The Central Bank of Russia and the Russian treasury are considering testing using the Russian CBDC, the digital ruble, to complete budget settlements. The tests would involve using this CBDC to make payments to businesses and citizens and receiving payments from these in CBDC, to ensure the targeted use of these funds. Russian Digital Ruble […]

The Central Bank of Russia and the Russian treasury are considering testing using the Russian CBDC, the digital ruble, to complete budget settlements. The tests would involve using this CBDC to make payments to businesses and citizens and receiving payments from these in CBDC, to ensure the targeted use of these funds. Russian Digital Ruble […]

Source link

Russia

United States OFAC places new sanctions on crypto firms with ties to Russia

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned 13 entities and two individuals for operating in the financial services and technology sectors of the Russian economy, including those developing or offering services in virtual assets that reportedly enable the evasion of US sanctions, as reported by the Treasury Department on Tuesday, March 26. Five entities were designated for being owned or controlled by OFAC-designated persons.

According to the Treasury, many designated individuals and entities facilitated transactions or offered services that helped OFAC-designated entities evade sanctions. These designations follow OFAC’s action earlier this year, targeting companies servicing Russia’s core financial infrastructure and curtailing Russia’s use of the international financial system to fund its war against Ukraine.

Under Secretary of the Treasury for Terrorism and Financial Intelligence, Brian E. Nelson stated,

“As the Kremlin seeks to leverage entities in the financial technology space, Treasury will continue to expose and disrupt the companies that seek to help sanctioned Russian financial institutions reconnect to the global financial system.”

The sanctioned companies include Moscow-based fintech firms B-Crypto, Masterchain, Laitkhaus, and Atomaiz, which have reportedly partnered with or provided services to various OFAC-designated Russian banks, such as Rosbank, VTB Bank, Sberbank, and Sovcombank, to facilitate cross-border settlements, issue digital financial assets, and tokenize precious metals and diamonds. Tokentrust Holdings Ltd., based in Cyprus and the majority shareholder of Atomaiz, was also designated.

Other sanctioned entities include Veb3 Tekhnologii and Veb3 Integrator, Moscow-based technology companies providing blockchain solutions and platforms to clients like Sberbank and Alfa-Bank, with their majority shareholder Igor Veniaminovich Kaigorodov also being designated. TOEP, a Moscow-based fintech company operating a virtual currency exchange under the business names Netexchange and Netex24, was sanctioned for enabling digital payments in rubles and virtual currencies to OFAC-designated entities such as Sberbank, Alfa-Bank, and Hydra Market, with its owner and director Timur Evgenyevich Bukanov also being designated.

The Treasury also targeted Bitpapa, a peer-to-peer virtual currency exchange that has conducted transactions worth millions of dollars with OFAC-designated Russian entities Hydra Market and Garantex, and Crypto Explorer, a Russia and UAE-based virtual currency exchange offering conversions between virtual currencies, rubles, and UAE dirhams, as well as cash services at its offices in Moscow and Dubai.

In addition to the crypto-related sanctions, OFAC designated several companies associated with the OFAC-designated Echelon Union for Science and Technology, a Moscow-based entity licensed by the Russian Federal Security Service and the Russian Ministry of Defense, for operating in the technology sector of the Russian economy.

As a result of these actions, all property and interests in property of the designated persons in the United States or the possession or control of US persons are blocked and must be reported to OFAC. The Treasury also warned that foreign financial institutions conducting or facilitating significant transactions or providing services involving Russia’s military-industrial base risk being sanctioned by OFAC.

The sanctions aim to disrupt Russia’s ability to use alternative payment mechanisms and leverage entities in the financial technology space to circumvent US sanctions and continue funding its war against Ukraine. As the Treasury continues to monitor and respond to Russia’s evolving sanctions evasion tactics, it remains committed to upholding the integrity of the international financial system and pressuring Russia to change its behavior.

Latest Alpha Market Report

Russia Regulates Use of Digital Assets for International Settlements

Russia has integrated the use of digital assets as payment for international transactions in its legislation. President Vladimir Putin signed into law a document that describes using these assets as payment for international settlements, a use case not contemplated in any law, appointing the Central Bank of Russia as the overseer of these transactions. Russia […]

Russia has integrated the use of digital assets as payment for international transactions in its legislation. President Vladimir Putin signed into law a document that describes using these assets as payment for international settlements, a use case not contemplated in any law, appointing the Central Bank of Russia as the overseer of these transactions. Russia […]

Source link

Trump’s NATO comments stir up a political storm as Russia keeps quiet

Former U.S. president Donald Trump pictured during a meeting with NATO Secretary-General Jens Stoltenberg at Winfield House, London on Dec. 3, 2019.

NICHOLAS KAMM | AFP | Getty Images

Former U.S. head of state and presidential candidate Donald Trump stoked the ire of U.S. lawmakers and international leaders, after remarking he would not protect NATO countries from Russian attacks if they lag on their membership payments.

Speaking at a rally in South Carolina on Saturday, Trump said that, as president, he warned NATO allies that he “would encourage” Russia “to do whatever the hell they want” to a member country that didn’t meet its defense spending guidelines.

Trump, who has a long history of criticizing the trans-Atlantic military alliance, recounted a time when an unspecified president of a NATO member challenged him on his threat not to defend them from a potential Russian invasion if they failed to meet NATO’s target of spending at least 2% of their gross domestic product on the military.

“You didn’t pay, you’re delinquent. … No, I would not protect you. In fact, I would encourage them to do whatever the hell they want. You got to pay. You got to pay your bills,” Trump said.

The U.S. has historically had the largest number of military personnel out of all NATO countries, counting 1.35 million troops in 2023, according to Statista.

Read more CNBC politics coverage

Trump has been accused of entertaining close ties with Russia during his first presidential mandate. The Kremlin declined to address Trump’s remarks.

“I am still [Russian President Vladimir] Putin’s press secretary, but not Trump’s,” Kremlin spokesperson Dmitry Peskov told reporters, according to Reuters.

Top Western officials, as well as both Democratic and Republican lawmakers, sharply criticized Trump’s comments. U.S. President Joe Biden, who is running for a second term, described Trump’s remarks as “appalling and dangerous.”

“Sadly, they are also predictable coming from a man who is promising to rule as a dictator like the ones he praises on day one if he returns to the oval office,” Biden said Sunday in a statement.

Trump is vying to clinch the 2024 Republican presidential nomination, facing off against former South Carolina Gov. Nikki Haley.

In an interview with CBS, Haley said Sunday that “the last thing we ever want to do is side with Russia.”

She added that the NATO alliance “allows us to prevent war.”

Former Republican presidential candidate Chris Christie also criticized Trump’s comments, saying in an interview with NBC News on Sunday that “this is why I’ve been saying for a long time that he’s unfit to be president of the United States.”

NATO Secretary General Jens Stoltenberg and US National Security Advisor Jake Sullivan (not seen) hold a joint press conference after the North Atlantic Council meeting held at the NATO Headquarters in Brussels, Belgium on February 7, 2024.

Dursun Aydemir | Anadolu | Getty Images

NATO Secretary-General Jens Stoltenberg said the alliance stands “ready and able” to defend all allies and any attack would be met with a “united and forceful” response.

“Any suggestion that allies will not defend each other undermines all of our security, including that of the US, and puts American and European soldiers at increased risk,” Stoltenberg said in a statement.

“I expect that regardless of who wins the presidential election the US will remain a strong and committed NATO Ally,” he added.

NATO’s spending target

NATO’s 31 members, which include the U.S., Canada, France, Italy, Turkey and the U.K., agreed in July last year to spend at least 2% of their GDP on defense, firming up a previous goal.

A report released by NATO last year showed only 11 of the then-30 member alliance were spending 2% of GDP or more on defense. The defense spending target is not a requirement and many countries have sought to ramp up their military spending since Russia launched its full-scale invasion of Ukraine.

NATO’s so-called Article 5 mutual defense clause means that an attack against one NATO member is considered an attack against all allies.

The European Union’s foreign policy chief, Josep Borrell, said Monday that the alliance cannot be dependent on the impulses of the U.S. political leadership.”

“NATO cannot be an ‘a la carte’ military alliance … depending on the humor of the president of the U.S.,” Borrell said when asked to respond to Trump’s comments, Reuters reported.

Germany’s Foreign Office on Sunday posted “One for all and all for one” on its English-language X social media account, supported by the hashtag “#StrongerTogether.”

Polish Defense Minister Wladyslaw Kosiniak-Kamysz said Sunday via X that NATO’s motto of “‘one for all, all for one’ is a concrete commitment.”

“Undermining the credibility of allied countries means weakening the entire North Atlantic Treaty Organization. No election campaign is an excuse for playing with the security of the Alliance,” he added.

Don’t miss these stories from CNBC PRO:

Russia draws up plans to classify mined crypto as an exportable commodity

The Russian Ministry of Finance has proposed allowing crypto miners to export their crypto akin to other commodities, local media outlet RBC reported.

During a round table discussion titled “Cryptocurrency and the Future of Digital Finance,” Ivan Chebeskov, the Deputy Finance Minister, unveiled this proposal. He highlighted the intention to create legislation mirroring the export norms of natural gas for cryptocurrency exports.

Chebeskov stated that the ministry had devised a concept and a project to enable miners to export their mined product—cryptocurrency—as an export commodity. A translated version of his statement reads:

“We developed a concept, a project so that a miner could export the product of what he mined, that is, cryptocurrency as an export product. Such a legislative initiative is also being formed in our country.”

Crypto mining in Russia

Russia produces the second-largest mining power in the world, indicating its strength in the sector. However, despite such advancements, the authorities are yet to legalize crypto-mining activities within their jurisdiction.

A bill addressing this lacuna was introduced to the State Duma last year. The proposed bill outlines procedures for selling mined crypto assets, including foreign platform sales. However, miners must disclose information to the Federal Tax Service under this legislation.

Meanwhile, the Central Bank of Russia permits the sale of mined cryptocurrencies exclusively on foreign platforms and to non-residents.

Russia’s crypto efforts

During the past year, Russia’s attitude toward crypto has shifted, with key stakeholders like the Bank of Russia acknowledging its potential for cross-border settlements. This interest stems from international sanctions limiting the country’s access to global payment systems.

Besides that, officials previously touted the country’s desire to establish a national crypto exchange. However, the idea was shelved after it was kicked against by several stakeholders in the industry. Instead, the authorities have been advised to formulate rules allowing private companies to establish such exchanges.

Oil prices rebound after Russia, Saudi Arabia urge OPEC+ production cuts

Oil futures finished higher on Friday, but still posted a seventh-straight weekly loss — the longest streak of weekly declines since 2018.

Some analysts attributed Friday’s gain to supportive comments from Russia and Saudi Arabia, but prices still fell for the week as traders remain unimpressed by output cuts my major oil producers.

Price action

-

West Texas Intermediate crude for January delivery

CL00,

+2.77%

CL.1,

+2.77%

CLF24,

+2.77%

rose $1.89, or 2.7%, to settle at $71.23 a barrel after closing on the New York Mercantile Exchange. Based on the front-month contract, prices ended 3.8% lower for the week. Prices were down a seventh consecutive week, the longest streak of weekly losses since 2018, according to Dow Jones Market Data. -

February Brent crude

BRN00,

-0.25% BRNG24,

-0.25% ,

the global benchmark, rose $1.42, or 1.9%, to $75.47 a barrel on ICE Futures Europe, losing nearly 3.9% for the week. Both Brent and WTI posted losses in each of the past six sessions. -

January gasoline

RBF24,

+2.89%

rose 2.4% to $2.0498 a gallon, ending 3.4% lower for the week, while January heating oil

HOF24,

+1.40%

gained nearly 1.3% to $2.581 a gallon, for a weekly loss of 3%. -

Natural gas for January delivery

NGF24,

-1.32%

fell almost 0.2% to $2.581 per million British thermal units, ending 8.3% lower for the week.

Market drivers

Oil prices have been under additional pressure since an underwhelming Nov. 30 OPEC+ meeting that offered more voluntary cuts for the first quarter of 2024, but left traders questioning whether all countries would adhere to those.

At the meeting, OPEC+ producers agreed to voluntarily cut around 2.2 million barrels a day (mbd) of crude from the market in the first quarter of next year. That pledge included a widely expected extension of Saudi Arabia’s 1 mbd voluntary output cut and Russia’s 300,000 barrel-a-day cut to crude exports.

Some credit the rise in prices on Friday to verbal support from Russia and Saudi Arabia.

“This bounce came after a meeting between Russian leader Vladimir Putin and Saudi Crown Prince Mohammed bin Salman, emphasizing the ongoing efforts to stabilize global oil markets and manage production levels,” Stephen Innes, managing partner at SPI Asset Management, said in a note to clients.

A joint statement was released on Thursday following Putin’s visit to Riyadh with the Saudi Crown Prince. “In the field of energy, the two sides commended the close cooperation between them and the successful efforts of the OPEC+ countries in enhancing the stability of global oil markets,” said the statement released by the Kremlin.

“They stressed the importance of continuing this cooperation, and the need for all participating countries to adhere to the OPEC+ agreement, in a way that serves the interests of producers and consumers and supports the growth of the global economy,” the statement added.

Weekly losses

WTI and Brent crude settled nearly 4% lower for the week, logging their seventh straight week of losses, the longest streak of consecutive weekly declines for both since 2018, based on the front-month contracts.

WTI crude oil has lost more than 20% since its September high, as the market is “concerned with future global demand amid record output from the U.S.,” said Violeta Todorova, senior research analyst at Leverage Shares. “Concerns about slowing global growth and China’s economic health are mounting after rating agency Moody’s lowered the country’s rating to negative from stable.”

In the U.S., economic data released Friday were upbeat, however, with new jobs created in November showing a gain of 199,000, compared with a 190,000 gain forecast by economists polled by The Wall Street Journal.

Despite OPEC+ announcing voluntary output cuts of 2.2 million bpd for the first quarter of 2024, “traders are concerned that the cuts are voluntary and not mandatory, which raises the question of whether the cartel can really follow through,” Todorova said.

Record U.S. oil production and exports nearing 6 million barrels per day have also been “negating” OPEC+’s ability to influence crude prices, said Todorova.

S&P Global Commodity Insights on Friday reported that OPEC+ crude production fell by 110,000 bpd in November to 42.6 million bpd. OPEC’s largest producers, Saudi Arabia kept November output float on the month at 9 million bpd, in line with its pledge to voluntarily cut 1 million bpd from June levels.

On Friday, the U.S. Energy Department announced a solicitation for up to 3 million barrels of oil for delivery to the Strategic Petroleum Reserve in March, as part of its ongoing efforts to refill the emergency oil reserve following a historic drawdown in the SPR last year. It said it has already purchased nearly 9 million barrels for the SPR for an average of about $75 a barrel.

Meanwhile, oil traders kept watch on any market developments tied to the approval of a referendum in Venezuela last weekend to claim sovereignty over an oil-rich piece of land from Guyana.

Read: What the Venezuela-Guyana border dispute means for oil prices

Biden’s Israel support leaves him as isolated as Russia on world stage: Bremmer

The Biden administration’s steadfast support of Israel in its war against Hamas in Gaza has cost him tremendous political capital internationally, according to Ian Bremmer, the CEO and founder of the Eurasia Group.

Washington’s stated unconditional backing of Israel — politically, financially, and militarily — has been a longstanding pillar of its Middle East foreign policy.

When Israel suffered a brutal terrorist attack on Oct. 7 by the Palestinian militant group Hamas that killed some 1,200 people and took more than 240 hostages, Biden flew to the country in a show of solidarity, pledging billions of dollars in military support. The U.S. already provides Israel some $3.1 billion annually in military aid, making it the largest recipient of American foreign aid in the world.

But in the ensuing days and weeks, the enormous and disproportionate scale of Palestinian deaths in Gaza caused by Israeli airstrikes and ground offensive operations raised anger in many parts of the world at both Israel and Biden, particularly in the Global South. Protests in major cities, including across Europe and the U.S., in support of Palestinians and demanding a cease-fire have made global headlines.

During multiple United Nations General Assembly votes calling for cease-fires, Israel and the U.S. were often the only countries or among a very small minority voting “against.”

“Biden is probably as isolated on the global stage, given how close he is to Israel, closest ally of the United States on this issue, as the Russians were when they first invaded Ukraine, which is a shocking thing to say,” Bremmer, the high-profile geopolitical commentator, told CNBC Tuesday. “But it shows just how challenging this war continuing is going to be for U.S. foreign policy.”

A picture taken from southern Israel near the border with the Gaza Strip on December 6, 2023, shows smoke billowing during Israeli bombardment in Gaza amid continuing battles between Israel and the militant group Hamas.

Jack Guez | Afp | Getty Images

Internationally, numerous leaders and human rights organizations have condemned the U.S. for its continued support of Israel. Biden and other members of his administration including Vice President Kamala Harris and Secretary of State Antony Blinken have said that “far too many” Palestinians have died, and that the way Israel defends itself “matters.” They have helped broker hostage-for-prisoner swaps during a fragile week-long truce and urged the allowance of more aid into Gaza.

But the administration officials hold to the position that Israel “has the right to defend itself,” which critics see as continuing to give Israel carte blanche in its military operations.

A former Egyptian foreign affairs minister, Nabil Fahmy, said last month that the U.S. is “losing a tremendous amount of credibility in the Arab world.”

The “U.S. needs to take a serious look at its role. If it wants to support a stable world order based on rule of law, it has to demand everybody respect international law, whether friend or foe,” Fahmy, who served as minister between 2013 and 2014, told CNBC in an interview.

Since Oct. 7, more than 16,200 people have been killed in Gaza, including more than 10,000 women and children, according to Hamas-run health authorities there. Israel declared a siege of the already blockaded territory shortly after the Hamas attacks, cutting off all water, food and fuel to Gaza. Weeks later, the first aid trucks were able to enter the Strip, but the provisions that have made it in so far are woefully inadequate, according to the United Nations.

U.S. President Joe Biden is welcomed by Israeli Prime Minster Benjamin Netanyahu, as he visits Israel amid the ongoing conflict between Israel and Hamas, in Tel Aviv, Israel, October 18, 2023.

Evelyn Hockstein | Reuters

The situation is also a problem for Biden domestically, Bremmer said.

“At home in the United States this is kind of a no-win situation for Biden, because he’s got a majority of Democrats that increasingly are aligned with the Palestinian position, while the Republicans are saying he’s too soft on Israel. And so, I mean, he just really wants this war to be over. He really wants it out of the headlines. And of course, that’s exactly what’s not happening right now.”

“In fact, the war on the ground in Gaza is now expanding,” Bremmer added. “The impact on Palestinian civilians is increasing, and the proxy war in the region, particularly the Houthis in Yemen, a proxy for Iran are engaging in their most significant attacks on commercial waterway traffic and on U.S. military vessels in the last 24 hours that we’ve seen since the war started. So this is really a problem from the perspective of the U.S. and this isn’t going to get better anytime soon.”

People use the lights on their telephones to search for victims amid the rubble of a smouldering building, following an Israeli strike in Rafah in the southern Gaza Strip on December 6, 2023.

Mahmud Hams | AFP | Getty Images

The White House did not immediately reply to a CNBC request for comment, but spokesperson previously told CNBC that “Israel has the right to defend itself in compliance with international law, including international humanitarian law, especially as Hamas terrorists have said that what happened on October 7th ‘will happen again and again and again’ until Israel is annihilated.”

The northern half of Gaza has been decimated, with Israeli forces now moving their ground offensive into the southern half of the enclave, after 1.1 million residents of the north evacuated south on the Israeli military’s orders. Palestinians in Gaza say they have “nowhere to go” to escape the bombings, and the World Health Organization warns that Gaza’s health system has collapsed and disease is spreading among the population.

Israel says it is not intentionally targeting civilians and that it gives warnings before it attacks certain areas. Its goals are to eliminate Hamas and its military capabilities and to ensure the return of all the hostages captured by the group during its October attack.

By Jacob Gronholt-Pedersen

COPENHAGEN (Reuters) -Carlsberg has cut all ties with its Russian business and refuses to enter a deal with Russia’s government that would make its seizure of the assets look legitimate, the brewer’s new CEO said on Tuesday.

The Danish group has since last year been trying to sell its Baltika subsidiary in Russia, following in the footsteps of many other Western companies exiting Russia since its invasion of Ukraine.

However, after the company announced in June it had found a buyer for its business, Russian President Vladimir Putin the following month ordered the temporary seizure of Carlsberg’s stake in the local brewer.

“There is no way around the fact that they have stolen our business in Russia, and we are not going to help them make that look legitimate,” said Jacob Aarup-Andersen, who took over as CEO in September.

Carlsberg had eight breweries and about 8,400 employees in Russia, and took a 9.9 billion Danish crown ($1.41 billion) write-down on Baltika last year.

Aarup-Andersen said that from the limited interactions with Baltika’s management and Russian authorities since July, Carlsberg had not been able to find any acceptable solution.

“We’re not going to enter into a transaction with the Russian government that somehow justifies them taking over our business illegally,” he said on a call with journalists following the company’s quarterly earnings statement.

This month, Carlsberg retaliated by ending license agreements for its brands in Russia that have enabled Baltika to produce, market and sell Carlsberg products in the country.

“When these licenses run out with the grace period, they’re not allowed to produce any of our products any more. Of course, I cannot guarantee that happens, but that is our expectation,” Aarup-Andersen said.

Russia’s finance ministry said that Rosimushchestvo, the federal government property agency, has been appointed as a temporary manager, exercising the powers of the owner with the exception of the powers to dispose of property.

“At the same time, the introduction of temporary management does not entail a change in the ownership structure,” the finance ministry’s media service said in a statement.

($1 = 7.0168 Danish crowns)

(Reporting by Jacob Gronholt-Pedersen and Reuters;Writinb by Jacob Gronholt-Pederson and Lidia Kelly; Editing by Jan Harvey and Gerry Doyle)

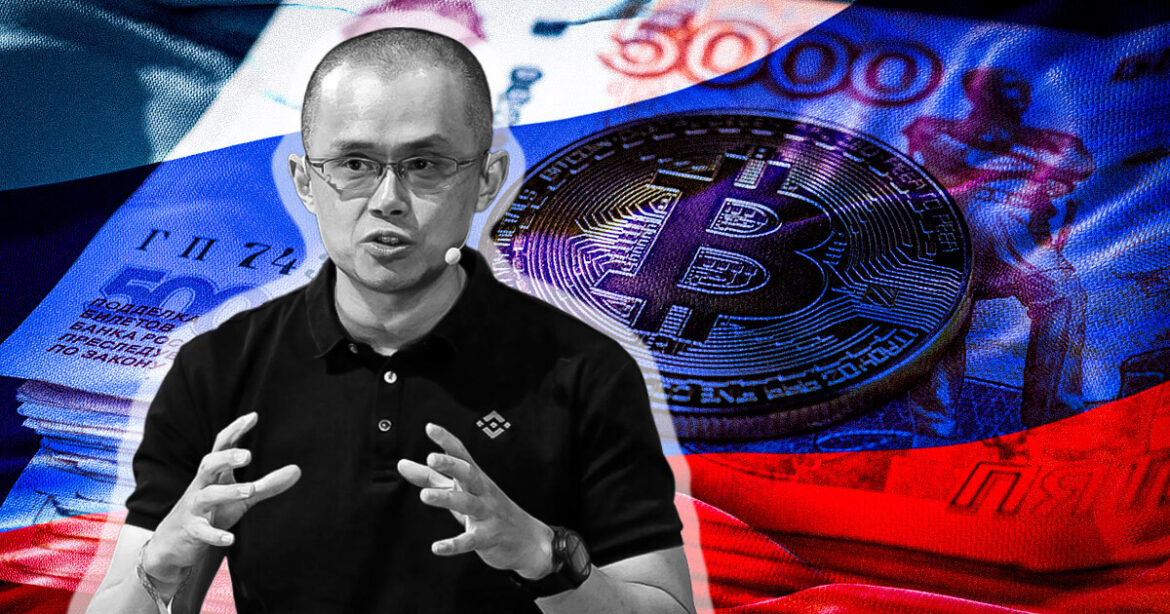

Amid growing skepticism about CommEx — the mysterious buyer of Binance’s Russian division — the newly launched firm has continued denying Binance’s ownership involvement.

On Sept. 29, CommEx issued an open letter to the community, reiterating that the company is not owned by Binance, which announced its exit from Russia by selling the firm to CommEx.

“Although we do not disclose our UBO, we want to make it clear that we are not owned by Binance,” CommEx wrote on its website. A spokesperson for CommEx declined to comment to Cointelegraph about the reasons it won’t share any information about its owners.

“We are a vibrant and efficient start-up team, made up of dozens of passionate individuals from diverse backgrounds,” CommEx said in the announcement, adding that some of its core members are former Binance veterans.

The CommEx announcement said the firm has been developing its platform for six months, during which time it onboarded some ex-Binance employees. “This has allowed us to learn from Binance’s product and operations experiences, establishing indirect connections with them,” CommEx added.

The announcement confirms that former team members of Binance’s division in the Commonwealth of Independent States (CIS) are part of CommEx, despite Binance having no ownership in the exchange.

Former employees at Binance CIS will join or may have already joined the new firm, Binance CEO Changpeng Zhao said on X (formerly Twitter) on Sept. 28. “We think that is a good thing,” he added.

Some answers about Binance/CommEx.

There will be crypto transfers between Binance & CommEx as users migrate with their funds. There are also older transactions during the testing phase of the integrations. This is expected.

A few ex-Binance CIS team members may join their team,…

— CZ Binance (@cz_binance) September 28, 2023

In addition to hiring some ex-Binance employees, CommEx has taken things like design, application programming interfaces, or APIs, and even terms of use from Binance. “We asked for this to ensure a smooth user experience,” CZ wrote.

The Binance CEO also stressed that CommEx does not provide services to users based in the United States and Europe. CZ noted that European and U.S. residents will face intellectual property and Know Your Customer blocks when trying to access CommEx. “This is a term we asked for in the deal,” CZ stated.

According to data from CommEx representatives in the firm’s official Telegram group, CommEx users can trade without completing KYC checks for up to 2 Bitcoin (BTC), or about $54,000.

Related: Binance successor in Russia: Everything you need to know about CommEx, so far

CommEx’s unwillingness to disclose information about its owners, paired with having ex-Binance employees and similar website design and APIs, has fueled chatter about Binance being the company’s owner in disguise.

Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, believes that CommEx is “just another shell company by Binance.”

On the other hand, some crypto observers believe that such a move would undermine Binance’s whole decision to leave Russia. “Obviously U.S. authorities could quickly determine if the new owners were simply straw men for Binance. This would make the situation look even worse than if Binance just held onto the business,” Lesperance & Associates founder David Lesperance told Cointelegraph.

Magazine: Web3 Gamer: Minecraft bans Bitcoin P2E, iPhone 15 & crypto gaming, Formula E

CZ says Binance Russia new owner CommEX will not serve EU, US customers

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.