This edition of Cointelegraph’s VC Roundup features Mira, Astria, Compute Labs, BOB, Dora and BITKRAFT Ventures.

Two U.S. senators have urged U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler to refrain from approving additional crypto exchange-traded fund (ETF) applications. The lawmakers cautioned: “However vulnerable bitcoin may be to fraud and manipulation, markets for other cryptocurrencies are far more exposed to misconduct.” Lawmakers Say SEC Should Not Approve Spot Crypto ETFs […]

Two U.S. senators have urged U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler to refrain from approving additional crypto exchange-traded fund (ETF) applications. The lawmakers cautioned: “However vulnerable bitcoin may be to fraud and manipulation, markets for other cryptocurrencies are far more exposed to misconduct.” Lawmakers Say SEC Should Not Approve Spot Crypto ETFs […]

Source link

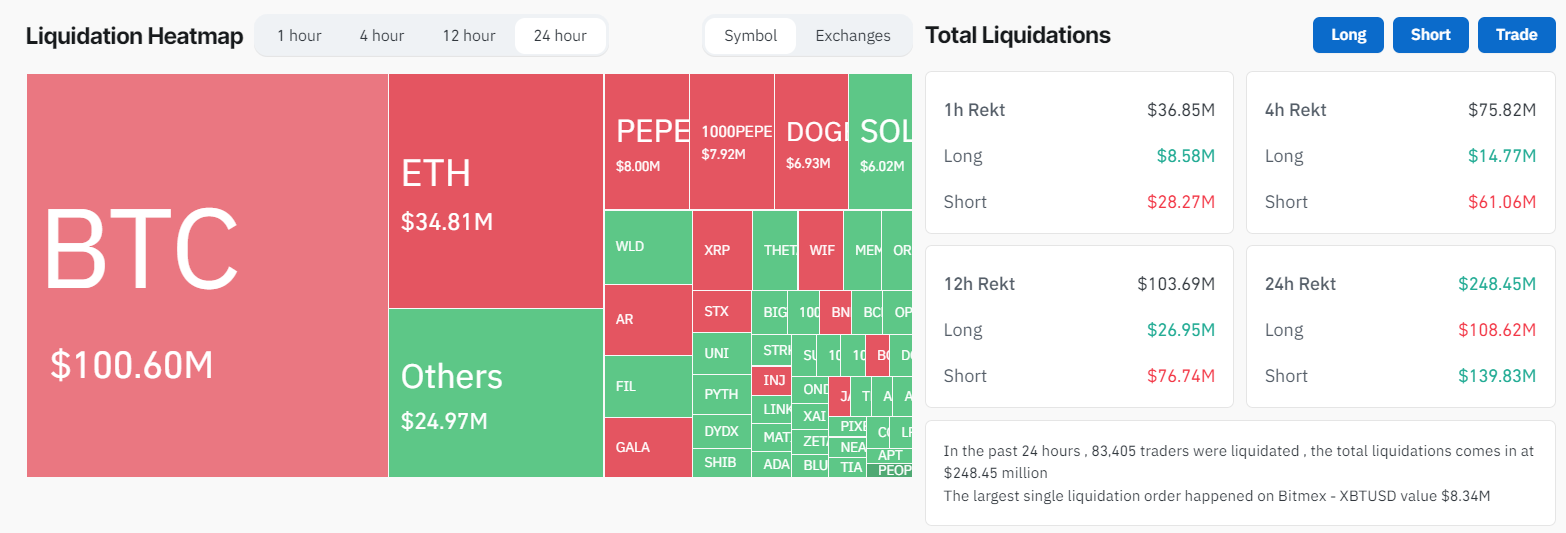

Bitcoin is currently demonstrating a robust market performance, bulldozing its way towards the $60,000 benchmark, up from its daily start of around $57,000. In the preceding 24 hours, a significant wave of liquidations hit the digital asset market, amounting to approximately $250 million. The liquidations depict a slight bias towards shorts, with an estimated worth of $140 million, according to Coinglass.

Coinglass data shows that in the same timeframe, Bitcoin experienced $100 million worth of liquidations, majorly shorts accounting for $70 million.

Simultaneously, the Exchange Traded Fund (ETF) inflows marked their third-best performance day, underlining the growing interest of institutional investors in this digital asset. A noteworthy mention is BlackRock, which recorded a record-breaking single-day performance with net inflows of $520 million.

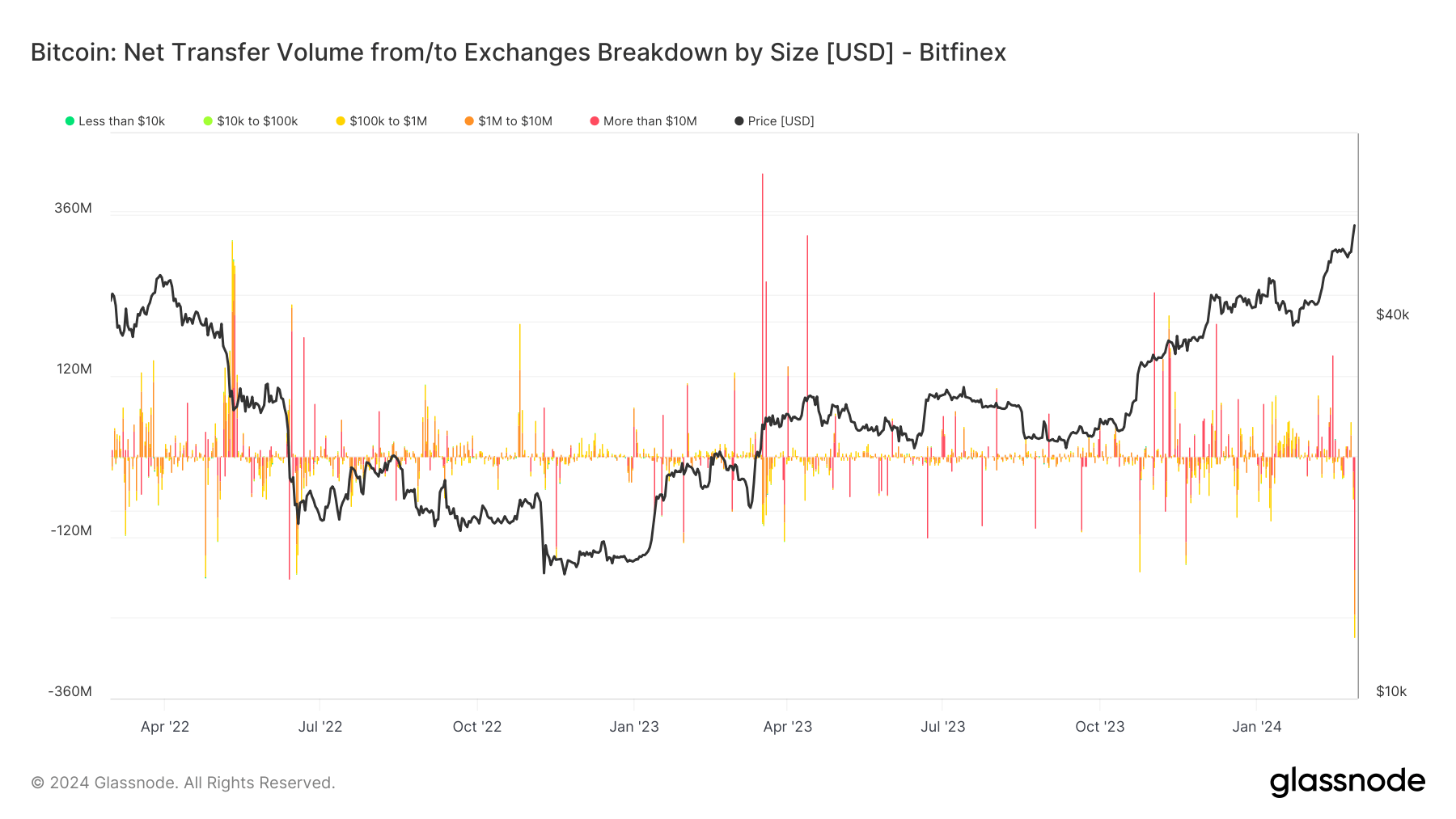

The day further witnessed the largest Bitcoin withdrawal from Bitfinex since 2021, exceeding $240 million. This substantial offloading, estimated to be the equivalent of 5,000 Bitcoins, was primarily attributed to large whale activities.

The post Whale transactions and ETF records fuel Bitcoin’s push toward $60,000 appeared first on CryptoSlate.

Scheduled for Feb. 15, 2024, the upcoming Bitcoin difficulty retarget is poised to mark a notable upswing in the network. Current projections forecast an estimated difficulty surge ranging from 8.45% to 9.2%, setting the record for the steepest increase of 2024 thus far. Bitcoin Difficulty Poised for a Steep Increase This week, bitcoin (BTC) mining […]

Scheduled for Feb. 15, 2024, the upcoming Bitcoin difficulty retarget is poised to mark a notable upswing in the network. Current projections forecast an estimated difficulty surge ranging from 8.45% to 9.2%, setting the record for the steepest increase of 2024 thus far. Bitcoin Difficulty Poised for a Steep Increase This week, bitcoin (BTC) mining […]

Source link

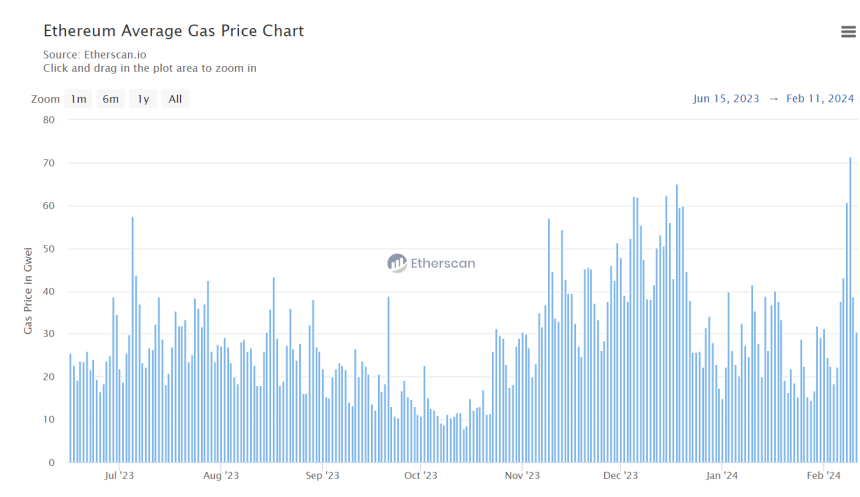

The new ERC-404 tokens have swiftly taken the spotlight, dominating the cryptocurrency market and consistently attracting interest from investors and traders. This surge in euphoria has led to a substantial increase in Ethereum gas fees, pushing costs to their highest levels in the past eight months.

Ethereum gas fees have surged to record highs, reaching unseen levels since March 2023, when the average gas price peaked at 101.26 Gwei. The sudden spike in Ethereum gas prices has been attributed to the recent hype surrounding ERC-404 tokens, an experimental token standard that enables native fractionalization of Non-fungible Tokens (NFTs).

Presently, reports from Etherscan, an Ethereum block explorer and analytics platform, reveal that on Friday, February 9, 2024, Ethereum gas fees reached an average gas price of 71.4 Gwei, with a maximum and minimum gas price of 59,956 Gwei and 34.4 Gwei respectively.

This price is the highest Ethereum gas fees have reached since its explosive peak in May 2023, when the average gas price surged to 155.8 Gwei.

The popularity of the ERC-404 can be attributed to the Pandora team heralding the unofficial token and taking advantage of its high liquidity. Additionally, various cryptocurrency traders have shown immense interest in the new token, aiming to capitalize on its potential and maximize its liquidity.

One trader recently made $59,000 from the popular ERC-404 token. He revealed that his “secret to making money” was buying and selling the ERC 404 token, MINER, using the high gas fees as an advantage.

The co-founder of Gaslite GG, identified as ‘Pop Punk’ on X (formerly Twitter), has also predicted that introducing ERC-404 tokens will lead to a continuous daily rise in the average Ethereum gas price.

Earlier Thursday, the market capitalization of ERC-404 tokens soared to $296 million, announcing their arrival in the crypto market. The token standard was launched on February 5 and has gained immense traction in crypto.

Although ERC-404 tokens remain unofficial due to the absence of a complete audit and endorsement by Ethereum developers, they have witnessed a significant surge in the days following their launch. One of the prominent ERC-404 tokens, Pandora, recently saw a rise of over 400%.

The experimental tokens have gained widespread popularity due to their unique approach of bridging the gap between fungible and non-fungible tokens for better liquidity and fractionalization.

Chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

By Ellen Zhang and Marius Zaharia

BEIJING/HONG KONG (Reuters) – When Kris Lin, who owns a lighting factory in China, received this year’s first order from a close overseas client, he faced a distressing choice: take it at a loss, or tell workers not to come back after the Lunar New Year.

“It was impossible for me to lose this order,” said Lin, who plans to re-start his factory in the eastern city of Taizhou at around half its capacity after the Feb. 10-17 holiday break.

“I could have lost this client forever, and it would have endangered livelihoods for so many people. If we delay resuming production, people might start doubting our business. If rumours spread, it affects the decisions of our suppliers.”

Prolonged factory deflation is threatening the survival of smaller Chinese exporters who are locked in relentless price wars for shrinking business as higher interest rates abroad and rising trade protectionism squeeze demand.

Producer prices have been falling for 15 straight months, crushing profit margins to the point where industrial output and jobs are now at risk and compounding China’s economic woes, which include a property crisis and debt crunch.

About 180 million people work in export-related jobs, commerce ministry data from 2022 shows.

Raymond Yeung, chief China economist at ANZ, says fixing deflation should be a higher policy priority than reaching the expected growth target of around 5% for this year.

“Companies cut product prices, then staff salaries. Then consumers won’t buy – this could be a vicious cycle,” he said.

Profits at China’s industrial firms fell 2.3% last year, adding to the 4% drop in COVID-hit 2022. An official survey showed manufacturing activity contracting for a fourth straight month in January, while export orders shrank for a 10th month.

For Lin, that has meant the $1.5 million order his client placed was 25% below a similar one last year. It was 10% below production cost.

Sluggish exports mean policymakers need to pull other levers to reach their growth target, increasing the urgency of stimulating household consumption, analysts say.

“The more ‘rebalanced’ growth is, the faster that downward pressure on prices and margins will dissipate,” said Louis Kuijs, Asia-Pacific chief economist at S&P Global.

‘RAT RACE’

China has been funnelling financial resources into the manufacturing sector, rather than consumers, exacerbating overcapacity and deflation concerns, even in booming higher-end sectors, such as electric vehicles.

An executive at an automotive moulds factory from the eastern Zhejiang province, who asked not to be named due to the sensitivity of the matter, expects the firm’s output and exports to rise, but earnings to fall, describing the intensifying competition in the industry as a “rat race.”

As China’s central bank unleashes liquidity into the financial system to spur growth, banks are chasing factories with cheap loan offers.

But squeezed out by bigger rivals, smaller firms are unwilling to take on loans to finance new business, in what economists see as a broken link in China’s increasingly inefficient monetary policy.

Investment by private companies, which according to state officials provide 80% of urban jobs, dropped 0.4% last year, while state investment rose 6.4%.

“Many bank managers call me and they sound very anxious when they can’t lend money,” said Miao Yujie, an e-commerce clothing exporter.

Even after halving his workforce to about 20 people last year, he cannot turn a profit as bigger firms elbow him out of the market.

“But you only need to borrow when you want to expand,” said Miao, adding he mulls closing his business.

THIS TIME IS DIFFERENT

China also went through a deflationary scare in 2015, when it faced overcapacity in primary industries, such as steel, dominated by state-owned enterprises. Authorities downsized these companies to reduce supply and accelerated infrastructure and property construction to boost demand.

“This time it’s more of a private sector surplus,” said Hwabao Trust economist Nie Wen, singling out electronics, chemicals and machinery makers. These firms employ large numbers of people, a sensitive spot for China’s policymakers.

“It is therefore difficult to shrink supply, so more effort should be made on the demand side this year,” Nie said.

Factory owners say the pressure to cut jobs is intense, even if some are reluctant to do so.

Yang Bingben, whose company makes industrial-use valves in the eastern city of Wenzhou, said he had thought of shutting down the business, but keeps it running as he feels indebted to his workers, most of whom are close to retirement age.

Still, he doesn’t know how long the factory can survive.

“This year will be the best of the next decade,” Yang said.

(Additional reporting by Qiaoyi Li; Graphic by Kripa Jayaram; Editing by Sam Holmes)

There has been a notable spike in the number of Polkadot transactions in recent days. The surge also coincides with DOT prices racing to new 2023 highs when writing on December 22.

Taking to X, asynchronous rob noted that Polkadot is currently processing around 250,000 transactions per hour or 400-450 per block. Polkadot is a modern blockchain that aims to drive blockchain interoperability.

Based on its design, relying on a Relay Chain and numerous Parachains, the network can process transactions cheaply, considering its high capacity.

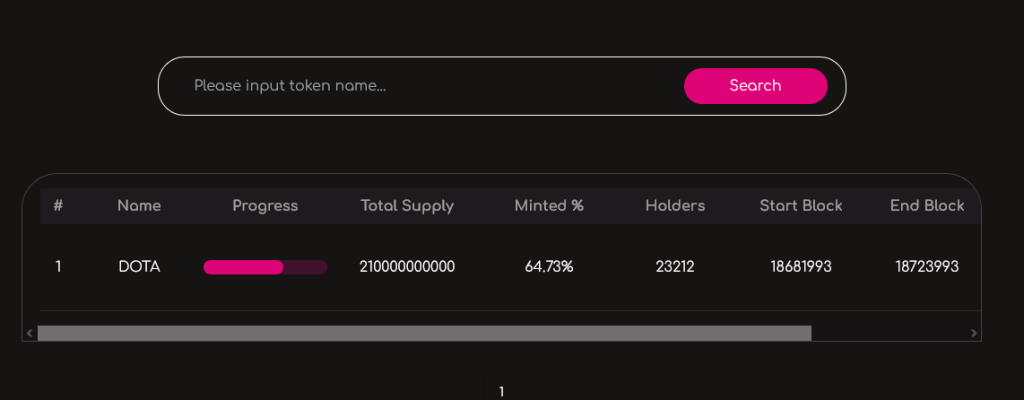

The rapid expansion of transactions on Polkadot can be attributed to the recent launch of inscriptions, a new type of cross-chain asset developed by the Dota platform. Uniquely, Dota’s inscriptions aim to simplify the process of deploying and minting assets on Polkadot’s parachains.

Though parachains operate independently as “chains” that rely on the Relay Chain for security, this design will eliminate the need for Cross-Chain Message Forma (XCM), which is needed for Polkadot parachains to communicate.

Usually, the XCM requires complex coding and can be time-consuming. Therefore, the simplicity of DOT-20 inscriptions by Dota directly explains why there is a surge in the number of transactions.

According to Dota on X, inscriptions on Polkadot account for 98% of the recent transaction volume.

Though there has been a change in the number of transactions processed, transaction fees on Polkadot remain low. At the same time, the network hasn’t “skipped a bit,” with capacity being around 10%.

By how Polkadot is designed, network fees will increase only once 25% of the total network capacity is changed. To reach this level, each block being confirmed on Polkadot must pack at least 1,250 transactions.

This will require even more inscriptions to be created via Dota, meaning despite the observed spike, Polkadot is technically underutilized from a bandwidth perspective.

While the deluge of transactions also coincides with rising DOT prices, currently at 2023 highs, there have been concerns about inscriptions causing network congestion in a network like Bitcoin facing scaling challenges.

Critics maintain that inscriptions, though defended by some, serve nothing more than spamming the network and discouraging use due to accompanying increases in transaction fees.

For now, it remains to be seen if inscriptions will be sustainable, helping onboard more users. So far, Polkadot, as mentioned, can handle the uptick in transactions.

Even so, if there is a 3X rise in transactions exceeding the 1,250 transactions per block threshold, the demand for DOT will rise. Subsequently, DOT will likely trend higher towards $10 and other critical resistance levels.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The House Financial Services and House Agriculture Committees have advanced bills actively seeking to provide a clear regulatory framework to govern the crypro and stablecoin market.

In 2023, the crypto industry witnessed a substantial surge in lobbying efforts aimed explicitly at shaping stablecoin regulations and influencing legislative outcomes in the United States, Bloomberg reported.

According to the report, lobbying on stablecoin legislation experienced a significant uptick this year, with 161 reports – a remarkable 79% increase compared to last year.

For clarity, Stablecoins are a type of digital asset that serves as a bridge between the traditional financial industry and the emerging economy. These digital assets gained heightened significance for their supposed backing by reserve assets like treasuries, bonds, and even fiat currencies such as the US dollar, European euro, and Mexican pesos.

Due to their supposed role in connecting both traditional finance and the crypto market, lawmakers in the United States have accelerated their efforts to provide a clear regulatory framework for governing the use of this asset class.

Both Democrats and Republicans, alongside the Biden administration, prioritized oversight of stablecoins this year. The bipartisan commitment remained strong despite disagreements on other digital asset-related issues following the collapse of Sam Bankman-Fried’s crypto empire FTX.

As per the Bloomberg report, several crypto firms, alongside traditional financial giants like Bank of America and Visa, engaged in lobbying efforts to influence legislative outcomes on Capitol Hill.

One of the crypto companies, Tether, the issuer of the leading stablecoin USDT, spent $760,000 during the first three quarters of 2023. The contribution placed the company as the sixth-highest spender among crypto firms.

The company’s major rival, Circle Financial, also spent approximately $300,000 during the same period compared to the $270,000 it spent in 2022. Invariant LLC represented the company.

Coinbase Global Inc (NASDAQ: COIN), on the other hand, emerged as the top spender overall on all issues, dedicating a portion of its $2 million expenditure to advocate for stablecoins rules. The Bank of America, Visa, and the US Chamber of Commerce also joined for the same issues as Coinbase.

The House Financial Services Committee emerged as a focal point for the stablecoin debate, actively advancing a bill in July. However, according to US Rep. French Hill (R-Ark.), the bill could be delayed until next year before making any progress.

In a statement emailed to Bloomberg, Bill Hulse, Senior Vice President at the US Chamber of Commerce Center for Capital Markets Competitiveness, emphasized the importance of introducing crypto bills to the US market.

According to him, policymakers in the country should provide comprehensive regulations for payment stablecoins to foster expansion within the United States’ digital assets market. Despite the country’s position in the financial market, the US is yet to agree on a law that could foster the adoption of digital assets, unlike Europe, which is working to provide a clear regulatory framework called MiCA for all things crypto.

Meanwhile, while stablecoins gained significant attention from lawmakers in the region this year, the crypto industry’s lobbying efforts extended beyond the asset class. Digital assets companies spent around $19.3 million within the first nine months of 2023, topping the previous high of $15.6 million during the same period last year.

The House Financial Services and House Agriculture Committees have advanced bills actively seeking to provide a clear regulatory framework to govern the market.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.