U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has outlined a “very real economic difference” between crypto like bitcoin and fiat currencies like the U.S. dollar. “You have a whole central bank, and support for one currency, generally per economic region,” the SEC chief noted, adding that we don’t have the same in bitcoin. […]

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has outlined a “very real economic difference” between crypto like bitcoin and fiat currencies like the U.S. dollar. “You have a whole central bank, and support for one currency, generally per economic region,” the SEC chief noted, adding that we don’t have the same in bitcoin. […]

Source link

SEC

Coinbase has lifted the freeze on Debt Box’s assets after discovering discrepancies in the Securities and Exchange Commission’s (SEC) representation of its case against the firm.

In a Feb. 13 post on social media platform X (formerly Twitter), Paul Grewal, Coinbase chief legal officer, highlighted the SEC’s flawed actions, saying the temporary restraining order (TRO) against Debt Box was “tainted by SEC’s misinterpretations” and criticized the regulatory body’s lack of immediate rectification upon acknowledging its deceptive stance.

According to Grewal, Coinbase challenged the SEC’s order because the regulator “sat silently” instead of “immediately pulling its order after admitting that it deceived the Court.” The exchange attempts to get an explanation from the authorities proved futile as it was met with “more silence.”

Consequently, Coinbase opted to unfreeze the assets, correcting the error while awaiting clarity from the SEC, which has remained silent.

“We have now righted that wrong by unfreezing the assets,” Grewal said.

Grewal furthered that the SEC’s move to dismiss the case without prejudice and mandatory training was insufficient redress for its actions.

SEC vs. Debt Box

The SEC’s pursuit of Debt Box has ignited a firestorm of critique regarding its handling of the emerging crypto industry.

Controversy flared when revelations surfaced about the SEC’s attorneys presenting false and misleading evidence in their bid for a TRO against DEBT Box. US District Judge Robert Shelby demanded explanations from the lawyers on why they shouldn’t face sanctions for their actions.

Following scrutiny, the SEC acknowledged its error and pledged to prevent such lapses. They sought the court’s acceptance of a motion to dismiss the action without prejudice as their sole penalty.

Yet, criticism of the SEC’s handling of the Debt Box case didn’t relent. Several crypto stakeholders and US lawmakers, including JD Vance, Thom Tillis, Bill Hagerty, Cynthia Lummis, and Katie Boyd Britt, condemned the regulator’s conduct as “unethical and unprofessional.”

“Regardless of whether Commission staff deliberately misrepresented evidence or unknowingly presented false information, this case suggests other enforcement cases brought by the Commission may be deserving of scrutiny. It is difficult to maintain confidence that other cases are not predicated upon dubious evidence, obfuscations, or outright misrepresentations,” the lawmakers wrote.

Former SEC chief criticizes NBA handling of controversial crypto partnerships

The National Basketball Association (NBA) should be held responsible for the alleged misconduct of its teams, according to a former official of the US Securities and Exchange Commission (SEC).

On Feb. 6, a proposed class-action lawsuit was filed against the sports organization concerning its marketing partnerships with the defunct crypto lender Voyager Digital.

The lawsuit asserts that the NBA demonstrated “gross negligence” by endorsing Voyager’s promotional agreement with the Dallas Mavericks. It further contends that the NBA should be accountable for approving Voyager’s unregistered securities.

Additionally, the plaintiffs argue that the NBA knowingly embraced the risks associated with collaborating with crypto entities like Voyager, Coinbase, and FTX.

They claim the NBA accepted “billions in promotional compensation” amidst challenges such as dwindling arena attendance and substantial television revenue losses due to the COVID-19 pandemic.

“The NBA violated their own written Crypto Currency Protocols, all solely for its own financial gain,” the lawsuit stated.

Former SEC official makes case against NBA.

A former SEC official argued that the NBA should be made to pay if it is complicit.

John Reed Stark, the former SEC Chief of Internet Enforcement, said:

“The NBA should be held responsible for Voyager-related and other similar kinds of alleged misconduct by NBA teams.”

Stark highlighted that the NBA, being a globally renowned and financially influential entity, likely exercises some degree of oversight on how its teams engage investors and navigate risky investments.

Therefore, the organization has to justify its actions or inactions, particularly as its teams continue to promote precarious NFT ventures, questionable crypto platforms, and other financially perilous investments.

The NBA has yet to respond to CryptoSlate’s request for comment as of press time.

While Stark suggested potential refunds for affected investors if NBA complicity in the Voyager matter is confirmed, he also emphasized the need for the NBA to establish a robust compliance framework for team advertising partnerships. Such measures, he argued, would prevent associations with questionable crypto firms and illicit businesses like heroin manufacturers.

Bakkt says it is ‘confident’ about continuing operations after disclosing liquidity issues in SEC filing

Bakkt Holdings said in a press release on Feb. 8 that it is “confident” it will continue operating despite expressing concerns earlier over its liquidity in a regulatory filing.

Bakkt wrote that “management remains confident” and intends to continue serving clients and moving toward profitability. The exchange added that its filing with the SEC for the quarter ending September 2023 described various risk factors in part related to its acquisition of Apex Crypto, which concluded in early 2023.

Bakkt said that its Feb. 7 amendment to that filing describes risk factors related to its ability to continue as a going concern for 12 months after the date of the amended form. The company said that its concern analysis can only include management plans that have been implemented or are probable; it must exclude new products and market launches and those without proven revenue.

Bakkt offers business products, including a turnkey crypto trading API, custody services, and crypto reward solutions. Bakkt discontinued an app aimed at retail users in March 2023. Its parent company, ICE, terminated Bakkt Bitcoin futures and options contracts in September 2023.

SEC filing tells a different story

Despite Bakkt’s assurances to the public, its submission to the SEC explicitly states in bold text:

“We might not be able to continue as a going concern.”

According to the filing, Bakkt said that it is not probable that its revenue will generate sufficient profit and cash flows to continue doing business. It also described “expected operating losses and cash burn for the foreseeable future.”

Another section reads:

” … We have determined that we do not believe that our cash and restricted cash are sufficient to fund our operations for the 12 months following the date of this [filing].”

The firm said it is currently seeking additional capital but noted that various methods of raising capital would not be available or acceptable. One option would be to issue securities, but that would dilute its stock value.

Bakkt said that lack of funding may lead it to reduce expansion efforts, cut operating costs, limit future development, or “even terminate operations.” The firm also expressed uncertainty around the handling of crypto in the event of bankruptcy.

The post Bakkt says it is ‘confident’ about continuing operations after disclosing liquidity issues in SEC filing appeared first on CryptoSlate.

Terraform Labs filed for bankruptcy to protect against potential SEC money judgment

Terraform Labs, the brains behind the Terra blockchain network, opted for bankruptcy protection as a strategic move against any “potential money judgment” that could be enforced by the U.S. Securities and Exchange Commission (SEC).

In a Jan. 30 court filing, Terraform Labs CEO Chris Amani explained that the company might need to close its business to meet the monetary penalties that could be imposed in favor of the financial regulator. This, in turn, would deprive the crypto company of its right to appeal and could have severe repercussions for holders of Terra-related tokens like Luna.

“Without the protection of chapter 11, the Debtor would likely have to liquidate after the trial and entry of final judgment, forfeiting its right to an appeal and causing disastrous consequences for the Debtor’s business, its approximately 60 employees, its creditors, and the hundreds of thousands of holders of Luna that depend on the Debtor to maintain the Terra Blockchain—the same token holders the SEC purports to protect,” Armani stated.

Last December, the SEC secured a favorable judgment from Judge Jed Rakoff, who ruled that Terraform Labs and its founder, Do Kwon, violated the Securities Act by offering and selling various securities tokens, including the failed algorithmic UST stablecoin, LUNA, wLUNA, and MIR.

However, the company has maintained that it disagrees with this ruling and revealed that it intends to file an appeal after the District Court enters its final judgment.

So, the Chapter 11 bankruptcy filing offers crucial legal protection, enabling Terraform Labs to potentially restructure its finances, continue operations, appeal the decision, and strive for long-term success.

Additionally, Amani emphasized that the company’s current focus is not profit generation. He clarified that Terraform Labs has reinvested all earnings into the business and the Terra blockchain ecosystem to foster growth.

“In fact, the Debtor does not currently operate to gain profits; all revenue earned is expected to be reinvested in the business and the Terra blockchain ecosystem,” Amani stated.

BlackRock warned SEC lack of in-kind orders for Bitcoin ETF shares could hurt investors

A novel aspect of the new spot Bitcoin ETFs, as approved by the SEC, is the cash-creation mechanism for issuing and redeeming shares. The ETFs are considered commodity-shares ETFs, yet, as BlackRock points out in its iShares Bitcoin ETF (IBIT) prospectus, “all spot-market commodities other than bitcoin, such as gold and silver, employ in-kind creations and redemptions with the underlying asset.”

In its filings, BlackRock strongly advocated for in-kind orders for shares, but the SEC guided applicants toward a cash-creation model due to the nature of specific regulatory processes. People allowed to buy and sell shares of the trust (Authorized Participants) have to be registered broker-dealers, which means they are officially recognized and must follow certain financial rules. Right now, it’s not clear how these broker-dealers can follow these rules if they’re dealing with Bitcoin directly.

Due to this uncertainty, it’s risky for these broker-dealers to use Bitcoin to buy or sell shares of the trust. The SEC probably would not have allowed a product like this on the stock exchange if it’s unclear how the rules apply. Therefore, all the ETF applications were updated from in-kind to cash-creates in December before approval.

If the “NASDAQ receives the in-kind regulatory approval” to allow buying and selling shares with Bitcoin directly in the future, the ETFs will likely request a change to enable in-kind orders. However, we don’t know when this will happen or if it will happen at all.

BlackRock’s view on the cash creation model for Bitcoin ETFs

This information has been available to investors since the Dec. 19 update to BlackRock’s S1 filing. However, following the successful launch of the Newborn Nine ETFs and billions of dollars in volume, revisiting the world’s largest asset manager’s warning to the SEC concerning cash-creates seems worthwhile. It’s important to note that BlackRock is required to state any material risks in its prospectus, so the inclusion of a potential scenario means it is possible, not probable.

That said, BlackRock does not believe the cash-creation method is efficient, stating that the trust’s current practice of buying and selling shares with cash instead of using Bitcoin directly could cause problems in keeping share prices aligned with Bitcoin’s actual value.

It cautions that this mismatch might happen because cash transactions are more complex and take longer than direct Bitcoin transactions. It continues to identify that delays in these transactions could mean that the prices used to calculate the value of the trust’s shares (NAV) may not accurately reflect the real-time price of Bitcoin.

Further, under a section entitled ‘Risk Factors Related to the Trust and the Shares,’ BlackRock also warns of reduced arbitrage opportunities for Authorized Participants,

“The use of cash creations and redemptions, as opposed to in-kind creations and redemptions, may adversely affect the arbitrage transactions by Authorized Participants intended to keep the price of the Shares closely linked to the price of bitcoin and, as a result, the price of the Shares may fall or otherwise diverge from NAV.”

Finally, BlackRock warned that there is a possibility that Authorized Participants might not want to continue facilitating the trust if they think these delays and extra steps have become too risky or costly. This reluctance may also make it harder to keep the trust’s share prices close to the actual value of Bitcoin. If this system doesn’t work well, investors might buy shares for more than they’re worth or sell them for less. This could cause losses for the shareholders.

BlackRock is a more prominent advocate for in-kind orders than the model approved by the SEC. The prospectus says in-kind share creation and redemption is “generally more efficient, and therefore less costly, for spot commodity exchange-traded products.”

Bitcoin ETF NAV correlation with cash creation model.

Most interestingly, BlackRock identifies cash-creation commodity-shares ETFs as “a novel product that has not been tested and could be impacted by any resulting operational inefficiencies.” Specifically, BlackRock highlights times of “market volatility or turmoil” where cash-creates could materially affect the ETF’s ability to trade.

“In addition, the Trust’s inability to facilitate in-kind creations and redemptions, and resulting reliance on cash creations and redemptions, could cause the Sponsor to halt or suspend the creation or redemption of Shares during times of market volatility or turmoil, among other consequences.”

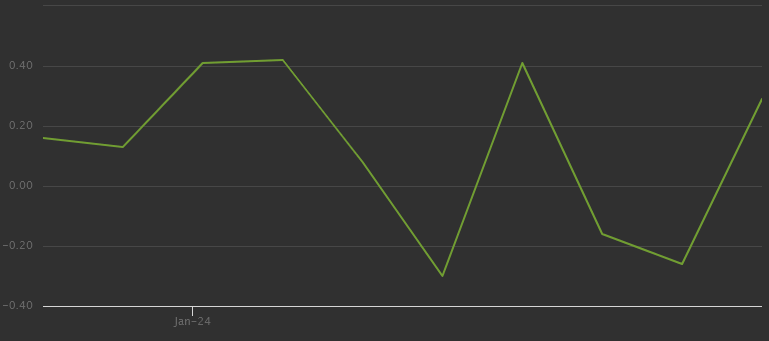

Since launch, the NAV premium to discount spread has been less than 100bps, ranging from +40bps to -30bps over ten trading days. By comparison, BlackRock’s iShares Core S&P 500 ETF (IVV) has not deviated more beyond +5bps and -11bps over the past twelve months.

In a more direct comparison, however, the iShares Gold Trust (IAUM) has seen a spread of around +300bps over the past twelve months. Its highest premium to gold was over +200bps, and the lowest discount was around -140bps.

Given that IAUM can use in-kind orders for gold and BlackRock believes cash-creates could create a more volatile discount or premium for IBIT, investors may wonder if we should expect it to see deviations from the NAV beyond 3% in the future. Alternatively, perhaps BlackRock’s resolve for in-kind orders was a foretelling of the exodus from Grayscale, which, if handled in-kind, may have simply seen Bitcoin leaving one ETF and flowing directly into another instead of being resold several times.

The next filing to look out for regarding potential in-kind Bitcoin ETF orders is whether the Nasdaq requests that Bitcoin be considered a viable asset for buying and selling shares. Until then, the cash creation of shares will continue.

SEC delays BlackRock’s spot Ethereum ETF; decisions are still due in May

The U.S. Securities and Exchange Commission (SEC) extended the decision period on BlackRock’s planned spot Ethereum ETF on Jan. 24.

That notice concerns a proposed rule change allowing Nasdaq to list and trade shares of the BlackRock iShares Ethereum Trust.

Previously, the SEC was required to approve, reject, or institute proceedings to approve or reject BlackRock’s proposal by Jan. 25, 2024. However, securities laws permit the agency to extend the decision period to March 10, 2024.

The SEC noted Nasdaq initially filed the proposed rule change on Nov. 21, 2023 and that the proposal was published for comment in the Federal Register on Dec. 11, 2023. The date of publication determines the deadlines described above.

The SEC added that it has not received any comments on BlackRock’s spot Ethereum ETF proposal. By contrast, BlackRock’s spot Bitcoin ETF proposal received about 15 comments within two months of its June 2023 filing.

SEC still expected to make decision in May

The delay around BlackRock is not expected to affect broader Ethereum ETF proceedings. Bloomberg ETF analyst James Seyffart said today:

“Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. [The] next date that matters is May 23rd.”

May 23 is relevant as the SEC must approve or deny VanEck’s spot Ethereum ETF by that date without any possibility of further delays. The securities regulator will likely decide on other similar applications with different deadlines, including BlackRock’s, alongside VanEck’s application at that time.

The SEC similarly delayed proceedings around Fidelity’s spot Ethereum ETF this month. Once again, this will not impact the May decision deadline.

Though it is required to make a decision by May 23, it is unclear whether the SEC will opt to approve the funds. FOX Business’ Eleanor Terrett has reported internal resistance at the SEC while suggesting that some ETF issuers are optimistic.

Polymarket odds currently suggest a 54% chance of approval by May 31. Bloomberg ETF analyst Eric Balchunas predicts a 70% chance of approval.

SEC to vote today on tough new rules for blank-check ‘SPAC’ companies

SEC Chair Gary Gensler testifies during the House Financial Services Committee hearing titled “Oversight of the Securities and Exchange Commission,” in Rayburn Building on Wednesday, September 27, 2023.

Tom Williams | Cq-roll Call, Inc. | Getty Images

The Securities and Exchange Commission, lead by Chair Gary Gensler, is voting Wednesday on new rules to curb SPACs.

Special Purpose Acquisition Companies, sometimes called “blank check companies,” are companies formed to raise capital through an initial public offering for the purpose of buying or merging with an existing company.

Gensler says the new rules are necessary to protect investors.

“Functionally, the SPAC target IPO is being used as an alternative means to conduct an IPO,” Gensler said in a March 2022 statement on the proposed regulations.

Gensler is no fan of SPACs

Gensler has been hostile to SPACs since the beginning of his tenure at the SEC. In a video published on the SEC website in December 2021, Gensler was openly disdainful of SPACs:

“Suppose a group of strangers came up to you and said, ‘I have a company that doesn’t do much of anything, but sometime in the next two years will merge with another company. I don’t know what that company is yet.’ Would you invest in the stranger’s company?” Gensler says in the clip. “That’s essentially what a special purpose acquisition company, a SPAC, does.”

Gensler has also been critical of the high 20% sponsor fees associated with SPACs, as well as other fees for bankers and financial advisors.

He’s also been critical of how SPAC investors have been diluted by the use of so-called private investments in public equity, which allow investors, mostly big institutions, an additional opportunity to put money into the SPAC. PIPE investors can often can buy shares at a discount after a target merger, Gensler has asserted.

SPACs: Much more disclosures will be required

The new rules will:

1) Expand disclosure requirements regarding SPAC sponsors, SPAC sponsor compensation, conflicts of interest, dilution, and the target company. After a blank-check SPAC goes public, it will usually announce within two years the acquisition of a target company, which is known as a de-SPAC transaction. The new rules would also require additional disclosures from a board of directors about whether the de-SPAC transaction is in the best interests of the SPAC and its shareholders.

2) More closely align disclosure and legal liabilities for de-SPACS with those of traditional IPOs. Executives marketing de-SPACs often made wild claims about the future profitability of their companies, claims which would never have been possible to make had a traditional IPO route been used.

“The idea is that parties to the transaction shouldn’t use overly optimistic language or over-promise future results in an effort to sell investors on the deal,” Gensler said in a March 2022 news release.

The new rules would make the legal obligations and liabilities for a de-SPAC transaction similar to those of traditional IPOs. It would, for example, make the target company legally liable for any statement made about future results by assuming responsibility for disclosures.

Forward-looking statements: No safe harbor

Companies are provided with a “safe harbor” when they make forward looking statements, which provide them with protection against certain legal liability.

However, IPOs are not afforded this “safe harbor” protection, which is why forward-looking statements in an IPO registration are usually very cautiously worded. The proposed rules would also make the “safe harbor” legal protections for forward-looking statements unavailable for blank check companies, meaning they could more easily be sued.

The SPAC market has already collapsed

2020 and 2021 were record years for SPAC IPO filing. In comparison, there were 86 SPAC IPOs in 2022, a significant decrease compared to the last two years, according to Statista.

In 2023, the SPAC craze collapsed. Bloomberg data cited by Forbes indicated that 21 firms that had gone public via SPACs went bankrupt in 2023, the largest of which was flexible workplace provider WeWork, which filed for Chapter 11 protection in November 2023. Lordstown Motors also filed for bankruptcy.

When asked if the SPAC craze was over on CNBC’s “The Exchange” on Tuesday, Duncan Davidson of Bullpen Capital laughed and said, “Yes. The SPAC companies were highly speculative and they collapse and nobody wants to touch a SPAC.”

Still, better late than never.

“Investors deserve the protections they receive from traditional IPOs, with respect to information asymmetries, fraud, and conflicts, and when it comes to disclosure, marketing practices, gatekeepers, and issuers,” Gensler said in the March 2022 statement when the rules were proposed.

An SEC spokesman acknowledged there had been a decline in SPAC activity since 2021, but there is still activity in the marketplace.

“The types of rules we are recommending are investor protections and disclosures that we think are necessary regardless of market fluctuations,” the spokesman said.

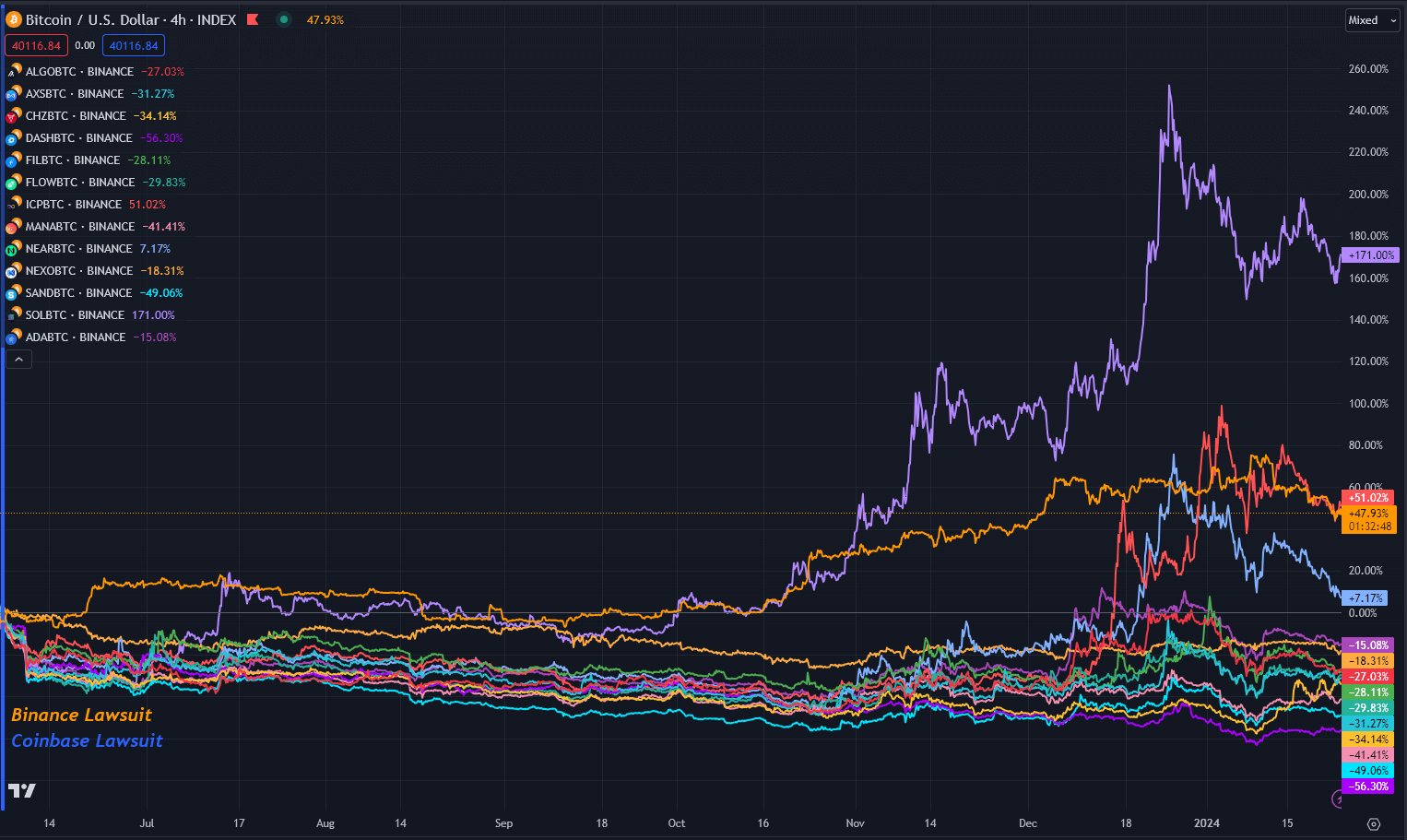

Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities

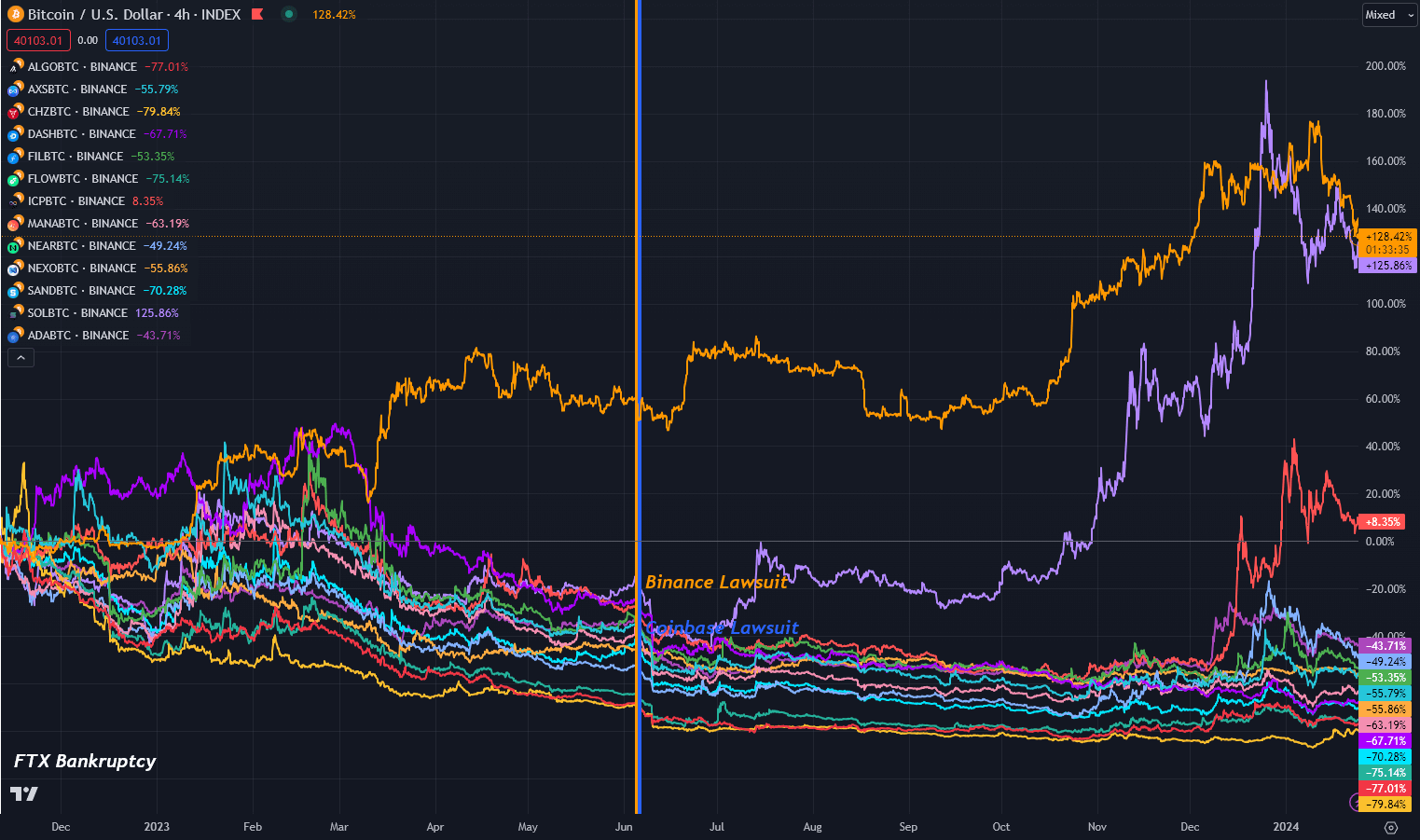

With Bitcoin down some 20% from its year-to-date high, it’s often helpful to zoom out and look at the broader picture. I have a saved chart of all the tokens listed in the Coinbase and Binance lawsuits filed (C&B suits) on June 6 and June 5, 2023, respectively, and their prices as denominated in Bitcoin.

For context, both Binance and Coinbase are currently defending their positions in U.S. courts. The central issue in both lawsuits is whether the crypto assets offered by these exchanges should be classified as securities and, therefore, fall under SEC regulation.

The tokens described as potential securities in the abovementioned lawsuits included Alogrand, Solana, Cardano, Near, Filecoin, and others, as shown in the chart below. Let’s examine how these assets have performed compared to Bitcoin over the past 8 months and then look at some of the standout tokens’ performance in dollar terms.

For context, we’ll first look at the performance of this cohort of digital assets since the black swan event that preceded the C&B suits, namely the bankruptcy filing and subsequent collapse of FTX. The exchange filed for Chapter 11 bankruptcy on Nov. 11, 2023, when Bitcoin was priced around $16,900. Since then, it has soared by approximately 140% against the dollar, with only two assets outperforming it.

Solana and ICP saw increases in their price in BTC terms, increasing 116% and 9% respectively. All other tokens listed as potential securities declined against Bitcoin between -41% and -80%

The best was Cardano, which lost 41% of its value against Bitcoin; the worst was Chilliz, which declined -80%. In dollar terms, Cardano is up 50%, while Chilliz is down -53%, showcasing the strength of Bitcoin over the past 15 months.

Performance since Coinbase and Binance SEC lawsuits.

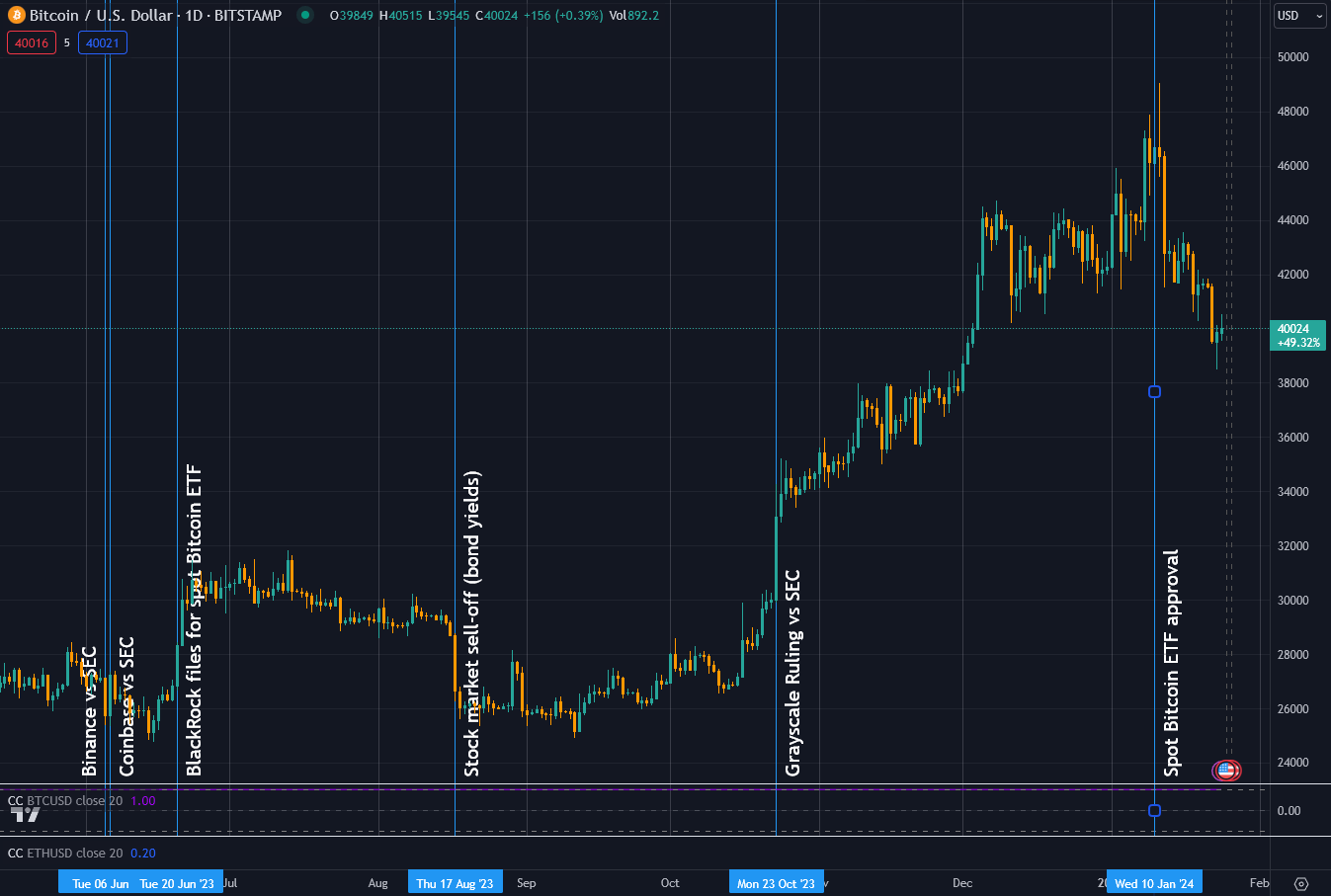

When Binance and Coinbase were hit with SEC lawsuits within a day of each other last June, the market reeled from the impact of the two most prominent names in crypto exchanges being so directly targeted. On June 5, when Binance was served, Bitcoin fell to $25,300 from around $26,800. However, on the day Coinbase was served, it regained its value before slowly bleeding out to around $25,00 mid-way through the money.

On June 20, 2023, BlackRock filed its application for a spot in Bitcoin ETF, which saw Bitcoin’s price elevate to over $30,000 until a stock market sell-off in August reversed the gains. From there, it traded sideways until Grayscale’s victory in court against the SEC, when the price took off toward its eventual 2-year high of $49,000 on the day the spot Bitcoin ETFs launched. At this peak, Bitcoin was up 90% since the C&B suits.

As of press time, having retraced somewhat, Bitcoin is up 47% since the C&B suits, with three assets having performed better. Solana and ICP outdid Bitcoin, this time by 169% and 49%, respectively. However, Near Protocol is also up 8% on Bitcoin.

All other tokens threatened with categorization as a Security fell against Bitcoin within the timeframe, the worst now Dash declining -56%, with the least affected being Cardano, down -15%.

Notably, against the dollar, Solana, ICP, and Near are up 286%, 265%, and 145%, respectively, over the same timeframe. Moreover, even the biggest loser against Bitcoin, Dash, is up 4%, and Cardano is up 87% against the dollar.

When you price everything in dollars in crypto, you can miss that your assets have declined in Bitcoin terms.

Binance and Coinbase defend their positions in court.

Although most of the industry has been focused on ETFs this year, Binance’s case was heard on Jan. 22 in a Washington courtroom, with Judge Amy Berman Jackson of the District of Columbia presiding, and Coinbase appeared in a New York court on Jan. 17, with Judge Katherine Polk Failla overseeing the proceedings.

The SEC’s argument against Binance focused on Binance’s BUSD stablecoin and BNB token, suggesting that at least the BNB token might have initially been sold as an investment contract. Binance’s defense challenged the applicability of the Howey test to cryptocurrencies and disputed the SEC’s comparisons to other court cases, such as Zakinov v. Ripple Labs.

Coinbase also contested the relevance of the Howey test for cryptocurrencies. The SEC’s broad approach raised concerns about extending the definition of securities to encompass categories typically outside its purview, such as collectibles. Judge Failla acknowledged the complexity of the issue and deferred her decision.

Elliott Stein, a senior litigation analyst at Bloomberg, assessed a 70% likelihood of the SEC’s June 2023 lawsuit against Coinbase being dismissed. However, a victory for the SEC in either case could have significant implications for the cryptocurrency industry. It could mandate crypto exchanges to treat digital tokens as securities, fundamentally altering how these assets are handled and regulated in the U.S.

The outcomes of these cases will set precedents for the future regulation of digital assets in the country and will likely have a tangible impact on the tokens named in the C&B suits.

Prominent crypto lawyer criticizes SEC overreach in Ripple lawsuit, advocates for financial freedom

John Deaton, a well-known crypto lawyer, said that regulatory actions against the crypto industry point to a significant government overreach and intrusion into the private sector.

Deaton made the statement on social media on Jan. 22, where he specifically called out the actions of various federal agencies, including the SEC, FBI, EPA, and the Federal Reserve — likening their operations to an Orwellian ‘Big Brother’ scenario.

His comments reflect a growing sentiment within the cryptocurrency community about the balance between regulation and financial liberty.

Ripple lawsuit

Deaton’s criticism was particularly pointed towards the SEC’s lawsuit against Ripple Labs Inc., CEO Brad Garlinghouse, and co-founder Chris Larsen. Initiated in December 2020, the lawsuit accused Ripple of conducting an unregistered securities offering through the sale of XRP.

He criticized the SEC’s broad classification of XRP tokens as illegal securities, suggesting it was an unconstitutional expansion of the watchdog’s authority. Deaton added that the dismissal of charges against Brad Garlinghouse and Chris Larsen demonstrates the regulator’s misuse of its power.

Deaton also pointed out that before the lawsuit, major players like Coinbase and MoneyGram had conducted due diligence on XRP without any objections from the SEC, which indicates a lack of clarity and consistency in the regulator’s approach toward cryptocurrencies.

The recent developments in the case bolster his argument. Judge Analisa Torres partially ruled in favor of Ripple Labs, determining that XRP sales on digital asset exchanges do not constitute a security.

Deaton has suggested that the lawsuit was used as a weapon against Ripple, a stance he has maintained since filing a Writ of Mandamus against the SEC shortly after the lawsuit was announced.

Attack on financial freedom

Deaton, who has initiated legal action against the SEC on behalf of XRP investors, users, and developers, explained that his lawsuit was motivated by the broader implications of the SEC’s actions rather than personal financial interest.

He stated that his holdings in XRP are minimal compared to other investments like Bitcoin and Ethereum. For Deaton and 75,000 others, the lawsuit represents an assault on a crucial liberty: financial freedom. He argued that in America, people should have the autonomy to own legal assets beneficial to their lives without government interference.

The attorney also criticized the Accredited Investor Rule, viewing it as a tool for the elite to restrict financial mobility for the majority of the population. He said the rule is a mechanism to maintain dependency on the government and restrict access to financial opportunities.