The value of Treasury bonds held by foreign investors fell to $8.02 trillion at the end of January, according to Treasury data released Tuesday.

Source link

record

The Dogecoin open interest rose to a new all-time high earlier in March, and while there has been a small retracement, the open interest has continued to maintain very high record levels since then. Given this continuous high level, it could point to where the price of the meme coin is headed next using historical data.

Dogecoin Open Interest Maintains High Level

Open interest is a measure of the total number of futures or options contracts of a particular coin in the market at a give time. It can help to tell how much money is flowing into that particular asset, thereby revealing if there a high or love interest in the asset.

On Dogecoin’s part, its total open interest has been rising over the last few months, especially as the crypto market recovered, as shown by data from Coinglass. A natural consequence of this was that the price was also climbing at the same time as the open interest and thus, there is a high correlation between open interest and price.

The DOGE open interest hit a new all-time high of $1.47 billion on March 5, and the meme coin has not looked back since. Despite a small decline in the following days, the open interest is rising once again, reaching $.144 billion on March 14 and taking the price with it.

While the rise in open interest does point to a lot of bullishness in the market, historical performance during times like these also calls for caution. Taking a look at what happened the previous times that the Dogecoin open interest hit new all-time highs could give an idea of where the price is headed next.

Where Can DOGE Go From Here?

Over the years, there have been various points at which the Dogecoin open interest has reached new all-time highs and a trend has emerged, in a manner of speaking. Looking as far back as 2021 when the open interest hit ATHs multiple time, this trend plays out similarly.

A sustained rise until a new all-time high is reached, with the price rising along, and then followed by a crash in open interest, as well as price. This was the case in September 2021 when the open interest reached a new all-time high and then again in November 2021 when it clocked another ATH.

Moving forward, the same trend is seen in October 2021 when the DOGE open rose close to its previous all-time high, but ended the same way as the previous ones – with a crash. These crashes almost always affect the DOGE price as well, causing it to drop to the levels before the surge in open interest.

If this pattern holds this time around, then a crash might be ahead for the Dogecoin open interest and the DOGE price by extension. A likely scenario is a 20% drop that could send the DOGE price back toward $0.15 before the crypto market picks up steam once again.

DOGE bulls hold up price | Source: DOGEUSDT on Tradingview.com

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

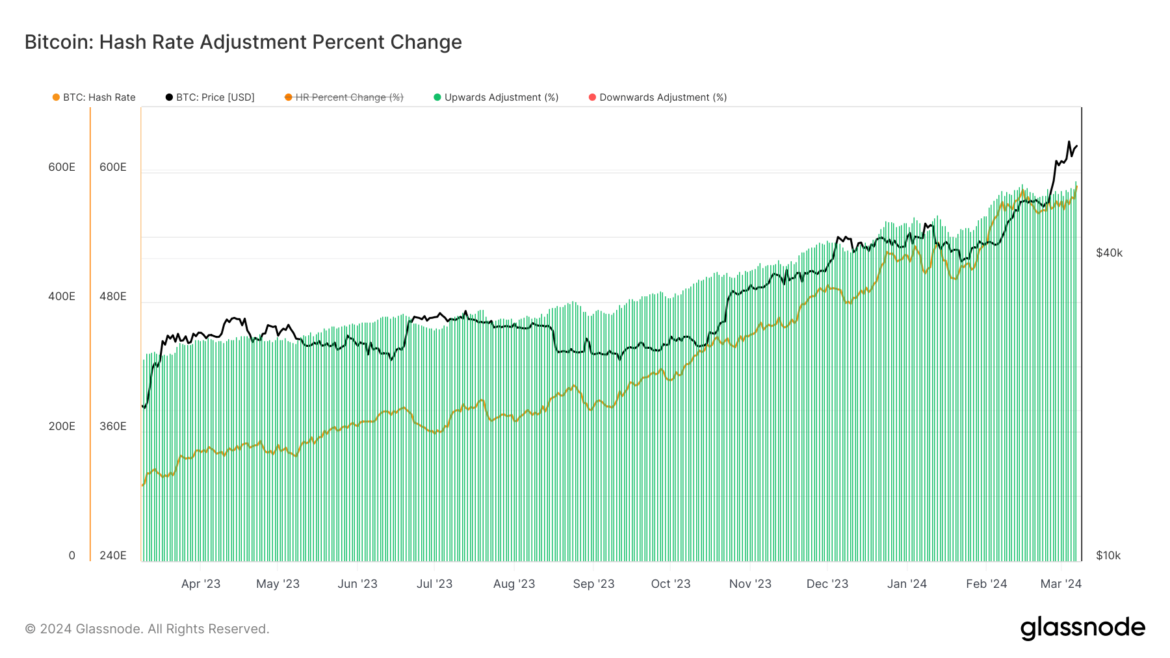

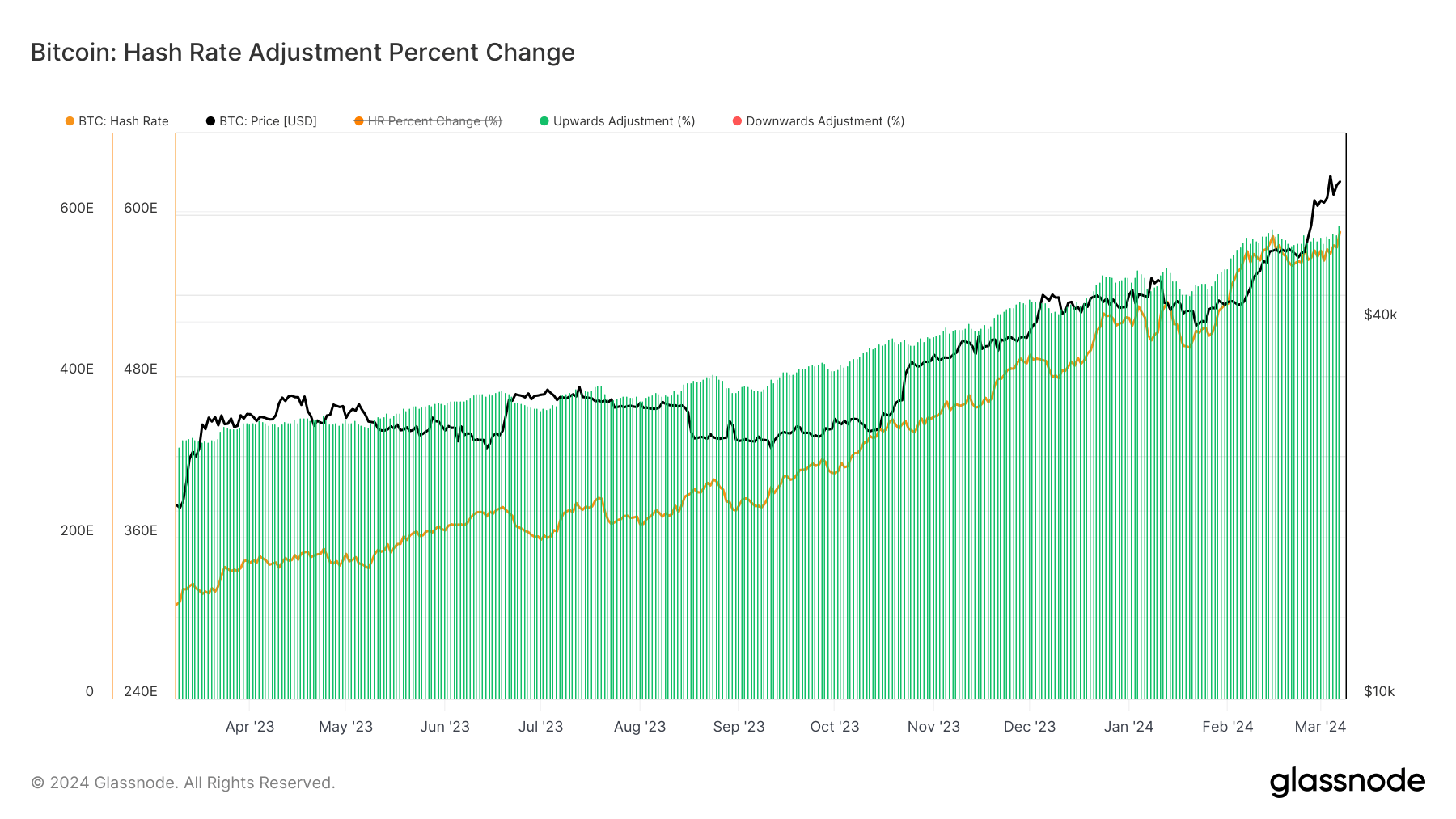

Bitcoin Mining Hits Record Difficulty as Countdown to 2024 Halving Begins

On Thursday, Bitcoin’s network difficulty escalated by 5.79% at block height 834,624, signaling the year’s fourth rising adjustment. The mining difficulty now stands at an unprecedented peak of 83.95 trillion, with the forthcoming adjustment anticipated around March 27, 2024. Bitcoin Difficulty Jumps 5.79% Mining Bitcoin has reached unprecedented levels of difficulty, peaking at 83.95 trillion […]

On Thursday, Bitcoin’s network difficulty escalated by 5.79% at block height 834,624, signaling the year’s fourth rising adjustment. The mining difficulty now stands at an unprecedented peak of 83.95 trillion, with the forthcoming adjustment anticipated around March 27, 2024. Bitcoin Difficulty Jumps 5.79% Mining Bitcoin has reached unprecedented levels of difficulty, peaking at 83.95 trillion […]

Source link

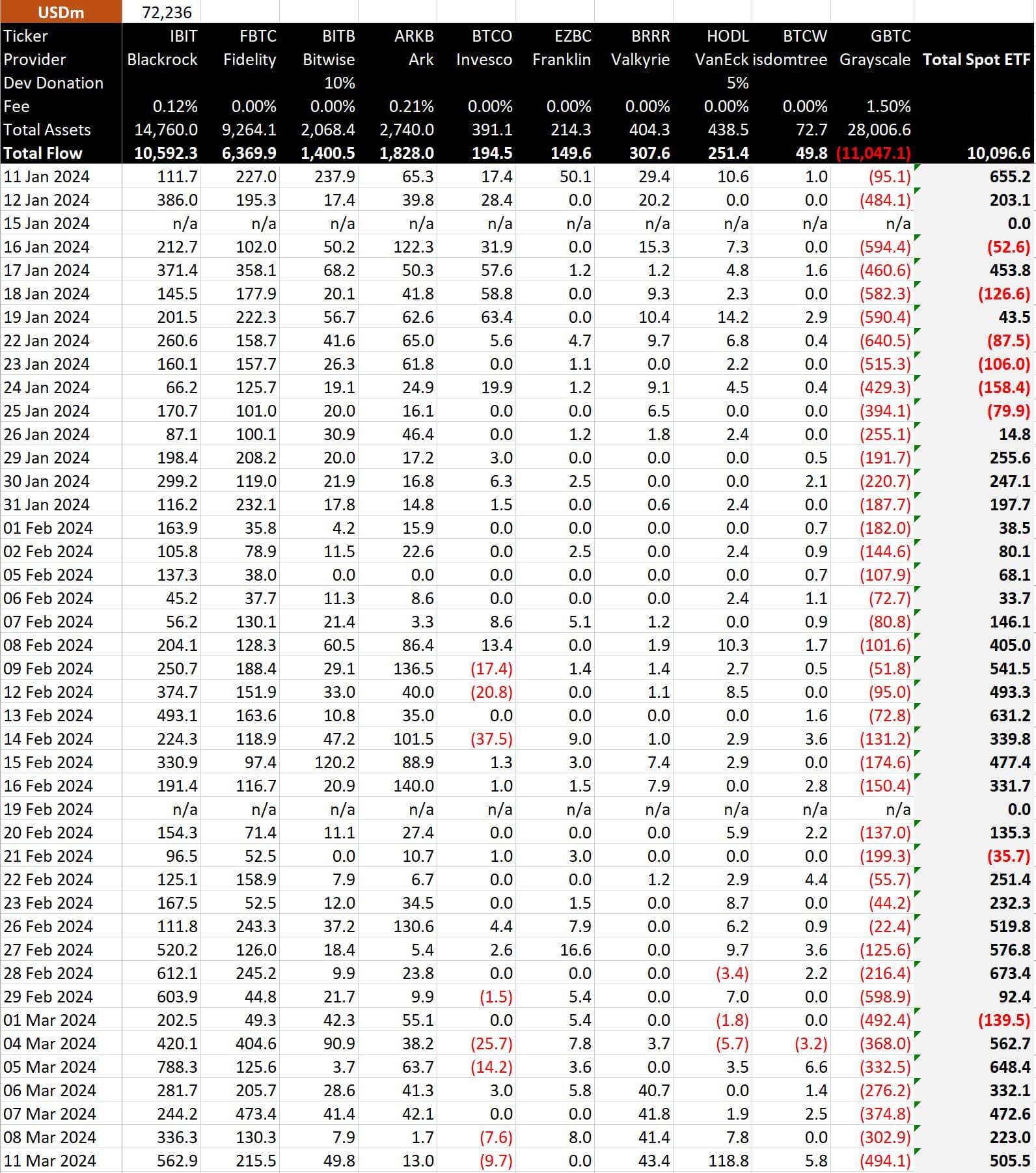

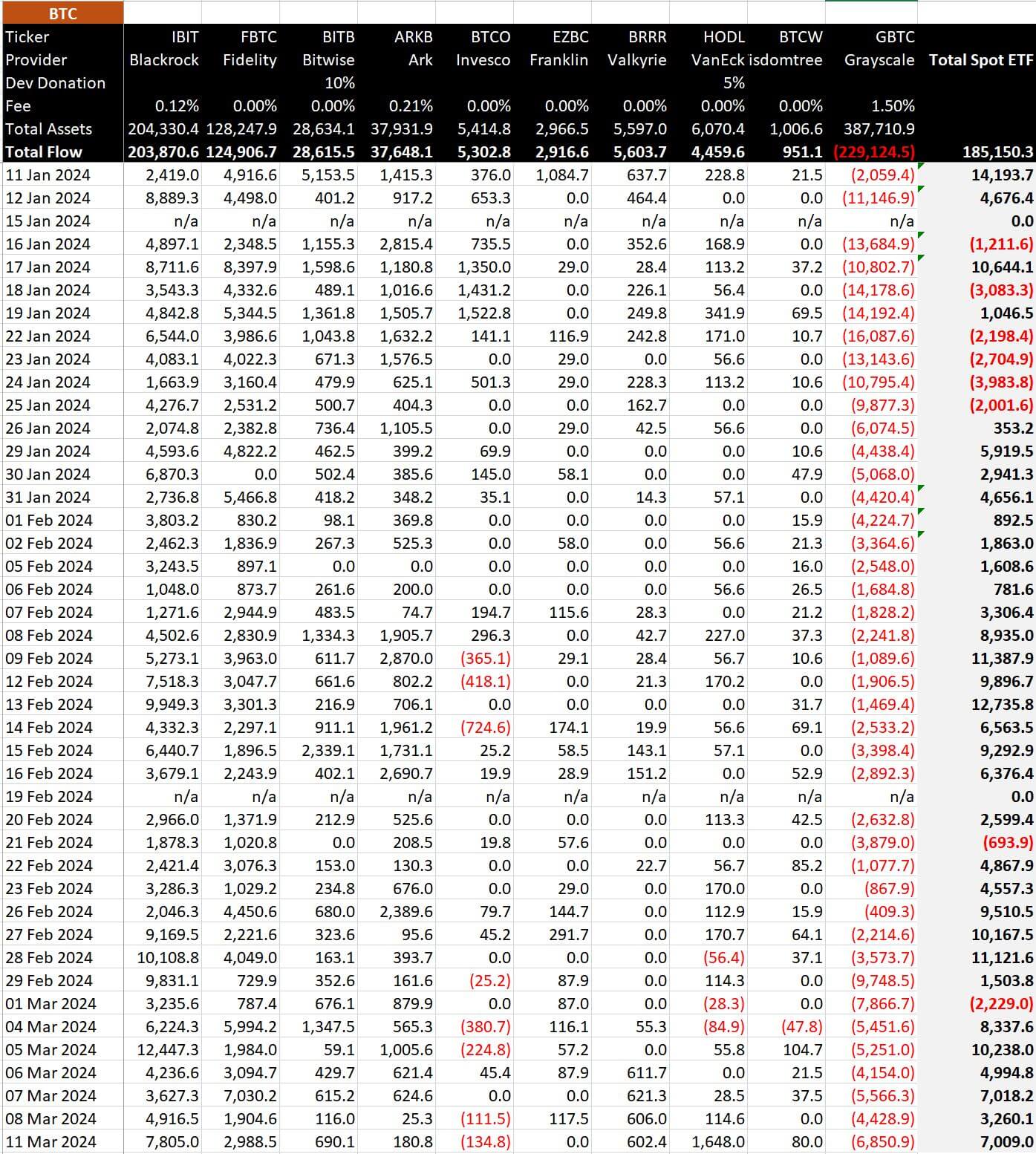

Bitcoin ETFs see $505 million total inflows led by BlackRock as VanEck breaks record

Bitcoin ETF inflows surged on March 11, 2024, with a net gain of $505.5 million, according to data from Bitmex Research. The strong performance was led by BlackRock’s iShares Bitcoin ETF (IBIT), which saw inflows of $562.9 million, representing a 0.12% increase in total assets. Fidelity’s FBTC fund also contributed to the positive momentum, attracting $215.5 million in new investments.

Other notable Newborn Nine ETFs with inflows included Bitwise’s BITB fund ($49.8 million), ARK Invest’s ARKB fund ($13.0 million), and VanEck’s BRRR fund ($118.8 million). VanEck’s announcement to waive fees until 2025 led to its strongest day by far. Previously, the fund had not seen more than $14.2 million in a single day. However, not all Newborn Nine funds experienced gains, with Invesco’s BTCO ETF reporting an outflow of $9.7 million.

Further, Grayscale continued its outflows, with $494 million leaving the fund, the highest level since Feb. 29. Yet, the inflows into Newborn Nine ETFs significantly outweighed the Grayscale outflow for the sixth consecutive day. Only two days since Jan. 26 have total outflows surpassed inflows.

In terms of Bitcoin, the net inflow amounted to 7,009 BTC, with BlackRock’s IBIT fund accounting for 7,805 BTC of the total. Fidelity’s FBTC fund added 2,988 BTC, while Bitwise’s BITB fund saw an inflow of 690 BTC. ARK Invest’s ARKB fund and VanEck’s BRRR fund gained 180 BTC and 1,648 BTC, respectively.

The strong performance of Bitcoin ETFs on March 11, 2024, affirms the growing interest in Bitcoin investments among institutional and retail investors alike.

The post Bitcoin ETFs see $505 million total inflows led by BlackRock as VanEck breaks record appeared first on CryptoSlate.

Report: Global Crypto Investments Surge to Record $2.7 Billion in Weekly Inflows

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

Source link

Bitcoin’s Hashrate Reaches 618 EH/s, Establishing a New 7-Day SMA Record in 2024

Bitcoin’s computing power has reached a new peak, ascending to 618 exahash per second (EH/s) as shown by the seven-day simple moving average. Currently, 56 entities are contributing at least 916.26 megahash per second (MH/s) to the network, with the mining pool Foundry USA at the forefront, delivering 204.41 EH/s. Bitcoin Edges Closer to Zettahash […]

Bitcoin’s computing power has reached a new peak, ascending to 618 exahash per second (EH/s) as shown by the seven-day simple moving average. Currently, 56 entities are contributing at least 916.26 megahash per second (MH/s) to the network, with the mining pool Foundry USA at the forefront, delivering 204.41 EH/s. Bitcoin Edges Closer to Zettahash […]

Source link

Record $1 Billion In Shorts Risk Liquidation If Bitcoin Hits This Price

The Bitcoin price is creeping up once again, rising to a new all-time high above $71,000 in the early hours of Monday. As the price surge continues, it has put a record number of shorts at risk, where a less than 10% move upward from here will see $1 billion in shorts liquidated.

$1 Billion In Shorts At Risk Of Liquidation

Crypto trader and analyst Ash Crypto took to X (formerly Twitter) to share a map that showed the number of short positions at risk as the price of Bitcoin rises. The map shared in the post showed that short liquidation leverage had risen above $1 billion.

These short leverage positions had been rising along with the price with a large number of crypto investors expecting the price to crash after pumping to a new all-time high. However, Bitcoin seems to have other plans in mind with its price surging close to $72,000 and increasing the risk of liquidations for these positions.

For these positions, Bitcoin reaching $75,000 would be detrimental to them. At this price level, over $1 billion worth of short positions will be liquidated. “$1,000,000,000 WORTH OF SHORTS WILL GET LIQUIDATED IF BTC HITS $75,000,” Ash Crypto revealed.

Will Bitcoin Stop Anytime Soon?

The Bitcoin price has seen a 10.33% increase in the last week and shows no signs of stopping soon. However, the debate of whether it continues upward or downward continues to wax strong as crypto analysts far and wide proffer their own predictions.

One crypto analyst know as MarcPMarkets suggests that the price of Bitcoin could hit resistance and then spiral back down if Bitcoin fails to properly clear the $70,000. But the analyst also explains that there is a possibility that the positive price action does continue if price does push above $71,500 and makes a close above it.

At the time of writing, Bitcoin is trading above $71,700, which shows it has cleared the level highlighted in the analyst. Now, what remains is to see if the cryptocurrency is able to make a daily close above $71,500, something that would be incredibly bullish for price. In this case, the BTC price could rise as high as $80,000 following this breakout.

The Bitcoin move over $71,000 has already had a significant impact on traders in the last day. Over $333 million has been lost by traders in one day. But interestingly, the majority of liquidations (64.29%) happen to be long positions, according to data from Coinglass.

BTC price reaches new ATH | Source: BTCUSD on Tradingview.com

Featured image from, chart from Tradingview.com Atlantic Council

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

NFT Market Flourishes With an 11.62% Rise This Week; Largest Ordinal Inscription Fetches Record 8 BTC

Sales of Non-fungible tokens (NFTs) have witnessed a notable uptick this past week, climbing 11.62% to hit $442.02 million over the previous seven days. The most significant transaction was the sale of the ‘Alien’ Cryptopunk #3,100, donning a headband, for $16 million, with Bitcoin-based NFTs claiming the lead in sales volume across 22 different blockchains. […]

Sales of Non-fungible tokens (NFTs) have witnessed a notable uptick this past week, climbing 11.62% to hit $442.02 million over the previous seven days. The most significant transaction was the sale of the ‘Alien’ Cryptopunk #3,100, donning a headband, for $16 million, with Bitcoin-based NFTs claiming the lead in sales volume across 22 different blockchains. […]

Source link

Quick Take

Bitcoin’s hash rate, an indicator of the computational power used for mining and processing transactions, has recently achieved a historic high. The 14-day moving average hash rate now stands at an unparalleled 586 eh/s, further enhancing the digital assets security. While the one-day hash rate peak of 711 eh/s on March 7 stands out, the 14-day moving average is considered a more reliable indicator as it smooths over short-term volatility.

This increase in hash rate signals a predicted adjustment of over 3% in the current difficulty epoch, expected on March 14, according to Newhedge.

This adjustment aligns with Bitcoin’s core design principle of maintaining a target block time of 10 minutes, directly influencing the projected timing of the next halving event. Per the Clarkmoody dashboard, if the ten-minute average block time is maintained, the halving event could potentially occur on April 21.

The post Bitcoin’s hash rate hits record high after difficulty drop appeared first on CryptoSlate.