A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

Source link

security

Uncomfortable Conversations About Privacy and Security Take the Stage in Amsterdam

PRESS RELEASE. Privacy is dead in crypto, people that know, know. People who don’t know, should know. That’s why CryptoCanal’s ETHDam Conference will gather people from all sides of the blockchain spectrum to discuss the future of privacy and security. “As a privacy and security-focused conference, we encourage panels on the harder discussion topics,” explains […]

PRESS RELEASE. Privacy is dead in crypto, people that know, know. People who don’t know, should know. That’s why CryptoCanal’s ETHDam Conference will gather people from all sides of the blockchain spectrum to discuss the future of privacy and security. “As a privacy and security-focused conference, we encourage panels on the harder discussion topics,” explains […]

Source link

Joe Biden Wants to Tax the Rich to Save Social Security, but This Isn’t as Cut-and-Dried a Solution as You Might Think

For a majority of future retirees, Social Security will play a key role in their financial well-being. We know this because more than two decades of annual surveys from national pollster Gallup have shown that between 76% and 88% of non-retirees expect to rely on their Social Security benefit, in some capacity, to make ends meet during their golden years.

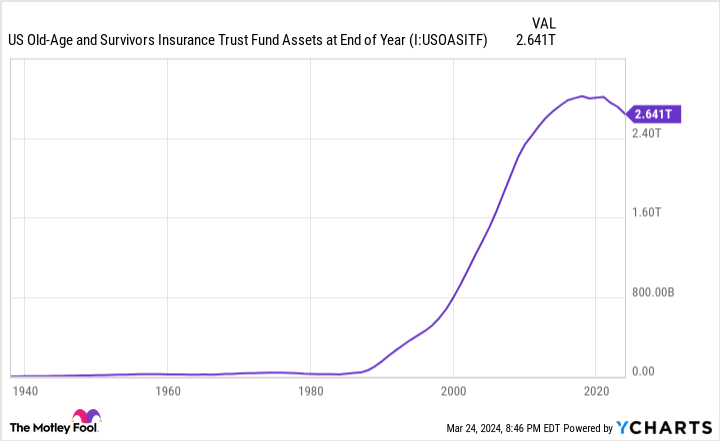

Although Social Security has been a guaranteed source of payouts for eligible retired workers since the first payouts began in January 1940, this all-important program is on ever-shakier financial footing.

Americans are looking to their elected officials in Washington, D.C. to shore up America’s top retirement program — and that begins at the top with President Joe Biden.

Social Security’s long-term funding shortfall has surpassed $22 trillion

For more than eight decades, the Social Security Board of Trustees has released an annual report that details the program’s current financial health, as well as makes assumptions about its financial outlook over the 10 years and 75 years (the long term) following the release of a report. These assumptions can be altered based on changes in fiscal and monetary policy, as well as demographic shifts.

Every year since 1985, the Social Security Board of Trustees Report has cautioned that Social Security is facing a long-term funding shortfall. As of the 2023 report, the program’s estimated funding-obligation shortfall had ballooned to $22.4 trillion (through 2097).

To be clear, a funding shortfall doesn’t mean bankruptcy or insolvency. Rather, it means the existing payout schedule, including cost-of-living adjustments (COLA), isn’t sustainable.

The 2023 Trustees Report projects that the Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for doling out monthly benefits to more than 50 million retired workers and approximately 5.8 million survivors of deceased workers, could exhaust its asset reserves by 2033. Should the OASI’s asset reserves be depleted, sweeping benefit cuts of up to 23% may be needed to avoid any further reductions through 2097. By 2033, this would reduce the average annual take-home benefit for retired-worker beneficiaries by more than $6,600!

While social media message boards are littered with false claims that Congress has stolen from Social Security or that undocumented workers are receiving benefits, the reality is that Social Security’s cash shortfall boils down to ongoing demographic changes. Some of the more important shifts that are adversely impacting Social Security include:

-

A historically low U.S. birth rate, which threatens to further reduce the worker-to-beneficiary ratio for future generations.

-

Rising income inequality, with a greater percentage of earned income escaping the payroll tax.

-

A more-than-halving in net legal migration into the United States. Migrants entering the U.S. are usually younger and will spend decades in the workforce contributing to Social Security via the payroll tax.

Joe Biden’s four-point plan to “fix” Social Security relies on the wealthy “paying their fair share”

Now that you have a better understanding of why Social Security is in trouble, let’s take a closer look at the plan Joe Biden presented prior to being elected president in November 2020.

While on the campaign trail, Biden and his team unveiled a four-point proposal designed to strengthen Social Security. One of these points is critical to the plan’s success — and it’s something Biden emphasized during his recent State of the Union address.

1. Increase payroll taxation on the wealthy

The essential aspect to Joe Biden’s Social Security proposal is that the rich “pay their fair share.” This would be accomplished by increasing payroll taxation on the wealthy.

In 2024, all earned income — i.e., wages and salary but not investment income — between $0.01 and $168,600 is subject to Social Security’s 12.4% payroll tax. Approximately 94% of workers will generate less than $168,600 in earned income this year. Meanwhile, the other 6% of workers will have their earned income above $168,600 exempted from Social Security’s payroll tax.

Biden’s approach would see the payroll tax reinstated on earned income above $400,000, with a doughnut hole created between the maximum taxable-earnings cap (the $168,600 figure) and $400,000 where earnings would remain exempt from the payroll tax. The key is that the maximum taxable-earnings cap rises on par with the National Average Wage Index over time. Thus, over a couple of decades, this doughnut hole would close and expose all earned income to the payroll tax.

2. Shift Social Security’s inflationary tether from the CPI-W to the CPI-E

In addition to raising revenue by reinstating the payroll tax on well-to-do workers, Biden’s plan involves lifting benefits for those who need it most. This would begin by shifting Social Security’s inflationary tether from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to the Consumer Price Index for the Elderly (CPI-E).

Although the CPI-W has been Social Security’s COLA-determining tool since 1975, it hasn’t done a particularly good job. That’s because it’s tracking the spending habits of “urban wage earners and clerical workers,” many of whom are younger and not receiving a Social Security benefit at the moment.

The CPI-E would strictly focus on the spending habits of households with persons aged 62 and above, which would be expected to result in more accurate (and higher) annual COLAs.

3. Boost the special minimum benefit above the federal poverty level

The third piece of the puzzle is lifting the special minimum benefit. In 2024, a lifetime low-earning worker with 30 years of coverage can expect to receive no more than $1,066.50 per month. That’s notably below the federal poverty level for a single filer of $1,255 per month this year.

Biden’s plan calls for an increase to the special minimum benefit to 125% of the federal poverty level, with inflationary adjustments made in subsequent years.

4. Gradually lift the primary insurance amount for aged beneficiaries

Last but not least, then-candidate Joe Biden called for a gradual increase to the primary insurance amount (PIA) for older beneficiaries. The PIA would be stepped up by 1% annually, beginning at age 78 and continuing through age 82, until a 5% aggregate increase is realized.

The purpose for this increase is to help offset higher expenses as we age. For instance, prescription medicine costs and medical transportation expenses can rise as we get older.

Joe Biden’s Social Security solution would come up short in more ways than one

On paper, the president’s proposal appears to make sense. Raising revenue from taxing the wealthy would help offset the immediate cash crunch the OASI is facing. At the same time, some of the revenue raised from taxing the rich can be repurposed to helping the beneficiaries who need it most.

However, a deeper dive into Biden’s Social Security proposal by researchers and economists reveals that it isn’t as cut-and-dried as you might think.

In October 2020, three researchers at Washington, D.C.- based think tank Urban Institute analyzed Biden’s proposal and came to a clear conclusion. While it does extend the solvency of the OASI’s asset reserves, it doesn’t come anywhere close to resolving Social Security’s long-term funding-obligation shortfall. As the publication notes:

We project that by extending the Social Security payroll tax to earnings above $400,000, his plan would close about a quarter of the program’s long-term funding deficit and extend the life of the trust funds [the OASI and Disability Insurance Trust Fund on a combined basis] by about five years.

Though taxing the wealthy has the potential to push the OASI’s asset-reserve exhaustion date decades into the future, Biden’s plan to repurpose most of this raised capital to increase the special-minimum benefit, lift the PIA for aged beneficiaries, and increase COLAs for all beneficiaries by switching to the CPI-E offsets much of what would be gained.

In a separate study conducted in March 2020, economists at the Penn Wharton Budget Model (PWBM) found additional concerns with Joe Biden’s Social Security proposal. While it would help “reduce the conventionally measured long-range imbalance by 1.5 percent of taxable payroll,” PWBM’s economists note that Biden’s plan leads to adverse consequences for the U.S. economy. Specifically, it would lower estimated U.S. gross domestic product (GDP) by 0.6% in 2030 and 0.8% by 2050.

The first issue raised by PWBM is that the broad-based increase in COLAs caused by the shift to the CPI-E would coerce workers with adequate retirement savings to work less and/or retire earlier. This means less productivity for the U.S. economy and therefore reduced GDP.

The second issue raised by PWBM’s economists is that raising the payroll tax on the wealthy would “distort labor supply decisions by more than the current payroll tax.”

While workers don’t get back the same dollar they put into Social Security, there exists the perception of a “contribution-benefit” link. In other words, if a worker has to pay more into the system, there’s the expectation that their payout will be greater during retirement. Biden’s plan disrupts this perception and would coerce the wealthy to work less, defer their income, or seek out ways to generate income that wouldn’t be subject to the payroll tax.

Although Biden’s Social Security proposal would, indeed, strengthen Social Security by extending the solvency period of the OASI’s asset reserves, it comes up short in a variety of other aspects.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets”

The Motley Fool has a disclosure policy.

Joe Biden Wants to Tax the Rich to Save Social Security, but This Isn’t as Cut-and-Dried a Solution as You Might Think was originally published by The Motley Fool

SBF to serve jail term in medium security prison near San Francisco, ordered to forfeit $11 Billion

Samuel Bankman-Fried, the former CEO of FTX, has been sentenced to serve his 24-year jail time in a medium-security prison, with a recommendation for a facility as close to the San Francisco – Bay Area as possible. This decision, made by Judge Lewis A. Kaplan during the sentencing on March 28, 2024, takes into account Bankman-Fried’s notoriety, his previous association with vast wealth, and his personal challenges, including autism and social awkwardness, which are likely to make him particularly vulnerable in a high-security prison environment.

Sam Bankman-Fried was held at the Metropolitan Detention Center (MDC) in Brooklyn, New York, prior to his trial and sentencing. The MDC is known for its stringent security measures and has faced criticism for its conditions that house both pre-trial detainees and inmates serving short sentences.

The sentencing details, as outlined in the minute entry from the proceedings, reveal a complex structure, with Bankman-Fried receiving a total of 291 months (approximately 24 years and three months) in prison. This sentence is broken down across multiple counts, with specific terms to be served concurrently and consecutively, highlighting the gravity of the charges against him.

In addition to the prison sentence, Bankman-Fried has been ordered to forfeit a staggering $11,020,000,000. This forfeiture is part of the court’s efforts to address the financial ramifications of the case, which has had a profound impact on countless investors and customers of FTX. The court declined to order direct restitution due to the complexity of the case and the vast number of victims involved. Instead, it has authorized the government to compensate victims through a remission process using the forfeited assets, a decision that illustrates the challenges in providing restitution in such a large-scale fraud case.

Furthermore, upon his release from prison, Bankman-Fried will be placed under supervised release for a term of 3 years, during which he will be required to participate in an outpatient mental health treatment program and adhere to strict financial oversight.

Bankman-Fried will be around 57 years old when he is released from prison, following his subsequent supervision, it is possible he may be able to re-enter the financial sector in some form by his 60th birthday.

Mentioned in this article

Here’s How to Tell If You Qualify for Spousal Social Security Benefits

Social Security offers a vital financial safety net and a cornerstone in the foundation for a secure future for millions of Americans. What happens, though, if your employment history doesn’t support those plans?

If your spouse is eligible to receive retirement benefits, you may qualify for spousal benefits. You’ll need to check the rules and regulations from the Social Security Administration (SSA) to determine if you meet the requirements but can begin your research with the following summary of the major ways you can qualify for spousal benefits.

Image source: Getty Images.

Meeting the basic requirements

The good news is that you don’t necessarily need your own work history to receive spousal benefits. Ways to qualify include reaching age 62 or caring for a qualified disabled child under age 16. The child also must be eligible for benefits on your spouse’s Social Security record.

You also may be able to make a claim on an ex-spouse’s work record if you’re 62 or older, were married at least 10 years, divorced for at least two, and currently unmarried.

Some other caveats and what you can expect

There are a few additional factors to keep in mind. First, if you remarry after you become eligible for divorced spousal benefits, you’ll lose those benefits. (But you can reapply if you later become single again.) In any case, the amount of your spousal benefit will depend on your spouse’s earnings history and when you start collecting benefits.

Generally, you can receive up to 50% of your spouse’s full retirement benefit. However, if you start receiving benefits before your full retirement age, your benefit will be permanently reduced. The SSA offers an online tool for estimating your potential spousal benefit.

Develop your plan strategically

Knowing these eligibility requirements can help you and your spouse plan your retirement strategy. If you’re the lower earner in the marriage, you may want to delay taking your own retirement benefits until you reach your full retirement age to maximize your potential spousal benefit.

You can estimate your retirement benefit and investigate various claiming situations, including spousal benefits, using the SSA’s online benefits planner. The planner also is a good aid for understanding some of the complexities involved in making educated decisions about your retirement income.

Maximizing your income, together or not

Spousal benefits can be a significant source of income for retirees. By understanding the eligibility requirements and how different claiming strategies can affect your benefit amount, you and your spouse can work together to maximize your retirement income. The same goes for your ex-spouse.

For more detailed information on spousal benefits and claiming strategies, visit the Social Security Administration’s website. Consulting with a financial planning advisor who understands both Social Security and how your benefits will fit in with the eggs already in your nest is also a good idea.

Older adults with student debt at risk of losing some Social Security benefits

Martinprescott | E+ | Getty Images

Millions of older adults who are behind on their student loans could soon receive a smaller Social Security benefit.

That was the warning from Democratic lawmakers, including Sen. Elizabeth Warren, D-Mass., and Sen. Ron Wyden, D-Ore., in a recent letter to the Biden administration.

“When borrowers are in collections, on average their Social Security benefits are estimated to be reduced by $2,500 annually,” the lawmakers wrote on March 19. “This can be a devastating blow to those who rely on Social Security as their primary source of income.”

The U.S. government has extraordinary collection powers on federal debts and it can seize borrowers’ tax refunds, wages and retirement benefits. Social Security recipients can see up to 15% of their benefit reduced to pay back their defaulted student debt, which “can push beneficiaries closer to — or even into — poverty,” the lawmakers wrote.

After the pandemic-era pause on student loan payments expired in October of last year, the U.S. Department of Education said it wouldn’t resume its collection practices for 12 months.

However, the lawmakers wrote, “we are concerned that borrowers will face the extreme consequences associated with missed payments when protections expire in late 2024.”

They asked the Biden administration to provide a briefing on its efforts to address the issue by April 3.

More from Personal Finance:

FAFSA fiasco may cause drop in college enrollment, experts say

Harvard is back on top as the ultimate ‘dream’ school

More of the nation’s top colleges roll out no-loan policies

The U.S. Department of Education did not immediately respond to a request for comment.

The government’s collection practices with student loan borrowers, including the garnishment of wages and Social Security benefits, is an area under review, a source familiar with its plans told CNBC.

‘A morally bankrupt policy’

Outstanding student debt has been growing among older people. To that point, more than 3.5 million Americans aged 60 and older had student debt in 2023, a sixfold increase from 2004, according to the lawmakers.

Consumer advocates say the government’s collection actions are extreme.

“Many retirees need their Social Security benefits to survive,” said higher education expert Mark Kantrowitz.

Social Security benefits constitute nearly all income for one-third of recipients over the age of 65, the lawmakers said in their letter. The average check for retired workers is $1,907 this year, according to the Social Security Administration.

The garnishments mean older adults are often “forced to choose between skipping meals or rationing medicine,” Kantrowitz said. “It is a morally bankrupt policy.”

Don’t miss these stories from CNBC PRO:

The majority of personal finance experts agree that waiting until you turn 70 to claim Social Security is a good bet.

The advantage of waiting until 70 is clear: You get much bigger monthly checks. While you can claim benefits based on your own work record starting at age 62, you’ll receive slightly bigger checks every month you delay beyond that. And the difference can add up. Someone claiming at 70 can receive a check 77% larger than if they claimed at 62.

And thanks to the long-term rise of life expectancy, waiting until 70 can maximize lifetime benefits for most retirees. With that in mind, here’s what the average retiree receives in Social Security benefits at age 70.

The biggest factors determining the size of your Social Security check

There are three things that go into determining how much you’ll receive in monthly Social Security retirement benefits.

Every January, the Social Security Administration receives information from your employer about how much you earned the previous year (if you’re self-employed, it will pull that data from your tax return). When it comes time to calculate your retirement benefits, it takes your 35 highest-earning years (adjusted for inflation) and calculates your average monthly income from them. It plugs that number into the Social Security benefits formula and determines the amount you’ll receive if you claim benefits at what the government has set as your full retirement age. This is called your primary insurance amount.

Your full retirement age is determined by the year you were born. Those born in 1954 or earlier reached full retirement age at 66. Full retirement age has been increasing by two months for each year a person was born after 1954. But for everyone born in 1960 or later, it’s 67.

With those two factors determined by the time you retire, there’s just one thing left within your control that can influence the size of your monthly checks: when you claim. While you can claim starting at 62, doing so before your full retirement age means you’ll receive less than your primary insurance amount — by a fraction of a percent for every month early you claim. On the other hand, waiting past your full retirement age will entitle you to delayed retirement credits that increase your check by 0.67% for each month you postpone, up until you reach 70. That adds up to an 8% boost per year.

Here’s what claiming Social Security at various ages looks like for someone with a full retirement age of 67.

|

Claiming Age |

Benefit as a Percentage of Primary Insurance Amount |

|---|---|

|

62 |

70% |

|

63 |

75% |

|

64 |

80% |

|

65 |

86.67% |

|

66 |

93.33% |

|

67 |

100% |

|

68 |

108% |

|

69 |

116% |

|

70 |

124% |

Data source: Social Security Administration. Calculations by author.

The average Social Security benefit at 70

Clearly, waiting until 70 results in a substantially larger monthly benefit than claiming early.

That shows up elsewhere in the data, too. In Dec. 2022 (the most recent month for which this data is available from the Social Security Administration), the average benefit for a 70-year-old was $1,963.48. By comparison, the average 62-year-old received just $1,274.87 in benefits that month.

But readers should note, the vast majority of 70-year-olds collecting Social Security benefits originally claimed their benefits well before they turned 70. That means the average benefit at 70 doesn’t fully reflect the difference of waiting until delayed retirement credits have maxed out before claiming.

There were nearly 309,000 people who waited until age 70 to apply for Social Security benefits in 2022. The average monthly benefit for those claimants was $3,027.00. That’s more than 50% higher than the average benefit for all 70-year-old recipients mentioned above.

And when you compare that to what the average retiree who applied at 62 received, the impact is even more substantial. The 808,000 retirees who applied for Social Security benefits at age 62 in 2022 received an average benefit of just $1,287.61. That’s a difference of $20,873 per year compared to those claiming at age 70.

Should you wait until you’re 70?

Readers should note that for any given person, the maximum increase they can get delaying benefits from 62 to 70 is about 77%. Meanwhile, the average person applying for benefits at 70 receives about 135% more than those applying at 62.

That suggests those who delay claiming until 70 earned more on average in their careers than those claiming at 62. That could be in part because those waiting until 70 continued to work in their 60s when their earnings were higher than earlier in their careers. Some retirees claiming at 62 could also have had their work history cut short by health issues or a sudden layoff late in their career. In those cases, claiming at 62 may have been the right move for them, even if it meant accepting a smaller monthly benefits check.

The average retiree who doesn’t have any health problems and is able to work a full career and stash away plenty for retirement will likely be better off by delaying their claim until 70. While you’ll have to give up eight years of Social Security checks upfront, that move usually pays off in the long run.

You can use the earlier years of your retirement to develop a tax-efficient retirement account withdrawal strategy and eventually enjoy the larger Social Security benefits. A 2019 study from United Income found the majority of retirees would maximize their chances of being able to afford retirement by delaying Social Security until 70.

There’s a reason personal finance experts overwhelmingly suggest anyone who can afford to wait until they turn 70 before claiming Social Security should do so. While each individual case is different, it works out best for the majority of people.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets”

The Motley Fool has a disclosure policy.

This Is the Average Social Security Benefit for Age 70 was originally published by The Motley Fool

Deciding when to take Social Security benefits is one of the most important questions to answer in planning your retirement strategy. Second to that is understanding what might increase—or reduce—your benefit amount. Does retirement income count as income for Social Security? No, but working while claiming benefits could shrink the amount that you’re able to collect. Talking to a financial advisor can help you to maximize Social Security benefits in retirement.

Understanding Social Security Benefits

Social Security retirement benefits are designed to provide a supplement source of income to eligible seniors. You can begin taking Social Security retirement benefits as early as 62, though doing so can reduce the amount you receive. Waiting until age 70 to begin taking benefits, meanwhile, can increase your benefit amount.

Benefits are calculated based on your earnings history. Specifically, Social Security considers earned income, wages and net income from self-employment. If any money is withheld from your wages for Social Security or FICA taxes, then your wages are covered by Social Security since you’re paying into the system.

When you apply for benefits, Social Security uses your average indexed monthly earnings to decide how much you qualify for. This average is based on up to 35 years of your indexed earnings and it’s used to calculate your primary insurance amount (PIA). The PIA determines the benefits that are paid out to you once you retire.

Does Retirement Income Count as Income for Social Security?

Retirement income does not count as income for Social Security and won’t affect your benefit amount. Specifically, the Social Security Administration excludes the following from income:

None of these are considered earnings for Social Security purposes. Again, Social Security only looks at money that you actually earn from working a job or being self-employed. That means that you could collect Social Security benefits while also taking withdrawals from a 401(k) or individual retirement account (IRA) or receiving payments from an annuity. Reverse mortgages won’t affect your Social Security benefits or eligibility for Medicare either.

With a reverse mortgage, you tap into your home equity but instead of making payments to a lender, the lender makes payments to you. You don’t have to pay anything back towards the reverse mortgage as long as you’re living in the home. Many retirees choose to supplement Social Security benefits with a reverse mortgage.

Does Working in Retirement Reduce Social Security Benefits?

Working while you’re also drawing Social Security benefits could reduce your monthly payments, depending on your age and earnings.

Under Social Security rules, you’re considered to be retired once you begin receiving benefits. If you’re below full retirement age but still working, Social Security can deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2023, the limit is $21,240.

In the year you reach your full retirement age (FRA), the deduction changes to $1 for every $3 earned above a different annual limit. For 2023, the limit is $56,520. Once you reach your full retirement age, your benefits are no longer reduced regardless of how much you earn. Social Security will also recalculate your benefit amount so that you get credit for any months that your benefits were reduced because of your earnings.

Coordinating Retirement Withdrawals and Social Security

Deciding when to take Social Security benefits starts with considering your other sources of retirement income. For example, that might include:

You could also add a health savings account (HSA) here, though it’s technically not a retirement account. An HSA lets you save money on a tax-advantaged basis for healthcare expenses but once you turn 65, you can withdraw money from it for any reason without a tax penalty. You would, however, pay ordinary income tax on the distribution.

From a tax perspective, it usually makes sense to start with taxable accounts first, then tax-advantaged accounts for withdrawals, leaving Roth and Roth-designated accounts last. In doing so, you allow your Roth investments to continue growing tax-free until you need them.

In terms of when to take Social Security benefits, delaying usually makes sense if you’re hoping to get a larger payout or you have other sources of income to rely on. You might also consider putting off taking benefits if you plan to continue working up until your full retirement age, as that could allow you to claim a larger benefit amount.

Creating Multiple Streams of Income for Retirement Without Affecting Social Security

Since retirement income doesn’t count as income for Social Security, it could be to your advantage to have more than one source that you can rely on. You might already be contributing to your 401(k) at work but you could add an IRA into the mix for additional savings.

Whether it makes sense to choose a traditional or Roth IRA can depend on where you expect to be tax-wise once you retire. You might choose a traditional IRA if you expect to be in a lower tax bracket down the line but could benefit from claiming deductible contributions now. On the other hand, a Roth IRA might be preferable if you’d like to be able to withdraw money tax-free in retirement.

An annuity is another option if you’d like to invest money now to generate guaranteed income later. When considering an annuity, it’s important to learn how different types of annuities work and what they can cost.

Real estate might be another possibility if you’re looking for a passive income option that won’t affect your Social Security benefits. You could purchase a rental property or become a flipper, but owning property directly isn’t a requirement. You can also create passive investment income through real estate investment trusts (REITs), real estate crowdfunding platforms or real estate mutual funds.

Talking to a financial advisor can give you a better idea of how to create multiple streams of income for retirement, without affecting your Social Security benefits. An advisor should also be able to help you formulate a strategy for getting the most benefits possible for yourself and your spouse if you’re married.

Bottom Line

Retirement income won’t affect your Social Security benefits, but income earned from working could. If you plan to draw Social Security while working, it’s helpful to know what that might mean for your benefits payout. Getting an early start with saving and investing for retirement could allow you to delay taking Social Security so that you’re able to claim a larger benefit.

Retirement Planning Tips

-

Working with a financial advisor can help you to fine-tune your retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Social Security benefits are taxable for retirees who have substantial income from wages, self-employment, interest and dividends. If you’re working while claiming benefits or earning interest and dividend income, you may have to pay taxes on some of your benefits, depending on how much income you have.

-

Check out our free retirement calculator for a quick estimate on what you can expect based on your age, expected retirement and sources of income.

Photo credit: ©iStock.com/SrdjanPav, ©iStock.com/AJ_Watt, ©iStock.com/RollingCamera

The post Does Retirement Income Count as Income for Social Security? appeared first on SmartReads by SmartAsset.

I was forced to take Social Security retirement benefits at 62 instead of SSI. I’m 71 now. Did the agency make a mistake?

Dear MarketWatch,

Most Read from MarketWatch

Hopefully you can lessen my confusion. For several years before I reached 62, I was disabled and qualified for Supplemental Security Income. It helped immeasurably. When I turned 62, I was forced to enroll in Social Security and my SSI was taken away from me. I was given no choice whatsoever. Even though Social Security paid marginally more than SSI at the time, I would have preferred to remain on SSI until at least full retirement or age 70 if I was financially able to do so.

In the ensuing years of receiving Social Security at or very near the minimum level based upon what my earnings had been over my lifetime (I am 71 now), I kept hearing and reading articles about people who got to keep their disability (SSI) while also receiving full Social Security, at an amount of course based upon their age when they chose to enroll in Social Security.

When I reached Full Retirement Age (age 66) I tried to have my Social Security payments adjusted from what I was forced to accept at age 62, to what I qualified for at 66. Despite spending a lot of time and effort, not to mention the financial impact, I was never able to restore my full retirement payment from SS.

Can you help?

Dear Reader,

Social Security can be very confusing — you’re certainly not alone. And when there are different programs and benefits at play, it gets even more complex.

Social Security’s two main programs are for retirement and disability benefits, the latter of which is known as SSDI. Supplemental Security Income, known as SSI, is a separate benefit, available to people aged 65 or older, or a person with a disability or blindness, who has little or no income or resources. The main difference between the two: SSDI is tied to work history, whereas SSI is not.

You probably already know the intricacies, but here are the eligibility requirements for SSI, according to the Social Security Administration, for any readers unaware:

If you qualify for retirement benefits, then beginning at 62 — which is the earliest a beneficiary can claim for those benefits — you would have to file for other benefits you might be eligible for, according to disability law firm Peña & Bromberg. “In the case of a disabled individual with prior work credits who was denied SSDI but granted SSI, they will be required to file for retirement benefits at the earliest age of eligibility,” the firm said on its site.

Your situation may not have been ideal, but it’s also not unheard of.

“Unfortunately, not only do SSI payments not automatically convert to retirement payments, but the Social Security Administration can essentially force you to apply for early retirement benefits at 62, instead of waiting for your full retirement age,” according to law firm Harris Guidi Rosner. “This can happen if you did not qualify for SSDI benefits, but you did work enough years to qualify for a small retirement benefit.”

As for Social Security Disability Insurance, that benefit automatically switches to a retirement benefit upon Full Retirement Age. “The law does not allow a person to receive both retirement and disability benefits on one earnings record at the same time,” the SSA said. The amount will remain the same, though. Beneficiaries who also receive a reduced widow or widower’s benefit should contact the administration so it can make the proper adjustments, the agency said.

Still, if you think your benefits were calculated incorrectly, it doesn’t hurt to reach out to the Social Security Administration, even if it might take a long time. You could also request an appointment at a local Social Security office. You can call the agency at 1-800-772-1213 (the TTY number for people with hearing and speech impairments is 1-800-325-0778) Monday through Friday between 8 a.m. and 7 p.m. local time. The office locator is available on their site.