JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

Source link

risk

Cardano At Risk Of Crashing To $0.4 As Important Metrics Turn Bearish

Cardano (ADA) risks a significant price decline as several on-chain metrics paint a bearish sentiment for the crypto token. This coincides with a recent technical analysis by a crypto analyst, who predicted that ADA could drop to as low as $0.4.

ADA Sees Decline In Trading Volume

Data from the on-chain analytics platform Messari shows a decline in ADA’s trading volume from its recent peak. The crypto token recorded a daily trading volume of $1.53 billion on March 14 but has been on a steady decline since then, recording a daily trading volume of $445.83 million on April 10.

Furthermore, data from IntoTheBlock shows three other on-chain metrics signaling a bearish sentiment for the crypto token. The first is the ‘Net Network Growth,’ which has experienced a 0.17% increase in the past week. This metric measures the total number of ADA addresses, meaning more users have left the ecosystem than new ones have come this last week.

The second metric is the ‘In the Money,’ which has seen a 0.20% decline in the last seven days. This metric measures the number of ADA holders that are currently in profit at the crypto token’s price level. Meanwhile, large transactions on the Cardano network have also dropped lately, with a 2.60 decline. These large transactions refer to transactions that are over $100,000, suggesting that ADA whales are cooling off on investing in the crypto token.

These bearish on-chain metrics further strengthen crypto analyst Alan Santana’s analysis, in which he mentioned that ADA could drop between $0.4444 and $0.3450. Back then, he noted that ADA still had a bearish outlook from a technical analysis perspective, and this outlook would extend until ADA found a strong support level on the charts.

ADA’s Derivatives Market Also Shows Bearish Outlook

Data from Coinglass shows that the bears are also firmly in control of the ADA ecosystem. In the last 24 hours, $632,720 has been wiped out from ADA’s derivatives market, with long positions ($502,170) accounting for most of these liquidations.

Meanwhile, trading volume in ADA’s derivatives market has dropped by over 11%, suggesting a declining interest in the ADA token among crypto investors. Furthermore, the Options trading volume paints a more bearish picture, dropping by 92% in the last 24 hours.

At the time of writing, ADA is trading at around $0.59, up over 1% in the last 24 hours according to data from CoinMarketCap.

ADA price at $0.58 | Source: ADAUSDT on Tradingview.com

Featured image from The Independent, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Polygon Labs CEO sees layer-3s like new Degen Chain as a risk to Ethereum

Polygon’s CEO Marc Boiron emphatically stated that the layer-2 network was not considering developing layer-3 protocols because of the potential risks they pose to Ethereum’s security.

Boiron made this statement on the back of the early success of Degen Chain, a layer-3 network running on the Coinbase-backed scaling solution Base.

Layer 3 protocols enhance scalability by building upon Layer 2 infrastructure, allowing developers to tailor application-specific blockchains to their requirements.

Degen Chain

Degen Chain is a layer-3 network built using Arbitrum Orbit for the DEGEN token. The digital asset has swiftly emerged as the primary community token among Farcaster users, the rapidly expanding web3 social media platform.

Since its launch on March 28, the network has captured substantial attention and transactional activity within the crypto industry, witnessing an impressive surge of over 200% in the past week.

Available data indicates that the network has facilitated the bridging of more than $30 million, alongside powering over 3.5 million transactions as of March 30.

Community debates layer-3

Degen Chain’s early successes have attracted debates from the crypto community, who hold differing views about the network.

In a March 31 post on X (formerly Twitter), Boiron asserted that layer-3 networks divert value from Ethereum onto the layer-2 platforms hosting them.

According to him, such a trajectory doesn’t align with Polygon’s commitment to Ethereum’s scaling, which the company already addresses through its proof-of-stake (PoS) and zero-knowledge Ethereum Virtual Machine (zkEVM) chains.

Additionally, Boiron pointed out the potential adverse effects of layer-3 adoption, highlighting their minimal performance enhancements and the looming threat to Ethereum’s security. He said:

“If all L3s settled to one L2, then Ethereum would capture basically no value and, thus, Ethereum security would be at risk.”

He added:

“If Ethereum earns no fees and has no prospect of earning fees other than a tiny amount of fees from this one L2, then the value of ETH will drop and, when it is clear that it’ll continue to drop because there is no economic future for it, validators will no longer be willing to hold ETH and, thus, no longer be willing to secure the network.”

Meanwhile, blockchain expert Cygaar explained that layer-2 networks are not yet “matured” and have yet to inherit Ethereum’s security level because of existing challenges like network centralization, upgradeable bridge contracts, and developing proving systems.

Consequently, he argued that integrating layer-3 networks atop layer-2s could exacerbate risks and compromise the security of these blockchain networks.

Mentioned in this article

Latest Alpha Market Report

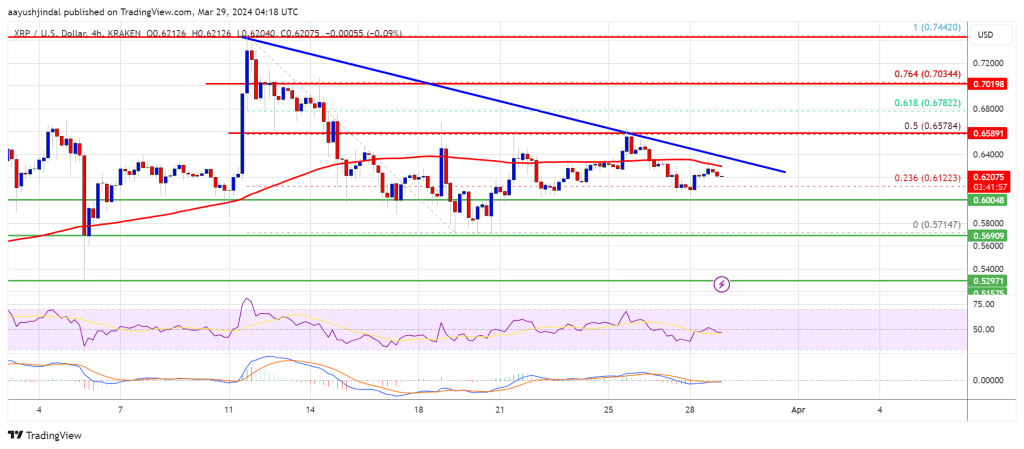

XRP price is holding gains above the $0.60 zone. The price could gain bearish momentum if there is a close below the $0.570 support zone.

- XRP is facing a major hurdle near the $0.6580 zone.

- The price is now trading below $0.640 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance near $0.640 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair could gain bearish momentum if there is a close below the $0.5720 support.

XRP Price Faces Uphill Task

After a steady decline, XRP price found support near the $0.5720 level. A low was formed at $0.5714 and the price started a fresh increase, like Bitcoin and Ethereum.

There was a move above the $0.5880 and $0.600 resistance levels. The price cleared the 23.6% Fib retracement level of the downward wave from the $0.7442 swing high to the $0.5714 low. The bulls pushed the price above the $0.620 resistance zone, but the bears are active near $0.640.

Ripple’s token price is now trading above $0.6320 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $0.640 zone. There is also a key bearish trend line forming with resistance near $0.640 on the 4-hour chart of the XRP/USD pair.

The next key resistance is near $0.6580. It is close to the 50% Fib retracement level of the downward wave from the $0.7442 swing high to the $0.5714 low. A close above the $0.6580 resistance zone could spark a strong increase. The next key resistance is near $0.700. If the bulls remain in action above the $0.700 resistance level, there could be a rally toward the $0.7440 resistance. Any more gains might send the price toward the $0.800 resistance.

More Losses?

If XRP fails to clear the $0.640 resistance zone, it could start another decline. Initial support on the downside is near the $0.600 zone.

The next major support is at $0.5720. If there is a downside break and a close below the $0.5720 level, the price might accelerate lower. In the stated case, the price could retest the $0.5250 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now losing pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $0.600, $0.5720, and $0.5250.

Major Resistance Levels – $0.640, $0.6580, and $0.700.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Older adults with student debt at risk of losing some Social Security benefits

Martinprescott | E+ | Getty Images

Millions of older adults who are behind on their student loans could soon receive a smaller Social Security benefit.

That was the warning from Democratic lawmakers, including Sen. Elizabeth Warren, D-Mass., and Sen. Ron Wyden, D-Ore., in a recent letter to the Biden administration.

“When borrowers are in collections, on average their Social Security benefits are estimated to be reduced by $2,500 annually,” the lawmakers wrote on March 19. “This can be a devastating blow to those who rely on Social Security as their primary source of income.”

The U.S. government has extraordinary collection powers on federal debts and it can seize borrowers’ tax refunds, wages and retirement benefits. Social Security recipients can see up to 15% of their benefit reduced to pay back their defaulted student debt, which “can push beneficiaries closer to — or even into — poverty,” the lawmakers wrote.

After the pandemic-era pause on student loan payments expired in October of last year, the U.S. Department of Education said it wouldn’t resume its collection practices for 12 months.

However, the lawmakers wrote, “we are concerned that borrowers will face the extreme consequences associated with missed payments when protections expire in late 2024.”

They asked the Biden administration to provide a briefing on its efforts to address the issue by April 3.

More from Personal Finance:

FAFSA fiasco may cause drop in college enrollment, experts say

Harvard is back on top as the ultimate ‘dream’ school

More of the nation’s top colleges roll out no-loan policies

The U.S. Department of Education did not immediately respond to a request for comment.

The government’s collection practices with student loan borrowers, including the garnishment of wages and Social Security benefits, is an area under review, a source familiar with its plans told CNBC.

‘A morally bankrupt policy’

Outstanding student debt has been growing among older people. To that point, more than 3.5 million Americans aged 60 and older had student debt in 2023, a sixfold increase from 2004, according to the lawmakers.

Consumer advocates say the government’s collection actions are extreme.

“Many retirees need their Social Security benefits to survive,” said higher education expert Mark Kantrowitz.

Social Security benefits constitute nearly all income for one-third of recipients over the age of 65, the lawmakers said in their letter. The average check for retired workers is $1,907 this year, according to the Social Security Administration.

The garnishments mean older adults are often “forced to choose between skipping meals or rationing medicine,” Kantrowitz said. “It is a morally bankrupt policy.”

Don’t miss these stories from CNBC PRO:

Record $1 Billion In Shorts Risk Liquidation If Bitcoin Hits This Price

The Bitcoin price is creeping up once again, rising to a new all-time high above $71,000 in the early hours of Monday. As the price surge continues, it has put a record number of shorts at risk, where a less than 10% move upward from here will see $1 billion in shorts liquidated.

$1 Billion In Shorts At Risk Of Liquidation

Crypto trader and analyst Ash Crypto took to X (formerly Twitter) to share a map that showed the number of short positions at risk as the price of Bitcoin rises. The map shared in the post showed that short liquidation leverage had risen above $1 billion.

These short leverage positions had been rising along with the price with a large number of crypto investors expecting the price to crash after pumping to a new all-time high. However, Bitcoin seems to have other plans in mind with its price surging close to $72,000 and increasing the risk of liquidations for these positions.

For these positions, Bitcoin reaching $75,000 would be detrimental to them. At this price level, over $1 billion worth of short positions will be liquidated. “$1,000,000,000 WORTH OF SHORTS WILL GET LIQUIDATED IF BTC HITS $75,000,” Ash Crypto revealed.

Will Bitcoin Stop Anytime Soon?

The Bitcoin price has seen a 10.33% increase in the last week and shows no signs of stopping soon. However, the debate of whether it continues upward or downward continues to wax strong as crypto analysts far and wide proffer their own predictions.

One crypto analyst know as MarcPMarkets suggests that the price of Bitcoin could hit resistance and then spiral back down if Bitcoin fails to properly clear the $70,000. But the analyst also explains that there is a possibility that the positive price action does continue if price does push above $71,500 and makes a close above it.

At the time of writing, Bitcoin is trading above $71,700, which shows it has cleared the level highlighted in the analyst. Now, what remains is to see if the cryptocurrency is able to make a daily close above $71,500, something that would be incredibly bullish for price. In this case, the BTC price could rise as high as $80,000 following this breakout.

The Bitcoin move over $71,000 has already had a significant impact on traders in the last day. Over $333 million has been lost by traders in one day. But interestingly, the majority of liquidations (64.29%) happen to be long positions, according to data from Coinglass.

BTC price reaches new ATH | Source: BTCUSD on Tradingview.com

Featured image from, chart from Tradingview.com Atlantic Council

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Retirees in These 10 States Risk Losing Some of Their Social Security Checks

Social Security is a central piece to most Americans’ retirement plans. Around half of retirees 65 or older receive at least 50% of their household income from their monthly benefit checks, according to data analyzed by the Social Security Administration. So the thought of losing even a portion of those benefits could have a drastic impact on many people’s budgets in retirement.

Unfortunately for those living in 10 states, there’s a chance they’ll see a reduction in their Social Security checks. Depending on your income, the state government may impose income tax on a portion of your benefits.

Here’s what you need to know.

How the federal government taxes Social Security

Before we dive into the details of state taxes, anyone collecting Social Security, or who’s about to start collecting, needs to know the details of how the federal government taxes that income.

The federal government uses a metric called “combined income” to determine what portion, if any, of your Social Security benefits are taxable. Combined income is equal to the sum of your adjusted gross income, any nontaxable interest income, and half of your Social Security income. If your combined income exceeds a certain threshold, a portion of your Social Security becomes subject to taxation.

The following table shows what portion of your Social Security benefits are taxed at the combined income thresholds.

|

Taxable Portion of Benefits |

Individual |

Married Filing Jointly |

|---|---|---|

|

0% |

Less than $25,000 |

Less than $32,000 |

|

Up to 50% |

$25,000 to $34,000 |

$32,000 to $44,000 |

|

Up to 85% |

$34,001 and up |

$44,001 and up |

Data source: Social Security Administration.

If you find those thresholds extremely low, you’re not alone. That’s because the numbers haven’t been adjusted for inflation for at least 30 years. As such, more and more households are finding it nearly impossible to stay below those thresholds and avoid taxes on their Social Security benefits. Careful tax planning can help mitigate the impact of Social Security taxes at the federal level, but retirees in 10 states have to worry about state taxes, too.

10 states that tax Social Security

Tax laws vary from state to state. While most states don’t tax any portion of Social Security no matter what, these 10 have special rules that may make some of your benefits subject to income tax.

If you live in one of these states, you should take the time to do some additional research or consult a tax professional to learn more about your specific situation and how to mitigate your tax bill. In the meantime, here are the basics.

Colorado: Taxpayers under 65 with more than $20,000 in taxable benefits on their federal income tax return will owe state income taxes on the amount above that threshold. Retirees 65 or older are exempt from taxes on Social Security benefits. The state tax rate is 4.4%.

Connecticut: Any Social Security income included on your federal income tax return may be subject to taxes in Connecticut. However, the amount is limited to 50% of your benefits received regardless of what percentage is included on your federal return. The tax rate ranges from 2% to 4.5%.

Kansas: Taxpayers will owe state income taxes on any Social Security benefits also subject to federal income tax if their adjusted gross income exceeds $75,000. The tax rate is 5.7%.

Minnesota: Taxpayers can deduct up to $4,560 as an individual or $5,840 for a married couple filing jointly in Social Security benefits from their taxable income. That amount is reduced for residents with combined incomes above $69,250 for an individual or $88,630 for a married couple before phasing out completely at incomes of $78,000 or $100,000, respectively. The tax rate ranges from 6.8% to 9.85%.

Montana: Any Social Security income on your federal income tax return is subject to state income tax in Montana. The tax rate ranges from 4.7% to 5.9%.

New Mexico: Taxpayers with adjusted gross incomes exceeding $100,000 for individuals or $150,000 for married couples filing jointly will owe taxes on any Social Security income also taxed at a federal level. The tax rate ranges from 4.9% to 5.9%.

Rhode Island: Taxpayers below their full retirement age as defined by Social Security with an adjusted gross income above $101,000 for individuals or $126,250 for married couples filing jointly will owe taxes on any portion of Social Security income also included on their federal income tax return. The tax rate ranges from 4.75% to 5.99%.

Utah: Taxpayers with an adjusted gross income exceeding $45,000 for individuals or $75,000 for married couples filing jointly will owe taxes on any Social Security income included on their federal tax return. Those below the threshold qualify for a credit to offset the taxes. The tax rate is 4.65%.

Vermont: Taxpayers with an adjusted gross income above $50,000 for individuals or $65,000 for married couples filing jointly will owe income tax on at least a portion of any Social Security income included on their federal income tax return. The tax rate ranges from 3.35% to 8.75%.

West Virginia: Taxpayers with adjusted gross income above $50,000 for individuals or $100,000 for married couples filing jointly owe income tax on a portion of Social Security income included in their federal income tax return. The tax rate ranges from 5.1% to 5.525%.

Read this before you decide to retire somewhere else

Just because these 10 states might tax some of your Social Security benefits, that shouldn’t be the reason you avoid retiring in one of them. There’s a lot more to enjoying your retirement than saving a few bucks on taxes. And you never know when legislation might change. Twelve states taxed Social Security last year, and the number keeps getting smaller.

Many of these 10 states have a low cost of living or great communities for seniors, or both. What’s more, they might put you close to family or friends, which can be one of the most important factors in retirement when you no longer have a job to occupy all your time. Even if you have a slightly higher tax bill, it might be a price worth paying.

Importantly, there are several strategies you can use to help keep taxes low in retirement without having to change states. Using tax-free withdrawals from Roth accounts and carefully planning capital gains can have a much bigger impact on your tax bill than state taxes on Social Security income.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets”

The Motley Fool has a disclosure policy.

Retirees in These 10 States Risk Losing Some of Their Social Security Checks was originally published by The Motley Fool

I don’t want to get dementia.

I really, really, really don’t want to get dementia. Almost any other way of dying would be OK with me. Just, please, not that.

And now it seems I will learn to play a musical instrument, too — though whether it ends up being the piano, the saxophone, the flute or the Cross-Granger Kangaroo-Pouch Tone-Tool (yes, it’s a thing) is another matter.

Evidence is mounting that learning an instrument and continuing to play it makes your brain stronger, faster and healthier — and that it can drastically reduce your risk of getting dementia.

A new study of 1,100 older adults, with an average age of 68, “shows that playing a musical instrument is associated with better working memory and executive function,” according to researchers from Exeter, Brunel, and London universities. “We also found positive associations between singing and executive function, and between overall musical ability and working memory,” they added.

Results were better among people who currently played an instrument than among those who had learned to play one as a child but didn’t keep up with it, the researchers found. Those who kept playing typically did so for at least two to three hours a week.

“A comparison of participants who currently play a musical instrument with those who have done previously showed significantly better performance in two of the three measures of working memory … and the working memory composite … in people who currently engage in music,” the researchers said.

The research appears in the latest issue of the Journal of Geriatric Psychiatry.

And this study is no outlier: There is research going back several decades. Other studies have found that, for example, adults who played a musical instrument at some point in their lives typically performed better on cognitive tests than those who didn’t, with better “global cognition, working memory, executive functions, language, and visuospatial abilities.” Musicians had better average long-term, short-term and working memory than nonmusicians.

The brains of professional musicians even look different under an MRI, according to research in the Journal of Neuroscience and the journal Human Brain Mapping. Active musicians may actually have “younger” brains. An overview of research shows.

Seneca Block, a music therapist and an adjunct instructor in psychiatry at Case Western Reserve University, says that brain scans even look different depending on the type of instrument a person plays. “You can see the difference between a piano player and a stringed-instrument player,” he says.

Not everyone is convinced. Scientists point out that many of these studies simply show correlation, not causation. Even if musicians score better, on average, than nonmusicians in various tests, it doesn’t prove that playing a musical instrument improves your brain, these skeptics say. It could simply mean that people with better brains end up playing musical instruments.

It’s a reasonable point.

But here’s why the music theory wins.

First, not every study is correlational. In this one, for example, people age 62 to 72 were given an hour of piano training per week for six months. They were also instructed to practice for half an hour each day. At the end of the period, MRIs showed actual physical differences in their brains compared with those of people in the control group. A similar study, in which a group of older people also received six months of piano training, found that those who had been learning the piano showed an increase in gray matter in five different areas of the brain. Another study found that just four months of training — this time on a keyboard harmonica — had an effect on the brains of people in their 60s, 70s and 80s who had never before played an instrument. One study even found an effect after just two weeks of music lessons.

Then there was a longitudinal study that followed more than 350 Scottish people from childhood into their 80s. Not only did it distinguish between those who had learned an instrument and those who hadn’t, it was also able to compare cognitive tests that the participants took at age 11 and at age 70. Bottom line: Music training made a difference. “There was a small, statistically significant positive association between experience of playing a musical instrument and change in general cognitive ability between ages 11 and 70,” the researchers found. And the more training a person had, the better their cognitive performance.

Probably the most remarkable study was one involving pairs of twins 65 and older in Sweden. Researchers looked at 157 cases where one of the twins had cognitive impairment or dementia and the other didn’t. About one-quarter of the pairs were identical, and the rest were fraternal.

Then they looked at which participants had taken up the piano, or the flute, or the double bass, or guitar, or the trombone or the didgeridoo (well, maybe).

Bottom line? The twin who had learned an instrument was less likely — much less likely — to have cognitive impairment or dementia. “Compared to their nonmusician co-twin,” the researchers found, “musicians playing an instrument in older adulthood had a 64% lower likelihood of developing dementia or cognitive impairment.”

No, really.

A purist might argue that this conclusion, too, is open to question. How do we know that the twin who took up music didn’t have a much healthier brain to begin with? Well, we can’t know that for sure — but remember that that twins share 50% or 100% of their DNA. Another study of twins also confirmed what we could have guessed intuitively: There are many factors that go into whether or not we end up playing an instrument, and most of them are random.

I’ve decided to apply the philosophical principle known as Pascal’s Bet, named after the 17th-century French philosopher Blaise Pascal, who famously decided that it would be logical for him to believe in God. Faith in God, he reasoned, exposed him to far less risk after death than atheism. How much would each option cost him, he asked himself? And what were the downside risks?

It would hardly make sense for me to hold off learning a new instrument until there is more definitive proof that doing so may help prevent dementia. By the time such proof arrives, if it ever does, it may be too late for me. And what’s the worst that can happen? I’ll waste time learning to play music — time others will constructively spend watching high-quality TV programs like “Stamp-Collecting Wars” and “The Real Housewives of Poughkeepsie.”

Bring on the music.

Markets underpricing risk of populist politics in U.S. and abroad, Summers says

Former U.S. Treasury Secretary, Larry Summers, has said markets may be underestimating the risks posed by an upsurge in political turmoil that threatens to undermine the basic order and stability that has underpinned America’s economic growth in recent decades.

The American economist said the risks of political strife are “really, very substantially greater” now than they have been throughout his career, as he warned the rise of populism in the U.S. and the rest of the world threatens to spark a period of political volatility that may stunt economic growth.

“The world is potentially headed into a period where there is a less of a sense of what the order is going to be, and therefore more risk of disorder, chaos, and the associated suffering, and I’m not sure that kind of risk is fully priced in to markets,” Summers told the FII Priority Summit.

Speaking in Miami to Eric Schmidt, the former CEO of Google, Summers said markets have taken political stability in the U.S. for granted and he argued this steadiness has driven huge economic growth in the U.S. that has seen American companies’ valuations surge over the past 25 years.

The economist instead argued markets have “insufficiently” priced-in risks associated with the rise of “populist, nationalist politics” that could see a breakdown in the rule of law in the U.S., ahead of the upcoming 2024 elections, and increased trade protectionism abroad.

“One of the clearest lessons of economic history is that over a period of a decade, populism is almost always bad for economic performance, whether it’s right-wing populism or left-wing populism,” Summers said.

He explained that increased restrictions on the flow of goods and people internationally, paired with the collapse of international collective security arrangements, could undermine global economic growth in the future.