Bitcoin Cash (BCH) experienced a notable fluctuation in its value surrounding its most recent block reward halving, initially dropping to $565 just before the halving but later recovering to around $676, marking an 11% increase for the day and nearly 20% for the week. The halving event, which reduced the reward for Bitcoin Cash miners […]

Bitcoin Cash (BCH) experienced a notable fluctuation in its value surrounding its most recent block reward halving, initially dropping to $565 just before the halving but later recovering to around $676, marking an 11% increase for the day and nearly 20% for the week. The halving event, which reduced the reward for Bitcoin Cash miners […]

Source link

resilience

Divergent performances highlight resilience and challenges for Bitcoin ETFs and equities

Quick Take

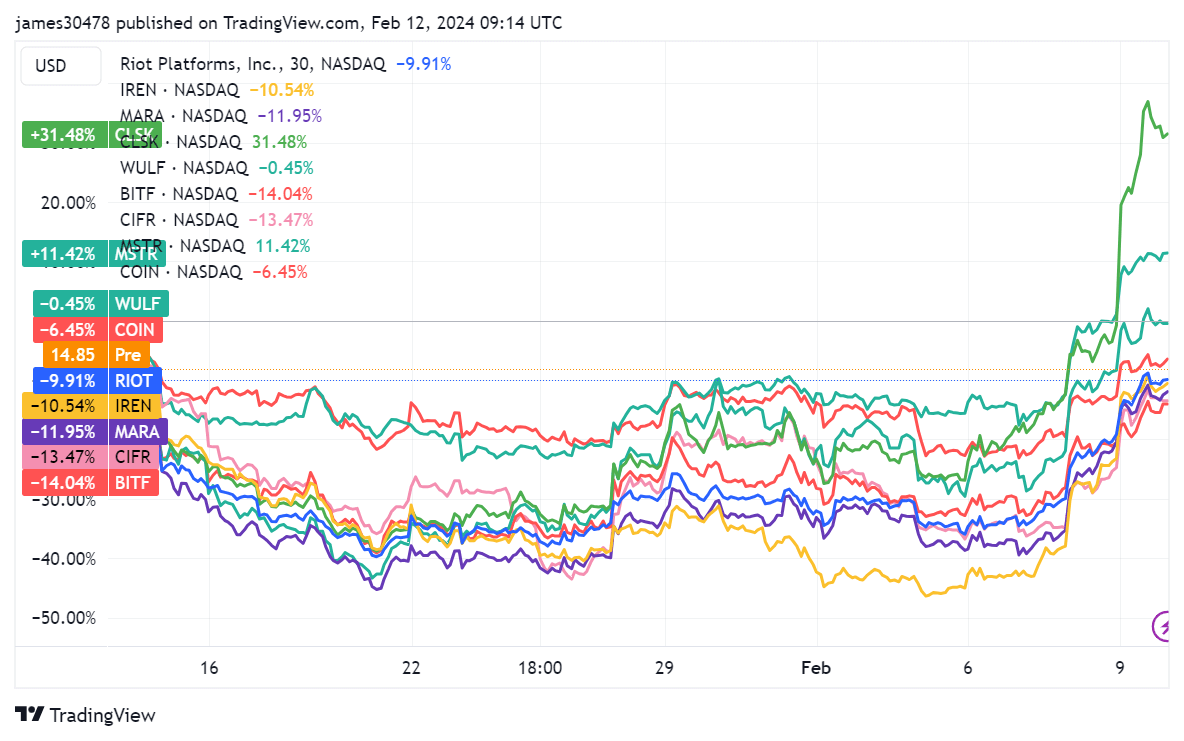

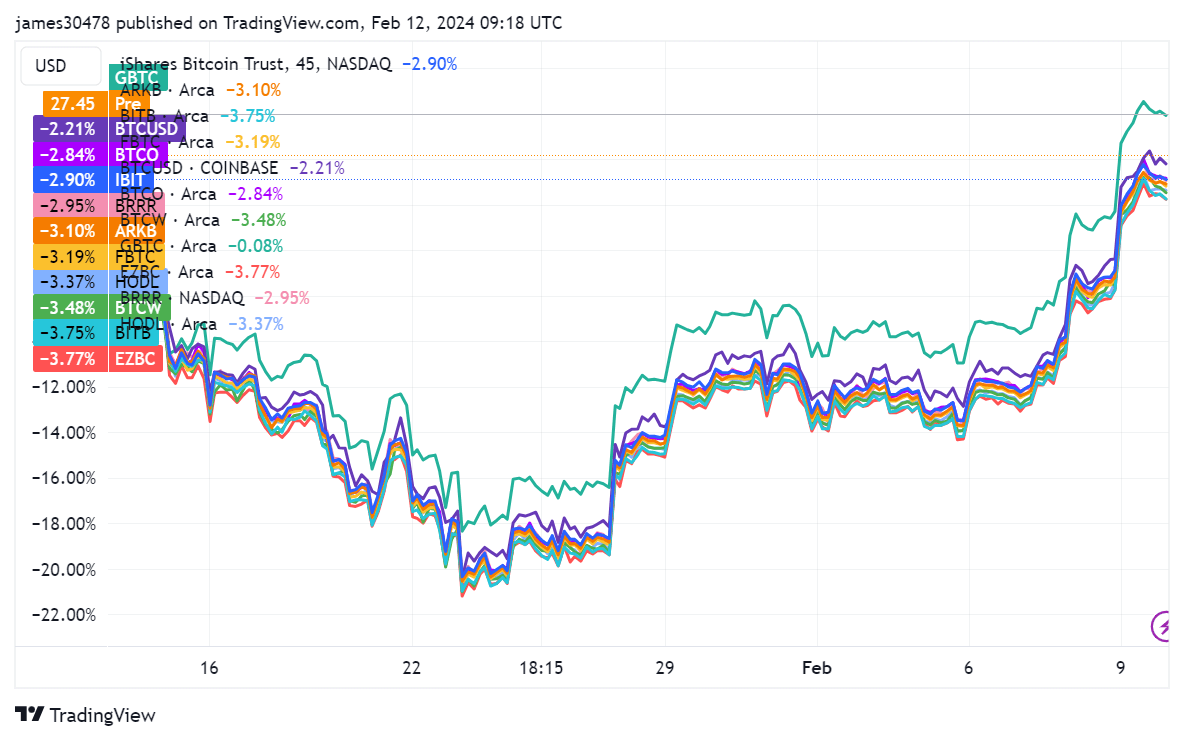

Since the approval of Bitcoin ETFs on Jan. 11, the price performance of the digital asset has illustrated an unpredictable pattern, peaking around $49,000 before dipping below $40,000. As of now, Bitcoin hovers around $48,000. This volatile behavior extends to crypto equities and Bitcoin ETFs, which have displayed divergent performances.

Bitcoin-related mining stocks such as Iris Energy and Marathon Digital Holdings have notably experienced double-digit declines of 11% and 12%, respectively. However, not all equities mimic this downward trajectory. CleanSpark and MicroStrategy, for instance, have seen their stock prices surge by 31% and 11%, respectively. Meanwhile, Coinbase suffered a 6% decline and is set to release its Q4 2023 earnings report on Feb. 15.

Owing to the slight decline in Bitcoin since the ETF approval, Bitcoin ETFs have recorded roughly a 3% drop, with GBTC remaining relatively flat. GBTC now records a small premium of 0.02% to its net asset value (NAV), according to YCharts. Nevertheless, the recent Bitcoin resurgence of over $48,000 has injected optimism in the pre-market, with many ETFs and crypto equities witnessing a rise.

The post Divergent performances highlight resilience and challenges for Bitcoin ETFs and equities appeared first on CryptoSlate.

Quick Take

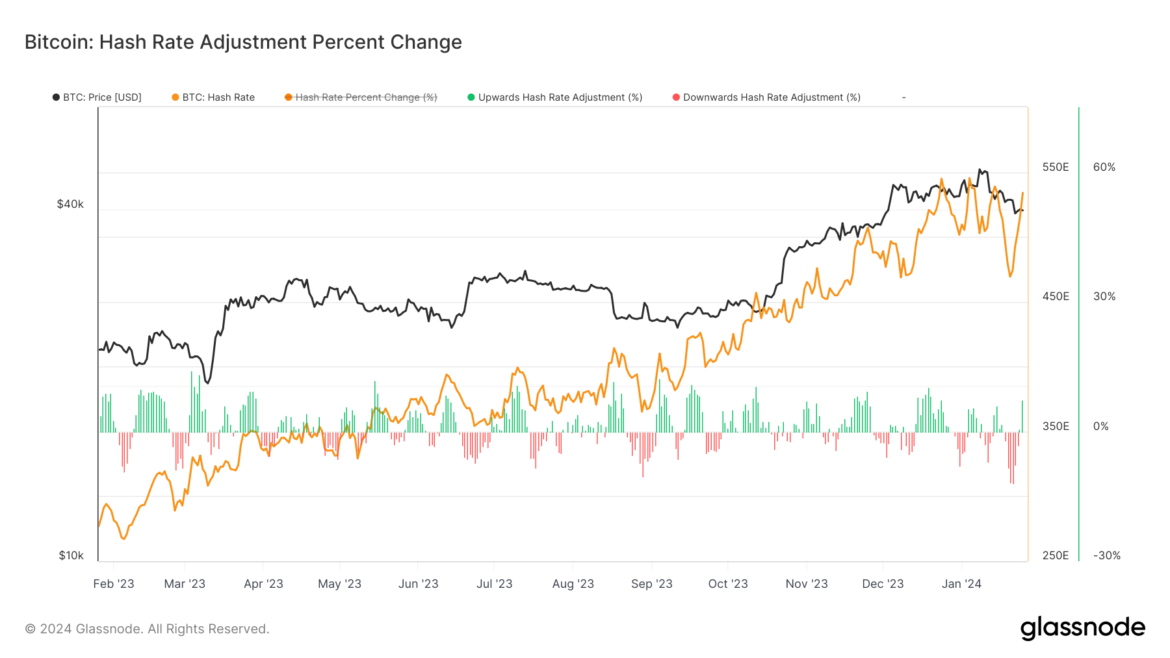

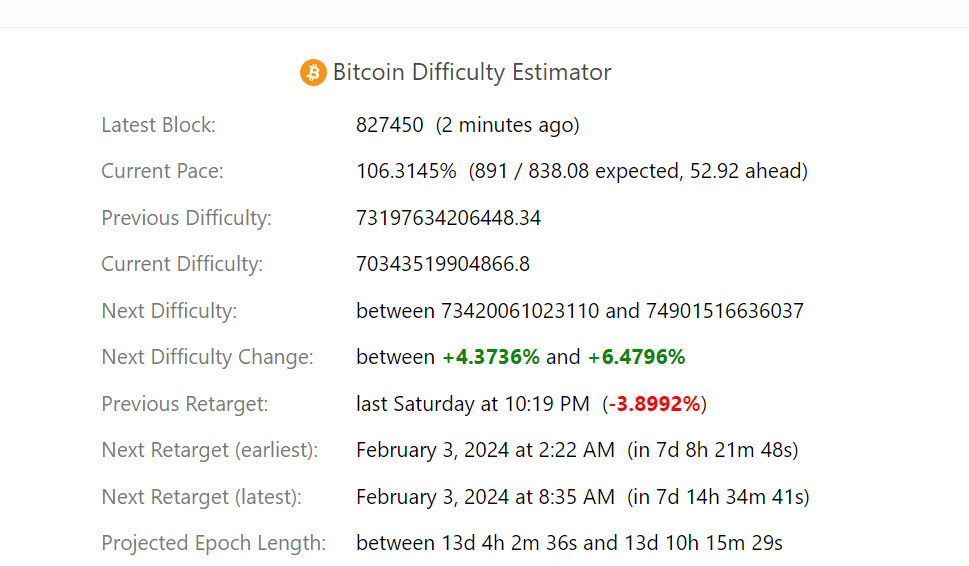

The Bitcoin hash rate experienced a significant drop in the middle of January, triggered by the Texas freeze, which saw it plunge 6% from its record peak. However, this plunge was short-lived, as evidenced by Jan. 25, which witnessed the most significant single-day hash rate ever recorded, at an impressive 638eh/s, marking a 24% day-over-day increase.

When examining the seven-day moving average, it’s evident that the Bitcoin hash rate has demonstrated remarkable resilience. It has entirely recuperated from its recent downturn, reporting a 7.5% increase at 533 eh/s. This swift recovery is a testament to the robustness of Bitcoin’s decentralized network during times of unexpected adversity.

As we move forward, with another week left until the subsequent difficulty adjustment, projections from Newhedge signal an adjustment between 4.3% and 6.4%. Despite prior fluctuations, this suggests a steady and healthy growth trajectory for the Bitcoin network.

The post From freeze to flourish as Bitcoin hash rate showcases resilience appeared first on CryptoSlate.

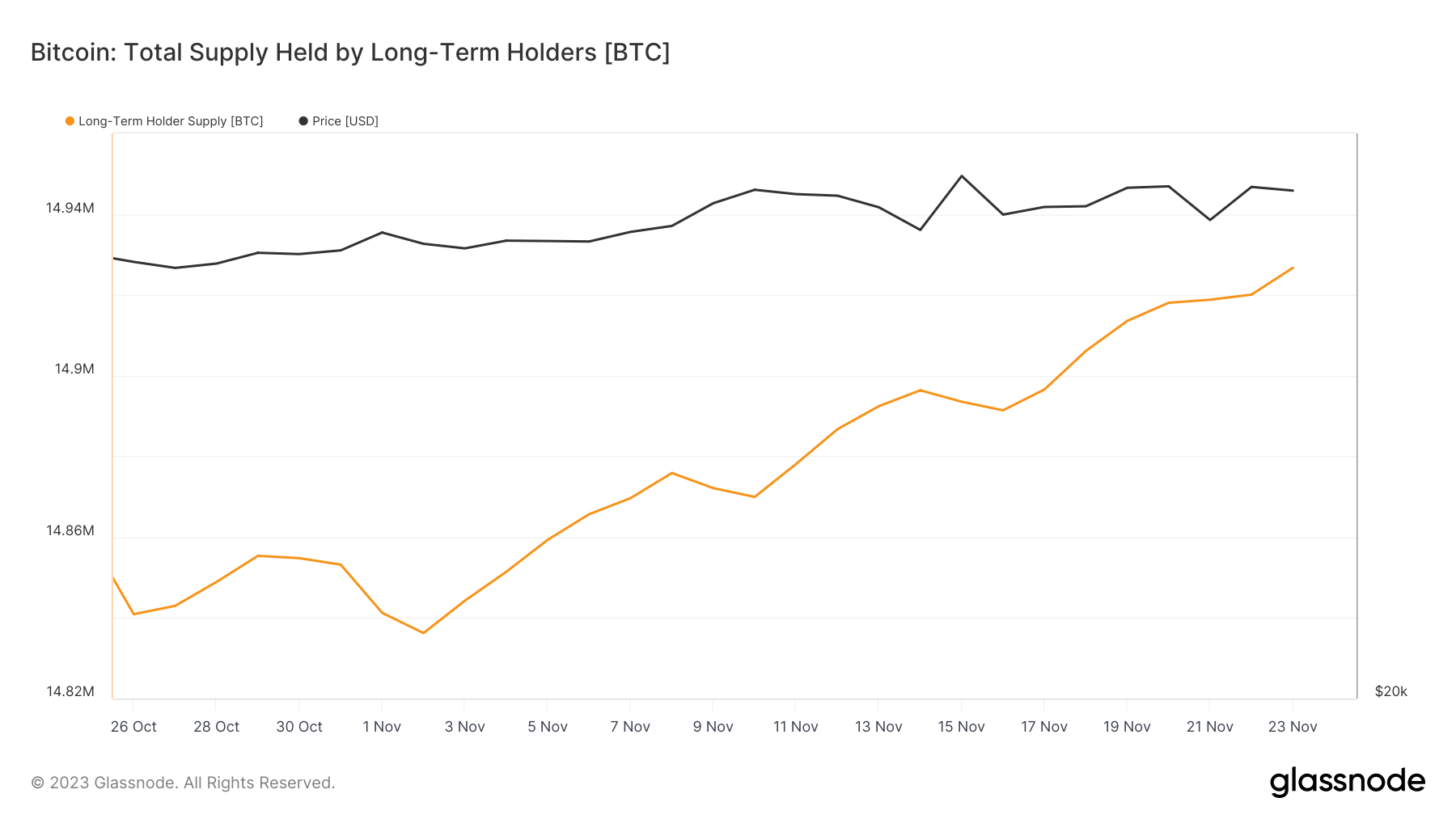

Bitcoin seems to have established solid support at the $37k level, demonstrated by its swift recovery following a dip to $35,000 upon news about Binance’s SEC fine. While this rebound represents a 122% increase since the beginning of the year, there has been relatively minimal distribution of BTC during this period.

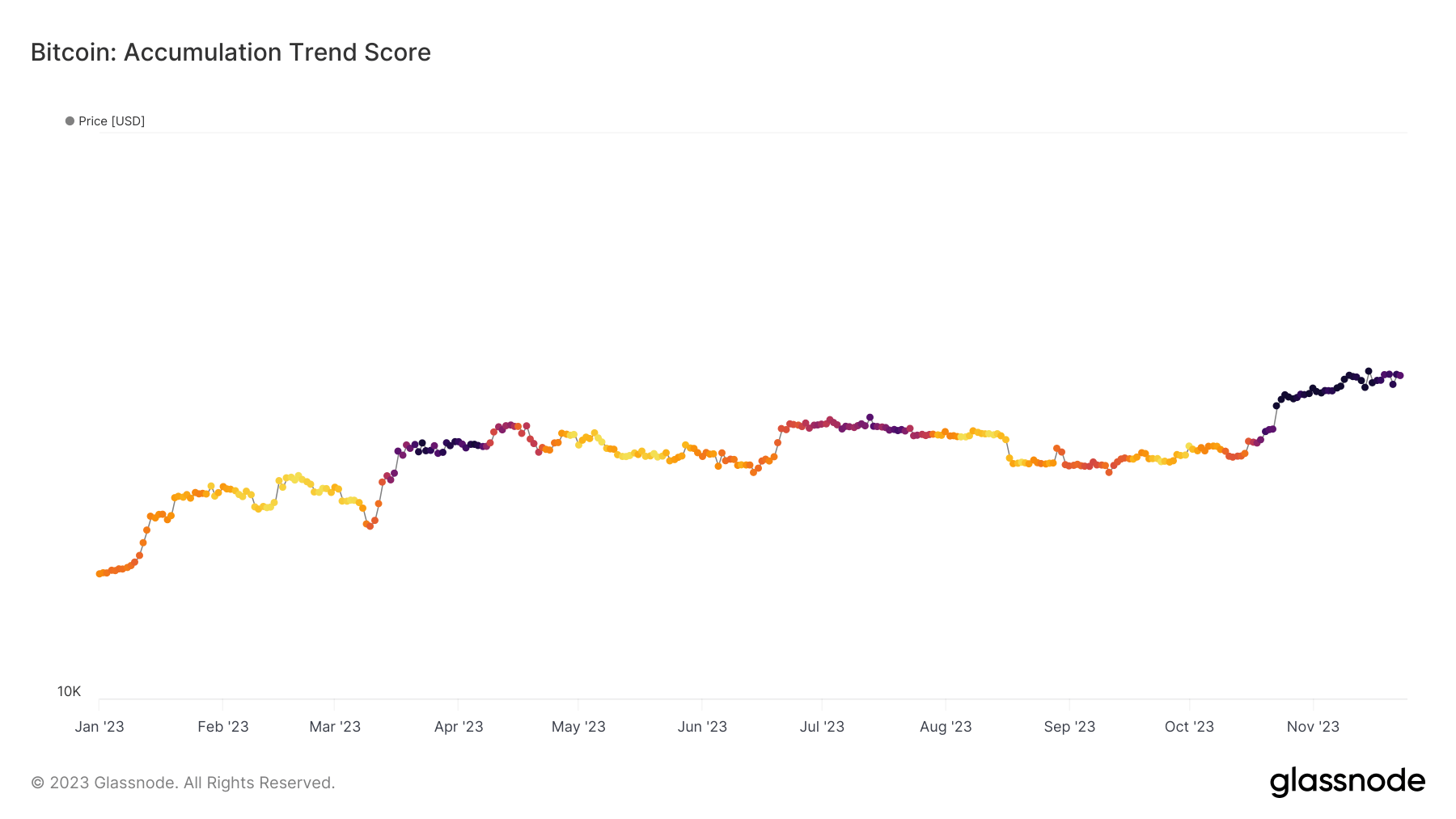

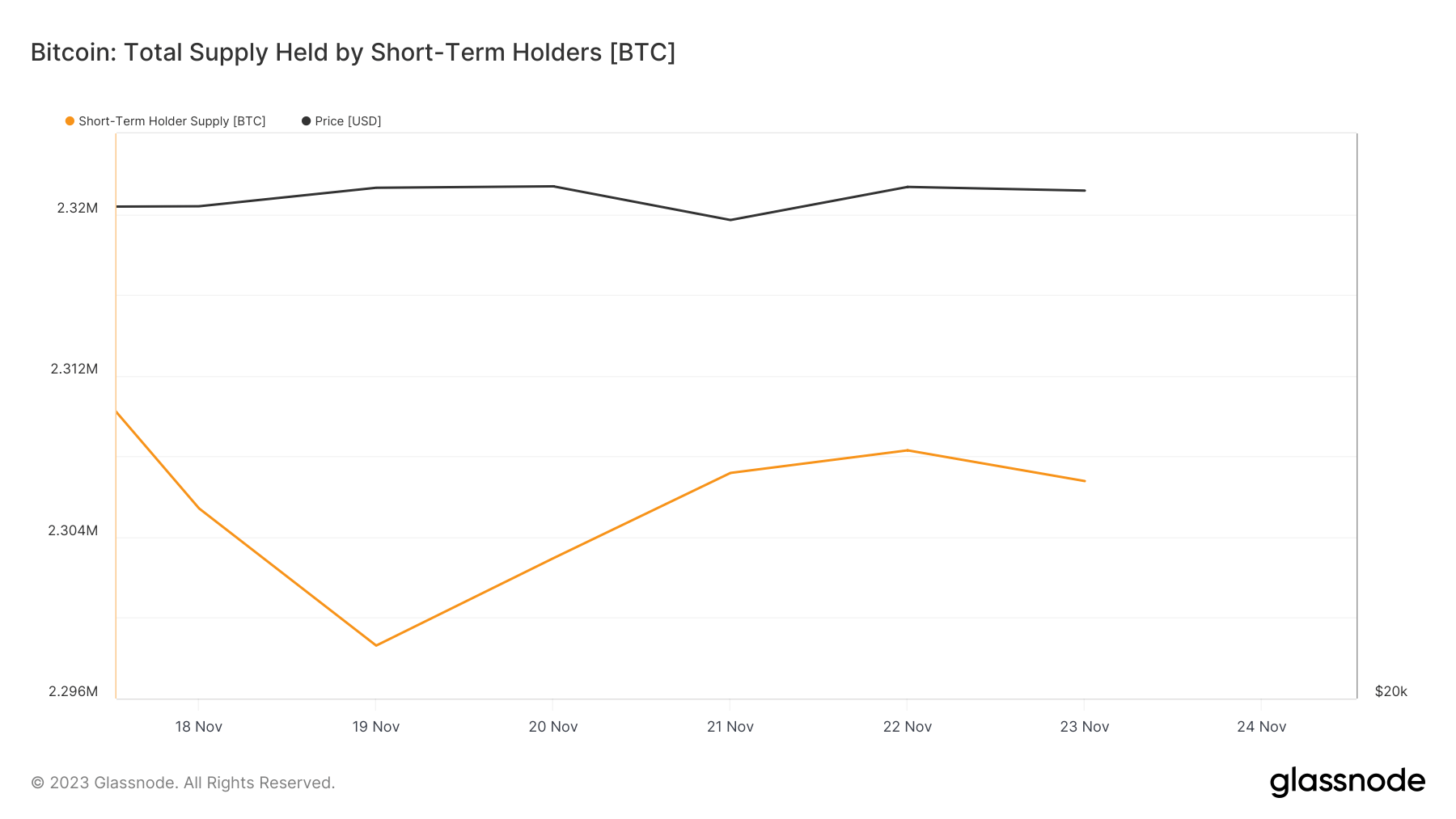

A closer examination of the Bitcoin supply held both by short-term and long-term holders shows a clear accumulation trend across the board. This trend only seems to have increased with Bitcoin’s spike above $37,000, indicating a determination among all holders to buy more BTC.

Glassnode data on long-term holders has been particularly telling over the past year. This cohort, known for their endurance in the market, has seen their holdings grow consistently, especially as Bitcoin’s price surpassed the $37,000 mark. The increase in long-term holder supply shows strong confidence in Bitcoin’s future prospects among these investors.

The Bitcoin accumulation trend score further supports this thesis. This metric, which gauges the degree of accumulation activity within the market, has shown positive signs. An increase in this score generally indicates heightened investor interest in acquiring more Bitcoin, often a bullish signal in the market. In this case, the trend score’s rise alongside climbing prices confirms that long-term holders are not just holding onto their assets but actively increasing their positions.

Over the past year, there has been a significant decline in short-term holder supply. Apart from distribution, this could indicate that a significant part of short-term holder supply has transitioned into the hands of long-term holders, as investors hold their coins beyond the 155-day threshold that typically differentiates short-term from long-term supply.

However, the last five days have seen an uptick in short-term holder supply. This recent increase suggests that Bitcoin’s escalating price has attracted new investors, keen on capitalizing on its growth. Monitoring short-term holder supply is crucial as it often reflects the market’s immediate reaction to price movements and can be an early indicator of changing market sentiments.

This accumulation has led to a significant spike in unrealized profits for Bitcoin holders. As of Nov. 23, 84.38% of Bitcoin’s supply is in a state of profit. This metric is pivotal as it represents the potential selling pressure or holding power within the market. Historically, high levels of unrealized profits have been precursors to bull rallies, as they indicate strong market confidence and a tendency for holders to await further price appreciation before distributing their coins to realize profits.

Bitcoin advances as gold and markets show resilience amid geopolitical unrest

Quick Take

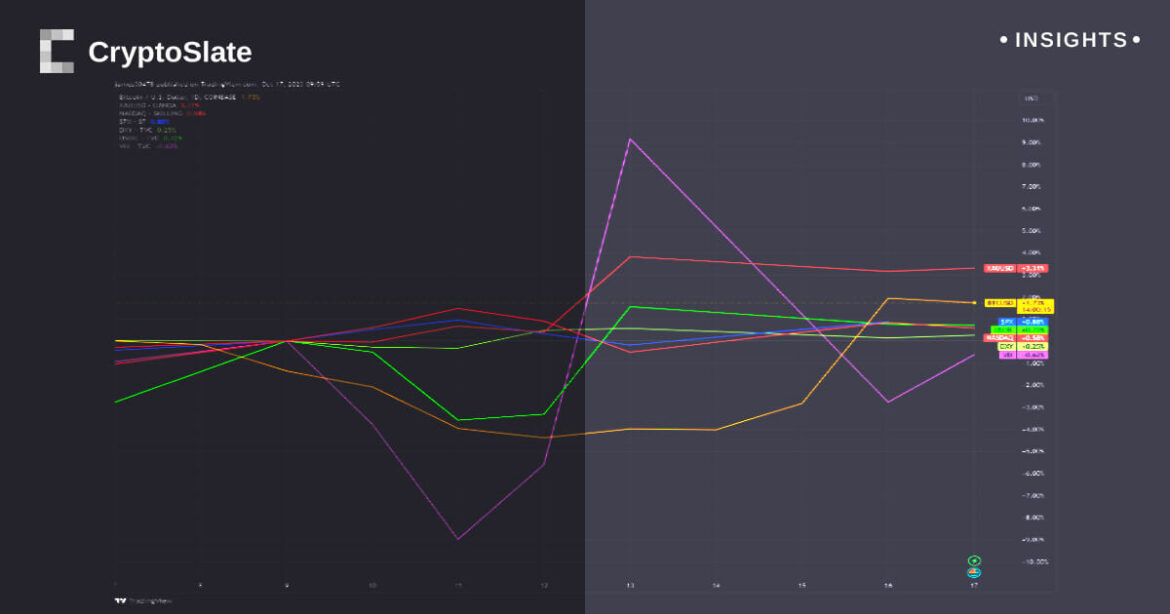

The recent conflict in the Middle East has surprisingly not destabilized the financial markets, as one might expect. Instead, data analysis reveals a slight increase across various financial assets. Gold, historically considered a safe haven during volatile periods, experienced a 3.31% hike. Bitcoin, the leading cryptocurrency, has also increased by 1.74% since the start of the war.

The SPX, Nasdaq, and DXY indices rose by 0.88%, 0.57%, and 0.27%, respectively, evidence of sustained market confidence. WTI Crude Oil, however, exhibited noticeable volatility, plunging from $90 to $82 per barrel before the war, regaining some ground to hover around $86. The Volatility Index (VIX) presented a similar scenario, jumping to 20 on Oct. 13 and then receding to just above 17 yesterday, Oct. 16.

The high volatility of traditional financial assets like WTI Crude Oil might indicate a potential ripple effect on Bitcoin and other cryptocurrencies.

The post Bitcoin advances as gold and markets show resilience amid geopolitical unrest appeared first on CryptoSlate.

Bitcoin’s resilience shines as cohort reaches new highs despite market shocks

Quick Take

Roughly two years ago, Bitcoin experienced a significant disruption when China enforced a ban on Bitcoin mining. This development caused the cryptocurrency’s value to tumble from $60,000 to $30,000.

However, in the wake of these challenges, Bitcoin’s “2 years Supply Last Active” cohort has shown resilience, continuously making new highs. At present, this cohort stands strong at 56%. Notably, since May, it has maintained a steady upward trajectory, suggesting a robust recovery.

Additionally, Bitcoin’s “1+ year” cohort has also been recording new highs. This uptrend is particularly remarkable as it follows the dramatic Luna collapse in June 2022, which triggered Bitcoin’s value to drop from $30,000 to $20,000. Despite these substantial market shocks, Bitcoin’s active supply cohorts continue to indicate a persistent strengthening.

The post Bitcoin’s resilience shines as cohort reaches new highs despite market shocks appeared first on CryptoSlate.

Bitcoin and select altcoins show resilience even as the crypto market sell-off continues

A bearish trend formation has been pressuring cryptocurrency prices for the past eight weeks, driving the total market capitalization to its lowest level in more than two months at $1.06 trillion, a 2.4% decline between June 4 and June 11.

This time, the move wasn’t driven by Bitcoin (BTC), as the leading cryptocurrency gained 0.8% during the seven-day period. The negative pressure came from a handful of altcoins that plunged over 15%, including BNB (BNB), Cardano (ADA), Solana (SOL), Polygon (MATIC) and Polkadot (DOT).

Notice that the downtrend initiated in mid-April has tested the support level in multiple instances, indicating that an eventual break to the upside would require extra effort from the bulls.

The United States Securities and Exchange Commission tagged multiple altcoins as securities in separate lawsuits filed last week against crypto exchanges Binance and Coinbase.

Despite the worsening crypto regulatory environment, two derivatives metrics indicate that bulls are not yet throwing in the towel but will likely have a hard time breaking the bearish price formation to the upside.

Crypto exchanges are under severe constraints in the U.S.

Binance.US announced on June 9 the upcoming suspension of U.S. dollar deposits and withdrawal channels, besides delisting USD trading pairs. The exchange added that it plans to transition to a crypto-only exchange but maintains a 1:1 ratio for customer assets. The SEC issued an emergency order on June 6 to freeze the assets of Binance.US.

Also on June 9, the Crypto.com exchange announced it would no longer service institutional clients in the United States. Although the Singapore-based company alleged a lack of client demand, the curious timing matching the recent actions against Coinbase and Binance has raised suspicions, as pictured by UtilizeWeb3 founder CryptoTea.

The SEC will likely sue Crypto .com

they sued Coinbase and Binance for selling securities

specifically naming Solana, Cardano, Sandbox, Matic, CHZ, BNB, Mana, Algo and more

crypto .com also sells ALL of these cryptos

plus they launched their own CRO coin

plus they offer… pic.twitter.com/2nuqd5ljVY— Crypto Tea (@CryptoTea_) June 8, 2023

Despite being spared from the attacks coming from the SEC, the vice-leader Ether (ETH) traded down 3.5% between June 4 and June 11 after co-founder Vitalik Buterin stated that the Ethereum network would “fail” if scaling doesn’t go through. In a June 9 post via his personal blog, Buterin explained that the success of Ethereum depends on layer-2 scaling, wallet security and privacy-preserving features.

Derivatives markets show balanced leverage demand

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours.

A positive funding rate indicates that longs (buyers) demand more leverage. Still, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

The seven-day funding rate for BTC and ETH was neutral, indicating balanced demand from leveraged longs (buyers) and shorts (sellers) using perpetual futures contracts. Curiously, BNB, SOL and ADA displayed no excessive short demand after a 15% or higher weekly price decline.

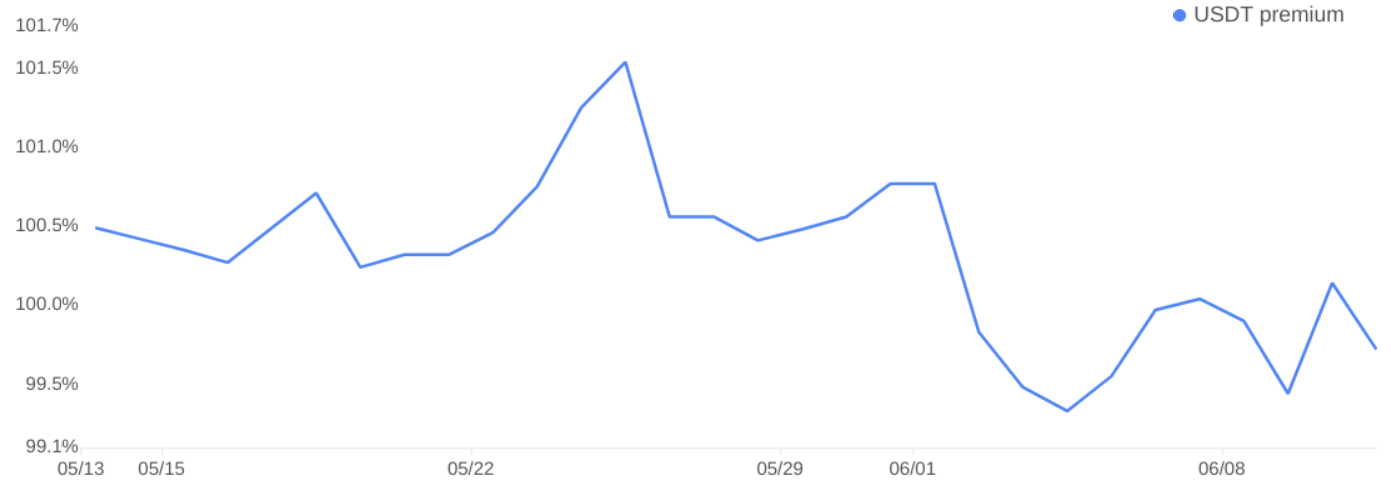

Tether demand in Asia shows modest resilience

The Tether (USDT) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether’s market offer is flooded, causing a 2% or higher discount.

Currently, the Tether premium on OKX stands at 99.8%, indicating a balanced demand from retail investors. Consequently, the indicator shows resilience considering the cryptocurrency markets dropped 17.7% over the last eight weeks to $1.06 trillion from $1.29 trillion.

Related: Democrats’ ‘war on crypto’ will lose its key voters, Winklevoss twins

Given the balanced demand according to the funding rate and stablecoin markets, bulls should be more than satisfied, given that the recent regulatory FUD was unable to break the cryptocurrency market capitalization below $1 trillion.

It is unclear whether the market will be able to break from the bearish trend. Moreover, there is no apparent rationale for bulls to jump the gun and place bets on a V-shaped recovery, given the uncertainty in the regulatory environment. Ultimately, bears are in a comfortable place despite the resilience in derivatives and stablecoin metrics.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.