This week’s non-fungible token (NFT) sales have taken another nosedive, intensifying the downtrend that began with a 16.55% decline from March 9 to March 16, 2024. The last seven days have witnessed an even steeper drop, with NFT sales plummeting by 18.57%. Cryptopunk #7,804 Shines in a Week of Falling NFT Sales In line with […]

This week’s non-fungible token (NFT) sales have taken another nosedive, intensifying the downtrend that began with a 16.55% decline from March 9 to March 16, 2024. The last seven days have witnessed an even steeper drop, with NFT sales plummeting by 18.57%. Cryptopunk #7,804 Shines in a Week of Falling NFT Sales In line with […]

Source link

retreat

After a spectacular ascent to record highs, Bitcoin (BTC) is facing a reality check. The past week has seen a dramatic price correction, leaving investors wondering if this is a temporary setback or a sign of a more bearish future.

The world’s most popular cryptocurrency reached an intraday low of $64,620 on March 17th, a significant drop from its recent peak above $73,000. This pullback has triggered a wave of pessimism, with analysts pointing to declining profitability and a drop in daily active addresses on the network.

Bitcoin down in the last week. Source: Coingecko

A Bearish Shadow Looms

According to analysts, investor sentiment has been hurt by a series of descending peaks and failed upturns, while selling pressure remains rampant as we approach the “weekly candle close.” This sentiment is echoed by data from IntoTheBlock, which shows a sharp decline in the number of addresses “In the Money,” signifying a decrease in overall profitability within the Bitcoin network.

Source: IntoTheBlock

Finding Support: A Beacon of Hope?

However, not everyone is hitting the panic button. Technical analysis suggests a potential support zone for buyers between $60,000 and $67,000. Popular trader Skew highlights this area as a possible turning point, while also acknowledging significant spot selling from major exchanges like Coinbase and Binance.

$BTC Spot Market Data Thread, in partnership @_WOO_X $BTC Binance Spot

Weekend spot buyer hereSpot Supply ($72K – $74K)

Spot Demand ($60K)Interestingly last bounce which was sold into also resulted in a stack of limit bids being quoted lower.

~ Keep an eye on those bids… pic.twitter.com/3PKHyddNlv— Skew Δ (@52kskew) March 17, 2024

Bulls On The Horizon: Are The Giants Awakening?

While the immediate future appears uncertain, some analysts remain bullish on Bitcoin’s long-term prospects. They view the current correction as a natural and healthy part of any bull run, pointing to historical data where similar pullbacks paved the way for further growth.

Related Reading: Bitcoin Crashes: Dip To $65,000 Triggers Over $400 Million Liquidation Avalanche

Adding fuel to the fire of optimism is the potential return of institutional capital. The recent resumption of buying from US Bitcoin ETFs and the prospect of a significant influx of funds from hedge funds and investment advisors in the coming months are seen as potential catalysts for a rebound.

BTCUSD trading at $68,087 on the weekly chart: TradingView.com

Thomas Fahrer, CEO of Apollo, a decentralized online cryptocurrency platform renowned for its comprehensive crypto reviews and analysis of ETF inflows, echoes sentiments regarding X.

Fahrer characterizes the current state as a “Bear Trap” and pinpoints the resumption of buying from US Bitcoin ETFs on March 18 as a potential catalyst for an upward surge in X’s value.

Related Reading: Forget Dogecoin, Shiba Inu Set To Become The Top Dog: Expert Predicts $100 Billion Market Cap

Emphasizing the significance of increased institutional acceptance, Fahrer anticipates a surge in liquidity within Bitcoin ETFs, suggesting that substantial capital inflows from institutional investors have yet to materialize.

The Verdict: Brace For A Volatile Week

This week will be crucial for Bitcoin. The coming days will be a test of the cryptocurrency’s resilience and its ability to overcome the current selling pressure. If bulls can regain control and positive sentiment prevails, a return to record highs remains a possibility. However, if the downtrend continues, Bitcoin could face a more extended period of correction.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

As of Feb. 12, 2024, bitcoin displays a robust upward momentum across several charts, underscored by its sharp ascent from $47,593 to $48,814 on Sunday. On the subsequent Monday, bitcoin’s market value reached $939 billion, with a trading volume of $21.57 billion for the day. Currently, the upward trend pauses, with the price dipping below […]

As of Feb. 12, 2024, bitcoin displays a robust upward momentum across several charts, underscored by its sharp ascent from $47,593 to $48,814 on Sunday. On the subsequent Monday, bitcoin’s market value reached $939 billion, with a trading volume of $21.57 billion for the day. Currently, the upward trend pauses, with the price dipping below […]

Source link

Whales dive deeper into Bitcoin as smaller holders retreat amid ETF pressures

Quick Take

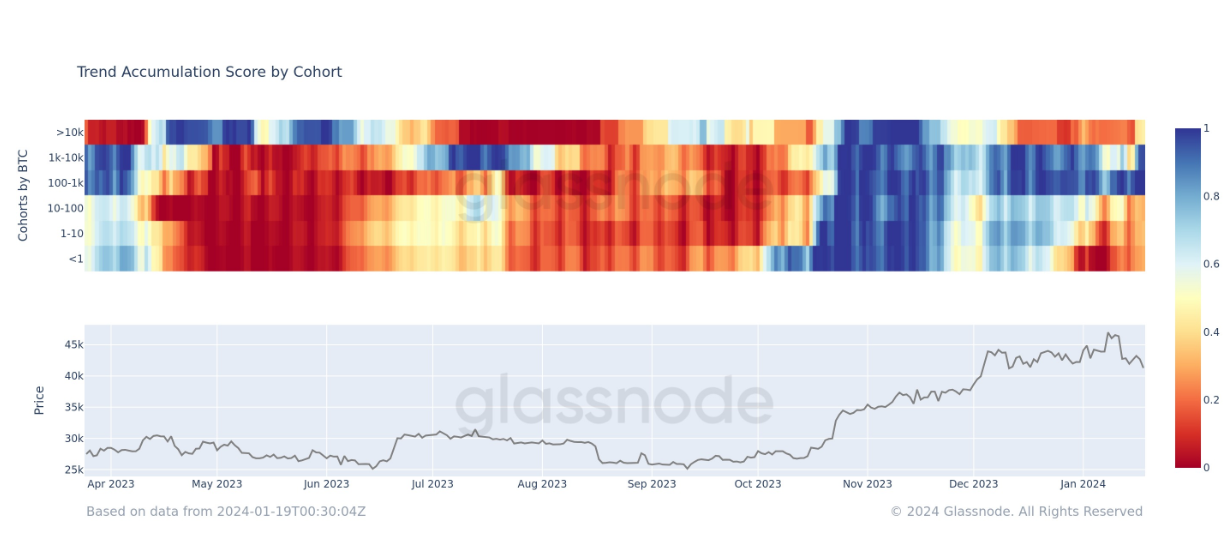

Amidst the accelerated pace of GBTC outflows contributing to downward pressure on Bitcoin’s price, two divergent behavioral patterns are becoming evident among older cohorts. Data demonstrates a growing preference among more oversized Bitcoin holders or ‘whales’ to accumulate more Bitcoins, while smaller cohorts appear to be more inclined towards selling.

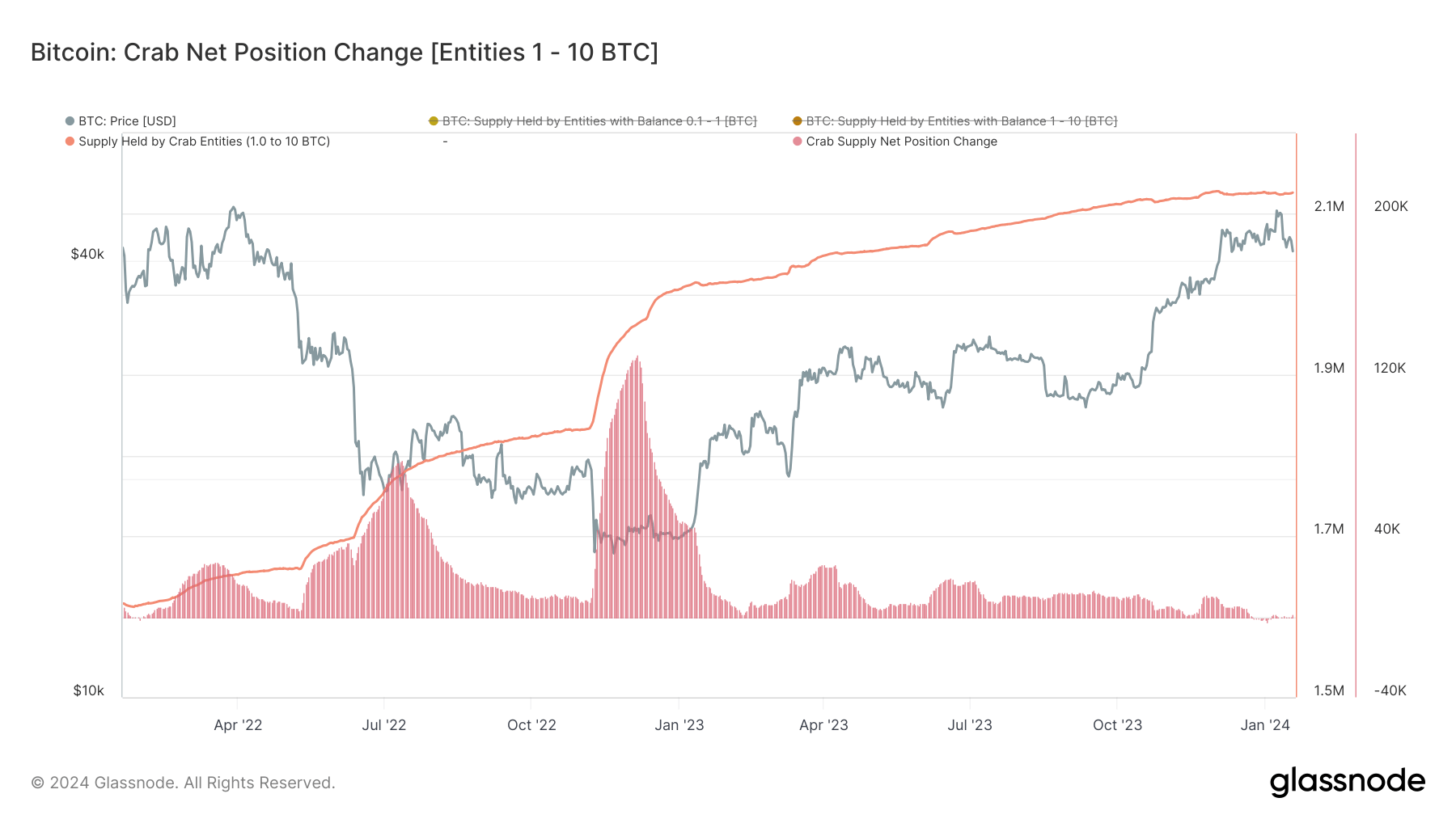

Specifically, holders identified as ‘crabs,’ known to possess 1-10 BTC, have maintained a flat to negative growth in their Bitcoin portfolios. Currently, this cohort holds approximately 2.1 million BTC, showing no substantial increase since December’s end.

This divergence becomes more apparent when considering the Accumulation Trend Score broken down by wallet cohorts. A score closer to 1 suggests accumulation, whereas a score closer to 0 indicates distribution. Interestingly, holders with at least 100 BTC have begun accumulating, and those with 10,000 BTC have ceased distribution and are seemingly moving towards gradual accumulation. This trend is expected to strengthen in the coming days.

In stark contrast, holders with 100 BTC or less show a distribution trend, affirming the disparity in the accumulation habits of larger and smaller cohorts.

The post Whales dive deeper into Bitcoin as smaller holders retreat amid ETF pressures appeared first on CryptoSlate.

Analyst Raises Red Flag On Bitcoin Rally, Predicts Imminent Retreat After 35% Spike

As Bitcoin (BTC) continues to consolidate above the $34,000 mark, aiming to surpass and reclaim its yearly high, theories suggest that a retracement may follow the current upward spike in the coming weeks.

On this matter, the renowned crypto analyst known by the pseudonym “Crypto Soulz” recently shared insights on the potential short-term retracement for Bitcoin in a recent post on X (formerly Twitter).

BTC’s Local Top At $36,000 Signals Potential Reversal

According to Crypto Soulz, a key resistance level for Bitcoin is identified at $37,370. The analyst suggests that this resistance level will not likely be retested from the current position.

Additionally, Soulz highlights that liquidity has been absorbed around $36,000, which he considers a “trigger” for taking short positions.

The analyst points out that the local top for BTC was observed at $36,000, where a long wick was formed, followed by a retracement. This price action is seen as a potential indication of a reversal.

Moreover, Crypto Soulz emphasizes using on-chain data as a confluence for BTC positions. Soulz highlights that the spot market showed an uptrend before the perpetual futures contracts followed suit.

The spot order book (OB) is stated to be increasing but expected to decrease, along with the perpetual market. If $36,000 indeed serves as a local top, the analyst suggests that both spot and perpetual should subsequently decrease.

Furthermore, Soulz highlighted that BTC successfully broke through key technical indicators, such as the 200-day simple moving average (SMA), the 200-week SMA, and the 365-day SMA, which is currently acting as support.

Ultimately, Soulz further states that there is no substantial liquidity available above $38,000. The analyst identifies two liquidity pools, as seen in the chart above: the first at $33,000, which he considers its initial target, and the second at $31,000, where a slight bounce may occur.

Bitcoin Potential As Store Of Value

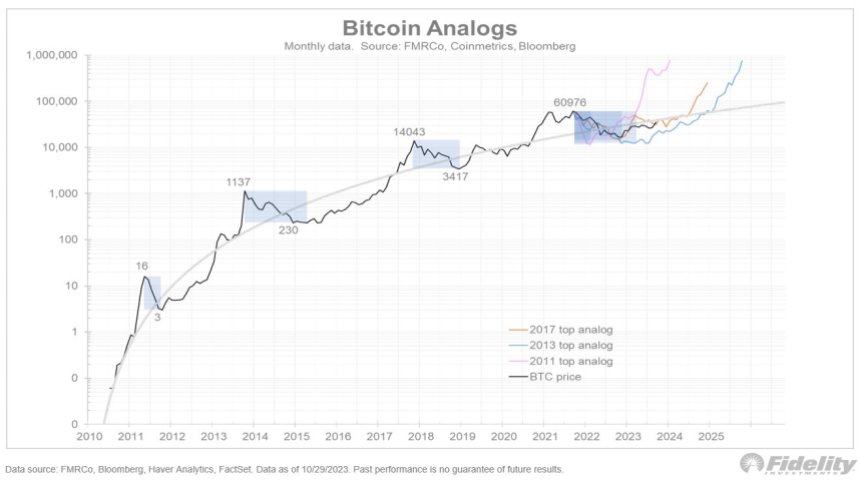

In another development, Jurrien Timmer, Fidelity’s Director of Global Macro, delved into the characteristics of Bitcoin and its potential to serve as a store of value and hedge against monetary debasement.

Drawing parallels to gold, Timmer highlighted Bitcoin’s “unique attributes” and its ability to potentially gain market share in times of inflation and excessive money supply growth.

Timmer acknowledged that Bitcoin had followed a pattern of “boom-bust cycles,” much like its previous market behavior. However, he also emphasized Bitcoin’s evolving role as a commodity currency that aspires to be a store of value.

Furthermore, Timmer described Bitcoin as “exponential gold,” suggesting that it shares similarities with gold but with additional growth potential.

While gold has traditionally been recognized as a store of value, Timmer noted its limitations as a medium of exchange due to its deflationary nature and lack of efficiency.

Timmer drew attention to historical periods, such as the 1970s and 2000s, when gold exhibited strength and gained market share. These periods coincided with structural regimes marked by high inflation, negative real rates, and excessive money supply growth.

Timmer hinted that Bitcoin, with its potential to serve as a hedge against inflation and debasement, could play a similar role in such environments.

Considering Bitcoin’s attributes and the changing macroeconomic landscape, Timmer expressed optimism about its potential to join the ranks of gold as a valuable asset.

While acknowledging the volatility and speculative nature of cryptocurrencies, Timmer believes that Bitcoin’s unique characteristics position it as a viable contender in the store of value space.

Currently, BTC is trading at $34,700, reflecting a 1.5% increase over the past 24 hours as it persists in reaching the $35,000 mark.

Featured image from Shutterstock, chart from TradingView.com

Stocks may see 12% retreat ahead of recession, says trader who called ’87 crash

“‘The stock market, typically, right before recession declines about 12%.That’s probably going to happen at some point from some level.’”

— Paul Tudor Jones, founder and CIO, Tudor Investment Corp.

That’s famed hedge-fund manager Paul Tudor Jones in an interview with CNBC Tuesday morning, explaining why he’s not enthusiastic about U.S. stocks and other risky assets as he awaits a recession induced by the Federal Reserve’s aggressive monetary tightening.

Jones said it’s difficult to be positive on equities amid what he described as “the most threatening and challenging geopolitical environment that I’ve ever seen,” which is occurring “at the same time the United States is at its weakest fiscal position since World War II. It’s a really difficult time.”

A 2023 rally in U.S. stocks has stalled, with the S&P 500 index

SPX

pulling back 5.5% from a 2023 high set on July 31, leaving the large-cap benchmark up 12.9% for the year to date through Monday’s close. The Dow Jones Industrial Average

DJIA

is up just 1.4% so far this year.

Jones is widely credited with predicting, and profiting, from the stock-market crash on Oct. 19, 1987, which saw the Dow lose nearly 23% of its value, marking the largest one-day percentage decline for the blue-chip benchmark in its history.

So what does Jones like?

“I would love gold and bitcoin, together,” he said.

“I think [bitcoin and gold] probably take on a larger percentage of your portfolio than historically they would because we’re going to go through a challenging political time here in the United States and…we’ve obviously got a geopolitical situation” in Israel and Ukraine, Jones said.

Bitcoin

BTCUSD,

was off 0.8% near $27,380 Tuesday morning and has rallied around 65% so far in 2023. Gold

GC00,

has retreated from a high above $2,000 an ounce earlier this year, slumping below $1,850 last week as Treasury yields marched higher and the dollar strengthened.

A pullback in U.S. bond yields has seen gold bounce 1.4% this week, trading recently near $1,871 an ounce.

Large, speculative short positions in gold will provide fuel for a rally as a recession takes hold, the investor said.

“In a recession, the market is typically really long assets like bitcoin and gold,” he said. “So there’s probably $40 billion worth of buying that has to come into gold at some point between now and if that recession actually occurs.

“So yeah, I like bitcoin and I like gold right here,” Jones said.