The U.S. Securities and Exchange Commission (SEC) is seeking nearly $2 billion in fines from Ripple Labs in the ongoing XRP lawsuit. “There is absolutely no precedent for this,” exclaimed Ripple’s CEO regarding the $2 billion fine. “We will continue to expose the SEC for what they are when we respond to this.” SEC Wants […]

The U.S. Securities and Exchange Commission (SEC) is seeking nearly $2 billion in fines from Ripple Labs in the ongoing XRP lawsuit. “There is absolutely no precedent for this,” exclaimed Ripple’s CEO regarding the $2 billion fine. “We will continue to expose the SEC for what they are when we respond to this.” SEC Wants […]

Source link

Ripple

In the XRP lawsuit, the US Securities and Exchange Commission (SEC) filed its motion for remedies and entry of final judgment against Ripple, proposing a suite of penalties that includes injunctive relief, disgorgement of profits, and a notable $2 billion in civil penalties today. But that’s not the whole story as the 210-page document contains some interesting statements and assertions.

#XRPCommunity #SECGov v. #Ripple #XRP The @SECGov has filed its Motion for Remedies and Entry of Final Judgment, its Memorandum of Law in Support of that Motion, and its “Proposed” Judgment.

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) March 26, 2024

Did Ripple Favor Select Institutional Investors?

One of the assertions made in the SEC document and pointed out by XRP community lawyer Bill Morgan was a key revelation that Ripple engaged in discriminatory pricing practices, offering substantial discounts on XRP tokens to a select group of institutional investors. This practice, the SEC alleges, created an uneven playing field, benefiting certain “favored” investors at the expense of others.

XRP community lawyer Bill Morgan provided a summary of this aspect, highlighting the potential damage to Ripple’s standing in the eyes of institutional investors. “The SEC’s brief is a possible problem for Ripple beyond this case. The SEC is able to argue that there were two groups of institutional sales investors (it calls them favored and unfavored) and Ripple offered one group significant discounts in XRP price over the other group that did not receive them,” Morgan noted via X (formerly Twitter).

He further delved into the SEC’s claim that such practices harmed the “unfavored” group of investors to the tune of $480 million, a figure based on assumptions that Morgan suggests need thorough examination. “The evidence of causation of this alleged harm seems thin,” he added.

The SEC’s filing goes on to argue that Ripple’s sales tactics, specifically the discounted sales to certain investors, directly contributed to downward pressure on the overall market price of XRP. This point is not just a matter of regulatory compliance but also raises the specter of legal action from those institutional investors who may feel aggrieved by not being privy to the same discounts.

Morgan also touched upon the ramifications of these actions being classified as investment contracts by the SEC, saying, “As these sales to institutions were found to be investment contracts, it means that this offering of discounts to some but not other institutions is the very disclosure according to the SEC that should have, and would have been made to the institutions, if the sales to institutions had been registered.”

He further noted that these claims by the SEC are also not great for the reputation of Ripple. “Not sure this revelation is great for Ripple’s reputation with institutional investors,” Morgan remarked.

Ripple CLO Alderoty Responds

Ripple’s Chief Legal Officer, Stuart Alderoty, also issued a broad response to the SEC’s filing via X, vehemently disputing the narrative presented by the regulatory body. Alderoty stated, “Our response will be filed next month, but as we all have seen time and again, this is a regulator that trades in statements that are false, mischaracterized and designed to mislead.”

He further attacked the SEC for its illegitimate reasoning, stating: “They stayed true to form here. Rather than faithfully apply the law, the SEC remains bent on wanting to punish and intimidate Ripple – and the industry at large. We trust the Court will approach the remedies phase fairly.”

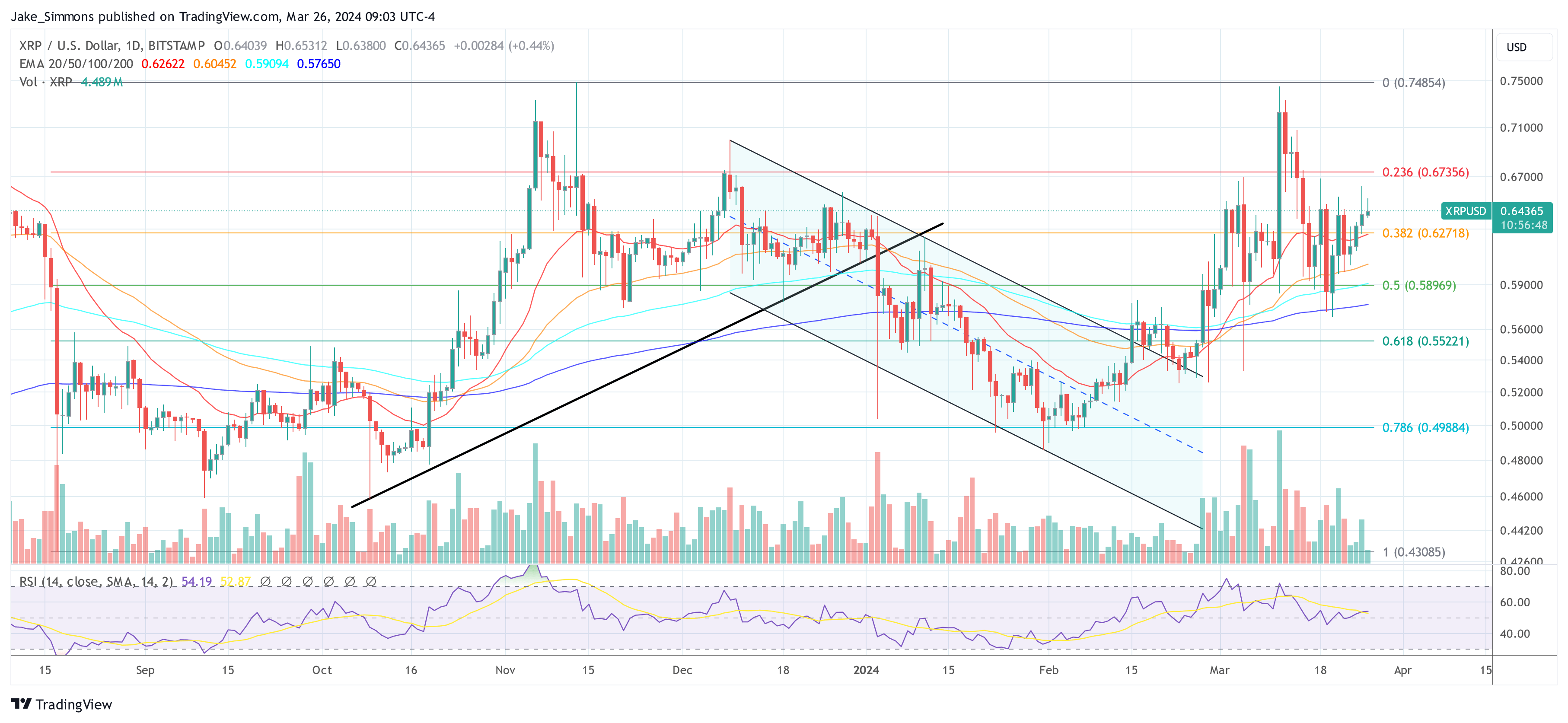

At press time, XRP traded at $0.64365.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Is Ripple Behind The XRP Price Crash? Massive Selling Spree Sparks Concern

Ripple’s occasional sale of XRP tokens has always been pinpointed as one reason for XRP’s tepid price action. Once again, the crypto firm’s recent offloading of a significant amount of XRP has raised concerns about its negative effect on the crypto token.

Ripple Offloads 240 Million XRP

On-chain data shows that Ripple transferred a total of 240 million XRP tokens to an unknown address in two separate transactions. The first transaction occurred on March 5, when it sent 100 million XRP to the address in question. Then, on March 13, the Ripple wallet again transferred 140 million XRP to this address.

These transactions have raised eyebrows, and members of the XRP community are contemplating whether these sales might have been the reason XRP’s price crashed recently. Notably, the crypto token rose to as high as $0.74 on March 11 before seeing a sharp correction.

It is worth mentioning that XRP’s price crashed on March 5, the day the first transaction was carried out. Data from CoinMarketCap shows that the crypto token, which was trading as high as $0.65 on the day, dropped to as low as $0.55 on the same day. However, it remains uncertain whether or not Ripple’s action was directly responsible for this price dip.

Meanwhile, XRP’s price was pretty stable on the day the second transaction occurred, although it was still declining from its weekly high of $0.7, recorded on March 11. The impact of Ripple’s XRP sales on the market continues to be heavily debated among those in the XRP community.

Pro-XRP crypto YouTuber Jerry Hall previously claimed that Ripple was suppressing XRP’s price with its monthly sales. However, there has also been a report that Ripple’s sale doesn’t impact prices on crypto exchanges.

If Not Ripple, Then Who?

Ripple’s price action defies logic, especially considering that the token’s fundamentals and technical analysis suggest it is well primed for a parabolic move. That is why talks about possible market manipulation continue to persist. It is also understandable that all fingers instantly point to Ripple since they are the largest XRP holders.

However, if Ripple is indeed not responsible for XRP’s stagnant price action, then there needs to be another explanation for why XRP has continued to underperform. Although the crypto token has continued to rank in the top 10 largest crypto tokens by market cap, it is worth mentioning that it is one of few tokens that has a negative year-to-date (YTD) gain.

At the time of writing, XRP is trading at around $0.61, up in the last 24 hours according to data from CoinMarketCap.

Token price at $0.6 | Source: XRPUSDT on Tradingview.com

Featured image from BitIRA, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Is Ripple Dumping Millions Of XRP? CTO Addresses Reasons Behind $34 Million Transaction

Ripple has always been subjected to claims of manipulating the price of XRP and its natural growth by selling coins. As the cryptocurrency’s largest holder, Ripple has faced constant criticism about the amount of XRP it holds, with detractors arguing it gives them too much control and influence over the price.

Particularly, there’s been some drama swirling around the altcoin lately and claims that Ripple has been manipulating the market and systematically dumping its large holdings. This has come in light of a large transfer of 60 million XRP tokens from Ripple to an unknown wallet address.

Ripple Accused Of Dumping XRP And Manipulating Market

Whale transaction tracker Whale Alerts recently posted on social media a transfer of 60 million XRP worth $34 million from a Ripple-controlled wallet address into a private address. A further look shows that the private recipient wallet currently holds over 138 million XRP worth $75.5 million, with this same address receiving 80 million XRP from Ripple on February 11.

🚨 🚨 60,000,000 #XRP (34,088,291 USD) transferred from #Ripple to unknown wallet

— Whale Alert (@whale_alert) February 20, 2024

At the time of writing, Ripple controls about 6% of the current circulating supply. Therefore, it is only natural that large transactions like this from Ripple would generate waves in the market and lead to speculations. Consequently, the large transfers have reignited claims of Ripple selling its holdings amidst ongoing consolidation in the price of XRP.

In addition, debates regarding XRP’s programmatic sales have resurfaced, as history shows this isn’t new to Ripple. According to details shared by a social media user, Jim_Knox, Ripple allegedly delivered XRP to three market makers in 2017 for the purpose of market sales, which resulted in a price suppression of the cryptocurrency during that particular period. Furthermore, recent accusations have taken root of Ripple using what it called the 4t and 6t bots to execute programmatic sales to exchanges.

Ripple CTO Addresses Concerns

Ripple CTO David Schwartz took to a social media thread to address the rumors of price manipulation. An XRP community member had shared a meme suggesting that Ripple’s 4t and 6t bots have always prevented the price of XRP from increasing, keeping it at the $0.50 level.

However, Schwartz pointed out that Ripple has discontinued the programmatic sales of XRP, with the company only selling its holdings through ODL transactions. The ODL transaction method is Ripple’s unique payment solution that offers instantaneous cross-border transactions. On the other hand, concerns regarding the recent large transactions from Ripple to unknown wallets are yet to be addressed, and it all remains speculative at this point.

XRP is trading at $0.5463 at the time of writing, down by 0.50% in the past 24 hours but still maintaining a meager 2% gain in a 30-day timeframe. Recent transaction alerts from Whale Alerts have shown large amounts of XRP leaving private wallets to crypto exchanges, hinting at potential selloffs.

Token price stalls at $0.54 | Source: XRPUSD on Tradingview.com

Featured image from U.Today, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Beyond Bitcoin: Ripple CEO Says Approval of Multiple Crypto ETFs ‘Inevitable’ — Embraces Idea of Spot XRP ETF

Ripple CEO Brad Garlinghouse believes that the U.S. Securities and Exchange Commission (SEC) will approve spot exchange-traded funds (ETFs) based on crypto tokens other than bitcoin. “I think it’s inevitable that there’ll be multiple ETFs around different tokens,” he stressed, noting that Ripple would welcome an XRP ETF. “In my opinion, it makes these markets […]

Ripple CEO Brad Garlinghouse believes that the U.S. Securities and Exchange Commission (SEC) will approve spot exchange-traded funds (ETFs) based on crypto tokens other than bitcoin. “I think it’s inevitable that there’ll be multiple ETFs around different tokens,” he stressed, noting that Ripple would welcome an XRP ETF. “In my opinion, it makes these markets […]

Source link

If You’d Invested $1,000 in Ripple (XRP) in 2018, This Is How Much You’d Have Now

Cryptocurrency has gone through boom and bust cycles for years. XRP (Ripple) (XRP -0.51%) once soared as high as $2.78 before a 2018 crash decimated it. Had you bought $1,000 of XRP in early 2018, you’d have just $185 left today.

So why hasn’t XRP bounced back like Bitcoin and other cryptos have? The cryptocurrency’s creator, Ripple, is locked in a fierce lawsuit with the Securities and Exchange Commission (SEC) over its regulatory status.

XRP is still one of the largest cryptocurrencies today, and the pending litigation overshadowing the cryptocurrency makes it a potentially high-risk, high-reward investment idea.

Here is what you need to know.

What is XRP (Ripple)?

Ripple is a blockchain payment network that helps financial institutions settle cross-border transactions. Though most people refer to Ripple stock as a cryptocurrency, Ripple is technically the network, and XRP is the cryptocurrency itself. Ripple’s primary goal is to help money move more freely and quickly worldwide.

Cross-border transactions, where money is exchanged between countries, take multiple steps and can take one to four business days to settle through the traditional SWIFT system, which is how banks currently transfer most money internationally. Transactions on Ripple can settle in seconds. The XRP token acts like a shapeshifter, converting from currency A to XRP, then to currency B at the other end. The process, which is made possible by Ripple Labs’ network of bank partnerships around the world, is typically transparent to the sender and receiver.

Despite XRP not recovering from its peak six years ago, it remains a prominent cryptocurrency today with a $27.5 billion market cap, the sixth-largest. Why hasn’t XRP rebounded like many other cryptos? The SEC sued Ripple (the company) on allegations it had improperly sold its XRP tokens.

The SEC vs. Ripple, boiled down to what matters

Image source: Getty Images

The lawsuit, filed in late 2020, boiled down to whether XRP should be treated like a security, much like a company’s stock (which is highly regulated), or as a currency. Ripple scored a significant victory in July 2023 when the judge presiding over the case ruled that selling XRP on secondary markets like an exchange didn’t break the law.

However, it wasn’t a clean sweep. The company had also sold large amounts of XRP directly to institutional buyers, which the judge ruled to violate federal securities laws. Now the two parties are preparing for remedies, a post-ruling court process to determine Ripple’s punishment for selling to institutions.

The two sides are currently sparring over what evidence can be used in the remedy proceedings. That process has several key deadlines over the next several months, so more is still to come. Ultimately, the remedies could include fines for Ripple or court orders that impact the broader cryptocurrency industry.

Should investors buy Ripple today?

XRP nearly doubled on the July 2023 partial Ripple win. However, that price has steadily faded lower again because there’s still a lot of uncertainty about XRP and Ripple. There is no way of knowing what the ultimate remedies will look like until the litigation concludes, so that makes XRP a very speculative token to own right now despite its large market cap.

It’s probably fair to say that XRP could create multibagger returns if Ripple does well through the rest of its court battle. After all, XRP was trading as high as $2.78 back in early 2018. Years from now, XRP’s price will largely depend on how widely adopted Ripple is across the global banking landscape.

The lawsuit remains a wildcard. If you’re a risk taker, consider buying a small amount of XRP to capture the potential returns if Ripple wins big in court. You can always buy in heavier later once more clarity follows the remedy process.

Justin Pope has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin and XRP. The Motley Fool has a disclosure policy.

Ripple must provide financial statements at SEC’s request, judge rules

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Ripple Labs, a leading American-based payment firm has locked away a substantial amount of XRP tokens in its escrow wallet as part of its monthly unlock program to help bolster its ecosystem and XRP.

Ripple Takes Back 800 Million XRP

A recent report from on-chain tracker Whale Alert revealed that Ripple took back about 800 million XRP tokens. This is no surprise, as the stated transaction has been a recurring outcome by the payment firm.

The payment firm locked the aforementioned funds after its monthly 1 billion XRP release, which has caught the attention of the crypto space. According to Whale Alert, the firm carried out the transaction in two distinct transfers.

For the first transaction, Ripple locked away 500 million XRP tokens, valued at $253 million at the time of the report. Data from XRPScan shows that the 500 million XRP were initially transferred from “Ripple 23” to “Ripple 11” wallets before they were locked away.

Meanwhile, the second transaction saw 300 million XRP valued at about $151 million being transferred to the company’s escrow wallet. Whale Alert revealed the transaction was carried out by another wallet address identified as “Ripple 10,” according to data from the XRPScan.

The firm has been releasing XRP from its escrow holdings every first day of the month. This process is a component of Ripple’s strategy to regulate the amount of XRP in circulation and uphold stability in the dynamic world of digital assets.

After making up 55% of all XRP supply at first, the escrow accounts now own 40.7% of the supply. This is a result of the progressive unlocking process since it began in December 2017.

As of December 2017, the firm held 55 billion XRP as part of the escrow system initiative, which was mostly implemented on the XRP Ledger (XRPL).

XRP Whales On Dumping Spree

Whale Alert has also detected a substantial dump of XRP on cryptocurrency exchanges (CEXs). Whale Alert reported that over 67 million XRP was observed being moved to Bitso and Bitstamp platforms.

Further data shows that the unknown wallet address r4wf7enWPx…5XgwHh4Rzn transferred 37.9 million XRP to a Bitso-based wallet address. As of the time of transfer, the funds were valued at approximately $19 million.

Later on, 29.7 million XRP was moved to Bitstamp, a Luxemburg-based crypto exchange, in a separate transaction. According to the tracker, the same wallet address carried out the transaction worth about $15 million. This particular wallet address has been carrying out this type of transaction to the CEXs for a while now. It is believed that this might be due to Ripple’s strategic partnership with these centralized exchanges.

The price of XRP is still down by over 2% in the past week, trading at $0.505. Its market capitalization is currently up by 2%, but its trading volume has decreased by over 36% in the past 24 hours.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP Price Poised For Liftoff? Whale Holdings Soar Despite Ripple Hack

In a recent turn of events, Ripple faced a significant security breach resulting in the loss of $112 million worth of XRP. Despite this setback, the cryptocurrency community has witnessed remarkable resilience from XRP whales, who have chosen to maintain their coin holdings. This unwavering support, coupled with Ripple’s swift response, has instilled confidence in the platform’s long-term viability.

XRP Whales Display Unwavering Faith

On-chain data provided by Santiment reveals that XRPLedger experienced a surge in whale transactions following the hack. A total of 217 transactions involving $1 million or more in XRP were recorded, marking the highest activity since July 2022. This surge underscores the whales’ belief in XRP’s potential, despite the temporary market turbulence caused by the hack.

Furthermore, wallets holding at least 10 million XRP now collectively possess 67.2% of the available supply, a concentration not seen since December 2022. This consolidation of XRP among influential investors indicates their long-term commitment to the asset.

Source: Santiment

Ripple Leadership Assures Community

In the wake of the hack, Ripple co-founder Chris Larsen provided reassurances that the Ripple blockchain itself remained secure. The unauthorized access was limited to his personal XRP accounts, separate from Ripple’s operations. Larsen’s prompt action in notifying exchanges to freeze the affected addresses demonstrates Ripple’s dedication to protecting its users’ assets.

Moreover, Ripple is actively collaborating with law enforcement agencies, and a substantial portion of the stolen funds has already been frozen. The team is diligently pursuing the remaining funds to ensure a comprehensive resolution of the situation.

XRPUSD currently trading at $0.49335 on the daily chart: TradingView.com

Binance’s Mysterious XRP Transfer

Amidst the Ripple hack incident, an unusual withdrawal of 20.62 million XRP tokens from Binance, the world’s largest cryptocurrency exchange, has raised eyebrows. While initial speculation pointed towards an external entity, further investigation revealed that the tokens were sent to an address associated with Binance’s hot wallet for storing XRP.

🚨 20,620,032 #XRP (10,572,279 USD) transferred from #Binance to unknown wallet

— Whale Alert (@whale_alert) January 31, 2024

This development suggests that the $10 million transfer may be an internal operation within the exchange rather than a whale’s activity in the broader cryptocurrency market. Binance has yet to provide an official explanation for this movement, adding an element of intrigue to the situation.

A Tale Of Resilience

The Ripple hack incident has undoubtedly shaken the cryptocurrency community, but the unwavering support from XRP whales and Ripple’s proactive response have demonstrated the platform’s resilience. As the investigation into the hack continues and Binance sheds light on its mysterious XRP transfer, the Ripple ecosystem stands poised to emerge stronger from these challenges.

As the crypto community grapples with the intriguing dynamics surrounding the recent substantial XRP withdrawal from Binance, the broader question emerges: Is the current dip in XRP’s price merely a temporary setback or a prelude to a significant upward trajectory? Despite the recent setback and a price decline to $0.49, down 3.7% in the last 24 hours, the resilience of whale holdings amid the aftermath of the Ripple hack introduces a compelling narrative.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Coinbase has donated $25M to crypto super-PAC Fairshake; Ripple has given $20M

Coinbase and Ripple are among the largest donors to a super PAC that aims to support pro-crypto politicians, Bloomberg reported on Jan. 31.

Coinbase has contributed $24.5 million to Fairshake, PAC spokesperson Josh Vlasto told Bloomberg. Coinbase CEO Brian Armstrong has also personally given $1 million to the PAC. Those donations make up about one-third of the $85 million that Fairshake has raised to date, according to the report.

Vlasto additionally told Bloomberg today that Ripple has donated $20 million to Fairshake. Two VC firms — Andreessen Horowitz (a16z) and Electric Capital — have donated $20 million and $500,000 respectively.

Bloomberg said that more information about Fairshake’s donors will be revealed in an upcoming filing with the U.S. Federal Election Commission.

Firms have not confirmed donation amounts

Though none of the above companies have confirmed their donation amounts publicly, Coinbase acknowledged that both it and Armstrong had contributed to Fairshake in a blog post published in December.

Coinbase said that Fairshake had raised just $78 million at the time. It added that Circle, Kraken, Ark Invest, and Gemini founders Cameron and Tyler Winklevoss were among the super-PAC’s numerous other donors.

Bloomberg also obtained a comment from Collin McCune, head of government affairs at Andreessen Horowitz today. McCune said that supporting bipartisan candidates with long views is an “important part of ensuring that clear rules of the road are developed for blockchain technology and digital assets.” The representative did not confirm the reported donation amount, however.

Fairshake supports both major parties

Fairshake supports pro-cryptocurrency political candidates on both sides of the political aisle but has slightly favored Democratic candidates so far.

Current data from OpenSecrets indicates that Fairshake has spent $700,000 on 13 Democratic candidates and $551,000 on eight Republican candidates.

Bloomberg noted that Fairshake’s largest spending to date has gone toward Republican Representative Patrick McHenry, a lawmaker extensively involved in crypto legislation who is set to retire in January 2025. Other funding has notably gone toward Republican Representative Tom Emmer and Democratic Representatives Josh Gottheimer and Ritchie Torres.