In a statement released on March 7, the Canadian fintech entity Mogo disclosed its strategy to diversify its portfolio by investing in bitcoin and bitcoin exchange-traded funds (ETFs), earmarking an initial outlay of as much as $5 million. Canadian Fintech Mogo Dives Deeper Into Bitcoin The publicly traded Canadian enterprise Mogo (Nasdaq: MOGO) (TSX: MOGO) […]

In a statement released on March 7, the Canadian fintech entity Mogo disclosed its strategy to diversify its portfolio by investing in bitcoin and bitcoin exchange-traded funds (ETFs), earmarking an initial outlay of as much as $5 million. Canadian Fintech Mogo Dives Deeper Into Bitcoin The publicly traded Canadian enterprise Mogo (Nasdaq: MOGO) (TSX: MOGO) […]

Source link

reserve

Crypto Community Fires Back at Hillary Clinton’s Criticism of Bitcoin Undermining US Dollar as Reserve Currency

The crypto industry has responded to criticism from Hillary Clinton, who said that cryptocurrency can undermine the role of the U.S. dollar as the world’s reserve currency. Galaxy Digital CEO Mike Novogratz argued that the only thing that can undermine the U.S. dollar as a reserve currency is reckless spending by both U.S. political parties. […]

The crypto industry has responded to criticism from Hillary Clinton, who said that cryptocurrency can undermine the role of the U.S. dollar as the world’s reserve currency. Galaxy Digital CEO Mike Novogratz argued that the only thing that can undermine the U.S. dollar as a reserve currency is reckless spending by both U.S. political parties. […]

Source link

Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter

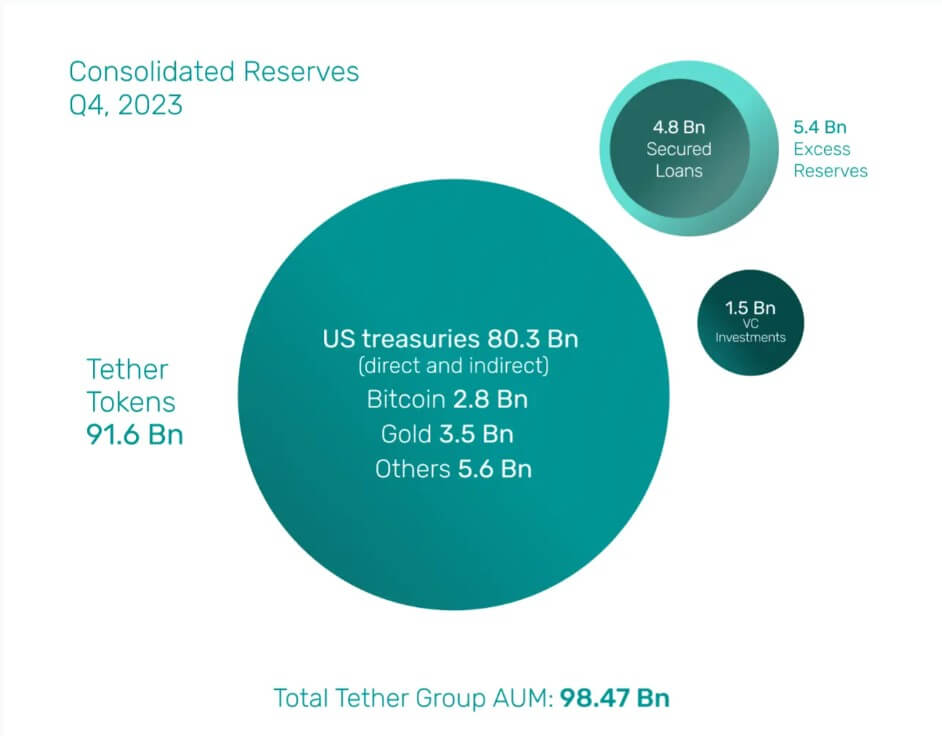

Goldman Sachs reported a profit of $2.01 billion in the last three months of the previous year, while Tether’s Q4 report revealed that its profits comprised $1 billion from U.S. Treasury bills and $1.85 billion from holdings in Gold and Bitcoin.

This remarkable performance can be attributed to the surge in the crypto market, driven by the enthusiasm surrounding the spot Bitcoin exchange-traded fund (ETF) between October and December 2023. During this period, Bitcoin’s value skyrocketed to over $42,000 from around $27,000, coinciding with Tether’s USDT supply rising to nearly 92 billion from approximately 83 billion tokens.

Observers noted that the increased demand for Tether’s fiat-backed stablecoin signaled a growing interest from institutional investors entering the market. CryptoSlate’s data shows that Tether’s USDT supply has risen to $96.2 billion as of press time.

However, despite its impressive performance, Tether’s overall profit for the year was $6.2 billion, notably lower than Goldman Sachs’s earnings of $8.52 billion.

Meanwhile, Paolo Ardoino, Tether’s CEO, emphasized that these substantial profits emphasize the company’s financial strength throughout the year.

“The substantial net profits generated not only in the last quarter of the year but throughout the year, amounting to $6.2 billion, showcases our financial strength,” Ardoino said.

Goldman Sachs, a globally renowned investment banking firm, holds the status of the second-largest investment bank in the world by revenue and is recognized as a systemically important financial institution by the Financial Stability Board.

Over $5 billion in excess reserves

The substantial profit margin enabled Tether to bolster its excess reserves to $5.4 billion. Of this, $640 million was allocated to various project investments, including sustainable energy, Bitcoin mining, AI infrastructure, and P2P communications. Tether does not consider these investments part of its reserves.

“Our investments in sustainable energy, Bitcoin mining, data, AI infrastructure, and P2P telecommunications technology illustrate our commitment to a more sustainable and inclusive financial future,” Ardoino explained.

BDO Italia, a prominent global accounting firm conducting Tether’s attestations, verified that the stablecoin’s excess reserves entirely covered its $4.8 billion in outstanding unsecured loans. Tether highlighted its achievement in eliminating the risk of secured loans from its token reserves.

As of December 31, 2023, Tether’s held assets were valued at $98.47 billion, with liabilities amounting to $91.59 billion.

Federal Reserve accelerates balance sheet reduction with $46 billion cut in a week

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Federal Reserve issues cease and desist letter to Bitcoin Magazine alleging IP infringement

The Federal Reserve Bank of Chicago has issued a cease and desist letter to Bitcoin Magazine, alleging it to have used a trademarked term IP — ‘FEDNOW’ — without its consent.

According to the letter, dated Oct. 27, 2023, the Federal Reserve confronted Bitcoin Magazine regarding its merchandise bearing the ‘FEDNOW’ mark, which they claim is likely to cause confusion and deception among consumers. The Fed believes people may misinterpret these items as being affiliated with or endorsed by the Federal Reserve.

The Federal Reserve, as per the trademark registration, owns all rights to the ‘FEDNOW’ service mark, which it uses to facilitate the electronic transfer of funds among financial institutions. Notably, the ‘FEDNOW’ mark was first used in commerce in Aug. 2019 and officially registered as a service mark in May 2023.

Bitcoin Magazine, in its defense, argues that its use of ‘FEDNOW’ is parodic and a form of political criticism directed at the Federal Reserve. In a reply letter dated Nov. 2, 2023, the magazine’s legal counsel, Zachary Shapiro, asserts that the design in question is a commentary on the “digital panopticon” symbolized by the Federal Reserve’s ‘FedNow’ platform, which enables 24/7 digital surveillance of transactions.

Shapiro wrote that given Bitcoin Magazine’s consistent critique of centralized financial entities, including the Federal Reserve, “any claim of consumer confusion concerning an endorsement or affiliation between its merchandise and the Federal Reserve seems rather far-fetched.” He also highlighted the perilous intersection of trademark law and free speech, suggesting that the Federal Reserve’s attempt to silence political critique raises concerns about First Amendment rights.

Mark Goodwin, the Editor in Chief of Bitcoin Magazine, has also issued an open letter to the Federal Reserve, asserting that the magazine refuses to comply with the cease-and-desist request and will not be silenced. Goodwin emphasizes that Bitcoin Magazine is merely exercising its First Amendment rights to social commentary and parody and is committed to defending its right to sell merchandise that critiques the FedNow system.

Clearly, this unfolding dispute presents another instance of the tension between traditional financial institutions and the emerging cryptocurrency industry. It remains to be seen how this legal face-off will conclude and what implications it might have for the broader discourse on financial systems, privacy, and the First Amendment.

Incoming Tether CEO Paolo Ardoino promises real-time reserve transparency

Paolo Ardoino, Tether’s incoming CEO, said the stablecoin issuer plans to publish real-time attestation of its reserves in the future, Bloomberg reported on Oct. 20.

Tether, due to its significant role in the cryptocurrency industry, has faced increasing pressure to enhance transparency regarding the reserves backing its USDT stablecoin, a digital asset pegged to the U.S. dollar. USDT is a crucial player in the cryptocurrency industry, commanding approximately 67% of the stablecoin market and ranks as the most traded digital asset in the sector, according to CryptoSlate’s data.

Following regulatory scrutiny from the U.S. Commodity Futures Trading Commission (CFTC) and a $41 million fine in 2021, Tether began publishing quarterly updates of its reserves, which some critics still find inadequate. Its most recent quarterly attestation shows that the stablecoin issuer has an excess reserve of up to $3.3 billion.

Since 2022, the demand for increased transparency has reached new heights following the collapse of Terra’s algorithmic UST stablecoin and the recent U.S. banking crisis that its rival USD Coin (USDC) was exposed to.

Additionally, reports suggest that Sam Bankman-Fried’s now-defunct crypto trading firm, Alameda Research, may have minted around $40 billion in USDT supply. Witnesses against Bankman-Fried, including former Alameda CEO Caroline Ellison and former FTX CTO Gary Wang, have testified that Alameda enjoyed and “unlimited” borrowing arrangement with FTX, raising substantial questions about the origin of the funds used to mint Alameda’s USDT.

Tether has publicly maintained that it remains fully backed. However, market observers argue that its disclosures should help investors better assess potential risks and scrutinize the auditors’ relationship with the company.

In the most recent quarterly report, Ardoino emphasized the company’s commitment to transparency, saying:

“We believe that open communication and strong financials foster trust and reliability, and this is what the global community deserves especially in a year devastated by many failures across the banking and crypto industry.”

Tether has yet to respond to CryptoSlate’s request for comment as of press time.

The post Incoming Tether CEO Paolo Ardoino promises real-time reserve transparency appeared first on CryptoSlate.

Opinion: Opinion: Most investors can ignore whatever the Federal Reserve does today

The Federal Reserve’s moves — or lack thereof — will affect everyone. And almost no one.

The Fed made no rate changes on Wednesday, holding back on at least one more hike before year’s end. There are plenty of experts who believe the central bank will then let rates sit until it turns around and starts to cut rates late in 2024.

MarketWatch…

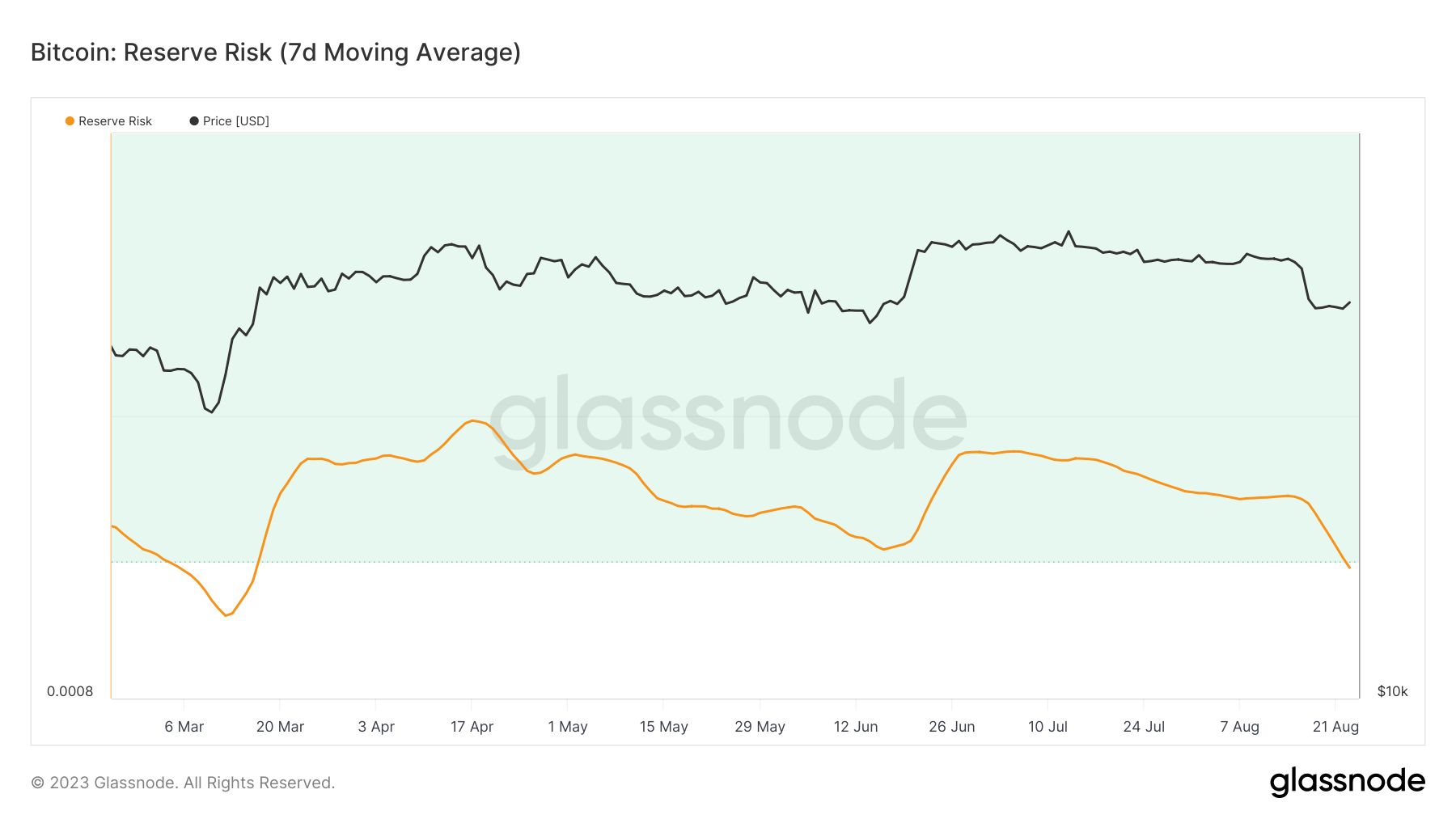

Last week, Bitcoin’s price dropped from $29,400 to a low of $25,000. While this decline might appear modest given Bitcoin’s historical volatility, it signifies a notable departure from the tight trading range observed over the past two months.

Yet, even amidst this volatility, the confidence of long-term holders remains unshaken, a sentiment that is crucial to monitor as it often serves as a barometer for the market’s underlying health.

This unwavering confidence is seen in Bitcoin’s reserve risk, an often underutilized on-chain metric.

Reserve risk is a metric used to evaluate the risk/reward ratio of investing in Bitcoin at any given point in time. It’s calculated by dividing the price of Bitcoin by the HODL Bank. The HODL bank represents the value of all coins in terms of their age (i.e., how long they have been held without being spent). The more coins are being held for longer periods, the higher the HODL Bank.

The metric essentially gauges the confidence of long-term holders in relation to the coin’s current price. A low Reserve Risk indicates that long-term holders are confident in the asset, and the current price is seen as attractive for investment. Conversely, a high Reserve Risk suggests that long-term holders might be less confident, and the price might be considered high relative to that confidence.

From Aug. 14 to Aug. 23, Bitcoin’s reserve risk plummeted from 0.0011 to 0.00098. Bitcoin’s price also decreased during this same period, moving from $29,400 to $26,400. To put this in perspective, the last instance when Bitcoin’s reserve risk touched these levels was on March 15, with the price at $25,050.

The drop in both Bitcoin’s price and reserve risk implies that even as the price dipped, the confidence of long-term holders surged. This can be interpreted as long-term holders perceiving the price drop as a lucrative buying window, reinforcing their belief in Bitcoin’s long-term value.

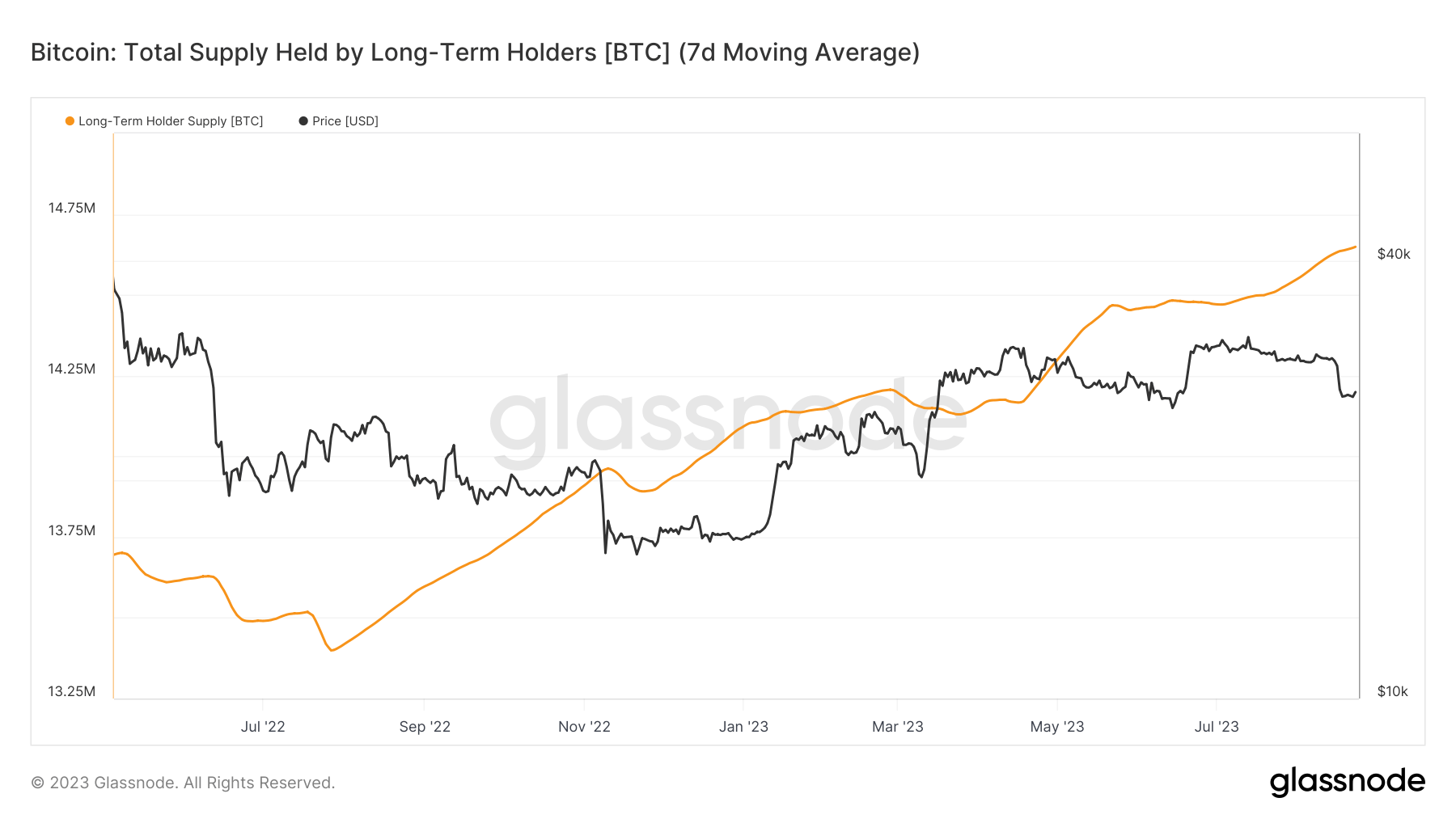

Other on-chain data further supports this, most notably the supply of Bitcoin held by long-term holders.

Despite the price slump, the number of Bitcoins held by long-term holders has increased, growing from 14.62 million to 14.64 in the past week. It’s important to note that this uptick continues an upward trend that began in July 2022.

The diminished reserve risk and the increased long-term supply indicate a prevailing sentiment that the current price offers a favorable risk/reward balance for investment.

While market fluctuations are inherent to the volatile nature of cryptocurrencies, metrics like reserve risk offer a deeper dive into the underlying sentiments. The recent data underscores a bullish outlook for Bitcoin, showing that its long-term holders remain steadfast in their belief in its long-term value, even during short-term price declines.

The post How Bitcoin’s falling reserve risk counters its price decline appeared first on CryptoSlate.

FedNow Service has no relation with CBDCs, Federal Reserve clarifies

The United States Federal Reserve clarified that its new service for instant payments between organizations — the FedNow Service — has no relation with central bank digital currencies (CBDCs).

The Fed certified the FedNow Service as “ready” after it onboarded 41 financial institutions, 15 service providers and the U.S. Department of the Treasury to test the system before its launch by the end of July 2023. However, the central bank had to clarify that the promise of instant fiat payments and real-time gross settlement (RTGS) is not powered by a CBDC.

#FedFAQ: Is the FedNow Service replacing cash? Is it a central bank digital currency?

Learn more about the #FedNow Service: pic.twitter.com/7CUaYZYyM9

— Federal Reserve (@federalreserve) July 19, 2023

In a tweet, the Fed stated that FedNow Service is similar to other payment services, such as Fedwire and FedACH, which work within the boundaries of the fiat ecosystem. It said:

“The FedNow Service is not related to a digital currency. The FedNow Service is a payment service the Federal Reserve is making available for banks and credit unions to transfer funds for their customers.”

The Federal Reserve further confirmed that it has not yet decided on issuing the highly anticipated CBDC and “would only proceed with the issuance of a CBDC with an authorizing law.”

The table above highlights the initial list of participants. However, the Federal Reserve plans to onboard all 10,000 U.S. financial institutions in time to come.

Related: Major US banks get passing grade in ‘severe recession’ stress test

On May 11, the Fed announced the integration of Metal Blockchain into the FedNow Service.

Metal Blockchain is a crypto network developed by Metallicus based on a fork of Avalanche’s code. According to its documents, the network features a subnet called X-Chain that allows developers to enact rules for transferring assets. For example, a token can be issued with the rule that it “can only be sent to US citizens” or “can’t be traded until tomorrow.”

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift

By James Glynn

SYDNEY–The Reserve Bank of New Zealand said Friday it is ramping up its monitoring of stablecoins and crypto assets in response to public concerns over their potential impact on the financial system and monetary sovereignty.

“A regulatory approach isn’t needed right now, but increased vigilance is,” said Ian Woolford, director of money and cash at the RBNZ.

“There are significant risks and opportunities from stablecoins and other private money innovations, but also significant uncertainties about how the sector will develop and where the optimal balance will lie,” he added.

Global policy harmonization around the issues is crucial to ensure effective regulation. As overseas regulatory regimes are implemented, best practice may become clearer, Woolford said.

Write to James Glynn at James.Glynn@wsj.com