PRESS RELEASE. [Singapore, Mar 22, 2024] Yala, a project that enables the seamless transfer of Bitcoin liquidity through a meta yield stablecoin, is thrilled to announce a comprehensive brand upgrade. This reflects our commitment to making Bitcoin liquidity universally accessible across blockchain ecosystems, enhancing DeFi liquidity efficiency. The upgrade includes a refreshed branding message, a […]

PRESS RELEASE. [Singapore, Mar 22, 2024] Yala, a project that enables the seamless transfer of Bitcoin liquidity through a meta yield stablecoin, is thrilled to announce a comprehensive brand upgrade. This reflects our commitment to making Bitcoin liquidity universally accessible across blockchain ecosystems, enhancing DeFi liquidity efficiency. The upgrade includes a refreshed branding message, a […]

Source link

roadmap

FXS Price Poised For Uptrend As Frax Finance Unveils Roadmap To Reach $100B TVL

Frax Finance, a decentralized finance (DeFi) protocol, recently unveiled its Singularity Roadmap. It aims to propel the total value locked (TVL) of its layer 2 blockchain, Fraxtal, to $100 billion by the end of 2026. This notable surge would represent a 760,000% increase from the current TVL levels, which stand at $13 million.

Frax Finance Singularity Roadmap

According to the protocol’s announcement, Fraxtal, the substrate that powers the Frax ecosystem, serves as Frax Finance’s operating system. With the launch of Fraxtal and achieving an effective 100% Collateralization Ratio (CR), Frax Finance claims to have consolidated its core product offerings.

To reach the ambitious $100 billion TVL goal, the protocol has announced that it has already generated over $45 million, reaching the coveted 100% CR.

As announced, with this milestone achieved, the FRAX stablecoin, which has remained relatively dormant during the process, and the FXS revenue share, which has been temporarily reduced by 90% to conserve assets, can now undergo a “transformative change.”

In addition, the upcoming introduction of Layer 3s (L3s) on Fraxtal is expected to be a key factor in further contributing to the growth and adoption of the protocol.

Fraxtal, which is built on the Optimism (OP) network, stands out as one of the most widely used layer 2 solutions on top of Ethereum (ETH), according to the protocol. The Frax team says it has developed its underlying incentives to provide a seamless experience for developers and users, further encouraging adoption.

In particular, by owning the entire stack, Frax can introduce advanced features such as account abstraction, new precompiles, privacy features, aggregated decentralized applications (dApps), and interoperability with Superchain.

The protocol believes these features will enhance the on-chain experience, making Fraxtal the “preferred” platform for holding, staking, and transferring crypto assets.

Expansion Strategy

The proposal also unveils Frax Finance’s plan to establish 23 Layer 3s within 365 days, kicking off the “Fraxtal Nation” community. By supporting these 23 chains with developer access, incentives, and investment, Frax aims to foster a positive-sum approach and provide additional support to official partners.

The protocol also suggests that these partners will receive “substantial allocations” of FXTL points, aiming to solidify the role of the FXS token as the ultimate beneficiary of the Frax ecosystem.

Moreover, Frax Finance founder Sam Kazemian intends to allocate 50% of the revenue from protocol fees to veFXS token holders. In comparison, the remaining 50% will be used to acquire FXS and other Frax assets for pairing in the FXS Liquidity Engine (FLE).

This initiative will increase liquidity, strengthen the Frax balance sheet, and provide additional incentives for the protocol’s stakeholders.

Frax Finance’s proposal also seeks to reactivate the protocol fee switch, which was temporarily turned off during the consolidation phase of the protocol.

By reigniting this switch, a portion of the yield generated from protocol fees will be directed toward veFXS token holders. veFXS, or veiled FXS, represents a locked version of the native token, FXS, and offers enhanced voting power and participation in the Frax ecosystem.

As of the time of writing, FXS has not responded favorably to the news. Its current trading price is $6.93, reflecting a 3.5% loss in the past 24 hours. It is important to note that the proposed protocol features are still in development, and the impact on the Frax Finance ecosystem and the token’s performance is yet to be determined.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tron is embarking on an ambitious journey to transform the Bitcoin ecosystem, as announced by its founder, Justin Sun. Through the integration of Bitcoin Layer two solutions, Tron seeks to decentralize and interconnect a variety of token types, including major stablecoins, with the Bitcoin network. Justin Sun’s Outlines Vision to Merge Tron and Bitcoin Networks […]

Tron is embarking on an ambitious journey to transform the Bitcoin ecosystem, as announced by its founder, Justin Sun. Through the integration of Bitcoin Layer two solutions, Tron seeks to decentralize and interconnect a variety of token types, including major stablecoins, with the Bitcoin network. Justin Sun’s Outlines Vision to Merge Tron and Bitcoin Networks […]

Source link

The Solana Foundation has unveiled a roadmap for 2024, focusing on innovation, developer engagement and network scalability. “2024 is the year of Solana,” the foundation proclaimed, focusing on the key milestones achieved and strategic goals for the year in the statement.

The “Solana Foundation’s State of Developer Ecosystem Report” highlights a surge in developer activity, with over “2,500 active developers committing to open source repositories” and an impressive increase in developer retention, rising “from 31% to over 50% throughout the previous year.”

The report further elucidated the evolution of Solana’s infrastructure, which in 2023 saw a leap in maturity with the deployment of “program frameworks for Rust, Python, and more,” as well as “SDKs available for 10 languages, laying a solid foundation for diverse dApp development.” Solana Labs’ innovative GameShift API has been a game-changer, a piece of “app-specific tooling” designed to revolutionize the gaming space on Solana’s blockchain.

On-chain data provided by Messari reinforces the network’s growth narrative, citing “a 65% quarter-over-quarter increase in daily average non-voting transactions, reaching 40.7 million, and a remarkable 102% quarter-over-quarter rise in average daily fee payers, amounting to 190,000.”

The roadmap also unveils forthcoming advancements poised to redefine blockchain capabilities. First, Solana aims to introduce “token extensions to empower more complex and multifaceted tokenomics.”

Second, a focus in 2024, will be on the launch of Firedancer, a new independent validator client for the Solana blockchain, built by Jump Crypto. It aims to support a higher number of concurrent transactions, increase network throughput, resilience, and efficiency, and address historical weaknesses in Solana’s peer-to-peer interface. Notably, Firedancer went live on the testnet in October 2023.

A third focus in the 2024 roadmap will be the development of Runtime v2 by Solana Labs, which aims to “significantly enhance the network’s performance and developer experience.”

This runtime is a concurrent transaction processor, handling transactions with specified data dependencies and explicit dynamic memory allocation. It introduces changes coordinated by epochs, influencing the cluster’s behavior. Moreover, Solana Core announced support for the Move programming language as a major modification in Runtime v2.

The Solana Foundation’s message via X echoes a commitment to innovation and community engagement: “The strength of the Solana ecosystem is amplified by our passionate community. With the community’s unwavering support, we are ready to accelerate into 2024 and solidify Solana’s position as the premier platform for blockchain development. It’s time to accelerate. Let’s keep building & make 2024 the year of Solana.”

Solana Price Prediction 2024: A Technical Analysis

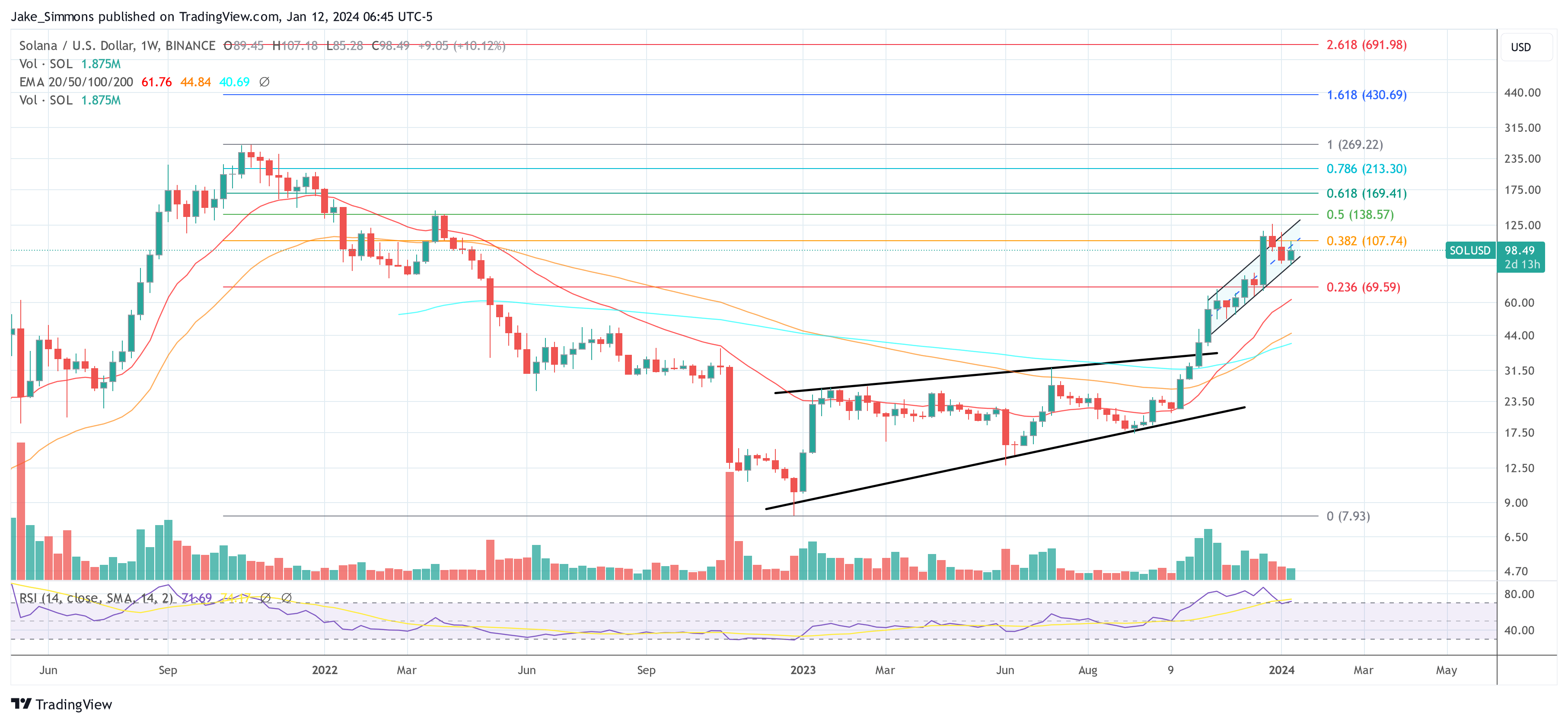

A technical analysis of the Solana price action in the weekly chart (SOL/USD) offers predictions for 2024. Since mid-November, SOL’s price movement has been encapsulated within a parallel uptrend channel, indicative of a stable and consistent upward trajectory. The parallel lines representing support and resistance have guided the price action, providing clear levels for potential buy and sell points.

The Fibonacci retracement tool, applied from the swing high of around $262 to the swing low of $7.93, unveils key levels that may act as barriers or support in the future.

- 0.236 at $69.59: A retracement level that previously acted as resistance and has turned into support.

- 0.382 at $107.74: This level has been tested and is the next major price target of a weekly close.

- 0.5 at $138.57: From 2021 till early 2022, this price level acted as strong support, but was turned into resistance in April 2022.

- 0.618 at $169.41: Often considered the ‘golden ratio,’ this level is crucial for assessing trend continuation.

- 0.786 at $213.30: Breaching this level could signal strong bullish momentum.

- 1 at $269.22: As soon as SOL reaches its all-time high, the price discovery phase begins.

Extended Fibonacci levels, such as 1.618 at $430.69 and 2.618 at $691.98, offer aspirational targets should the uptrend persist. The latter would be an ultra-bullish price target.

The Exponential Moving Averages (EMA) for the 20, 50, 100, and 200 periods all lie below the current price, confirming the strength of the uptrend. A ‘golden cross’ is evident in mid-December with the 50-EMA crossing above the 100-EMA, traditionally a bullish signal.

The trading volume shows a constructive pattern, with higher volume seen on upswings, a positive sign for continued interest in SOL. The Relative Strength Index (RSI) is positioned around 60, suggesting that while the momentum is upward, there is still room for growth before reaching overbought conditions.

The technical analysis, grounded in the weekly chart’s display of a parallel uptrend channel, robust Fibonacci levels, supportive moving averages, and healthy volume and RSI readings, paints a very optimistic price outlook for Solana in 2024.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum has released its roadmap for 2024, focusing on scalability, security, and sustainability improvements.

Ethereum co-founder Vitalik Buterin announced the plan on social media on Dec. 31, outlining several key initiatives for the platform’s development.

Enhancements in scalability

In 2022, Ethereum underwent a significant change known as ‘The Merge,’ transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. The transition is expected to reduce the platform’s energy consumption and lay the groundwork for future enhancements.

‘The Surge,’ a crucial component of Ethereum’s roadmap, aims to increase network scalability through data sharding. By dividing the blockchain into smaller parts, Ethereum intends to boost its transaction processing capabilities and reduce costs, addressing one of the most pressing issues faced by blockchain technologies today.

This development is expected to bring Ethereum closer to achieving its goal of processing over 100,000 transactions per second, as noted by Buterin in recent statements.

Network streamlining and future research

‘The Scourge’ and ‘The Verge’ focus on enhancing network security and user experience, respectively.

The Scourge is designed to tackle potential security vulnerabilities and improve the robustness of the network, including the challenges posed by Miner Extractable Value (MEV) and liquidity pooling.

On the other hand, The Verge aims to streamline user experiences and provide improved tools for developers, making Ethereum more accessible and efficient.

The roadmap also includes ‘The Purge’ and ‘The Splurge.’

The Purge involves removing outdated code to improve network efficiency and security.

Meanwhile, The Splurge represents an investment in Ethereum’s future, exploring emerging technologies like zero-knowledge proofs and rollups and fostering innovation within the Ethereum ecosystem.

Foundational principles

Buterin has emphasized the need for Ethereum to reconnect with its original cypherpunk vision, which prioritizes decentralized applications, privacy protection, and peer-to-peer communication.

This includes integrating rollups and zero-knowledge proofs to enable more private and censorship-resistant applications on the Ethereum network.

Ethereum’s 2024 roadmap reflects a comprehensive strategy to address current challenges and capitalize on emerging opportunities in the blockchain space. With a focus on scalability, security, sustainability, and staying true to its foundational principles, Ethereum is poised to strengthen its position as a leader in the digital currency ecosystem.

BNB Chain Reveals Basic Principles, Features and Roadmap for Its Greenfield Decentralized Storage Network

The recent updates for BNB Greenfield contains extensive details on its roadmap, basic principles, and features that support AI adoption.

BNB Chain has published an official tech roadmap for BNB Greenfield, a decentralized storage network for data decentralized applications (dApp) operating in the BNB ecosystem. The roadmap contains several interesting developments that combine Web2 performance and Web3 features to improve user experience.

Basic Principles and Features of the BNB Greenfield Roadmap

BNB Chain created the Greenfield roadmap based on three design principles. The first is for the blockchain to have such high performance that it competes favorably with most Web2 offerings. This way, transactions, and other on-chain activities are processed faster. While ensuring that the blockchain is high-performance, the second design principle – a simplified development experience – guarantees that the Greenfield platform is user-friendly and accessible. This way, navigating BNB Greenfield will be easy for developers regardless of experience level.

The third principle is that while BNB Greenfield is a BNB Chain platform, it functions as a multi-chain network. Developers would be able to create multiple blockchains and design projects with seamless interaction between dApps on different blockchains. In addition to this interaction, users will also enjoy several other cross-chain services.

The Roadmap describes extensive features tied to each of these principles. For instance, the high-performance principle seeks to significantly improve transaction speed. With the current download and upload speeds at 20MB/s and 2MB/s, respectively, the aim is to 5x these numbers. In addition, there is a bundle service for data handling, which allows users to organize multiple data files into single blockchain objects for better processing.

The second principle offers improved storage features, like sorting and organizing data using tags. These tags help users move and update large amounts of data without confusion. For the third principle, the exciting feature is cross-chain programmability. This gives smart contracts more flexibility as they currently do not allow others to use their resources. BNB Greenfield solves this problem by introducing a cross-chain permission module.

Artificial Intelligence (AI), Stability, and Network Governance

All of BNB Greenfield’s features lay the groundwork for AI adoption. The decentralization, innovation, and transparency enjoyable on BNB Greenfield are features that facilitate AI adoption and create an enabling environment for AI and Web3 integration.

The overarching aim is to ensure that access and use of BNB Greenfield is easy and affordable for all interested parties, including developers, storage providers, and regular users. Storage providers will enjoy “lightweight architecture”, with low computational requirements, sparse device footprint on the network, and reduced energy consumption. Despite all of that, BNB Greenfield has a simple exit process for all storage providers who would like to withdraw their deposits and exit the platform.

The specific Roadmap for BNB Greenfield will see the platform begin in Q4 this year by simplifying the exit process for storage providers and enabling features that allow smart contracts to function as “resource owners”, for robust permission control. The next course of action is to improve storage provider performance while increasing upload and download speeds by 5x in Q2/Q3 2024. The Web3 AI adoption comes next and may stretch past 2024.

next

Binance News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Ethereum (ETH) developers have outlined a comprehensive plan for the network’s development in 2024, including significant upgrades and new proposals after their latest execution layer meeting on Dec. 8.

A key focus is on the deprecation of the Goerli testnet, with a fork scheduled for early 2024. This move is part of the strategy to activate ‘Dencun’ on the Ethereum network in January, marking a significant advancement in its technological capabilities.

Dencun Activation

The Dencun upgrade will introduce a novel concept in transaction processing termed ‘blob-carrying transactions.’ In this context, ‘blobs’ is an acronym for ‘Binary Large Objects’. The primary purpose of these blobs is to refine the way Ethereum stores and retrieves data by reducing the amount of data that must be stored indefinitely on the Ethereum blockchain.

Consequently, the transaction costs associated with data storage are expected to decrease, making overall transactions more economical. It is a critical step toward the long-term goal of danksharding, a planned scaling solution that breaks the network into smaller, parallel segments (shards) to increase capacity and efficiency.

Another notable development is the introduction of a new proposal aimed at enhancing the power of Execution Layer (EL) clients. The proposal, designed to counteract potential censorship in the mempool, would enable EL clients to override local builders using various heuristics.

For instance, clients could override when detecting transactions with excessively high fees pending for extended periods. However, adopting such heuristics has not yet been implemented broadly, with only Geth currently having an open pull request on the issue.

In terms of process updates, the development of a Meta Ethereum Improvement Proposal (EIP) for Dencun has been a significant milestone. This is complemented by a draft for a “Meta EIP backfill,” which aims to provide specifications for upgrades previously lacking Meta EIPs.

The discussion around Meta EIPs has been vital in simplifying access to fork specifications, although there is an ongoing conversation about their role and naming conventions, according to ETH developer Tim Beiko.

Prague/Electra upgrade

Looking forward, the Ethereum community is preparing for the Prague/Electra network upgrade. Among the proposals for this upgrade is EIP-6110, which proposes a new method for supplying validator deposits on-chain, replacing the older Eth1 bridge system.

Future upgrades may also include Verkle Tries on the Execution Layer and Data Availability Sampling (DAS) on the Consensus Layer, necessitating in-depth technical reviews and discussions.

The Ethereum community is encouraged to take an active role in shaping the future of the network by participating in these technical discussions and expressing their preferences for potential features in the upcoming upgrades through forums and GitHub threads.

Client teams are set to review these proposals, with more detailed discussions planned for January. This planning forms part of the broader strategic development of the Ethereum network, reflecting the continuous efforts by the developer community to evolve and refine the platform.

The Ethereum developer community remains actively engaged in enhancing the network’s capabilities, with a clear roadmap set for 2024. The upcoming developments and proposals highlight the network’s ongoing commitment to innovation and responsiveness to community feedback.

This Brand New Meme Coin Just Raised $11 Million In A Firesale With No Roadmap

The cryptocurrency space is indeed full of surprises. Recently, an emerging meme coin called $MEME, which has no roadmap or utility has already raised over $11 million in its ongoing firesale.

Memecoin (MEME) Achieves A Major Milestone With Firesale

MEME is an Ethereum-based memecoin that operates under the ERC-20 network, with a total supply of 69 billion MEME tokens. The token was designed by a web3 startup called Memeland and launched by the team that worked on 9GAG.

According to the Memecoin fire sale page, the brand new meme coin reportedly sold over 11.4 billion MEME tokens selling at $0.001 in its ongoing firesale. This indicates a significant 150% surge, beating the team’s expectations from the very beginning.

The token’s active firesale which has amassed over $11 million already has done this despite being a waitlist-only sale.

In line with Memecoin’s whitepaper, the team highlighted that the token “has no functions, no utility and no intrinsic value, no promise or expectation of any financial return, profit, interest or dividend.”

The team further asserts that in regard to the Memeland ecosystem, the Memecoin does not represent “any entitlement to any voting rights.”

However, despite the meme coin not having a roadmap, utility, and future return, it did not sway crypto investors from purchasing the meme coin. In addition, the crypto community is still eager to buttress the startup, demonstrating crypto investors’ trust and faith in the new meme coin.

According to data from MEME’s tokenomics, it was revealed that the first 2.7% of the total supply of the MEME token will be released on October 27. Meanwhile, the remaining portion will be “unlocked daily over the course of eighteen months.”

Meme Coin Captures Crypto Investors’ Interest

The cryptocurrency community’s interest in the newly introduced MEME token can be traced back to the future profit potentials of meme coins. Meme coins can offer huge investment returns for investors, although they can also be risky for those who do not engage in proper research before investing in the tokens.

One notable meme coin that has garnered huge returns for investors and produced hundreds of millionaires in the 2021 bull run is the Shiba Inu (SHIB) meme coin.

Related Reading: The Battle of Memecoins: EverLodge vs Shiba Inu – Which Holds the Key to Success?

The Dogecoin rival was launched in 2020 but later rose to fame in 2021 after significant price surges. The token has managed to remain a vital meme coin to this day.

The Shiba Inu was launched with an initial price of $0.000000001009, according to CoinMarketCap. By May 2021, the token was traded at $0.00003469, indicating an over 10,000% surge in price. The token is the currency being traded at $0.000008 as of the time of writing.

Featured image from Memeland, chart by Tradingview.com

Opinion: Here’s a roadmap for stocks to own and avoid this earnings season

With corporate earnings season just around the corner, Todd Gervasini, a portfolio manager at Wakefield Asset Management, is giving a lot of thought to potential stock-market winners and losers.

Information technology and energy stocks should beat estimates and outperform, he says — especially Meta Platforms

META,

Applied Materials

AMAT,

Cadence Design Systems

CDNS,

Fortinet

FTNT,

and Marathon Petroleum

MPC,

But be careful with consumer staples, industrials and communications services stocks like telecom and cable company names, he adds.

Why should you listen to Gervasini? For starters, the firm he founded has a great investment track record. Since inception in April 1997 through June 2023, the Wakefield Large-Cap Equity Portfolio gained 11.6% annualized vs. 8.8% for the S&P 500

SPX.

Gervasini also is an expert in earnings and earnings-surprise trends.

Here’s a look at five lessons we can learn about investing from how Gervasini gets his edge, and stocks that look attractive to him now.

1. Exploit the psychology of sell-side analyst crowd behavior to find big, unexpected earnings growth: Job security is fundamental. On Wall Street, this translates into a basic rule of thumb for sell-side analysts: It’s better to be wrong with the pack than on your own as an outlier. After all, if you’re wrong with the group, you can always say “Well, everyone else got it wrong, so don’t fire me!”

This dynamic leads to a way to predict “unexpected” earnings growth not priced into a stock. For instance, if an analyst expects a company’s earnings will grow to $2 per share next year from $1, but the average forecast is $1.50, he’s more likely to publicly increase his estimate to $1.50 or $1.60. This conservative stance tells you more upward estimates are on the way. Then, as the company’s growth story is confirmed, the analyst will move earnings estimates higher. In short, you want to own companies getting decent upward estimate revisions, because it’s likely that more are coming.

Developed in the early 1990s, this stock-selection system is called “earnings estimate revisions analysis.” In the vernacular, Wall Streeters call it the “cockroach theory” because when you have seen one upward estimate revision, there are probably more where that came from.

Revisions analysis is at the core of Gervasini’s investing approach. “We are trying to take advantage of sell-side behavior,” he says. “It is predictable behavior and you can get into stocks before future revisions happen.”

A good example, Gervasini says, is Meta Platforms, a stock he purchased in February 2023. Even though the shares are up 138% so far this year, Gervasini still likes Meta because it continues to rank well in his estimate revisions model. A more recent purchase that ranks well is Marathon Petroleum, which he bought in August.

2. Find companies that will continue to surprise on earnings: Gervasini’s model here tells him when earnings surprises are on the way. Key factors include the size of a recent surprise in the absolute sense, and relative to the average for both the company’s sector and the market overall. The model also favors surprises that are reversals from prior disappointments. Companies with good estimate revisions may also likely surprise.

A prime example here is insurer Arch Capital Group

ACGL,

Gervasini and his team bought this stock in May because it had posted a series of earnings surprises, including a big 59% surprise last February. He still owns the stock because it has continued to surprise and rank well in his estimate revisions and surprise models. This suggests it may surprise again when it reports on October 24.

Caterpillar

CAT,

is another example. The company missed slightly on fourth-quarter 2022 earnings and then surprised nicely in the following two quarters.

3. Take the emotion out of investing: The sell decision always seems to be much harder than the buy decision. Why is this? It’s all about emotion. “If you have a company that has done unbelievably well, it is hard to sell. You fall in love with the company,” Gervasini says. The same thing can happen in the opposite direction: Too many people hold on to losers because it is hard to admit they made a mistake.

Gervasini avoids these pitfalls in two ways: If a holding no longer ranks well in his estimate revisions, surprise and valuation models, he sells. He uses position size as a guide. He likes positions to be around 3.3% of the portfolio. When they grow to 4%, he trims. If positions fall to 2.1%, he adds.

“This forces us to sell what has done well and buy what is highly ranked but has not done well. It takes the emotion off the table,” he says. One stock that looks buyable because it has fallen to around 2.1% of the portfolio (but still ranks well) is Hershey

HSY,

4. Buy what is out of favor: To understand Gervasini’s tactics here, you need to recall the difference between the market-cap and equal-weighted S&P 500. The equal-weight S&P 500 index owns all stocks in the index in equal size. In the market cap weighted index, bigger market-cap names have a proportionately larger representation.

This difference offers a way to stay out of extremely popular names that are probably overvalued because the crowd loves them, and favor names that investors do not like. The trick is to keep your portfolio sector neutral relative to the equal-weighted version of an index. This gives you a relatively a small position in popular sectors overrepresented in the cap-weighted index, and bigger positions in out of favor groups.

Let’s take an example. Because the “Magnificent Seven” tech names including Microsoft

MSFT,

Alphabet

GOOGL,

Nvidia

NVDA,

and Meta have performed so well, computer and technology stocks recently accounted for 35% of the market-cap weighted S&P 500. If instead you owned the 15% they represent in the equal-weighted S&P 500, you have relatively low exposure to this group compared to the S&P 500 market-cap weighted index. Meta Platforms is the only stock Gervasini has in this group, because it still ranks well for earnings revisions and surprises and is still arguably cheap.

The same tactic gives you an overweight position in unliked groups, such as financials. Match the equal-weighted index by having 17% of your portfolio in financials, and you are overweight the group relative to their 10% representation in the cap-weighted S&P 500.

“This keeps us out of insane multiples and makes us buy boring stocks that I think will ultimately be rewarded,” Gervasini says. “It forces us to look at the sectors that people ignore.” In financials, this means owning Arch Capital Group, JPMorgan Chase

JPM,

and insurance giant AFLAC

AFL,

5. Mind the valuations: Another way to invest in out-of-favor names is to own stocks that look cheap relative to their groups. Caterpillar, for instance, trades at a p/e of 15.47 compared to its sector p/e of 48.8, Gervasini says. Meta Platforms trades at a p/e 19.6 vs. 45.8 for its group. Marathon Petroleum has a p/e of 6.0 vs. 18.4, and Arch Capital group trades at a p/e of 13.0 compared to 14.7 for its peers.

Gervasini also likes to keep things simple by using only the three tests described above: earnings estimate revisions; earnings surprise, and relative valuation. He says: “We are all-in on the concepts that we think are very robust. That’s where the opportunity to outperform is.”

More: Why stocks are likely to be especially volatile this October

Plus: ‘Anxiety’ high as stock market falls, bond yields rise — what investors need to know after S&P 500’s worst month of 2023

On June 23, the price of VeChain (VET) spiked to a high of $0.01899, marking a 16-day high.

Coinbase tweeted on June 22 that it had added VeChain, and its gas token, VeThor, to its new asset listing roadmap. However, the platform has not yet provided details on when they will be available for trading.

VeChain price

VeChain recorded a year-to-date peak of $0.03257 on February 20 before sinking 40% to $0.01962, approximately two weeks later, when a series of U.S. bank failures rattled crypto markets.

The ensuing bounce topped out around mid-April, with the $0.0265 zone proving strong resistance.

Into June, and the ramping up of regulatory hostility at the hand of the Securities Exchange Commission, VeChain sunk further to form a local bottom at $0.01419 – representing a 95% drawdown from its all-time price of $0.281, achieved in April 2021.

By June 17, its price began a reversal trend that culminated in a peak above the downtrend line depicted below – before moving back beneath the line – suggesting indecision on the part of bulls at this time.

Coinbase changes listing policy

Currently, VeChain and VeThor are not available to trade on Coinbase.

Coinbase explained it had discontinued its previous practice of publishing a list of assets under consideration as part of its drive to become more transparent about token listings. Instead, under its roadmap model, assets that the company has “affirmatively decided to list” will be shown on the roadmap page of its website.

But crucially, no information on dates or expected timelines is given, with investors expected to wait until an official listing announcement is made.

Coinbase settled with the Securities Exchange Commission in May over insider trading charges. The regulator said Ishan Wahi, a former product manager at the company, tipped off his brother Nikhi and his friend Sameer Rami on token listings before they were public knowledge.

The pair used this information to buy the tokens, selling them for profit after being listed. This was said to have occurred on at least 25 separate token listings. Wahi was sentenced to 24 months in prison for his part in the crime, while his brother received a 10-month sentence.

At the time, Coinbase said it had “zero tolerance for this kind of misconduct and will not hesitate to take action against any employee when we find wrongdoing.”

The post VeChain pumps 11% on being added to Coinbase’s listing roadmap appeared first on CryptoSlate.