On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

Source link

rally

Can Ethereum Touch $4,000? Crypto Analyst Says ETH Rally Far From Over

Like Bitcoin, Ethereum has also picked up steam, with the second-largest crypto token crossing the $3,000 resistance level for the first time since 2021. Interestingly, this crypto analyst believes the rally is far from over, as he highlighted a key price level that ETH could hit soon enough.

Ethereum Could Rise To As High As $4,000

Crypto analyst Altcoin Sherpa suggested in an X (formerly Twitter) post that Ethereum could rise to as high as $4,000. His prediction looks feasible when one considers crypto analyst Bitcoin Ape’s recent analysis of Ethereum from a technical analysis perspective.

In his X post, Bitcoin Ape noted that the ADX (average directional index) indicator is currently “very high,” signalling that ETH’s bullish trend is strong. Indeed, this bullish momentum might be very strong as the crypto token has since crossed the $3,130 price level, which Bitcoin Ape highlighted in his post as ETH’s new resistance level.

Interestingly, the analyst noted that Ethereum had already faced four resistance levels in February alone and has so far broken all of them, having also crossed the $3,130 mark. Although Bitcoin Ape failed to give his short-term prediction for ETH, he expects the crypto token to hit its all-time high (ATH) of $4,891 when the bull run returns in full force.

Meanwhile, Altcoin Sherpa isn’t the only one who believes that ETH could rise to $4,000 soon enough. Standard Chartered Bank had also predicted that the crypto token would hit this price level by the time the Spot Ethereum ETF is approved in May.

Crypto analyst Rager also recently gave a bullish prediction for ETH’s price, although he put his short-term target at $3,500. However, he added that this price level is only the beginning, stating that it isn’t the “peak high by any means.”

Ethereum’s Rally Not Hinged On Bitcoin’s Success

There is reason to believe Ethereum’s current bullish momentum isn’t due to Bitcoin’s price surge, as the Ethereum ecosystem also has narratives that may be driving ETH’s rally. For one, the Ethereum network’s ‘Dencun’ upgrade is set to take place on March 13. This much-anticipated event is significant as it would usher in advancements in the scalability, security, and usability of the Ethereum network.

Meanwhile, talks about a Spot Ethereum ETF likely being approved in May have created a lot of excitement for investors who have chosen to double down on their investments in the second-largest crypto token in anticipation of this happening.

The increased interest in ETH is expected to spark significant rallies in its price ahead of the May deadline, when the SEC will have to approve or deny VanEck’s Spot Ethereum ETF application.

ETH bulls maintain hold above $3,200 | Source: ETHUSD on Tradingview.com

Featured image from Bitcoinist, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto analyst Egrag Crypto has put out an ultra-bullish price prediction for VeChain (VET), which the analyst predicts will achieve significant gains soon enough.

VeChain To See A 140x Gain

Egrag mentioned in an X (formerly Twitter) post that the VeChain token could see a 50x or 140x gain. He further highlighted how the crypto token could achieve any of this move to the upside. Analysing the chart, he stated that a 50x move could be in play if VET sees a similar percentage increase to the one that occurred around 2019.

Source: X

Back then, VET is said to have seen a 5,892% increase. Egrag predicts that the crypto token could rise to $0.9 if this move is indeed in play. Meanwhile, for the 140x gain, the analyst claimed that this move could be in play if the market eventually witnesses a similar percentage increase to the one around 2021 when VET’s price increased by 14,638%.

Related Reading: Pro-Ripple Lawyer Tags Poor XRP Price Performance As Unnatural, Rally Imminent?

That was when the crypto token hit its all-time high (ATH) of $0.27. Egrag predicts that VET could rise to as high as $2 if this is the move that ends up materializing. This prediction also means that VET will likely see a new ATH in the next bull run.

This is not the first time Egrag has offered a bullish price prediction for the VET token. Last year, the analyst predicted that VET could rise to $1.6 based on historical patterns. This prediction came after the crypto token made an impressive surge of 77%, hitting price levels unseen since May 2022.

Big Moves Still Lie Ahead For VET

IEgrag isn’t the only analyst who has recently laid out a bullish narrative for the VeChain token. Crypto analyst and YouTuber Crypto ZX also gave an analysis where he predicted that the crypto token could hit new ATHs if it succeeded in breaking certain resistance levels. One level he highlighted then was the $0.033 mark.

The analyst had also suggested that VET was currently in a period of consolidation as it gears up for another move to the upside. On the next leg up, Crypto ZX predicted that the crypto token was going to surge above the $0.033 resistance level. The analyst further revealed that a move above that level would be vital to unlocking new highs.

Interestingly, VeChain has since risen above that level. At the time of writing, the crypto token is trading at $0.0474, up over 5% in the last 24 hours, according to data from CoinMarketCap.

VET price at $0.048 | Source: VETUSDT on Tradingview.com

Featured image from Adaas Capital, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The cryptocurrency market witnessed a significant shift in momentum on February 23rd, as Uniswap native token, UNI, skyrocketed by an impressive 71%. This surge marks the token’s highest price point since March 2022, sending shockwaves through the crypto landscape and reigniting interest in the decentralized finance (DeFi) sector.

Source: Coingecko

Uniswap Proposes Fee-Sharing Feast For Stakers

The primary catalyst behind this astronomical rise appears to be a pivotal proposal unveiled by the Uniswap Foundation. This proposition advocates for the implementation of a novel fee-sharing mechanism, fundamentally altering the token’s utility and incentivizing long-term participation within the Uniswap ecosystem.

Under the proposed system, UNI holders who stake their tokens will be rewarded with a portion of the fees generated by the Uniswap protocol. This not only grants them a direct financial incentive but also empowers them to choose delegates who vote on governance proposals, shaping the future direction of Uniswap.

This revolutionary approach resonates with a broader trend of resurgent interest in DeFi. According to on-chain data provider Santiment, assets associated with decentralized lending, borrowing, and cryptocurrency exchange, like $COMP, $SUSHI, and $AAVE, have all experienced notable value increases, mirroring UNI’s upward trajectory.

Trade Volumes On A Roll

Further bolstering this trend, trading volumes across these protocols have also seen explosive growth. For instance, the COMP price jumped alongside a staggering 400% increase in trading volume, reaching over $175 million.

Similarly, SushiSwap (SUSHI) witnessed a 27% price surge coupled with a 153% increase in trading volume. This shift in investor focus is further underscored by a corresponding decline in the value of AI-related coins, indicating a potential capital rotation within the market.

UNI currently trading at $12.16 on the daily chart: TradingView.com

Uniswap v4 Upgrade On The Horizon: Efficiency And Customization Beckon

Adding fuel to the fire is the impending arrival of the highly anticipated Uniswap v4 upgrade, slated for release in Q3 2024. This transformative update promises to enhance the protocol’s efficiency and customizability, catering to the evolving needs of the DeFi space.

While the direct impact of v4 on the current price surge remains debatable, its potential to revolutionize the Uniswap experience undoubtedly contributes to the overall bullish sentiment surrounding UNI.

Beyond Uniswap: DeFi Dominance On The Rise?

The Uniswap fee-sharing proposal and upcoming v4 upgrade have not only revitalized the UNI token but also cast a spotlight on the broader DeFi landscape. Analysts predict that other DeFi protocols like Blur and Lido Finance could witness similar surges in the wake of Uniswap’s bold move.

This potential domino effect underscores the growing importance of DeFi within the cryptocurrency ecosystem, attracting investors seeking innovative financial solutions beyond traditional centralized systems.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Dogecoin Begins Massive Recovery Trend, But Can These Factors Drive A Rally To $0.2?

The Dogecoin price action in the past few days is showing signs of the crypto embarking on a bullish recovery. Particularly, DOGE has seen a strong uptick in trading volume in the last few days, fueled by an increase in activity from whale addresses.

At the time of writing, DOGE spiked by over 6% in the past 24 hours to break over $0.09 for a brief moment. This spike in DOGE came despite the price of Bitcoin showcasing a weakening of bullish momentum at $52,000 and most cryptocurrencies sparking corrections, indicating a lingering bullish momentum among DOGE traders.

DOGE Recent Metrics Indicate Recovery Trend

Dogecoin mostly went through a lackluster price action throughout January, with the cryptocurrency ending the month at $0.07973, a negative 13% from its open price on January 1. The $0.079 price level acted as a major support, as DOGE started to rebound in early February after the formation of a double bottom. Consequently, DOGE technicals, transaction count, and price action pointed to a change in momentum and sentiment amongst traders.

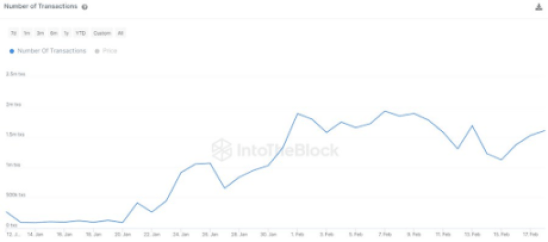

According to metrics from the on-chain analytics platform IntoTheBlock, the Dogecoin ecosystem has witnessed a lot of activity in the past month, processing more than 1 million transactions every day since the 30th of January. This increase in activity seems to have been reflected in the price of Dogecoin, with the cryptocurrency up by 11% since the beginning of February.

Source: IntoTheBlock

At the time of writing, DOGE’s trading volume from Coinmarketcap is approximately $824 million, an increase of over 129% in the past 24 hours. The majority of the recent increase in activity can be attributed to whales of large investors.

According to Dogecoin whale data, whale transactions greater than $100,000 now stand at $2.53 billion in the past seven days. Notably, this transaction count from large investors reached 1,570 in the past 24 hours with a total volume of 15.88 billion DOGE. This huge surge of activity seems to be providing the cryptocurrency with a big boost, fueling an impressive recovery that could see it crossing the $0.1 threshold once more and possibly reaching the $0.2 price level.

DOGE Price Action – Rally To $0.2?

Dogecoin has started showing signs of life again, fueled in large part by whale activity. The crypto recently surged to $0.09115 in the past 24 hours. Although still up by 1% in the same timeframe, DOGE has since corrected by 4.5% and is currently trading at $0.08702.

A minor support is at the $0.08693 price level, with metrics and general market sentiment pointing to continued bullish price action in the short time. The first price level would be the return to $0.09. If Dogecoin manages to maintain a stronghold above this key milestone, it is expected to create a more bullish momentum among traders which could see it breaking past above $0.1 for the first time in three months.

This breakthrough over $0.11 could mark an important milestone for Dogecoin’s price trajectory, as the next target would be $0.2.

DOGE price at $0.087 | Source: DOGEUSD on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cardano Poised For Massive Rally As Key Indicators Signal Bullish Reversal, ADA Surges 14%

ADA, the native token of the Cardano ecosystem, has experienced a notable surge in price, taking advantage of Bitcoin’s (BTC) stagnation above the $52,000 level. With gains of 20% and 14% over the past thirty and fourteen days, respectively, ADA has reignited bullish sentiment among investors.

The token’s recent performance has not gone unnoticed, as crypto analyst “Trend Rider” makes a bold price prediction, highlighting key indicators that suggest a potential long-term bull run for ADA.

ADA’s Potential Bull Run Ahead

In a social media post on X (formerly Twitter), Trend Rider emphasized that ADA is striving to consolidate above the crucial $0.600 mark, which holds significant prospects for the token’s future.

The analyst drew attention to an indicator called Impulse colors, which tracks the price distance from key moving averages. During the bear market, opposing trends were predominantly indicated by fuchsia and pink hues as seen in the chart below.

However, recent weeks have witnessed a return to dark blue, the most bullish color on this scale. Notably, this shift in momentum last occurred in 2020 when ADA’s price surged from $0.03 to $1.4 before the re-emergence of pink hues.

Furthermore, Trend Rider highlighted another positive development— the Wave Oscillator has re-entered the positive zone after 20 months. According to the analyst, this shift indicates growing bullish momentum for ADA.

The pivotal level identified in this context is the $0.60 mark. To solidify this shift, ADA’s price must hold and close above $0.60, which may catalyze a bullish long-term breakout.

It is worth noting that this analysis is based on the 1-month timeframe, which significantly influences long-term market movements.

These indicators suggest that ADA may be poised for a sustained uptrend, potentially paving the way for a long-term bull run.

Cardano Sustained Bullish Trend

According to the one-day ADA/USD chart below, Cardano’s token reached a 21-month high of $0.679 on December 28, which marked the beginning of a period of volatility in ADA’s price. Following a price correction, ADA dropped to $0.449 on January 23.

However, in line with the overall market trend, ADA has regained bullish momentum. Nonetheless, this upward movement may face resistance from bears as it encounters various obstacles.

If the current uptrend continues in the coming weeks, ADA must overcome significant resistance levels that have hindered its growth above the $0.679 mark.

Successful consolidation above the critical $0.600 level will be crucial. ADA will face the $0.637 obstacle soon before potentially surging above $0.670, the last hurdle before reaching $0.700. Reaching this milestone would position Cardano’s native token favorably to target the $1 mark, benefiting from the overall market growth expected in the coming months of 2024.

Adding to the bullish prospects for Cardano, ADA has been establishing higher lows and higher highs during its price surge, indicating a healthy price action and a sustained bullish trend. However, it remains to be seen whether this trend can be sustained or if bears will dictate ADA’s future price direction.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Nvidia faces stiff test in Q4 earnings after ‘parabolic’ stock rally

When Nvidia reports fiscal fourth-quarter earnings after the market close Wednesday, it will do so as the world’s third most valuable public company. Investors are giving the company little margin for error.

Nvidia’s stock price has soared fivefold since the end of 2022, as demand has skyrocketed for its graphics processing units that sit at the heart of the artificial intelligence boom. Nvidia’s chips, such as the H100, are used by AI developers to create cutting-edge models like the ones OpenAI used to develop ChatGPT.

The company’s market cap climbed to about $1.8 trillion last week, surpassing Alphabet and Amazon and now trailing only Microsoft and Apple.

“NVDA’s stock appreciation has been parabolic,” analysts at Bank of America wrote in a report Thursday. They reiterated their buy rating and said, “We think one interpretation of this NVDA move is a mix of fear and greed and indiscriminate investor chase for all things AI.”

The other megacap tech companies all reported quarterly results weeks ago. All eyes are now on Nvidia.

Analysts are expecting a startling 240% increase in revenue from a year earlier to $20.6 billion for the period ending Jan. 28, according to LSEG, formerly known as Refinitiv. For every new dollar of sales the company generates, it’s squeezing out even more profit.

Net income likely surged more than sevenfold to $10.5 billion from $1.41 billion a year earlier. In the third quarter, Nvidia’s gross margin jumped to 74% from 53.6% the prior year.

Outsize growth is expected in Nvidia’s data center business, which includes its AI chips. Analysts project an almost fourfold increase in revenue on an annual basis to $17.06 billion, according to FactSet.

Wall Street will be listening closely to commentary from Nvidia CEO Jensen Huang for an indication of how long these stratospheric growth rates are expected to last. The company already reported 200% year-over-year growth in the third quarter, and analysts are expecting a similar rate of expansion in the first period of this year.

One potential concern is that many of Nvidia’s GPU sales are going to big tech companies such as Microsoft, Amazon, Meta and Google. Any or all of them could decide to slow AI hardware spending at some point if they’re not seeing intended benefits.

“All four communicated plans to significantly increase investment in their AI infrastructure this year, which bodes very well for NVDA’s fourth quarter results and 2024 Q1 guidance,” wrote D.A. Davidson analyst Gil Luria in a note Thursday. He has a neutral rating on the stock with a $410 price target.

However, he warns that the long-term picture for demand from Nvidia’s top customers could be more mixed.

“They referred to their purchasing as ‘flexible’ and ‘demand driven,’ implying they would scale it down if we got past the current hype cycle,” Luria wrote. “While we do not believe we are there yet, we are seeing possible early signs.”

Nvidia’s gaming segment, which includes graphics cards for PCs and laptops and used to be the company’s primary business, is also expected to grow, but at a more measured rate of 49% to $2.72 billion in revenue. Some of Nvidia’s gaming cards are also used by small companies and researchers for AI.

Thomas O’Malley of Barclays said the report will be fairly simple to analyze.

“The [data center] GPU number will be the only key metric that matters along with commentary on broader market adoption,” O’Malley, who has a neutral rating on the shares, wrote Friday. “Most conversations we have center on the sustainability of the current run-rate in [data center], which is approaching $100B per year.”

Other analysts are focused on whether Nvidia has enough supply to meet short-term demand, in part because the company relies on Taiwan Semiconductor Manufacturing Company for its chips. There’s also budding anticipation regarding the company’s newest top-end AI chip, called B100, which starts shipping this year.

“We are particularly excited about Nvidia’s plans to launch the B100 later in 2024 and the X100 in 2025,” wrote Melius Research analyst Ben Reitzes, who recommends buying the stock, in a report last week. “If the upgrade from the A100 to the H100 is any indication, the Total Cost of Ownership benefit for data center operators will be enticing enough to fuel the upgrade and make 2025 a growth year.”

WATCH: New Nvidia price target hikes

VeChain (VET), a blockchain platform focused on supply chain management and enterprise solutions, is experiencing a surge in price and trading volume, fueled by bullish predictions and anticipation of a major announcement related to environmental sustainability.

Over the past 24 hours, VET has jumped an impressive 12%, currently trading at $0.047. This follows a remarkable week where the altcoin gained a solid 67%, defying the recent lull in the broader cryptocurrency market. Notably, trading volume has skyrocketed by a staggering 155%, reaching over $135 million within the same period.

VET price action. Source: Coingecko

VeChain: Technical Breakout And Price Target

Crypto analyst Ali Martinez has garnered attention with his technical analysis, suggesting that VET is nearing the end of its consolidation phase. Martinez, referencing historical price patterns, predicts a breakout to the $0.05 region this week. If his prediction holds true, this would represent a further increase of 36% from the current price.

It feels like it will be a big week for #VeChain! If history repeats itself, $VET could be looking at a move to $0.054 this week, a brief correction until June, and then a bull run to $0.70 by November! pic.twitter.com/wTdPW34NNH

— Ali (@ali_charts) February 14, 2024

Martinez’s analysis draws parallels to VET’s 2021 bull run, preceded by a 595-day consolidation period. He posits that a similar trajectory could unfold this year, with a potential first target of $0.054, a level not seen since February 2022. This would translate to a remarkable 56% gain from the current price.

Impending Announcement Fuels Speculation

Adding to the bullish sentiment is the anticipation of a significant announcement from VeChain. Industry insiders hint at the company’s plans to unveil initiatives leveraging blockchain technology to address environmental challenges. The potential for blockchain to promote sustainable practices and create interconnected ecosystems that reward eco-conscious behavior is resonating with investors.

VeChain is joining the global tech community later this month, embarking on a tech-driven campaign to drive a sustainable future at #MWC2024.

— vechain (@vechainofficial) February 14, 2024

This strategic direction aligns with VeChain’s core values of sustainability and transparency, potentially attracting new investors and partnerships focused on environmental solutions. The announcement’s specifics remain undisclosed, but the buzz has undoubtedly contributed to the recent price surge.

VET market cap currently at $3.543 billion. Chart: TradingView.com

Community Anticipates Price Explosion, Analyst Cautions

VeChain’s strong community is particularly optimistic, with some predicting a price of $0.7 by November 2024. This ambitious target represents a staggering 1,921% increase from the current price. While the potential for growth is undeniable, it’s crucial to approach such predictions with caution.

Martinez acknowledges the bullish sentiment but warns of a potential short-term correction in June before the anticipated upward rally. He emphasizes the inherent volatility of the cryptocurrency market, reminding investors to conduct thorough research and adopt a risk-management approach before making any investment decisions.

Meanwhile, VeChain’s recent price surge and upcoming announcement have ignited excitement within the cryptocurrency community. While technical analysis suggests a potential breakout and ambitious price targets are circulating, it’s essential to remember the inherent volatility of the market and exercise caution.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Matt Dines, the Chief Investment Officer at Build Asset Management, has identified a classical ‘Cup and Handle’ pattern in the Bitcoin (BTC) price chart, which he believes could signal an impending rally to $75,000. This technical formation is often considered a strong bullish signal and is closely watched by market analysts and traders.

Bitcoin Price Validates Cup And Handle Pattern

The ‘Cup’ part of the pattern, resembling a bowl or rounding bottom, began forming in March 2022 when the price plunged below $48,000 and entered one of the longest Bitcoin bear markets. The pattern reached its lowest point at approximately $17,600, signifying a strong support level for Bitcoin.

The left side of the pattern shows a rounded bottom resembling a “cup.” It forms when the price initially declines, then consolidates, and finally starts to rise again. Since hitting this bottom, Bitcoin’s price has made a steady recovery, mimicking the right side of the cup, indicating a bullish reversal of the previous downtrend.

“The saucer or the ‘cup’ signifies a consolidation period, a pause in the downward trend, before the price begins to rise back up to the test resistance levels,” Dines explained. The recovery to the initial resistance line completes the ‘cup’ portion of the pattern. The Bitcoin price completed this step in early January this year.

The subsequent ‘Handle’ is represented by a moderate retracement following the recovery, which forms a small dip or pullback from the peak. This handle is identified by a slight downward trajectory and is considered the final consolidation before a breakout.

BTC’s price drop to $38,600 at the end of January marked the bottom of the pullback. With the breakout above $48,000, the Bitcoin price validated the cup and handle pattern.

Setting A BTC Price Target

Dines also addressed the placement of the vertical projection from the bottom of the handle, clarifying its basis: “It’s totally arbitrary and in the eye of the beholder. But longer answer, traders are eyeing charts for formations.”

The vertical target line, or the ‘stick’ on the right, is projected from the bottom of the handle. The height of the cup — from the low at around $17,600 to the resistance line at $48,000— sets the stage for the price target.

Dines added, “A lot of traders will use the height of the bowl (from the low of the bowl to the top at the resistance line) to set their price target. Just add that height to the bottom of the handle … that’s a decent guesstimate for where we’d see the longs who entered on the breakthrough to set their price target.”

Based on the chart, the height from the cup’s low to the resistance level is roughly $31,973, marking the increase in Bitcoin’s price from its lowest point to the current level when the chart was produced. Projecting this height from the handle’s formation suggests a target in the vicinity of $75,000.

Dines further adds that the collective behavior of market participants will indeed guide the price movement: ” A lot of those longs would set a retrace at ~$75k as they close out their W. If enough participants put this trade on it will set the dominant price action … they win out and it will turn the chart into reality. I know it sounds ridiculous, but in the real world this is how markets actually discover price.”

At press time, BTC traded at $51,821.

Featured image created with DALLE, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum, Solana see gains as Bitcoin’s rally above $50,000 causes $184 million liquidations

Bitcoin’s surge past $50,000 catalyzed a broader market upswing, propelling numerous large-cap alternative digital assets such as Ethereum (ETH), Solana (SOL), and others to significant gains.

According to data from CryptoSlate, Ethereum saw a 7% uptick, reaching $2,661, while SOL surged 8% to hit $114. Among the top 10 digital assets, Avalanche’s AVAX spiked 6% to $41, Cardano’s ADA rose by 3.74% to $0.5574, while BNB Coin (BNB) and Ripple’s XRP experienced more modest gains, each climbing by less than 3%.

Market analysts attribute this bullish trend to the buzz surrounding the multiple spot Bitcoin exchange-traded funds (ETFs) in the US. Vetle Lunde, a senior analyst at K33 Research, noted that inflows into these ETFs have remained robust more than a month after their launch.

“Yesterday saw a net inflow of 9,870 BTC, pushing the net U.S. spot ETF flow since launch to 72,312 BTC. The new nine now hold 228,000 BTC,” Lunde added.

During the past day, BTC’s price crossed the $50,000 threshold for the first time since late 2021. The top crypto’s value has risen 4.2% to $50,146 as of press time, extending a positive run that had seen it gain 16% over the past week.

$184 million in liquidation

The broader crypto market rally resulted in a significant liquidation totaling over $184 million from more than 56,000 traders, according to Coinglass data.

Short traders, or speculators betting against price increases, bore losses amounting to $134 million, while long traders betting on price increases lost approximately $50 million.

Across assets, Bitcoin led the liquidation charts with a total loss of $69.80 million. Short Bitcoin traders accounted for $55.04 million in losses, while long traders lost $14.76 million. Ethereum followed closely, contributing $39.85 million to the overall liquidation.

Other assets like Solana, LINK, and ORDI also experienced liquidations of $10.14 million, $5.93 million, and $4.81 million, respectively.

Across exchanges, Binance witnessed the highest proportion of liquidations at 43.13%, totaling $79.42 million. Other platforms like OKX and ByBit recorded liquidations of $58.29 million and $18.73 million, respectively.

Notably, the most significant liquidation order occurred on Bitmex for LINKUSD, amounting to $3.14 million.