to Cointelegraph, he said that Polygon 2.0 will test how the Polygon ecosystem’s various networks can scale and integrate through the implementation of zero-knowledge proofs.

Magazine: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

200,000 students accepted to college under direct admissions program

More schools offer guaranteed admission

In the wake of the Supreme Court’s affirmative action ruling, colleges are looking for new strategies to recruit students from diverse backgrounds, according to Jenny Rickard, CEO of the Common App.

“It’s about removing barriers,” she said. “It’s about equity and access.”

Each year, more than 1 million students — one-third third of whom are first-generation — use the common application to apply to school, research financial aid and scholarships, and connect to college counseling resources, according to the nonprofit organization.

Individual schools and school systems have also rolled out similar initiatives to broaden their reach. Last spring, the State University of New York sent automatic acceptance letters to 125,000 graduating high school students.

College enrollment is falling

Photo: Bryan Y.W. Shin | Wikicommons

This fall, undergraduate enrollment grew for the first time since 2020, according to the National Student Clearinghouse Research Center’s latest report.

But gains were not shared across the board. Community colleges notched the biggest increases year over year, the report found, accounting for almost 60% of the increase in undergraduates.

“Students are electing to pursue shorter-term programs,” said Doug Shapiro, executive director of the National Student Clearinghouse Research Center. “More 18- to 20-year-olds, especially at four-year institutions, are opting out.”

Tuition keeps rising

Not only are fewer students interested in pursuing a four-year degree after high school, but the population of college-age students is also shrinking, a trend referred to as the “enrollment cliff.”

In fact, undergraduate enrollment in the U.S. topped out at roughly 18 million students over a decade ago, according to the National Center for Education Statistics.

These days, only about 62% of high school seniors in the U.S. immediately go on to college, down from 68% in 2010. Low-income students who feel priced out of a postsecondary education are often those who opt out.

Recent data from the Common App found that that more than half, or 55%, of students who use the Common App’s online application are from the highest-income families.

Steadily, college is becoming a path for only those with the means to pay for it, other reports also show.

And costs are still rising. Tuition and fees at four-year private colleges rose 4% to $41,540 in the 2023-24 school year from $39,940 in 2022-23. At four-year, in-state public colleges, the cost increased 2.5% to $11,260 from $10,990 the prior school year, according to the College Board.

Financial aid is key

“Just because a school offers acceptance doesn’t mean the finances will line up,” cautioned Robert Franek, The Princeton Review’s editor-in-chief and author of “The Best 389 Colleges.”

“It’s important to ask critical questions,” he said. Students should consider how much aid is being awarded, as well as the academic fit, campus culture and career services offerings.

Further, even if acceptance is not guaranteed, there are many schools that accept the majority of those who apply, Franek said.

In fact, of The Princeton Review’s list of 389 best colleges, 254 schools admit at least half of all applicants. More than one-quarter admit at least 80% of those who apply. (On the flip side, only 8% of schools on the list of best colleges admit less than 10% of applicants.)

“We always think of the most competitive schools but there is a school, and likely many schools, out there to consider,” Franek said.