As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […]

As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […]

Source link

resistance

The crypto market is currently abuzz with discussions on Bitcoin (BTC), as it teeters on the brink of reaching the $50,000 threshold. This is fueled by the fast-approaching halving as well as a “bullish divergence” observed over the past week, with Bitcoin breaking past the $48,000 mark.

Analyst Analysis On Bitcoin

Michaël van de Poppe, a prominent figure in the realm of crypto analysis, recently shared insights on the bullish divergence. Van de Poppe pointed out the notable weekly candle that propelled Bitcoin’s value beyond $48,000, signaling a potential challenge at the $50,000 resistance level in the near term.

#Bitcoin looking at the resistance.

Massive weekly candle, through which Bitcoin is back above $48,000.

I’m personally interested what price will do around $50,000 in the upcoming 1-2 weeks. pic.twitter.com/6I927U20pg

— Michaël van de Poppe (@CryptoMichNL) February 12, 2024

Further echoing this challenge, IntoTheBlock highlighted a key obstacle Bitcoin faces on its path to $50,000 in the latest post. The firm identified a crucial resistance level, noting that over 800,000 addresses have purchased nearly 270,000 BTC at an average price of $48,491.

Currently, at a loss, these holders may exert selling pressure as Bitcoin approaches its break-even point, potentially impacting its ascent to the coveted $50,000 mark.

Bitcoin has set its sights on $50k!

To get there, there is one important resistance level left. Over 800k addresses acquired nearly 270k $BTC at an average price of $48,491. These addresses are currently in the red and might provide sell pressure as they break even on their… pic.twitter.com/nEw4tP8wUc— IntoTheBlock (@intotheblock) February 12, 2024

Over the past week alone, Bitcoin’s value has increased by more than 10%, igniting discussions among crypto enthusiasts and experts regarding its future trajectory. This bullish momentum and the impending halving event reinforce optimistic stances within the crypto sphere about Bitcoin’s value proposition.

Bullish Outlook On BTC And Market Sentiment

Amid this bullish phase, several crypto analysts and market observers have put forward their forecasts regarding Bitcoin’s potential price movement shortly. Crypto Rover, another analyst with a significant following, suggested that surpassing the $48,500 resistance and reaching the 0.618 Fibonacci level could set Bitcoin on a path to the “official trend reversal to a bull market.”

Once #Bitcoin breaks the $48,500 mark, better said, the 0.618 Fibonacci level,

that will mark the official trend reversal to a bull market. I’m keeping a close eye on this level! pic.twitter.com/ne2SvugHRp

— Crypto Rover (@rovercrc) February 10, 2024

Furthermore, data from IntoTheBlock indicates a positive trend regarding Bitcoin address profitability. Currently, 91% of Bitcoin addresses are profitable, with the total number of addresses in profit at 46.87 million, accounting for 90.53% of all addresses.

This is contrasted with 3.44 million addresses that are still at a loss. IntoTheBlock’s analysis also reveals that most addresses that purchased BTC within the $40,919.92 to $55,413.77 range are now profitable, underscoring a bullish sentiment among Bitcoin holders.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum Price Loses Steam – This Resistance Could Spark Another Decline

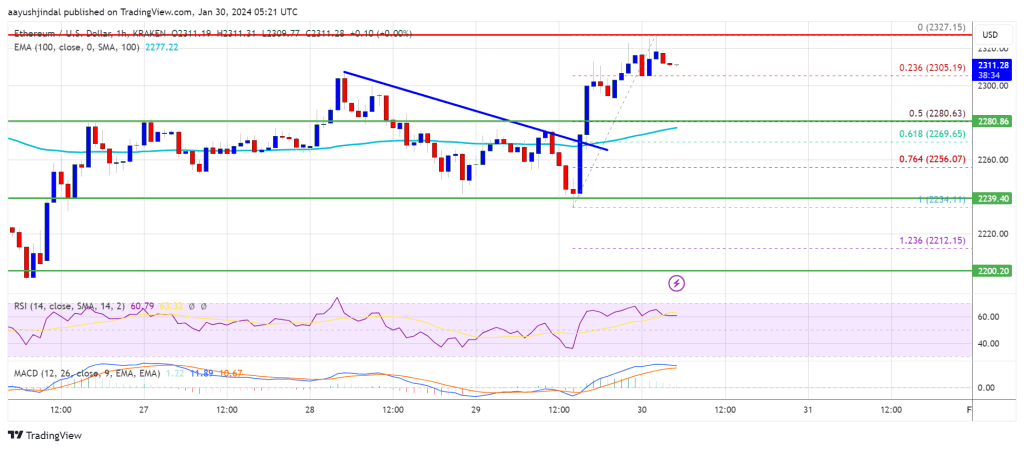

Ethereum price jumped above the $2,280 resistance zone. ETH could gain bullish momentum if it clears the $2,330 resistance zone.

- Ethereum started a decent increase above the $2,250 resistance zone.

- The price is trading above $2,280 and the 100-hourly Simple Moving Average.

- There was a break above a connecting bearish trend line with resistance near $2,260 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair might struggle to clear the $2,325 resistance zone and might correct lower.

Ethereum Price Revisits Resistance

Ethereum price started a decent increase above the $2,250 resistance zone. ETH cleared the $2,280 resistance zone like Bitcoin to start a steady recovery wave.

The bulls even pushed the price above the $2,300 resistance. There was a break above a connecting bearish trend line with resistance near $2,260 on the hourly chart of ETH/USD. A new weekly high was formed near $2,327 and the price is now consolidating gains.

It is now trading above the 23.6% Fib retracement level of the upward move from the $2,234 swing low to the $2,327 high. Ethereum is also trading above $2,280 and the 100-hourly Simple Moving Average.

Source: ETHUSD on TradingView.com

On the upside, the first major resistance is near the $2,330 level. The next major resistance is near $2,350, above which the price might rise and test the $2,420 resistance. If the bulls push the price above the $2,420 resistance, they could aim for $2,450. A clear move above the $2,450 level might start a decent increase. In the stated case, the price could rise toward the $2,550 level.

Another Bearish Wave in ETH?

If Ethereum fails to clear the $2,330 resistance, it could start another decline. Initial support on the downside is near the $2,300 level.

The next key support could be the $2,280 zone or the 50% Fib retracement level of the upward move from the $2,234 swing low to the $2,327 high. A daily close below the $2,280 support might start another major decline. In the stated case, Ether could test the $2,200 support. Any more losses might send the price toward the $2,120 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $2,280

Major Resistance Level – $2,330

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

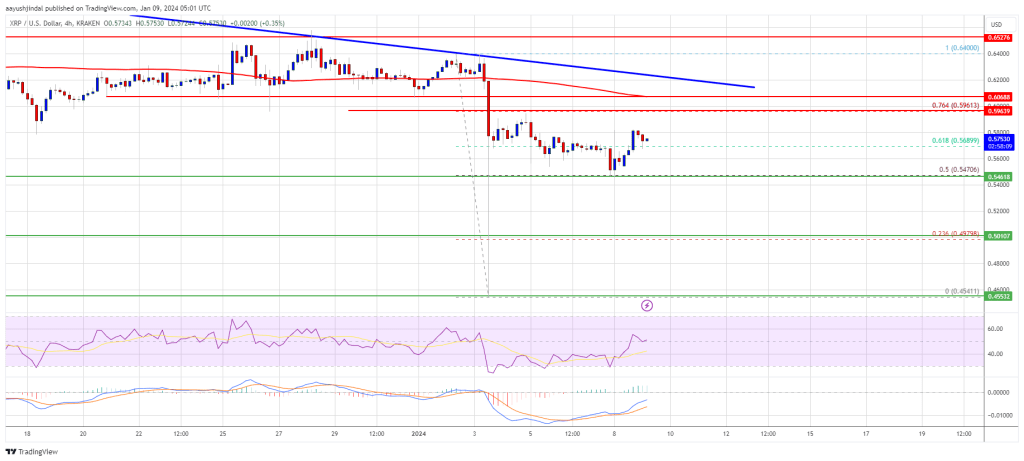

XRP price is moving higher from the $0.4540 support. The price could start a fresh rally if there is a clear move above the $0.600 resistance.

- XRP is attempting a fresh increase from the $0.4540 support level.

- The price is now trading below $0.5950 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance near $0.6080 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair start a fresh rally if it clears the $0.600 and $0.608 resistance levels.

XRP Price Faces Hurdles

This past week, XRP price saw a sharp decline below the $0.550 level. The price declined below the $0.500 support and even spiked below $0.480. A low was formed near $0.4541, and the price is now moving higher, like Bitcoin and Ethereum.

There was a move above the $0.500 and $0.520 resistance levels. The bears cleared the 61.8% Fib retracement level of the main drop from the $0.640 swing high to the $0.454 swing low. However, the price is still below $0.5950 and the 100 simple moving average (4 hours).

On the upside, immediate resistance is near the $0.595 zone or the 76.4% Fib retracement level of the main drop from the $0.640 swing high to the $0.454 swing low. The first key resistance is near $0.600 and $0.608. There is also a key bearish trend line forming with resistance near $0.6080 on the 4-hour chart of the XRP/USD pair.

Source: XRPUSD on TradingView.com

A close above the $0.6080 resistance zone could spark a strong increase. The next key resistance is near $0.640. If the bulls remain in action above the $0.640 resistance level, there could be a rally toward the $0.670 resistance. Any more gains might send the price toward the $0.700 resistance.

Another Drop?

If XRP fails to clear the $0.608 resistance zone, it could start a fresh decline. Initial support on the downside is near the $0.550 zone.

The next major support is at $0.520. If there is a downside break and a close below the $0.520 level, XRP price might accelerate lower. In the stated case, the price could retest the $0.500 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $0.550, $0.520, and $0.500.

Major Resistance Levels – $0.595, $0.600, and $0.608.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

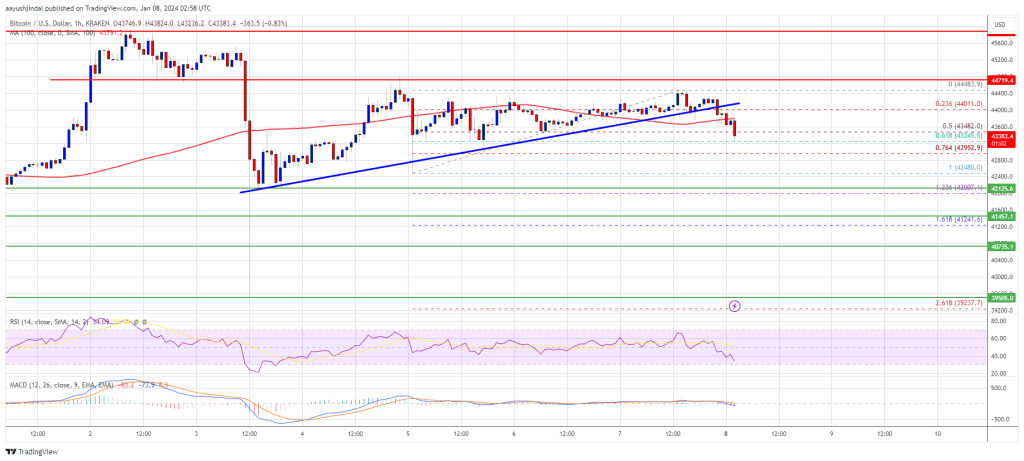

Bitcoin price is still struggling to clear the $44,500 and $44,700 resistance levels. BTC is showing a few bearish signs and might drop toward $42,150.

- Bitcoin is facing a major hurdle near the $44,500 resistance zone.

- The price is trading below $44,000 and the 100 hourly Simple moving average.

- There was a break below a key bullish trend line with support at $44,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could decline toward the $42,350 and $42,150 support levels.

Bitcoin Price Faces Hurdles

Bitcoin price attempted a fresh increase above the $43,500 resistance zone. BTC even broke the $43,800 resistance zone but the bears were active near the $44,500 resistance zone.

There were a few attempts to gain strength above $44,500, but the bears remained active. A high was formed near $44,483 and the price is now showing a few bearish signs. There was a drop below the $44,000 support zone. The price traded below the 50% Fib retracement level of the upward move from the $42,480 swing low to the $44,483 high.

Besides, there was a break below a key bullish trend line with support at $44,000 on the hourly chart of the BTC/USD pair. Bitcoin is now below $44,000 and the 100 hourly Simple moving average.

Source: BTCUSD on TradingView.com

On the upside, immediate resistance is near the $44,000 level. The first major resistance is $44,200. The main resistance is now forming near the $44,500 level. A close above the $44,500 level could send the price further higher. The next major resistance sits at $45,450. Any more gains above the $45,450 level could open the doors for a move toward the $46,200 level.

More Losses In BTC?

If Bitcoin fails to rise above the $44,000 resistance zone, it could continue to move down. Immediate support on the downside is near the $43,200 level or the 61.8% Fib retracement level of the upward move from the $42,480 swing low to the $44,483 high.

The next major support is near $42,800. If there is a move below $42,800, the price could gain bearish momentum. In the stated case, the price could drop toward the $42,150 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $42,800, followed by $42,150.

Major Resistance Levels – $44,000, $44,200, and $44,500.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Polygon is closing out 2023 on a high note as its native token, MATIC, experienced a significant surge over the past 24 hours, despite its founder highlighting a “painful ride”.

MATIC’s current price stands at $0.8939, accompanied by a 24-hour trading volume of $701,503,128.22. This represents a notable 4.20% price increase within the last 24 hours and a remarkable 14.10% increase over the past 7 days.

Polygon Founder Embraces Underdog Status

Despite a challenging journey throughout 2023, Polygon’s founder, Sandeep Nailwal, recently expressed his contentment with the platform’s underdog status. In a statement on X (formerly Twitter), Nailwal stated:

Polygon is back to where it’s the best at being an underdog. Not going to lie, it’s been a painful ride, the whole of 2023, but right now, it feels incredibly liberating to be the underdog again.

Furthermore, Nailwal went on to outline several reasons why he believes investors should feel bullish about Polygon’s prospects.

One key feature is Ethereum Virtual Machine (EVM) Compatibility, which allows Polygon to replicate the Ethereum environment as a rollup. This compatibility ensures that any application running on Ethereum or other EVM-compatible chains can be deployed onto zkEVM, Polygon’s layer 2 solution, with minimal modifications.

Another aspect highlighted is the utilization of Zero-Knowledge Proofs (ZKPs) for transaction validation. By leveraging ZKPs, Polygon enhances transaction speeds and reduces gas fees, addressing critical pain points experienced by users on other blockchain platforms.

Scalability is a paramount concern in the blockchain industry, and Polygon aims to address this challenge by executing smart contracts using zero-knowledge technology.

This approach ensures “scalability without compromising decentralization” and security, bolstering the platform’s overall appeal to developers and users alike.

Moreover, Polygon’s strategic affiliation with zkEVM positions it to leverage the existing ecosystem of over 400 decentralized applications (dApps) within the Polygon network.

This ecosystem includes a diverse range of DeFi protocols, gaming platforms, and NFT marketplaces. By capitalizing on this thriving ecosystem, Polygon aims to further solidify its position as a leader in the blockchain space.

Midterm Targets And Strategy For MATIC Price Action

Renowned analyst Captain Faibik has released a comprehensive analysis of the price action for Polygon’s native token, MATIC. In his assessment, Captain Faibik identifies key targets and a strategic approach for investors to capitalize on potential gains.

According to Captain Faibik’s analysis, MATIC’s midterm targets are projected at $1.20, $1.60, $2.50, and $4.00. These targets represent potential price levels that MATIC could reach based on historical patterns.

Notably, to manage risk and protect their investment, Captain Faibik recommends implementing a stop-loss strategy. If the weekly closing price of MATIC falls below $0.55, it is suggested to exit the position.

Furthermore, Captain Faibik advises investors to adopt a long-term mindset and hold their MATIC investment for a minimum of 60 days. This holding period enables investors to ride out short-term price fluctuations and potentially capitalize on the projected targets identified.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

On-chain data shows Cardano is currently retesting a major resistance wall, breaking through which might pave the way to higher price levels.

Cardano Is Facing On-Chain Resistance At Current Price Levels

According to data from the market intelligence platform IntoTheBlock, there appears to be key on-chain resistance around the $0.38 mark. In on-chain analysis, levels are judged to be “resistance” or “support” based on whether they host the cost basis of a significant number of investors or not.

The cost basis here naturally refers to the price at which a Cardano investor bought their tokens. This price is obviously an important level for any holder, as the asset’s spot value retesting this level could mean a potential swing in their profit-loss situation.

Because of this reason, holders are particularly sensitive when such a retest happens and as such, they may be more likely to show some kind of move. What kind of move this would be, though, depends on the prior profit-loss situation of the investor.

Investor psychologically works so that if the trader had been holding a profit before this retest, they might want to take a further gamble at it, as they could believe this same price level would be profitable again in the future.

Similarly, the holder might lean towards selling instead if the retest is happening from below since they would fear a scenario where the price declines again and they dip back into losses.

Now, here is what the various Cardano price ranges are looking like right now in terms of the concentration of investors or addresses who acquired their coins at them:

Looks like the current price range is offering a significant amount of impedance to the price | Source: IntoTheBlock on X

In the above graph, the size of the dot represents the amount of investors who bought inside the range. As mentioned before, investors are likely to show some reaction when the price retests their cost basis, so if a large number of them share their cost basis inside the same range, the effect that the market would feel from the retest would also be equally sizeable.

From the chart, it’s visible that the ADA price range between about $0.37 and $0.39 has a cost basis of over 319,000 addresses, which acquired a total of 7.19 billion ADA at these levels.

This is the same range that Cardano has been retesting recently and has been struggling to break out of. It would appear that the reason behind this might be the resistance being offered by the sellers who are attempting to exit at their break-even prices.

Given the large scale of this resistance wall, it would be tough for the cryptocurrency to mow through it and gain some distance. If the asset can achieve this, though, then the zone might turn into support instead and provide some solid ground for a move towards higher levels.

ADA Price

Cardano is trading around the $0.38 level right now, which is right in the middle of the resistance wall.

The value of the asset appears to have been moving sideways in the last few days | Source: ADAUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com

THORChain’s price has been up by over 100% since the last week of October, hitting levels not seen since May 2022. This is an amazing increment in price. But caution is advised since RUNE, an altcoin, seems overbought, possibly signaling a 20% drop in the near future.

At the time of writing, RUNE was trading at $3.42, climbing over 15% in the last 24 hours, and registering an impressive 37% rally in the last seven days, figures by CoinMarketCap shows.

RUNE: Potential To Reverse Bearish Trajectory

If RUNE closes above the psychological $3.500 mark, it could negate the present downturn and cause the bearish attitude to change. The significance of RUNE closing above the critical $3.500 mark lies in its potential to reverse the prevailing bearish trend and trigger a shift in market sentiment.

Achieving this milestone could signify a break in the current downtrend, potentially instigating a more positive outlook among investors and traders.

Source: CoinMarketCap

THORChain underwent a notable phase of consolidation, a period marked by relatively stable prices and limited fluctuations. Following this consolidation, the market witnessed a substantial surge, propelling THORChain’s price upwards by over 40%.

However, in the aftermath of this surge, the price has demonstrated a consistent stability, remaining within a relatively similar range. This stability has coincided with a broader downturn in market dynamics, where fluctuations and overall activity have shown a decrease across the market.

Despite the prior surge, THORChain’s price has maintained a consistent level, reflecting a degree of resilience amid the current market trends.

RUNE market cap currently at $1.16 billion on the weekend chart: TradingView.com

The RUNE token holds a substantial long-term liquidation value surpassing $70 million, signifying a considerable reserve or potential value inherent in the token’s existence. However, a cautionary note emerges from the chart analysis, which reveals a prominent positive deviation highlighted in green.

3. $RUNE LIQUIDATION LEVEL analysis:

– More than 70M in futures liquidations. Green DELTA, means confluence to short.

– More than 1M in Liquidation profile between 2.75$ and 2.65$ (support)

– PA and MS is bearish. There’s more liquidity below than above, at current price. pic.twitter.com/48j9hI5h35

— CryptoSoulz (@SoulzBTC) November 2, 2023

This deviation might signify an impending decrease in price in the near future, suggesting a potential shift or correction in the market valuation of the token. This could prompt investors to stay vigilant and consider potential fluctuations in the token’s value in their future investment decisions.

The price of RUNE garnered significant attention subsequent to a substantial market surge, as the cryptocurrency experienced a portfolio increase of more than 40% inside that period.

Signs Of Market Correction For RUNE?

Analyzing the technical indicators, THORChain reveals an RSI figure of 72.24, typically signaling overbought conditions when surpassing 70. This situation hints at the possibility of profit-taking or a slight downturn in the coming days.

Despite indicating a robust bullish sentiment with an RSI above 50, THORChain might be treading into overextended territory, potentially requiring cautious observation for signs of a market correction or adjustment.

Source: Santiment

Meanwhile, according to Santiment’s research, there is a decline in the social dominance of the RUNE cryptocurrency, which means there is less of a presence and conversation on social media. When conversations do happen, they usually center on the altcoin’s remarkable rise, which may allude to investor anticipation of an upcoming fall.

In line with this reality is the rising open interest, which is the sum of all long and short positions in the market. After such a meteoric increase of 120%, short sellers should outnumber long sellers for RUNE among traders.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Frank Cone/Pexels

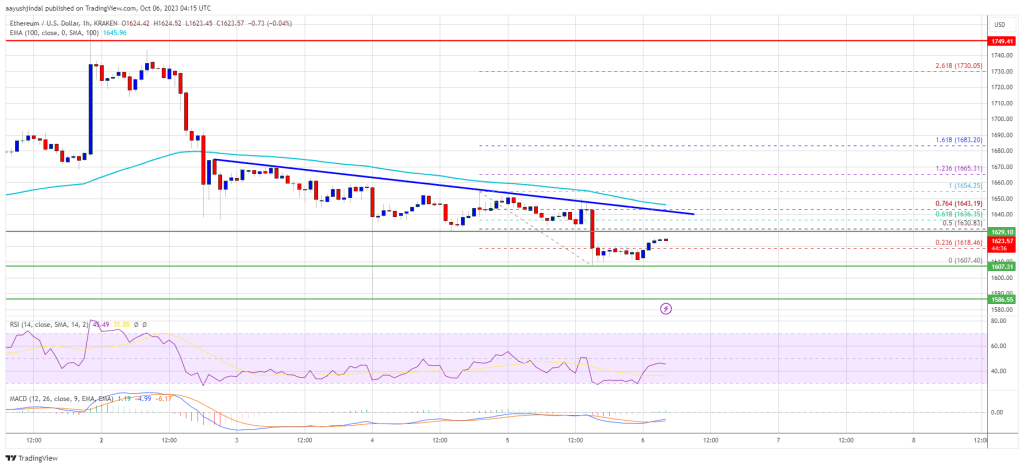

Ethereum Price At Risk of Sharp Decline Unless ETH Clears This Heavy Resistance

Ethereum price is slowly moving lower toward the $1,585 support against the US dollar. ETH must clear the $1,650 resistance to start a recovery wave.

- Ethereum is struggling to stay above the $1,600 support zone.

- The price is trading below $1,650 and the 100-hourly Simple Moving Average.

- There is a major bearish trend line forming with resistance near $1,645 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,650 and $1,665 resistance levels.

Ethereum Price Grinds Lower

Ethereum attempted a recovery wave from the $1,630 zone. ETH climbed above the $1,650 resistance level but upsides were limited, like Bitcoin.

The price struggled to gain pace for a move above the $1,665 resistance level. A high was formed near $1,654 and the price reacted to the downside. It declined below the $1,620 support and even traded close to the $1,600 level. A low is formed near $1,607 and the price is now consolidating losses.

Ethereum is now trading below $1,650 and the 100-hourly Simple Moving Average. There is also a major bearish trend line forming with resistance near $1,645 on the hourly chart of ETH/USD.

On the upside, the price might face resistance near the $1,630 level. It is close to the 50% Fib retracement level of the recent decline from the $1,654 swing high to the $1,607 low. The next major resistance is $1,650, the trend line, and the 100-hourly Simple Moving Average.

The trend line is close to the 76.4% Fib retracement level of the recent decline from the $1,654 swing high to the $1,607 low. A close above the $1,650 resistance might send the price toward the key resistance at $1,665.

Source: ETHUSD on TradingView.com

To start a steady increase, Ether must settle above the $1,650 and $1,665 levels. The next key resistance might be $1,720. Any more gains might open the doors for a move toward $1,750.

More Losses in ETH?

If Ethereum fails to clear the $1,650 resistance, it could continue to move down. Initial support on the downside is near the $1,610 level. The next key support is $1,600.

The first major support is now near $1,585. A downside break below the $1,585 support might start another strong decline. In the stated case, the price could decline toward the $1,540 level. Any more losses may perhaps send Ether toward the $1,500 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $1,585

Major Resistance Level – $1,665

XRP, the cryptocurrency associated with the Ripple platform, has experienced a tumultuous ride in recent weeks. The price action of XRP showed that the bears were firmly in control, extinguishing the brief euphoria that followed Ripple’s legal triumph over the United States Securities and Exchange Commission.

At the pinnacle of Ripple’s legal victory, XRP surged above the $0.80 mark, a level unseen since April 2022. However, this jubilation was short-lived. The excitement fizzled out as XRP’s value nosedived, erasing its gains and plunging it back into bearish territory. The abrupt reversal raised questions about the sustainability of the crypto’s upward trajectory.

Investors, once filled with hope, are now left wondering about the future of this once-promising token.

XRP Market Insights Paint A Grim Picture

Popular crypto trader Benjamin Cowen pointed out on X that “XRP has retraced the entirety of the move that came after the SEC vs. Ripple case.” This statement underscores the market’s sentiment, suggesting that the legal triumph’s positive impact on XRP’s price was only temporary.

$XRP has retraced the entirety of the move that came after the SEC vs. Ripple case.

Narratives do not drive the market, liquidity does. pic.twitter.com/8295jFRdHB

— Benjamin Cowen (@intocryptoverse) September 11, 2023

As of now, XRP’s price hovers at $0.480443, according to CoinGecko, with a modest 2.0% gain over the past 24 hours. However, a more concerning statistic is the seven-day dip, which stands at nearly 5%. This decline reflects the current bearish sentiment surrounding the digital asset.

Since early August, the 1-day chart for XRP has displayed a bearish market trend and a downward movement. Since bulls failed to break through last week’s $0.5 resistance, a revisit of that level could be a good opportunity for short sellers.

Selling Pressure Evident

A closer look at XRP’s on-chain metrics reveals that the selling pressure has been palpable. The On-Balance Volume (OBV), an indicator that tracks buying and selling volumes, has been in a downtrend alongside the price over the past month.

XRP market cap currently at $25 billion. Chart: TradingView.com

This suggests that sellers have been dominant in the market, while buyers have struggled to exert influence, especially in higher timeframes. This scenario further confirms the bearish grip on XRP.

Another metric worth noting is the mean coin age, which measures the average age of coins being transacted on the network. The metric experienced a sharp decline on August 30 and September 1 but has since started to climb higher.

While this may indicate network-wide accumulation, it does not guarantee an immediate uptrend. Investors must remain cautious and observant in the face of uncertain market conditions.

The recent price action of XRP has cast a shadow on the crypto’s prospects. Despite the initial excitement surrounding Ripple’s legal victory, the bears have reclaimed control, driving XRP’s value downward. With key metrics reflecting selling pressure and uncertainty in the market, XRP’s future remains uncertain, leaving investors to ponder their next moves in this volatile landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from The Change Management Blog