“When one friend made a fuss over wanting to fly business class, I threatened to cancel completely.”

Source link

Rich

Rich Dad Poor Dad Author Robert Kiyosaki Believes Bitcoin Price Will Reach $2.3 Million

Rich Dad Poor Dad author Robert Kiyosaki says he believes that the price of bitcoin will reach $2.3 million, citing a prediction by Ark Invest CEO Cathie Wood. Meanwhile, he said stock, bond, and real estate markets are “set to crash,” and he expects the U.S. to go bankrupt. Robert Kiyosaki Foresees Bitcoin Hitting $2.3 […]

Rich Dad Poor Dad author Robert Kiyosaki says he believes that the price of bitcoin will reach $2.3 million, citing a prediction by Ark Invest CEO Cathie Wood. Meanwhile, he said stock, bond, and real estate markets are “set to crash,” and he expects the U.S. to go bankrupt. Robert Kiyosaki Foresees Bitcoin Hitting $2.3 […]

Source link

Composable Data Assists Dapp Developers in Unlocking Rich Data Applications – Swaroop Hegde

Composable data, a flexible and modular approach in the field of data analytics, benefits decentralized application (dapp) developers constrained by the limitations of current data protocols. Swaroop Hegde, co-founder of Powerloom, explains that composable data maintains a decentralized database of data points verified through a consensus mechanism. Clean Insights Versus Actionable Intelligence Hegde, a thought […]

Composable data, a flexible and modular approach in the field of data analytics, benefits decentralized application (dapp) developers constrained by the limitations of current data protocols. Swaroop Hegde, co-founder of Powerloom, explains that composable data maintains a decentralized database of data points verified through a consensus mechanism. Clean Insights Versus Actionable Intelligence Hegde, a thought […]

Source link

A hypothetical stock portfolio has taken hands-off investing to a whole new level.

Jeffrey Ptak, a chartered financial analyst (CFA) for Morningstar, recently devised a passive investment portfolio that’s based on the composition of the S&P 500. But instead of replacing stocks with new companies as they’re delisted from the index, Ptak’s strategy takes an alternative approach: it does nothing.

A financial advisor can help you select investments aligned with your financial goals. Find a fiduciary advisor today.

This laissez-faire approach to investing produced some compelling hypothetical returns: the portfolio would have beaten the S&P 500 by 5.6% during the 30-year period of March 1993 to March 2023. Here’s how it works, as well as some important lessons you can take from it.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

About the Do Nothing Portfolio

Appropriately, Ptak has dubbed this super-passive approach the “Do Nothing Portfolio.” The strategy started with a simple hypothetical: “Imagine you bought a basket of stocks 10 years ago and then you didn’t trade them, not even to rebalance,” he wrote on Morningstar.com. “You just let ’em sit. How would you have done?”

To find out, Ptak compiled the S&P 500’s holdings as of March 31, 2013, and then calculated each stock’s monthly returns going back 10 years. Over 100 of those holdings were no longer in the index 10 years later, many of which were acquired by other companies, according to Ptak. What was left at the end of the 10 years was a portfolio of surviving stocks and cash that had built up over the years following company acquisitions.

The Do Nothing Portfolio would have generated a 12.2% annual return during those 10 years – practically identical to the S&P 500’s return during that time. That caught Ptak’s attention, considering 5.5% of the Do Nothing Portfolio’s assets were cash. By comparison, the S&P 500 was fully invested. The Do Nothing Portfolio was also less volatile during that period and produced better risk-adjusted returns than the index, Ptak wrote.

Ptak took his experiment several steps further and tested the Do Nothing Portfolio in two other non-overlapping 10-year periods – March 31, 1993 to March 31, 2003, and March 31, 2003 to March 31, 2013. The portfolio beat the index by nearly one percentage point during the first 10-year stretch and nearly matched it in the second, all while offering better risk-adjusted returns.

In total, the Do Nothing Portfolio would have outperformed the index over the full 30-year period and been less volatile. For example, Ptak found that $10,000 invested in the Do Nothing Portfolio at the end of March 1993 would have grown to $172,278 within 30 years, while the same investment in the S&P 500 would have been worth $163,186.

How could this hands-off approach produce such impressive returns compared to the S&P 500? Ptack surmised that the Do Nothing Portfolio’s cash position – which would have grown over the years – would have helped an investor weather the stock sell-offs of 2000 and 2008. Since stocks were not replaced when they were delisted over that 30-year stretch, the Do Nothing Portfolio would have also been more heavily concentrated in winning stocks like Apple.

“What looks to have made the difference is the way the portfolio let its winners run and refrained from entering new positions,” Ptak wrote. “Because the Do Nothing Portfolio doesn’t have to immediately make room for new index additions, such as Tesla (TSLA) and Meta Platforms (META), or replace names that have left the portfolio (through delisting), it gives stocks like Apple the ability to run further than they otherwise could. This can be a competitive advantage, as larger institutions, like mutual funds, lack the same ability to concentrate to this extent.”

Lessons from the Do Nothing Portfolio

You may not scrap your investment plan altogether in favor of this novel strategy, but there are several lessons Ptak says can be learned from the experiment.

Let winners run. Ptak acknowledges this won’t suit all investors, especially those who are uncomfortable with concentrated portfolios, but a large part of the Do Nothing Portfolio’s success can be attributed to the dominance of its top 10 holdings, especially Apple.

You don’t need to be fully invested all of the time. Instead of rushing to replace delisted stocks with newcomers, the Do Nothing Portfolio lets cash build slowly over the years. As Ptak notes, “the fewer decisions we have to make, the better.” The cash acts as a ballast for a portfolio that is more concentrated in its top stocks than the S&P 500 would be otherwise.

Don’t try to intuit your way to portfolio growth. “The responsible voice in our head tells us that a strategy of doing nothing can’t possibly work,” Ptak concluded. “Yet, markets repeatedly upend our expectations, which we often form by attempting to decode recent events and their future implications.” Instead, opt for “patience and humility” over “action and good intentions,” he says.

Bottom Line

Morninstar’s Jeffrey Ptak recently conducted an interesting experiment, in which he explored how an investor would fare if they bought a basket of stocks and then refrained from any further buying or selling. Ptack found that this hypothetical Do Nothing Portfolio would have performed quite well during recent 10-year periods and outperformed the S&P 500 between March 1993 and March 2023. By slowly amassing cash, not replacing delisted stocks and letting winners run, the Do Nothing Portfolio would have been a winning strategy.

Investing Tips

-

While the Do Nothing Portfolio doesn’t need to be rebalanced, your investment strategy may benefit from periodic rebalancing. SmartAsset’s asset allocation calculator can help you determine how much of your portfolio should be in stocks, bonds and cash based on your risk tolerance.

-

A financial advisor can help you select investments and provide ongoing portfolio management for a fee. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/Chinnapong, ©iStock.com/John Kevin, ©iStock.com/hobo_018

The post How This ‘Do Nothing Portfolio’ Can Beat the S&P 500: Sit Back and Get Rich appeared first on SmartAsset Blog.

Joe Biden Wants to Tax the Rich to Save Social Security, but This Isn’t as Cut-and-Dried a Solution as You Might Think

For a majority of future retirees, Social Security will play a key role in their financial well-being. We know this because more than two decades of annual surveys from national pollster Gallup have shown that between 76% and 88% of non-retirees expect to rely on their Social Security benefit, in some capacity, to make ends meet during their golden years.

Although Social Security has been a guaranteed source of payouts for eligible retired workers since the first payouts began in January 1940, this all-important program is on ever-shakier financial footing.

Americans are looking to their elected officials in Washington, D.C. to shore up America’s top retirement program — and that begins at the top with President Joe Biden.

Social Security’s long-term funding shortfall has surpassed $22 trillion

For more than eight decades, the Social Security Board of Trustees has released an annual report that details the program’s current financial health, as well as makes assumptions about its financial outlook over the 10 years and 75 years (the long term) following the release of a report. These assumptions can be altered based on changes in fiscal and monetary policy, as well as demographic shifts.

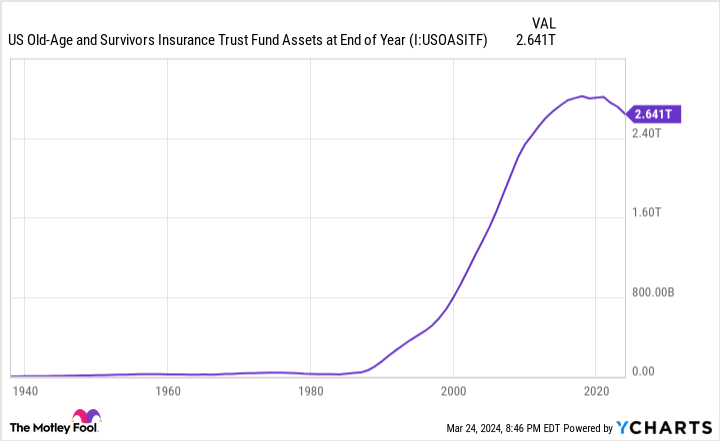

Every year since 1985, the Social Security Board of Trustees Report has cautioned that Social Security is facing a long-term funding shortfall. As of the 2023 report, the program’s estimated funding-obligation shortfall had ballooned to $22.4 trillion (through 2097).

To be clear, a funding shortfall doesn’t mean bankruptcy or insolvency. Rather, it means the existing payout schedule, including cost-of-living adjustments (COLA), isn’t sustainable.

The 2023 Trustees Report projects that the Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for doling out monthly benefits to more than 50 million retired workers and approximately 5.8 million survivors of deceased workers, could exhaust its asset reserves by 2033. Should the OASI’s asset reserves be depleted, sweeping benefit cuts of up to 23% may be needed to avoid any further reductions through 2097. By 2033, this would reduce the average annual take-home benefit for retired-worker beneficiaries by more than $6,600!

While social media message boards are littered with false claims that Congress has stolen from Social Security or that undocumented workers are receiving benefits, the reality is that Social Security’s cash shortfall boils down to ongoing demographic changes. Some of the more important shifts that are adversely impacting Social Security include:

-

A historically low U.S. birth rate, which threatens to further reduce the worker-to-beneficiary ratio for future generations.

-

Rising income inequality, with a greater percentage of earned income escaping the payroll tax.

-

A more-than-halving in net legal migration into the United States. Migrants entering the U.S. are usually younger and will spend decades in the workforce contributing to Social Security via the payroll tax.

Joe Biden’s four-point plan to “fix” Social Security relies on the wealthy “paying their fair share”

Now that you have a better understanding of why Social Security is in trouble, let’s take a closer look at the plan Joe Biden presented prior to being elected president in November 2020.

While on the campaign trail, Biden and his team unveiled a four-point proposal designed to strengthen Social Security. One of these points is critical to the plan’s success — and it’s something Biden emphasized during his recent State of the Union address.

1. Increase payroll taxation on the wealthy

The essential aspect to Joe Biden’s Social Security proposal is that the rich “pay their fair share.” This would be accomplished by increasing payroll taxation on the wealthy.

In 2024, all earned income — i.e., wages and salary but not investment income — between $0.01 and $168,600 is subject to Social Security’s 12.4% payroll tax. Approximately 94% of workers will generate less than $168,600 in earned income this year. Meanwhile, the other 6% of workers will have their earned income above $168,600 exempted from Social Security’s payroll tax.

Biden’s approach would see the payroll tax reinstated on earned income above $400,000, with a doughnut hole created between the maximum taxable-earnings cap (the $168,600 figure) and $400,000 where earnings would remain exempt from the payroll tax. The key is that the maximum taxable-earnings cap rises on par with the National Average Wage Index over time. Thus, over a couple of decades, this doughnut hole would close and expose all earned income to the payroll tax.

2. Shift Social Security’s inflationary tether from the CPI-W to the CPI-E

In addition to raising revenue by reinstating the payroll tax on well-to-do workers, Biden’s plan involves lifting benefits for those who need it most. This would begin by shifting Social Security’s inflationary tether from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to the Consumer Price Index for the Elderly (CPI-E).

Although the CPI-W has been Social Security’s COLA-determining tool since 1975, it hasn’t done a particularly good job. That’s because it’s tracking the spending habits of “urban wage earners and clerical workers,” many of whom are younger and not receiving a Social Security benefit at the moment.

The CPI-E would strictly focus on the spending habits of households with persons aged 62 and above, which would be expected to result in more accurate (and higher) annual COLAs.

3. Boost the special minimum benefit above the federal poverty level

The third piece of the puzzle is lifting the special minimum benefit. In 2024, a lifetime low-earning worker with 30 years of coverage can expect to receive no more than $1,066.50 per month. That’s notably below the federal poverty level for a single filer of $1,255 per month this year.

Biden’s plan calls for an increase to the special minimum benefit to 125% of the federal poverty level, with inflationary adjustments made in subsequent years.

4. Gradually lift the primary insurance amount for aged beneficiaries

Last but not least, then-candidate Joe Biden called for a gradual increase to the primary insurance amount (PIA) for older beneficiaries. The PIA would be stepped up by 1% annually, beginning at age 78 and continuing through age 82, until a 5% aggregate increase is realized.

The purpose for this increase is to help offset higher expenses as we age. For instance, prescription medicine costs and medical transportation expenses can rise as we get older.

Joe Biden’s Social Security solution would come up short in more ways than one

On paper, the president’s proposal appears to make sense. Raising revenue from taxing the wealthy would help offset the immediate cash crunch the OASI is facing. At the same time, some of the revenue raised from taxing the rich can be repurposed to helping the beneficiaries who need it most.

However, a deeper dive into Biden’s Social Security proposal by researchers and economists reveals that it isn’t as cut-and-dried as you might think.

In October 2020, three researchers at Washington, D.C.- based think tank Urban Institute analyzed Biden’s proposal and came to a clear conclusion. While it does extend the solvency of the OASI’s asset reserves, it doesn’t come anywhere close to resolving Social Security’s long-term funding-obligation shortfall. As the publication notes:

We project that by extending the Social Security payroll tax to earnings above $400,000, his plan would close about a quarter of the program’s long-term funding deficit and extend the life of the trust funds [the OASI and Disability Insurance Trust Fund on a combined basis] by about five years.

Though taxing the wealthy has the potential to push the OASI’s asset-reserve exhaustion date decades into the future, Biden’s plan to repurpose most of this raised capital to increase the special-minimum benefit, lift the PIA for aged beneficiaries, and increase COLAs for all beneficiaries by switching to the CPI-E offsets much of what would be gained.

In a separate study conducted in March 2020, economists at the Penn Wharton Budget Model (PWBM) found additional concerns with Joe Biden’s Social Security proposal. While it would help “reduce the conventionally measured long-range imbalance by 1.5 percent of taxable payroll,” PWBM’s economists note that Biden’s plan leads to adverse consequences for the U.S. economy. Specifically, it would lower estimated U.S. gross domestic product (GDP) by 0.6% in 2030 and 0.8% by 2050.

The first issue raised by PWBM is that the broad-based increase in COLAs caused by the shift to the CPI-E would coerce workers with adequate retirement savings to work less and/or retire earlier. This means less productivity for the U.S. economy and therefore reduced GDP.

The second issue raised by PWBM’s economists is that raising the payroll tax on the wealthy would “distort labor supply decisions by more than the current payroll tax.”

While workers don’t get back the same dollar they put into Social Security, there exists the perception of a “contribution-benefit” link. In other words, if a worker has to pay more into the system, there’s the expectation that their payout will be greater during retirement. Biden’s plan disrupts this perception and would coerce the wealthy to work less, defer their income, or seek out ways to generate income that wouldn’t be subject to the payroll tax.

Although Biden’s Social Security proposal would, indeed, strengthen Social Security by extending the solvency period of the OASI’s asset reserves, it comes up short in a variety of other aspects.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets”

The Motley Fool has a disclosure policy.

Joe Biden Wants to Tax the Rich to Save Social Security, but This Isn’t as Cut-and-Dried a Solution as You Might Think was originally published by The Motley Fool

Robert Kiyosaki, ‘Rich Dad Poor Dad’ Author, Says, ‘I Am a Billionaire in Debt’ — And Calls Dave Ramsey An Idiot For Encouraging People To Live Debt-Free

Robert Kiyosaki, the author renowned for his best-selling book “Rich Dad Poor Dad,” has again captured the public’s attention with his unconventional financial strategies, this time revealing a staggering $1.2 billion in debt. The revelation follows a statement he made in September 2022 via a YouTube short, where he disclosed being $1 billion in debt at the time, accompanied by the caption, “The reason I’m so rich is because I’m in debt.”

In the YouTube video, Kiyosaki explains his financial status, saying, “If you understand history, the reason I pay no taxes is because I borrow money. I’m a debtor.”

He directly addresses his critics and those with contrasting economic ideologies, saying, “And check this out … I mean all you communists out there, check this stuff out … I am a billionaire in debt. You know why? Because I get tax breaks for borrowing money.”

Don’t Miss:

Kiyosaki’s approach to wealth and debt contrasts with more traditional financial advice. He believes that leveraging debt is a key driver of his wealth because of the tax advantages it provides.

Kiyosaki goes on to critique the common financial advice of living debt-free, as popularized by financial expert Dave Ramsey, saying, “And my friend Dave Ramsey says ‘live debt free.’ Well, you’re an idiot. I mean he’s my friend, but I say ‘Dave, I like debt.’”

He acknowledges Ramsey’s caution toward debt saying, “I know but most people can’t handle debt.” This admission highlights a critical divide in financial philosophy — while Kiyosaki sees debt as a tool for wealth accumulation, he concedes that not everyone possesses the financial acumen to manage it effectively.

Kiyosaki’s commentary extends beyond personal finance to critique the broader educational system, arguing, “But that’s why there is no financial education in schools because if you knew how to handle debt you wouldn’t save that crappy dollar you have in your hand. I’d rather borrow the money tax-free.”

Through this statement, he advocates for a more nuanced understanding of debt and finance, suggesting that conventional wisdom on saving and debt avoidance may be limiting for those looking to maximize their financial potential.

The author’s financial strategy capitalizes on the tax benefits associated with borrowing in the United States. The principle at work here is that interest payments on debt, especially when used for investment purposes, can be tax-deductible. This means that the costs of borrowing can effectively reduce the amount of taxable income an individual or entity reports, lowering their overall tax liability.

In the context of Kiyosaki’s investments, particularly in real estate, borrowing money to finance these investments allows him to deduct the interest paid on the debt from his taxable income. This deduction is a significant factor in why he says, “The reason I pay no taxes is because I borrow money.” The tax code in the United States offers provisions that incentivize investment and business activities by allowing deductions for various expenses, including interest on loans that finance productive activities.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Robert Kiyosaki, ‘Rich Dad Poor Dad’ Author, Says, ‘I Am a Billionaire in Debt’ — And Calls Dave Ramsey An Idiot For Encouraging People To Live Debt-Free originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here’s How You Can Tell If You’ve Gone From ‘Middle Class’ To ‘Rich’ – It’s About More Than Just Your Bank Account And Salary

Transitioning from the middle class to a wealthier status involves more than just an increase in income; it encompasses a broad range of financial behaviors, assets and mindsets. Key indicators of this transition include diversifying income streams beyond a primary job, such as through rental income; dividends from investments; or side business profits. This diversification strategy is crucial for building wealth and suggests a move toward financial independence.

Investing In Long-term Assets For Financial Growth

Investing in assets like real estate or stocks that consistently contribute to your income signifies a departure from middle-class financial limitations. The reduction or absence of debt, coupled with the growth of assets that generate passive income, marks a significant step towards accumulating wealth. This transition is often evidenced by a substantial increase in net worth, sometimes reaching into the millions, as these assets grow over time.

Don’t Miss:

Net Worth As A Benchmark For Wealth

A net worth exceeding $2 million is frequently cited as a threshold for wealth, though this figure can vary based on individual circumstances and lifestyle choices. True wealth encompasses more than just a high income or substantial net worth; it includes financial freedom and the capacity to maintain a desired standard of living without compromising financial security.

Embracing Passive Income

Shifting towards passive income is a critical step for those moving from the middle class towards greater wealth. It involves creating income sources that do not require active daily effort, such as rental properties, dividends from investments or earnings from a business that does not demand constant hands-on management.

This strategy is not merely about augmenting your income; it’s a fundamental change in how you generate wealth, indicating a move towards financial independence. Passive income allows for the accumulation of wealth over time, offering a buffer that can lead to a more secure financial future and is indicative of a strategic approach to achieving long-term financial goals.

Entrepreneurship And The Creation of Wealth

Creating a successful business or venture that consistently generates income is a clear indication of moving towards greater wealth. This success is usually supported by consistent growth in savings and investments, underscoring the importance of a solid financial foundation and the strategic accumulation of wealth.

—

Trending: Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

—

The Role Of Professional Support In Wealth Management

Having a team of financial advisers, accountants and legal advisors is crucial for those transitioning from the middle class to richer statuses. These professionals provide strategies to optimize investments and minimize tax liabilities, facilitating greater wealth accumulation and offering guidance on navigating the complexities of financial growth.

Lifestyle And Mindset Shifts: Indicators Of Wealth

A significant change in lifestyle and mindset towards prioritizing financial success, viewing money and time from a different perspective and the ability to enjoy leisure without financial concern are hallmarks of this transition. Such shifts reflect a deeper, strategic approach to wealth management, focusing on long-term security over immediate gains.

Leveraging Tax-Efficient Strategies And Investments

Understanding and employing tax-efficient strategies, along with investments in additional real estate beyond a primary residence, showcase financial sophistication. Entrepreneurial initiatives and the creation of multiple income streams further signal a proactive approach to wealth building, demonstrating a comprehensive shift in managing and sustaining wealth.

Meeting Your Personal Goals

The journey from middle class to a wealth is marked by a series of strategic decisions and changes in financial behavior, asset management and mindset. This transition reflects not just an improvement in financial standing but a fundamental shift in the approach to accumulating and managing wealth, emphasizing the importance of diversification, investment and strategic planning in achieving financial independence and security.

Even if you’re not yet rich by societal standards, consulting with a financial adviser can be an important step in reaching your own personal financial goals. A financial adviser can provide tailored advice that aligns with your unique circumstances, aspirations and risk tolerance. Whether it’s building an emergency fund, planning for retirement, investing in the stock market or saving for a home, a financial adviser can help you navigate the complexities of financial planning, ensuring you’re on the right path to achieving your personal version of financial success.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Here’s How You Can Tell If You’ve Gone From ‘Middle Class’ To ‘Rich’ – It’s About More Than Just Your Bank Account And Salary originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Port of Fontvieille Harbor in the Principality of Monaco.

Education Images | Universal Images Group | Getty Images

The ultrawealthy are looking for a better lifestyle and strong investment when it comes to buying their next home, according to a new study.

One-quarter of American ultra-high-net individuals, or those worth $30 million or more, plan to buy a residential property this year, according to the Douglas Elliman and Knight Frank Wealth Report. The average ultra-high-net-worth individual already owns four homes, according to the report. One-quarter of their residential portfolio is outside their home country.

When it comes to priorities for their next big purchase, the ultrawealthy ranked “lifestyle” and “investment” at the top of the list, followed by taxes and safety.

Sign up to receive future editions of CNBC’s Inside Wealth newsletter with Robert Frank.

While luxury real estate has been buffeted by many of the same pressures as the rest of the market — low supply, slow sales, rising prices — the ultra-high-end has fared slightly better. Last year in the U.S., there were 34 sales over $50 million, down from 45 in 2022 but still way up from the pre-pandemic years.

With interest rates stabilizing and possibly falling this year, real estate experts say there are early signs that luxury supply may be growing, which could lead to more sales.

“If we do see a pivot to lower rates, or at least more confidence that inflation is going in the right direction, I think you will begin to see inventory building up again,” said Liam Bailey, partner and global head of research at Knight Frank.

The report forecasts that the best-performing U.S. luxury market this year for price growth will be Miami, with an expected increase of 4%, according to the report. New York ranked second in the U.S., with expected price growth of 2%, followed by Los Angeles with 1% growth.

Globally, the top market for luxury real estate is expected to be Auckland, New Zealand, with projected price growth of 10% in 2024. Mumbai ranks second, at 5.5%; followed by Dubai (5%); Madrid (5%); Sydney (5%); and Stockholm (4.5%).

Cars drive along a street in front of high-rise buildings in Dubai, on February 18, 2023. Dubai saw record real estate transactions in 2022, largely due to an influx of wealthy investors, especially from Russia.

Karim Sahib | Afp | Getty Images

Last year, the world’s top 100 luxury real estate markets posted a solid 3% gain on average price. The best-performing luxury real estate market in the world was Manila, Philippines, with 26% growth, fueled in part by investors fleeing Hong Kong and China. Dubai came in second place, at 16% price growth, followed by the Bahamas at 15% and the Algarve region in Portugal at 12%.

Among the worst performers last year were New York, with prices down 2%, and San Francisco, basically flat at 0.5%. The biggest decline in the world among prime markets was Oxford, in the U.K., down 8%.

Bailey said ultrawealthy American buyers are increasingly venturing overseas. He said U.S. buyers are now the leading foreign purchasers of ultraprime London properties — those priced above $10 million. They are also increasingly active in Europe.

“They’ve become quite a big presence, so much more noticeable now in Italy, France and Portugal particularly than they were,” Bailey said. “I think the American buyers have become much happier to explore and kind of think about alternatives.”

Still, $1 million doesn’t buy what it used to in the U.S. and abroad. In Monaco, the world’s most expensive real estate market, $1 million gets you 172 square feet of prime real estate, according to the Wealth Report. In Aspen, you get 215 square feet, while in Hong Kong, you get 237 square feet, which makes New York look like a bargain with 367 square feet.

Don’t miss these stories from CNBC PRO:

Dave Ramsey Tells Mark Cuban, ‘75% Of Wealthy People — Not Your Broke Brother-In-Law’ Say This Is How You Get Rich

You can only imagine the knowledge that’s shared when billionaire Mark Cuban and financial guru Dave Ramsey get together.

When the two sat down on “The Ramsey Show” in November 2022, the conversation quickly turned to credit card debt.

“If you use your credit cards, you do not want to be rich,” Cuban said. “That’s my favorite line; I tell it to people all the time.”

Both Cuban and Ramsey went on to explain the perils of credit card debt, with Cuban making it clear that the best place to invest is to pay off all of your credit cards and burn them.

Don’t Miss:

“Your credit card, you know what your return is,” he added. “If you’re paying 15%, 20% interest, if you pay that down, you just earned 15% or 20%.”

Despite the well-meaning advice, avoiding credit card debt is easier said than done. Many Americans rely on credit cards to make ends meet.

A recent update by the Federal Reserve Bank of New York notes that Americans, as a whole, have $1.3 trillion in credit card debt. Yes, that’s a trillion with a “T.”

And if that’s not scary enough, the average credit card balance of an American household is closing in on $8,000. Roughly 10 years ago, that number stood around $5,500.

Ramsey shared his 2 cents, explaining that the wealthiest people in North America understand the benefits of eliminating debt from their lives.

“The Forbes 400, the 400 wealthiest people in North America, when surveyed and asked what’s the way to build wealth, 75% of wealthy people — not your broke brother-in-law with an opinion — but wealthy people say, get out of debt and stay out of debt,” he said.

Trending: Around 50% of Americans Can’t Afford a $1000 Emergency- Will you make enough each month?

He went on to add that the reason for this approach is simple: Eliminating debt gives you power over your largest wealth-building tool, which is your income.

Consulting a financial adviser can provide additional guidance and support for those struggling with debt. Financial advisers offer personalized strategies to manage debt, create effective budgets and work toward long-term financial goals. They can help with everything from debt management to retirement planning.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Chris Bibey has written about personal finance and investment for the past 15 years in a variety of publications and for a variety of financial companies. He is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Bibey believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Tells Mark Cuban, ‘75% Of Wealthy People — Not Your Broke Brother-In-Law’ Say This Is How You Get Rich originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fraught with worry over high housing costs, impending student loan payments, and compounding credit card debt, millennials face financial challenges unlike other generations. Yet they’re still the generation that’s most money obsessed—and the one that wants to show it off.

While more than half of affluent millennials say they’ve been “greatly affected” by the cost-of-living crisis, 59% feel it is important to “look or appear” financially successful to others, according to a recent Wells Fargo study. This is yet another sign of “money dysmorphia” (as Intuit Credit Karma dubs it), in which people obsess over the idea of being rich so much so, that they lose sight of the actual state of their finances.

What’s even more telling is that Wells Fargo’s study actually focuses on “affluent” millennials who make at least $250,000 a year, which means it’s not just lower-income young people who feel the need to keep up with the Joneses, so to speak. More than 40% of the approximately 1,000 respondents said it’s important to have visible signs of wealth, whether it be purchasing a fancy car, clothing, or place to live. By comparison, just 21% of Gen Xers, 8% of baby boomers, and 7% of the silent generation feel the same.

“Affluent millennials are, in fact, working hard and gaining financial success,” Emily Irwin, managing director of advice and planning for Wells Fargo, tells Fortune. “Yet they’re grappling with this external image, and as a result, there’s a growing trend to present themselves with an image that isn’t reflective [of] their actual financial situation. For some, it could be even be a ‘fake it until you make it’ mentality.”

Even some of the wealthiest millennials face money dysmorphia, and more than 40% of them have to rely on credit cards or loans to fund their lifestyle—all while accumulating debt, the Wells Fargo survey shows. The national average debt among credit card holders during the fourth quarter of 2023 was $6,864, according to LendingTree. And millennials are among the consumers struggling most with unpaid balances.

“Millennials have seen the largest increase in their delinquency rates and now have rates definitely above pre-pandemic levels,” New York Federal Reserve researchers said in a November 2023 press call. “Given the strong labor market and general economy, these increases are somewhat surprising.”

Social media fuels spending anxiety among millennials

But it’s not so surprising how much millennials spend when we look at how easily and how often they’re influenced by social media—whether in the form of advertisements or subtle (or not so subtle) nudges from influencers.

“We live in a hyper-sexualized, distracted, visually curated society now all narrowly tailored into the confines of the infinite scroll,” Christopher M. Naghibi, executive vice president and chief operating officer at First Foundation Bank, tells Fortune. “Endless pictures and videos … are put in the face of the viewer, and it is simply human nature to want to be as beautiful, well-traveled, and more than anything else—rich.”

And the data shows that affluent millennials are no different. Nearly 30% said that they buy things they can’t afford in order to impress others or “fit in” with a certain lifestyle, the Wells Fargo survey found—and another third reported lying or exaggerating about their finances to keep up appearances.

“For millennials, being the first generation on the internet means that ‘keeping up with the Joneses’ isn’t just having the best of something on your block or in your neighborhood, it’s feeling pressure to match the level of consumption of a much wider net of online influencers,” Jonathan Ernest, an associate professor of economics at Case Western Reserve University, tells Fortune. “This also means that millennials may perceive more benefit from owning luxury items, as they earn the admiration of not only their peers, but also their friends, family, and followers from a larger online presence.”

But Irwin warns this “charade” isn’t sustainable.

“It’s a vicious cycle because most people are reluctant to talk about their actual circumstances, and instead it’s the image of ‘I’m living my best life,’” Irwin says. “Now, it would be great if the trend would segue into: Share what you’ve done to be so financially responsible. How freeing it would be if everyone ‘put their cards on the table,’ and not receive judgment or embarrassment.”

Millennials aren’t letting inflation, debt, and student loans get in their way of a lavish lifestyle

Despite being a highly educated generation with staggering student loan debt, millennials look past these longer-term costs and instead choose to live in the moment, experts agree.

“Coupled with the fact that millennials as a whole may find more value in indulgences after putting in the work to become the most educated generation in American history, it’s understandable how a small splurge on a luxury item can seem an insignificant cost in the face of seemingly insurmountable student loan and housing costs,” Ernest says.

But in some cases, making expensive purchases like buying a home despite high mortgage rates could make sense for millennials because savings account yield rates have been relatively lower.

Millennials “may have rationalized that it may have made sense to stretch for a dream home versus allocating dollars to a savings account that wasn’t yielding a high interest rate,” Irwin says. “And it may make sense—assuming they’re setting aside funds for emergencies and not incurring revolving debt, like credit card debt.”

In terms of tips for fighting money dysmorphia, experts agree that thinking long-term about purchases can make a difference. Irwin says she challenges millennials to not indulge the “consumer fix” or “purchasing high” from buying something new, and others encourage millennials to take a look at long-term financial planning.

“Paying off high-interest loans, and thinking of the opportunity cost of spending a dollar today as the lost ability to earn interest on investments for tomorrow can help millennials reconsider whether that next luxury purchase is truly worth the cost,” Ernest says.

This story was originally featured on Fortune.com