Quick Take

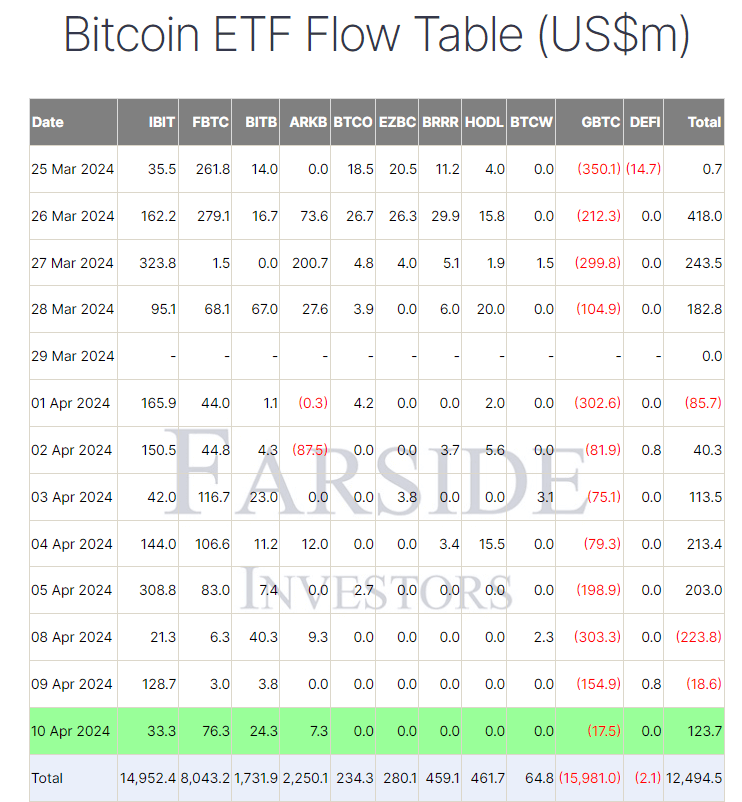

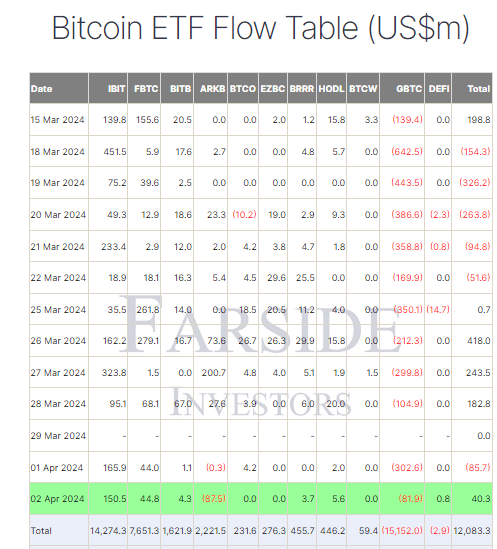

Farside data indicates that Bitcoin (BTC) Exchange-Traded Funds (ETFs) experienced a significant inflow of $123.7 million on Apr. 10, following a period of consecutive outflows. Notably, the Grayscale GBTC ETF saw its lowest outflow at just $17.5 million since launch. However, its total outflows reached $15,981.0 billion.

Farside data highlights that among the BTC ETFs, including BlackRock IBIT, Fidelity FBTC, ARK’s ARKB, and Bitwise BITB, which have seen the most significant inflows, only these four registered positive inflows on Apr. 10. Leading the group was FBTC, with an inflow of $76.3 million, its largest since Apr. 5, pushing its total inflows to $8,043.2 billion. The total net inflows to Bitcoin ETFs now stand at $12,494.5 billion.

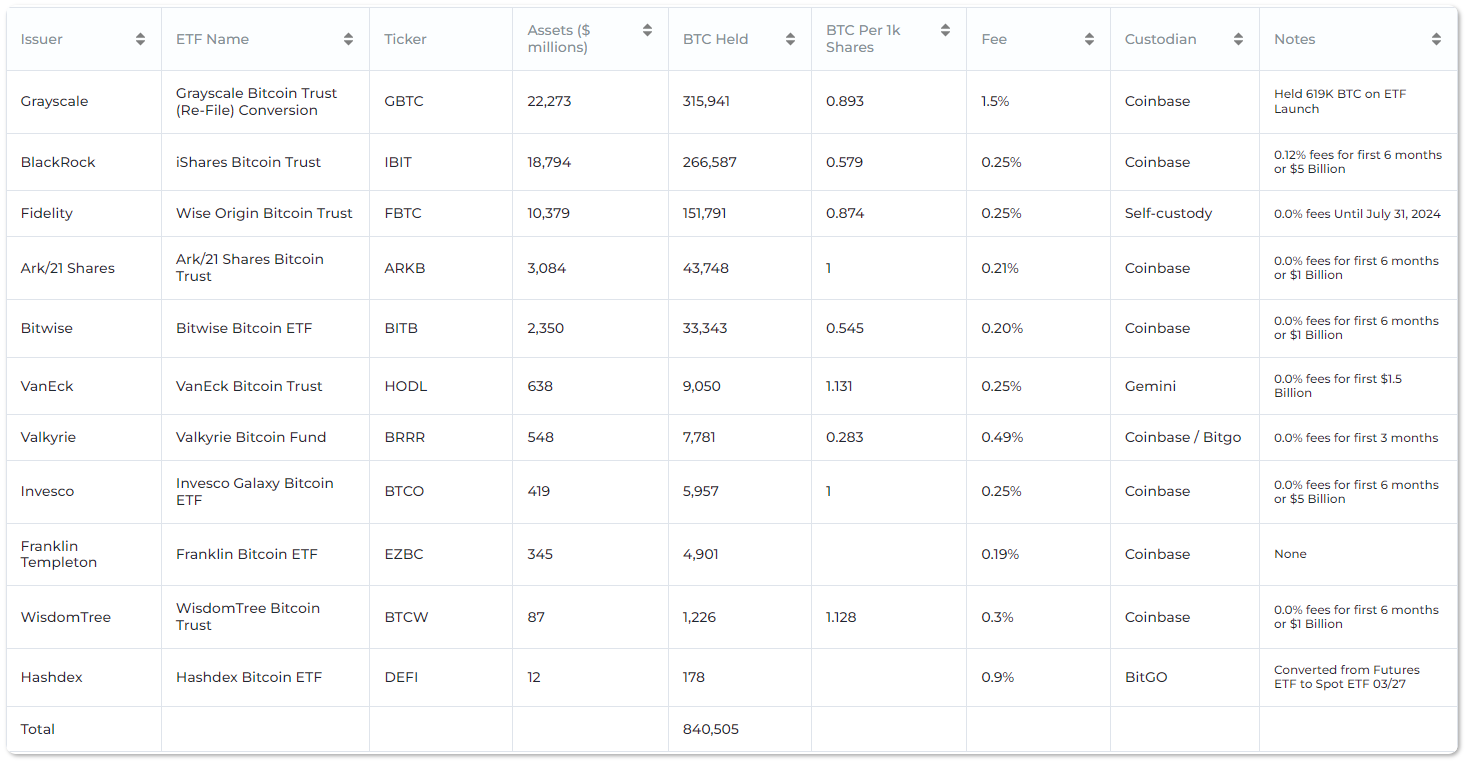

According to Heyappollo data, the eleven US spot BTC ETFs collectively hold 840,505 BTC.

The post GBTC ETF records lowest outflow since launch: $17.5 Million appeared first on CryptoSlate.

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]