This week, the crypto asset dogwifhat (WIF), a meme coin, ascended to the third-highest valuation among all meme tokens. In the last day, WIF appreciated by 17% against the U.S. dollar and saw a 435% increase over the past 30 days. WIF Surpasses Major Competitors, Securing Third Spot Among Meme Coins In the recent week, […]

This week, the crypto asset dogwifhat (WIF), a meme coin, ascended to the third-highest valuation among all meme tokens. In the last day, WIF appreciated by 17% against the U.S. dollar and saw a 435% increase over the past 30 days. WIF Surpasses Major Competitors, Securing Third Spot Among Meme Coins In the recent week, […]

Source link

Rises

Speculation Rises on Whether Bitcoin’s Halving Is Reflected in Current Prices

Bitcoin has witnessed new highs in its price lately, with the premier cryptocurrency experiencing an over 60% increase since the beginning of the year. Meanwhile, the crypto community is abuzz with debates on whether the impending halving event is already reflected in the price. There’s a prevailing suspicion that despite bitcoin’s climb against the U.S. […]

Bitcoin has witnessed new highs in its price lately, with the premier cryptocurrency experiencing an over 60% increase since the beginning of the year. Meanwhile, the crypto community is abuzz with debates on whether the impending halving event is already reflected in the price. There’s a prevailing suspicion that despite bitcoin’s climb against the U.S. […]

Source link

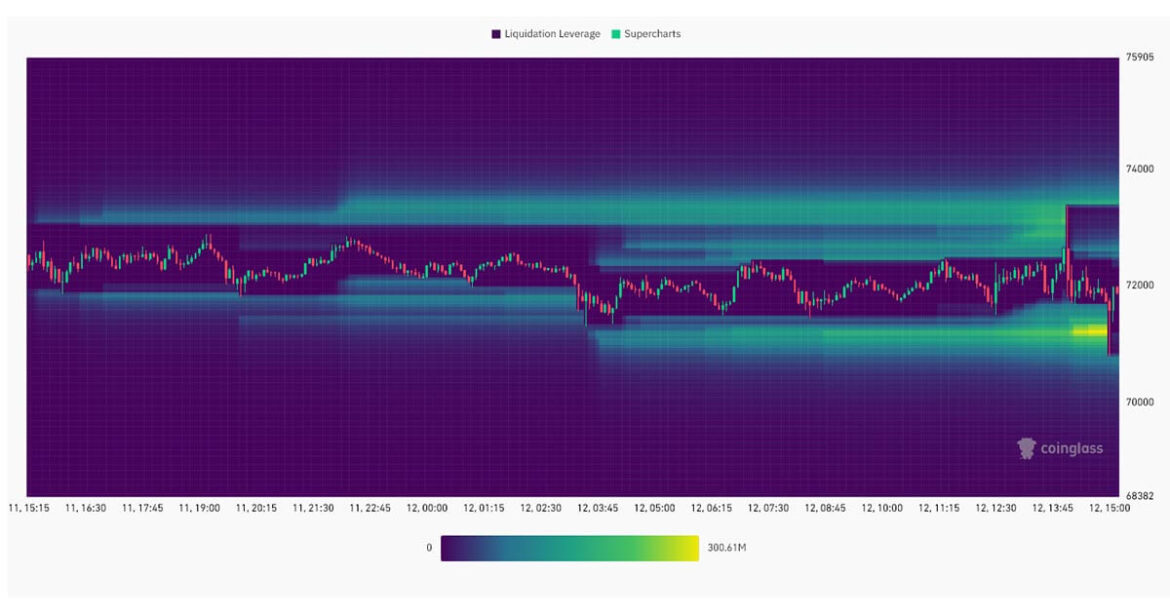

Bitcoin leverage again flushed at US Market Open as inflation rises, misses estimates

In the wake of new inflation data, the crypto market experienced $164.52M in liquidations over the past 12 hours, with $119.88M in long positions and $44.64M in short positions being flushed out. Bitcoin accounted for $48.31M of the total liquidations.

The US Market Open again seemed to be a bigger catalyst than inflation data as the open saw another leverage sweep, aligning with yesterday’s analysis of crypto leverage. Bitcoin rose by 1 % to create a new all-time high of $72,940, followed by a decline to $70,900 before returning to around $71,880 as of press time.

The US annual inflation rate unexpectedly increased to 3.2% in February, surpassing forecasts of 3.1% and rising from January’s 3.1%, per the US Bureau of Labor Statistics. The monthly inflation rate also rose to 0.4% from 0.3%, with shelter and gasoline prices contributing over 60% of the increase.

Despite the higher-than-expected inflation figures, core inflation eased slightly to 3.8% from 3.9%, compared to forecasts of 3.7%. The monthly core inflation rate remained steady at 0.4% instead of the predicted 0.3%.

| Calendar | GMT | Reference | Actual | Previous | Consensus | TEForecast |

|---|---|---|---|---|---|---|

| 2024-02-13 | 01:30 PM | Jan | 3.1% | 3.4% | 2.9% | 3.1% |

| 2024-03-12 | 12:30 PM | Feb | 3.2% | 3.1% | 3.1% | 3.2% |

| 2024-04-10 | 12:30 PM | Mar | 2.6% |

(Source: Trading Economics)

However, Aurelie Barthere, Principal Research Analyst at Nansen.ai, does not expect the US CPI release to end the crypto bull market or significantly impact prices in the coming weeks, according to comments made to CryptoSlate. She attributes this to the strong bullish momentum in the crypto space, citing recent announcements such as BlackRock allocating its own BTC ETF to two of its asset management funds.

Barthere anticipates a repricing of expected Fed rate cuts, with future markets likely to adjust from four rate cuts to two or three by December 2024. She said,

“We do not expect a significant sell-off for crypto as this repricing has happened in the past few months without questioning the bull market “

The post Bitcoin leverage again flushed at US Market Open as inflation rises, misses estimates appeared first on CryptoSlate.

Retail investors are easing back into crypto while VC funding rises for first time in 1.5 years

Bitcoin prices climbed nearly 70% in the fourth quarter of 2023 and the crypto market has been rebounding, marking the re-entry of small retail investors. However, retail investors, who lost billions of dollars in the 2022 market crash, are moving in more slowly and cautiously this time, compared to the bull market in 2021, according to a Bloomberg report.

Venture capital funding in crypto and blockchain startups also recorded a 2.5% increase in Q4 2023 after constantly declining for six quarters, according to a Pitchbook report.

Retail traders want to be part of the bull market

Crypto exchange Coinbase has seen its net revenue from customer transactions rise 60% during the fourth quarter of 2023 compared to a year ago, according to the Bloomberg report. Compared to Q3 2023, the net revenue increased by 80%.

This is because the retail trading volume on Coinbase was up 164% in Q4 2023 compared to the previous quarter. The growth in retail trading volume outpaced that of institutional trading volume, which grew by 92% in Q4.

Retail trading on Coinbase also made up a larger chunk of the total trading volume — 19% in Q4 compared to 14% in Q3. However, it is still well below the 28-40% range recorded during the previous bull market.

Robinhood Markets reported a similar trend, with crypto notional volumes increasing by 242% in December compared to a year ago.

Retail investors are returning to the market with Bitcoin prices crossing the $50,000 mark for the first time in two years and the impending Bitcoin halving. Historically, Bitcoin halving, when mining rewards are slashed in half, leads to “more retail engagement and growth,” Coinbase CFO Alesia Haas told Bloomberg.

Alyssa Choo, crypto equities specialist at BitInvest, noted in a post on X:

“As the crypto market cap and trading volumes go up, retail trading goes up as well. Everyone wants to be a part of the bull market.”

Google searches for the term ‘Bitcoin,’ which indicates retail interest according to Wall Street analysts, increased in January when the Bitcoin exchange-traded funds (ETFs) were launched in the U.S. However, Google Trends show that the searches have slumped back to bear-market levels, indicating that retail investors are not diving headfirst into the market.

Kyle Doane, a trader at Arca, an institutional asset management firm, told Bloomberg:

“There are signs that the retail audience is starting to get back into the market, but not nearly to the extent of the last bull market yet.”

Things are starting to look up for crypto startups

Crypto and blockchain startups bagged $1.9 billion from 326 deals in Q4 2023, marking the first growth in crypto funding in a year and a half. Despite being only a “tiny percentage” increase, the Pitchbook report said it could mean it will become easier for startups to raise funds in the coming quarters.

Negative news surrounding large crypto exchanges like Binance and FTX and the bear market saw venture capital in crypto drying off significantly over the past year and a half. A series of bankruptcies, including that of FTX, and Binance’s historic $4.3 billion plea deal shook the market.

However, centralized exchanges still offer the lowest barrier to entry and a better user experience, which is why investors are still “optimistic” about them, the Pitchbook report noted.

Although the amount invested in the startups increased, deal volume decreased by 2.4% over the past quarter.

Crosschain bridging protocol Wormhole signed the biggest deal in Q4, securing $225 million in an early-stage round from Coinbase Ventures, Jump Trading, and ParaFi Capital.

Traders in the crypto realm are watching Chainlink (LINK) with bated breath as the price coils up near the $16 mark, hinting at a possible break out towards $17, or even $20 given the right conditions this week.

Since November, LINK has been consolidating between $13.00 and $17.00, exhibiting classic market cycle behavior that presents prime opportunities for savvy traders.

Technical analysts are buzzing with potential bullish scenarios, with many pointing to the current price action as the telltale sign of an “accumulation phase.” As per the renowned Wyckoff method, this phase sees sellers exiting, prices stabilizing, and indecision ruling the market.

Will Chainlink Hit The Vaunted $20 Mark?

Following accumulation comes the much-anticipated “markup phase,” characterized by surging buying pressure, rapid price increases, and heightened activity.

And that’s precisely what the charts seem to be foreshadowing for LINK. Indicators like the Awesome Oscillator and MACD are flashing green and pushing towards bullish territory, suggesting growing confidence and impending upward momentum.

Chainlink currently trading at $15.57682 on the daily chart: TradingView.com

The Relative Strength Index (RSI) also leans north, potentially primed to cross its signal line and add fuel to the bullish fire.

Further bolstering the optimistic outlook are the Simple Moving Averages (SMAs). Both the 100- and 200-day SMAs are pointing north, with the latter currently nestled comfortably at $9.994. This upward trajectory indicates the path of least resistance lies in ascending territory for LINK.

Source: TradingView

Should buying pressure build steam above current levels, analysts predict a potential leapfrog over the 50-day SMA at $16.95, paving the way for a psychological $17 price point. In a highly bullish scenario, LINK could even tap into its full $20 potential, marking a 20% surge from its current position.

LINK price up nearly 17% in the weekly timeframe. Source: Coingecko

17% Rally Ignites More Optimism For LINK

But a fresh spark ignites the conversation – Chainlink just surged 17% today, propelling it closer to the long-held $17 barrier. Could this recent rally be the catalyst that sends LINK rocketing past its immediate target and into uncharted territory?

It’s still too early to definitively say. While the technical indicators remain encouraging, external factors and market sentiment can shift rapidly. However, one thing is certain: Chainlink’s latest surge adds another layer of intrigue to its already captivating price action.

Whether it coils upward for a glorious breakout or succumbs to profit-taking, the next few days promise to be a thrilling ride for LINK holders and a fascinating case study for technical analysis enthusiasts alike.

Featured image from iStock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cathie Wood’s ARK exits Grayscale GBTC entirely as spot ETF anticipation rises

Cathie Wood’s asset management firm ARK Invest’s Next Generation Internet ETF (ARKW) sold all its positions in Grayscale’s Bitcoin Trust (GBTC) on Dec. 27 and purchased $92 million worth of ProShares Bitcoin Strategy ETF (BITO), according to the company’s latest trade filing.

ARK divesting positions in COIN and GBTC

The trading activity continues a recent selling spree that has impacted several Bitcoin-related holdings, including Coinbase’s COIN stock, as ARK tries to rebalance its fund weightings.

In November, the fund divested more than 700,000 units of GBTC holding despite the rising value of the shares due to the market optimism surrounding the possible approval of a spot Bitcoin (BTC) exchange-traded fund (ETF) in the U.S. At the time, GBTC represented more than 9% of ARKW’s portfolio.

Additionally, the firm has sold over $200 million worth of Coinbase stock this month, dumping around 500,000 units of COIN stocks during the past week alone.

COIN is one of the best-performing stocks of the past year, up more than 400% on the year-to-date metric, according to Tradingview data.

‘Temporary’ BITO purchase

Meanwhile, the firm’s purchase of BITO shares makes it the second-largest holder of the fund. However, this purchase is surprising, considering its BTC spot ETF application is currently under review.

Eric Balchunas, a senior ETF analyst for Bloomberg, explained that ARK’s purchase of BITO shares was likely a “liquidity transition tool” to retain “high beta” with Bitcoin. He said:

“ARK is now the second biggest holder of BITO, although again this is a temporary parking spot. They (and institutions generally) use highly liquid ETFs for transitions like this.”

Additionally, Balchunas pointed out that the move would help to enhance the ETFs’ assets under management (AUM) and potentially offer advantages to their investors by improving expense ratios.

BITO is ARKW’s sixth-largest holding, ahead of electric car giant Tesla and crypto investment platform Robinhood.

Manchester United’s stock rises after Jim Ratcliffe clinches 25% stake

Manchester United’s stock climbed Tuesday after British billionaire Jim Ratcliffe clinched his 25% minority stake in the iconic English soccer club.

Shares of operator Manchester United Ltd. MANU rose 2.4%, outpacing the S&P 500 index’s SPX gain of 0.4%.

Manchester United announced the agreement on Dec. 24, with Ratcliffe acquiring 25% of…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

Inflation as measured by personal spending increased in line with expectations in October, possibly giving the Federal Reserve more incentive to hold rates steady and perhaps start cutting in 2024, according to a data release Thursday.

The personal consumption expenditures price index, excluding food and energy prices, rose 0.2% for the month and 3.5% on a year-over-year basis, the Commerce Department reported. Both numbers aligned with the Dow Jones consensus and were down from respective readings of 0.3% and 3.7% in September.

Headline inflation was flat on the month and at a 3% rate for the 12-month period, the release also showed. Energy prices fell 2.6% on the month, helping keep overall inflation in check, even as food prices increased 0.2%.

Goods prices saw a 0.3% decrease while services rose 0.2%. On the services side, the biggest gainers were international travel, health care and food services and accommodations. In goods, gasoline led the gainers.

Personal income and spending both rose 0.2% on the month, also meeting estimates and indicating that consumers are keeping pace with inflation. However, both numbers fell on the month; income rose 0.4% in September while spending was up 0.7%. Slower spending growth, though, aligns with the Fed’s goal of cooling the economy so inflation can recede.

Stocks rallied following the news, as the Dow Jones Industrial Average hit a 2023 high. Bonds sold off, with Treasury yields popping as the rate-sensitive 2-year note moved up more than 6 basis points (0.06 percentage point) to 4.71%.

Futures market pricing continued to point to the likelihood that the Fed won’t raise rates at any of its upcoming meetings and in fact likely will start cutting by the springtime. In all, traders are pricing in as many as

While the public more closely watches the Labor Department’s consumer price index as an inflation measure, the Fed prefers the core PCE reading. The former measure primarily looks at what goods and services cost, while the latter focuses on what people actually spend, adjusting for consumer behavior when prices fluctuate. Core CPI was at 4% in October while headline was at 3.2%.

In other economic news Thursday, initial weekly jobless claims rose to 218,000, an increase of 7,000 from the previous period though slightly below the 220,000 estimate. However, continuing claims, which run a week behind, surged to 1.93 million, an increase of 86,000 and the highest level since Nov. 27, 2021, the Labor Department said.

“The Fed is on hold for now but their pivot to rate cuts is getting closer,” said Bill Adams, chief economist at Comerica Bank. “Inflation is clearly slowing, and the job market is softening faster than expected.”

Markets already had been pricing in the likelihood that the Fed is done raising interest rates this cycle, and the PCE reading, along with signs of a loosening labor market, could solidify that stance. Along with the anticipation that the rate hikes are over, markets also are pricing in the equivalent of five quarter percentage point rate cuts in 2024.

New York Fed President John Williams said Thursday that he expects inflation to continue to drift lower, finally hitting the Fed’s 2% target in 2025. However, he said policymakers will need to stay vigilant and keep rates at a “restrictive” level.

“My assessment is that we are at, or near, the peak level of the target range of the federal funds rate,” he said in prepared remarks for a speech in New York. “I expect it will be appropriate to maintain a restrictive stance for quite some me to fully restore balance and to bring inflation back to our 2 percent longer-run goal on a sustained basis.”

The fed funds rate, the central bank’s benchmark level for short-term lending, is targeted in a range between 5.25%-5.5%, its highest in more than 22 years. After implementing 11 hikes since March 2022, the Fed skipped its last two meetings, and most policymakers of late have been indicating that they are content now to watch the impact of the previous increases work their way through the economy.

Other economic signals lately have shown the economy to be in fairly good shape, though several Fed officials recently have said the data doesn’t square with comments they are hearing on the ground.

“I’m hearing consumers slowing down,” Richmond Fed President Thomas Barkin said Wednesday at the CNBC CFO Council Summit. “I’m not hearing [the] consumer falling off the table. I’m hearing normalizing, not recession, but I am hearing consumer slowing down.”

The Fed’s inflation report comes the same day as encouraging news from the euro zone.

Headline inflation there fell to 2.4% on a 12-month basis, though core, which excludes food, energy and tobacco, was still at 3.6%, though down from 4.2% in September. Like the Fed, the European Central Bank targets 2% as a healthy inflation level.

Don’t miss these stories from CNBC PRO:

Advanced Micro Devices

Advanced Micro Devices

AMD

$3.35

2.81%

3%

IBD Stock Analysis

- Stock trying to break out from tiny handle

Composite Rating

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Cup with Handle

* Not real-time data. All data shown was captured at

10:59AM EST on

11/22/2023.

Advanced Micro Devices (AMD) is the IBD Stock of the Day for Wednesday, as AMD stock is attempting a breakout from a small handle. AMD shares have gained more than 90% this year as the chipmaker positions itself in the growing artificial intelligence market.

X

The Santa Clara, Calif.-based AMD competes with Intel (INTC) in making central processing units, or CPUs, for personal computers and servers. But the firm is also a challenger to Nvidia (NVDA) in the market for graphics processing units, or GPUs, for PCs, gaming consoles and data centers.

AMD is targeting the white-hot market for AI chips sparked by the rapid expansion of generative AI applications, an arena dominated by Nvidia. An upcoming event will officially launch new AI chips that AMD detailed earlier this year.

On the stock market today, AMD stock rose 2.8% to close at 122.51.

is up 3.5% at 123.29 in recent action. Shares have gained more than 20% since the firm’s Oct. 31 earnings report, forming a cup-with-handle base with a 122.11 buy point.

AMD Stock: Sales, Earnings Top Estimates

In its recent Q3 report, AMD said it earned an adjusted 70 cents per share on sales of $5.8 billion in the September quarter. Analysts polled by FactSet had expected AMD earnings of 68 cents a share on sales of $5.7 billion. Sales and earnings both rose 4% year over year.

The third-quarter report broke a streak of three quarters with year over year earnings declines for AMD.

Meanwhile, AMD’s guided for $6.1 billion in sales for the current quarter, short of analysts expectations of $6.39 billion. But the disappointment was tempered by AMD’s prediction of more than $2 billion in 2024 sales for its MI300 AI accelerators.

Unveiled in June, the MI300 accelerator is designed to compete against the advanced H100 chips sold by generative artificial intelligence market leader Nvidia. The product will officially launch Dec. 6.

“In the fourth quarter, we expect to see strong growth in data center and continued momentum in client, partially offset by lower sales in the gaming segment and additional softening of demand in the embedded markets,” Chief Financial Officer Jean Hu said in the Oct. 31 news release.

AI Push

The 2024 sales projection “supports the view that AMD is well-positioned to participate in the large and growing Gen AI compute market,” wrote Goldman Sachs analyst Toshiya Hari in a Nov. 1 client note.

Meanwhile, NVDA’s booming business selling chips for generative AI has powered its stock to 230% gains this year, the best performance in the S&P 500. On Tuesday, Nvidia reported earnings that easily topped Wall Street’s lofty expectations. But NVDA stock was down about 2% in recent action.

A potential catalyst for AMD stock is coming up early next month. AMD is hosting an event on Dec. 6 called “Advancing AI” to officially launch its MI300 accelerators. The event will also “highlight the company’s growing momentum with AI hardware and software partners,” AMD said in a news release.

AMD Stock: Technical Ratings

AMD ranks third among 37 stocks in IBD’s fabless semiconductor industry group, according to IBD Stock Checkup. NVDA is the top stock in the group.

Further, AMD stock has an IBD Relative Strength Rating of 94 out of 99. The Relative Strength Rating shows how a stock’s price performance stacks up against all other stocks over the last 52 weeks. The best growth stocks typically have RS Ratings of at least 80.

AMD stock carries an IBD Composite Rating of 91 out of 99. IBD’s Composite Rating combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.

Further, AMD stock is on the IBD Tech Leaders list.

YOU MAY ALSO LIKE:

See Stocks On The List Of Leaders Near A Buy Point

Find Winning Stocks With MarketSmith Pattern Recognition & Custom Screens

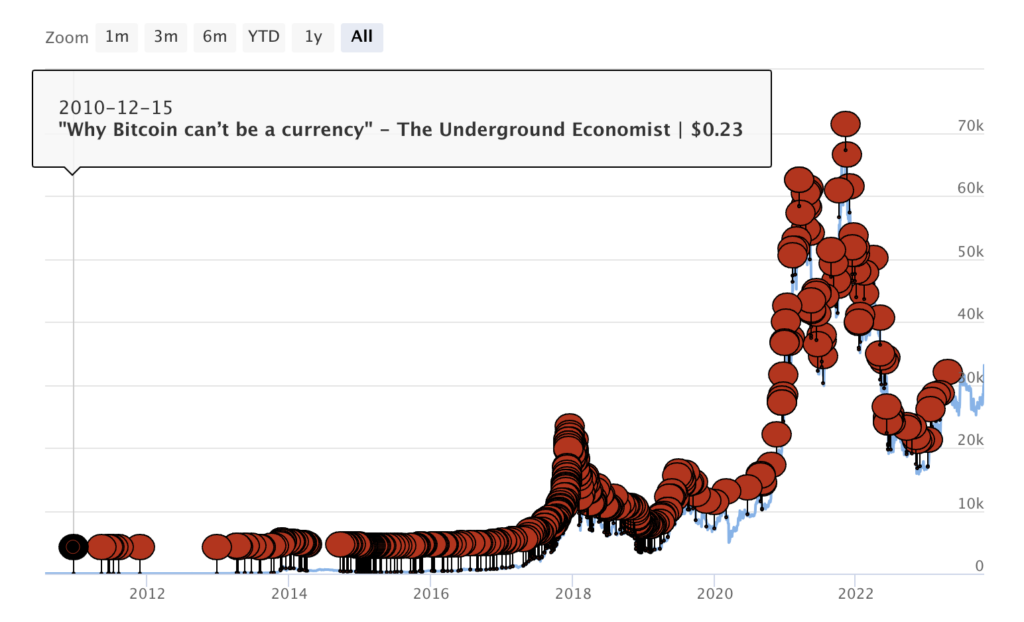

CNBC leads Bitcoin ‘obituaries’ declaring it dead 35 times as it rises 78% YoY

Like a phoenix rising from the ashes, Bitcoin has once again defied critics and bounced back from predictions of its demise.

The leading cryptocurrency has faced hundreds of so-called “obituaries” declaring it dead or doomed to fail since its creation in 2009. Yet Bitcoin has shown longevity and resilience in the face of constant critiques. According to 99bitcoins, the latest recorded ‘death’ was back in April when the price declined from $31,000 to $27,500.

Reviewing the historical ‘obituaries,’ CNBC and Bloomberg appear most frequently, with 35 and 24 articles calling for the death of Bitcoin, respectively. Headlines included ‘Bitcoin Is Still Doomed, ‘Bitcoin Is A Decentralized Ponzi Scheme,’ and ‘Bitcoin Isn’t The Future Of Money.’

While the cryptocurrency’s long-term trajectory depends on many factors, its ability to repeatedly recover from crashes and criticism is noteworthy. The cryptocurrency continues to find renewed life after each metaphorical funeral.

Bitcoin’s recent bullish movement and endorsement from BlackRock brings its price to around $34,000 as of Oct. 24, following a period of stability around the $27,000 mark between March and October, up 78% over the past year.

Accompanying the latest peak was a spike in trading volume, signaling increased buying pressure.

Bitcoin died and rose again.

The number of predictions of Bitcoin’s demise generally increased over time as crypto went more mainstream. From just a handful in the early years, obituaries numbered in the hundreds starting in 2017 when Bitcoin prices spiked.

Critics often declared Bitcoin dead during major price crashes, with clusters of obituaries around events in late 2017, early 2018, March 2020, and mid-2021. Volatility prompted accusations of bubbles bursting, like the 2013 headline “The Bitcoin Bubble Has Burst,” when the price was just $84.

Both experts and casual commentators have foretold Bitcoin’s failure. Sources range from mainstream media to individual bloggers, showing broad skepticism.

Initially more measured, criticism grew more hyperbolic over time. Early headlines expressed doubt, while later proclamations labeled Bitcoin a scam, Ponzi scheme, or a bubble ready to pop like 2021’s “Bitcoin Is Worse Than A Madoff-style Ponzi Scheme” in the Financial Times.

Some sources persistently predict Bitcoin’s downfall despite being proven wrong by its continued survival. An ongoing desire by some to see cryptocurrency fail appears present.

The reasons cited evolved from Bitcoin’s inability to function as money to lack of regulation, environmental harm, and competition from other coins. Yet, the core narrative of impending collapse persisted.

While Bitcoin has been proclaimed dead 474 times, it endures, whether rising from ashes or emerging from each’ death.’ The recurring story of underestimation remains unfinished, with Bitcoin’s next chapter still unwritten.

All eyes fall on the highly anticipated spot Bitcoin ETF from BlackRock as the investment firm looks to add Bitcoin to its trillions of dollars worth of assets under management.

If Bitcoin is dead, why did no one tell Larry Fink?