Oil prices probably won’t spike, but buy the yen if they do.

Source link

Ready

As AI strengthens these companies’ offerings, they can be great long-term investments.

Artificial intelligence (AI) has been the hottest topic in tech over the past year and a half. It has seemingly become unavoidable as the technology has been thrust into the mainstream, largely because of the commercial success of generative AI tools like ChatGPT.

The commercialization of AI has been a catalyst for many tech companies’ stock prices recently as well. Lots of companies even remotely dealing with AI have seen their stock prices surge as investors rushed to capitalize on the recent boom. Despite the success of many of these companies, there seems to be a lot more room for growth.

Investors looking to get exposure to the industry should consider the following three companies that are ready for a bull run.

1. Microsoft

After years of trailing behind Apple, Microsoft (MSFT -1.19%) has become the world’s most valuable public company, with a market cap of over $3.1 trillion.

Microsoft’s AI involvement primarily comes from its strategic partnership with ChatGPT creator OpenAI. What began as an initial $1 billion investment in OpenAI in 2019 has become deeply mutually beneficial.

OpenAI needs vast, scalable supercomputing capabilities to operate as effectively as possible. That’s where Microsoft comes into the picture. Microsoft’s cloud platform, Azure, serves as OpenAI’s main computing infrastructure, and in return, Microsoft gets exclusive licenses to OpenAI’s large language models (LLMs).

Having access to OpenAI’s LLMs has given Microsoft a leg up because it’s able to integrate them into its products and services and boost its offerings. Microsoft already has a diverse ecosystem of services that many consumers and corporations rely on. Add an AI component to make them more effective and “intelligent,” and the potential for these services to dominate their industries increases.

2. CrowdStrike

CrowdStrike (CRWD 0.84%) is one of the first pure AI cybersecurity companies, having used the technology to automate cybersecurity processes for well over a decade.

Other companies are undoubtedly adding AI capabilities to their cybersecurity platforms, but CrowdStrike has a competitive advantage that should hold strong: data. For AI-based tools to be as effective as possible, they must be trained on tons of data, and “tons” is putting it lightly. CrowdStrike’s head start means it has years’ worth of data that can’t be matched.

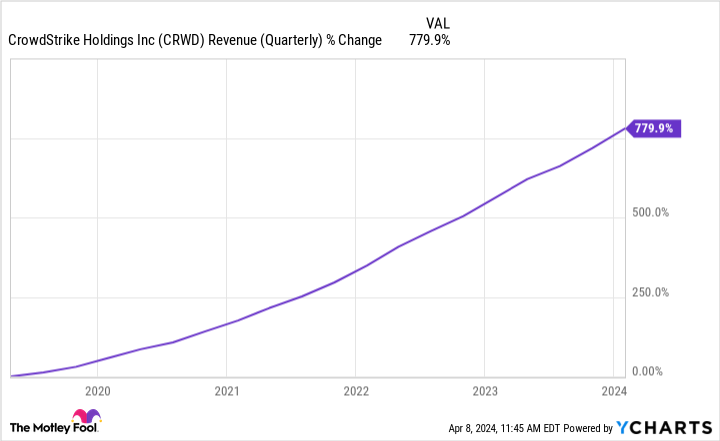

Business and financial results highlight just how effective CrowdStrike’s platforms have been. Around 27% of its clients use seven or more of its modules (products in its ecosystem), and 64% use five or more. CrowdStrike’s dollar-based net retention rate was also 119% in the fourth quarter of its fiscal 2024, meaning its established customers spent 19% more with it, on average, than they had in the prior-year period.

CRWD Revenue (Quarterly) data by YCharts.

According to CrowdStrike and market intelligence firm IDC, the AI-native cybersecurity market is estimated to be around $100 billion this year. By 2028, it’s expected to hit $225 billion. This gives CrowdStrike plenty of opportunity to continue asserting its market dominance and providing good long-term investor value.

3. Taiwan Semiconductor Manufacturing Company

As a semiconductor foundry, Taiwan Semiconductor Manufacturing Company (TSM 1.03%) (TSMC) may not seem like an AI stock, but its importance to the AI ecosystem can’t be overstated.

If AI apps like ChatGPT or other LLMs are the end products of a tree, the semiconductors fabricated by TSMC are the initial seeds. And it all begins with data and data centers. Data centers are vital because they are the only way to store the vast amount of data needed to train AI, and these data centers rely heavily on graphic processing units (GPUs), which function as the brains for computing power.

Before you have functioning GPUs, you need semiconductors, and TSMC is the global leader in fabricating semiconductors. That’s why companies like Nvidia are among TSMC’s biggest customers; they know other semiconductors pale in comparison to TSMC’s, cementing it as the go-to for other major corporations.

Without TSMC’s advanced processes, the AI pipeline would surely take a hit, as it’s likely that progress in the field would be slowed. That reliance alone makes TSMC one of the more important AI-adjacent companies. This domino effect is also expected to make AI-related semiconductors account for a decent portion of TSMC’s revenue (high teens) by 2027.

TSMC is far from the only semiconductor foundry in the AI world, but it’s the most critical.

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, CrowdStrike, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

ADA Price Ready To Soar As Cardano Network Hits New 88.6 Million Transaction Milestone

The Cardano (ADA) price looks set for a significant move to the upside. The network recently hit a new milestone in terms of transactions processed so far, in addition to other bullish fundamentals that could also contribute to the price surge.

Cardano Has Processed Over 88 Million Transactions

Data from Cardano’s latest weekly development report shows that the network has processed 88.6 million transactions to date. This is significant as sustained network activity can positively affect ADA’s price. Moreover, ADA has always been criticized as a “ghost chain,” this achievement dispels that notion and proves that people are actively using the network.

Source: Essential Cardano

Meanwhile, the report revealed that 1,353 projects are actively building on the network, which means the network will keep expanding as more users get onboarded through those projects. Additionally, Cardano’s Fund12 officially launches on April 26, with this decentralized and innovative incubator program set to usher in a new set of developers into the Cardano ecosystem.

That event also underlines Cardano’s potential to experience exponential network growth soon enough. It is also a testament to Cardano founder Charles Hoskison’s statement that the network is growing organically like Bitcoin, seeing as the team has continued to put in the work rather than solely depending on hype.

Considering these bullish developments, ADA’s price could be well primed for a significant move to the upside. This will provide a much-needed relief for ADA holders who have continued to worry about the crypto token’s lagging price action. ADA’s price had remained pretty tepid despite the broader crypto market recording massive price gains.

ADA Price Chart Says Otherwise

From a technical analysis perspective, the Cardano ecosystem is currently bearish. Technical analyst Alan Santana recently mentioned that further price declines are more feasible as ADA’s price has continued to lag. He revealed that ADA’s weekly chart is producing a “break below the EMA10 (Exponential Moving Average) with a very strong bearish candle as the RSI (Relative Strength Index) turns red. “

Santana also suggested that ADA’s price could drop to as low as $0.34 in a bid to establish support. Therefore, he stated that the “only wise decision is to remain bearish until the chart and market conditions change.” “Once support is found and established, we become bullish again,” the analyst added.

At the time of writing, ADA is trading at around $0.58, up in the last 24 hours according to data from CoinMarketCap.

ADA sees sharp drop to $0.58 | Source: ADAUSDT on Tradingview.com

Featured image from Biztech Africa, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Chewy (CHWY -10.26%) has been a dog stock lately, and Wednesday afternoon’s mixed financial update isn’t going to get it out of the doghouse. The pet supplies e-tailer has been a disappointing investment through most starting lines. The stock is down 25% in this otherwise buoyant year for the general market.

Chewy is also trading 54% lower over the past year and down 78% over the last three years but obviously wasn’t supposed to be this way. The pandemic four years ago saw a surge in pet adoptions. That was naturally a boost for Chewy as traditional retailers initially shuttered and it became a potential health risk to go shopping in person.

Net sales surged 47% in 2020, a year that found many traditional retailers stumble. But top-line annual growth has slowed dramatically for the last three years, culminating in a mere 4% increase in net sales for the fiscal fourth quarter that the company posted after Wednesday’s market close.

The dogs and cats that people adopted when the country sheltered in place have only grown, requiring more food, treats, and playthings. Chewy’s business should be accelerating instead of tapping the brakes, but this could also be the buying opportunity that the market is missing right now.

The bark side of the swoon

When net sales rose just 8% in Chewy’s fiscal third quarter, it was the first time the company posted single-digit growth since going public five years ago. The top-line jump was cut by half for the fiscal fourth quarter, which ended on Jan. 28. It’s not a good look, but this was actually ahead of market expectations.

Chewy’s guidance was calling for a 3% uptick, and analysts had whittled their target down to 2% in the past few months. It’s a beat, and the bottom-line surprise is even stronger.

The online retailer’s gross and net margins widened. Chewy posted a profit of $0.07 a share and an adjusted profit of $0.18 a share, while analysts were bracing for a slight deficit. Free cash flow rose 59% for the quarter, nearly tripling for the entire fiscal year.

The stock initially moved higher on the news but shifted into reverse after Chewy’s outlook came into play. The company now sees net sales climbing just 2% in the current quarter and rising 4% to 6% for all of fiscal 2024. Analysts figured it would be a slow start this year but were perched just above Chewy’s outlook for the current quarter, splitting the difference with a 5% increase for the whole year.

Image source: Getty Images.

Teaching an old dog industry some new industry tricks

It’s OK to remain bullish because there’s a lot still going right at Chewy. A steady part of its model is Autoship, where customers receive a discount by subscribing to receive shipments at predetermined intervals. Autoship revenue now accounts for a whopping 76.4% of total shares and net sales rose 8% for the quarter, doubling its overall performance on the top line.

Chewy customers — the ones that stick with it, at least — are leaning more on the platform. Net sales per active customer rose 12% to $555 for the entire fiscal year, outpacing the 10% overall gain in net sales. Chewy’s active customer count has dipped nearly 2% to 20.1 million, a figure that will have to start growing again if it wants to turn market sentiment around.

There are other revenue streams in which Chewy can doggy paddle. It launched in Canada in the second half of last year and recently announced a push into the veterinary care clinics, a move that will expand its total addressable market by roughly $25 billion.

Chewy is cautious about its performance, in particular, and pet food companies, in general, this year. It’s more upbeat about the market normalizing next year.

In the meantime, the stock is trading at an enterprise value that’s just 0.6 times trailing net sales and 31 times forward adjusted earnings. Challenges remain to attract new customers, but the Autoship penetration rate confirms that its existing following of pet parents is solid. Better days could be ahead for Chewy’s ugly stock chart.

Cardano is yet to venture into the $0.8 price level this year, despite most cryptocurrencies breaking past old price levels. Although the blockchain has seen some exciting developments, the price action has been a little bit behind when compared to its peers. However, Cardano continues to give investors a glimmer of hope, as activity keeps soaring to new highs.

On-chain data shows that the active addresses on the Cardano network are spiking, with the monthly active count reaching its highest in the past year.

Monthly Cardano Active Addresses Hit One-Year High

Cardano’s active address count just hit a one-year high, signaling major network adoption and hinting at big things to come. According to data from Danogo, the active addresses in the past 30 days reached 596,915 on March 11, its highest since May 2023.

Interestingly, this number almost doubles the 279,000 active addresses recorded in September 2023, the lowest monthly active addresses in the past year.

Active addresses are one of the few metrics to look at when measuring the adoption rate of cryptocurrencies. Notably, various metrics have shown a surge in activity on the Cardano network and its ability to process a high number of transactions.

A further look at the chart data presented by Danogo shows that the monthly active addresses reversed to start a spike at the end of February after going on a free fall in January.

Data from Cardano Blockchain Insights tells a similar tale of increased activity, with the active daily addresses steadying above 50,000 since February 29. Active addresses in the past 24 hours were 66,970.

A similar activity metric from IntoTheBlock shows increased activity from Cardano whales. Its large transaction metric, which measures transactions greater than $100,000, puts the number of whale transactions at 6,810 in the past 24 hours and $73.86 billion in the past seven days. For comparison, Ethereum’s large transactions stand at $63.17 billion in the same time frame.

The supply in the top 1% has also shown a strong accumulation from whales, spiking by around 60 million ADA on March 10.

ADA To Reclaim $1?

Interestingly, ADA has more than tripled from a $0.24 price in the monthly active addresses low in September. At the time of writing, ADA is trading at $0.79, up by 42% in the past 30 days.

ADA has been rejected at $0.8 twice this month already, but it is now on its way to retesting the price level again. If the bulls can push ADA above $0.8, this could give the cryptocurrency free rein to reach $1 for the first time since April 2022. Overall, the overall crypto market continues to retain a bullish sentiment, which could push ADA above $1 this month.

ADA price at $0.78 | Source: ADAUSDT on Tradingview.com

Featured image from Binance Academy, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cardano (ADA) could be on the path to breaking new price levels in the coming weeks, as indicated by on-chain data and adoption growth. The creation of new wallets on the Cardano blockchain has seen multiple spikes on various days since the beginning of February, showing a potential influx of new money into Cardano.

According to on-chain data, new addresses on the Cardano network spiked 89% between February 22 and February. Similarly, this metric witnessed a 248% surge earlier in the month between February 1 and February 2. Such a huge influx of new wallets is a very bullish signal for ADA.

Cardano Metrics Points To Increased Interest

One of the major factors to consider when considering the adoption rate of cryptocurrencies is the amount of new wallets created. According to on-chain data, the number of new wallets added to the Cardano blockchain spiked from 1,706 on February 22 to 3,227 on February 23. Similarly, this metric witnessed a larger spike from 1,553 on February 1 to 5,414 on February 2.

While the number of new wallets created daily has slowed down since February 23, it has steadied above 1,500 since the beginning of February. The total number of wallets registered on the Cardano network has also been steadily climbing and is almost at 4.6 million addresses.

Active daily addresses have climbed above 30,000 since the beginning of the year, recently reaching 64,568 active addresses on February 16. This growth on the back end shows that interest in the Cardano ecosystem is skyrocketing as more people want to get their hands on the native ADA token. This could translate into more demand for ADA, leading to a price increase.

ADA To Reclaim $3.1 Price Level?

ADA holders have been left wondering if the price can revisit its all-time high above $3.1 this year. After ranging and trading mostly $0.6 last week, ADA has now broken past the $0.62 mark again after a 6.99% influx into the entire crypto market. At the time of writing, Cardano is now trading at $0.6211, up by 6.23% in the past 24 hours and up 29.85% in the past 30 days.

However, ADA’s path back to the all-time high of $3.1 remains difficult, as it must overcome numerous price resistances. The first stage would be to get significant traction above $0.63. If successful, ADA might launch a new rise above $0.63, reaching $0.66 for the first time since December 2023.

As long as Cardano stays above $0.66, it is in good shape to eventually reach $1.20. Many long-term holders (529,000 addresses) who bought around this price point would likely sell here to break even. But if adoption increases and demand is strong enough, ADA could power right through.

ADA price at $0.619 | Source: ADAUSD on Tradingview.com

Featured image from Eightcap EN, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

If retirement is all about money, you might not be ready to stop working

Not only is retirement readiness different for each individual, not many of us are even able to describe what that actually looks like.

Successful retirement planning requires a multi-layered exploration of our wants, needs, financial anxieties and risk tolerance, along with sensitivity to what we really mean in addition to what we actually say. There’s a close analogy to psychotherapy.

This is why it’s an exercise in futility for Wall Street firms to conduct their periodic surveys of retirement readiness. Not surprisingly, these surveys often reach widely divergent conclusions.

Wall Street nevertheless keep trying. A half-dozen such firms have reached out to me already this year, publicizing their latest surveys. One published a report on Feb. 13 announcing that the U.S. retirement crisis is worse than ever, with two-thirds of workers not saving enough for retirement — and nearly one in four without enough savings to even pay for their funeral expenses.

Meanwhile, another survey — released two weeks earlier — found that 70% of U.S. workers are confident that they have saved enough for a comfortable retirement.

The inherent weakness in these surveys is that they are trying to quantify the unquantifiable. Take, for example, the survey finding that two-thirds of workers aren’t saving enough for retirement. It reached this conclusion by measuring the size of respondents’ retirement portfolios, then comparing it to a single across-the-board dollar amount that the surveyors claimed was necessary to retire comfortably.

But there is no one-size-fits-all when it comes to a retirement portfolio. Benjamin Graham, the father of fundamental analysis, made this point in his famous book “The Intelligent Investor”: “The best way to measure your investing success is not by whether you’re beating the market, but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

How many of us can answer the question “where you want to go” with more than bromides? This isn’t to say that having a sizeable portfolio is unimportant to retirement readiness. But the relationship between money and happiness is surprisingly inscrutable. Take recent research by Matthew Killingsworth, a professor at the Wharton School, and Princeton University professors Daniel Kahnemann and Angus Deaton.

The researchers found that more money brings more happiness in large part only if you are a happy person to begin with. If you’re an unhappy person, then money helps you only to a limited extent. Even for happier people, the impact of more money is a lot less than you think: A “four-fold difference in income is… less than a third as large as the effect of a headache” on a person’s feelings of happiness on a given day.

Financial advisers can play a valuable role in helping us sort out these thorny questions, Of course there are unscrupulous advisers who take advantage of vulnerable retirees and near-retirees. The presence of such advisers only reinforces the importance of searching for an adviser carefully. Just don’t let the considerable complexity of retirement planning dissuade you from the search.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

More: These are the two biggest retirement expenses. Start planning for them now.

Also read: I have to take RMDs from multiple accounts. How can I avoid making a mistake?

Filecoin (FIL) has been among the top gainers during the current market rally. Throughout February, FIL has shown a formidable performance fueled by the bullish momentum and its partnership with a major blockchain.

This performance has analysts and important crypto actors predicting a potential bullish run around the corner for the decentralized storage network’s native token.

Should Filecoin Investors Get Ready For A Bull Run?

Pseudonym analyst and trader Crypto Breakout highlighted that FIL broke through a crucial resistance in the 3-day timeframe, signaling that the “bulls return with force.” The chart shared by the analyst illustrates a downtrend pattern in FIL’s price since 2022.

Two years ago, as the chart below shows, the token traded at $11 before facing a pullback that shredded about 70% of the token’s value in the following months. By February 2023, the token recovered and broke through the $9 resistance level before repeating a similar downtrend.

FIL's downtrend pattern since 2022. Source: Crypto Breakout on CoinMarketCap

Since 2023, the price has remained well below this level, only breaking through the $8 support zone once at the very beginning of 2024. Throughout January, FIL’s price had a turbulent performance, falling around 40%.

The price has picked up the crypto market uptrend, and, as the analyst highlights, it has been gaining positive momentum. The 3-day time frame shows that FIL has been following an upward trend that led to the token breaking through the crucial $8 support zone this Friday.

As the post suggests, this break out of the downtrend could signal FIL’s “beginning of an epic bullish rally” and that investors should “get ready for exciting moves ahead.”

Renowned crypto analyst Ali Martinez made a similar prediction. Earlier this week, Martinez highlighted Filecoin moving within a parallel channel on the 3-day chart. He suggested a successful breakthrough from the $8.50 barrier could catapult the token’s price to $25.5.

Artur Hayes Predicts $100 As FIL Continues To Rise

After the token’s recent surge, BitMEX co-founder Arthur Hayes shared his FIL prediction. On an X (former Twitter) post, Hayes forecasted that FIL’s price would rally to $100, also calling the arrival of the bull market.

Welcome to the bull market. May all things AI related levitate. $FIL = $100

Yachtzee 😘😘😘😘 pic.twitter.com/oggCeY8IGc

— Arthur Hayes (@CryptoHayes) February 23, 2024

Filecoin, a decentralized storage network, recently integrated with Ethereum’s rival Solana to make its blockchain history more accessible and usable. According to the announcement, the integration is a significant move away from centralized storage solutions, which seek to improve reliability and scalability in the Solana blockchain.

This move has considerably fueled the ongoing upward momentum for FIL. The token has shown a considerable performance in recent weeks, with FIL increasing 53.9% in the last two weeks and 67.7% in 30 days.

The token trades at $8.19 at writing time, representing a 9.6% surge in 24 hours and 39.0% in the last seven days. FIL is currently the 25th largest cryptocurrency by market capitalization, at $4.2 billion, a 12.38% increase from yesterday. Its trading activity also saw a recent rise, with its daily trading volume at $895.2 million, 44% more than the day before.

FIL performance in the 1-day chart. Source: FILUSDT on TradingView.com

Featured image from Unsplash.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto CEO Says Get Ready For Solana To ‘Rally Higher Again’ With New Target

Founder and Chief Executive Officer (CEO) of Evai Crypto Ratings, Matthew Dixon, has expressed optimism about the Solana future price outlook, projecting a new bullish target for the cryptocurrency.

CEO Predicts Bullish Outlook For Solana

In a recent post on X (formerly Twitter), Dixon shared a Solana and USD pair price chart originally published on TradingView, a crypto analysis platform. The crypto CEO indicated that the ongoing price correction for Solana, identified as “wave 4 (blue)” on the price chart, has not concluded and is expected to experience further declines.

He predicted that the ongoing wave 4 (blue) would reach a price level similar to Solana’s previous price correction, albeit to a lesser degree. The Evai CEO also anticipates that after the conclusion of the recent correction, Solana may experience a price rally once again.

Previously, Solana witnessed a major surge, nearly surpassing the $125 threshold. However, the cryptocurrency lost a substantial portion of its gains as the bullish hype faded, eventually settling below the $100 price mark at some point.

Additionally, on Tuesday, February 6, the Solana blockchain was temporarily halted due to an outage, resulting in no new blocks being produced for over 25 minutes. This unexpected disruption significantly impacted the overall sentiment of the cryptocurrency, causing slight declines in the price of SOL. Following this, a solution was coordinated among validators, and the network officially resumed operations.

Presenting another price chart for Solana, Dixon has projected a new upside target of $120 for the cryptocurrency. The crypto CEO has stated that despite the recent blackout, Solana has maintained both short-term and long-term positive prospects. Nonetheless, investors are advised to anticipate a potential mid-term price correction for the cryptocurrency.

SOL Price Surges Above $100 Mark

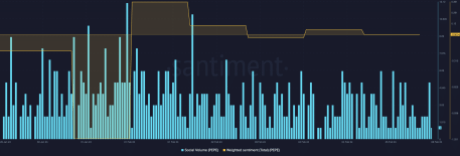

Reports from Santiment, a global market intelligence platform, have also indicated a bullish outlook for Solana. Earlier on Thursday, the crypto data platform disclosed on X that Solana is currently dominating the altcoin market and has become one of the few cryptocurrencies outperforming Bitcoin.

Santiment shared a price chart illustrating Solana’s recent price action, showcasing a robust climb over the past few days. According to their data, in the last 36 hours, Solana’s price relative to Bitcoin has increased by over 4.5%.

The cryptocurrency market intelligence platform disclosed that the outage earlier this week has instigated “Fear, Uncertainty and Doubt” (FUD) amongst investors, contributing to the current price rebound in Solana.

Solana rallied by almost 5% in the last day, and at the time of writing, the cryptocurrency is trading at a price of $105.46, reflecting a weekly increase of 4.39%, according to CoinMarketCap.

SOL price trending at $105 | Source: SOLUSD on Tradingview.com

Featured image from Crypto News, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The PEPE meme coin has seemingly faded into the shadow as new and exciting meme coins make it to the fore. This can be attributed to the likes of BONK and other Solana ecosystem meme coins that have taken the attention away from the Ethereum ecosystem. However, as excitement around these new meme coins begins to wane, expectations fall back to the leaders of the market, one of which is PEPE, who could be getting ready to make a comeback.

What On-Chain Indicators Say About PEPE

On-chain indicators are one way to know if investor interest is turning toward a particular cryptocurrency, in this case, PEPE. These indicators include things like Weighted Sentiment, Transactions Volumes, New Holders, etc. In this case, the focus is on the Weighted Sentiment, which measures sentiment across social media platforms to figure out how crypto investors are viewing a coin.

This indicator can be useful, especially in times like these when there are no clear indicators of where the price of a coin could be headed next. So, by checking what investors are saying about PEPE on social media platforms such as X (formerly Twitter), one can get a good idea of where the price may be headed next.

According to the Weighted Sentiment by the on-chain analytics tracker Santiment, PEPE is looking quite bullish. The indicator takes into account the mentions of PEPE on social media platforms over the past week, and it shows that there has been a significant uptick in the positive sentiment that is associated with the meme coin.

Source: Santiment

While it is not the highest that the indicator has been since the year began, it is still sitting at a considerably high level, suggesting a turn in the average sentiment. This also coincides with a drastic rise in the holdings of the largest PEPE whales, showing a willingness to accumulate at the current levels.

Daily Trading Volume Sees A Significant Jump

The Weighted Sentiment is not the only PEPE metric that has seen a significant increase lately. In the same vein, the daily trading volume for the meme coin has been on the rise as well. As data from CoinMarketCap shows, the meme coin’s volume is up approximately 62% in the last day, bringing it to $89.8 million at the time of writing.

Such a rise in volume can either point to buying or selling, but seeing that the PEPE price has managed to hold steady over this time period, it suggests that there is more buying than selling. Given this, it could point to bulls finally establishing support and marking $0.0000009 as a buy level. If this general bullish sentiment continues, then the meme coin could be looking toward a recovery to $0.000001, which would translate to a 10% move from here.

Due to its decline over the last month, PEPE has lost its position as the third-largest meme coin in the space. It is currently sitting at fifth position behind the likes of BONK and CorgiAI.

Token price falls to $0.000000896 | Source: PEPEUSDT on Tradingview.com

Featured image from ABP Live, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.