Investors pile into a currency-hedged Japan ETF on Thursday for protection as the Japanese yen falls on a historic BOJ policy shift.

Source link

protection

A partnership between privacy-focused projects Nym and Zcash was recently announced. The partnership aims to address some persisting issues in the sector to enhance user protection and data privacy in the Zcash ecosystem.

Data Leakage, A Challenging Issue

Electric Coin Company (ECC), the Zcash development organization, is collaborating with Nym, a privacy blockchain project focused on enhancing data confidentiality. The collaboration is possible through a Zcash Community Grants (ZCG) grant, as the project’s team announced on its X (former Twitter) account.

The partnership aims to address challenging user protection issues by integrating Nym’s mixnet into the Zcash ecosystem. Integrating with the Zcash light client libraries would allow the wallet developers to implement Nym mixnet’s privacy protection at their discretion.

1/6 🎉 Nym is happy to announce a grant from Zcash Community Grants to integrate the Nym mixnet with Zcash, and enhance privacy for Zcash users by protecting against metadata leaks.

— Nym (@nymproject) February 13, 2024

The goal, as the announcement explains, is for the integration process of Nym and Zcash to fill the gap in the network layer. This gap allows the metadata of user’s transactions to be traceable and leaves the data vulnerable, which then presents a privacy problem for users, as the post explains:

Powerful adversaries can analyze traffic patterns such as the stream of TCP/IP packets used to submit transactions, which can then be used to de-anonymize users. ISPs can snoop on traffic patterns to passively record Zcash activity. And the growing crypto surveillance industry can passively spy on peer-to-peer traffic, as well as conduct active attacks.

Nym will work with Zcash’s already existing privacy-preserving infrastructure to “help provide an end-to-end protected solution for users’ privacy. Zcash uses zero-knowledge proofs to secure transaction privacy, but “even advanced privacy protections like Zcash’s auto-shielding feature are vulnerable at the network later.”

The Nym mixnet is a technology that prevents government, corporate, and criminal surveillance adversaries from tracing metadata by encrypting user data into sphinx packets and dispersing them across global ‘mix nodes’, making metadata patterns untraceable and ensuring online privacy:

The mixnet achieves this by splitting data into identically sized encrypted Sphinx packets and dispersing these in three hops to ‘mix nodes’ worldwide at randomized intervals. Next, the mixnet shuffles in dummy ‘cover’ traffic, further complicating tracing. Together these features make tracking metadata patterns impossible even for powerful adversaries with a global view of the network.

A Shared Vision: Privacy For Everyone

Nym and Zcash are privacy-focused projects that protect users’ rights to their personal information and transaction data. “It is an alienable right to a dignified life free from gross intrusion and interference,” said Harry Halpin, cofounder and CEO at Nym Technologies.

Halpin also commented on the state of the digital realm regarding privacy matters. The CEO believes that although intrusion and interference are the “normal state of affairs,” a change is needed. “With this groundbreaking integration, Nym and Zcash are working to make real privacy online a reality,” he concluded.

Josh Swihart, CEO of ECC, expressed his positive outlook on the partnership, reaffirming that network-level privacy has been a “missing piece since Zcash’s inception.” He believes that privacy ecosystems coming together will only “deepen protections from everyday users to protect their financial privacy.”

Global regulators have scrutinized privacy-focused projects and accused them of enabling criminal activity. Last year, Zcash (ZEC), alongside other privacy coins like Monero (XMR), was announced to be delisted from Binance, the largest crypto exchange in the world, in four European countries. Similarly, Binance recently announced its plan to delist Moreno in the US amid regulatory pressure.

ZEC is trading at $20.71 in the hourly chart. Source: ZECUSDT on tradingview.com

Feature image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Rudy Giuliani filed for Chapter 11 bankruptcy protection in New York on Thursday, citing debts that include a nearly $150 million recent civil judgment for defaming two Georgia election workers while serving as a lawyer for former President Donald Trump.

The filing by Giuliani came a day after a federal judge in Washington, D.C., ordered him to begin paying election workers Ruby Freeman and Shaye Moss monetary damages, and three days after they filed a new suit seeking to bar him from again defaming the mother and daughter.

The U.S. Bankruptcy Court in Manhattan filing legally pauses, for now, the $146 million defamation judgment against the former New York City mayor that resulted from a jury verdict last week.

Giuliani, while representing Trump in efforts to reverse his loss on the heels of the 2020 election, falsely accused Freeman and Moss of ballot fraud. The claims sparked death threats against them.

Their attorney, Michael Gottlieb, in a statement about Giuliani’s bankruptcy petition, said, “This maneuver is unsurprising, and it will not succeed in discharging Mr. Giuliani’s debt to Ruby Freeman and Shaye Moss.”

Giuliani’s filing estimates he has assets worth between $1 million and $10 million and estimated current liabilities of between $100 million and $500 million. A worksheet in the filing lists his current actual debts at $151.8 million.

While the defamation judgment is the lion’s share of that total, Giuliani also declared he has nearly $1 million in debt to the IRS and New York State Department of Taxation and Finance for unpaid taxes, and that he owes several million dollars in debts to various law firms.

Giuliani was sued in September by his former lawyer Robert Costello for $1.36 million in unpaid legal fees dating back to late 2019.

The list of nonsecured creditors in the new filing includes plaintiffs currently suing him, among them the Dominion and Smartmatic election machine companies, President Joe Biden’s son Hunter Biden, and former Giuliani employee Noelle Dunphy, who accuses him of sexual harassment and wage theft.

Filers use Chapter 11 of the Bankruptcy Code to reorganize their debts and come up with a plan to pay their creditors.

His bankruptcy lawyers in a statement Thursday said, “The filing should be a surprise to no one.”

“No person could have reasonably believed that Mayor Giuliani would be able to pay such a high punitive amount” from the defamation case, the attorneys, Heath Berger and Gary Fischoff said.

“Chapter 11 will afford Mayor Giuliani the opportunity and time to pursue an appeal, while providing transparency for his finances under the supervision of the bankruptcy court, to ensure all creditors are treated equally and fairly throughout the process,” the lawyers said.

In addition to serving two terms as New York mayor, Giuliani is a former Department of Justice official and former Manhattan U.S. Attorney.

Giuliani was in the final months of his mayoralty on Sept. 11, 2001, when a terror attack leveled the Twin Towers of the World Trade Center in lower Manhattan.

After being widely lauded for his leadership of the city on the heels of that attack, he made millions of dollars from consulting work and made a failed bid for the White House in 2008.

In recent years, Giuliani has been criticized, sued, and prosecuted for actions during his work as Trump’s lawyer. Since late 2020 he has made false claims that Trump lost to Biden only as a result of widespread ballot fraud.

Earlier this year, Giuliani, Trump, and 17 other people were charged in Georgia court with crimes related to an alleged conspiracy in their efforts to undo his defeat in that state in the 2020 election. Giuliani has pleaded not guilty in that case, as have Trump and most of the other defendants.

In July, the disciplinary board of the D.C. Bar Association recommended that Giuliani be stripped of his law license as a result of his false election fraud claims.

Giuliani’s law license in New York is suspended due to those claims.

— Additional reporting by CNBC’s Jim Forkin.

Don’t miss these stories from CNBC PRO:

SBF was almost extorted for ‘protection’ in Brooklyn jail, recalls ex-inmate

Former FTX CEO Sam “SBF” Bankman-Fried was reportedly worried for his safety during his pretrial detention time at the Brooklyn Metropolitan Detention Center and even considered paying another inmate for “protection,” according to a former inmate.

New York mob enforcer-turned-informant Gene Borrello told crypto blogger Tiffany Fong in a Nov. 30 interview that he spent time with Bankman-Fried in the lead-up to his criminal trial. He said SBF was “out of his element” in jail and worried for his safety.

I got a chance to interview Gene Borrello, a former mob enforcer who was in jail with Sam Bankman-Fried. Gene tells me SBF was on suicide watch, was extorted & did not eat or shower for several days. We also discuss how Sam spends his time in jail, bullying, sentencing & more. pic.twitter.com/nszTXVUrSQ

— Tiffany Fong (@TiffanyFong_) November 30, 2023

Borrello said that during his time there, other prisoners saw the former crypto mogul as timid, having “the body of the 80-year-old,” and he was presumed to have access to money.

“He has the body of the 80-year-old. He has, like, no shape to him, you know what I mean?”

A prisoner reportedly attempted to make Bankman-Fried fearful to extort him for protection money, according to Borello.

“[The other prisoner] wanted Sam Bankman to feel like ‘this is dangerous in here, you need protection,’” he recalled.

However, Bankman-Fried was housed in a unit of the Brooklyn Metropolitan Detention Center that separated the wealthy and government cooperators from the general prison population, said Borello.

“I kept saying, ‘It’s not dangerous in here. You don’t need protection. Don’t worry about it. You ain’t got to pay nobody nothing. Don’t listen to these fucking kids.’”

Borrello claims he confronted the other prisoner, leading to a fight. Both were put in the jail’s special housing unit — solitary confinement — and Borello claimed he spent 80 days there.

Borrello recalled speaking to Bankman-Fried, saying, “When he talks to you, he puts his head down. He’s very timid. He talks very nervous.” He also said he asked the former billionaire what he spent his money on.

“I said, ‘What are you doing with the money? What kind of watch did you have?’ He said, ‘I had an Apple Watch,’” Borrello recounted. “I said, ‘What kind of car were you driving?’ He said, ‘A 2020 Toyota Camry.’”

“Me and my friends go, ‘So, what the fuck did you steal the money for? You wanna look at it?’”

Borello opined that Bankman-Fried “can’t go into regular population” due to his perceived wealth — an estimated $26 billion at its peak — as others will again try to extort him.

SBF didn’t realize “how much trouble he was in”

Borrello recounted a conversation he had with Bankman-Fried, who was apparently of the belief that he “was not getting a lot of time.”

“He just didn’t understand how much trouble he was in,” Borrello said. “We were trying to explain to him that this is the feds, you’re accused of stealing billions of dollars. […] He just didn’t understand how screwed was until we started breaking it down to him.”

Borrello claimed Bankman-Fried was more nervous about jail than his case and believed he’d spend 20 years in prison.

“We looked at him like he was crazy. I kept trying to explain to him, you’re never going to see the outside again.”

On Nov. 2, Bankman-Fried was found guilty of seven counts of money laundering, fraud and conspiracy and faces a maximum sentence of 115 years in jail. His sentencing is scheduled for March 28, and his lawyers are expected to appeal.

Related: Crypto exchange FTX gets nod to sell $873M of assets to repay creditors

Borello also said he attempted to warn Bankman-Fried that New York Judge Lewis Kaplan, overseeing his case, is the “strictest judge in the Southern District.”

In most cases, judges go with the prosecution’s sentencing recommendation — yet to be filed in Bankman-Fried’s case — “which could be something out of this world,” said Borrello.

“I think it’s bullshit to get that much time,” he added. “There’s no reason to give the guy a hundred years. That’s just insane.”

Borrello called Bankman-Fried’s situation “a glory case” that every prosecutor wants a part of, as they wish to become “judges, politicians, analysts [and] big-time federal attorneys.”

“All they care about is glory. He’s the glory case. So he’s fucked.”

Magazine: Tiffany Fong flames Celsius, FTX and NY Post: Hall of Flame

No civil protection for crypto in China, $300K to list coins in Hong Kong? Asia Express – Cointelegraph Magazine

Our weekly roundup of news from East Asia curates the industry’s most important developments.

Hot week for Hong Kong exchanges

Hashkey Exchange — one of the first regulated crypto exchanges in Hong Kong — has announced insurance coverage for clients assets stored in its hot and cold wallets. accounts. The policy will cover 50% of Hashkey’s digital assets in cold wallets and 100% of digital assets in hot wallets, paying out from $50 million to $400 million in the event of a claim.

Hashkey’s partnership with fintech OneDegree will also see the pair co-develop novel crypto security solutions for the exchange to manage server downtime, data back-up, and load control. “Getting insurance cover from OneInfinity by OneDegree not only fulfills the Securities and Futures Commission requirements, we believe the collaboration can also enhance our financial, technical, and service infrastructure to provide our customers with comprehensive protection,” said Livio Wang, chief operating officer of Hashkey Group.

Read also

Features

Crypto critics: Can FUD ever be useful?

Features

ZK-rollups are ‘the endgame’ for scaling blockchains: Polygon Miden founder

Wang also disclosed that the exchange plans to submit four major altcoins for listing approval to the Hong Kong Securities & Futures Commission. Since its license was approved in August, Hashkey has grown to over 120,000 customers with a cumulative trading volume surpassing $10 billion.

BC Technology Group, the owner of another licensed exchange, OSL, has announced a $91 million strategic investment from BGX crypto group. BGX CEO Patrick Pan called the investment “a strategic move that reflects our belief in the immense potential of the digital asset market.” Last month, Bloomberg reported that BC Technology Group was seeking to spin off the OSL exchange for $128 million, which the company denied at the time.

While Hong Kong crypto exchanges are gaining traction, the barrier to entry for users and token developers alike appears to be high. In an announcement on Nov. 15, Hashkey stated that token developers must pay a non-refundable application fee of $10,000 for listing their coins or tokens on the exchange.

Hashkey also warned that developers should expect a total cost of $50,000 to $300,000 for the listing process, if approved, in addition to due diligence or advisory fees.

The Block gets a fresh start

Crypto media publication The Block has received a $60 million investment for 80% of its equity from Singaporean venture capital firm Foresight Ventures but will still operate as a separate company.

As told by CEO Larry Cermak on Nov. 13, the deal “gives The Block a fresh start ahead of the bull market and provides us with more capital to build out new exciting products and expand our footprint into Asia and the Middle East.”

Forrest Bai, CEO of Foresight Ventures, told Cointelegraph that “the purchase of The Block marks a crucial milestone, substantially strengthening Foresight Ventures’ position in the cryptocurrency sector.”

The Block became embroiled in the FTX scandal last year when it came to light that former CEO Mike McCaffrey took millions of dollars in loans from FTX founder and convicted felon Sam Bankman-Fried. Much of the capital was used to buy out his shares. The Block reportedly laid off 33% of its staff due to the overall market downturn and fallout from the incident.

Read also

Features

Fan tokens: Day trading your favorite sports team

Features

WTF happened in 1971 (and why the f**k it matters so much right now)

No civil protection for crypto in China

A third Chinese court has voided a crypto investment contract on the basis that cryptocurrencies contravene the spirit of its crypto ban and, therefore, are not protected by law, at least in civil disputes.

As narrated by the Liaoning Zhuanhe People’s Court on Nov. 14, the plaintiff, Wang Ping, lent the equivalent of $552,300 Tether (USDT) to a friend, Zhao Bin, for the purposes of investing in altcoins in 2022. The transaction resulted in heavy losses for Wang, leading them to subsequently file a lawsuit demanding the return of the principal. The defendant, Zhao, refused.

At trial, the presiding judge ruled that the plaintiff had no right to judicial relief as transactions between cryptocurrencies are classified as “illegal activity.” Therefore, all “virtual currency and related derivatives violate public order and good customs, and the relevant civil legal actions are invalid, and the resulting losses shall be borne by them.”

“Virtual currency does not have the same legal status as legal currency. Virtual currency-related business activities are illegal financial activities. It is also an illegal financial activity for overseas virtual currency exchanges to provide services to residents in my country through the internet.”

The ruling follows other precedents set by Chinese civil courts earlier this year. However, recently, the Chinese government has clarified that certain criminal acts pertaining to digital currencies, such as theft of nonfungible tokens, are prosecutable under the penal code. Chinese has enforced its crypto ban since 2021.

Philippines to issue tokenized bonds

The Philippines’ Bureau of Treasury (BTr) is seeking to raise the equivalent of $180 million from its domestic capital market through the issuance of tokenized bonds.

As announced on Nov. 16, the tokenized bonds are one-year fixed-rate government securities that pay semi-annual coupons offered to institutional investors starting next week. The bonds will be issued in the form of digital tokens and maintained in the BTr’s distributed ledger technology (DLT) registry. “As part of the National Government’s Government Securities Digitalization Roadmap, the maiden issuance of TTBs aims to provide the proof-of-concept for the wider use of DLT in the government bond market,” the institution said.

In July, Cointelegraph reported that nonprofit The Blockchain Council of the Philippines partnered with the Department of Information and Communications Technology (DICT) to foster Web3 adoption in the Southeast Asian country. The organizations will be working to educate and collaborate with local stakeholders within the Philippine blockchain ecosystem, including government bodies, Web3 developers, and civil societies.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Zhiyuan Sun

Zhiyuan Sun is a journalist at Cointelegraph focusing on technology-related news. He has several years of experience writing for major financial media outlets such as The Motley Fool, Nasdaq.com and Seeking Alpha.

Garlinghouse emphasized the need for the SEC to reassess its regulatory approach, moving away from a pattern of enforcement through lawsuits.

During the just-concluded Ripple’s Swell conference in Dubai, the company’s CEO Brad Garlinghouse shared his views regarding the United States Securities and Exchange Commission’s (SEC) role in protecting consumers against bad actors.

In an interview with CNBC’s Dan Murphy, Garlinghouse stated that, in his opinion, the SEC has strayed from its commitment to investor protection, questioning the agency’s priorities in the process.

“I think the SEC, in my opinion, has lost sight of their mission to protect investors. And the question is, who are they protecting in this journey?” Garlinghouse told CNBC.

Ripple’s Win Is a Positive Step for the Industry

Garlinghouse’s opinion stemmed from the SEC’s enforcement actions against the crypto industry, as the agency has chosen a litigious approach to regulating the emerging economy instead of working with Congress to introduce befitting regulations for the crypto space.

In 2020, the financial watchdog sued Ripple alongside two executives, including the CEO, for orchestrating a $1.3 billion securities fraud by selling XRP to retail investors in the US.

The lawsuit centered around Ripple’s failure to register the continuous sale of XRP tokens, leaving investors without essential information about the digital asset and Ripple’s business activities.

After over two years of court battles between the SEC and Ripple, US District Judge Analisa Torres in Manhattan finally ruled in July that XRP is not a security and possesses no qualities of a security token.

The SEC’s request for an interlocutory appeal was subsequently denied, and in October, the agency dropped securities law violation charges against Garlinghouse and another Ripple executive, Chris Larsen.

Garlinghouse, reflecting on the developments, expressed optimism not only for Ripple but for the entire industry. He sees the SEC being put in check as a positive step, hoping it will pave the way for the crypto industry to flourish in the United States.

“I think it is a positive step for the industry, not just for Ripple, not just for Chris and Brad, but for the whole industry, that the SEC has been put in check in the United States. And I’m hopeful this will be a thawing of the permafrost in the United States for really seeing an amazing industry that has immense potential to thrive in the largest economy in the world,” Garlinghouse told CNBC.

Ripple to Hire 80% of Employees Outside the US

In criticizing the SEC’s regulatory strategy, Garlinghouse drew parallels with other legal battles in the industry. The Ripple CEO referenced Grayscale’s victory regarding a Bitcoin exchange-traded fund (ETF), where a federal judge accused the SEC of being “arbitrary and capricious.”

Garlinghouse emphasized the need for the SEC to reassess its regulatory approach, moving away from a pattern of enforcement through lawsuits.

“Generally, judges tend to be pretty down the middle and try not to be dramatic — those are damning words. So I think at some point the SEC has to step back and realize that their regulatory approach through enforcement, let’s bring lawsuits, has to break,” said he.

Garlinghouse, influenced by the SEC’s regulatory style against the industry, asserted that Ripple had redirected its recruitment focus to other jurisdictions.

During a September interview at the Token2049 conference in Singapore, he outlined the company’s strategy to recruit 80% of its workforce from countries he deemed more proficient in crypto regulation.

Expressing his dissatisfaction, Garlinghouse pointed out the contrast in markets like Singapore, where governments collaborate with the industry, provide explicit regulations, and witness substantial growth.

“It’s super frustrating to see markets like we have here in Singapore … where the governments are partnering with the industry, and you’re seeing leadership providing clear rules and growth. And frankly, that’s why Ripple is hiring there,” explained the CEO.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

‘Stay Cautious,’ Says Billionaire Leon Cooperman About the Stock Market — Here Are 2 High-Yield Dividend Stocks He’s Using for Protection

For most of this year, investor sentiment was high, and the markets were on an upward tear. But that sputtered to a halt at the end of the summer, and this fall has seen a pullback in the main indexes. We’re still up for the year-to-date, but not by as much as we were in July. At this writing, the S&P 500’s year-to-date gain is 9%, and the NASDAQ’s is 22%.

It is most accurate to say that current conditions are volatile and unsettled. Both the bulls and bears can find plenty of evidence and precedent to back up their claims. The result: confusion among investors, who just aren’t sure where to go from here.

Leon Cooperman, the billionaire investor and hedge manager who got his start at Goldman Sachs and now runs Omega Advisors, takes a more moderate stance. Urging caution for investors, Cooperman has stated his belief that the S&P 500 is overvalued now, and will likely face a downturn in the near future.

“I don’t think we’re in a bubble; I think we’re in a rolling correction,” Cooperman has said, and he’s added that it will “take a long time for us to work out the problems.” The S&P hit its last peak, near 4,800, in January of last year, and Cooperman thinks it will take a long while before it can climb back to that level.

So, a cautious mind set is required and that will lead us to dividend stocks. These are the stocks that will ensure a steady income no matter the day-to-day market swings and protect the portfolio against any incoming volatility.

Turning to Cooperman for more inspiration, we took a closer look at two high-yield dividend stocks in which the billionaire investor has placed his trust. Here are the details.

Don’t miss

Energy Transfer

First up, Energy Transfer is a major player in the North American midstream sector, the vital segment of the energy industry that connects oil and natural gas producers with their end customers. Midstream companies operate networks of pipelines, transport assets, storage facilities, and terminal facilities, moving hydrocarbons and refined products to where they are needed. Energy Transfer has operations in 41 states, plus international offices in Panama City, Panama, and Beijing, China.

The company’s core operations include the transport, storage, and terminalling of crude oil, natural gas, natural gas liquids, and refined hydrocarbon products. Energy Transfer’s two largest areas of operation are centered in Texas, Oklahoma, and Louisiana, and in the Great Lakes-Mid Atlantic regions. ET’s network includes gathering facilities, fractionation facilities, pipelines, processing plants, and import/export terminals.

Energy Transfer is a dominant player in the midstream sector, boasting a market cap of $43 billion, and this past summer, the company completed a move that will expand its market share and footprint. In August, Energy Transfer and Crestwood announced an acquisition agreement; ET will fully acquire Crestwood and its assets. The transaction, which will be conducted wholly in stock, is valued at nearly $7.1 billion and is expected to close in early November.

Also in early November, Energy Transfer will release its 3Q23 financial results. Looking back at the Q2 results, we find that the company had a top line of $18.3 billion, a result that was down 29% year-over-year and missed the forecast by over $2 billion. The midstream company’s bottom-line EPS, at 25 cents per diluted share, missed the estimates by 7 cents. For Q3, the Street is expecting ET to show $20.4 billion in revenue and 25 cents per share in earnings.

One recent metric that bodes well for return-minded investors comes from the company’s dividend. ET, on October 20, announced a modest increase in the common share dividend payment, from 31 cents to 31.25 cents. The new payment will go out on November 20; at the new rate, the dividend annualizes to $1.25 per common share and yields 9%.

As for Leon Cooperman, he remains long and strong here. The billionaire investor holds an impressive 11,912,500 shares in ET, which are worth $163 million at current prices.

For Stifel analyst Selman Akyol, Energy Transfer is a company with high return potential going forward in a favorable commodity market environment. He writes of the stock, “Over the last several years ET has focused on reducing debt while finishing a campaign of large capital investments. With the upturn in the commodity environment and production on the rise across the US, Energy Transfer is poised to generate significant free cash flow. We believe investors will be well served by owning ET as demand for US energy increases around the globe… The set up for 2024 looks great for ET.”

The 5-star analyst goes on to give ET stock a Buy rating, with an $18 price target that suggests it will gain 30% in the year ahead. Add in the dividend yield, and the total return potential hits 31%. (To watch Akyol’s track record, click here)

Overall, ET shares maintain a Strong Buy consensus rating from the Street, based on 9 recent reviews that include 8 Buys and 1 Hold. The stock is selling for $13.69 and its $16.78 average price target implies an upside of ~23% on the one-year horizon. (See ET stock forecast)

Arbor Realty Trust

From energy, we’ll switch to another segment that is well known for perennial dividend champs: real estate investment trusts. The REITs are companies that acquire, own, lease out, and manage real properties – residential, commercial, industrial, and more – as well as invest in mortgages and mortgage-backed securities. They attract shareholders with strong profit-sharing policies, including high dividend yields.

Arbor Realty works in the commercial REIT segment, focusing on funding the development and building of multifamily residential projects. That is, the company provides commercial mortgages for developers and builders working on apartment complexes. Arbor is involved in multiple commercial property funding operations, and in addition to private loan funding also works with both Fannie Mae and Freddie Mac.

As of June 30 this year, the end of 2Q23, Arbor’s fee-based loan servicing portfolio totaled $29.45 billion, with the bulk of that – slightly more than $20 billion – serviced through Fannie Mae. Arbor’s loan and investment portfolio had an unpaid principal balance of $13.49 billion and had an average current interest pay rate of 8.76%.

This portfolio activity generated a net interest income for Arbor of $108.5 million in Q2, up 15% year-over-year and $9.7 million better than had been expected. The company’s bottom line, a non-GAAP distributable earnings per diluted share, came to 57 cents, beating the forecast by 12 cents. Arbor will report its Q3 results on October 27, and the Street is looking for 47 cents per share in distributable earnings and $98.35 million in revenues.

The company last paid its common share dividend on August 31 at 43 cents per common share. This was up a penny from the previous quarter and was fully covered by the distributable earnings. The dividend’s annualized rate of $1.72 gives a forward yield of 12.5%.

Cooperman also has a big position here. He currently owns 3,454,694 shares of ABR, which command a market value of ~$45 million.

ABR also gets the support of Raymond James’ 5-star analyst, Stephen Laws, who likes Arbor for both its dividend and its clear ability to cover that dividend.

“Our distributable earnings estimates are increasing, as the benefits of wider portfolio spreads and lower expenses more than offset the impact of more conservative portfolio growth assumptions. Our Outperform rating reflects the attractive portfolio characteristics (floating rate, primarily multifamily), business diversification, high earnings visibility provided by the agency segment, and strong dividend coverage,” Laws opined.

Laws uses this stance to support his Outperform (i.e. Buy) rating on the shares, and his $17 price target implies that ABR will gain ~31% in the coming year. Combined with the dividend yield, that return can reach ~43%. (To watch Laws’ track record, click here)

The rest of the Street is less confident, however; based on 1 Buy and Hold, each, plus 2 additional Sells, the stock has a Hold consensus rating. Yet, the $15.75 average target price suggests an upside of ~21% in the next 12 months. (See ABR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

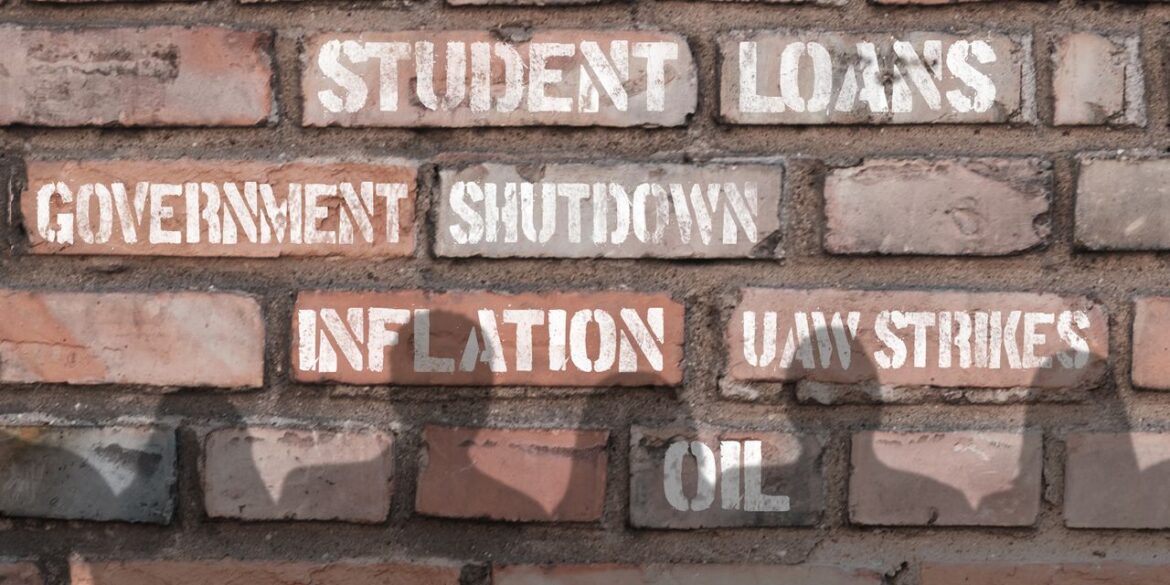

Stock investors’ wall of worry keeps growing, creating the need for protection

Investors face a growing list of risks heading into the fourth quarter that just keeps getting bigger — from rising interest rates to a possible revival of inflation and gridlock in Washington that may become a headwind for economic growth.

The Federal Reserve remains in rate-hiking mode and is unlikely to cut borrowing costs next year by as much as previously thought. The prospect of $100-a-barrel oil at a time of expanded strikes by the United Auto Workers union is reigniting inflation concerns. Meanwhile, mitigating factors that could slow economic growth — such as the possibility of a government shutdown and the resumption of student-loan payments — might not be enough to shake the Fed’s inflation-fighting resolve.

Read: Risk of government shutdown soars as House Republicans leave town in disarray amid hard-right revolt and Student-loan payments are about to resume. Defaults are expected to follow.

See also: Fed’s Collins doesn’t rule out more interest-rate hikes

It all adds up to an ever-growing wall of worry for many investors and traders, who had expected inflation to fade and the Fed to be done with raising interest rates. The phrase wall of worry is typically associated with rising stocks — given the market’s ability to often keep climbing, despite developments that might otherwise spark a selloff — but this time might be different. With the central bank’s main interest-rate target already at a 22-year high and likely to go higher by December, Treasury yields have reached levels not seen in at least a dozen years, putting a cap on how much further equity markets can climb and creating the need for investors to search for protection.

A day after the Fed’s policy update on Wednesday, which underscored a message of higher-for-longer rates, strategists Jay Barry, Jason Hunter and others at JPMorgan Chase & Co.

JPM,

the biggest U.S. bank, said their bearish equity view was “gaining material traction” and that September through mid-October “also happens to be the most bearish time of the year for risky markets from a cyclical perspective.”

Comparing the current period to 1987, the year of the “Black Monday” crash, they said they expect the U.S. stock market’s slide to accelerate into the fourth quarter, but stopped short of calling for a “crash.”

The rise in market-implied rates that followed the Fed’s announcement has created an environment of “more losers than winners” — in the words of portfolio manager Christian Hoffmann at Thornburg Investment Management — with equity prices and bond prices both falling on Thursday.

On Monday, all three major U.S. stock indexes

DJIA

SPX

COMP

managed to score their first gains in five straight sessions after struggling for momentum over much of the day. Meanwhile, 10- and 30-year Treasury yields ended at their highest levels since Oct. 17, 2007, and March 8, 2011, respectively, as fed funds futures traders priced in a 39% likelihood of further Fed tightening by year-end.

Read: ‘The world has changed’ as investors absorb highest Treasury yields in a dozen years or more

Some analysts remained optimistic. “Higher rates for longer is not necessarily this terrible thing if the Fed hangs out there because growth is good,” said Jeffrey Cleveland, chief economist at Payden & Rygel in Los Angeles, which manages more than $144.4 billion in assets. “Growth is coming in stronger than everyone expected, and that’s what is forcing the revisions in interest rates. That’s not necessarily bad for the riskier parts of our portfolios,” like high-yield corporate bonds.

“The economy seems to have pretty good momentum and should be able to withstand some of those worrisome issues,” Cleveland said via phone. “The momentum is sufficiently strong enough that most investors should be able to jump over the wall of worry, without running into the wall,” he said, adding that the U.S. economy should dodge a recession over the next 12 months.

However, not even Fed Chairman Jerome Powell is entirely sure the U.S. can achieve a soft landing and avoid a recession, despite the fact that’s the outcome policy makers are hoping for, judging by their projections for growth, unemployment, and inflation through 2026. The central bank’s favorite inflation gauge, the personal consumption expenditures price index, is set to be released on Friday and is the data highlight of the week ahead. July’s PCE report showed the annual rates of headline and core inflation stubbornly stuck above 2%.

At the moment, the world’s largest economy appears to be undergoing a “controlled landing,” in which the labor market is healthy but cooling, wage growth is moderating, and consumers and businesses are conservatively spending, according to chief economist Gregory Daco of EY-Parthenon, the global strategy consulting arm of Ernst & Young in New York. His firm expects real GDP growth of 2.2% in 2023 and a more muted 1.3% in 2024.

“We are not going back to a free-money era anytime soon, and the best way to approach the new paradigm of higher-for-longer interest rates is to acknowledge and adjust to it,” Daco said via phone. “Every portfolio is going to be different and have its own approach to risk objectives and returns, so it’s not about one asset class versus another. It’s about understanding what your risk tolerance is and how to maximize your returns when the cost of capital and the cost of equities is going to be higher.”

Michael Landsberg, chief investment officer of Landsberg Bennett Private Wealth Management in Punta Gorda, Fla., which manages $1 billion in assets, said that there are “big question marks about earnings season, which begins in mid-October” and “we need earnings to grow meaningfully in order to have any kind of noticeable move higher in markets.”

“With inflation, interest rates and earnings growth fears in the U.S., it’s important for investors to have exposure to non-U.S. equities, particularly countries like Japan and India, whose central banks are not aggressively raising rates like they are in the U.S.,” Landsberg wrote in an email to MarketWatch. “We have been bullish on the U.S. dollar and favor foreign ETFs in Japan that are short the yen.” His firm also likes using ETFs in India “for both large- and small-cap exposure.”

China property developer Evergrande files for bankruptcy protection in US

A residential complex constructed by Evergrande in Huai’an, Jiangsu, China, on July 20, 2023.

Future Publishing | Future Publishing | Getty Images

China’s heavily indebted property giant Evergrande Group on Thursday filed for Chapter 15 bankruptcy protection in a U.S. court.

In a filing with the Manhattan bankruptcy court, the company referenced restructuring proceedings in Hong Kong, the Cayman Islands and the British Virgin Islands.

In a separate statement, Evergrande on Friday said that it will ask the U.S. court for “recognition of the schemes of arrangement under the offshore debt restructuring for Hong Kong and the British Virgin Islands.”

It added, “The application is a normal procedure for the offshore debt restructuring and does not involve bankruptcy petition.”

The world’s most indebted property developer defaulted in 2021 and announced an offshore debt restructuring program in March. Trading of Evergrande shares have been suspended since March 2022.

Chapter 15 bankruptcy protection allows a U.S. bankruptcy court to intervene in cross-border insolvency case involving foreign companies that are undergoing restructuring from creditors. It aims to protect the debtors’ assets and facilitate the rescue of businesses that are in financial trouble.

Tianji Holdings, an affiliate of Evergrande, and its subsidiary, Scenery Journey, also filed for Chapter 15 protection in Manhattan bankruptcy court, according to the filing.

Property sector fallout

China’s massive real estate sector has long been a vital engine of growth for the world’s second-largest economy, and accounts for as much as 30% of the country’s gross domestic product.

In July, Evergrande posted a combined loss of $81 billion over the past two years, after struggling to finish projects and repay suppliers and lenders.

Net losses for 2021 and 2022 were 476 billion yuan ($66.36 billion) and 105.9 billion yuan ($14.76 billion), respectively, as a result of property write-downs, return of lands, losses on financial assets and financing costs, the company said.

The bankruptcy filing was signed by Jimmy Fong, who listed himself as a “foreign representative” of China Evergrande Group. A “scheme creditors” meeting is set for Wednesday at the Hong Kong office of Sidley Austin, the U.S.-based law firm representing Evergrande, the petition added.

— CNBC’s Evelyn Cheng and Elliot Smith contributed to this story.

Evergrande’s affiliate Tianji Holdings and the company’s subsidiary Scenery Journey have also filed for Chapter 15 protection in the US court.

Evergrande Group, the Chinese second-largest property developer, has filed for Chapter 15 bankruptcy protection in the Manhattan bankruptcy court. The application would allow Evergrande to protect its assets in the US while it is working on a multi-billion dollar deal with creditors.

Evergrande’s Crisis

Evegrande is an investment-holding real estate company engaged in property development, property investment, property management, and property construction. With more than 1,300 projects in more than 280 cities in China, Evergrande has cooperated with more than 860 well-known companies around the world. The company was prospering until 2020 when Chinese authorities introduced new rules to control the amount that big real estate firms could borrow.

In 2020, the Chinese government imposed a “three red lines” policy to regulate the leverage taken on by developers, limiting their borrowing based on the following metrics: debt-to-cash, debt-to-equity, and debt-to-assets. Notably, by October 2021, those regulations were violated by 14 of China’s 30 biggest developers at least once.

The real-estate crisis began, as major property giants ran out of cash. It affected Evergrande Group, leading to its multiple debts and default. The company missed a crucial deadline and failed to repay interest on around $1.2 billion of international loans. In October 2021, Evergrande announced that it would raise $5 billion by selling a 51% stake in its property management unit to Hopson Development.

For 2021 and 2022, Evergrande suffered an $81 billion combined loss that was primarily attributed to write-downs of properties, return of land, losses on financial assets, and mounting finance costs. By the end of 2022, Evergrande’s total liabilities surged from $300 billion at the time of its default to $340 billion.

Filing for Chapter 15 Protection

Earlier this year, Evergrande revealed its plans to restructure around $20 billion in overseas debt. The filing for Chapter 15 in the US court is a part of the restructuring strategy. Within the filing, Evergrande Group is seeking the court’s approval to restructure more than $19 billion in the company’s offshore debts.

Later this month, Evergrande’s creditors will vote on the company’s restructuring proposal, with possible approval by Hong Kong and British Virgin Islands courts in the first week of September.

Chapter 15 is a new chapter added to the Bankruptcy Code by the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. In general, it aims to provide effective mechanisms for dealing with insolvency cases involving debtors, assets, claimants, and other parties of interest involving more than one country.

Once a foreign entity files for bankruptcy under Chapter 15, the US bankruptcy court can authorize the appointment of a trustee or examiner to act in the other country on behalf of the bankruptcy estate in the United States. Besides, Chapter 15 allows US courts to offer additional aid to foreign representatives, assistance to foreign companies filing bankruptcy cases when the laws of the foreign court may be lacking, and gives foreign creditors the right to participate in bankruptcy cases in the US.

Evergrande’s affiliate Tianji Holdings and the company’s subsidiary Scenery Journey have also filed for Chapter 15 protection.

next

Business News, Editor’s Choice, News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.