Discussions about adjusting Ethereum’s issuance curve due to staking concentration and other factors are taking place on social media, with some developers in favor and some against this change. A recent article by Mike Neuder, an Ethereum Foundation researcher, highlights that Ethereum issuance should “preserve the viability and proportion of solo stakers.” Ethereum Issuance Curve […]

Discussions about adjusting Ethereum’s issuance curve due to staking concentration and other factors are taking place on social media, with some developers in favor and some against this change. A recent article by Mike Neuder, an Ethereum Foundation researcher, highlights that Ethereum issuance should “preserve the viability and proportion of solo stakers.” Ethereum Issuance Curve […]

Source link

reduction

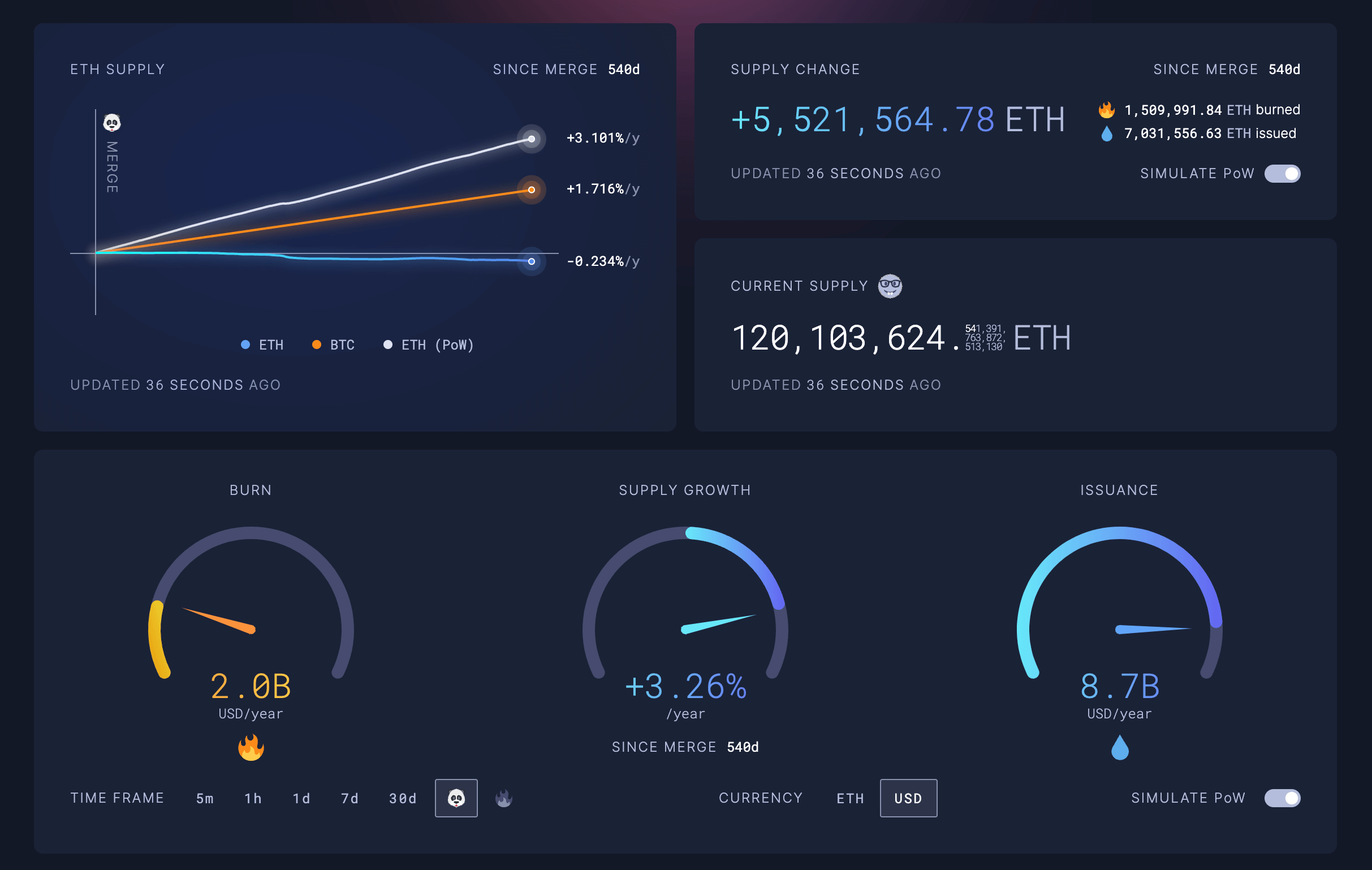

The Ethereum network has seen a reduction of 417,413 ETH in supply since transitioning to a Proof-of-Stake (PoS) consensus mechanism in September 2022, per data from ultrasound.money. In the 540 days since The Merge, 1,509,991 ETH has been burned while the network has issued 1,092,578 new ETH, resulting in a net decrease.

As of press time, the market value of the ETH removed from the supply stands at $1,653,797,635, marking an annual inflation rate of -0.23%.

In contrast, Bitcoin’s supply has grown by 1.716% over the same period. This highlights the divergent monetary policies of the two largest cryptocurrencies, as Bitcoin maintains a predictable issuance schedule. At the same time, the balance between staking rewards and transaction fee burning now determines Ethereum’s supply change.

A Proof-of-Work (PoW) simulation on the ultrasound.money dashboard shows Ethereum’s supply would have increased by over 5.5 million ETH during the same period had the network not shifted to PoS. Under the PoW model, the simulation indicates 7,031,556 ETH would have been issued with the same 1.5 million ETH burn rate, leading to a net increase of 5,521,564 ETH since The Merge. The value of the ETH issued under this simulation would amount to $21,865,393,440, representing a theoretical inflation rate of 3.26%.

The stark difference highlights the deflationary impact of Ethereum’s new consensus design compared to its previous mining-based system. The transition to PoS has significantly reduced new ETH issuance, as validators staking ETH now secure the network instead of PoW miners. This shift, combined with the ongoing burn mechanism introduced in EIP-1559, has put downward pressure on Ethereum’s supply growth.

According to the real-time data, Ethereum’s total circulating supply currently stands at 120,103,624 ETH. Meanwhile, the PoW simulation estimates the supply would have reached 125,625,188 ETH if miners were still powering the network under the old model.

The supply reduction since The Merge aligns with the Ethereum community’s vision of making ETH a deflationary asset over time, diverging from Bitcoin’s fixed inflationary schedule. Proponents believe the combination of staking rewards and fee burning will continue to offset new issuance, potentially leading to net negative supply change periods.

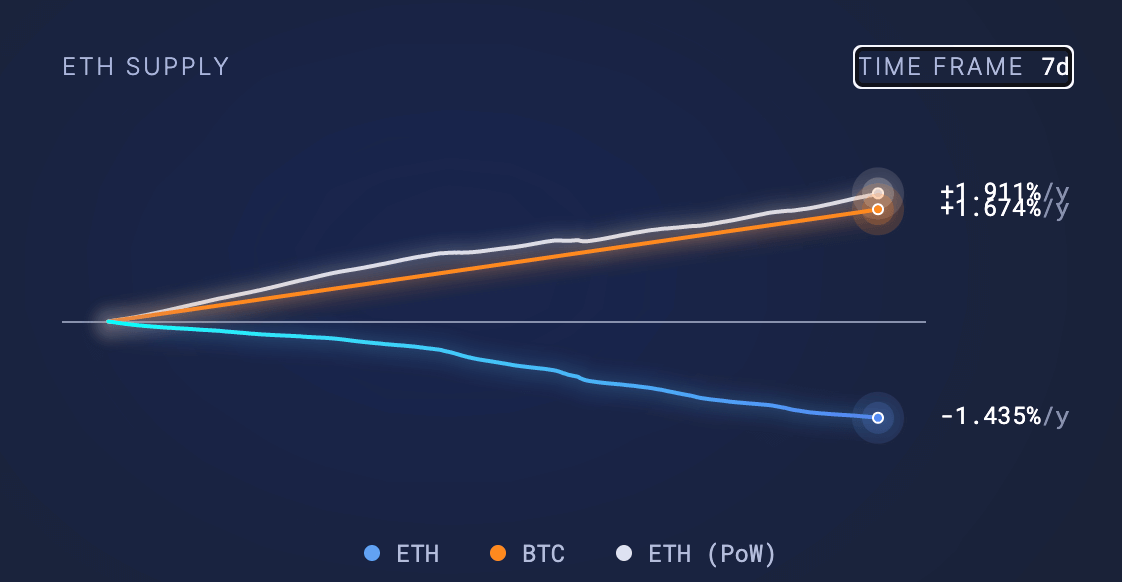

Over the past seven days, increasing ETH network fees has facilitated an uptick in deflationary behavior as it rose to -1.435%. Moreover, even under PoW, its inflation rate would have fallen to 1.911% due to the surge in network activity and its correlation with the burn mechanic.

However, critics argue the move to PoS has centralized control of the network in the hands of major staking entities and exchanges. Some warn that the concentration of staked ETH could undermine Ethereum’s decentralization and security guarantees, in contrast to Bitcoin’s more distributed mining network.

As Ethereum continues to evolve under its new PoS regime and Bitcoin maintains its established PoW model, observers will closely watch how their respective supply dynamics and security trade-offs unfold. With Bitcoin’s issuance about to half due to the upcoming halving, its inflation rate will drop to 0.8%, which is within 1% of Ethereum. Bitcoin, however, has a fixed supply and will eventually have an inflation rate of zero. Ethereum’s inflation rate is tied to network activity and the amount burned through network transactions.

Still, the deflationary trend in ETH over the past 540 days offers an early glimpse into the potential future of the two largest cryptocurrencies ahead of the first Bitcoin halving since The Merge. The long-term sustainability and implications for both networks remain to be seen, with Bitcoin currently thriving at a $1.3 trillion market cap and Ethereum next in line at $478 billion.

Mentioned in this article

Latest Alpha Market Report

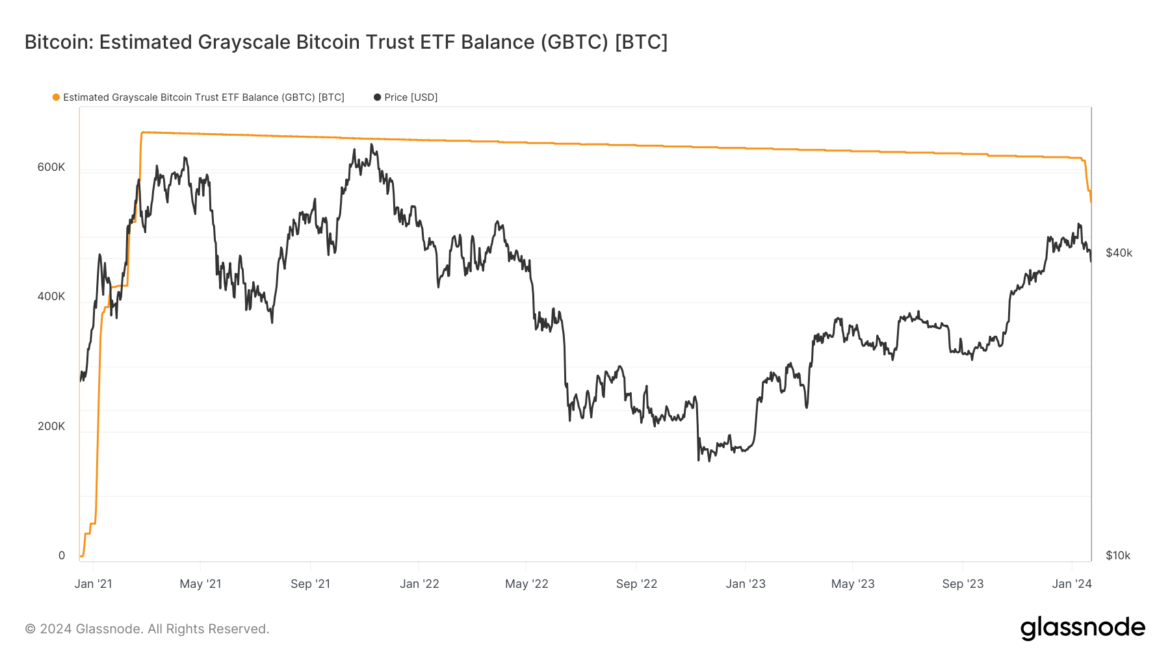

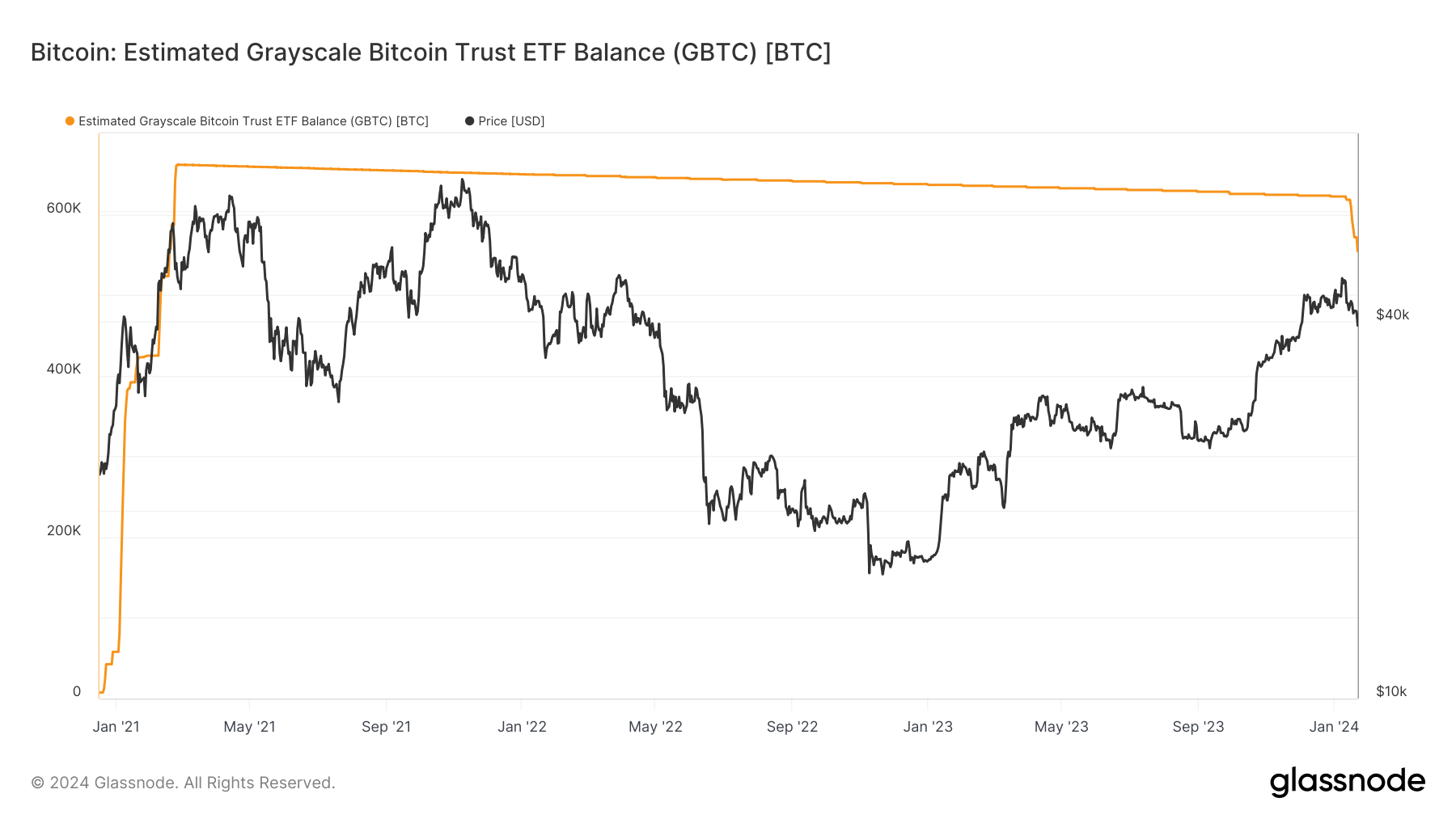

Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow

Quick Take

Recent data analysis from Glassnode reveals a substantial decrease in the balance of the Grayscale Bitcoin Trust ETF (GBTC), now estimated at around 553,000 Bitcoin, which is roughly 12% down from its high of 630,000 Bitcoin.

A key contributing factor to this decline appears to be the increasing outflows, which have been estimated at around $3.5 billion over its seven most recent trading days. These outflows are on the rise while the discount to the Net Asset Value (NAV) continues to close, currently roughly -0.11%, according to Y Charts. As this discount continues to narrow, the market may witness a further surge in GBTC selling.

Similarly, the digital asset exchange FTX reports significant sales nearing $1 billion, resulting from FTX’s bankruptcy estate offloading approximately 22 million shares, according to CoinDesk. Some of the outflows from GBTC have been redeemed into spot Bitcoin ETFs, roughly a third, according to Bloomberg analysts. However, it is noteworthy that about a third of the GBTC outflows ended up in USD, not in ETF vehicles, due to the FTX bankruptcy.

The post Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow appeared first on CryptoSlate.

Federal Reserve accelerates balance sheet reduction with $46 billion cut in a week

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Binance is celebrating its sixth anniversary, with over 1,000 people reportedly laid off in recent weeks, The Wall Street Journal reported.

According to former employees, cuts were global and customer service workers were heavily affected, particularly in India. Including this week’s layoffs, over 1,000 employees have lost their jobs at the exchange. Before the slash, Binance’s global headcount was estimated at 8,000. The exchange could lose more than a third of its staff due to the ongoing reorganization.

Binance announced a 20% reduction in staff on May 31, claiming it was not downsizing but reallocating resources. “As we prepare for the next major bull cycle, it has become clear that we need to focus on talent density across the organization to ensure we remain nimble and dynamic,” a spokesperson told Cointelegraph at the time.

Data from Glassdoor recently unveiled that Binance was home to some of the least happy employees in the crypto industry. An exchange spokesperson explained that the company seeks to hire candidates “who can thrive in a truly high-performance environment,” in addition to being “obsessively focused on delivering for our users.”

Since early June, when Binance was hit by a wave of regulatory challenges across the globe following a lawsuit by the United States Securities and Exchange Commission, the exchange has experienced several setbacks.

Binance was ordered to cease operations in Belgium, failed to obtain a license in the Netherlands, was denied a crypto custody license in Germany and lost its euro banking partner all within 30 days. The exchange is also under scrutiny in France and was subpoenaed to appear before Brazil’s Congress concerning a Ponzi scheme investigation.

According to The WSJ, Binance’s most enduring challenge is the ongoing investigation by the U.S. Justice Department of its activities and executives. Binance CEO Changpeng “CZ” Zhao has refused to give up control or step aside, raising concerns over the exchange’s survival.

Zhao’s response to the investigations reportedly sparked the departure of several top executives recently, including former chief strategy officer Patrick Hillmann. In his remarks on Binance’s anniversary, celebrated on July 14, Zhao said the company’s journey was “never all smooth sailing.”

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How smart people invest in dumb memecoins — 3-point plan for success