Customer interest seems healthy and new products could soon start to contribute financially, according to a new bull.

Source link

Rough

Stock market fails to stage a ‘Santa Claus rally’ in rough start to 2024

Santa Claus was pretty much a no-show on Wall Street.

As defined by the Stock Trader’s Almanac, the “Santa Claus rally” refers to the S&P 500’s tendency to rise during the last five trading days of a calendar year and the first two trading sessions of the new year.

Since 1950, the Santa rally has boosted the S&P 500 by an average of 1.3% over the seven trading-day range. The benchmark large-cap index

SPX

closed higher 78% of the Santa Claus trading window in the past 75 years, and gained during that time for the past seven years, according to Dow Jones Market Data.

That compares with an average return of 0.2% for the S&P 500 during any seven trading-day range since 1950. The index also closed higher 58% of any seven-day trading window over the same period, according to Dow Jones Market Data.

But this time around, the Santa rally period, which ran from Dec. 22 through Wednesday, Jan. 3, saw the S&P 500 fall 0.9%. That was the worst performance for a Santa-rally period since 2015-2016, snapping a streak of seven positive Santa stretches, according to Dow Jones Market Data.

The Nasdaq Composite

COMP

also dropped over that time span, down 2.5% since Dec. 22 to book its third consecutive negative Santa rally period, while the Dow Jones Industrial Average

DJIA

eked out a modest gain of less than 0.1% over the same period, according to Dow Jones Market Data.

A failure to rally in that stretch is seen by some market analysts as a signal for more rough sledding ahead.

“Years when there was no ‘Santa Claus rally’ tended to precede bear markets or times when stocks hit significantly lower prices later in the year,” wrote Jeff Hirsch, editor of the Stock Trader’s Almanac & Almanac Investor Newsletter.

U.S. stocks finished lower on Wednesday as most megacap technology stocks fell for a second session to start the new year. Investors appeared to reassess the year-end rally which helped the Nasdaq Composite surge 43% in 2023, while digesting the monetary-policy path in 2024 following the release of the minutes from the Federal Reserve’s last policy meeting.

The S&P 500 was down 0.8%, to end at 4,704 on Wednesday, while the Dow industrials also dropped 0.8%, at 37,430, and the Nasdaq tumbled 1.2%, to finish at 14,592, according to FactSet data.

3 Reasons Artificial Intelligence (AI) Stocks May Be In for a Rough 2024

In case you haven’t noticed, the bulls are, once again, in full control on Wall Street. Although the 30-component Dow Jones Industrial Average has generated a modest 7% year-to-date return, through the closing bell on July 28, the benchmark S&P 500 and growth-driven Nasdaq Composite have been practically unstoppable. The S&P 500 and Nasdaq closed out July 28 with scorching-hot year-to-date gains of 19.3% and 36.8%, respectively.

While a number of factors have played a role in the outperformance of the innovation-fueled Nasdaq, such as recessionary fears melting away, perhaps the most-prominent reason the Nasdaq is on fire is the exuberance surrounding artificial intelligence (AI) stocks.

Image source: Getty Images.

Artificial intelligence describes the use of software and systems to handle tasks typically overseen by humans. What makes AI such a game changer is its incorporation of machine learning. The ability of software and systems to learn and evolve over time gives AI utility across virtually all sectors and industries.

This potential isn’t lost on Wall Street or analysts. Earlier this year, PwC released a report that estimated the global impact of AI will be $15.7 trillion in 2030, with China and North America among the biggest benefactors, as a percentage of gross domestic product. PwC believes $9.1 trillion of this increase will come from the consumption side of the equation, with an additional $6.6 trillion derived from productivity improvements.

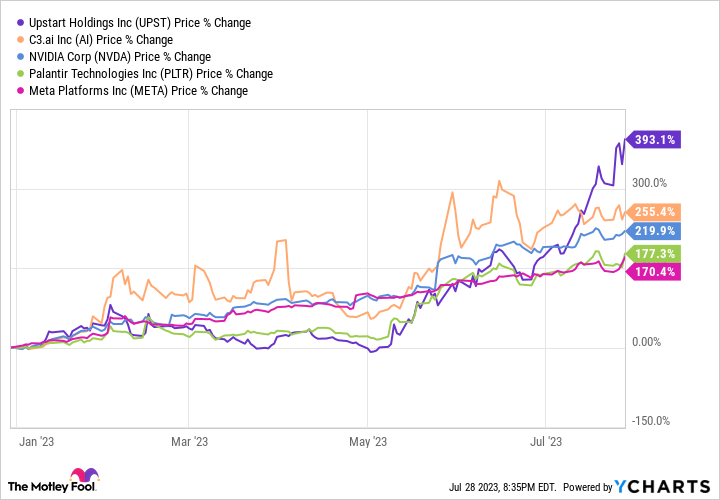

The hype surrounding AI stocks has been impossible to miss, with shares of Upstart Holdings, C3.ai (AI 3.19%), Nvidia (NVDA -0.10%), Palantir Technologies, and Meta Platforms, just to name a few, respectively higher by 393%, 255%, 220%, 177%, and 170% since the year began.

Unfortunately, the tea leaves suggest Wall Street’s hottest trend could run into a brick wall sooner than later. Here are three reasons artificial intelligence stocks may be in for a rough 2024.

1. History repeats itself

The first challenge for AI stocks is that history says they’re doomed — at least in the short run.

Over the past 30 years, there have been no shortage of next-big-thing investments that have excited Wall Street and investors. In no particular order, some examples include the advent of the internet, businesses-to-business commerce, genome decoding, 3D printing, cannabis, blockchain technology, the metaverse, and now artificial intelligence. Each of these trends resulted in jaw-dropping short-term gains for the companies whose future growth depended on them.

But if there’s one consistency with next-big-thing investments, it’s that Wall Street and investors overestimate their adoption. Every new technology or trend takes time to mature — yet investors continue to make the same mistake and believe that the next “big thing” on Wall Street will be different.

In some instances, next-big-thing investments fail to materialize altogether. For instance, the personal-use case of 3D printers from a decade ago still hasn’t materialized on a grander scale.

Meanwhile, other next-big-thing investments, such as the internet, took time to mature and shook out numerous weaker players. Many of today’s biggest winners from the internet hype of the mid-to-late 1990s saw sizable share price drawdowns before their success.

The point being that all next-big-thing bubbles over the past 30 years have eventually popped. Artificial intelligence shows no indications of being any different than previously hyped trends and technologies. This isn’t to say AI won’t be a wild success over the long run. Rather, it’s to convey that all trends need time to mature.

Image source: Getty Images.

2. Capacity becomes a front-and-center problem

The second reason AI stocks could be in for a challenging 2024 is capacity. With businesses from an assortment of sectors and industries wanting to jump aboard the AI euphoria, meeting demand and satiating investor hype is going to become increasingly difficult.

According to a recently released research report from Dylan Patel, the chief analyst of SemiAnalysis, along with Myron Xie and Gerald Wong, AI capacity is being constrained by two factors.

The first trouble spot has to do with high-bandwidth memory (HBM), which is limited in supply but ramping, per the report. Since the parameters of AI are expanding almost exponentially, the memory needs of data center graphic processing units (GPUs) are intensive. HBM’s are a necessity for enterprise data centers running AI-driven GPUs.

The second and arguably bigger issue cited by Patel and his team is chip on wafer on substrate (CoWoS) capacity. The report notes that virtually all HBM systems are being packaged on CoWoS because of its reasonable cost, as well the fact that CoWoS is needed for HBM integration in AI-accelerated data centers. Without getting overly technical, there simply aren’t many efficient/cost-friendly alternatives to CoWoS.

The vast majority of top-notch GPUs — i.e., Nvidia’s AI-driven GPUs, the A100/H100 — are packaged on CoWoS by the world’s leading chip fab company, Taiwan Semiconductor Manufacturing Company (TSM -2.00%), or TSMC as it’s more commonly known. While TSMC is doing everything it can to double its CoWoS capacity, the industry’s biggest AI GPU provider Nvidia has effectively maxed out what it can provide until TSMC expands its operations.

3. Valuations no longer take a backseat

The third reason artificial intelligence stocks may be in for a rough 2024 is their valuations. Specifically, there are two aspects to AI stock valuations that could be troublesome.

To start with, AI stocks could have a hard time living up to the lofty expectations of Wall Street and investors. Take Nvidia for example. Even though the company’s fiscal second-quarter guidance of $11 billion completely blew the consensus analyst estimate of $7.2 billion out of the water, shares are, arguably, as pricey as they’ve ever been.

Between 2013 and 2015, investors could snag shares of Nvidia for 2 to 4 times revenue and roughly 11 to 17 times trailing-12-month (TTM) cash flow. Today, investors are paying approximately 44 times sales and nearly 168 times TTM cash flow to own the dominant player in AI-driven data center GPUs. There’s probably not a figure Nvidia will be able to offer investors from its upcoming quarterly report that merits such a lofty valuation.

It’s a similar story with AI software company C3.ai. Although shares have nearly quadrupled this year, the company’s sales growth is fairly pedestrian for an AI stock (an estimated 16% in fiscal 2024). More importantly, C3.ai hasn’t delivered a profitable year since going public in 2020.

The second aspect of AI stock valuations that could be troublesome is the expectation that the U.S. economy will have weakened by the end of this year, or perhaps early 2024. The Conference Board Leading Economic Index, which has never been wrong when it comes to predicting eventual U.S. recessions, suggests economic weakness is in the cards.

When U.S. recessions take shape, stocks tend to perform poorly. Companies with lofty valuations are usually those hit the hardest. If U.S. economic growth slows, traditional metrics, such as the price-to-earnings ratio, could come back into focus. That would be terrible news for a trend where investors have largely overlooked traditional valuation metrics.