Rent the Runway Inc. on Wednesday said it expected breakeven free cash flow this year, following cost cuts and signs of a revival in shoppers’ enthusiasm.

Source link

rent

Forget Rent Hikes, This Is Where Long-Term Growth Will Come From for Prologis

Prologis (PLD 0.76%) is one of the world’s largest real estate investment trusts (REITs), with a market cap of about $120 billion. That size is important to keep in mind as you look at its long-term business opportunity. Of late, however, investors have been more focused on the short term. Here’s why you may want to dig deeper.

Prologis’ shares have cooled off

Supply chain problems related to the coronavirus pandemic caused investors to rush into the warehouse market. As the leader of this REIT sector, Prologis was a big beneficiary. The story is pretty simple. With more people stuck at home, online shopping grew quickly. Companies needed more warehouse space to accommodate those sales. On top of that, supply chain snarls caused by the pandemic resulted in companies holding higher levels of inventory than normal. Again, a need for more warehouse space was the end result.

Image source: Getty Images.

Increased demand resulted in rising rental rates. The numbers are kind of shocking. For example, in the third quarter of 2023 Prologis was able to increase rents by a whopping 74% on expiring leases, which was actually down sequentially from the second quarter. As you might expect, big rent hikes are good for business. All of the REIT’s leases don’t expire at the same time, so the benefit has been ongoing and is likely to continue for a while longer.

Early on, Wall Street was very excited about this story and pushed Prologis’s share sharply higher. And then reality seems to have set in that this situation wouldn’t last forever. The stock has since fallen back down to earth, though it remains well above where it started out in 2020.

Here’s the thing: Rent hikes are only one avenue for growth that Prologis has to offer investors.

Prologis has other levers to pull

This brings the story back to Prologis’s size, which its enormous market cap highlights. The most obvious growth path was put on display in 2022, when Prologis agreed to pay $26 billion to buy rival Duke Realty. That’s a big chunk of change, but given Prologis’s size it was a manageable transaction. It’s highly likely that no other REIT could have pulled off that deal. Being an industry consolidator is a key growth path, as indicated by Prologis’s follow-up purchase of a large property portfolio from alternative investment manager Blackstone.

But there’s something of a hidden gem waiting to be taken advantage of within Prologis’ globally diversified portfolio. Here are the numbers. In North America the REIT owns 803 million square feet of space across 3,877 buildings and 7,885 acres of undeveloped land. In South America the numbers are 83 million square feet across 341 buildings and 1,960 acres of undeveloped land. In Europe the REIT owns 242 million square feet across 1,112 buildings and has 2,157 acres of undeveloped land. And in Asia, Prologis operates 114 million square feet of warehouse space across 283 buildings and owns 89 acres of undeveloped land.

The takeaway is that it owns a massive portfolio of working properties in key transportation hubs. And, right in the same areas, it has land that it can develop if demand for property merits the investment. Prologis estimates that this land could be a $40 billion investment opportunity, which is even bigger than the Duke deal. Clearly, that won’t all happen at one time. But that’s actually good news, since it suggests that there are years of growth ahead for Prologis even after the benefit from rent increases dwindles.

There are still reasons to like Prologis

It is likely that Wall Street got ahead of itself with Prologis coming out of the pandemic disruptions. But investors looking at the REIT today need to think long-term. Yes, the benefit of rolling over expiring leases to higher rates will eventually peter out. But the company’s ability to act as an industry consolidator and its massive portfolio of vacant land suggest that there are other powerful growth drivers here. With the 2.7% dividend yield still near its highest levels in five years, growth and income investors should probably give Prologis a second look.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Blackstone and Prologis. The Motley Fool has a disclosure policy.

Medical Properties Trust’s stock drops to 14-year low as tenant falls $50 million behind on rent

Medical Properties Trust Inc.’s stock fell 29% on Friday after the real-estate investment trust said one of its tenants, Steward Health Care System, is $50 million behind in rent payments.

Medical Properties Trust’s stock

MPW,

closed at $3.55, down $1.45, its lowest level since since 2009.

The stock also drew at least one downgrade from an analyst on Friday.

The REIT said late Thursday that it’s taking fourth-quarter noncash charges of about $350 million, including $225 million to write off consolidated straight-line rent receivables, as well as its $25 million share of straight-line rent receivables related to the unconsolidated Massachusetts partnership and consolidated unpaid rent receivables of approximately $100 million.

“No assurances can be provided that further impairment of real-estate and non-real-estate assets will not be taken with MPT’s fourth-quarter 2023 reporting,” the REIT said.

Medical Properties Trust is expected to report fourth-quarter results on Feb. 1.

The REIT said it will accelerate its efforts to recover uncollected rents and outstanding loan obligations from Steward, which recently informed MPT that its “liquidity has been negatively impacted by significant changes to vendors’ payment terms,” the company said.

The move by MPT comes about a month after Steward said it will close down New England Sinai Acute Long-Term Care and Rehabilitation Hospital in Stoughton, Mass.

Steward cited chronic low reimbursement rates for services paid to Medicare and Medicaid patients, according to a statement reported by Boston25 News.

“Nearly 75% of Steward hospital patients are public-pay, which chronically underpays, sometimes at rates less than the cost of delivering services,” the statement said.

A spokesperson for Steward did not respond to an email from MarketWatch.

MPT has hired Alvarez & Marsal Securities LLC as its financial adviser to assist with options for recovering the rent.

MPT said it agreed to fund a new $60 million bridge loan that is “secured by all MPT’s existing collateral” plus new second liens on Steward’s managed-care business, subordinate only to Steward’s asset-based lenders.

Meanwhile, KeyBanc downgraded MPT to sector weight from overweight due to “uncertainty and ongoing risks” to its tenant health that “remain an overhang.”

“Management is pursuing steps to improve its balance sheet, which we view favorably, but pricing and execution remain uncertain,” KeyBanc said.

Visibility into the company’s earnings trajectory “remains low and we are moving to the sidelines until there is better clarity,” KeyBanc said.

In the third quarter, Steward accounted for about $70.7 million, or roughly 23%, of MPT’s total revenue of $306.58 million.

Prior to Friday’s moves, MPT’s stock had fallen 59.6% in the past year, compared with a 23% rise by the S&P 500

SPX.

Dallas-based Steward Health Care describes itself as the largest physician-led, minority-owned integrated healthcare system in the U.S.

Tomi Kilgore contributed.

Web3 firm sees future where gamers rent out their in-game assets for crypto

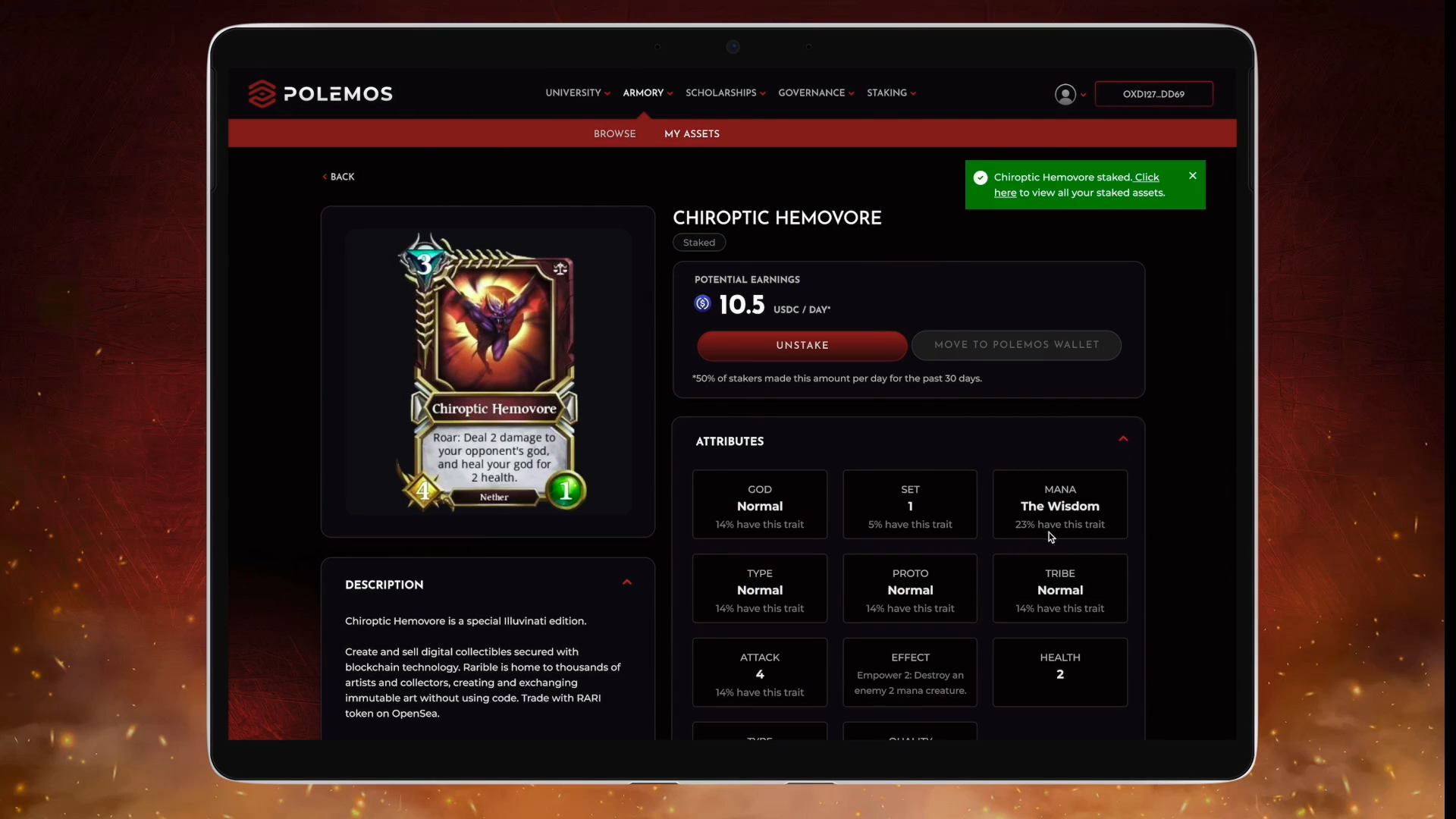

Imagine a future where a player is able to rent an in-game item via blockchain, giving them tools to pass a difficult level, or borrow a nonfungible token (NFT) that gives them the ability to try a new game on their wishlist.

Such a feature is one that Polemos co-founder Richard McLaren is hoping will one day become the norm, along with an economy where players rent out their in-game assets for a fee.

In an interview with Cointelegraph, McLaren announced a new partnership between his gaming infrastructure service Polemos and fantasy battle game Illuvium, a move he said would help break down barriers for players looking to get started on Illivium’s platform.

“It just represents a much easier entry point for players financially and widens the base of people who would be prepared to play those games,” McLaren said.

A key pain point for blockchain games is that they often require players to front up significant sums of capital just to get started. Instead, newbies can rent an NFT for a few days and dip their toes in the water more easily, McLaren explained.

“We think that not only will it increase sales, but it’s only increasing your ability to attract players because they can check things out. Players who have these massive inventories, who put the time into your game, have a reason to stick around, which increases retention and player base.”

Polemos’ non-collateralized NFT lending protocol, dubbed “The Armory,” utilizes a pay-up-front model so that players don’t even need to put down collateral to rent the in-game assets.

“You don’t have to cover the value of the asset because we’re confident the technology prevents you from damaging that in any way. So, it opens up this as non-collateralized lending to a much wider audience of people who don’t have the capital to put down to secure an asset.”

While game asset NFT lending might seem like a niche market, McLaren predicts the total market size for game asset lending could grow to somewhere between 30% and 40% of the roughly $2.3 billion that was invested in NFT gaming in 2023.

Related: 40% of crypto game devs are banking on trad gaming in 2024

“The reason for that is rental is really part of your marketing expense as a game studio. So, it’s money paid by players that you don’t receive unless they’re your assets, but they’re paid to other asset holders, which provides a reason for players to play your game,” he said.

“You have major IP and major studios getting into ownership — maybe not blockchain — but definitely into ownership as a mechanic, and renting is a way of making ownership more engaging and more real for a player who is already invested in a game.”

The rental model also offers long-time players and game studios with a warchest of in-game assets the ability to earn income on unused assets.

“You can receive some passive income — maybe not life-changing income — but passive income from those assets, which is a very positive retention mechanic for staying engaged in the game, which we think the gamers will get very heavily involved in.”

As to why game studios would choose to go with his company instead of simply creating their own “walled garden” lending service, McLaren said decentralized public infrastructure removes the need for relying on game studios altogether.

“The concept of player ownership in general relies on public infrastructure. A big part of its appeal is you’re not dependent on the game studio being around forever,” McLaren said. “So, the argument for having lending as a third-party marketplace is very similar to having NFTs in general.”

Additionally, McLaren shared that Polemos was currently closing its strategic pre-sale for a native token due to be launched midway through 2024.

Magazine: Web3 Gamer: Games need bots? Illivium CEO admits ‘it’s tough,’ 42x upside

BofA reveals rent is cheaper than mortgages in all but two of 97 major metros

This housing market has Bank of America economists in a Shakespearean mood about the eternal debate: The slings and arrows of buying versus renting. In a recently released Hamlet-esque research note, “To buy or not to buy, that is the question,” BofA economists found that buying, to paraphrase the prince of Denmark, is an outrageous fortune these days.

Mortgage rates have created a sea of troubles for homebuyers, hitting the once-unthinkable 8% mark before falling for weeks in the wake of cooler-than-expected inflation reports and the prospect of an end to the Federal Reserve’s rate hiking cycle. While that’s nobler in the mind in terms of affordability, home prices have still risen substantially in just three years, and consumers don’t think it’s a good time to buy, the economists said, citing a University of Michigan consumer sentiment survey. The economists also suggested that buyers should anticipate the undiscovered country of a higher-for-longer rate environment (echoing other investment banks who have said as much.)

At the same time, rents have gone up substantially as well—only recently has rent growth slowed as the rental market softens. “It clearly has not been a buyers’ market due to low affordability, but the situation has not been all that much better in the rental market,” they wrote in the note.

‘Rent was still cheaper than mortgages in all but two’

The BofA economists took a look at the rent versus buy conundrum, comparing rent and mortgage payments (they included property taxes in their calculation, but excluded home insurance, utilities and maintenance costs). Nonetheless, their analysis found that “rent was still cheaper than mortgages in all but two of 97 major Metro Areas,” as of October, despite the fact that both rents and mortgage payments have gotten more expensive, relative to median income, since the pandemic. It’s not hard to understand this, given that the whips and scorns of the pandemic let millions perchance dream of a different way of life—and a different housing situation, sending home prices up more than 40% nationwide and fueling a rent spike that has settled down faster than the buying market.

There’s the rub: It’s worse in some places than others. Along the west coast, economists found it more expensive to purchase a home than rent in cities like Los Angeles, where as a percentage of median income, mortgage payments and tax are 83% and rent is 41%; or San Jose, where it’s 80% versus 26%; or San Francisco, where it’s 71% versus 29%; or San Diego, where it’s 74% versus 38%; or Seattle, where it’s 55% versus 25%.

But there’s also cities like New York, where it’s 62% versus 43%. Meanwhile, New Orleans and Jackson, Mississippi, are the only two cities that are less expensive to buy than rent, according to their analysis.

Realtor.com’s recent rental report, published in late-October, found that for the fifth straight month, rents dropped. “It’s become more economical to rent than to buy in nearly all major markets,” Danielle Hale, chief economist at Realtor.com, said in a statement, at the time. An earlier report showed the cost of buying a starter home was significantly more expensive on a month-to-month basis than the cost of renting a similar-size home; that was true in 47 of the top 50 metros.

The equity question

But then BofA’s pale cast of thought turns to the question of equity. When you buy a home, you build equity over time, all the while the value of your home appreciates. Your home becomes a sort of cash reserve into which you can tap. None of that is true for renting, but that doesn’t mean it’s not a viable option, particularly at this moment.

“A similar story applies to the United States as a whole,” they wrote. “Despite the costs of renting and homeownership both increasing, renting is more affordable than owning. On a national basis, rents have increased from 23% to 26% of median U.S. household income, while the ratio of mortgage payments to income has grown from 19% to 32%.”

The data suggests a housing market that has become “more burdensome” on the average buyer than pre-pandemic—one that’ll take some time before achieving a balance between supply and demand. The investment bank expects the Fed to cut rates next year, and after, they wrote, housing activity should pick up amid improved demand and supply. That being said, the economists expect both existing home sales (which are at their slowest pace in over a decade) and new home sales to “warm up” in the second half of next year, along with more building to support housing starts. In other words, BofA is betting against conscience making (housing) cowards of us all.

This story was originally featured on Fortune.com

Urban Outfitters Inc., or URBN, has been quietly building a new segment near its headquarters in Philadelphia.

Launched in 2019, Nuuly is a clothing rental subscription service that features the company’s brands Urban Outfitters, Free People and Anthropologie, as well as more than 400 other brands and designers.

URBN leaders say Nuuly further expands the company’s flagship brands, rather than diluting its wholesale profitability among customers.

“They’re getting exposure to our family of brands, and they are actually more inclined to go buy from our sister brands,” said Nuuly President and URBN Chief Technology Officer Dave Hayne.

Nuuly is set to reach profitability in its third or fourth fiscal quarter of 2023. The service has seen substantial growth in its short existence. Its revenue almost doubled year over year in URBN’s second quarter, driven by an 85% increase in active subscribers.

“In 2019, they launched with $0 in revenue. This is going to be one of the fastest kind of concepts to get to break even profitability that we’ve ever seen,” said Adrienne Yih, a consumer discretionary analyst at Barclays.

The number of users is only growing. Nuuly boasted about 198,000 subscribers as of Nov. 3, just 2,000 shy of the goal its leaders set out to achieve by the end of the fiscal year.

“Most of the timeframes that we’ve set up until now, we’ve been running ahead of,” Hayne said.

Analysts project Nuuly will add $1 billion in value to URBN over the next three to five years.

Nuuly leaders hope the momentum continues. As the platform grows, the company is opening a new $60 million facility in the Kansas City, Missouri, region in January 2024, which it says will help support upward of 600,000 subscribers.

“The goal is to triple the overall business. And Kansas City is really what allows us to do that,” Hayne said.

Though Nuuly isn’t the first rental service on the market, analysts said there’s a lot of opportunity in the nascent space.

Consumers are increasingly curious about rental. The current millennial and Gen Z generations are interested in both sustainability and newness. Of this group, 15% say they’re willing to try clothing rental and 48% are willing to buy apparel secondhand, according to a McKinsey & Company report.

The report predicts the rental industry could represent 3% of the total retail market by 2030, while re-commerce, or secondhand sales, will likely represent 12%.

Analysts said Nuuly is well-positioned because of the backing of its parent company, which has invested more than $100 million in its development and essentially sped up development by “at least three years,” Yih said.

As Nuuly rises in the industry, another company is falling. Rent the Runway’s share price has dropped about 97% since it went public in late October 2021. In its second quarter this year, the company reported $75.5 million in revenue, down 1% from the same quarter the year prior.

An industry source said this was a reflection of Rent the Runway’s performance, rather than the rental market as a whole. Other companies such as Express, Vince Camuto and Banana Republic all launched rental platforms in 2018 and 2019, though unlike Nuuly, they only offer their own labels.

While data on the emerging segment varies greatly, experts agree the potential is huge. McKinsey & Company predicts it could reach $2.1 billion by 2025.

Watch the video to learn more.

I will leave my daughter my house, but she doesn’t want to take over my $250,000 mortgage. Should she rent the house, or just sell it?

Dear MarketWatch,

My daughter has a similar issue that this lady is facing, whose mother left her the family home.

I will be leaving my daughter my house in my will. But she has a physical disability that affects her head and ability to work full-time, so her income is limited.

She lives in an apartment close to her work and doesn’t want to move into my house.

My house is worth $450,000, with a loan balance of $248,000, which I had recently refinanced to a 3.35% mortgage rate.

My suggestion to her is to lease the house when it ends up in her hands. She can get about $2,800 in income, and since the mortgage is just under $1,600 a month, that gives her additional income. And if she does this, that extra money would almost fully pay her rent.

Her other option is to sell, and take approximately $200,000 out of the house.

So my question is, should she sell or should she lease?

Trying My Best

‘The Big Move’ is a MarketWatch column looking at the ins and outs of real estate, from navigating the search for a new home to applying for a mortgage.

Do you have a question about buying or selling a home? Do you want to know where your next move should be? Email Aarthi Swaminathan at TheBigMove@marketwatch.com.

Dear Trying,

Ask her to lease this house if you predecease her. Do not recommend that she sell it just yet.

But start working with her now so she can find her feet as a landlord, if and/or when that happens. Together you can see the best ways to find tenants, how to set up rent payments, and how to care and maintain the home.

If she’s not able to take on this responsibility, you can research a property-management company that can help you at a cost. A property-management company typically takes about 8% to 12% of the monthly rate as a fee.

I love that she has a little bit of money left over from the rent if she leases. That will boost her income, give her more financial stability, and help her to put money money aside for an emergency.

Many people in America who are renting dream of owning their own home, so you have helped to set her up for a successful and secure retirement. Plus, that 3.35% mortgage interest rate was a catch. She would be lucky to see that again soon.

I don’t know what medical issues she has, and what other financial needs she may have in the medium- to long-term, but if there’s no immediate and pressing need to draw on that $200,000, why go down that route?

I truly appreciate how much you have done — and what you are leaving behind — for your daughter. It is kind of you to give your daughter a financial leg-up by willing your home to her.

By emailing your questions, you agree to having them published anonymously on MarketWatch. By submitting your story to Dow Jones & Company, the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.