In the wake of Bitcoin’s exhilarating climb to surpass $67,000, marking a new milestone in its storied journey, Real.Casino announces a celebratory $5,000 giveaway. This event is not just a celebration of Bitcoin’s latest achievement but also an invitation to the broader community to engage with the cryptocurrency ecosystem in a meaningful way. As the […]

In the wake of Bitcoin’s exhilarating climb to surpass $67,000, marking a new milestone in its storied journey, Real.Casino announces a celebratory $5,000 giveaway. This event is not just a celebration of Bitcoin’s latest achievement but also an invitation to the broader community to engage with the cryptocurrency ecosystem in a meaningful way. As the […]

Source link

Recordbreaking

Record-Breaking 164 Million Daily Transactions, Market Cap Reaches $2.9 Billion

Hedera (HBAR), the open-source Proof-of-Stake (PoS) blockchain network, has made significant strides in the fourth quarter (Q4) of 2023, according to a recent report by Messari. The network’s performance showcased notable growth in key metrics, outpacing the crypto market.

Hedera Outpaces Crypto Market With 78% QoQ Increase

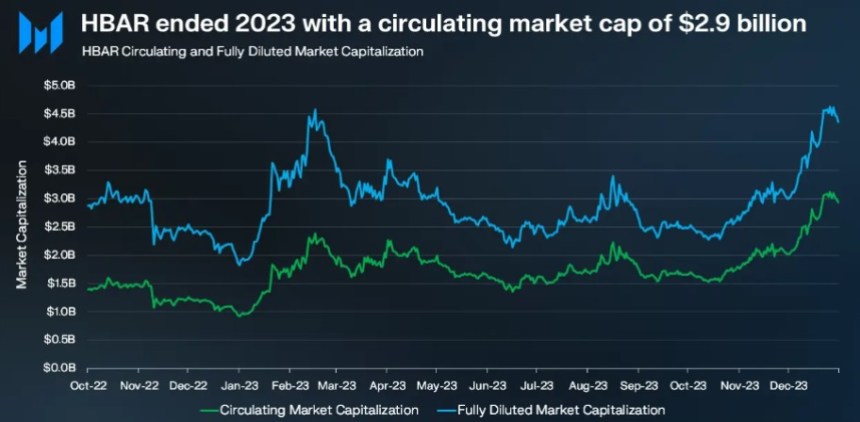

During Q4 2023, Hedera’s circulating market cap experienced a 78% quarter-over-quarter (QoQ) increase, reaching $2.9 billion. This growth surpassed the overall crypto market’s growth rate of 54%, signifying Hedera’s growing influence. The year-on-year (YoY) change for HBAR stood at 211%, reflecting the network’s progress and adoption.

In the same line, Hedera Network’s revenue witnessed a substantial 59% QoQ increase, amounting to $1.6 million in Q4 2023, primarily driven by a 66% QoQ surge in transactions, notably propelled by the Hedera Consensus Service.

Furthermore, the revenue generated from Token and Smart Contract Services contributed approximately 14% of the total revenue, exemplifying a healthy distribution in Hedera’s revenue streams.

With a fixed total supply of 50 billion HBAR, Q4 2023 saw 33.6 billion HBAR, or 67% of the total supply, in circulation.

The quarterly distribution of HBAR, reported through the Hedera Treasury Management Report, anticipates an additional 10% of the total supply to be unlocked in Q1 2024, including new ecosystem grants.

While the number of addresses experienced a decline in Q4 2023, with average daily active addresses decreasing by 22% QoQ to 6,600 and average daily new addresses dropping by 39% QoQ to 5,200, there was still substantial YoY growth. Active addresses were up 90% YoY, and new addresses witnessed a 123% YoY increase.

Hedera Network achieved a new record in transaction volume for the sixth consecutive quarter, with an impressive daily average of 164 million transactions in Q4 2023, marking a 66% QoQ surge. The Hedera Consensus Service remained the primary driver of this activity, accounting for 99% of all transactions on the network.

DEX Trading Volume Skyrockets 164% QoQ

In Q4 2023, the Hedera network reported 28 billion HBAR staked, representing 85% of the circulating and 56% of the total supply.

Entities such as Swirlds and Swirlds Labs played a significant role in staking their HBAR allocations, and the Hedera Treasury supported validators in meeting the minimum staking threshold for network consensus.

The Hedera network’s Total Value Locked (TVL) demonstrated positive growth, reaching $64 million by the end of 2023, reflecting a significant YoY increase of 169%. The TVL denominated in HBAR reached 733 million, indicating a 16% QoQ and YoY increase. Interestingly, Hedera’s TVL ranked among the top 40 blockchain networks.

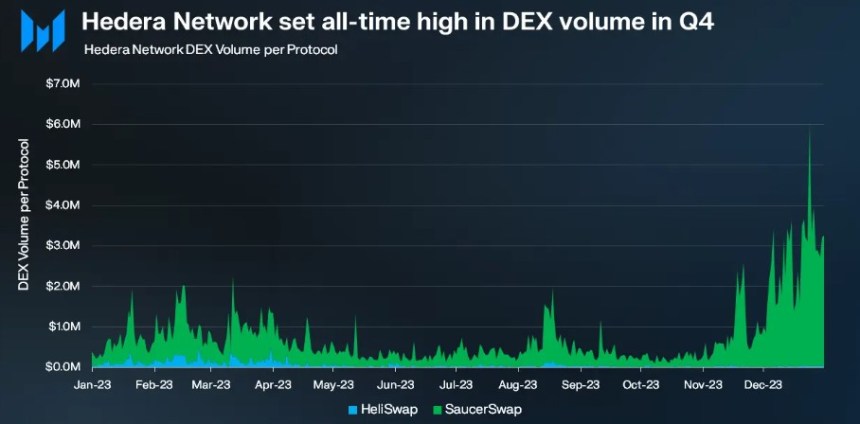

Moreover, Hedera Network experienced a 164% QoQ increase in average daily decentralized exchange (DEX) trading volume, reaching $1.3 million, an all-time high. SaucerSwap dominated DEX trading volume on the Hedera network, accounting for most of the trading activity, as seen in the chart below.

Lastly, the stablecoin market cap on the Hedera network grew by an impressive 73% QoQ, culminating in a year-end total of $6.3 million. Circle’s USDC stood as the sole stablecoin available on Hedera.

The network’s rank in the stablecoin market cap among blockchain networks improved by four spots QoQ, solidifying Hedera’s position in the stablecoin market.

Under current market conditions, the price of HBAR stands at $0.0736, showcasing substantial growth in the past 24 hours, with a 5% increase.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Record-breaking $17.5 billion traded in crypto products following Bitcoin ETF debut

Inflows into crypto-related investment products soared to more than $1 billion last week as investors piled in for the newly launched spot Bitcoin exchange-traded funds (ETF) in the U.S.

In its latest weekly report, CoinShares disclosed a notable uptick in the total inflow into cryptocurrency products, reaching $1.18 billion (subject to T+2 settlement) for the specified period.

While this figure represents a marked increase, it falls short of the $1.5 billion recorded in October 2021, when U.S. authorities approved futures-based Bitcoin ETFs.

Meanwhile, CoinShares noted that the trading volume for these crypto products soared to $17.5 billion last week, the highest on record. This is almost nine times higher than the average weekly volume of $2 billion in 2022.

James Butterfill, CoinShares’ head of research, wrote:

“These trading volumes represented almost 90% of daily trading volumes on trusted exchanges last Friday, unusually high as they typically average between 2%-10%.”

Bitcoin, U.S. dominates flows

A breakdown of the inflows by assets shows that Bitcoin saw the most, with $1.16 billion, representing 3% of BTC’s total assets under management (AuM) of $38.7 billion.

This trend was also extended to Short Bitcoin products as investors with bearish sentiments for the emerging industry invested over $4 million in bets against the space.

Other digital assets like Ethereum, XRP, and Solana observed notable inflows of $26 million, $2 million, and $200,000, respectively.

Similarly, blockchain equities saw large inflows totaling $98 million, bringing its total inflows over the last seven weeks to $608 million.

Across regions, the U.S. dominated the flow trend thanks to its recent approval of spot BTC ETFs. Per CoinShares, investors in the country poured $1.2 billion into the space, while other regions like Switzerland, Australia, and Brazil saw inflows of $21 million, $2.3 million, and $5.6 million, respectively.

On the other hand, investors in Canada and European countries like Germany and Sweden saw outflows of $44 million, $27 million, and $16 million.

The asset manager suggested that the outflows from these places could be linked to “basis traders looking to switch from Europe to the U.S.”

Meanwhile, Grayscale, one of the issuers of the newly launched ETFs, saw outflows of $579 million last week.

Bloomberg analyst Eric Balchunas suggested that the outflows could be attributed to investors fleeing the ETF’s high management fees and that traders might be taking profit from the significant closure of its previous discount.