This weekend, many are intrigued by the potential outcomes following the cessation of the U.S. Federal Reserve’s Bank Term Funding Program (BTFP), launched amidst the significant banking collapses in March 2023. Some argue that the banking turmoil is far from over, suggesting it has merely been postponed, with institutions like New York Community Bancorp (NYCB) […]

This weekend, many are intrigued by the potential outcomes following the cessation of the U.S. Federal Reserve’s Bank Term Funding Program (BTFP), launched amidst the significant banking collapses in March 2023. Some argue that the banking turmoil is far from over, suggesting it has merely been postponed, with institutions like New York Community Bancorp (NYCB) […]

Source link

sectors

Quick Take

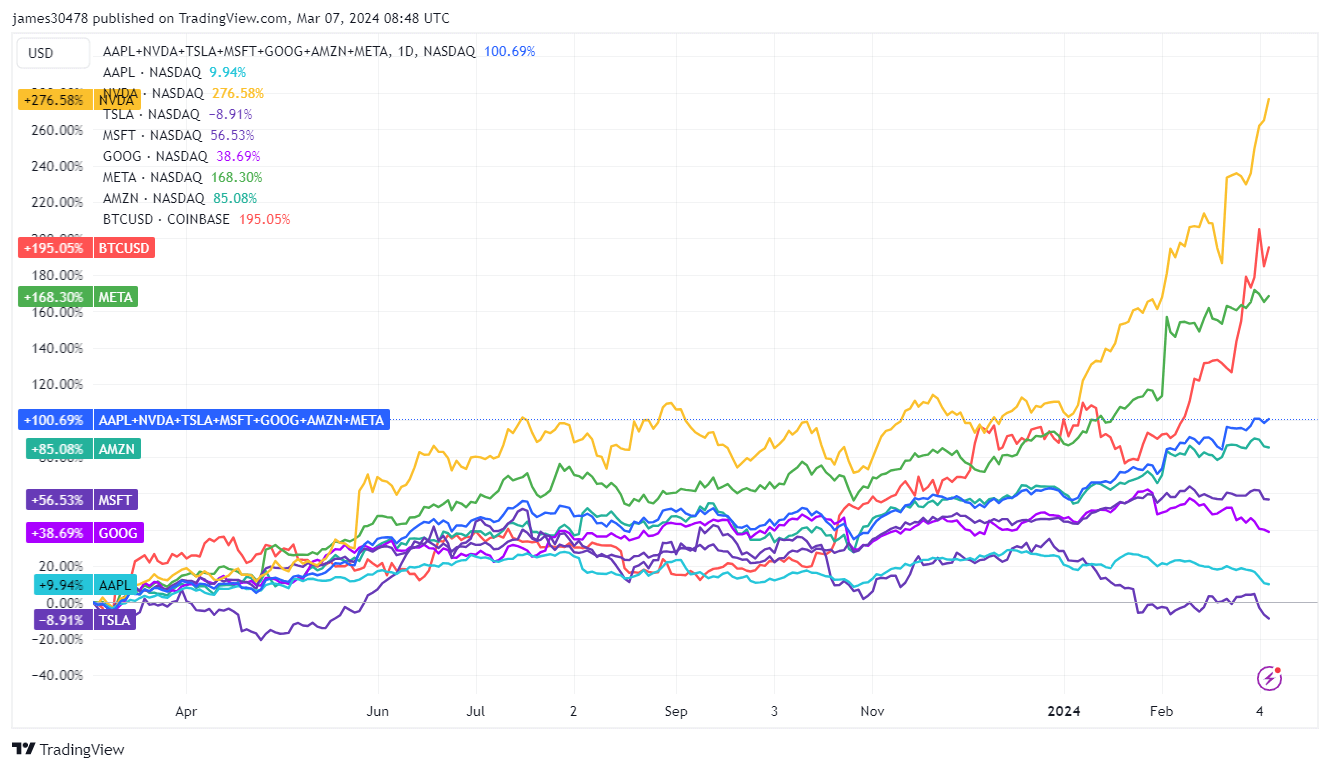

Comparing the performance of the ‘Magnificent 7’ tech stocks—Nvidia, Meta, Microsoft, Amazon, Google, Tesla, and Apple—to Bitcoin shows that the coveted group of assets is seeing significant competition from Bitcoin. A one-year comparison reveals Bitcoin’s superior performance, posting a 195% increase compared to the Mag 7’s average rise of 101%. Although the two were fairly correlated, Bitcoin’s surge since late February led to a noticeable decoupling.

Over the past year, Nvidia stands as the sole tech stock among its peers to have exceeded Bitcoin’s performance, achieving a remarkable increase of 277%.

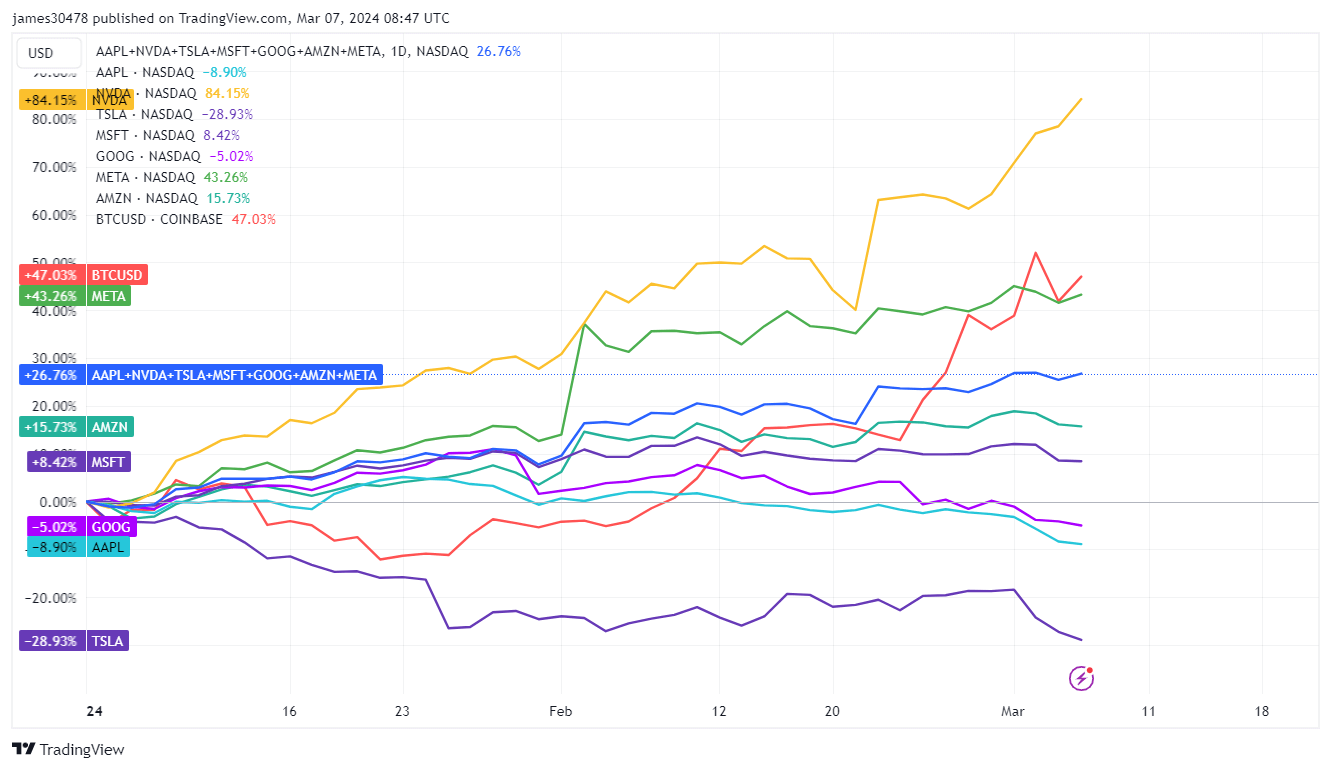

Bitcoin, up 47% year-to-date (YTD), would be second only to Nvidia, which is up 84% since the beginning of the year. Three out of the seven tech stocks are showing negative YTD returns — Tesla is down 29%, while Apple and Google are down 9% and 5%, respectively.

Bitcoin’s performance nearly doubles the Mag 7 average of 27%. This leads to speculation on whether sustained BTC growth could trigger a financial shift from these tech stocks into Bitcoin.

The post Bitcoin’s 195% gain overshadows the tech sector’s ‘Magnificent 7’ appeared first on CryptoSlate.

Health of several key sectors, including the U.S. consumer, plus an outlook from Fed’s Powell on radar this coming week

Recession fears are rising. Nothing beats fear better than good information and that’s what we will get this week. Investors and economists will get good insight into the mood of U.S. consumers and hear the last words of Federal Reserve Chair Jerome Powell ahead of the central bank’s next interest-rate meeting on Dec. 12-13.

November consumer confidence

Tuesday, 10:00 a.m. Eastern

Economists surveyed by the Wall Street Journal expect that consumer’s view on the outlook have soured over the past few weeks. Geopolitical…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In