Wall Street errs on its forecasts of slower hiring and weaker economic growth. What is the Fed to do?

Source link

Report

1 Semiconductor Stock to Buy Hand Over Fist After Micron Technology’s Stellar Report

Micron Technology (NASDAQ: MU) wowed investors last week with an outstanding set of results for the second quarter of its fiscal 2024, reporting a massive jump in its revenue and a surprise profit, and this sent shares of the memory specialist soaring.

The chipmaker benefited from a jump in demand for memory chipsr. As a result, its revenue increased a massive 58% year over year to $5.8 billion. Micron is anticipating stronger year-over-year growth of 76% in its top line in the current quarter, driven by increased appetite for memory chips from artificial intelligence (AI) servers, smartphones, and personal computers (PCs).

The memory industry has witnessed a significant turnaround of late as demand for consumer electronics is back on track, while AI has created the need for advanced memory chips known as high-bandwidth memory (HBM). Micron management remarked on the latest earnings-conference call that its HBM capacity for 2024 is sold out, while the “overwhelming majority of our 2025 supply has already been allocated.”

This is good news for Lam Research (NASDAQ: LRCX), a semiconductor equipment manufacturer that gets a big chunk of its revenue from selling its goods to memory manufacturers such as Micron. Let’s look at the reasons why Micron’s latest results are an indication that investors would do well to buy Lam Research stock right now.

Lam Research is about to witness a solid turnaround

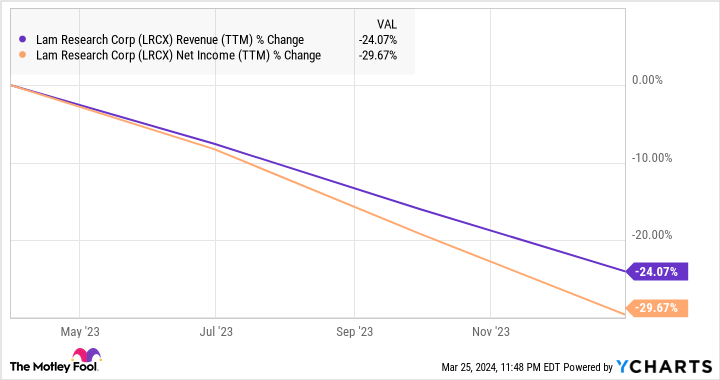

In the most recent quarter, Lam Research got 48% of its revenue from selling semiconductor manufacturing equipment to memory manufacturers. This explains why the company’s results in recent quarters have been poor. An oversupply in the memory market forced the likes of Micron and others to put a hold on capacity expansion, and so Lam’s top and bottom lines have been heading south.

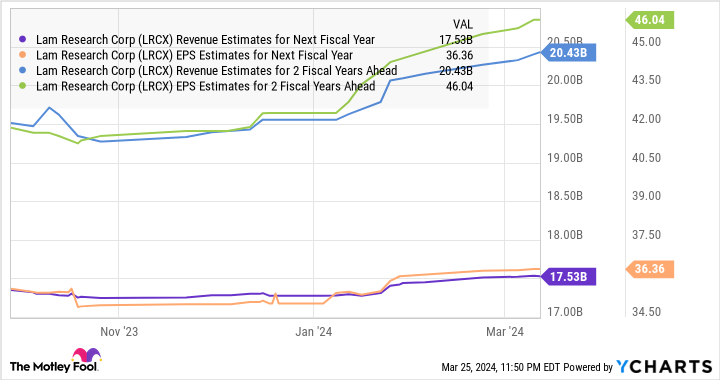

Analysts expect the company to finish the current fiscal year with a 22% decline in revenue to $13.6 billion. Additionally, earnings are expected to drop to $26.76 per share from $34.16. However, as the following chart shows, Lam Research’s revenue and earnings could jump sharply in the next fiscal year, which will begin at the end of June 2024.

Micron’s latest results and management commentary tell us just why Lam’s fortunes are set to turn around. Memory makers will need to increase their supply of HBM to cater to the growing demand from AI servers. The good part is that Lam is already witnessing solid orders for HBM equipment. CEO Tim Archer pointed out on the company’s January conference call with analysts: “In 2024, we expect our HBM-related DRAM and packaging shipments to more than triple year on year… “

It is also worth noting that the overall memory market is set to jump big time in 2024. According to Gartner, the memory industry’s revenue could jump 66% this year following a 39% drop in 2023. More importantly, the growing adoption of AI is set to drive robust long-term memory demand.

According to Micron, AI-enabled PCs are likely to carry 40% to 80% more DRAM (dynamic random access memory) content when compared to traditional PCs. On the other hand, the company expects AI-capable smartphones to “carry 50% to 100% greater DRAM content compared to non-AI flagship phones today.”

Meanwhile, the demand for HBM is forecast to more than double in 2024, generating $14 billion in revenue as compared to $5.5 billion last year. Even better, the HBM market could generate almost $20 billion in revenue next year. All this indicates that memory manufacturers will have to ramp up their production capacities, and a closer look at the industry indicates this is just what’s happening.

Samsung, for example, is expected to increase HBM production by 2.5 times in 2024, followed by a 2x increase next year. Similarly, SK Hynix expects to increase its capital expenditure this year to support increasing HBM demand. As such, the end-market conditions are set to turn favorable for Lam Research.

Buying the stock is a no-brainer right now

Lam Research is currently trading at 27 times forward earnings estimates. That’s a small discount to the Nasdaq-100‘s average multiple of 28 (using the index as a proxy for tech stocks). If Lam Research’s earnings hit the $46 estimate, and it were to trade at 28 times earnings, that would put its stock at $1,288, a 33% jump from its current price.

However, don’t be surprised to see the stock delivering stronger gains as the market may reward it with a higher earnings multiple thanks to its AI-fueled growth, which is why investors should consider buying this semiconductor stock before it jumps higher.

Should you invest $1,000 in Lam Research right now?

Before you buy stock in Lam Research, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

1 Semiconductor Stock to Buy Hand Over Fist After Micron Technology’s Stellar Report was originally published by The Motley Fool

TRM Labs Report: Tether’s USDT Was the Go-to Stablecoin for Illicit Activities in 2023

A report issued by TRM Labs indicated that Tether’s USDT, the largest stablecoin in the cryptocurrency industry, was the preferred stablecoin used for illicit transactions during 2023. TRM Labs alleges that 1.6% of USDT’s volume was linked to illicit activity last year, with $19.3 billion worth of USDT used in illegal transactional flows. TRM Labs […]

A report issued by TRM Labs indicated that Tether’s USDT, the largest stablecoin in the cryptocurrency industry, was the preferred stablecoin used for illicit transactions during 2023. TRM Labs alleges that 1.6% of USDT’s volume was linked to illicit activity last year, with $19.3 billion worth of USDT used in illegal transactional flows. TRM Labs […]

Source link

Greenpeace’s Anti-Bitcoin “Mining for Power” Report Receives Fierce Backlash on X

“Mining for Power,” an anti-Bitcoin report by Greenpeace USA that explains the links between the bitcoin mining industry and fossil fuel companies, has faced a backlash in social media due to its inaccurate portraits of the mining activity. Using community notes, social network users detailed the report contained “many factual errors,” including outdated information. Greenpeace […]

“Mining for Power,” an anti-Bitcoin report by Greenpeace USA that explains the links between the bitcoin mining industry and fossil fuel companies, has faced a backlash in social media due to its inaccurate portraits of the mining activity. Using community notes, social network users detailed the report contained “many factual errors,” including outdated information. Greenpeace […]

Source link

Navigating the Bitcoin Halving: Glassnode Report Discusses a New Trading Landscape

As Bitcoin’s network halving event draws near, Glassnode’s latest report sheds light on the evolving trading strategies in the face of significant demand from ETFs, signaling a pivotal shift in the cryptocurrency market. Glassnode Report Unveils Shift in Bitcoin Trading Strategies Ahead of Halving In the countdown to Bitcoin’s much-anticipated halving, the crypto community is […]

As Bitcoin’s network halving event draws near, Glassnode’s latest report sheds light on the evolving trading strategies in the face of significant demand from ETFs, signaling a pivotal shift in the cryptocurrency market. Glassnode Report Unveils Shift in Bitcoin Trading Strategies Ahead of Halving In the countdown to Bitcoin’s much-anticipated halving, the crypto community is […]

Source link

Inflation rose again in February, keeping the Federal Reserve on course to wait at least until the summer before starting to lower interest rates.

The consumer price index, a broad measure of goods and services costs, increased 0.4% for the month and 3.2% from a year ago, the Labor Department’s Bureau of Labor Statistics reported Tuesday. The monthly gain was in line with expectations, but the annual rate was slightly ahead of the 3.1% forecast from the Dow Jones consensus.

Excluding volatile food and energy prices, the core CPI rose 0.4% on the month and was up 3.8% on the year. Both were one-tenth of a percentage point higher than forecast.

While the 12-month pace is off the inflation peak in mid-2022, it remains well above the Fed’s 2% goal as the central bank approaches its two-day policy meeting in a week.

A 2.3% increase in energy costs helped boost the headline inflation number. Food costs were flat on the month, while shelter rose another 0.4%.

The BLS reported that the increases in energy and shelter amounted to more than 60% of the total gain. Gasoline jumped 3.8% on the month while owners’ equivalent rent, a hypothetical gauge of what homeowners could get renting their properties, rose 0.4%.

“Inflation continues to churn above 3%, and once again shelter costs were the main villain. With home prices expected to rise this year and rents falling only slowly, the long-awaited fall in shelter prices isn’t coming to the rescue any time soon,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Reports like January’s and February’s aren’t going to prompt the Fed to lower rates quickly.”

Fresh chicken breasts are displayed for sale in the meat area of a Sprouts Farmers Market grocery store in Redondo Beach, California on February 23, 2024.

Patrick T. Fallon | AFP | Getty Images

Airline fares posted a 3.6% increase, apparel prices rose 0.6% and used vehicles were up 0.5%. Medical care services, which helped feed a higher-than-expected CPI increase in January, decreased 0.1% last month.

The year-over-year increase for headline CPI was 0.1 percentage point higher than January, while core was one-tenth of a point lower.

Wall Street opened higher following the report, major stock averages as well as Treasury yields positive in early trading.

While the 12-month pace is off the inflation peak in mid-2022, it remains well above the Fed’s 2% goal as the central bank approaches its two-day policy meeting in a week.

Fed officials in recent weeks both have signaled that rate cuts are likely at some point this year and expressed caution about letting up too soon in the battle against high prices. The statement after the January meeting indicated that policymakers need “greater confidence” that inflation is moving back to target.

Chair Jerome Powell, in congressional testimony last week, echoed those concerns, though he did mention that the Fed is probably “not far” from the point where it can start easing up on monetary policy.

Tuesday’s report “leaves Fed officials some way from attaining the ‘greater confidence’ needed to begin cutting interest rates,” said Paul Ashworth, chief North America economist at Capital Economics.

For financial markets, the shift in the Fed stance from its apparent policy pivot in late 2023 has meant a repricing on the pace of rate cuts. Where futures traders entered the year expecting cuts to start coming in March, with six or seven total on the year, they have pushed out the first reduction to June, with two or three to follow, assuming cuts in quarter percentage point increments.

A bustling economy has helped the Fed focus on incoming data and allowed policymakers to avoid having to rush to lower rates. Gross domestic product expanded at a 2.5% annualized pace in 2023 and is on pace to increase at a 2.5% pace in the first quarter of 2024, according to the Atlanta Fed’s GDPNow tracker.

One key ingredient in that growth has been a resilient consumer boosted by a strong labor market. The economy added another 275,000 nonfarm jobs in February, though the increase skewed heavily to part-time positions and the unemployment rate rose to 3.9%.

Such strength can be a double-edged sword: While the growth in the face of aggressive rate hikes has bought the Fed time on policy, it also raises concerns that inflation could be more durable than expected.

Housing costs in particular have caused concern.

Shelter comprises about one-third of the CPI weighting and has been slow to decelerate, at least according to the BLS measure. Fed officials see rental prices coming down through the year, and other measures outside the CPI computation of owners-equivalent rent have shown easing price pressures.

Correction: The BLS reported that the increases in energy and shelter amounted to more than 60% of the total gain. An earlier version misstated a sector.

Don’t miss these stories from CNBC PRO:

Report: Global Crypto Investments Surge to Record $2.7 Billion in Weekly Inflows

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

Source link