Jerome Powell just revealed a hidden reason why inflation is staying high: The economy is increasingly uninsurable

Source link

revealed

Satoshi Correspondence Revealed by Witnesses in Legal Clash Against Craig Wright

In the unfolding lawsuit between the Crypto Open Patent Alliance (COPA) and Craig Wright, three key witnesses who had early interactions with Bitcoin’s creator, Satoshi Nakamoto, provided their testimonies. Among them were early Bitcoin developers Martti Malmi and Mike Hearn, as well as Adam Back, the creator of Hashcash, the proof-of-work (PoW) algorithm integral to […]

In the unfolding lawsuit between the Crypto Open Patent Alliance (COPA) and Craig Wright, three key witnesses who had early interactions with Bitcoin’s creator, Satoshi Nakamoto, provided their testimonies. Among them were early Bitcoin developers Martti Malmi and Mike Hearn, as well as Adam Back, the creator of Hashcash, the proof-of-work (PoW) algorithm integral to […]

Source link

Key Requirements For Spot XRP ETF Approval Revealed Amidst 4500% Price Surge Target

Following Bitcoin’s spot exchange-traded fund (ETF) approval on January 11, market speculation has grown around the possibility of similar investment vehicles for major cryptocurrencies, including a spot XRP ETF. However, certain requirements and regulatory considerations must be met before such a development can occur.

Regulatory Prerequisites For Spot XRP ETF

FOX reporter Eleanor Terret clarifies the matter, stating that launching an XRP spot ETF would first require the establishment of a futures ETF.

In the case of Bitcoin, the approval of spot ETFs was conditional upon the Securities and Exchange Commission (SEC) concluding that the Chicago Mercantile Exchange (CME) Bitcoin futures market provided sufficient surveillance against fraud and manipulation.

Terret suggests that for XRP to have a spot ETF, a futures ETF must first be established, marking a step in the right direction.

Bloomberg ETF expert James Seyffart shares a similar sentiment, stating that he does not anticipate an XRP ETF launching this year. Seyffart cites the ongoing SEC case against Ripple as a factor influencing his stance, suggesting that an XRP ETF is more likely to emerge once the regulatory matter is resolved.

Seyffart adds that XRP futures trading on a regulated platform like the Chicago Mercantile Exchange would be a prerequisite for the SEC to consider any applications for a spot XRP ETF. Seyffart hints that an XRP futures ETF could also be advantageous in this context.

The SEC has maintained a cautious approach towards spot ETFs involving crypto assets due to concerns about potential market manipulation. Seyffart emphasizes that the availability of XRP futures trading on a regulated platform, such as the CME, would provide a favorable framework for the SEC’s consideration of a spot XRP ETF, especially given previous court rulings highlighting the correlation between futures and spot markets.

Amidst the ongoing speculation, blockchain firm Ripple seems to be preparing for potential involvement in the ETF space.

A recent job advertisement posted on Ripple’s website reveals their search for a Senior Manager in business Development, with a focus on institutional decentralized finance (DeFi). The role includes spearheading cryptocurrency-related ETF initiatives with internal trading teams and relevant partners.

XRP’s Future Potential – From $0.5299 To $27?

Crypto market analyst EGRAG crypto has conducted a comprehensive price analysis of the XRP token. Despite peaking in 2023, when the price reached a high of $0.9376 on July 13, the token has retraced more than 15% since the start of 2024 to a current trading price of $0.5299.

However, according to EGRAG, the 21 Exponential Moving Average (EMA) on the monthly time frame is a significant indicator for assessing XRP’s price movement.

The analysis focuses on three price levels: $3.5, $6.5, and $27. Based on previous instances (labeled A, B, and C), EGRAG extrapolates potential future price movements using the same percentage increases observed in the past.

The first potential scenario is a significant price surge to $27, representing a massive 4500% increase. This prediction is based on a similar percentage move observed in the past (from previous instance A), seen in the chart above.

The second scenario suggests a more conservative projection, with XRP potentially experiencing a solid 1000% increase to $6.5. This projection is based on historical patterns observed in previous instance B.

In the third scenario, EGRAG anticipates a significant 500% rise in XRP’s price, reaching $3.5. Based on previous instance C, this projection indicates a significant upward movement for the token.

Whether the XRP token can successfully surpass the upper resistance levels that have impeded its rise to the $0.600 mark since late December remains to be seen.

Additionally, the market eagerly awaits a catalyst that could prompt a breakthrough in XRP’s seven-month downtrend structure, potentially resulting in a price surge above $0.700.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

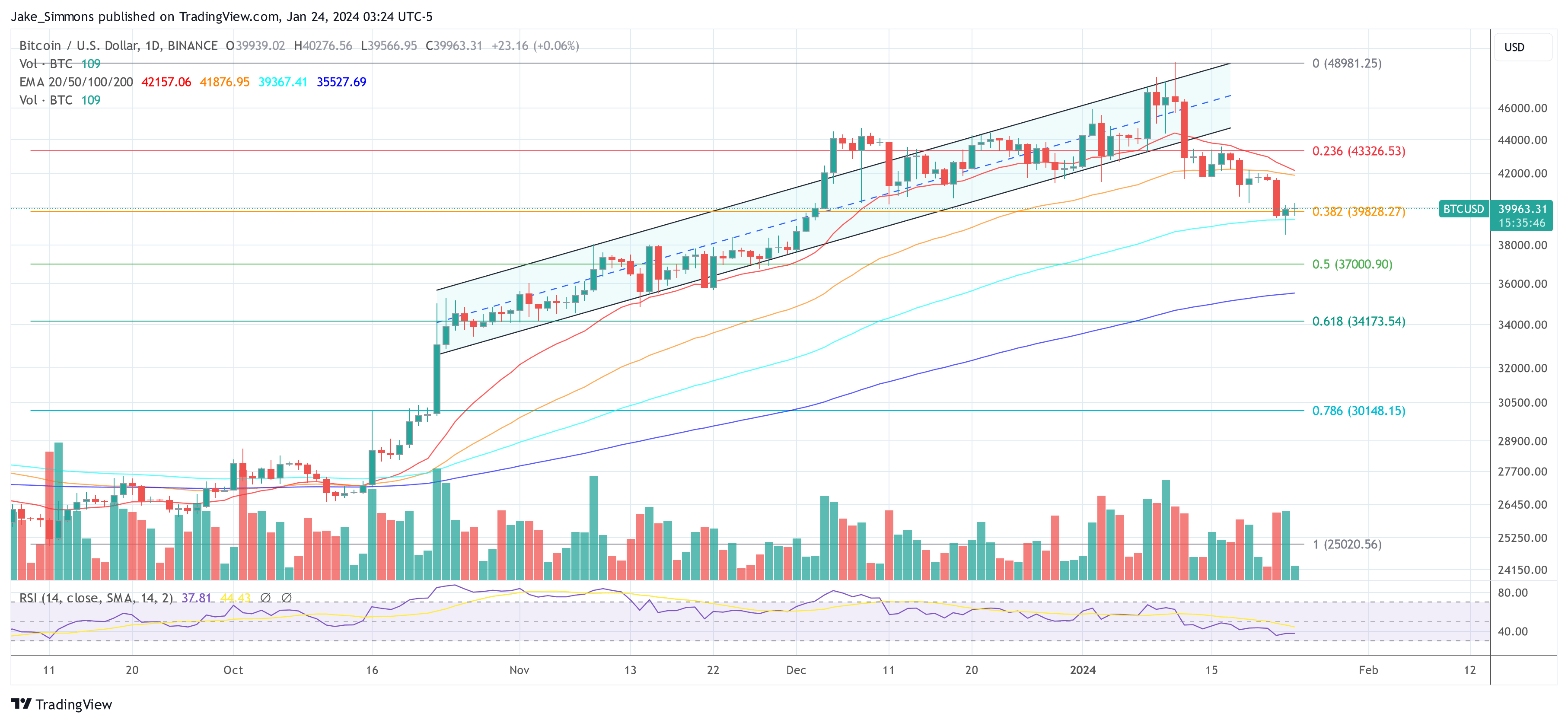

In his latest essay, Arthur Hayes, the founder of BitMEX, articulates a contrarian perspective on the recent downturn in Bitcoin’s price, refuting the mainstream narrative that attributes the decline to outflows from the Grayscale Bitcoin Trust (GBTC). Instead, Hayes points to macroeconomic maneuvers and monetary policy shifts as the real drivers behind Bitcoin’s volatility.

Monetary Policy And Market Reactions

Hayes kickstarts his analysis by shedding light on the US Treasury’s recent strategic shift in borrowing, a decision announced by Janet Yellen on November 1. This pivot towards Treasury bills (T-bills) has triggered a substantial liquidity injection, compelling money market funds to reallocate their investments from the Fed’s Reverse Repo Program (RRP) to these T-bills, offering higher yields.

Hayes articulates the significance of this move, stating, “Yellen acted by shifting her department’s borrowing to T-bills, thus adding hundreds of billions of dollars’ worth of liquidity so far.” However, he contrasts this tangible financial maneuver with the Federal Reserve’s mere rhetoric about future rate cuts and the tapering of quantitative tightening (QT), pointing out that these discussions have not translated into actual monetary stimulus.

While the traditional financial markets, particularly the S&P 500 and the Nasdaq 100, responded positively to these developments, Hayes argues that Bitcoin’s recent price trajectory serves as a more accurate barometer of the underlying economic currents. He remarks, “The real smoke alarm for the direction of dollar liquidity, Bitcoin, is throwing a cautionary sign.”

He notes the cryptocurrency’s decline from its peak and correlates it with the fluctuations in the yield of the 2-year US Treasury, suggesting a deeper economic interplay at work. “Coinciding with Bitcoin’s local high, the 2-year US Treasury yield hit a local low of 4.14% in mid-January and is now marching upwards,” Hayes remarked.

Dissecting True Reasons Behind The Bitcoin Dip

Addressing the narrative surrounding GBTC, Hayes emphatically dismisses the notion that outflows from GBTC are the primary catalyst for Bitcoin’s price movements. He clarifies, “The argument for Bitcoin’s recent dump is the outflows from the Grayscale Bitcoin Trust (GBTC). That argument is bogus because when you net the outflows from GBTC against the inflows into the newly listed spot Bitcoin ETFs, the result is, as of January 22nd, a net inflow of $820 million.”

This realization shifts the focus to economic mechanisms at play. The crux of Hayes’s argument lies in the anticipation surrounding the Bank Term Funding Program (BTFP)‘s expiration and the Federal Reserve’s hesitancy to adjust interest rates to a range that would alleviate the financial strain on smaller, non-Too-Big-to-Fail (TBTF) banks.

Hayes elucidates, “Until rates are reduced to the aforementioned levels, there is no way these banks can survive without the government support provided via the BTFP.” He predicts a looming mini-financial crisis in the event of the BTFP’s cessation, which he believes will compel the Federal Reserve to pivot from rhetoric to tangible action—namely, rate cuts, a tapering of QT, and potentially a resumption of quantitative easing (QE).

“I believe Bitcoin will dip before the BTFP renewal decision on March 12th. I didn’t expect it to happen so soon, but I think Bitcoin will find a local bottom between $30,000 and $35,000. As the SPX and NDX dump due to a mini financial crisis in March, Bitcoin will rise as it will front-run the eventual conversion of rate cuts and money printing talk on behalf of the Fed into the action of pressing that Brrrr button,” Hayes writes.

Strategic Trading Moves In A Turbulent Market

In a revealing glimpse into his tactical trading strategies, Hayes shares his approach to navigating the tumultuous market landscape. He discloses his positions, including the purchase of puts and the strategic adjustment of his BTC holdings. He concludes:

A 30% correction from the ETF approval high of $48,000 is $33,600. Therefore, I believe Bitcoin forms support between $30,0000 to $35,000. That is why I purchased 29 March 2024 $35,000 strike puts. […] Bitcoin and crypto in general are the last freely traded markets globally. As such, they will anticipate changes in dollar liquidity before the manipulated TradFi fiat stock and bond markets. Bitcoin is telling us to look for Yellen and not Talkin’.

At press time, BTC traded at $39,963.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

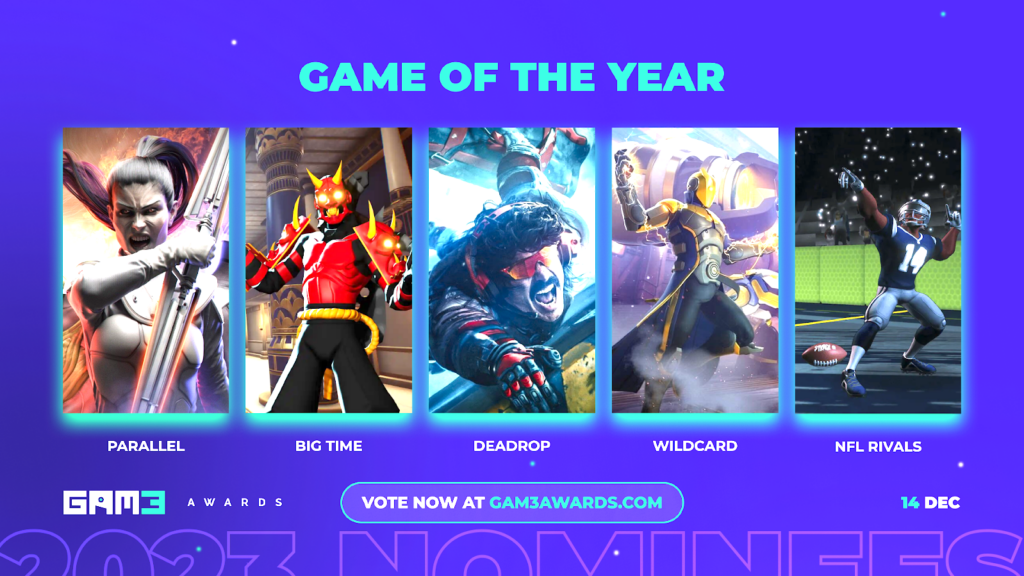

The GAM3 Awards final nominees have been revealed with $2M prize pool

The GAM3 Awards 2023 in collaboration with GAM3S.GG and Magic Eden features a prize pool exceeding $2M. It will take place on Dec. 14.

With 214 games initially nominated, the selection process was entrusted to a panel of over 70 experts from the traditional and web3 gaming sectors. This jury comprises executives from tech giants like Amazon, Google, Ubisoft, Microsoft, and Samsung, alongside leaders from the blockchain gaming ecosystem. The criteria for selection focused on gameplay, mechanics, replayability, the “fun” factor, accessibility, and overall quality, leading to a shortlist of 40 games now open for community voting.

The 2023 awards have seen a notable increase in qualified games with playable versions, more than doubling from the previous year. This growth indicates the sector’s robust development and the rising standard of web3 games. The finalists span nine blockchain networks, with Arbitrum making its debut and the top five networks being Polygon, Ethereum, Immutable X, Arbitrum, and Avalanche.

The jury’s role in the voting process holds a 90% influence, while community votes contribute 10%. Notably, the ‘People’s Choice Award’ and ‘Best Content Creator’ rely solely on community votes, amplifying the voice of the gaming community in these segments. Several games have stood out, with Big Time, Wildcard, Parallel, and Deadrop securing five nominations.

The Game of the Year category nominees are Parallel, Big Time, Deadrop, Wildcard, and NFL Rivals.

The prize pool for winners includes cash grants, tech service credits, marketing support, and more, provided by a consortium of partners like Amazon, Magic Eden, AD Gaming, and others, highlighting the broad support and investment in the future of web3 gaming.

George Yousling, Director of Business Development at Polygon Labs, stated,

“Despite the macro headwinds, I’m encouraged by high quality games reaching open beta and early access. Games that are fun to play with fleshed out core loops, tutorials, in-game economies, and progression systems. User flows that remove friction through account abstraction and help get players enjoying the experience upfront as opposed to clunky onboarding.”

The GAM3 Awards are looking to actively engage the gaming community through an exclusive free mint for voters by Magic Eden and a $100k prize pool for community members.

For the complete list of nominees, visit gam3awards.com. Final voting starts Nov. 22 and runs until Dec. 1.

The earnings report from Hertz (HTZ 1.19%) wouldn’t normally break any news for a company like Tesla (TSLA -0.80%), but that wasn’t the case this quarter. It was Hertz that said it missed estimates because costs are higher than expected on Tesla vehicles.

In this video, Travis Hoium covers what Hertz said and why it means Tesla’s cost of ownership is higher than expected. This isn’t good for the argument that EVs, and specifically Teslas, are going to save consumers money.

*Stock prices used were end-of-day prices of Oct. 30, 2023. The video was published on Oct. 30, 2023.

Travis Hoium has positions in General Motors. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and Stellantis and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy. Travis Hoium is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.

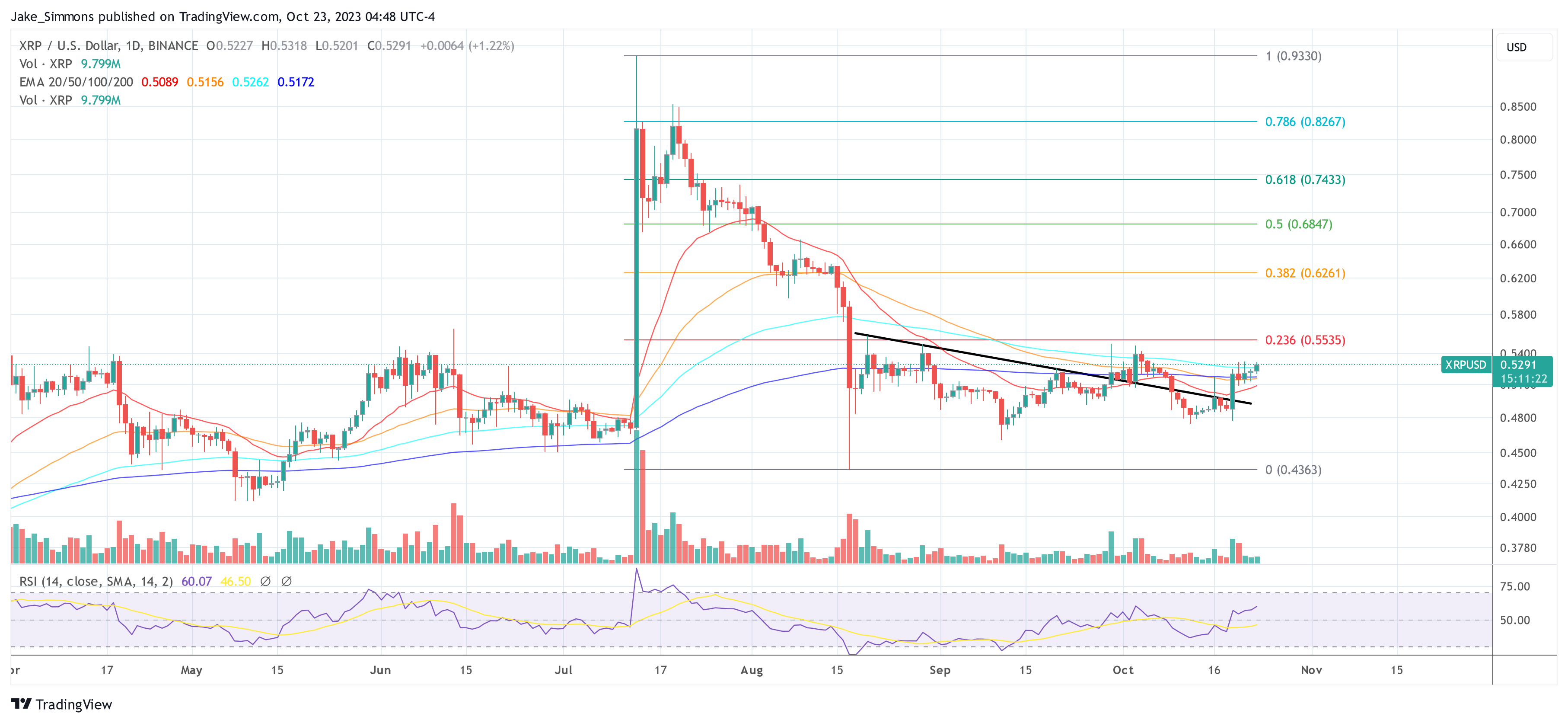

Egrag, a crypto analyst, today presented his medium-term predictions for the XRP price on X (formerly Twitter). He backed up his projections with the 3-day chart and pointed out several potential price points that investors should watch out for.

Analysis Of The 3-Day Chart XRP/USD

Egrag’s chart, based on Binance’s 3-day XRP/USDT pair, suggests that XRP is currently in the midst of a crucial breakout retest phase. He emphasized the current market dynamics by saying, “What’s happening right now is merely a retest of the breakout; the true pump is still on the horizon, and it’s bound to be epic!”

The analyst highlighted XRP’s triumphant rally from mid-July, which surpassed his original target of $0.85 and rose to a commendable $0.93, surpassing the original price target by 9.41%. Egrag’s 3-day chart shows a descending trend line, which the analyst calls the “Final Wake Up Line.”

According to him, the breakout above the trend line on July 13 after the summary judgment in the lawsuit between Ripple Labs and the US Securities and Exchange Commission (SEC) was the final wake-up call for investors who were still waiting on the sidelines.

Currently, the XRP price sits at around $0.52. As the analyst shows in the chart, XRP has experienced a retest of the trend line and passed it with flying colors. In particular, Egrag also points out that XRP was able to stay above the 0.236 Fibonacci retracement level at $0.4534.

This laid the foundation for the XRP price to enter bullish territory at this point. However, the price still faces the resistance zone between $0.55 and $0.60, which Egrag calls the “backbone junction”. Noteworthy is that the upper end of the price range coincides with the 0.382 Fibonacci retracement level. Exceeding this resistance is crucial, especially because it has provided strong resistance several times in the past.

Once this is accomplished, Egrag’s medium-term XRP price targets will come into focus. As explained, he has made an adjustment to his price targets as a result of the July increase. Due to the 9.41%-higher July rise compared to his original price target, Egrag now expects XRP to rise to $1.10 (instead of $1) in an initial rally.

Egrag has also raised the $5.5 price target to around $6, and the previous $6.4 benchmark has been recalibrated to nearly $7. He stated:

So, if we apply this same percentage increase to our upcoming targets, here’s what we can look forward to:

A) $1 * 9.41% = Approximately $1.10

B) $5.5 * 9.41% = Roughly $6

C) $6.4 * 9.41% = About $7

Lower Price Targets

Egrag’s analysis is based on several Fibonacci levels and shows potential resistance points. These are the Fibonacci 0.5 ($0.7528), 0.618 ($0.9442), 0.702 ($1.1095), 0.786 ($1.3038), 1 ($1.9664), and the Fibonacci extension levels at 1.272 ($3.3153), 1.414 ($4.3546), and 1.618 ($6.4420).

Overall, the analysis suggests that XRP’s upward momentum is likely to continue and build on its recent successes. The recent rise in price above the analyst’s lower target suggests robust upside sentiment in the market. However, investors should remain keenly aware of the crypto market’s inherent unpredictable nature and exercise due diligence at all times.

Egrag ended his tweet on an encouraging note for the community, “XRP Army STAY STEADY, We’re advancing step by step towards our exciting targets.”

At press time, XRP traded at $0.5291.

Featured image from Shutterstock, chart from TradingView.com

![]()

The nonprofit Human Rights Foundation (HRF) has launched a central bank digital currency (CBDC) tracker, the organization announced at the same Oslo Freedom Forum event it hosts. The online tracker has published educational materials and a tip line. It is expected to become fully functional by year-end.

The tracker came out of an eight-month fellowship at the HRF that was announced in January. The fellowship was awarded to Cato Institute policy analyst Nick Anthony, researcher Janine Romer and podcaster Matthew Mezinskis. The Cato Institute is an ardent opponent of CBDCs.

HRF chief strategy officer Alex Gladstein said in a promotional video about the tracker:

“It’s going to be an online resource that describes the progress of central bank digital currencies around the world, especially in authoritarian countries, and the civil liberties red flags and risks that come along with this.”

Because a CBDC is a central bank liability, it “creates a direct link between citizens and the central bank,” which “opens the door to so many human rights concerns when it comes to the adoption of CBDCs,” according to the CBDC tracker on the HRF website.

The first phase of the @HRF CBDC Tracker is now live!

Just announced at the Oslo Freedom Forum, the full resource will be unveiled at the end of the year.

For now, check out the landing page (phase 1) here: pic.twitter.com/FHB9DWXDqs

— Nick Anthony (@EconWithNick) June 13, 2023

The HRF is an active supporter of Bitcoin (BTC). Gladstein has told Cointelegraph in the past that Bitcoin “fixes democracy” and could disincentivize wars.

Related: 7 central banks and BIS continue examination of ongoing policy issues for retail CBDC

According to the unrelated, open-source CBDC Tracker website, the vast majority of the world’s central banks are at some stage of CBDC research, but only three CBDCs have been launched so far. Those are the Bahamas’ Sand Dollar, the Jamaican Jam-Dex and the eNaira in Nigeria. The website also lists 14 pilot projects, including China’s digital yuan. According to HRF, the digital yuan already has 300 million users.

Magazine: Are CBDCs kryptonite for crypto?