The Federal Reserve should keep credit conditions tight for now.

Source link

rates

The outlook for Binance Coin (BNB) has turned cloudy, with both futures market data and technical indicators flashing bearish signals. Based on our analysis of Coinglass data, negative funding rates and declining open interest in BNB futures contracts paint a picture of growing pessimism among traders.

A negative funding rate suggests that more traders are holding short positions, anticipating a decline in the price of the asset. This sentiment was confirmed on April 1st, when BNB’s funding rate dipped into negative territory at -0.012%.

Binance Coin Funding Rate And Open Interest Down

Further fueling the bearish narrative, BNB’s futures open interest has also witnessed a slight decline of 0.15%. Open interest reflects the total amount of outstanding futures contracts that haven’t been settled yet.

A decrease in open interest suggests traders are exiting their positions without opening new ones, potentially signaling waning confidence in the market.

Source: Coinglass

Funding rates are a crucial mechanism in perpetual futures contracts that keep the contract price aligned with the spot price. When the contract price trades higher than the spot price, long position holders pay a fee to shorts, resulting in positive funding rates.

Conversely, negative funding rates materialize when the contract price dips below the spot price, indicating that short sellers are currently paying fees to longs.

Source: Coinglass

More Traders Close Their Positions

As negative sentiments mount, this open interest is expected to plummet further. This would imply that more traders are closing their positions and not opening new ones, suggesting a potential price drop for BNB.

The bearish sentiment isn’t confined to the futures market. The Moving Average Convergence Divergence (MACD), another technical indicator, is suggesting a possible resurgence in selling pressure.

There’s an indication that the MACD line might cross below the signal line, typically interpreted as a bearish sign signaling the return of sellers to the market. It’s noteworthy that since March 18th, the MACD lines for BNB have been positioned for a downtrend.

BNB market cap currently at $87.9 billion. Chart: TradingView.com

BNB Price Retreat In The Offing?

Considering both the futures market and technical analysis, there’s a potential for a short-term decline in BNB’s price. However, it’s important to acknowledge that market sentiment can shift rapidly, and technical indicators aren’t infallible predictors of future price movements.

At the time of writing, BNB was trading at $587, up 6% in the last 24 hours, data from CoinMarketCap shows.

Meanwhile, a closer look at BNB’s technical indicators on the 24-hour chart reveals another trend.

The Directional Movement Index (DMI), used to gauge trend strength, displayed a bearish crossover where the negative directional index sits above the positive directional index. This positioning suggests that bearish momentum is currently dominating the market.

Analysts commonly interpret this particular crossover as an imperative signal prompting traders to consider exiting long positions and initiating short positions.

This strategic move aligns with the prevailing trend indicated by the DMI, reinforcing the notion of a prevailing bearish sentiment within the market ecosystem.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bank of England set to hold rates, but falling inflation brings cuts into view

The Bank of England in the City of London, after figures showed Britain’s economy slipped into a recession at the end of 2023.

Yui Mok | Pa Images | Getty Images

LONDON — The Bank of England is widely expected to keep interest rates unchanged at 5.25% on Thursday, but economists are divided on when the first cut will come.

Headline inflation slid by more than expected to an annual 3.4% in February, hitting its lowest level since September 2021, data showed Wednesday. The central bank expects the consumer price index to return to its 2% target in the second quarter, as the household energy price cap is once again lowered in April.

The larger-than-expected fall in both the headline and core figures was welcome news for policymakers ahead of this week’s interest rate decision, though the Monetary Policy Committee has so far been reluctant to offer strong guidance on the timing of its first reduction.

The U.K. economy slid into a technical recession in the final quarter of 2023 and has endured two years of stagnation, following a huge gas supply shock in the wake of Russia’s invasion of Ukraine. Berenberg Senior Economist Kallum Pickering said that the Bank will likely hope to loosen policy soon in order to support a burgeoning economic recovery.

Pickering suggested that, in light of the inflation data of Wednesday, the MPC may “give a nod to current market expectations for a first cut in June,” which it can then cement in the updated economic projections of May.

“A further dovish tweak at the March meeting would be in line with the trend in recent meetings of policymakers gradually losing their hawkish bias and turning instead towards the question of when to cut rates,” he added.

At the February meeting, two of the nine MPC decision-makers still voted to hike the main Bank rate by another 25 basis points to 5.5%, while another voted to cut by 25 basis points. Pickering suggested both hawks may opt to hold rates this week, or that one more member may favor a cut, and noted that “the early moves of dissenters have often signalled upcoming turning points” in the Bank’s rate cycles.

Berenberg expects headline annual inflation to fall to 2% in the spring and remain close to that level for the remainder of the year. It is anticipating five 25 basis point cuts from the Bank to take its main rate to 4% by the end of the year, before a further 50 basis points of cuts to 3.5% in early 2025. This would still mean interest rates would exceed inflation through at least the next two years.

“The risks to our call are tilted towards fewer cuts in 2025 – especially if the economic recovery builds a head of steam and policymakers begin to worry that strong growth could reignite wage pressures in already tight labour markets,” Pickering added.

Heading the right way, but not ‘home and dry’

A key focus for the MPC has been the U.K.’s tight labor market, which it feared risked entrenching inflationary risks in the economy.

January data published last week showed a weaker picture across all labor market metrics, with wage growth slowing, unemployment rising and vacancy numbers slipping for the 20th consecutive month.

Victoria Clarke, U.K. chief economist at Santander CIB, said that, after last week’s softer labor market figures, the inflation reading of Wednesday was a further indication that embedded risks have reduced and that inflation is on a path towards a sustainable return to target.

“Nevertheless, services inflation is largely tracking the BoE forecast since February, and remains elevated. As such, we do not expect the BoE to conclude it is ‘home and dry’, especially with April being a critical point for U.K. inflation, with the near 10% National Living Wage rise and many firms already having announced, and some implemented, their living wage-linked pay increases,” Clarke said by email.

“The BoE needs data on how broad an uplift this delivers to pay-setting, and hard information on how much is passed through to price-setting over the months that follow.”

Santander judges that the Bank could decide it has seen enough data to cut rates in June, but Clarke argued that an August trim would be “more prudent” given the “month-to-month noise” in labor market figures.

This sentiment was echoed by Moody’s Analytics on Wednesday, with Senior Economist David Muir also suggesting that the MPC will need more evidence to be satisfied that inflationary pressures are contained.

“In particular, services inflation, and wage growth, need to moderate further. We expect this necessary easing to unfold through the first half of the year, allowing a cut in interest rates to be announced in August. That said, uncertainty is high around the timing and the extent of rate cuts this year,” Muir added.

Federal Reserve Chair Jerome Powell testifies during the Senate Banking, Housing and Urban Affairs Committee hearing titled “The Semiannual Monetary Policy Report to the Congress,” in the Dirksen Building in Washington, D.C., on March 7, 2024.

Tom Williams | Cq-roll Call, Inc. | Getty Images

Forecasters in the CNBC Fed Survey are increasingly confident that the U.S. economy will avoid a recession and pull off a soft landing, and unlike past surveys, don’t even see growth slowing much below potential in the next couple of years.

The potential downside of the better forecast: less Fed easing with the possibility that officials at their meeting this week forecast fewer rate cuts in 2024 than they did in December.

“For now, the narrative that the U.S. economy is so fragile that it cannot survive without ultra-low rates has been debunked and discarded into the rubbish bin of history,” wrote John Donaldson, director of fixed income at the Haverford Trust Company, in response to the survey.

The March survey finds the average probability of a soft landing at 52%, up from 47% in the January survey, and the first time that it has been above 50% since the question was first asked in July. The probability of a recession in the next 12 months fell to 32%, the lowest since February 2022, and down from 39% in January and 63% in November.

“The U.S. economy continues to move toward a modest growth and modest inflation environment,” said Scott Wren, senior global market strategist at the Wells Fargo Investment Institute. “This may take longer than initial expectations, but the trend is favorable.”

The Fed’s two-day meeting ends Wednesday, when the central bank is largely expected to keep the federal funds target rate at a range of 5.25% to 5.5%.

Forecasters in general have a bad track record of predicting recessions. The 27 respondents to this survey, among them economists, strategists and fund managers, joined other forecasters in the past year in being fairly certain a recession would hit in 2023. That turned out not to be the case. While the average recession probability is down, about 20% of respondents still say there’s an even-money chance or greater of a downturn in the next 12 months.

“The larger-than-consensus reduction in the federal funds rate in my forecast is contingent on a recession that brings inflation down,” said Robert Fry of Robert Fry Economics. He has a 60% recession probability and sees the Fed slashing rates to 3.6% by year-end from the current level of 5.38%.

Rate cut forecasts

Respondents still see three cuts this year, on average, which would bring the funds rate down to 4.6%. Survey respondents never became as euphoric as futures markets about rate cuts and so they haven’t had to backtrack from the six cuts that the markets priced in. Even then, there are those who believe the Fed could be more hawkish at the upcoming meeting.

Guy LeBas, chief fixed income strategist at Janney Montgomery Scott, said, “The last two months of slightly elevated inflation readings have slammed the door on a rate cut at the moment. …There is a high probability the dot plot will include 2 rate cuts in 2024…”

In December, the last time the Fed released its official forecasts, members called for three cuts this year.

Half of respondents believe the biggest risk is that the Fed cuts too late, while 46% worry the Fed will cut too early. But continued high inflation is judged to be the biggest risk to the economic expansion.

Respondents are a bit more optimistic about rate cuts next year, with the average funds rate forecast to decline to 3.6% compared with a 3.9% forecast in September.

One notable feature of the forecast is call for a very modest economic slowdown. GDP is predicted to grow 1.6% this year, down from 2.5% last year, but far above the 0.7% forecast for 2024 made back in July. The 1.6% is just barely below what is judged to be potential growth and, the economy is seen rising a bit above that level to around 2% in 2025. While not a boom, it’s also not nearly as much of a slowdown as has been routinely predicted for the year ahead in prior surveys.

The March forecast marks the third-straight increase in the 2024 outlook. Now, GDP is not seen below 1% in any of the next four quarters, something that had been a persistent feature of the more pessimistic forecasts of the past year.

Inflation forecast

With more growth comes only modest inflation reduction this year. The Consumer Price Index is forecast to fall to 2.7%, down from the current level of 3.2%. It is expected to fall to 2.4% next year, about equal to the Fed’s 2% target for the PCE Price Index because CPI is believed to run about a half point above PCE.

The unemployment rate ticks up to 4.2%, from 3.9% now, but stays there through 2025. Mark Zandi, chief economist at Moody’s Analytics, writes, “The Federal Reserve has all but achieved its goals of full employment … and low and stable inflation. … The Fed should declare victory and begin to slowly cut short-term interest rates and wind down its QT.”

The balance sheet runoff, or QT, is now forecast to end in January, compared with November in the prior survey. The Fed is seen reducing its total reserves by about a trillion dollars to $6.7 trillion before quitting quantitative tightening and letting bank reserves decline to $2.9 trillion, from the current level of $3.6 trillion.

One-third of respondents say the bigger risk is the Fed stopping too early and leaving its balance sheet too large, 19% are worried about the Fed stopping the runoff too late and a 37% plurality say neither is much of a risk.

While a soft landing has for the first time become the bet of a majority in the survey, 58% also believe equities may be “somewhat overpriced” for that scenario. As a result, respondents see only muted gains in the S&P of 1.8% this year and 5.8% next year from the current level. Those returns are not far off or even better than what investors could receive by buying risk-free one- or two-year treasury notes, offering a persistent challenge to equities from bonds if rates remain high. The 10-year is expected to remain around 4% for this year and the next.

Economist Hugh Johnson believes markets have come too far, too fast and sees “a somewhat more difficult equity market environment in 2024 … before beginning a recovery to the upside…”

Others see a challenge to equity markets directly from the Fed. “The Fed is in no hurry to cut rates,” wrote Richard Sichel, senior investment strategist at The Philadelphia Trust Company. “Current interest rates are more normal than they have been in fifteen years. A diversified high quality stock portfolio should continue to provide good returns.”

Don’t miss these stories from CNBC PRO:

Egypt Devalues Currency, Raises Interest Rates to Fulfill Key IMF Aid Requirement

Authorities in Egypt recently allowed the local currency’s exchange rate versus the U.S. dollar to decrease by more than 60%. Additionally, the central bank raised interest rates by 600 basis points. Both steps were key conditions set by the IMF which Egypt had to meet before the approval of a new financial aid package. IMF […]

Authorities in Egypt recently allowed the local currency’s exchange rate versus the U.S. dollar to decrease by more than 60%. Additionally, the central bank raised interest rates by 600 basis points. Both steps were key conditions set by the IMF which Egypt had to meet before the approval of a new financial aid package. IMF […]

Source link

Funding rates soared as traders bet big on Bitcoin’s future gains before correction

Funding rates are an often overlooked yet vital aspect of the crypto market. These rates are essential in perpetual futures contracts — financial instruments that allow traders to bet on Bitcoin’s price without an expiration date.

Funding rates help align the price of these contracts with the actual market price of Bitcoin through periodic payments between buyers and sellers. Buyers pay sellers if the rate is positive, showing a bullish market mood. Conversely, a negative rate indicates bearish sentiment, with sellers paying buyers.

Funding rates show the market’s leverage direction and overall sentiment. High funding rates suggest a strong bullish sentiment, with traders willing to pay more to hold onto their bets for rising prices. Meanwhile, low or negative rates hint at a bearish outlook, where expectations lean towards a price drop.

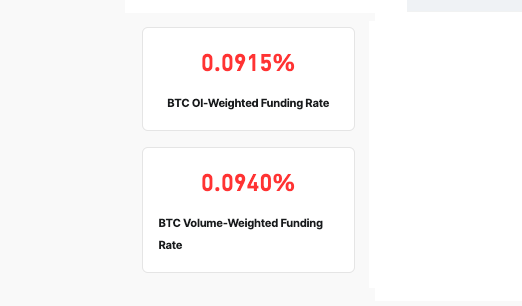

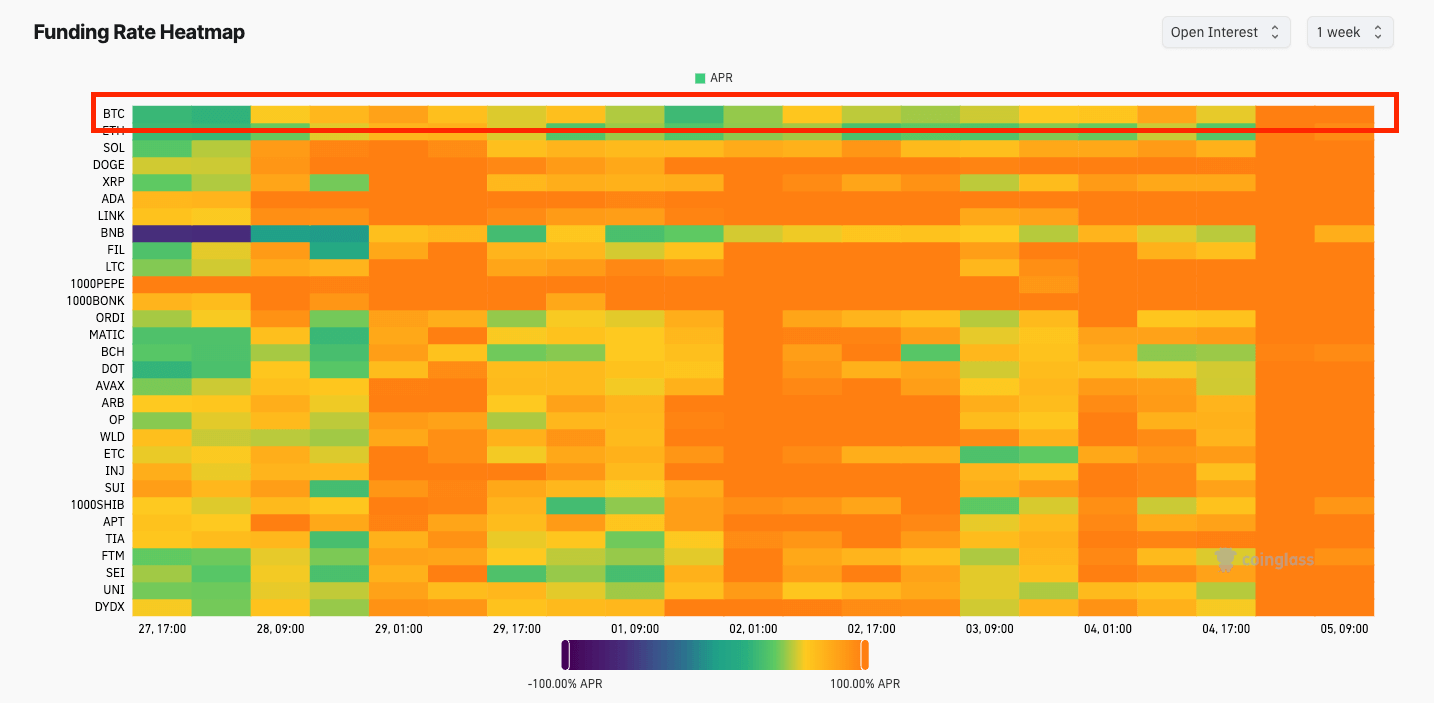

According to CoinGlass data, the open interest-weighted funding rate of 0.0921% and the volume-weighted funding rate of 0.0942% showed a high cost for traders holding long positions in perpetual futures prior to Bitcoin’s March 5 correction. The slight difference between these rates comes from the distribution of open interest and volume across different price points or times, showing a slight difference in market sentiment and leverage.

This high cost of holding long positions shows that most of the market was expecting prices to rise even further in the near future. This is especially significant as BTC had been struggling to regain its ATH of $69,000. Bitcoin briefly broke $69,000 on several exchanges on March 5, but a swift correction brought its price back to $59,500 before recovering to around $67,000.

The bullish sentiment was seen in the dramatic increase in the Bitcoin APR. On March 1, Bitcoin’s price was $61,480, and the funding rate APR stood at 27.72%. And while an uptick in APR was seen in the last few days of February, it wasn’t until the beginning of March that it picked up momentum. The progression from 27.72% APR on March 1 to a sharp increase to 117.52% by the morning of March 5 followed Bitcoin’s price increase from $61,480 to $68,296 over the same timeframe.

The increase in funding rate APRs, particularly the jump observed on March 5, shows bullish sentiment among traders has intensified. The market is increasingly willing to pay higher premiums to hold long positions in anticipation of further price appreciation.

The rapid escalation in APR between March 1 and March 5, particularly the hourly jump between 01:00 and 09:00 on March 5, represents the culmination of speculative fervor, potentially driven by FOMO as traders rush to capitalize on the bullish trend. This scenario often leads to a highly leveraged market where the cost of maintaining long positions becomes exceptionally high, reflected in the surging APR. The fallout of the March 5 price correction saw the Open Interest weighted funding rate fall to 0.0504% as of press time following $309 million in BTC liquidations over the past 24 hours.

Such conditions increase the market’s vulnerability to volatility and corrections. An over-leveraged market is susceptible to sudden price pullbacks, where even minor sell-offs can trigger a cascade of liquidations of leveraged positions, leading to sharp price corrections. Historically, significant run-ups in price and funding rates have occasionally preceded corrections.

The post Funding rates soared as traders bet big on Bitcoin’s future gains before correction appeared first on CryptoSlate.