Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Source link

Rewards

Stepn Rewards Move-to-Earn Users With $30 Million in FSL Points Airdrop

On Wednesday, the Web3 fitness and move-to-earn platform Stepn unveiled a $30 million airdrop campaign, offering participants the chance to earn FSL points that can be exchanged for GMT tokens. Stepn Reveals $30M Airdrop, Precedes Big Brand Collaboration The Solana-based Stepn has begun the allocation of 100 million FSL points among its users, which they […]

On Wednesday, the Web3 fitness and move-to-earn platform Stepn unveiled a $30 million airdrop campaign, offering participants the chance to earn FSL points that can be exchanged for GMT tokens. Stepn Reveals $30M Airdrop, Precedes Big Brand Collaboration The Solana-based Stepn has begun the allocation of 100 million FSL points among its users, which they […]

Source link

Blockchain-Based Loyalty Rewards Foster Brand-Customer Connection, Accelerate Web3 Adoption — Gennady Volchek

Universal loyalty programs can serve as potent tools, not only forging a direct link between a brand and its consumers but also influencing the latter’s shopping behaviour, Gennady Volchek, the CEO of the loyalty rewards app Shping, has said. However, by harnessing the power of blockchain and cryptocurrency, these loyalty programs empower brands to connect […]

Universal loyalty programs can serve as potent tools, not only forging a direct link between a brand and its consumers but also influencing the latter’s shopping behaviour, Gennady Volchek, the CEO of the loyalty rewards app Shping, has said. However, by harnessing the power of blockchain and cryptocurrency, these loyalty programs empower brands to connect […]

Source link

Bitcoin miners to get instant non-custodial rewards via Lightning Network

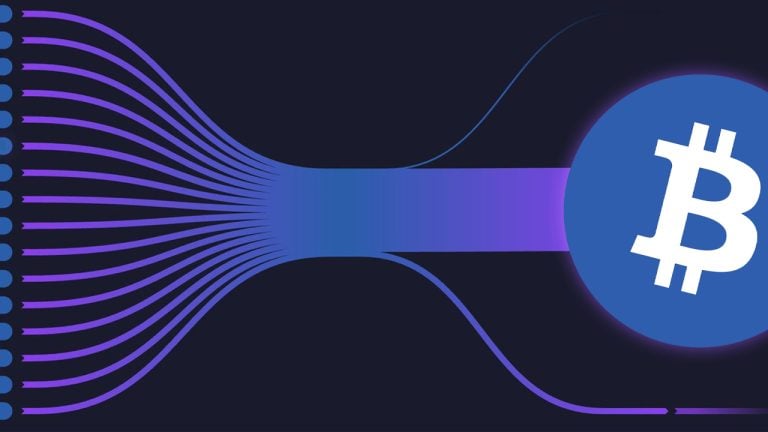

Enterprise Bitcoin mining pool company Titan Mining has announced Titan Lightning, intending to transform how Bitcoin miners receive rewards by empowering miners with near-instant access to their earnings.

Using the Lightning Network, Titan Lightning facilitates direct on-chain disbursement of rewards to miners’ non-custodial wallets after every new block discovery on the Bitcoin network. This departs significantly from delayed payouts associated with custodial mining pools.

Titan Mining CEO Ryan Condron explained, “At Titan, we believe in empowering miners worldwide. The Titan Lightning solution offers immediate access to mining rewards, enhancing liquidity and putting control back in the hands of miners.” The integration of the Lightning Network allows miners to receive block rewards every ten minutes with no minimum payout.

Further, Titan Lightning’s integration with the Lumerin Hashpower Marketplace aims to democratize access to Bitcoin mining. Founded by the same team as Titan Mining, Lumerin provides a peer-to-peer platform for trading mining capacity, meaning non-miners can also participate and experience the potential benefits of accelerated Bitcoin payouts. As Lumerin reported, this development positions Bitcoin mining hash power as a unique, real-world asset for global on-chain exchange.

The Titan Lightning mining pool and Lumerin integration present a novel application of Bitcoin hash power, which Titan describes as

“Bitcoin now” is more valuable than “Bitcoin later.”

Miners will now be able to receive payment “near-instantly as soon as a new block is recorded on the Bitcoin blockchain.” As the Bitcoin halving draws near, focus and interest in Bitcoin mining will likely increase as it does each cycle. While ASIC miners are still in short supply, the ability to participate in hash power marketplaces and use Lightning payments is a fascinating concept for new users to explore.

The post Bitcoin miners to get instant non-custodial rewards via Lightning Network appeared first on CryptoSlate.

Bitcoin’s recent surge past $34,000 has been a significant event in the cryptocurrency market. Monitoring miner behavior and metrics is paramount when analyzing the Bitcoin market, as miners play a foundational role in network security, transaction validation, and new Bitcoin issuance. Their actions and decisions can offer insights into market trends, future price movements, and overall network health.

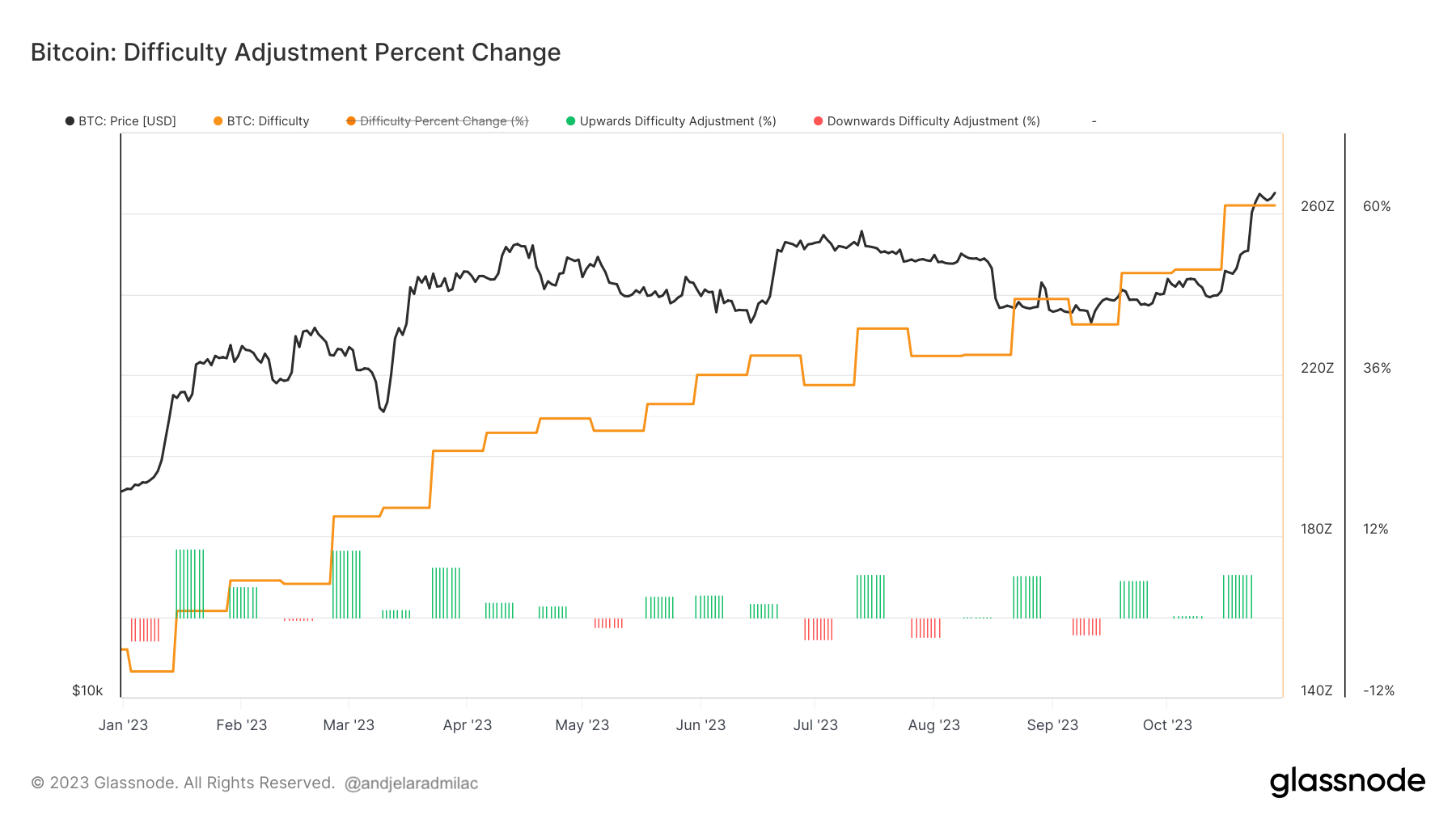

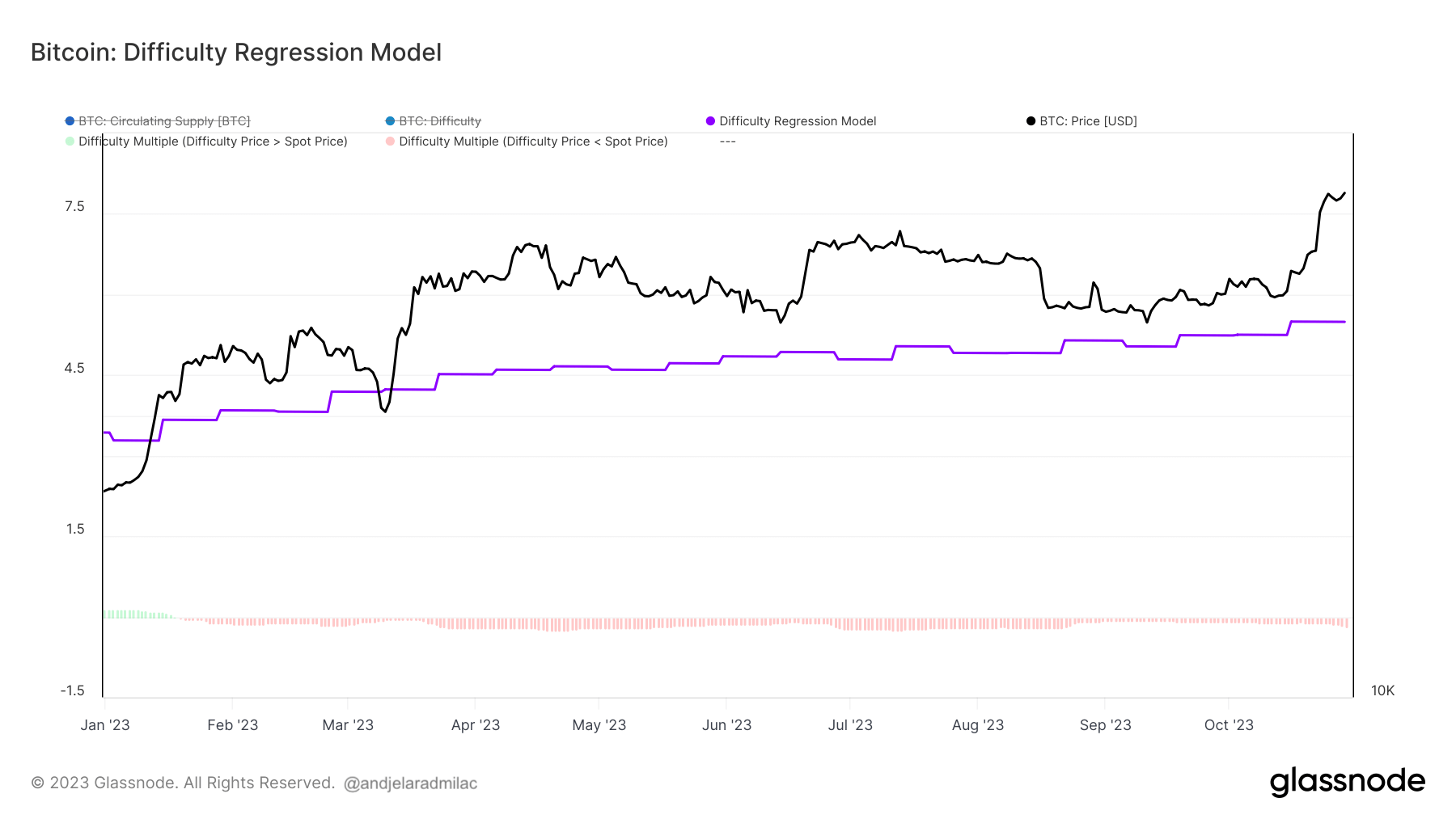

Between October 15 and 16, the mining difficulty of Bitcoin increased by 6.47%. This adjustment, which occurred as Bitcoin surpassed $28,000, reflects the network’s self-regulating mechanism to maintain consistent block times. As the price rose, it’s likely more miners were incentivized to join the network, escalating the competition. Consequently, while the increased price means rewards in USD value are higher, the intensified competition might make obtaining Bitcoin slightly more challenging.

The difficulty regression model provides further clarity on the mining landscape. It represents the estimated cost of producing a Bitcoin. On October 15, this cost was $24,370, which modestly increased to $25,169 by October 29. This metric is crucial as it offers an understanding of the profitability landscape for miners. The growing disparity between the production cost and market price suggests a favorable profit margin, which could in turn, draw more participants to mining, augmenting the network’s overall security.

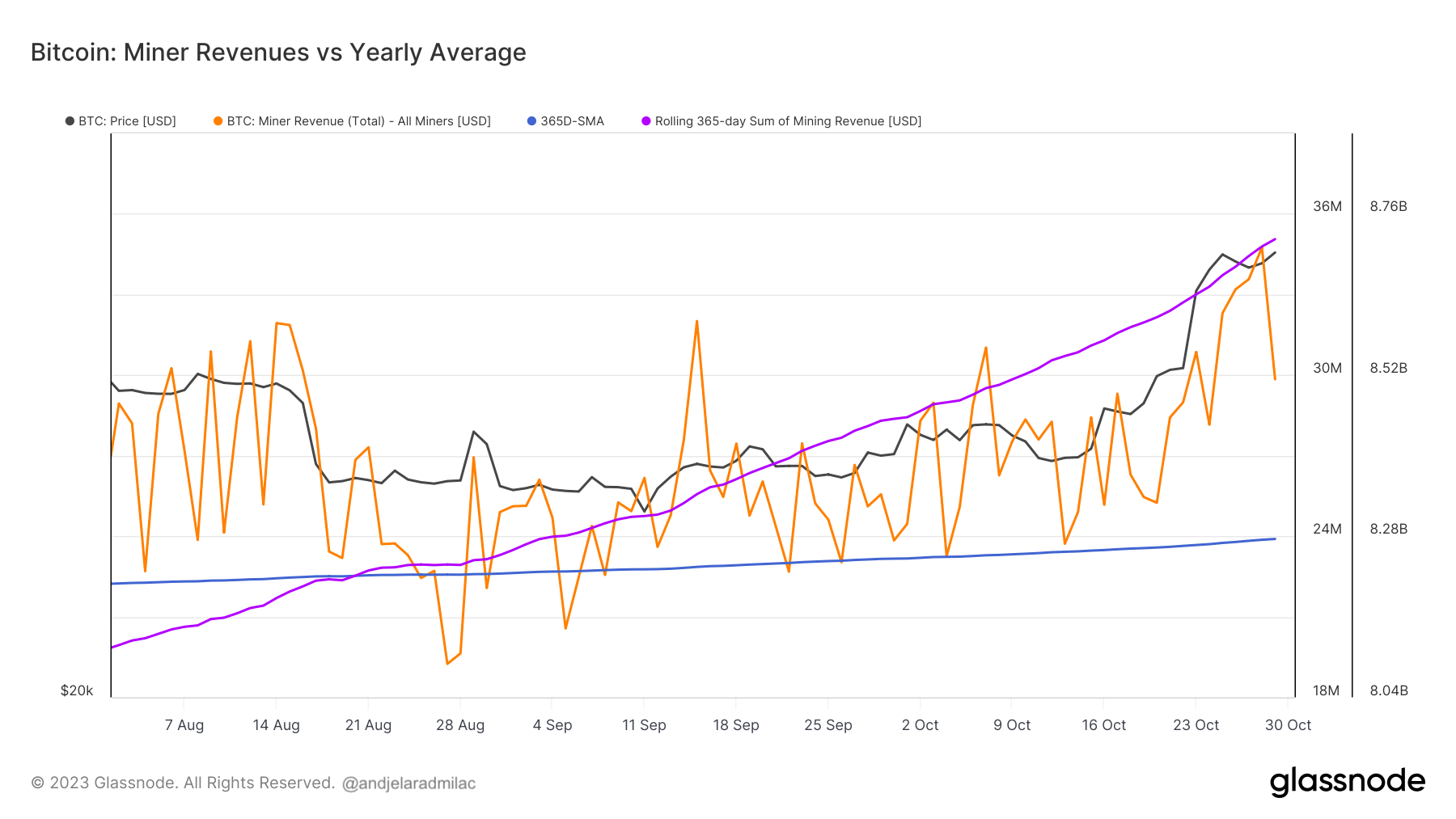

Miner revenue, another pivotal metric, underwent a significant change in October. As Bitcoin’s price escalated, so did the revenue for miners. The 365-day rolling sum of miner revenue, a comprehensive measure of their annual earnings, surpassed its 365-day simple moving average on September 9, and by October 29, it stood at a substantial $8.7 billion. This indicates a consistent and robust revenue stream for miners, which can be interpreted as a period of heightened activity and profitability.

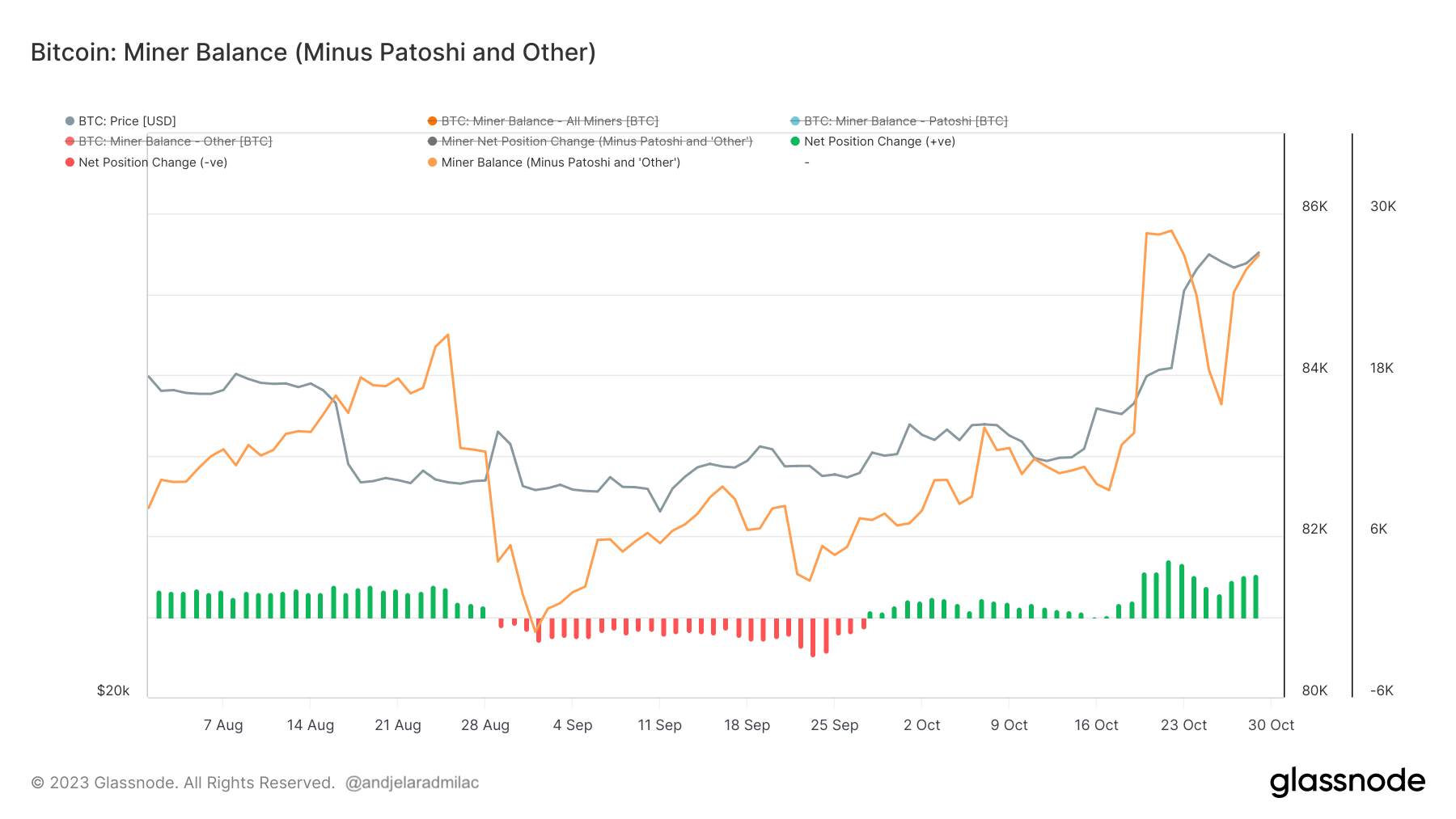

Lastly, the miner balance metric offers a window into miner sentiment and strategy. Excluding the Patoshi pattern, the balance rose from 82,800 BTC on October 15 to 85,500 BTC by October 23. Interestingly, after Bitcoin’s price exceeded $30,000, there was a decrease of around 2,000 BTC in this balance, suggesting some miners capitalized on the high prices. However, subsequent accumulation indicates a potential long-term bullish sentiment among miners, as they seem to anticipate further price appreciation.

In conclusion, when analyzed collectively, these metrics hint at a dynamic yet profitable environment for Bitcoin miners. The increased difficulty signifies a secure and robust network, the rising production cost against a surging market price indicates healthy profitability, the elevated revenue underscores sustained miner activity, and the evolving balances suggest strategic decision-making among miners. All these factors, taken together, reflect a market that is both competitive and optimistic.

The post Bitcoin miners navigate increasing difficulty for higher rewards appeared first on CryptoSlate.

DYdX to unlock 6.52M tokens worth $14M for community treasury, rewards

Decentralized exchange (DEX) platform dYdX will unlock $14.02 million worth of its native DYDK tokens to be allocated to its community treasury and rewards for traders and liquidity providers.

On Aug. 29, dYdX will release 6.52 million tokens, representing 3.76% of the DYDX circulating supply. Out of the lot, 2.49 million DYDX tokens — worth $5.36 million — will be allocated to the community treasury. The treasury funds contributor grants, community initiatives and liquidity mining, among other programs.

The remaining 4.03 million DYDX tokens will be split between liquidity provider rewards (1.15 million tokens worth $2.47 million) and trading rewards (2.88 million tokens worth $6.18 million).

DYdX conducted an identical unlock event on Aug. 1 with the same allocation of funds. Data on dYdX’s full allocation from TokenUnlocks suggests that investors hold the highest allocation at 27.7%, followed by trading rewards and community treasury at 20.2% and 16.2%, respectively.

DYDX has a maximum supply of 1 billion tokens, and over 75% are locked, as shown above.

Related: dYdX exchange launches testnet for ‘fully decentralized’ version 4

DYdX founder Antonio Juliano recently recommended crypto entrepreneurs explore markets outside the United States.

Crypto is aligned with American values. What could be more American & capitalist than a financial system of the people, by the people, and for the people

That is literally what we’re building here. America will realize that eventually

— Antonio | dYdX (@AntonioMJuliano) August 25, 2023

Juliano emphasized that crypto startups could scale faster overseas in friendlier markets:

“Crypto builders should just give up serving US customers for now and try to re-enter in 5-10 years. It’s not really worth the hassle/compromises. Most of the market is overseas anyways. Innovate there, find PMF [product market fit], then come back with more leverage.”

As the U.S. government continues to drag its heels on establishing crypto regulation, Juliano suggested that the crypto sector needs to grow further to have more sway over U.S. policy.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

The team behind the Sui network and its native SUI token has denied allegations that they unlocked SUI staking rewards and “dumped” them on cryptocurrency exchange Binance .

The Sui Foundation knocked back the claim in a five-part Twitter thread on June 27, stating that none of the locked or non-circulating tokens, including SUI staking rewards, had been sold:

“Sui Foundation has not sold staking rewards or any other tokens from locked and non-circulating staked SUI on Binance or otherwise.”

“All insider token allocations remain subject to and compliant with their lock ups and other restrictions on transfer,” the foundation added.

The purpose of this communication is to share information regarding the tokenomics of the Sui Network including the SUI token supply and certain distributions of SUI tokens. Here’s what you need to know:

— Sui Foundation (@SuiFoundation) June 27, 2023

Sui is a decentralized proof-of-stake blockchain. Users can stake their Sui tokens to participate in its proof-of-stake mechanism in exchange for more SUI. No minimum staking period is required.

Sui’s recent denial was in response to claims by pseudonymous crypto commentator DeFiSquared in a June 27 Twitter thread, where they accused the Sui Foundation of “dumping rewards from *locked* and *non-circulating* staked SUI” on Binance.

Exclusive new research on SUI:

Intentionally misrepresented emissions and proof the team themselves are dumping rewards from *locked* and *non-circulating* staked SUI onto Binance. (1/12) pic.twitter.com/jYRyeTFY56

— DeFi^2 (@DefiSquared) June 27, 2023

While Sui said the specific transactions were subject to a “contractual lockup,” DeFi Squared said the SUI tokens could be unlocked “without restriction.”

The DeFi-focused pundit claimed that Sui Foundation’s wallet address “0x341f” transferred 3.125 million of the total 27 million SUI in staking rewards to three separate addresses, which were then transferred to Binance.

The specific transaction referenced was a payment subject to a contractual lockup.https://t.co/ViYxQoJMos

— Sui Foundation (@SuiFoundation) June 27, 2023

DeFi Squared claimed this process occurred many times before “most of it” ended up on Binance:

“While the amounts are split many times, most of it ends up at Binance eventually. This could either be to obfuscate the selling, or perhaps because it is being split between different team members. But regardless, most of it is reaching Binance in the end.”

Related: Over $204M was lost in Q2 DeFi hacks and scams: Report

The commentator said their “curiosity was piqued” in May by SUI’s “seemingly endless sell pressure” while failing to publish an emissions chart separate from Binance’s launchpad, which supposedly wasn’t legitimate. Notably, they claimed the foundation is inflating the supply of the SUI token by roughly 20% month-on-month for non-foundation token holders:

“This is higher than the inflation rate of the hyperinflating Venezuelan Bolivar in 2022.”

Sui’s blockchain is designed to offer users high transaction throughput at low fees, according to Mysten Labs, the creators of the Sui Foundation.

The SUI token currently has a market cap of $427.7 million, from a circulating supply of about 604 million tokens, according to CoinMarketCap. SUI is trading for $0.70 at the time of publication, down 2.4% in the past 24 hours.

The Sui Foundation said it will publish a “detailed projection” of the token release schedule soon.

The next unlock of 61 million tokens ($43 million) is scheduled for June 3, according to tokenomics dashboard Token Unlocks.

Magazine: Web3 Gamer: District 9 director’s shooter, Decentraland red-light district battle

Not having a rewards credit card is a waste of a good credit score, but owning a rewards credit card without maximizing your points is just as wasteful.

There are plenty of ways to collect extra points, miles, and cash back without spending extra money. Follow these simple credit card tricks, and you could be adding a zero or two to your points balance in no time.

Image source: Getty Images.

Couple up your credit cards

Maybe your credit card offers extra points on travel spending, and the issuer has another card that offers extra points on groceries and gas. Consider getting a second card and switching them up depending on what you’re purchasing in order to maximize rewards.

Transfer unused points

If you have a few thousand points sitting around in a rewards account you no longer use, you might be able to transfer those points to the rewards account you’re currently using. Check your rewards program’s point transfer policies and partnerships.

Put home improvements on the card

Planning on renovating the kitchen or adding a spare bedroom? Put those expenses on your rewards credit card, as long as you aren’t charged a fee to do so.

Add an authorized user

This one requires a judgment call on your part. Adding someone as an authorized user makes you responsible for any debt they accumulate and fail to repay. It also means that any mistake you make, such as a late payment, will show up on their credit report, affecting their credit score. However, if you’re sure you can trust each other, many credit cards give you extra bonus points — usually around 5,000 — for adding an authorized user who makes a purchase in the first few months. Plus, if that authorized user adds additional expenses to your card, the points they accumulate are added to your account.

Pay your mortgage or rent with a credit card

Services like RadPad and Plastiq let you pay your rent with a credit card. Your landlord doesn’t even have to sign up; these websites send a rent check to your landlord on your behalf. Unless you find a promotion, it will cost you a 2%-3% transaction fee. This means you’re paying 2 to 3 cents per $1, so you need to be getting back more than 2%-3% in rewards to profit. If you’re trying to hit a minimum spend requirement to get the sign-up bonus on a credit card offer, the 2%-3% fee is almost always worth it.

Pay tuition with a credit card

If you’re covering tuition for your kid, you might as well get a reward for all the money you’re spending. Most colleges now allow you to pay tuition with a credit card, although many charge a fee. If you’re lucky and the college you pay doesn’t charge a fee for credit card transactions, charge away. Just make sure you have the funds to pay off your credit card immediately.

Pay your taxes with a credit card

As of 2018, the fee for paying any taxes you owe the federal government is 1.87% to 2%. That means this option is only worth it if you’re getting more than 2% back, which can be in the form of high value points or a good cash-back credit card. If you’re trying to meet a minimum spend requirement for a sign-up bonus, this option has lower fees than paying your rent online.

File a complaint

Did you recently experience an inconvenience with the airline or hotel chain you’re trying to earn points for? Whether your flight was seriously delayed or your room was overbooked, complaining to the company will often result in them depositing a generous amount of miles or points into your account in exchange for your forgiveness.

Buy gift cards

Buying gift cards for places where you know you’ll shop is an effective way to hit a minimum spend requirement. This can also be a good way to get extra cash back. For example, if your credit card offers 5% cash back on groceries, then buying restaurant or department stores gift cards at your local grocery store may let you get 5% cash back on purchases that aren’t part of your bonus category.

Close your credit card — and then reapply

Some credit cards only allow you to get a sign-up bonus once in a lifetime. However, other offers simply state that you cannot earn the sign-up bonus if you’ve already earned it once within the past 24 months. So, if you’ve had your rewards credit card for more than two years, you may be eligible to get the sign-up bonus again by closing it and reapplying. Just read the terms of the sign-up bonus carefully to make sure that you qualify. Also be aware that closing a credit account may ding your credit score by lowering your average account age.

Redeem your rewards wisely

Accumulating points quickly is only half of the process. In order to get the most out of your rewards, you have to redeem them wisely as well.

To choose what you want to redeem your points for, calculate how much you’d typically spend on your award redemption and divide that by the number of points it costs — that’s the value of each point, and you should aim for at least 1.5 cents. Redeeming points for products on a marketplace or for cash will typically get you the lowest value per point, while redeeming them for travel rewards like flights and hotels tends to get you the highest value.

Remember to weigh the costs of these methods with your potential rewards. After all, it’s never worth it to spend more than you earn. It’s also not worth charging more than you can afford to multiply your rewards, as credit card interest rates will surely cancel out any benefit. Whatever you do to earn points faster, don’t let it get you into debt.