“I don’t want to make promises I can’t financially live up to. I own my own house and struggle to keep that in order.”

Source link

Retire

Social Security: Here’s How to See Exactly How Much You’ll Receive in Benefits When You Retire

Social Security benefits are a lifeline for millions of older adults. Roughly 90% of current retirees say they rely on their checks to some degree, according to a 2023 poll from Gallup, and of that group, close to 60% say their benefits are a major source of income.

If you’re going to be depending on Social Security to any extent, it’s often helpful to know how much you can expect to receive. This can give you a more realistic idea about how far your benefits will go, making it easier to see whether you’re saving enough to cover the rest of your expenses.

The good news is that it only takes a few minutes to see an estimate of your future benefit amount. And if it’s less than what you expected, there are a few simple ways to boost your monthly checks.

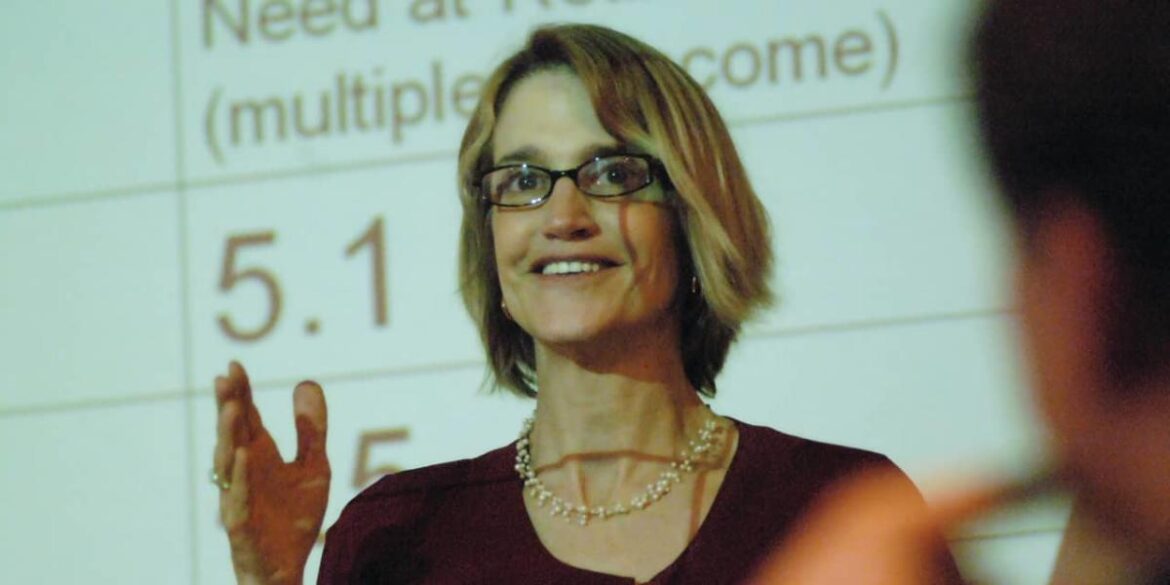

Image source: Getty Images.

How to check your future Social Security benefit

Perhaps the easiest way to see your future benefit amount is to check your statements online. If you haven’t already, you’ll first need to create a mySocialSecurity account. From there, you can see an estimate of your future benefit based on your real earnings throughout your career.

Keep in mind, however, that you have to qualify for benefits before you’ll see an estimate. If you haven’t worked and paid Social Security taxes for at least 10 years, you likely won’t be eligible for retirement benefits yet.

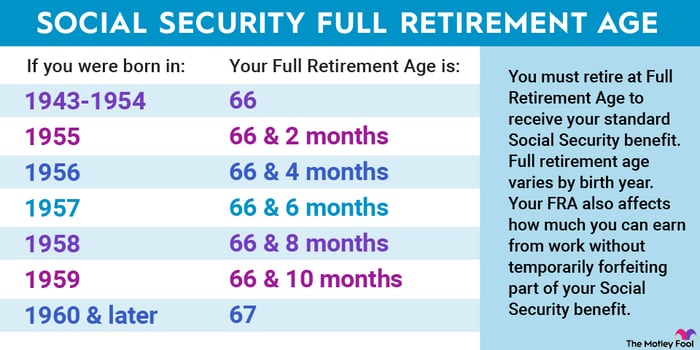

Also, this estimate is the amount you’ll receive at your full retirement age (FRA). Your FRA is the age at which you’ll receive 100% of your benefit based on your earnings history, and it’s age 67 for everyone born in 1960 or later.

Image source: The Motley Fool.

You can file before or after your FRA, but it will affect your benefit amount. By claiming as early as possible at age 62, your payments will be permanently reduced by up to 30%. Delay benefits past your FRA (up to age 70), and you’ll receive your full benefit plus a bonus of at least 24% per month.

Finally, if you still have many years left in your career, that could also affect your benefit amount — especially if your income changes dramatically between now and retirement.

Simple ways to boost your benefits

Delaying filing for Social Security is one of the most straightforward ways to increase your benefit amount. Again, waiting until age 70 to claim will boost your payments by at least 24%, which can amount to hundreds of dollars per month. There are a few other options, though, for increasing your benefits:

- Work for a full 35 years: The Social Security Administration calculates your benefit amount by taking an average of your wages over the 35 highest-earning years of your career. That number is then run through a complex formula and adjusted for inflation, and the result is the amount you’ll receive at your FRA. If you’ve worked fewer than 35 years by the time you begin claiming, you’ll have zeros added to your earnings average — which will bring down your benefit amount.

- Consider working for more than 35 years: Working more than 35 years can also increase your benefit, as you’re likely earning a higher income now than you were at the start of your career. Because only your highest-earning 35 years are included in your average, working longer now while you’re earning a higher salary can increase your earnings average and your benefit amount.

- Boost your income: The more you’re earning, the more you’ll receive in benefits — up to a point. The maximum taxable earnings limit is the highest income subject to Social Security taxes, and in 2024, that limit is $168,600 per year. While you don’t have to reach that limit, the closer you can get to it, the higher your benefit amount will be.

Small steps can go a long way toward earning larger Social Security checks. If you can’t work more than 35 years, delay benefits until age 70, or substantially increase your income, that’s OK. Maybe you can delay claiming by just one or two years, for example, or increase your income by a couple thousand dollars per year. Either one of those moves could still result in a bigger monthly benefit.

Social Security can make an enormous difference in retirement, so it’s wise to make the most of it. By checking your estimated benefit and maximizing your payments the best you can, you’ll be setting yourself up for a more financially secure retirement.

Opinion: Here’s what people about to retire really need their 401(k) plan to provide

“Any financial professional or organization that gives rollover-related advice would have to adhere to the fiduciary standard.”

Baby boomers and Gen Xers will leave the workforce by the millions over the coming decade. Yet many have no idea whether the money they’ve saved in their retirement plans over the years will be enough to let them live the way they want to during retirement.

It’s a huge question, and it often goes unanswered because retirement-plan sponsors can’t possibly analyze an employee’s future cash flows, potential investment returns or tax strategies. Plan sponsors are typically more focused on convincing retiring employees to move their retirement plan money into their firm’s proprietary IRAs and annuities. Therein lies the conflict.

The U.S. Department of Labor believes that the best way to address employees’ retirement planning needs is to propose a new set of rules designed to rein-in unethical rollover-related product recommendations.

No one doubts the DOL’s good intentions. After all, a rollover is one of the biggest financial decisions most people will ever make. Retire and keep the money in the 401(k)? Roll the money over to an IRA? What’s the right allocation for stocks and bonds? What are the downsides and costs to annuities that promise income forever? What about taxes in retirement?

These are not trivial questions. The DOL has always required retirement plan sponsors to provide educational resources to broadly explain the pros and cons of these various options.

But in terms of personalized rollover advice, employers tend to lean on the plan’s recordkeepers and service providers. Most of which are owned by commission-driven broker-dealers, asset managers, banks and insurance companies armed with teams of salespeople whom employees believe are “retirement planning experts.”

Their overriding mandate? Keep retirement assets in-house.

You don’t need to be a Wall Street compliance guru to see the glaring conflicts of interest here. Would any broker recommend that a retiree move their 401(k) money into an IRA with a different (competing) custodian? What kind of insurance agent wouldn’t advise a participant to put some or all of their nest egg into annuities?

The DOL wants to nip these questionable practices in the bud by requiring any financial professional or organization that gives rollover-related advice to adhere to the fiduciary standard. In other words, those making product recommendations must clearly demonstrate that their recommendations align with each participant’s best interests.

If this all sounds familiar, it is. Remember Reg BI? It was the SEC’s attempt to require brokers to act as fiduciaries when providing investment advice.

But rigorous opposition from broker-dealers watered down the rules so much that in many cases all a broker needs to do to fulfill the letter of the law is to document their unavoidable conflicts of interest (often buried in hundred-page disclosures).

“The proposals don’t even come close to addressing the most crucial financial questions that keep most soon-to-be-retirees up at night.”

Considering the complex networks of recordkeepers, asset managers, insurance agents, advisors, third-party administrators and payroll companies that work together to design and service retirement plans, it will be a Sisyphean challenge for the DOL’s new rules to cover all of these rollover-related fiduciary bases.

And when breaches of the rules inevitably occur, angry participants will take employers to court. Most importantly, consider the typical employee who’s about to retire. The DOL’s proposals don’t even come close to addressing the most crucial financial questions that keep most soon-to-be-retirees up at night.

Don’t miss: MarketWatch’s “Help Me Retire” columns

Here’s what people about to retire tell me: They’re worried about their future cash flows; when to start taking Social Security, and how to keep track of required minimum distributions and minimize their taxable impact.

They want to know if and when they should convert to a Roth IRA, and how to pass these assets on to their heirs or donate them to charities. They need professional advice for the rest of their lives that also encompasses the needs of their partners or spouses. And many believe that the rollover recommendations coming from the plan’s service providers are objective and unencumbered by self-interests.

The simple solution is to give employees access to advice from from highly-qualified, independent registered investment advisers who are already held to the fiduciary standard, not because they’re forced to comply, but because they’ve elected to take on this fiduciary responsibility.

Unfortunately, most of these plans’ in-house rollover consultants and brand name brokerage service providers can’t provide this kind of help because they’re not highly qualified fiduciary advisers. But rather than try to force a plan’s financial salespeople to act like fiduciaries, the DOL should instead provide resources and incentives that encourage employers to offer retirees access to vetted independent, state or SEC registered fee-only fiduciary investment advisers and financial planners.

To help retirees find these advisers, employers could provide links to reputable organizations and vetted partners that connect individuals with these fiduciary advisors.

Providing access to these fee-only advisers won’t prevent employees from working with their plan’s existing rollover consultants if they want to. Instead, it will simply provide a different advice option that they might not be aware of.

It’s critical that we take a step back and ask what is the actual problem we’re trying to solve? If providing better retirement advice is truly the goal, adding fiduciary advice to the rollover menu is a far better option and, at the same time, will help employers reduce their exposure to lawsuits.

Companies that embrace this initiative can meet their rollover-related fiduciary obligations far more effectively than having to jump through yet another confusing set of DOL regulatory hoops. After all, making it easier to help employees plan for their retirement is in everybody’s best interests.

Pam Krueger is the founder and CEO of Wealthramp, a fee-only financial adviser matching service. She is also the creator and co-host of the award-winning MoneyTrack investor-education TV series, seen nationally on PBS, and the Friends Talk Money podcast.

Also read: I’m 73 and just took my first RMD. Can I roll over my IRA into my 401(k)?

More: If retirement is all about money, you might not be ready to stop working

‘I’ll Likely Die Before I Can Retire’ – Gen X, ‘The Forgotten Generation’ Is Struggling With ‘Virtually Nonexistent’ Retirement Accounts – The Average Gen Xer Has Only $40,000 Saved

As Generation X edges closer to the traditional retirement age, with the oldest members born in 1965, a palpable sense of financial unpreparedness permeates this cohort.

Insight from a Fortune article featured on Yahoo Finance, fueled by responses from numerous Gen Xers, lays bare the anxieties many feel about their retirement readiness. In addition to being tagged with various monikers such as the “forgotten generation” and “the latchkey generation,” a significant portion of Gen X finds itself grappling with the reality of insufficient retirement savings.

Don’t Miss:

The challenge of securing a financially stable retirement is underscored by data shown in a report from the National Institute on Retirement Security, which signals a glaring disparity between the desired and actual savings among many Gen Xers. This sentiment is echoed in the Schroders 2023 U.S. Retirement Survey, revealing that over 60% of non-retired Gen Xers doubt their ability to achieve a comfortable retirement.

The survey highlights that the average Gen X household has amassed $40,000 in retirement savings, a figure drastically inadequate compared to the million-plus dollars financial experts recommend.

The narratives of individual Gen Xers further illustrate the depth of the retirement readiness crisis. “I’ve followed my dreams, as my generation was told to do, but found that some dreams cost more to follow than others,” writes one Gen Xer. “My savings are virtually nonexistent.” Another candidly shares, “I’ll likely die before I can retire. Fun stuff,” underscoring the dire financial outlook some face as they approach retirement.

Trending: If the average American household is a millionaire, why do people feel so broke?

These personal accounts shed light on the myriad challenges that have contributed to the financial predicament facing Gen X. From navigating economic downturns and market crashes to adjusting to the shift from pensions to 401(k) plans, Gen Xers have contended with significant financial hurdles. Additionally, they bear the burden of higher student loan debts and healthcare costs compared to previous generations.

However, not all Gen Xers view their retirement prospects through a lens of pessimism. Some have successfully navigated the economic landscape, achieving financial security and even early retirement. These success stories, though less common, provide a glimmer of hope and a different perspective on the retirement readiness of Gen X.

The broader picture, however, remains one of concern and calls for action. Industry experts like Deb Boyden from Schroders highlight the precarious position of Gen X, being the first generation to predominantly rely on 401(k) plans.

While Gen X may not be prepared overall as a generation, they can employ targeted strategies to strengthen their retirement readiness. Incorporating the wisdom and expertise of a financial adviser into a retirement planning strategy could bolster Generation X’s efforts to achieve a secure and comfortable retirement.

Financial advisers play a crucial role in navigating the complexities of retirement savings, offering tailored advice that considers an individual’s income, assets and retirement goals.

Diversification stands as a cornerstone strategy for Gen Xers to mitigate risk and enhance potential returns. By spreading investments across a variety of asset classes, such as stocks, bonds and real estate, individuals can protect their portfolios from significant losses tied to any single investment. This approach is complemented by exploring alternative investments, including commodities or private equity, which can offer growth opportunities outside traditional markets.

Maximizing retirement savings is important, particularly through vehicles like 401(k) plans and Individual Retirement Accounts (IRAs). For those with access to a 401(k), making the most of employer contributions and taking advantage of catch-up contributions for those over 50 can substantially increase retirement savings. IRAs, both Traditional and Roth, offer unique tax advantages that can be tailored to an individual’s financial situation, with Roth IRAs providing tax-free growth and withdrawals, beneficial for those expecting to be in a higher tax bracket in retirement.

For self-employed Gen Xers, the retirement saving landscape includes distinct options such as Solo 401(k)s and Simplified Employee Pension (SEP) IRAs. A Solo 401(k) plan allows self-employed individuals to make contributions both as an employer and employee, significantly increasing the potential for savings. SEP IRAs offer a straightforward, high-contribution limit option for entrepreneurs, while a Roth IRA remains a flexible choice for those with variable incomes. For those seeking to rapidly accelerate their retirement savings, defined benefit plans can provide a pathway to save large amounts in a short timeframe, particularly beneficial for older business owners focusing on catch-up contributions.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘I’ll Likely Die Before I Can Retire’ – Gen X, ‘The Forgotten Generation’ Is Struggling With ‘Virtually Nonexistent’ Retirement Accounts – The Average Gen Xer Has Only $40,000 Saved originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘No Matter How Much We’ve Saved, We’re Not Going To Be Able To Retire’ — Generation X, ‘America’s Neglected Middle Child,’ Is Freaking Out About Retirement And Experts Say Rightfully So

As retirement looms, a sense of unease grips Generation X, often considered “America’s neglected middle child,” which is facing a financial landscape that feels increasingly unstable. An AARP article highlighted the stories of people like freelance writer Gretchen Elhassani, 47, and university professor Mike Cundall Jr., 49, who represent the growing concern among their peers about securing a comfortable retirement.

Despite diligent savings efforts, including contributions to 401(k) plans and Roth individual retirement accounts (IRAs), the goal of a $5,000 monthly retirement income now seems fraught with uncertainty for Cundall and his wife, Amy Werner.

The unpredictability of the stock market, exemplified by the 2008 financial crisis’s dramatic impact on savings, along with inflation and escalating healthcare costs, compounds their worries. “All this has led me to believe that no matter how much we’ve saved, we’re not going to be able to retire and simply enjoy the golden years,” Cundall said, reflecting a sentiment widespread among his Generation X counterparts.

Dubbed “Generation anXious” by a Northwestern Mutual report, 55% of Gen Xers reportedly doubt their financial readiness for retirement, a perspective not as prevalent among other age cohorts. This generation faces a unique blend of challenges: A significant portion has meager retirement savings, with 35% having less than $10,000 set aside. The report underscores the acute anxiety pervading this demographic, struggling to envision a future that mirrors the stable retirements of previous generations.

According to the Schroders 2023 U.S. Retirement Survey, a substantial wealth gap exists within this generation. On average, Gen X workers believe they need over $1.1 million for a comfortable retirement but expect to have only around $660,000 saved. Over 60% of nonretired Gen Xers lack confidence in achieving their dream retirement.

The National Institute on Retirement Security (NIRS) and other studies confirm that Gen X’s financial preparedness for retirement is lacking. The typical Gen X household has only $40,000 saved for retirement, with a clear disparity between the top earners and the bottom quartile. This generation faces unique challenges, such as being the first to rely primarily on 401(k) plans instead of pensions, higher healthcare costs and the burden of student loan debt.

Building wealth through passive income: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Brian Ream, a Gen X member and managing principal at CliftonLarsonAllen, acknowledges the reality of this apprehension. “The anxiety is real, and I think it’s probably somewhat well placed,” he said, pointing to a general unpreparedness for retirement as traditionally conceived. This sentiment is echoed by wealth management adviser Thomas Jensen, who said, “On the financial side, our retirement’s going to look different than that of our parents. There’s some anxiety with that.”

Complicating matters, Gen Xers’ life choices and societal roles have delayed family planning and placed them in the “sandwich generation,” juggling the care of aging parents with child-rearing responsibilities. These factors, alongside the economic volatility and unique generational challenges, paint a picture of a generation at a crossroads, searching for alternative pathways to a secure and fulfilling retirement.

For those concerned about approaching retirement without ample savings, alternative investment platforms present practical options beyond traditional methods. Fractional real estate platforms, for example, enable people to invest in real estate with just $100, making it feasible to start building wealth through property. This method offers a straightforward way to diversify investment portfolios and work toward a more secure financial future. By investing in shares of rental homes and vacation properties, people can tap into real estate’s potential for passive income, providing a valuable avenue for enhancing retirement funds without necessitating large initial investments.

Don’t Miss:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘No Matter How Much We’ve Saved, We’re Not Going To Be Able To Retire’ — Generation X, ‘America’s Neglected Middle Child,’ Is Freaking Out About Retirement And Experts Say Rightfully So originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

To become a millionaire, most investors probably need to generate robust investment returns for years and even decades. To do that, you’ll want to find high-quality businesses that are poised to grow their profit steadily over the long term.

Let’s look at three such companies.

1. Berkshire Hathaway

CEO Warren Buffett has managed Berkshire Hathaway (BRK.A -0.29%) (BRK.B -0.24%) for nearly six decades, delivering fortune-building gains for its shareholders. Yet Buffett’s crowning achievement may be how he’s built the company to thrive even after the legendary investor eventually steps down.

Berkshire is a financial powerhouse, with diverse and battle-tested revenue streams. The investment conglomerate houses over 60 operating subsidiaries across a wide variety of industries, including insurance, railroads, real estate, energy, and retail. These competitively advantaged businesses generate annual free cash flow of approximately $27 billion.

Berkshire’s massive cash reserves also help to lessen the risks for its shareowners. With $157 billion in cash and equivalents on its fortress-like balance sheet as of Sept. 30, Buffett and his lieutenants have plenty of dry powder to use on new investment opportunities. Berkshire’s equity portfolio is chock-full of quality stocks including Apple, Occidental Petroleum, and American Express — and Buffett is always on the hunt for new additions.

Importantly, Buffett has made certain Berkshire will remain in able hands after he retires. His hand-picked successor, Greg Abel, will take on the role of chief executive officer. And Buffett’s trusted deputies, Ted Weschler and Todd Combs, are slated to manage the company’s investments. Buffett, in turn, is confident that “there will be no finish line” for Berkshire Hathaway.

2. Palo Alto Networks

Betting on powerful long-term trends is another proven path to wealth. The rising need for effective cyber defenses is one such trend — and Palo Alto Networks (PANW -1.57%) is a formidable force in this rapidly expanding industry.

As more of the world shifts online, massive amounts of data are being stored in the cloud. Demand for tools that safeguard this sensitive information could top $500 billion by 2030, according to Grand View Research. Looking further ahead, consulting firm McKinsey estimates that the total addressable market for cybersecurity services could eventually approach a staggering $2 trillion.

Palo Alto Networks’ broad array of products and entrenched customer relationships give it an edge over its rivals. From next-generation firewalls to endpoint protection, the cyber guardian’s platform provides a simplified yet comprehensive solution to its customers’ growing lists of challenges. Moreover, with over 80,000 corporate clients, Palo Alto Networks can collect more data to strengthen its artificial intelligence (AI)-powered threat detection and prevention offerings.

With demand for its services booming, analysts see Palo Alto Networks growing its profits by more than 22% annually over the next half-decade. Buy shares today, and you can position yourself to profit alongside this cybersecurity leader.

3. Palantir Technologies

Like Palo Alto Networks, Palantir Technologies (PLTR 2.28%) stands to benefit from advances in AI. The data analytics specialist helps its customers reap valuable insights from their mountains of data.

Palantir earned its stripes as a counterterrorism partner with the U.S. Defense Department and its allies. The company’s software continues to play an important role in helping the U.S. government and its allies protect their citizens from a growing list of threats. Palantir was recently awarded contracts from the U.S. Army and the U.S. Special Operations Command that together could be worth more than $700 million.

Businesses are also keen to harness the power of Palantir’s technology. Its U.S. commercial revenue surged by 70% year over year to $131 million in the fourth quarter. The gains were driven by a 55% jump in customers, to 221.

In a letter to shareholders, CEO Alex Karp said that “unrelenting” demand for AI models is creating enormous interest in Palantir’s new Artificial Intelligence Platform. The decision-centric system combines the company’s powerful machine-learning technology with real-time data and secure access to advanced AI models.

Better still, Palantir’s profitability is rapidly improving as it scales its revenue base. Its adjusted operating margin has expanded for five straight quarters. Management, in turn, expects the AI leader to generate an adjusted operating profit of as much as $850 million in 2024, up from $633 million in 2023.

American Express is an advertising partner of The Ascent, a Motley Fool company. Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Palantir Technologies, and Palo Alto Networks. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

I Have $500k in an IRA and Will Receive $2,000 Monthly From Social Security. Can I Retire at 67?

Half a million dollars might sound like a lot of money, but if you’re approaching retirement, is it enough?

If you have $500,000 in a pre-tax IRA and expect $2,000 per month from Social Security, you may have enough money to retire at age 67. A half million dollars is a relatively modest nest egg, but it can still generate a comfortable income depending on your standard of living. Here’s what to think about as you plan for retirement around these figures.

A financial advisor can help you build a comprehensive plan for retirement. Match with a fiduciary advisor today.

How Health and Longevity Affect Retirement Options

First of all, make sure to consider your health and longevity. Are you planning to retire at age 67 for health reasons or will you be healthy enough to continue working, if you need to?

As you hit your late 60s and 70s, your health may become more unpredictable. Even if you’re still in good health, your workday may become more tiring as time goes on. You may not be able to continue working after 67, regardless of finances. So while it’s worth considering whether you can continue to work beyond age 67, it’s also critical to think about how long your $500,000 may last in the event that you need to call it a career at 67. A financial advisor can help you decide when the right time is to retire.

Income and Social Security

The next question is how much money your portfolio will generate.

“Lower net worth situations typically imply less room for error,” Bryan M. Kuderna, founder of the Kuderna Financial Team told SmartAsset. “There’s always a lot to consider, but… removing variables to simplify the math means $500,000 over a 20-year hypothetical retirement equals $25,000 annual spend down.”

That’s the starting point: $4,000 per month in cash withdrawals and Social Security income.

While half a million dollars seems like a lot of money, it’s a rather modest retirement savings. A lot of your income will depend on how you invest this money and structure your withdrawals. For example, as Kuderna notes, you could keep everything in cash and withdraw about $2,000 per month for 20 years.

On the other hand, say you invest your entire portfolio in bonds. On average, modern corporate bonds tend to return about 4% per year. By doing so, you could reduce your withdrawals slightly and live indefinitely on about $3,666 per month in Social Security and interest payments. Or, if you’re willing to draw down on the principal, you could generate $4,800 per month over 20 years in combined benefits and withdrawals.

A lifetime annuity could generate a little more, giving you a combined income of about $5,300 per month in Social Security and retirement payments. The difference here is that it would last indefinitely, with no risk of exhausting the principal. And if you need help picking investments for your retirement accounts and want advice on annuities, consider speaking with a financial advisor.

Your Spending in Retirement

Spending is a key component of retirement planning.

Depending on how you manage your money, you can probably expect an annual income between $48,000 (at roughly $4,000 per month) and $63,000 (at roughly $5,300 per month). More is possible if you invest for more aggressive returns, but that will mean taking on more risk.

Whether this income will be enough money is largely dependent on your spending.

Now, one of the green flags here is your Social Security income. A $2,000 monthly benefit at full retirement age means that you likely earned around $70,000 per year in your working life – not far off from what your combined retirement income.

But there are three major things to consider here.

First, taxes will take a bite out of this income. Your IRA is a pre-tax portfolio, so withdrawals are taxed as regular income, not capital gains. The IRS will tax you based on the tax bracket you’re in when you make your withdrawals.

Second, you must plan for inflation. While your Social Security benefits will be indexed for inflation – meaning they typically increase on an annual basis – cash and fixed-income assets such as the bonds and annuities discussed above are not. You may need to invest in assets that will provide a growth element to your portfolio and help you outpace inflation.

Finally, you may have to choose a more aggressive withdrawal rate, which could expose you to longevity risk – the possibility of outliving your money. Adhering to the standard 4% rule would mean withdrawing just $1,666 per month from your IRA in your first year of retirement and that may not be enough to meet your spending needs. An approach that generates about $3,000 per month in IRA income will get you closer to your likely pre-retirement income, but it will mean withdrawing 7.2% of your portfolio in year 1 of retirement, which is quite high. A financial advisor can help you figure out how much money you can afford to withdraw from your IRA.

Bottom Line

Can you afford to retire? It depends entirely on how your portfolio is invested and your goals.

IRA Management Tips

-

Building an IRA requires more planning than a 401(k), which is typically managed by a professional on your behalf. Here are a few tips and strategies for making the most of your IRA.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/Luke Chan, ©iStock.com/GetUpStudio, ©iStock.com/Ridofranz

The post I Have $500k in an IRA and Will Receive $2,000 Monthly From Social Security. Can I Retire at 67? appeared first on SmartReads by SmartAsset.

Working longer won’t solve the retirement crisis — seniors need a ‘Gray New Deal’ to retire with dignity, this economist says

The Value Gap is a MarketWatch interview series with business leaders, academics, policymakers and activists on reducing racial and social inequalities.

Most Read from MarketWatch

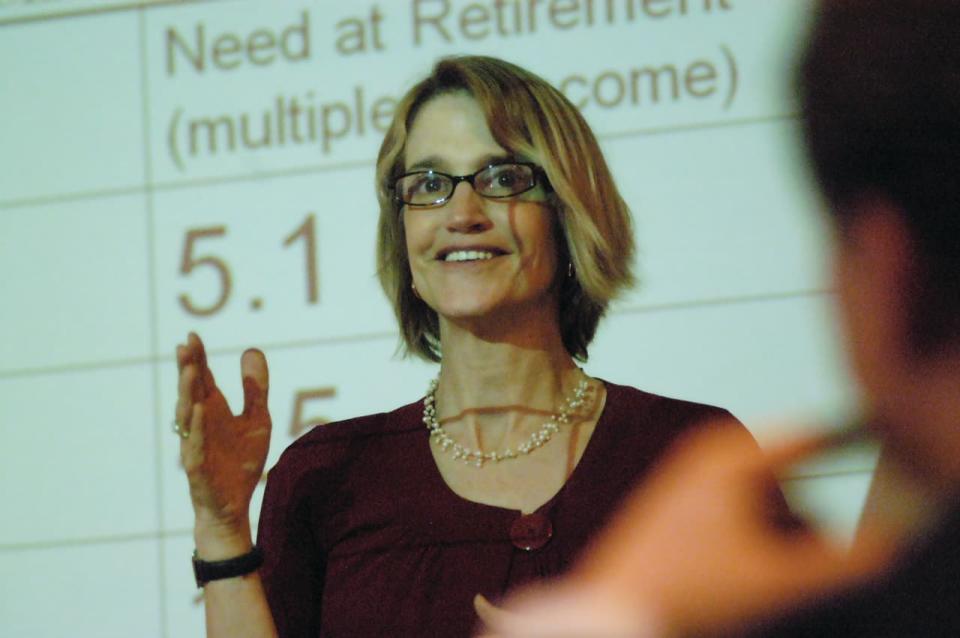

Teresa Ghilarducci thinks older adults shouldn’t have to work in retirement. She wants people to stop feeling shame about the size of their retirement accounts, and envisions a “Gray New Deal” that creates job and pension improvements for older Americans.

Those positions may be surprising for a labor economist.

But Ghilarducci is also a professor at the New School for Social Research and an expert on retirement security who explains complicated subjects in an accessible way. She has authored several books and papers, and her latest book, “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy,” talks about how employees are laboring in the broken U.S. retirement system.

As American society urges people to work longer, this takes a disproportionate toll on middle- and lower-income people who may not have the ability to work longer in physically demanding jobs, Ghilarducci told MarketWatch in an interview.

Fifty percent of women and 47% of men between the ages of 55 and 66 have no retirement savings, according to the Census Bureau.

Ghilarducci calls for a Gray New Deal as a public-policy imperative. Today’s do-it-yourself retirement system — in which workers fund their retirement through 401(k)s, savings and sheer grit — is not working, she said. This interview has been edited for length and clarity:

MarketWatch: You’ve written several books. What did you still want to say in this new book?

Ghilarducci: My other books really focused on how to have enough money for retirement. This is a different subject about the policy push to work longer. We have a retirement crisis that’s a complex problem and expensive to fix. People retreated to the safe place that we can’t fix it. They say, “We have to work a little longer,” and that’s the solution.

My experience with the rest of the world was that they did not have this sense that working longer was the solution. Other countries have 25- to 30-year work lives and have a dignified old age. This working-longer idea robs us of a dignified old age, which we deserve. There’s a cost to our bodies and our lives in working longer.

MarketWatch: Can you talk about the Gray New Deal, what it entails and how insurmountable it may be to see it come to fruition?

Ghilarducci: We have a responsibility to rethink how people work and retire from that work. If you do not ignore the retirement period — people are entitled to retire — there’s got to be new ways to think about it. It has to be part of public policy. It has to be as encompassing as the original New Deal. Ninety percent of workers have no problem embracing this idea of retirement, but 53% of retired people when surveyed say they didn’t choose when to retire. They were laid off or their bodies wore out. Workers get it that they won’t be able to work until they’re 62, and working to 70 is nearly impossible for most.

Policy makers, meanwhile, have better, easier jobs. No one’s telling them what to do — they are telling other people what to do. It makes them a bit unsympathetic. But if they hear enough from workers — there’s lots of support for Social Security. I’m hopeful.

MarketWatch: The demographic bubble known as Peak 65 is happening this year, with a historic number of people turning 65. What will this mean for society, the economy and our culture?

Ghilarducci: Peak 55 happened 10 years ago, and people got really nervous about their retirement savings. Now it’s Peak 65, and all illusions about what’s possible are gone. There will be 35 million people realizing that their work lives are over and the money won’t stretch. We’ll have a sea change in views on Social Security. There’s no stomach among voters for benefit cuts. There’s a bill in Congress — from [Democratic Sen. John] Hickenlooper, [Republican Sen. Thom] Tillis, [Democratic Rep. Terri] Sewell and [Republican Rep. Lloyd] Smucker — that calls for a government match. It gets the individual employer out of it and focuses on the worker and the government.

Peak 65 shows me that the population is aging, and older people vote. There’s also an electorate that’s younger, and they support Social Security. They’re struggling with student debt and they are financially sophisticated. They’re learning about compound interest in high school. There’s a groundswell of concern about their parents. There’s also women in their late 40s and 50s who are having to take care of older parents. Not only are they taking care of older parents, but a lot of the care costs are coming out of their own retirement savings. They’re also giving a lot of their own time to provide care that they could be using for work, making more money and providing for their own security, and they’re not.

MarketWatch: Does increased longevity mean increased senior poverty?

Ghilarducci: We started charting higher levels of increased poverty years ago — millions of people living in de facto poverty. As the numbers of people go up, the rate and number of people in poverty will go up. The ghoulish good news is that people living in poverty don’t live as long. There’s a real inequality in longevity, in that the people with means are living longer. That inequality is real.

MarketWatch: In your book, you talk about how working longer weakens political pressure to expand Social Security and employer retirement plans. How so?

Ghilarducci: It could cost $1 trillion to bring Social Security up to full benefits. It would be spread out over decades, but it’s still a lot of money. Workers and employers have to set aside money for retirement. Workers also have to pay for emergency savings, housing, student debt. The urgency on the retirement crisis dissipates when people say everyone can work more years, and by working for more time, they won’t draw on Social Security. But that’s like saying, “Hey, we can afford lunch by not having lunch.” And people can just work longer? That’s not realistic. There’s a push to have everyone in the labor pool and a spate of work to end age discrimination. But a lot of that is turning the other way.

It’s also psychological — people making policy didn’t want to think of themselves as useless and facing mortality. It’s appealing to human beings: Never say die. The do-it-yourself retirement system is false that one can do it themselves. There’s this shame that you didn’t save enough. We’re a country of very old baristas — people are doing jobs that are a lot less than they had before because they have to.

But I think people are rising up. People are angry and empowered. There’s all sorts of ways to do that — vote for politicians who pay attention. It’s hard to talk to 55-year-old women who have no retirement. They should be angry.

MarketWatch: What do you see happening to Social Security in 10 years as the trust funds supporting it hit insolvency?

Ghilarducci: Social Security is purely a political problem. The country could afford to put more money into the system. We could have a 3-percentage-point increase in payroll tax. It wouldn’t mean job displacement or funding taken away from other groups. It’s not an economic problem. It’s a political problem that will be solved at the last minute, which will make it even more expensive. Any cuts to Social Security will mean more poor older adults. The last time there was a crisis, in 1983, we went to the brink. This time, I think politically there is the will to get something done because no one wants to see benefits cut.

MarketWatch: Will you ever retire? And what will that look like?

Ghilarducci: I have one of the strangest jobs in the U.S. I’m like a medieval priest or something. I have an endowed chair and I’m tenured. I have no supervisor. I have a really rare job. I’ll only retire when my body or my mind gives out. I’m not typical. And those of us with atypical jobs — and policy makers are not typical — we need to be more humble and realize we are not representative of most people.

MarketWatch: What’s the one lesson you want people to take away from your new book?

Ghilarducci: I want people to realize that they deserve retirement and a dignified retirement. It’s not shameful if they haven’t been able to save. It’s not because they got a divorce or had too much avocado toast in their 20s. It’s not their fault. Every American deserves a retirement, and working longer is not the solution.

Most Read from MarketWatch

Plan to retire? 20% of young Americans say they don’t think they can.

Not everyone believes they will retire one day: 15% of Americans overall said they don’t plan to retire at all, and younger people as a group were less confident than their fellow workers, a new study found.

More than one in five younger Americans have no plans to retire, and 21% of Hispanic participants said the same, according to TIAA Institute’s latest report, “State of Financial Preparedness in a Diverse America.”

The biggest reason to skip retirement? The inability to save enough. Social reasons, such as having a sense of purpose, avoiding boredom and career enjoyment, were also reasons not to retire, participants said.

“If most people are planning for retirement but can’t follow their plans, that’s a call to action for employers, policymakers, financial advisors, retirement services providers and others. We need to better identify the steps we must take to give people the resources they need,” Surya Kolluri, head of the TIAA Institute, said in a statement.

Source: TIAA Institute

Less than half of people still working were confident they’d retire one day. Young Americans and Hispanics were tied for lowest confidence, with more than a third in each demographic responding as such.

The survey included responses from 1,684 adults between the ages of 22 and 75 years old, who represented a mix of demographics, including age and racial and ethnic groups.

TIAA Institute also found Americans had little to no liquid investable savings — 26% of Black participants, 26% of Native American participants and a quarter of Hispanic Americans have none, the survey found — and three in 10 respondents said they’d be unable to pay for a $2,000 emergency. People are more likely to have no liquid investable assets (15%) or under $50,000 (29%) than to have more than $500,000 (19%), the survey found.

Read: Retirement planning for Gen X and millennials: To make it effective, make it bite-sized

For about three-quarters of current retirees, Social Security was the top retirement source, followed by more than half who said employer pensions. But that may not be the case for younger workers — almost half of participants between 22 and 34 years old said they don’t expect to take advantage of Social Security or pensions when they retire.

Two-thirds of people did have a retirement account, such as the 401(k), but almost a quarter of people didn’t know how much they had saved, including 24% of those currently retired and 22% planning to retire.

Can we retire on the beach in Hawaii with a budget of $1 million or less?

We are new empty nesters in our mid-50s and are ready to retire. Where can we buy a move-in-ready beach house with room for guests, in Hawaii or someplace similar, for $1 million or less?

Dear Empty Nesters,

Congratulations on this new era of your life as empty nesters approaching retirement. That’s a lot to achieve by your mid-50s, and a lot to celebrate. That’s all great news.

Now for the bad news.

A beach house that’s big enough for guests, that’s move-in-ready, in Hawaii or someplace like it, for under $1 million? You’re going to need a bigger budget. Or different parameters.

The median sales price for single-family homes on O’ahu remains above $1 million, ending the year at $1,050,000, according to the Hawaii Board of Realtors. The median sales price for a condo was $508,500, a 0.3% decrease from the year before. And that’s for all the homes on O’ahu — not just beach homes. A median price, of course, means that half of homes sold for more than that amount and half sold for less.

If you adjust your parameters, you might be able to buy a home in a beach town, but a property on the beach for $1 million is out of reach. Even in locales far from the Hawaiian paradise —the Jersey Shore, for example — beachfront homes go for millions. A humble 1,225-square-foot beachfront cottage in Stone Harbor, N.J., that will be knocked down recently sold for $10 million.

So where can you move to get a beach vibe on your budget?

The MarketWatch “Where Should I Retire” tool came up with several suggestions of places in Florida and North Carolina where you can live in a beach town, if not directly on the water. One suggestion was Fernandina Beach, Fla., which we’ve written about before. Other top suggestions are below.

Vero Beach, Fla.

The median home-sale price in Vero Beach was $392,000 in December, according to Realtor.com, which has the same parent company as MarketWatch. The range of homes in Vero Beach is vast, ranging from as high as a $60 million beachfront mansion down to more modest, inland homes selling for a few hundred thousand.

Still, Vero Beach gets you a town boasting 26 miles of beaches along the Atlantic Ocean. In 2023, Southern Living Magazine named Vero Beach the seventh-best small beach town in Florida for its “unspoiled beaches, saltwater lagoons, and protected wildlife refuges.”

Vero Beach also offers a downtown area featuring galleries, boutiques and restaurants, along with opera, ballet and theater, as well as the McKee Botanical Gardens. The town has become popular in recent years with snowbirds and boasts the fourth-largest concentration of wealthy households in the U.S., according to Vero Beach Real Estate.

Nags Head, N.C.

The median sales price of a home in Nags Head, N.C., was $875,000 in December 2023, according to Realtor.com. Your $1 million budget could actually get you on the beach or close to it in Nags Head, depending on your taste in homes and your appetite for storm-related risk.

Nags Head is part of the Outer Banks, a 200-mile stretch of barrier islands off the coast of North Carolina and southern Virginia. With that come the downsides of tourist season and hurricanes, but also the bonus of beach life. Nags Head is home to Jockey’s Ridge State Park, which has the tallest natural sand dune on the East Coast, boasting great views of the ocean.

The Bodie Island Lighthouse is a landmark of Nags Head on the Outer Banks of North Carolina.

Getty Images/iStockphoto

The Outer Banks boasts five lighthouses, wild horses on the beach in Corolla, four seasons of weather and swimmable water temperatures due to the Gulf Stream. If you don’t like Nags Head itself, you can explore other Outer Banks towns. Be sure to visit during all seasons so you get a sense of whether you might want to call the area home.

There are plenty of shops and restaurants, although some close down in the offseason. About 37,000 people live year-round in Dare County, N.C., a number that that swells exponentially during tourist season.

Readers, where should our beach lovers retire?

Looking for ideas on the best place for you to retire? Email HelpMeRetire@marketwatch.com